Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 19, 2021

Daily Global Market Summary - 19 July 2021

All major US and European equity indices and most APAC markets closed lower on concerns of slower growth and renewed restrictions due to the rapidly spreading COVID-19 delta variant. US government bonds closed sharply higher and most benchmark European bonds were also higher on the day. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar and natural gas closed higher, while oil, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; Nasdaq -1.1%, Russell 2000 -1.5%, S&P 500 -1.6%, and DJIA -2.1%.

- 10yr US govt bonds closed -10bps/1.19% yield and 30yr bonds -9bps/1.83% yield, which were the lowest closing yields since 12 February and 29 January, respectively.

- CDX-NAIG closed +2bps/52bps and CDX-NAHY +11bps/298bps.

- DXY US dollar index closed +0.2%/92.89.

- Gold closed -0.3%/$1,809 per troy oz, silver -2.5%/$25.14 per troy oz, and copper -2.8%/$4.20 per pound.

- Crude oil closed -7.3%/$66.35 per barrel and natural gas closed +2.9%/$3.78 per mmbtu.

- Stocks, bond yields and oil prices declined Monday in the most acute sign yet that investors are second-guessing the strength of the global economic recovery that sent markets soaring this year. Behind the rout, investors say, is a growing list of concerns about the recovery. The Delta coronavirus variant has spread rapidly, reigniting the debate in several countries about whether governments should resume lockdowns and curb activity. Meanwhile, inflation has accelerated faster than many anticipated, and strained U.S.-China relations have put pressure on trillions of dollars' worth of U.S.-listed Chinese companies. (WSJ)

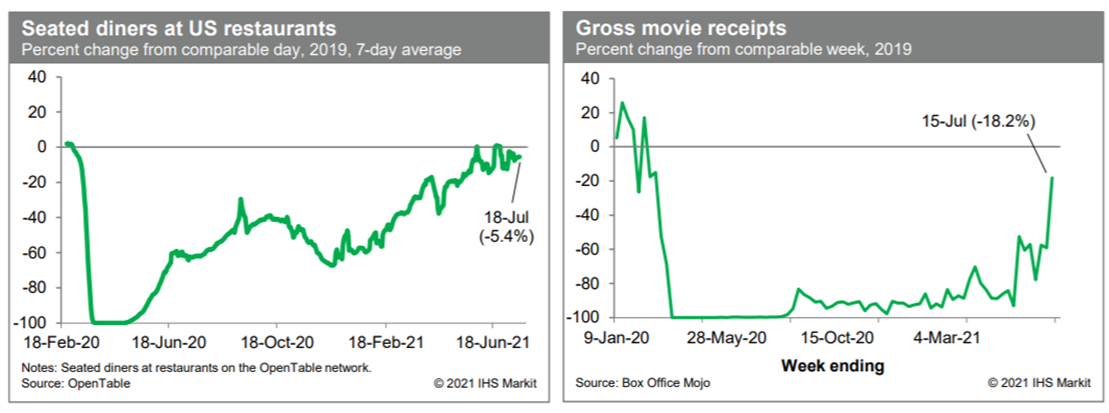

- Averaged over the last week, the count of seated diners on the

OpenTable platform was only 5.4% below the comparable week in 2019.

Restaurant activity has enjoyed nearly a full recovery. Meanwhile,

box office revenues during the week ending last Thursday jumped to

18.2% below the comparable week in 2019, up sharply from prior

weeks. This was the first full week that included the release of

Black Widow. The willingness of consumers to return to movie

theaters, as indicated last week, suggests that the movie industry

may be poised for recovery. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- The headline US housing market index ticked down 1 point to a

solid 80 in July. A reading above 50 indicates that more builders

view conditions as good rather than poor. The current sales

conditions index decreased 1 point to 86; the index measuring sales

prospects over the next six months moved up 2 points to 81; the

traffic of prospective buyers' index dropped 6 points to 65. (IHS

Markit Economist Patrick

Newport)

- By region, the Northeast (72 in July), South (83 in July), and West (84 in July) fell two points from their June levels, while the Midwest increased 1 point to 71.

- The good news for builders regarding construction costs: lumber's price bubble has burst. The Random Length Lumber Continuous Contract, which peaked at $1,670 on 7 June, has tumbled to $536 as of 19 July (prior to the pandemic, this contract traded at about $450). The bad news: the producer price indexes for some materials used in construction soared in June, including those for diesel fuel (up 127% y/y), steel mill products (up 88% y/y), copper and brass mill shapes (up 61% y/y), aluminum mill shapes (up 33%), and gypsum products (up 18% y/y). On top of this, the price of oriented strand board, another type of wood used to build houses, "has increased 510% since January 2020," according the National Association of Home Builders (NAHB).

- The average price of a new home soared to a record $430,600 in May, up 17% from a year earlier, suggesting that builders' profit margins are widening (the Census's construction cost index for homes under construction was up 10.2% from a year earlier in May).

- Workers in the construction industry were quitting at record rates in March, when the quit rate climbed to 2.7% (it fell back to 2.1% in May). To counter this development, builders are having to increase wages.

- At least three major medical centers in the United States have said that they do not plan to administer Biogen's (US) recently approved Alzheimer's disease treatment Aduhelm (aducanumab-avwa) to patients. According to a report in The New York Times, two of the centers are the Cleveland Clinic and Mount Sinai Health System in New York City, while a subsequent report in The Wall Street Journal revealed that Providence in Renton, Washington, had also decided not to administer the drug. The Cleveland Clinic reportedly explained that it had "reviewed all available scientific evidence on this medication" and that, "based on the current data regarding its safety and efficacy, we have decided not to carry aducanumab at this time". Meanwhile, the director of the Mount Sinai Center for Cognitive Health, Dr Sam Gandy, reportedly said that Mount Sinai would not consider administering Aduhelm "until or unless" an independent review into the drug's approval "affirms the integrity of the FDA-Biogen relationship", and confirms that the FDA's approval decision was well-founded. (IHS Markit Life Sciences' Milena Izmirlieva)

- Tesla has announced the introduction of a subscription service for its advanced driver-assistance system (ADAS) software, reports Reuters. According to the report, the electric vehicle (EV) maker says the service makes available "FSD [Full Self-Driving] subscription capability". The subscription option has been introduced for some customers for a payment of USD199 per month, instead of the USD10,000 that was previously required upfront for the system. Reportedly, according to the automaker, the current features "do not make the vehicle autonomous". The automaker added in its statement that the features "require a fully attentive driver, who has their hands on the wheel. FSD capability subscriptions are currently available to eligible vehicles in the United States." According to the news source, citing the automaker, the subscription service is available in vehicles that are equipped with FSD computer version 3.0 and above; however, an upgrade to the new hardware will cost the customers USD1,500. Tesla, who has been testing its new semi-autonomous driving software for city streets, released the FSD Beta v9 version in the past week, again to a limited number of customers. (IHS Markit AutoIntelligence's Tarun Thakur)

- Lyft has announced plans to resume a shared rides booking option in select US markets for the first time since the outbreak of COVID-19 virus pandemic, reports Reuters. Lyft's shared rides option, which allows multiple passengers to share a car travelling in the same direction, will be now available in Chicago, Philadelphia, and Denver. The company plans to expand the service to more markets in the coming months. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) startup Rivian has delayed the first deliveries of its R1T battery electric pick-up truck until September, reports Automotive News. The report cites a letter by Rivian CEO RJ Scaringe to customers who expected their vehicles this month, saying the timing for the first deliveries of the R1T has shifted to September, with the R1S sport utility vehicle (SUV) shortly afterwards. The delay is the result of a number of issues, including the COVID-19 virus pandemic, ongoing global semiconductor shortage issue and the difficulty of producing three new vehicles in a new plant. (IHS Markit AutoIntelligence's Jamal Amir)

- Latin America has been severely hit by the COVID-19 pandemic,

but industry reports that the agriculture and agrochemical sectors

have largely overcome all hurdles posed by the pandemic. Latin

American governments deemed agrochemicals among products and

services that continued to be supplied as previously, despite the

lockdown resulting from the coronavirus pandemic. (IHS Markit Crop

Science's Robert Birkett)

- However, the value of the continent's largest national market fell last year as the "extreme" fall in value of the Brazilian real against the US dollar hit sales. The Brazilian crop protection trade association, the Sindiveg, contrasts a higher volume sales for the country's market last year against a fall in dollar terms for calendar year 2020. The association is expecting an 8% rise in the product area treated (PAT), but a similar fall in sales in US dollar terms. The PAT formula has the treated area multiplied by the volume of crop protection used, and then by the number of applications. Another industry association reported a 2% drop in imports of agrochemicals.

- Meanwhile, the pandemic had other impacts. It hit the scheduling of parliamentary debate and halted progress on a draft bill in Brazil from the previous year that sought to change the law governing agrochemicals from those of highest priority. The bill would allow the Ministry of Agriculture to authorize a product prior to the approval of two other competent authorities: the environmental agency, the Ibama, and the national health surveillance agency, the Anvisa.

Europe/Middle East/Africa

- All major European equity indices markets closed sharply lower; UK -2.3%, Spain -2.4%, France -2.5%, Germany -2.6%, and Italy -3.3%.

- Most 10yr European govt bonds closed higher except for Italy +1bp; UK -7bps, Germany/France -3bps, and Spain -2bps.

- iTraxx-Europe closed +2bps/49bps and iTraxx-Xover +9bps/247bps.

- Frozen food sales in the UK have continued to outperform total

grocery growing rate both in value and volume in the 52-week period

ending 13 June, a recent report from data analysis company Kantar

suggests. (IHS Markit Food and Agricultural Commodities' Cristina

Nanni)

- Demand for frozen products rose by almost 8% in value to GBP7.3 million (USD9.6 million) and 5% in volume to 2.3 million tons, while the grocery shopping was up by 7% and 5% for each entry. The sector did also better than fresh and chilled on value growth as the two reported a 7.3% growth.

- Within the frozen aisle, ice cream value sales showed the largest growth (+11.7%), followed by fish (+11.6%), savory food (+10%), confectionery (8.8%), potatoes (+7.4%) and pizza (+4.3%), while vegetables and ready meal sales were more stable increasing by just 1.2% and 2.1%, respectively. However, comparing 2021 with 2019 data, sales rose sharply across the sector suggesting that, despite the relaxation of lockdown measures, frozen product demand is still above pre-pandemic levels.

- Ice cream, savory food and frozen fish charted a 22% increase in sales in 2021 compared with 2019. For potatoes, pizza and vegetables, the difference is of 17%, 14% and 8.6%, respectively.

- Looking at volume, frozen fish, savory and confectionary products rose the most (+8.5%, 7.4% and +7.1%), followed by potatoes (+6.5%), vegetables (+6.3%) and ice cream (+4.3%).

- The difference between value and volume growth in a year-on-year comparison is linked to prices. Sector prices rose on average by 2.4% year-on-year with the only exception of vegetables (-5%) due to aggressive market pricing. Fish had the highest average price of GBP7.5/kg (+2.9% y-o-y) and ice cream saw the largest increase (+7.2%).

- McLaren Group announced on 16 July that it has signed a deal for a GBP550-million equity investment by existing and new shareholders. According to a statement, GBP400 million is being invested by Private Equity and Credit Groups of Ares Management Corporation and Saudi Arabia's Public Investment Fund (PIF) in the form of preference shares and equity warrants. The company said that this will bring in not only capital, but also "significant financial and strategic expertise" to the company. In addition, its existing shareholders, including Bahrain sovereign wealth fund Mumtalakat, alongside a limited number of new private investors, are investing GBP150 million in the form of convertible preference shares. It said that this will allow for the repayment of the loan received from the National Bank of Bahrain in June 2020 and the rightsizing of the capital structure. It said that the completion of the capital raising transactions remains subject to mutually agreed closing conditions, including raising new senior secured financing. The company has followed this with another statement today (19 July) in which it confirmed that it is launching the offering of USD620 million aggregate principal amount of senior secured notes that are due in 2026. It added that alongside the capital increase, it will be used to redeem in full outstanding existing senior secured notes, repay the existing revolving credit facility, add cash to the balance sheet and pay fees, premiums and expenses incurred in connection with the foregoing transactions. The company confirmed that it also intends to enter a new revolving credit facility agreement with an initial commitment of GBP95 million, and an accordion of up to GBP110 million. (IHS Markit AutoIntelligence's Ian Fletcher)

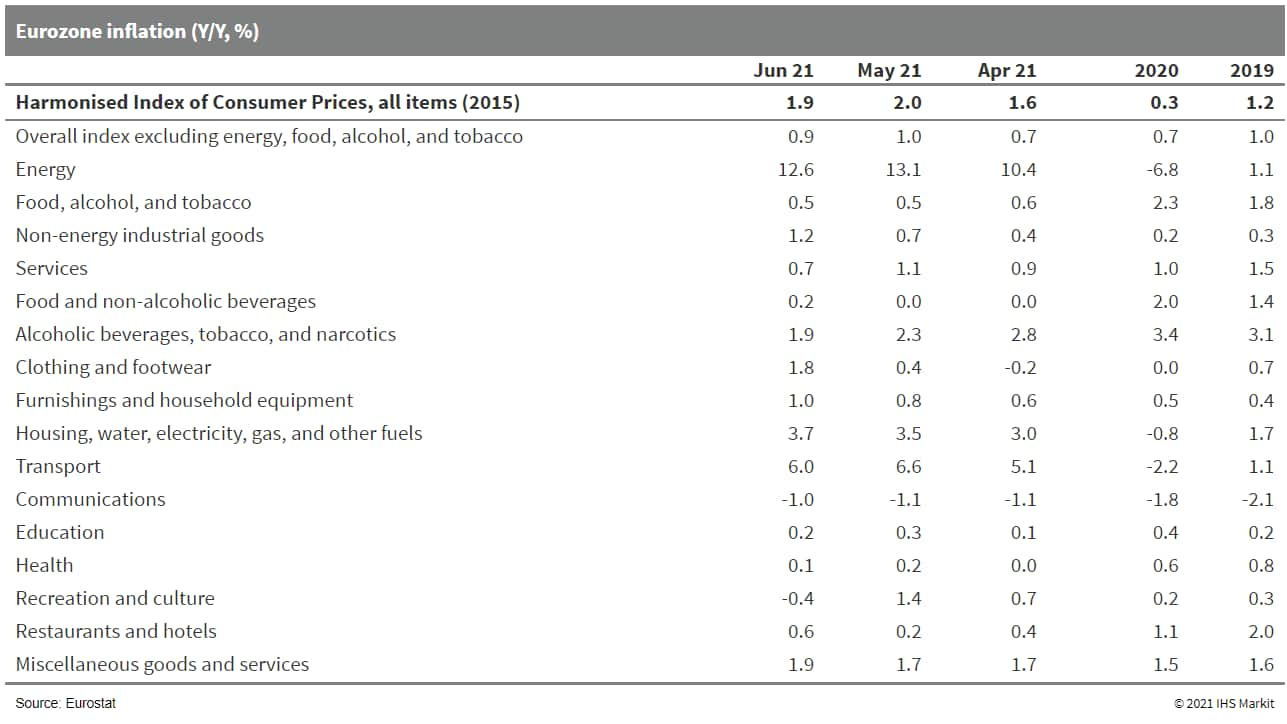

- Eurostat's "final" release has confirmed June's easing of the

eurozone Harmonised Index of Consumer Prices (HICP) inflation from

2.0% to 1.9%. This is the first deceleration since September 2020

and is in line with the market consensus expectation. (IHS Markit

Economist Diego

Iscaro)

- Core inflation - excluding food, energy, alcohol, and tobacco prices - also moderated from 1.0% to 0.9%. The "final" core inflation rate was also unchanged compared with the "flash" estimate.

- Less intense base effects led to the first easing of energy inflation in seven months, although energy prices continued to be the main contributor to the annual rate of inflation rising by 12.6% year on year (y/y).

- Inflation for services also eased from 1.1% y/y to 0.7% y/y, its lowest reading in six months. Prices of services related to package holidays fell at their sharpest pace in eight months, while the decline in prices of transport services also accelerated from 0.9% in May to 2.0% y/y in June. This more than offset a softer decline in prices of accommodation services (-2.2% y/y following -3.2% y/y in May).

- Food inflation accelerated but remained well below the headline inflation rate. Food prices, including alcoholic beverages and tobacco, rose by 0.6% y/y, following 0.3% y/y growth in May.

- Non-energy industrial goods inflation also accelerated from

0.7% y/y to 1.2% y/y in June, a five-month high. Prices of clothing

and footwear accelerated markedly from 0.4% y/y to 1.8% y/y, while

prices of motor cars rose by 2.4% y/y, the fastest increase since

at least 1997.

- Volkswagen (VW) has started the certification process for 3D printed structural components with a view to building 100,000 components annually by 2025, according to an Automotive News Europe (ANE) report. VW is working with Siemens, which is providing the manufacturing software, and Hewlett Packard (HP), which is providing the actual printers, on the technology. Key to using 3D printing to make automotive components is a process known as binder jetting, in which a liquid binder is sprayed onto a bed of powder, solidifying the cross-section of the component, building it up layer by layer. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Czech government is in talks with two potential investors interested in establishing battery electric vehicle (BEV) battery-cell production in the country, reports Reuters. According to the report, Czech Industry Minister Karel Havlicek said that Volkswagen (VW) Group was one of the potential investors, with group brand Skoda having recently begun production in Czechia of its first bespoke BEV model, the Enyaq. Any investment in a battery manufacturing plant in Czechia would balance out the footprint of battery-cell manufacturing across Europe. There are extensive and advanced plans to build battery plants in Western Europe, but central and Eastern Europe does not have the equivalent planned coverage at this time, despite some existing facilities such as SK Innovation's plant in Hungary. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Nigerian government is unlikely to meet its 2021 fiscal

targets as net oil and gas revenue falls below the first five

months of 2021's projections. (IHS Markit Economist

Thea Fourie)

- Government revenue in Nigeria will most likely not meet fiscal targets in 2021 as net oil and gas revenue trail 49.5% below the prorate target for first five months of the year. This revenue stream, accounting for 25.1% of the Federal Government of Nigeria (FGN), including government-owned enterprises (GOEs), expected revenue, performed poorly following the deduction of the unbudgeted petroleum subsidy costs.

- Non-oil taxes remained in line with the 2021 prorated budget target, ending May 0.3% below budget projections. Value-added tax (VAT) and corporate tax proceeds surpassed the prorate January-May target by 24.7% and 2.4% respectively.

- The slower rollout of the government's capital expenditure program left FNG government spending 14.2% below the prorate target for first five months of 2021. The 2022-24 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) show a 43.1% and 1.7% underperformance in capital spending and non-debt recurrent expenditure while debt servicing costs exceed the January-May 2021 prorate fiscal target by 30.1%.

- The MTEF and FSP assume that Nigeria's GDP will average 2.5% in 2021, accelerating to 4.2% in 2022. Total oil production projections have been left unchanged at 1.86 million barrels per day (mbpd) in 2021, accelerating to 1.88 mbpd in 2022 and 2.22 mbpd in 2024. Global oil price projections remain conservative for 2021 at USD40/barrel, rising to USD57/barrel in 2022-2023 before ending 2024 at USD55/barrel.

Asia-Pacific

- All APAC equity indices closed lower except for Mainland China flat; Australia -0.9%, South Korea -1.0%, India -1.1%, Japan -1.3%, and Hong Kong -1.8%.

- Mainland China's average new home prices increased by 0.41% month on month (m/m) in June, down by 0.11 percentage point from May, according to the survey conducted by the National Bureau of Statistics covering 70 major cities. (IHS Markit Economist Lei Yi)

- The month-on-month new home price disinflation in June came from smaller price increases in tier-2 and tier-3 cities, while tier-1 cities held up. Note that while new home price inflation of Guangzhou remained the highest among the four tier-1 cities, the latest June reading of 1.0% m/m had lowered by 0.5 percentage point from May. On the contrary, new home price inflation edged up by 0.6 percentage point to 0.9% m/m in the capital city Beijing, the highest since end 2019.

- Up to 55 out of the 70 surveyed cities reported month-on-month new home price gains in June, compared with 62 from March through May. On the flip side, 12 cities registered month-on-month new home price declines, up from 5 in May and back to the February level.

- Average year-on-year (y/y) new home price inflation edged down by 0.2 percentage point to 4.3% in June, the first decline so far in 2021. The change was also driven by tier-2 and tier-3 cities, and the decline in year-on-year new home price inflation had persisted for three consecutive months for tier-3 cities through June.

- Autonomous vehicle (AV) startup WeRide.ai has partnered with Chinese LiDAR manufacturer Hesai Technology to jointly promote the adoption of driverless technology. The companies will co-build a sensor suit required for autonomous operations. Hesai will assist WeRide in building a more advanced hardware platform for autonomous cars by providing its LiDAR sensors, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Chinese city of Shanghai has released draft regulations to protect data collected during smart vehicle testing, reports Reuters. The Shanghai Economic and Information Technology Commission said that the companies involved with smart vehicle testing would be required to appropriately handle data gathering, processing, application, and transfer. It added that the data collected is not permitted to be transmitted overseas unless approved by the relevant authorities. The companies should also take appropriate steps to protect data confidentiality, establish a personal information protection system, and refrain from engaging in illegal trading, transfer, or disclosure of relevant data. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Chinese authorities have announced a plan for better traceability and recycling of batteries used in new energy vehicles (NEVs) to reduce their impact on the environment, reports the China Daily, citing a five-year plan for developing the 'circular economy' released by the National Development and Reform Commission earlier this month. The plan focuses on how batteries' remaining power is utilized after their primary use, as well as more effective recycling. The plan confirms that China will build a traceability management system for NEV batteries and measures will be taken to encourage NEV manufacturers to set up recycling service networks. According to the data from the China Automotive Technology and Research Centre, China's total amount of decommissioned power batteries reached some 200,000 metric tons by the end of last year and is likely to reach 780,000 tons by 2025. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Nissan Motor, in partnership with NTT DoCoMo, will demonstrate an on-demand vehicle dispatch service using autonomous vehicles (AVs), according to a company statement. The companies will deploy four AVs on a route with 23 stops in the Yokohama Minato Mirai and Chinatown areas of Japan. The companies will hire 200 qualified passengers (volunteers) who will participate in this demonstration to provide feedback about their experience. The service will combine DoCoMo's artificial intelligence (AI)-based on-demand service, "AI-operated bus" and the autonomous mobility service Easy Ride, which is jointly developed by Nissan and DENA. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-july-2021.html&text=Daily+Global+Market+Summary+-+19+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 19 July 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+19+July+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}