Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 19, 2021

Daily Global Market Summary - 19 February 2021

Major European equity markets closed higher across the region, while APAC and US indices closed mixed. US and most benchmark European government bonds closed sharply lower. European iTraxx closed slightly tighter across IG and high yield, and CDX-NAHY was close to unchanged. Copper closed at the highest price since April, with gold and silver also higher on the day. The US dollar and oil closed lower.

Americas

- US equity indices closed mixed; Russell 2000 +2.2%, Nasdaq +0.1%, DJIA flat, and S&P 500 -0.2%.

- 10yr US govt bonds closed +4bps/1.34% yield and 30yr bonds +4bps/2.13% yield, which is +28bps and +30bps month-to-date, respectively.

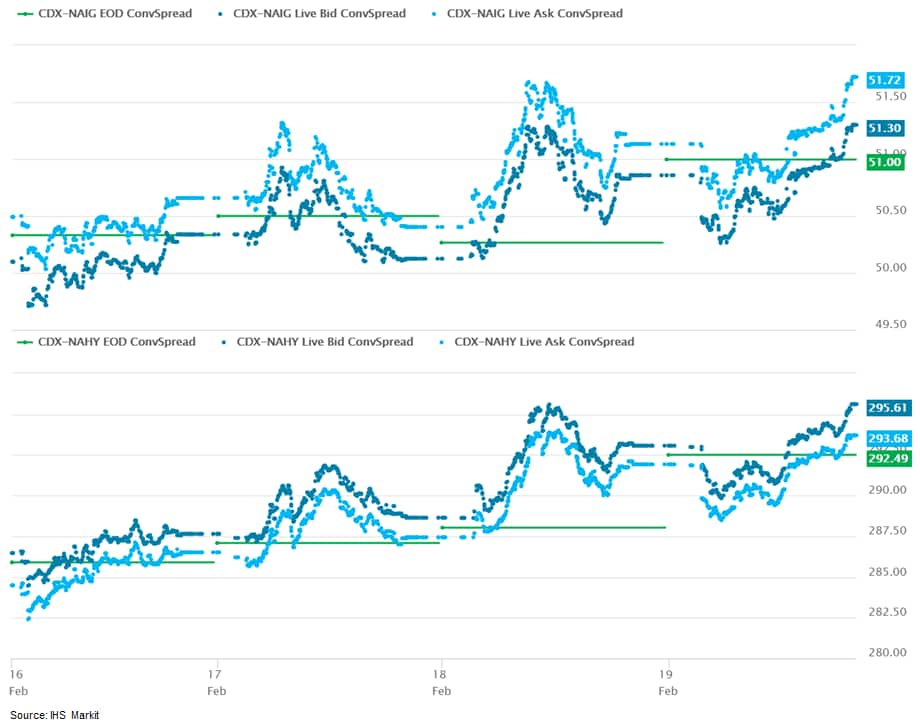

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +2bps/295bps, which is

+1bps and +9bps week-over-week, respectively.

- Copper closed +4.4%/$4.07 per pound and is now at the highest level since April 2011.

- DXY US dollar index closed -0.3%/90.36.

- Gold closed +0.6%/$1,777 per ounce and silver +0.6%/$27.25 per ounce.

- Crude oil closed -3.1%/$59.26 per barrel.

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 58.8 in February, up slightly

from 58.7 in January. The upturn was the sharpest since March 2015.

(IHS Markit Economist Chris Williamson)

- The seasonally adjusted IHS Markit Flash U.S. Services PMI Business Activity Index registered 58.9 in February, up from 58.3 in January. The rise in business activity was the strongest for almost six years, as service sector firms noted greater client demand.

- Manufacturing firms signaled a marked improvement in operating conditions in February, as highlighted by the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index (PMI) posting 58.5, down slightly from 59.2 in January. The headline index reading was buoyed in part due to a substantial deterioration in vendor performance (ordinarily a sign of improving manufacturing conditions).

- Supply chain disruption remained apparent, as suppliers' delivery times lengthened to the greatest extent since data collection began in May 2007. Key raw material and component shortages, alongside transportation delays, were often cited as factors behind worsening vendor performance.

- US existing home sales rose 0.6% in January to a

6.69-million-unit annual rate, the second highest reading in 14

years. Sales were up 23.7% from a year earlier. (IHS Markit

Economist Patrick Newport)

- Sales in the South were at a record high; in the other three regions, sales were near 14-year highs.

- Lawrence Yun, the National Association of Realtors (NAR)'s chief economist, wrote: "Sales easily could have been even 20% higher if there had been more inventory and more choices."

- Inventory remained at a record-low 880,000 single-family homes for sale.

- Note: many survey respondents include pending sales as part of inventory. The economist Thomas Lawler has written that "effective inventory," which excludes pending sales, has shrunk much more than the official number, meaning that record-tight markets are even tighter than the data suggests.

- The median price of a single-family home was up a sizzling 14.8% from a year earlier.

- The Mortgage Bankers Association's seasonally adjusted purchase index and the Pending Home Sales Index have slipped recently, suggesting that home sales will start edging down soon.

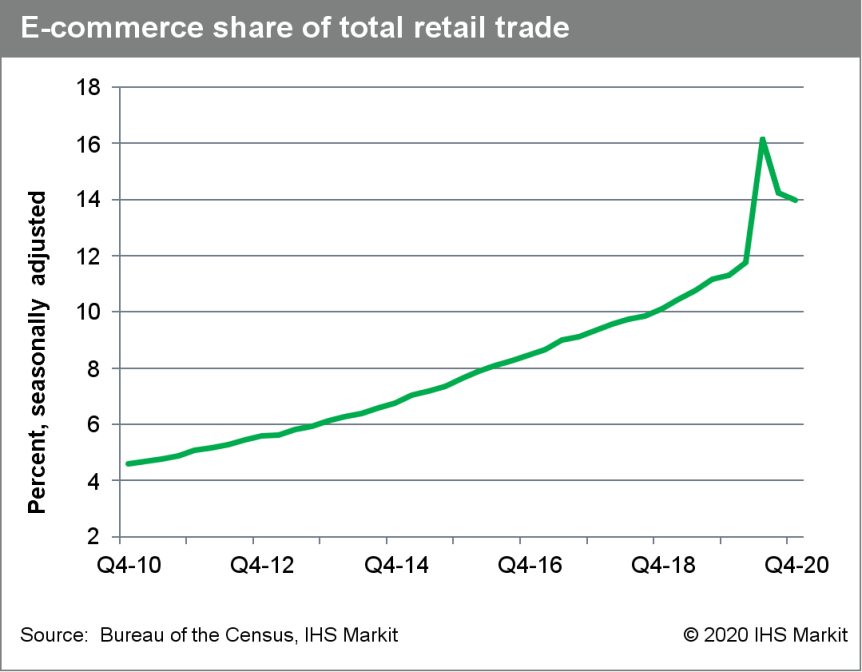

- US seasonally adjusted e-commerce retail sales registered

$206.7 billion in the fourth quarter of 2020, a decrease of 1.2%

from the third quarter. (IHS Markit Economist James Bohnaker)

- Growth was 32.1% year on year (y/y), down from its peak of 44.5% y/y in the second quarter and subsequent 36.6% rate in the third quarter of 2020.

- The e-commerce share of total retail trade ticked down 0.2 percentage point to 14.0% from 14.2% in the third quarter and 16.1% in the second quarter of 2020. The share was up from 11.3% in the fourth quarter of 2019.

- Among retail categories for which detailed e-commerce data is

available, year-on-year growth of e-commerce sales at food and

beverage stores (125%) lead the pack. Health and personal care

(61%), building materials and garden equipment stores (62%),

furniture and home furnishing stores (55%), and sporting goods,

hobby, musical instruments, and book stores (54%) were among the

other categories with outsize growth above 50% y/y.

- Eli Lilly (US) has signed a global exclusive license and research agreement with Rigel Pharmaceuticals (US) to co-develop and commercialize Rigel's R552, a receptor-interacting serine/threonine-protein kinase 1 (RIPK1) inhibitor, for all indications including autoimmune and inflammatory diseases. R552 has completed Phase I clinical testing and will commence mid-stage trials this year. Lilly will cover all costs of commercialization for R552, with Rigel entitled to co-commercialization in the United States. Under the terms of the agreement, Lilly will lead all clinical development of the pre-clinical RIPK1 inhibitor in central nervous system (CNS) diseases. Rigel will receive USD125 million upfront from Lilly, and will be eligible for up to USD835 million in potential development, regulatory, and commercial milestone payments, as well as tiered royalties. (IHS Markit Life Sciences' Margaret Labban)

- Toyota has announced plans to invest USD210 million in a US plant to increase its assembly capacity of 4-cylinder engines, involving the addition of 100 new jobs. The planned investment is in the Toyota Motor Manufacturing West Virginia (TMMWV) plant and is to involve an upgrade to the current 6-cylinder engine production line with new equipment and machinery to improve production flexibility. The extra capacity is to come from investment in a third shift for production of the 4-cylinder engine, creating 100 new jobs. The new engines will support RAV4 production, according to Toyota's statement, and production capacity of engines for the RAV4 will increase by 5,900 units per month and more than 70,000 engines per year. (IHS Markit AutoIntelligence's Stephanie Brinley)

- May Mobility has selected Ouster's digital LiDAR sensors for its autonomous shuttle platform. Ouster will supply four units of its OS1 sensor per vehicle for May Mobility's next generation of autonomous shuttles. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Albemarle yesterday reported fourth-quarter net income down

6.4% year-over-year (YOY), to $84.6 million, while net sales

declined 11.4%, to $879.1 million. Adjusted earnings were down

32.4% YOY, to $1.17/share, short of analysts' consensus estimate of

$1.30/share, as reported by Refinitiv (New York, New York). Lower

YOY results in catalysts and lithium drove the declines, partly

offset by improved results in bromine. Adjusted EBITDA was down

25.0% YOY, to $221.1 million. (IHS Markit Chemical Advisory)

- Lithium segment sales fell 12.8% YOY, to $358.6 million, while segment adjusted EBITDA was down 12.8%, to $122.1 million. Lower YOY prices were partly offset by higher volumes.

- Bromine specialties segment sales grew 8.2% YOY, to $263.4 million, while segment adjusted EBITDA increased 10.2%, to $87.9 million.

- Catalyst segment sales declined 30.7% YOY, to $195.7 million, while segment adjusted EBITDA declined 71.3%, to $22.1 million. Volumes fell YOY for fluidized catalytic cracking (FCC) and hydroprocessing catalysts, although FCC catalyst volumes rose sequentially. Catalysts results are expected to be flat for full year 2021, due to changes in customer order patterns in North America.

Europe/Middle East/Africa

- European equity markets closed higher; Spain +1.2%, Italy +0.9%, France/Germany +0.8%, and UK +0.1%.

- Most 10yr European govt bonds closed lower except for Italy -4bps; UK +7bps, Germany +4bps, and France/Spain +2bps.

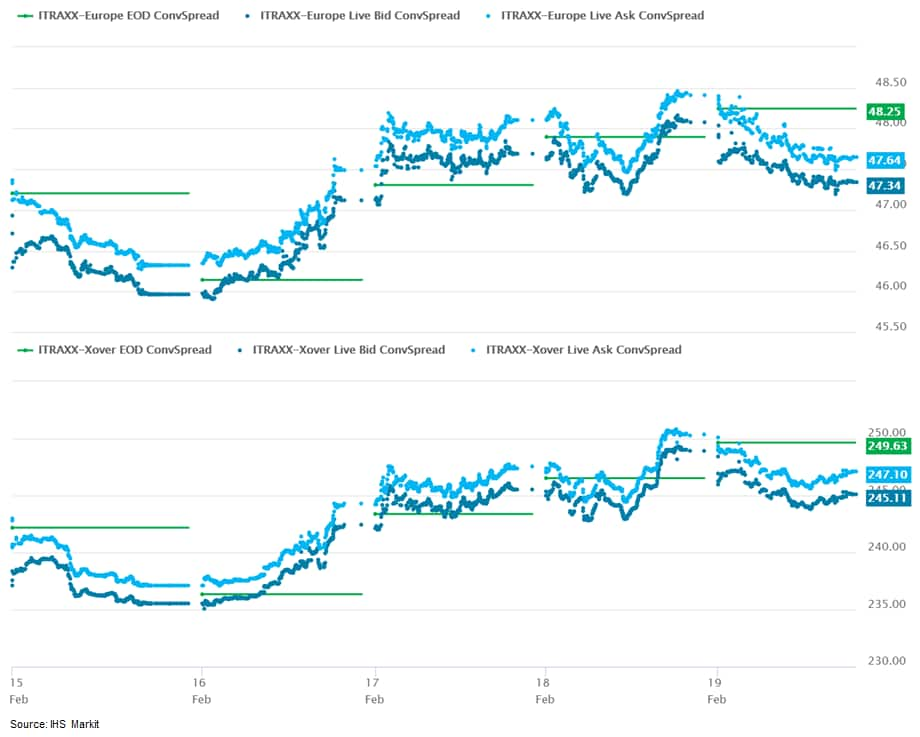

- iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -4bps/246bps,

which is flat and +4bps week-over-week, respectively.

- Brent crude closed -1.6%/$62.91 per barrel.

- The UK's Office for National Statistics (ONS) reported that

retail sales (including fuel sales) in volume terms decreased by

8.2% month on month (m/m) in January. (IHS Markit Economist Raj

Badiani)

- However, the impact of restrictions on the retail sector was less acute during the first full month of retail restrictions in April 2020 when sales tumbled by 22.2% when compared to the pre-COVID-19 virus level.

- Nevertheless, retail sales volumes in January stood 5.5% lower their pre-COVID-19 virus level in February 2020.

- Clothing stores reported sales falling by 34.7% m/m during January, 2021 after a 25.6% drop in the full-year 2020.

- Sales in food stores increased by 1.4% m/m in January, after a 3.4% m/m drop in December. Supermarkets continued to benefit from the closure of the hospitality industry and other non-essential retail sectors across the UK.

- Sales on the high street, or in physical shops, fell again to stand even lower when compared to their pre-lockdown levels. Specifically, spending in non-food stores plunged by 24.4% m/m in January to stand 26.6% lower than the February 2020 pre-COVID-19 virus levels.

- Non-store retailing grew by 7.5% m/m in January, implying that it was 52.4% higher than the February 2020's level. It accounts for a record 35.2% of all retail spending in January, up from 19.5% a year earlier.

- Fuel sales volumes fell by 1.2% between December and January and remained 25.3% below February 2020's level because of reduced travel as more people worked from home during the tighter COVID-19 restrictions.

- Uber Technologies has lost a UK Supreme Court ruling over the status of its drivers, reports Bloomberg. The judges said that Uber drivers should be classified as employees rather than independent contractors, entitling them to rights such as the minimum wage, holiday pay, and rest breaks. Uber said that the ruling "only applies to the handful of drivers that filed the initial case". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US Dole and the Irish fresh giant Total Produce are

planning to merge to create the world's largest fresh produce

company with an estimated revenue of USD10 billion. (IHS Markit

Food and Agricultural Commodities' Hope Lee)

- In 2018, Total Produce acquired a 45% stake in Dole. If the merger goes ahead, Total Produce will assume the Dole brand name. Dole is a household brand in the US while it is less familiar to Irish consumers.

- The merger is expected to bring in benefits such as a simplified ownership structure and synergies.

- The merged Dole will be listed in the US, with headquarters in Dublin. The target is to raise USD500-700 million from the initial public offering.

- The company will accelerate its development of strong growth crops such as avocados and berries and organic produce.

- Additionally, there will be opportunities for collaboration between different parts of the business in North America and Europe. Collaboration in sourcing from Chile and South Africa is also expected.

- By working together more in regions such as the UK, France and Spain, Dole and Total Produce will be able to increase its sales further and offer a larger variety of products.

- The headline flash IHS Markit Eurozone Composite PMI edged

higher from 47.8 in January to 48.1 in February. By remaining below

50.0, the latest reading indicated a fourth consecutive monthly

contraction of business activity, but also registered a slight

easing in the rate of decline compared to January. Despite the rise

in the PMI, the average reading of 47.9 for the first quarter so

far is marginally lower than the average of 48.1 seen in the fourth

quarter of last year. <span/>(IHS Markit Economist Chris Williamson)

- Particularly strong manufacturing growth meant Germany once again outperformed, However, at 51.3 (up only modestly from 50.8 in January) the composite index registered only a marginal expansion due to the offsetting impact of weaker services.

- At 45.2, down from 47.7, the equivalent composite index for France meanwhile signaled the steepest deterioration since November due to the faster service sector downturn. Business activity also declined across the rest of the eurozone as a whole, albeit at a reduced rate.

- One concern is the further intensification of supply shortages, which have pushed raw material prices higher. Supply delays have risen to near-record levels, leading to near-decade high producer input cost inflation. At the moment, weak consumer demand - notably for services - is limiting overall price pressures, but it seems likely that inflation will pick up in coming months.

- Faurecia is in talks to sell its Acoustics and Soft Trims unit to Germany's Adler Pelzer Group. According to a statement released by Adler Pelzer, an agreement has been reached to engage in "exclusive discussion" towards a deal. The company added that talks also include a partnership on Acoustics for Automotive Interiors to "capitalize on current footholds and grow the business further, providing innovations to customers". It noted that submissions to the relevant competition authorities have also begun. The talks relate not only to eight production facilities based across Europe in France, Luxembourg, Poland, Spain, and the UK, but also a research and development (R&D) facility at Mouzon (France) which employs 1,820 people. During 2019, this business is said to have generated EUR385 million. (IHS Markit AutoIntelligence's Ian Fletcher)

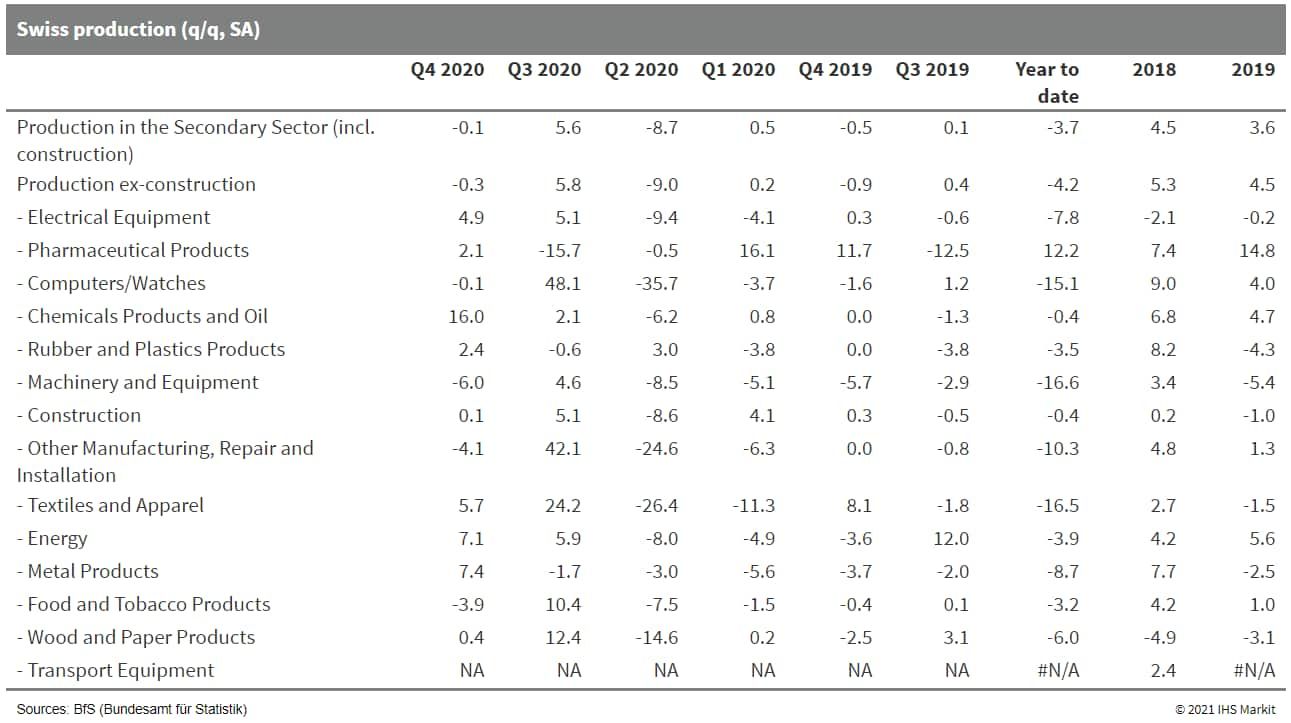

- The absence of strict lockdown conditions in Switzerland in

late 2020 has limited the negative impact of the COVID-19 pandemic

on economic activity. In addition, strong demand in the important

chemical/pharmaceutical sector has provided an offset for output

declines elsewhere. Tighter restrictions in January and February

will probably dampen production in the first quarter, however. (IHS

Markit Economist Timo Klein)

- Based on indices according to the NOGA 2008 classification, Swiss Federal Statistics Office (BFS) secondary-sector production in the fourth quarter of 2020 declined just marginally by 0.1% quarter on quarter (q/q) in seasonally adjusted terms, following the third-quarter partial rebound to the second-quarter plunge, which was triggered by the onset of the pandemic.

- In year-on-year terms, overall production has reached -3.1% in

the fourth quarter of 2020, virtually equal to the fourth-quarter

situation in Germany, Switzerland's most important trading partner.

This is up from -3.7% in the third quarter and a bottom at -8.6% in

the second.

- Plastic Omnium has announced that its 2020 financial results have taken a hit as a result of the COVID-19 virus pandemic, although its second-half performance has helped pull things back. During the 12 months ending 31 December, the company's economic revenues - which include a percentage of sales by its various joint ventures (JVs) - tumbled by 15.8% year on year (y/y) to EUR7,732 million, while its consolidated revenues retreated by 16.7% y/y to EUR8,494 million. It also said that its earnings before EBITDA contracted by 35.5% y/y to EUR648 million. (IHS Markit AutoIntelligence's Ian Fletcher)

- Fugro has launched MASSPeople, the Maritime Autonomous Surface Ships (MASS) International Training Standards Working Group in coalition with SeaBot XR and the UK Maritime and Coastguard Agency. The group will collaborate to develop world-class training and competency standards for remote and autonomous vessels. This will include development of new standards and a training framework to upskill mariners in the operation of remote and autonomous vessels. The group will provide recommendations on new competency standards for inclusion into the International Convention of Standards on Training, Certification and Watchkeeping for Seafarers (STCW). (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Spanish city Malaga is to begin a three-week public trial of an electric autonomous bus manufactured by Irizar Group. The bus model, Irizar ie, which is 12-metres long, will be operated by Spanish transport service company Avanza. The vehicle will be operated on line 90 to transport passengers from the Maritime Station in the port area to the Paseo del Parque in the front of the City Hall. The bus, which comes with dual driving mode, uses a high-precision positioning and guidance system for navigation and will be connected to a control center for specific instructions. The vehicle will function using smart traffic lights, a EUR180,000-million (USD218,400-million) investment by the city council, which will communicate with the bus, guiding it when to go and stop. (IHS Markit Automotive Mobility's Surabhi Rajpal)

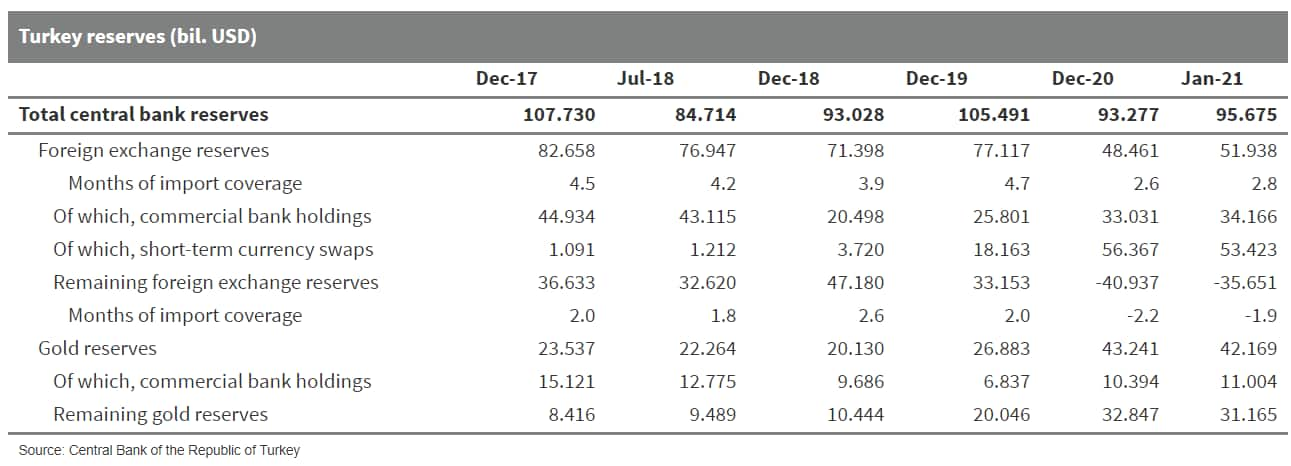

- The Central Bank of the Republic of Turkey (TCMB) held its main

policy rate unchanged at 17.0% at its regularly scheduled, 18

February meeting. Governor Naci Aǧbal has repeatedly promised that

monetary policy would remain restrictive throughout 2021, until

inflation began to decelerate. IHS Markit expects the rate to be

held steady at least until the third quarter. The further

acceleration of inflation could raise the risk of another rate

increase. (IHS Markit Economist Andrew Birch)

- Following the installation of current TCMB Governor Naci Aǧbal in early November 2020, the Bank raised the main policy rate at the subsequent two policy meetings by a total of 675 basis points. In the two most recent meetings, however, the rate has been kept unchanged.

- From October 2020 to January 2021, annual consumer price inflation jumped from 11.9% to 15.0%. In its press release alongside the February meeting, the TCMB acknowledges elevated inflationary pressures, deriving from domestic demand, exchange rate effects, rising global food and commodity prices, and growing consumer expectations. To battle these upward pressures on prices, the Bank pledges to maintain a tight monetary stance.

- IHS Markit is unsurprised that the TCMB held interest rates

unchanged at this meeting. There had been some risk of another rate

increase due to the faster-than-expected acceleration of inflation

in January. However, the prevailing rate of inflation remained 200

basis points below the level of the one-week repo rate.

- The monetary policy committee (MPC) decided to raise the Bank

of Zambia (BoZ)'s policy rate by 50 basis points to 8.5% during the

15-16 February meeting. The escalating inflationary pressures in

the economy underlined the interest rate decision. (IHS Markit

Economist Thea Fourie)

- High food prices combined with a strong feedthrough of the kwacha's weaker exchange rate on general price levels in the economy pushed Zambia's headline inflation rate to a four-year high of 21.5% year on year (y/y) during January, well above the BoZ's inflation target range of 6-8%. The BoZ expects headline inflation to remain above the upper end of the BoZ's inflation target range for the remainder of 2021 as currency and food-price pressures persist.

- Output in the mining, electricity, gas and water, and information and telecommunications sectors is expected to improve during 2021, supporting an overall recovery in GDP. Downside risks to the growth outlook prevail, of which the resurgence in COVID-19 cases and narrow fiscal space are the most prominent.

- Zambia's headline inflation is unlikely to move back into the BoZ's inflation target range of 6-8% during 2021, IHS Markit estimates show, but instead remain in double digits for the remainder of the year.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.7%, Mainland China +0.6%, Hong Kong +0.2%, Japan -0.7%, and India -0.9%.

- Tesla has launched a new program in China that allows owners of its electric vehicles (EVs) to try out its Enhanced Autopilot (EAP) functions free of charge. According to Tesla, customers who have their Tesla vehicles delivered before 15 February and did not purchase the EAP or Full Self Driving (FSD) features will be able to use EAP functions between 16 February and 26 February for free. Customers who placed orders for new vehicles before 27 February and have their vehicles delivered between 16 February and 30 June are also eligible to the free trial program for 30 days. The Autopilot feature, Tesla's driver-assistance system, comes as standard on all new Tesla vehicles. The EAP provides additional features, such as navigation-assisted driving for highways, auto lane changing, and auto parking. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Bloomberg reports that the pricing has been adjusted downward by as much as 24% in Japan. Bloomberg reports that the base price of the standard version of the Model 3 has been reduced to JPY4.29 million (USD40,720), from JPY5.11 million. The price of the Model 3 Long-Range version has been dropped by JPY1.56 million, to JPY4.99 million. There has been no change to the price of the Performance model, which is JPY7.17 million. According to IHS Markit's light-vehicle sales forecast, Tesla's sales in the Japanese market reached only 1,294 units in 2020, compared with 1,291 in 2017. The addition of the Model Y in the market in 2021 is forecast to help, although sales are forecast to reach only about 2,100 units this year and rise to 2,300 units in 2023, but not maintain that level. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Toyo Engineering has signed a collaboration agreement with Velocys Inc. (USA) to start the development of commercial projects to produce Sustainable Aviation Fuel (SAF) and other renewable fuels. This collaboration agreement combines Fischer-Tropsch Synthesis (FTS) using Velocys' microchannel technology and Toyo's experiences and achievements in plant engineering. Toyo, in collaboration with Velocys, will promote development, design, sales cooperation, project development, construction, and other project execution for commercial-scale facilities that produce SAF and other renewable fuels from woody biomass, municipal waste, and emitted carbon dioxide. In addition to Toyo and Velocys having broadened their alliance for other regions as preferred partners, the collaboration agreement will further help Toyo to strengthen its cooperation, including the exclusive license of Velocys technology in the Japanese market. (IHS Markit Upstream Costs and Technology's Ravi Rawat)

- South Korea's Kakao Mobility has received USD200 million in funding from investment firm The Carlyle Group, reports Pulse News Korea. This deal will bring Kakao Mobility's valuation to around KRW3.42 trillion (USD3.09 billion). The company will use the capital to strengthen new businesses and invest in technology development. Kakao Mobility, a subsidiary of Kakao Corporation, provides transportation services such as online taxi-hailing, parking, navigation, and electric bike sharing. The company offers these services through its app, KakaoT, which has 28 million registered users. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai has signed a memorandum of understanding (MoU) with South Korea's Ministry of Trade, Industry and Energy as well as Hyundai Glovis, LG Energy Solution and KST Mobility for a pilot battery lease program for electric taxis and the sustainable reuse of electric vehicle (EV) batteries in energy storage systems (ESS), according to a company statement. Under the MoU, Hyundai will oversee overall business operations while selling EVs to KST Mobility, a taxi operator. Twenty Hyundai Kona Electric taxis will be used in a pilot program starting next month. Hyundai is also responsible for providing battery warranty and replacement batteries for vehicles that return batteries after use. KST Mobility will sell the ownership of batteries in newly purchased EVs to Hyundai Glovis, the battery lessor. The taxi operator then pays a monthly fee for battery usage, which could lower the upfront cost of EV purchases. LG Energy Solution will analyses safety and residual value by purchasing batteries after use. It will also install these batteries into ESS units for fast-charging service and sell them to KST Mobility to use the chargers for its fleet of EV taxis. The driving and battery data from these EVs are shared with all parties under the MoU. The Ministry of Trade, Industry and Energy plans to actively support the project in consultation with relevant ministries. (IHS Markit AutoIntelligence's Jamal Amir)

- Bank Indonesia's (BI) Board of Governors cut its policy rate -

the seven-day reverse repurchase (repo) rate - on 18 February by 25

basis points to 3.50%, while simultaneously trimming 25 basis

points from the Deposit Facility rate (now 2.75%) and the Lending

Facility rate (now 4.25%). BI has now lowered the policy rate by

150 basis points since the start of the COVID-19 pandemic, with the

first rate cut arising a year ago. (IHS Markit Economist Bree Neff)

- The decision to cut was supported by the weak fourth-quarter 2020 GDP data as well as the sustained weakness in consumer price inflation. In particular, the central bank's official post-decision press release indicated that increased Large-Scale Social Restrictions (PSBB) introduced primarily around Jakarta during the fourth quarter of 2020 weighed on private consumption and building investment.

- Also discouraging since the GDP release earlier this month has been the evidence of sustained weakness in the recently published January 2021 data for consumer confidence, which dipped because of the introduction of broader public activity restrictions (PPKM) for large portions of Java and Bali in January.

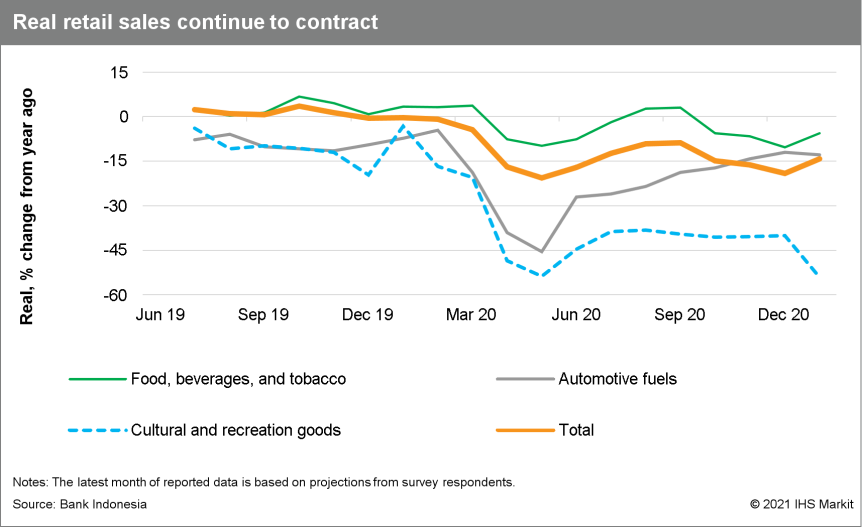

- Retail sales remain firmly in contraction in year-on-year (y/y) terms, with the PPKM further denting estimated spending on cultural and recreation goods during the month.

- As part of BI's forecast revisions, the credit growth forecast

was also downgraded to 5-7% for 2021 from 7-9% previously. Lending

contracted by 1.9% y/y in January 2021, up only marginally from

-2.4% y/y in December 2020 and well below deposit growth of 10.6%

y/y.

- The government of Indonesia will temporarily suspend the luxury tax on passenger vehicles with engines smaller than 1500 cc for three months between March and May in a bid to boost vehicle sales in the country, reports Reuters. The current luxury tax rate for such vehicles ranges from 10-30% of the vehicle's cost. Between June and August, the government will give a 50% discount on luxury tax payments. This will be halved again in the subsequent three months, said the coordinating ministry of economic affairs, adding that the scheme would be evaluated every three months. After a 48.5% year-on-year (y/y) plunge in 2020, wholesale new vehicle sales in Indonesia nosedived by 34.2% y/y to 52,910 units during January 2021, according to data from the Association of Indonesia Automotive Industries (IHS Markit AutoIntelligence's Jamal Amir)

- VinFast plans to install more than 2,000 electric vehicle (EV) charging stations with more than 40,000 charging ports across Vietnam in 2021, according to a company statement. These charging stations will be installed in car parks of apartments, office buildings, commercial centers, supermarkets, bus stations, public car parks, universities, and colleges, among others. The charging stations are developed by VinFast and meet European standards. They are operated through the VinFast application. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-february-2021.html&text=Daily+Global+Market+Summary+-+19+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 19 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+19+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}