Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 22, 2021

Daily Global Market Summary - 22 February 2021

All major European and most APAC and US equity indices closed lower today. US government bonds closed lower, while benchmark European bond were higher. European iTraxx and CDX-NA credit indices closed modestly wider across IG and high yield. The US dollar closed lower, while oil, gold, silver, and copper were all higher on the day.

Americas

- Most US equity markets closed lower except for DJIA +0.1%; Nasdaq -2.5%, S&P 500 -0.8%, and Russell 2000 -0.7%.

- US technology stocks fell sharply on Monday as rising inflation expectations and long-term interest rates undercut arguments for their high valuations. (FT)

- 10yr US govt bonds closed +2bps/1.36% yield and 30yr bonds +5bps/2.18% yield.

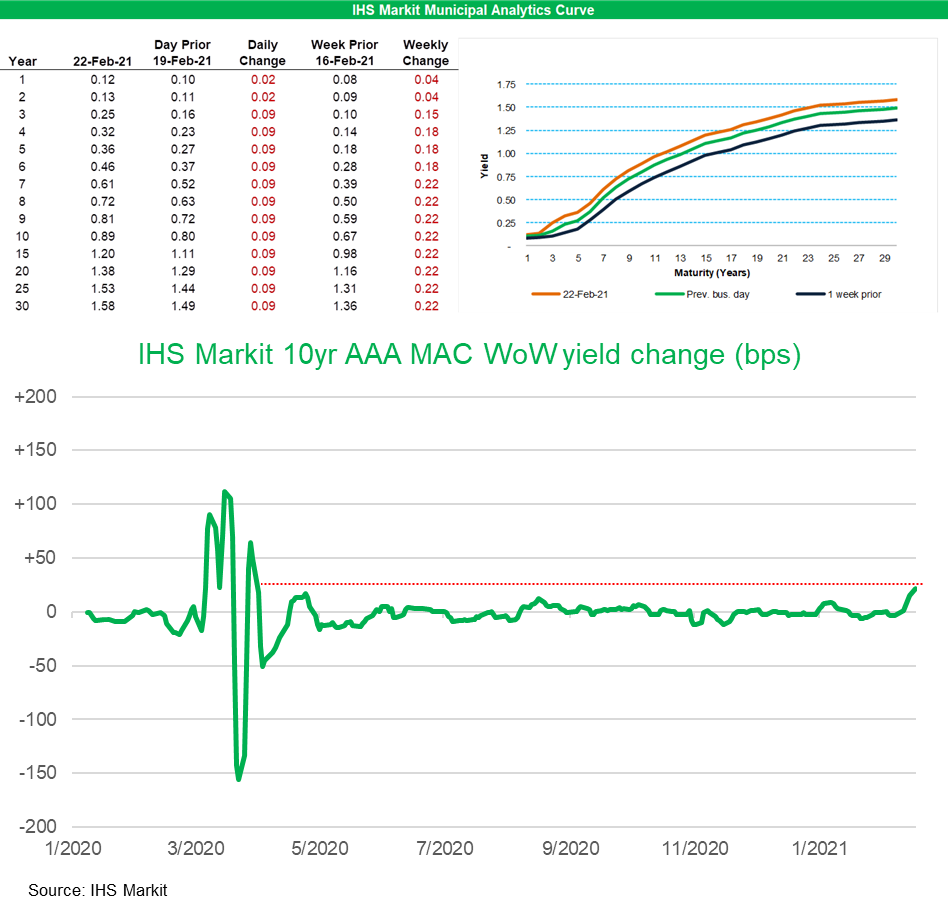

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

yields increased sharply today, closing +9bps for 3yr and longer

paper and is now +22bps week-over-week for ≥7yr paper (top

table/chart). Today's close is the largest week-over-week increase

in yields for 10yr AAA tax-exempt municipal bonds since 3 April

(bottom chart).

- CDX-NAIG closed +2bps/54bps and CDX-NAHY +8bps/303bps.

- DXY US dollar index closed -0.4%/90.01.

- Gold closed +1.7%/$1,808 per ounce, silver +3.1%/$28.09 per ounce, and copper +1.7%/$4.14 per ounce. Copper closed at the highest price since September 2011.

- Crude oil closed +4.1%/$61.70 per barrel.

- The US Conference Board's indicator of future growth continued to rise in January, increasing 0.5%. The index has regained more than three quarters of the level lost during March and April 2020 and is 1.4% beneath its February 2020 level. The four components making the largest positive contributions to the index's growth in January were building permits, the average workweek of manufacturing production workers, the ISM New Orders Index, and the interest rate spread on 10-year Treasury bonds. The drags on the index came from average weekly initial claims of state unemployment insurance, average consumer expectations for business conditions, and manufacturers' new orders of nondefense capital goods excluding aircraft. (IHS Markit Economist Gordon Greer)

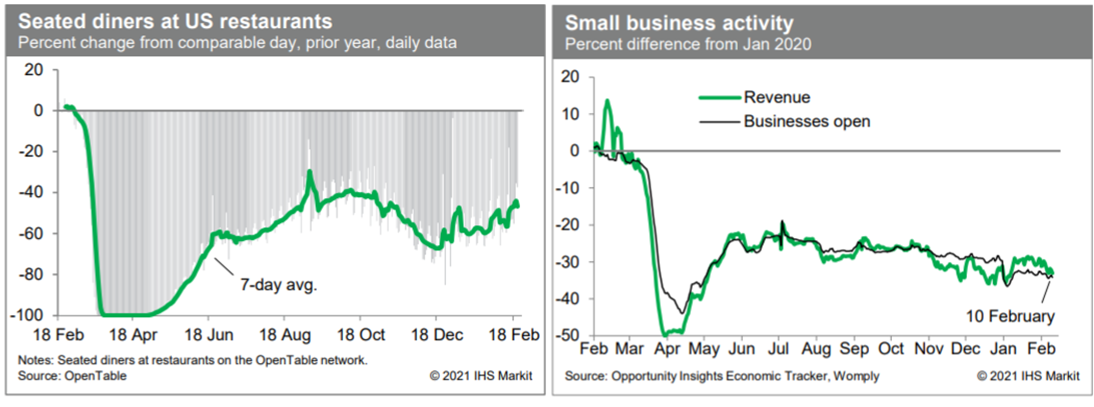

- The trend in seated diners at US restaurants has improved in

recent days, but recovery in the restaurant industry still has a

long way to go. Meanwhile, activity at small businesses (both

revenue and the number open for business) remained weak in early

February, according to the Opportunity Insights Economic Tracker.

There is no sign yet of even the beginning of a sustained recovery

in this sector. (IHS Markit Economists Ben Herzon and Joel

Prakken)

- Apple is reportedly in discussions with multiple suppliers to procure LiDAR sensors for its autonomous vehicle (AV) division. LiDAR sensors are necessary for AVs as they measure distance via pulses of laser light and generate 3D maps of the world around them. Apple is looking to outside vendors to supply hardware, as it has developed most of the software, underlying processors, and artificial intelligence algorithms necessary for its AV project, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) registrations in the US reached a record 1.8% market share in 2020, according to IHS Markit's research. In December 2020, the share reached a new monthly peak of 2.5%. Increased EV choice and availability contributed to the improvement in market share. Automakers are increasing investment in EVs, including all-electric vehicles, which are analyzed in the article, as well as other forms of electrified propulsion systems, and an increase in market share is a step forward in the evolution of the market. Increased EV choice and availability, as well as consumer education and awareness regarding electrified vehicles, are all contributing to the change. In addition, charging infrastructure is improving slowly and automakers are aiming programs at creating a rewarding EV ownership experience. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The JD Power annual vehicle dependability results are in, measuring 2018 model year vehicles, three years into ownership. In 2021, average PP100 declined by 13PP100, compared with only 2PP100 and 6 PP100 improvements in 2020 and 2019 results, respectively. Lexus reclaimed its position as the most reliable brand, for the ninth time in the past 10 years. Toyota, offering vehicles in nearly every segment measured, took home more segment awards than others (five); GM and Hyundai followed with four each. JD Power notes that the pace of improvement continues to slow, and although in-vehicle technology shows greatest improvement as well as accounting for the most PP100. Study results do not necessarily reflect market sales performance, however. While brand image may be burnished by strong performance, repeat strong ratings here do not predict or reflect market performance. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Environmentalists have urged the US Court of Appeals for the Ninth Circuit to vacate EPA's registration of the insecticide sulfoxaflor, arguing the agency failed to ensure legal uses won't harm endangered species and don't pose unreasonable risks to honeybees and other pollinators. The petition for review challenges EPA's 2019 decision to allow spraying of sulfoxaflor on an array of crops and continues a legal dispute over the agency's review of the insecticide that stretches back several years. The Center for Food Safety and Center for Biological Diversity contend EPA has repeatedly failed to adequately assess the risks from sulfoxaflor and ignored evidence of harm to honeybees, alleging violations of the Endangered Species Act (ESA) and the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA). EPA is scheduled to file its response with the court by March 30. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Chemical production along the US Gulf Coast (USGC) remained

largely offline Friday morning, but with the winter storm passing

and temperatures on the rise, producers will be turning their

attention to restoring operations. The precise timing will be

difficult to gauge, however. (IHS Markit Chemical Advisory)

- IHS Markit estimates that about 76% of US toluene capacity has been either shut down or operating at reduced rates. At least 74% of US benzene production capacity has been either shut down or curtailed, and the figures are even higher for derivatives—79% of styrene capacity, 89% of cumene capacity, and 100% of cyclohexane capacity.

- The picture is similar for olefins, with 62% of US ethylene capacity offline and 66% of US polymer/chemical-grade propylene offline.

- IHS Markit says the vast majority of polyethylene and polypropylene lines have been down since Sunday, and they are not expected to return to service until the middle of next week. At least half of chlor-alkali and vinyls capacity on the USGC could be out of service.

- Sherwin-Williams (SW) today announced the sale of Wattyl, a division of the company active in the architectural and protective paints market in Australia and New Zealand, to Hempel. Terms of the deal, including purchase price, were not disclosed. Wattyl generates around $200 million/year in revenue and has 750 employees. SW acquired Wattyl in 2017 as part of its acquisition of Valspar. The business has reported results as part of SW's consumer brands segment. (IHS Markit Chemical Advisory)

- According to the most recent data released by the Colombian National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística: DANE), Colombia's economy contracted by 6.8% in 2020. This contraction is slightly less severe than expected and will result in a smaller rebound effect, lowering IHS Markit's forecast growth rate in 2021; pre-COVID-19-virus levels are still not expected until the end of 2022. (IHS Markit Economist Lindsay Jagla)

- Brazilian financial markets sold off sharply on Monday, as investors sold the country's currency and stocks, while pushing up interest rates, after President Jair Bolsonaro moved late on Friday to replace the head of state-run oil firm Petrobras following weeks of clashes over fuel price hikes. (Reuters)

- Brazil's 5yr CDS closed +20bp/184bps and are now at the widest spread since 6 November. (IHS Markit Financial Market's Gavan Nolan)

Europe/Middle East/Africa

- European equity markets closed lower; Italy -0.6%, Spain -0.5%, Germany -0.3%, UK -0.2%, and France -0.1%.

- 10yr European govt bonds closed higher; France/Germany/Spain -3bps and UK/Italy -2bps.

- iTraxx-Europe closed +1bp/49bps and iTraxx-Xover +5bps/251bps.

- Brent crude closed +2.3%/$64.36 per barrel.

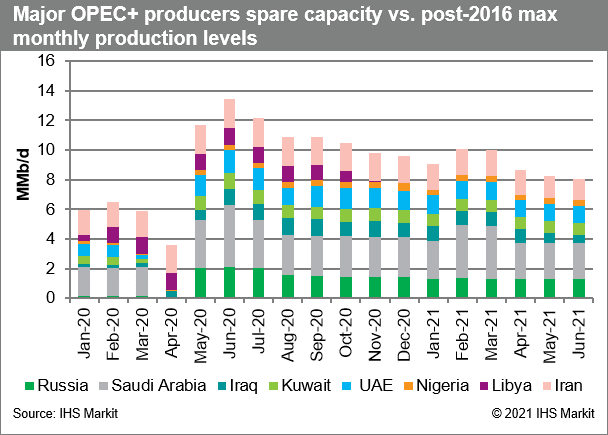

- OPEC+ schedule moves to the fore. Brent tip toeing at $65/bbl,

technical charts showing the way higher and a growing chorus of

$70+/bbl prognosticators are raising the pressure thin OPEC+ to

increase production, with the next meeting on 4 March. Saudi

Arabia's unilateral 1 MMb/d cut is set to expire in April, pointing

to at least 2 MMb/d in incremental crude output in the second

quarter should a return of voluntary cuts dovetail with a broader

collective unwinding. Ultimately, at least 2 MMb/d of OPEC+ oil is

forecast to come back to the market through June. Physical crude

markets are tightening, both in terms of visible inventories in the

US and in the shape of forward curves. Brent prompt contracts for

April trade $3.43/bbl higher than contracts six-months out, the

highest since 2018 - a year that saw Brent test $80/bbl. When April

WTI rolls to the front this week, the six-month WTI curve will be

trailing at $2.91/bbl, but should be finally showing a healthy

backwardation, if it holds. More Saudi barrels will put the oil

rally, and by proxy the global recovery, to the test. We think this

oil will come just in time, as vaccinations ramp up, pumping more

confidence into the markets, to keep oil prices at current levels.

After the freeze-induced trading frenzy subsided last week, oil

prices fell for the first time in three weeks on Friday. Some of

this is an acknowledgement of more supply that will soon flow to

market, but we do not see significant immediate catalysts to spur a

significant downside correction. (IHS Markit Energy Advisory's

Roger Diwan, Karim Fawaz, Sean Karst, and Edward Moe)

- Bentley has announced a three-year research program with multiple industry and academic partners, focusing on the sustainability of electric motors in automotive applications, according to a company press statement. The program is aimed at supporting Bentley's recently announced strategy of offering only full battery electric vehicles (BEVs) or plug-in hybrids (PHEVs) by 2026. The program is titled RaRE (Rare-earth Recycling for E-machines) and intends to build on work completed at the University of Birmingham in devising a method of extracting magnets from waste electronics. Bentley is looking to eventually scale up this process and repurpose the extracted magnetic material into new recyclable magnets for use within bespoke ancillary motors. (IHS Markit AutoIntelligence's Tim Urquhart)

- In February, Germany's headline Ifo index, which reflects

business confidence in industry, services, trade, and construction

combined, has unwound the previous month's two-point dip to 90.3

(revised up from 90.1). (IHS Markit Economist Timo Klein)

- At 92.4, it has reached its highest level since October 2020, broadly recovering from the interim downward correction that had followed the May-September rebound because of the second wave of the pandemic.

- Nevertheless, the headline index remains below the February 2020 pre-pandemic level of 95.7 and also its long-term average of 97.0.

- The Ifo institute highlight the robustness of the German economy despite the ongoing strict lockdown and that this owes particularly to industry.

- The Volkswagen (VW) Group's Wolfsburg plant is facing another production constraint in the form of tight supplies of battery packs for the hybrid Golf in addition to the existing situation with semiconductor shortages. According to a Bloomberg report, the company has a very high number of advanced orders for the plug-in hybrid (PHEV) version of the Mark 8 Golf, which the limits of battery pack supply could affect in terms of customer delivery lead times. According to the head of VW's Works Council Bend Osterloh, who always keeps a close eye on events at VW's biggest manufacturing plant, the company currently has 93,000 advanced orders for the Mark 8 Golf which are to be built at Wolfsburg. This translates to four full months of production; 60% of advanced orders in Germany are the hybrid models while 40% of the total European order book is for the PHEV. Osterloh made the claim about the limited supply of the PHEV Golf's battery pack in an interview with Braunschweiger Zeitung which was reported by Bloomberg. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volkswagen (VW)'s all-electric free-floating car-sharing service WeShare will begin operations in the German city of Hamburg this week. The automaker postponed the launch of this service several times due to the COVID-19 virus pandemic. WeShare is the first service offered under the "Volkswagen We" ecosystem, which is a digital platform that combines all digital mobility services and apps. VW first launched WeShare in Berlin (Germany) by deploying 1,500 units of the e-Golf. The company claims that the WeShare service in Berlin has around 100,000 registered customers and 50% of these registered customers are active users. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Bosch has announced its collaboration with Microsoft for the development of a software platform for connecting vehicles to the cloud, reports Zawya. The software platform, which is based on Microsoft Azure, aims to accelerate the development and deployment of vehicle software during the vehicle's entire lifetime, while complying with automotive quality standards. The platform will help to integrate software modules from Bosch, allowing development and download of software to the control units and vehicle computers. With this collaboration, the companies intend to make the platform available for first vehicle prototypes by the end of 2021. (IHS Markit AutoIntelligence's Tarun Thakur)

- Continental has announced it will not offer a dividend for its 2020 financial year because it has posted a net loss for the year, according to a company statement. The company will release preliminary full-year results on 9 March, and it stated that it remained committed to a mid-term dividend policy of paying out 15-30% of net income to shareholders. (IHS Markit AutoIntelligence's Tim Urquhart)

- In mid-February, National Bank of Tajikistan Chairman

Kholiqzoda Hokim reported that Tajik GDP grew by 4.5% in 2020 as a

whole. The report was in line with previously reported partial-year

data from the Bank. (IHS Markit Economist Andrew Birch)

- This reported strong economic growth is likely inflated and only reflects the official economy. The spread of COVID-19 certainly heavily curtailed black market activity, particularly among the border, shuttle trade that is prominent for the country.

- According to officially reported data, a vigorous, 9.7% expansion of industrial production and a strong, 8.8% rise in agricultural production supported headline economic growth.

- Average annual inflation for 2020 as a whole was 9.4%, accelerating from previous years. According to Hokim, supply-side pressure due to COVID-19 was the primary cause for the acceleration. Elevated inflation triggered a devaluation of the Tajik somoni in November, by 8.5% against the US dollar. Trading at TJS11.3/USD1 at the end of 2020, the currency depreciated by a total 16.6% against the dollar over the course of the year.

- Israel's real GDP fell only 2.4% in 2020, one of the smallest

contractions among OECD countries and globally. Growth in 2021 will

be impacted by the shutdown in the first quarter; however, Israel's

vaccination program and a potential new treatment, if effective in

reducing virus cases and restrictions on economic activity, could

permit a faster recovery. (IHS Markit Economist Ana Melica)

- The largest decline in 2020 came from private consumption (-9.4%) given shutdown measures that impacted retail, dining, and other spending activities. This was followed by fixed investment (-4.6%). GDP was aided by the sharp drop in imports (-8.4%) and by exports, which actually grew 0.9%.

- Government consumption was also a key driver, rising 3.0%. However, it expanded at a pace similar to recent years (not notably faster despite additional COVID-19-related spending), as a decline in the first quarter partly offset increased government consumption in the remaining quarters.

- The IMF board's approval could secure the USD320-million ECF

for the Madagascan government in the near term. The IMF financial

package would support the government's post-COVID-19 economic

recovery program and free up fiscal space for future investment and

social spending. (IHS Markit Economist Thea Fourie)

- Fiscal policies will be geared towards the enhancement of revenue flows through revenue efficiency, while government spending will focus on limiting transfers, particularly to state-owned entities, and better budgeting of public-sector wages and pension payments. State electricity and water company JIRAMA's financial and operational recovery plan will be prioritized, while cost recovery prices for fuel will be maintained.

- A stronger monetary framework will focus on the transition to interest targeting, increase the efficiency of the foreign-exchange market, strengthen financial sector stability and development, and favor financial inclusion.

Asia-Pacific

- Most APAC equity markets closed lower except Japan +0.5%; India -2.3%, Mainland China -1.5%, Hong Kong -1.1%, South Korea -0.9%, and Australia -0.2%.

- The China Banking and Insurance Regulatory Commission (CBIRC)

issued the final version of the internet lending rules on 19

February. The rules will come into force from the beginning of

2022, and financial institutions will need to adhere and fully

implement them by July 2022. There are four main rules (IHS Markit

Banking Risk's Angus Lam):

- Online platforms will need to contribute at least 30% of the joint loan (with banks) distributed online.

- The maximum amount of a loan allowed for a bank with a single online platform must be less than 25% of the bank's tier-1 capital.

- Loans distributed online with online platforms should not be more than 50% of the bank's total assets.

- Local private-sector banks are not allowed to use online lending platforms to expand their geographic serving area beyond their local registered area.

- Geely is planning to set up a dedicated company to explore new approaches to product planning, marketing and sales for electric vehicle (EVs), reports Reuters, citing sources familiar with the matter. The automaker will establish a company called Lingling Technologies this year to manage models based on the Sustainable Experience Architecture (SEA), its EV platform. The new company is expected to take over sales and marketing activities of SEA-based EVs under the Lynk&Co brand, including the upcoming Zero EV, as well as new models from the Geometry brand. Geely had not commented on the report, at the time of writing. Geely is expected to launch its first SEA-based model, the Lynk&Co Zero EV in the first half of the year. The Zero EV will be a critical product for Geely; as the first one based on the group's SEA platform, it will showcase Geely's technology capacities in the field of electrification. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Foxconn Technology Group (Foxconn) said that new electric vehicles (EVs) based on its new EV platform will be launched later this year, reports Bloomberg. Two EVs will be unveiled in the fourth quarter, according to Young Liu, chairman of Foxconn's parent company Hon Hai Precision Industry, speaking to reporters at the company's headquarters in suburban Taipei on 20 February. The company may also help launch an electric bus around the same time, according to Liu. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Toyota has announced another production suspension in its Japanese plants for the second time in two weeks after a strong earthquake hit the country earlier this month. According to a company press statement, of the total 28 assembly lines at its 15 plants, Toyota will suspend operations on 12 production lines at eight plants on 22 and 23 February. The plants affected by this production suspension include Takaoka, Tahara, Miyata, Fujimatsu, Yoshiwara, Gifu, and Hamura. Among the vehicles whose production will be affected are the Toyota Harrier, Prius, RAV4, Prado, and the Lexus NX, UX, LS, IS, RC, and CT, among others. The automaker has not revealed how much production will be lost as a result of this suspension. IHS Markit currently forecasts a production loss of around 30,000 units for Toyota during February as a result of the two suspensions announced this month. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- SsangYong has again extended a production suspension at its Pyeongtaek plant from 22 to 24 February owing to a lack of parts from suppliers, reports the Yonhap News Agency. The automaker already halted operations at its plant on 24 and 28 December, 3-5 February, 8-10 February, and 15-19 February after its subcontractors refused to deliver parts because of outstanding payments. The automaker will continue to negotiate with subcontractors to resume the halted supply of auto components. (IHS Markit AutoIntelligence's Jamal Amir)

- With the Chinese ban on Australian coal cargoes looking unlikely to end any time soon, four ships laden with Australian coal which waited for several months at the Chinese anchorage finally were diverted to discharge in India. Due to ongoing import restrictions at the Chinese ports on Australian coal cargoes there was an increase in January 2021 of coal arrivals into India from Australia (8.2mt, up 64% y/y) but slowed down from Indonesia (8.5mt, down 22% y/y) and South Africa (2.9mt, down 37%). There was an increase in coal arrivals from Australia, both thermal as well as metallurgical coal, and stood at 2.7mt (versus 0.2mt in the previous year) and 5.5mt (versus 4.8mt), respectively. (IHS Markit Maritime and Trades' Pranay Shukla)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-february-2021.html&text=Daily+Global+Market+Summary+-+22+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}