Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2021

Daily Global Market Summary - 23 February 2021

Major APAC, European, and US equity indices closed mixed across regions, with the US markets having a particularly challenging morning as the recent rise in rates and increased inflation expectations continue to weigh on the market. US government bonds closed almost unchanged, while European bonds were lower. European iTraxx closed slightly wider across IG and high yield and CDX-NA was tighter. The US dollar, Brent, and copper were higher, WTI flat, and gold and silver were lower on the day.

Americas

- US equity markets closed mixed after a roller coaster ride of a day; DJIA/S&P 500 +0.1%, Nasdaq -0.5%, and Russell 2000 -0.9%. The Nasdaq and Russell 2000 were down as much as 3.9% and 3.6%, respectively, around 9:45am EST.

- Federal Reserve Chairman Jerome Powell kicked off the turnaround in today's US equity market, after a sharp sell-off shortly after the open, by tamping down inflation worries that had reared from a recent rise in bond yields. (WSJ)

- 10yr US govt bonds closed -1bp/1.35% yield and 30yr bonds flat/2.18% yield.

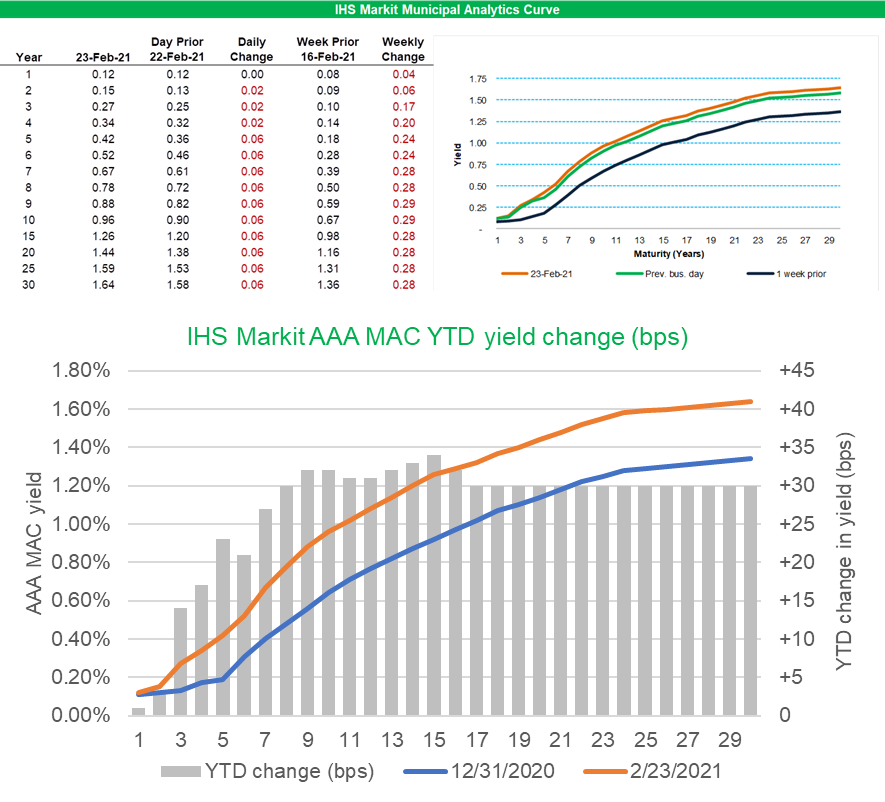

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

yields increased again today, closing +6bps for 5yr and longer

paper and is now almost +30bps week-over-week for ≥7yr paper (top

table/chart). Today's close resulted in ≥7yr paper yields being

30bps or more higher year to date (bottom chart).

- CDX-NAIG closed -1bp/53bps and CDX-NAHY -6bps/297bps.

- DXY US dollar index closed +0.2%/90.17.

- Gold closed -0.1%/$1,805 per ounce, silver -1.4%/$27.69 per ounce, and copper +1.0%/$4.18 per pound (highest close since August 2011).

- Crude oil closed flat/$61.67 per barrel.

- The decline in Covid-19 fatalities is exceeding expectations in the U.S., and virus modelers are revising forecasts to reflect a more optimistic outlook heading into March. The country is expected to have about 7,922 such deaths in the week ending March 20, the lowest since the first week of November, according to the University of Massachusetts' Reich Lab Covid-19 Forecast Hub, which issued a 28-day forecast on Tuesday based on dozens of independent models. (Bloomberg)

- The US Conference Board Consumer Confidence Index rose 2.4

points (2.7%) in February to 91.3. Although a three-month high, the

reading was still meaningfully below the October 2020 reading of

101.4. (IHS Markit Economists David Deull and James Bohnaker)

- The February increase in the headline index was driven by views on the present situation. The current conditions index rose 6.5 points to 92.0, reversing a January dip, while the expectations index slipped a marginal 0.4 point to 90.8. The gap between the two, which was wide prior to the pandemic, has essentially collapsed.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) rose 3.2 points to 0.7%. Views on the labor market have been nearly balanced between positive and negative since June.

- Purchasing plans declined in February. The share of respondents planning to buy autos in the next six months slipped 0.8 percentage point to 10.2%, while the share planning to buy homes fell 1.5 points to 5.9%. The share with plans to purchase major appliances fell 4.7 percentage points to 44.0%, close to the recent low.

- Despite sharply reduced rates of new COVID-19 infections this month, broad strength in equity markets since early November, and relief payments issued to qualifying Americans in early January, consumer confidence has seen only marginal improvement. Consumers are unlikely to show a significant shift in attitudes, and the attendant spending patterns, until the pandemic is truly under control.

- The Federal Housing Finance Agency (FHFA) House Price Index

(purchase-only) soared 3.8% in fourth quarter from the third

quarter, the largest quarterly gain on record, breaking the record

set the previous quarter. The index dates to 1991, but even if it

dated back to 1891, the 3.8% increase would still likely be a

record. (IHS Markit Economist Patrick Newport)

- The purchase-only index was up 10.8% from a year earlier, also a record.

- Prices were up from a year earlier in all 50 states. Idaho (21.1%), Montana (15.5%), and Utah (15.4%) saw home prices rise the fastest; home price growth was slowest in Louisiana (5.9%), Hawaii (6.1%), and North Dakota (6.7%). Thirty-five states saw double-digit growth.

- Home prices were also up in all 100 of the largest metropolitan areas, with Boise City, Idaho (prices up 23.4%) leading the pack and San Francisco-San Mateo-Redwood City, California (up 2.4%) in last place.

- Adjusted for inflation, the national index and all nine division indexes are at all-time highs for the first time ever.

- Inventory keep shrinking, which will fuel home price growth in the first quarter of this year.

- Goodyear Tire has agreed to acquire Cooper Tire, in a deal expected to create opportunities for cost efficiency and widen the tire offering for each company's distribution networks, according to a company statement. The proposed transaction has been approved by the boards of both companies. According to a joint statement, once the transaction is closed, Goodyear shareholders will own about 84% of the combined company and Cooper shareholders will own about 16%. Cooper shareholders will receive about USD41.75 per share in cash and a fixed ration of 0.907 shares of Goodyear common stock. Goodyear says the transaction will expand its product offering with complementary tires from Cooper, as well as creating a stronger US-based manufacturing footprint and larger distribution and retail channel distribution. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lucid Motors has announced an agreement with Churchill Capital Corp IV (CCIV) to go public, in a special purpose acquisition company (SPAC) merger deal due to be closed in the first quarter. According to a joint statement, the transaction will include a USD2.1-billion cash contribution from CCIV and USD2.5 billion in formally committed public investment in private equity (PIPE). Lucid says the PIPE investment includes an investor lock-up provision which binds holders "well beyond" closure of the deal, or specifically until 1 September 2021 or the date the PIPE shares are registered, whichever is later. The Lucid and CCIV combined company is claimed to have a transaction equity value of USD11.75 billion. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Central Reserve Bank of Peru (Banco Central de Reserva del

Perú: BCRP) has reported a current-account surplus worth 0.5% of

GDP in 2020 as improvements in the trade and primary income

balances more than compensated for worsening of the services

balance. Copper prices are high and trending upwards, offering an

upside for 2021. (IHS Markit Economist Jeremy Smith)

- Peru's terms of trade improved by 8.2% in 2020, allowing the merchandise trade surplus to widen even though export volumes fell further than import volumes. The price of mineral products, which account for around 60% of Peru's exports, fell sharply in the first quarter but rebounded strongly in the second half of the year.

- The services deficit widened considerably, caused in particular by a collapse in travel receipts, which were negligible for the final three quarters and down by 79% for the year.

- Corporate profits of foreign investors fell sharply amid the economic downturn, reducing outflows and improving the primary income deficit by more than USD4 billion. Nonetheless, by the fourth quarter results were comparable to those in 2019 as the mining sector recovered amid rising export prices.

- The BCRP's large stockpile of foreign-exchange reserves increased by a further 9.4% in 2020, bringing the total value to USD74.7 billion, or 37% of GDP.

- Peru's current-account balance has significant upside potential for 2021. The trade surplus could be even larger than in 2020 as copper prices continue to rise, reaching a 10-year high in mid-February, while production volume nears pre-COVID-19-virus crisis levels

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +1.7%, France/UK +0.2%, Italy -0.3%, and Germany -0.6%.

- 10yr European govt bonds closed lower; Italy/Spain +5bps, UK +4bps, and Germany +2bps.

- iTraxx-Europe closed +1bp/49bps and iTraxx-Xover +4bps/255bps.

- Brent crude closed +0.2%/$64.48 per barrel.

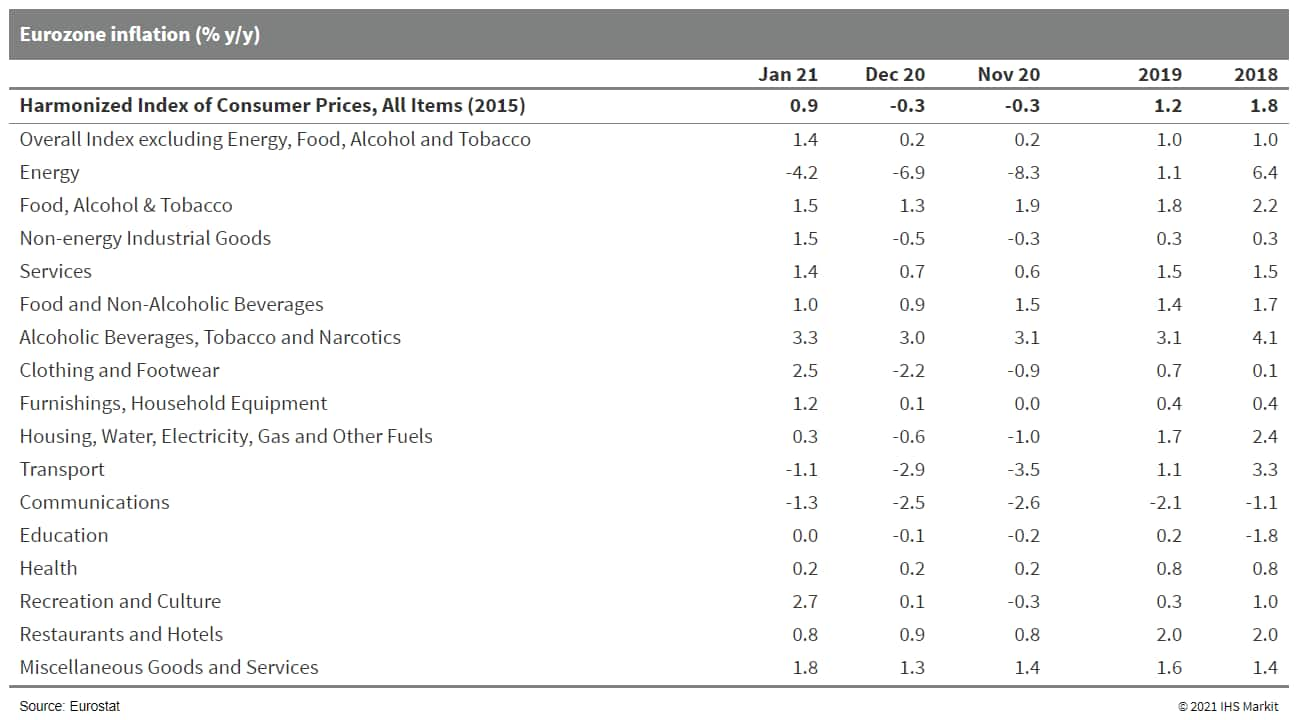

- Eurostat's final HICP release has confirmed the jump in

January's headline inflation rate to 0.9%, following five months of

sub-zero rates. The 1.2 percentage point surge represents the

sharpest one-month acceleration in the history of the series by

some distance. (IHS Markit Economist Ken Wattret)

- The jump in the inflation rate excluding food, energy, alcohol, and tobacco prices to 1.4% was also confirmed, following four months at just 0.2%, a record low. Again, the 1.2 percentage point jump was the highest on record by some distance.

- Both inflation rates surpassed the initial market consensus expectation by around half a percentage point.

- The recent upward pressure on headline inflation from energy

prices has further to go. From February to May 2021, base effects

will continue to lean upwards, reflecting the pronounced COVID-19

virus-driven declines in oil prices in the equivalent period of

2020.

- The European soft drinks industry's Circular Packaging Vision 2030 has been announced by UNESDA, the European Soft Drinks Association. The industry has committed to 100% recyclable packaging by 2025 and that its PET bottles will use 50% recycled content. Its aim is for bottles made of 100% recycled and/or renewable PET, where technically and economically feasible, by 2030. It also pledges that more than 90% of its packaging will be collected and that it will use more refillable packaging. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- A strong recovery in demand, combined with continued

cost-saving measures, saw Covestro's fourth-quarter net income soar

to €312 million ($379 million), up substantially from €37 million

in the prior-year period. The company has also forecast a rebound

in 2021 earnings growth to above pre-pandemic levels. (IHS Markit

Chemical Advisory)

- Covestro's polyurethanes segment saw core volume growth of 0.8% in the fourth quarter, with sales increasing 13% YOY to €1.52 billion. EBITDA in the segment more than doubled to €379 million. For the full year 2020, sales were down by 13.1% to €5.0 billion compared with 2019, due mainly to lower average selling prices and a decline in total volumes sold. EBITDA fell 3.5% to €625 million, also on account of lower volumes sold, partially countered by cost-saving measures, it says.

- In the polycarbonates segment, sales in the fourth quarter fell 1.4% YOY to €803 million despite core volume growth of 3.2%, but EBITDA more than doubled to €200 million. For the full year, a robust recovery in demand in the second half of 2020 failed to fully counter a 14.1% decline in sales to €3.0 billion, due primarily to lower selling prices and the decline in total volumes sold. EBITDA for the year rose 3.2% YOY to €553 million, "a trend primarily attributable to lower raw material prices and lower costs as a result of cost-saving measures," it says.

- The company's coatings, adhesives, and specialties segment saw core volume growth of 2.8% in the fourth quarter, with sales slightly down YOY to €529 million. EBITDA declined 16% YOY to €52 million. Demand recovered in the second half of the year after a sharp drop in the first six months of 2020 due to the pandemic, with sales declining almost 14% compared with 2019 to €2.0 billion. EBITDA fell 27.3% to €341 million for the year due to lower volumes sold, lower margins, and expenses for the planned €1.6-billion acquisition of DSM's business, it says.

- Navya and Bluebus have signed a letter of intent to co-operate in the development of a 6-metre autonomous bus, using each other's expertise to design and develop it. Bluebus will offer its electric buses integrated with lithium metal batteries and Navya will provide its autonomous vehicle (AV) software to automate the braking, acceleration, and directional components. Navya focuses on deploying Level 4 autonomous systems on a wide range of vehicle platforms. The company launched its Autonom Shuttle more than five years ago and claims to have sold more than 180 units across 23 countries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Siemens Gamesa Renewable Energy has been awarded a firm order from the EDF Renewables-Enbridge-wpd consortium for the 448 MW Courseulles-sur-Mer offshore wind power project. The order includes the SWT-7.0-154 direct drive offshore wind turbines. Installation and commissioning of the Courseulles-sur-Mer project is scheduled for 2024. Located 10 km off the Bessin coast, the project brings the total capacity awarded to Siemens Gamesa by the consortium in France to approx. 1 GW. Both the wind turbine nacelles and blades for the Courseulles-sur-Mer project are scheduled to be produced at the Siemens Gamesa facility currently under construction in Le Havre. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- SEAT has held talks with the Spanish government over a potential project to build a battery plant to support its electrification program. According to a Reuters report, SEAT and the Spanish government have been in "advanced conversations" over the company's plan to build a small battery electric vehicle (BEV) at its Martorell plant near Barcelona. SEAT president Wayne Griffiths said that such a project would make it "essential" to have a battery factory in Spain, and that the best solution would be if the batteries were assembled close to the Martorell plant. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Swiss essential oil and taste company Firmenich's revenues

totaled CHF1.99 billion (USD2.22 billion), 2.3% more year-on-year

on an organic basis and 4.9% on a reported basis, in H1 FY2021

(July-June). Adjusted EBITDA totaled CHF167 million,1.6% more on an

organic basis and 12.4% less on a reported basis. China, India and

North America were the drivers of growth. (IHS Markit Food and

Agricultural Commodities' Jose Gutierrez)

- Taste & Beyond Revenue increased by 3.6%, organically at constant currency, led by beverages, and sweet goods, offsetting the temporary negative impact of the crisis on Foodservice and Savory goods.

- Perfumery and ingredients revenue increased by 1.6% led by consumer fragrance and Ingredients. The company's mid-market Perfumery platform in North America delivered strong double-digit organic growth.

- Firmenich reported that it has completed the integration process of DRT, whose revenues were hit by low sales in the fine fragrance market due to COVID-19 restrictions.

- After expanding by 2.1% year on year (y/y) in December 2020,

Russian industrial output, excluding construction, fell by 2.5% y/y

in January, on a non-seasonally adjusted basis. (IHS Markit

Economist Lilit Gevorgyan)

- The drag on the headline index came from the mining sector's 7.1% y/y fall in January, preceded by 7.5% y/y declines in the previous two months.

- More specifically, the crude oil extraction contracted by 8.0% y/y in January, in contrast to natural gas and coal production, which were in growth territory. Compared to the previous months the crude oil production y/y losses have eased from around 10.2% in October-December 2020.

- Conversely, the IHS Markit Manufacturing PMI expanded for the first time since August 2020. The seasonally adjusted index rose to 50.9 points in January from 49.7 points in December 2020, and 46.3 points in November.

- New orders and output supported growth, like the Manufacturing PMI, while business confidence was also buoyed by similar expectations of declining pandemic as Russia has rolled out a mass COVID-19 vaccination program.

- The print data showed that despite improved sentiment, retail sales continued to fall in January, although the pace of contraction eased to 0.1% y/y, from 3.6% y/y fall in December. The slower decline in the sector was in part due to increased sales of goods.

- Despite the difficult start to the year, Russian economic activity is expected to gain pace in the coming months. Growth will be broad-based. Rising crude oil prices will remove the need for hefty crude oil production cuts agreed within OPEC+ through 2020, and thereby support the recovery in the extractive sector.

- Nigeria's real GDP increased 9.1% quarter on quarter (q/q)

during the fourth quarter of 2020, after a rebound of 12.9% q/q

growth during the previous quarter, the Nigeria National Bureau of

Statistics (NBS) reports. This leaves Nigeria's real GDP down by

1.8% during 2020, better than the 3.2% contraction initially

expected for the year. (IHS Markit Economist Thea Fourie)

- Output in Nigeria's oil and gas sector fell by 8.8% during 2020, while non-oil GDP contracted by 1.2% last year. The oil and gas sector made an 8.8% contribution to real GDP during 2020, NBS numbers show.

- Most sectors of the Nigerian economy recorded q/q gains during the fourth quarter of 2020, except for the agricultural sector, which fell by 3.9% q/q. A sharp slowdown in crop production was primarily responsible for sluggish farming output over the period.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +1.0%, Australia +0.9%, Japan +0.5%, India flat, Mainland China -0.2%, and South Korea -0.3%.

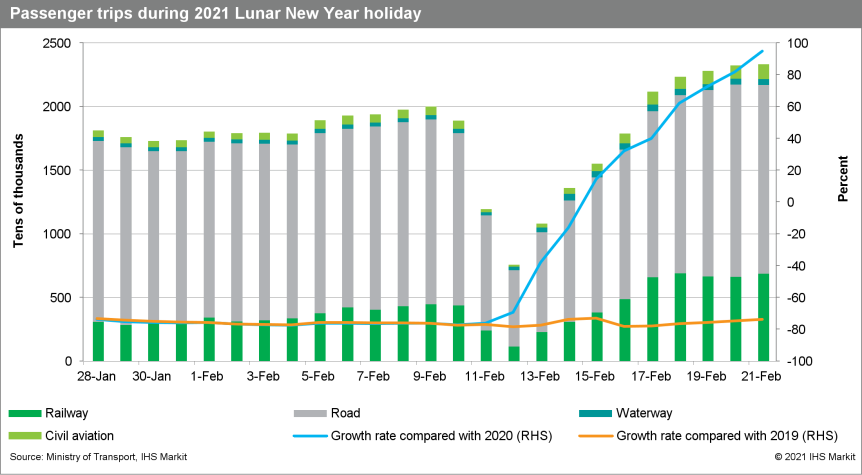

- Mainland China's transportation sector's performance was

lackluster compared with other sectors owing to the government's

measures to discourage long-distance travel. Cumulatively, from 11

to 17 February, passenger trips by rail, road, water, and air were

down by 76.8% from the 2019 level and down 34.8% from the 2020

level. Though the year-on-year growth rate has been in expansion

territory since mid-February 2021, the improvement is attributed

more to the postponement of work resumption in 2020, as daily

passenger trips remain over 70% lower relative to 2019 levels. (IHS

Markit Economist Lei Yi)

- Mainland China's new home price inflation averaged 0.28% month

on month (m/m) in January 2021, up by 0.16 percentage point from

December 2020, according to the survey by National Bureau of

Statistics covering 70 major cities. (IHS Markit Economist Lei Yi)

- The January month-on-month uptick in new home price inflation, led by tier-1 cities, was the largest since April 2020. Notably, new home prices in Guangzhou increased by 1.0% m/m, outpacing the price increase in the three other tier-1 cities owing to its relatively looser local housing market regulations.

- Up to 53 out of the 70 surveyed cities reported month-on-month new home price gains in January 2021, compared with 42 cities in December 2020.

- Average year-on-year (y/y) new home price inflation stabilized at 3.7% in January, just about the same level registered in early 2016.

- New home price inflation in tier-3 cities either declined for the 22nd consecutive month or remained unchanged year on year, tier-1 and tier-2 cities registered wider year-on-year price gains in January compared with the preceding month.

- Despite the efforts by local governments since December 2020 to address speculative loopholes in some of mainland China's largest housing markets including Shenzhen and Shanghai, housing demand seems to be holding up. This may be partially attributed to the relatively low housing inventory levels, as the post-pandemic recovery in property sales continued to outpace construction.

- Chinese electric vehicle (EV) startup Xpeng Motors has issued details of its highway-driving feature Navigation Guided Pilot (NGP), launched on 26 January for eligible customers in China. The NGP feature, part of Xpeng's autonomous vehicle (AV) package XPILOT 3.0, is offered on the premium version of Xpeng's P7 sedan. The NGP feature enables safe highway driving by "automatically performing speed limit adjustment, automatic switching to highways, optimized lane choices, automatic entering and exiting ramps, and automatic overtaking", says the company. Since the release of the feature, the Xpeng P7 under the control of NGP has driven for a cumulative distance of 1.02 million kilometers. During the 25-day period, automatic lane changing and overtaking were conducted 131,484 times, and automatic highway ramp entering and exiting were conducted 105,943 times. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese battery maker SVOLT Energy Technology will invest CNY7 billion (USD1.1 billion) in a new battery manufacturing plant in Huzhou, Jiangsu province (China). The new plant will have capacity of 20 GWh per year, according to local media reports. SVOLT is a spin-off from Chinese automaker Great Wall Motor and specializes in electric vehicle (EV) battery manufacturing. The company started production at its Changzhou plant in Jiangsu province in November 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- SAIC Motor has entered into an agreement with Horizon Robotics to jointly develop technologies related to smart vehicles. According to China Daily, SAIC will use its SAIC Passenger Vehicle unit as a platform to create a collaborative ecosystem with the top companies in related areas, including automotive AI development and smart vehicle. Horizon Robotics will provide a full series of chips for SAIC's new models. Horizon is one of the leading manufacturers of automotive-grade microchips in China. Its microchips are specifically designed to facilitate the deployment of Level 2 and Level 3 automated operation solutions in electric vehicles. (IHS Markit AutoIntelligence's Abby Chun Tu)

- South Korea-based radar startup bitsensing has partnered with Infineon Technologies to launch of the 60-GHz MOD620 radar for an in-cabin monitoring solution, according to a company statement. The MOD620 detects the vital signs of vehicle occupants and sends the driver alerts if a child is left unattended inside a car. It can detect a child regardless of clothes or blankets. (IHS Markit AutoIntelligence's Jamal Amir)

- Reliance Industries says it expects the regulatory approval

process for the previously announced spin-off of the company's

oil-to-chemicals (O2C) business to be completed by the end of

September 2021. The O2C carve-out became effective in January and

Reliance has received approval from the market regulators and

stock-exchange authorities. (IHS Markit Chemical Advisory)

- Reliance will seek approval from shareholders and creditors at meetings during the company's fiscal first quarter ending 30 June 2021. It expects approval from India's National Company Law Tribunal in the following quarter, ending 30 September.

- The O2C business is the second-largest producer of para-xylene, fourth-largest producer of purified terephthalic acid, and sixth-largest producer of polypropylene and ethylene glycol, and is one of the largest integrated producers of polyester, according to Reliance. The company is a leading player in India with a 35% share of the domestic polyester and polymers market.

- The O2C unit also includes all assets related to Reliance's ethane regasification operations, including storage tanks at the Dahej site, but excludes ethane vessels.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-february-2021.html&text=Daily+Global+Market+Summary+-+23+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}