Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 22, 2021

The Quiet Revolution: A Decade of Transformation in Leveraged Loans

It is fair to say the reputation of the leveraged loan market is not one of innovation and automation. The perception persists of an industry characterized by old-fashioned paper trails, faxes and emails. We hear about market participants working in silos, with limited data and little collaboration on foundational activities. But is this perception fair? The answer is complex but, generally speaking, the majority of market participants enjoy advanced levels of automation and the business benefits that this brings. In this blog, we take a look back at some of the key milestones of the past decade that have set the industry on the path of automation and we look forward to some key technology developments on the horizon.

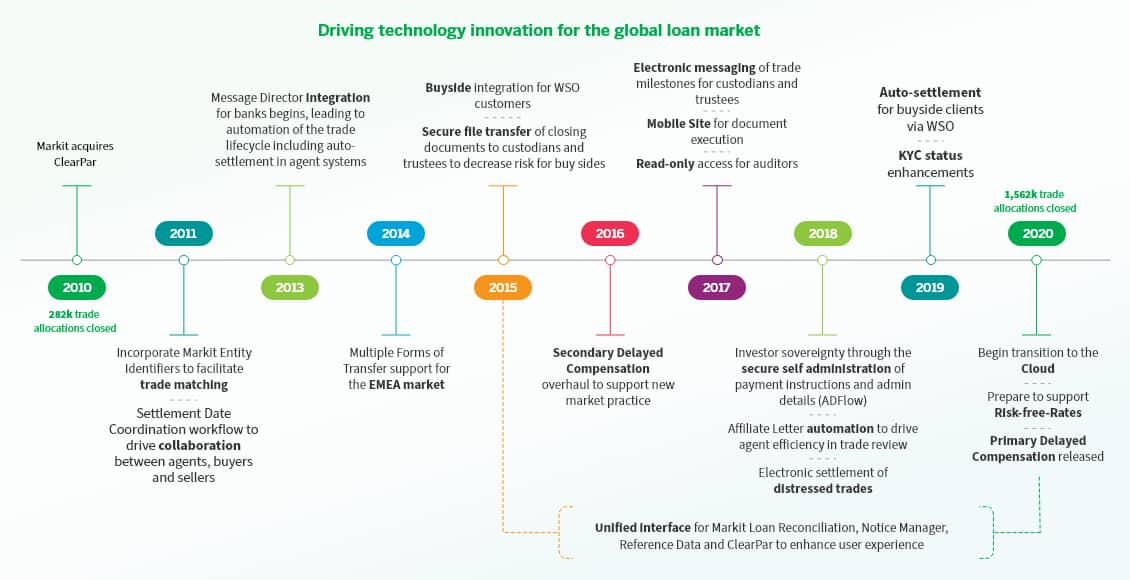

The last decade has seen the transformation of trade settlement through the end-to-end automation of the process, with our ClearPar platform playing a central role in this evolution. In the last ten years, the number of trades settled has quintupled and market participants now number in the thousands rather than the hundreds. This huge growth has been supported by enterprise-grade processing power; the rise of managed services; and a drive to digitize and automate trade documents, data, wire generation and workflows. Here are just a few key milestones in the development of ClearPar:

ClearPar milestones, 2010-2020

What do these milestones mean in practice for our clients? Well, hundreds of millions of API calls made via our platform mean that our clients, large and small, consume vast amounts of highly actionable trade data and customize their own workflows to suit their priorities. Let's take another example - the automation of Standard Settlement Instructions. This development puts investors in the driver's seat for payment instructions - a key area of risk as billions of dollars for trade proceeds, interest and principal paydowns flow between market participants daily.

Clients that have invested in these tools and others have beaten the market in settlement times, overhauled their operations and markedly improved their risk management profiles. We will dive into some of these tools and how they are used in the real world in future pieces.

In addition to ClearPar, our managed service for client onboarding has yielded double-digit improvements in settlement times for large clients, while our reference data for LIBOR replacement (LiRD) delivers key insights into the fallback provisions for over eight thousand facilities to leading asset managers.

The decade ahead

As we look to the next ten years, there is even better news on the horizon. With the foundation we have established, we are now in a strong position to increase the velocity of transformation in the loans space.

Looking to the immediate future, our 2021 roadmap includes a strategic project to move our data centres to the Amazon Web Services (AWS) cloud. This is a significant effort and one that will deliver greater resiliency and speed to the market.

Longer term, we are focused on bringing even greater scale to our clients. What would we, in conjunction with our partners, need to do in order to support the market if it were to double or triple in size? Perhaps the best indication lies far away from the high-volume, highly-traded US market, weighted as it is by complicated, legacy market practices. Last summer, we entered into a partnership with iLex to enable the development of a fully automated market in the Asia-Pacific region. This will span from syndication through to execution and settlement, with the aim of boosting liquidity and efficiency for the corporate loan market. You can read about it here and watch our recent webcast here.

Is this the future of the global loans market? It is too early to tell, but we are committed to challenging the status quo and collaborating with clients and partners to bring greater automation and efficiency to the industry. Look out for our next blog, which will dive into some of our innovations in more detail.

Learn more about our solutions for the automation and settlemt of loans.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-decade-of-transformation-in-leveraged-l.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-decade-of-transformation-in-leveraged-l.html&text=The+Quiet+Revolution%3a+A+Decade+of+Transformation+in+Leveraged+Loans+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-decade-of-transformation-in-leveraged-l.html","enabled":true},{"name":"email","url":"?subject=The Quiet Revolution: A Decade of Transformation in Leveraged Loans | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-decade-of-transformation-in-leveraged-l.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Quiet+Revolution%3a+A+Decade+of+Transformation+in+Leveraged+Loans+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-decade-of-transformation-in-leveraged-l.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}