Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 20, 2021

Daily Global Market Summary - 20 July 2021

All major US and European equity indices closed higher, while all major APAC markets were lower. US government bonds closed lower and benchmark European bonds closed mixed. European iTraxx was close to flat on the day, while CDX-NA closed tighter. The US dollar, natural gas, oil, copper, and gold closed higher, while silver was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +3.0%, DJIA +1.6%, Nasdaq +1.6%, and S&P 500 +1.5%.

- 10yr US govt bonds closed +3bps/1.22% yield and 30yr bonds +5bps/1.88% yield, and yields reached as low as 1.13% and 1.78% near the NY open, respectively.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -6bps/292bps.

- DXY US dollar index closed +0.1%/92.97.

- Gold closed +0.1%/$1,811 per troy oz, silver -0.6%/$25.00 per troy oz, and copper +1.5%/$4.26 per pound.

- Crude oil closed +1.3%/$67.20 per barrel and natural gas closed +2.6%/$3.88 per mmbtu.

- US single-family permits, a key number in the report, dropped

6.3% (plus or minus 1.4%; statistically significant) to a 1.063

million rate in June. This category fell for the third straight

month; it is down 16% from its January peak, but still about 5%

above its February 2020 pre-pandemic reading. (IHS Markit Economist

Patrick

Newport)

- Multifamily permits fell 2.6% to a still-impressive 535,000 annual rate. This category recorded its highest first-half total since 1986.

- Housing starts and permits declined in the second quarter; both were down in all four regions.

- Housing starts jumped 6.3% (plus or minus 11.5%, not statistically significant) in June to a 1.643 million annual rate in June; single-family starts rose 6.3% (plus or minus 11.7%, not statistically significant) to a 1.160 million rate; multifamily starts climbed 6.2% to a solid 483,000 rate.

- The pace of new single-family construction is still strong, but slowing. Builders are facing two major headwinds: higher material costs and material shortages.

- The good news is that the shortages and high material prices are temporary and some material prices, such as lumber prices, are falling back to earth.

- The bad news is many material costs have not come down and strong demand will likely raise labor costs.

- EPA has been hit with a lawsuit contesting its registration of trifludimoxazin, a BASF herbicide recently approved for use on corn, soybeans and other crops. The Center for Food Safety and the Center for Biological Diversity filed the petition for review on July 19 in the US Court of Appeals for the Ninth Circuit, alleging the agency violated federal pesticide law and the Endangered Species Act (ESA). EPA approved the BASF product in May after a review jointly conducted with Canada's Pest Management Regulatory Agency, finding "no dietary, aggregate, or occupational risk concerns for potential human health exposure" from use of the herbicide. Trifludimoxazin is also not likely to result in "risks of concern" to non-target animals, EPA said, concluding that any concern to aquatic species is address by mitigation measures. In its May 12 decision, EPA said it had determined that the herbicide "will benefit the agriculture industry, as an additional tool to combat pest management issues, thereby helping the growers throughout the nation to increase production and prevent significant financial loss." The agency specifically touted trifludimoxazin as a new tool for weed control of waterhemp and palmer amaranth in field crops - notably corn and soybean - where herbicide resistance is a problem. (IHS Markit Food and Agricultural Policy's JR Pegg)

- While Brazil has always been a sizeable food animal market, it

has been dogged by issues regarding its scale and infrastructure.

At the recent Animal AgTech South America Summit, local experts

discussed how innovation has helped Brazil evolve into a bankable

and modern livestock sector. (IHS Markit Animal Health's Joseph

Harvey)

- According to Delair Angelo Bolis of MSD Animal Health, it takes only 30 minutes for Brazil to produce enough animal protein to feed a city of 100,000 habitants for one year - a clear illustration of the magnitude of the country's capacity.

- The nation's meat and dairy production sector has witnessed rapid growth in recent years, with obstacles such as African swine fever and COVID-19 providing opportunities to boost exports overseas. This acceleration of the livestock industry has been enabled by the adoption of innovation in the form of digital technologies, on-farm automation and vaccines.

- Yet issues remain in Brazil, where connectivity and infrastructure still pose barriers to the uptake of on-farm innovation. These deficiencies have created a market that still has to take on more new technologies. Many of the tools being created for the country will come from domestic players that have an understanding of the market's needs and idiosyncrasies.

Europe/Middle East/Africa

- All major European equity indices markets closed higher; France +0.8%, Spain +0.7%, Italy +0.6%, Germany +0.6%, and UK +0.5%.

- 10yr European govt bonds closed mixed; Germany/France/Italy -2bps and Spain/UK flat.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -1bp/246bps.

- Brent crude closed +1.1%/$69.35 per barrel.

- In the Eurozone, export recovery is moderating and construction

sector rebound stabilizing. However the negative impact from

supply-chain disruptions on industrial output, and through it on

exports as well as construction activity, is becoming clearer. (IHS

Markit Economist Venla

Sipilä)

- Similarly to the latest industrial output results, May's trade and construction sector data in the eurozone show some deterioration in performance.

- While industrial production is mostly suppressed by supply constraints, interpretation of trade developments and construction sector activity - alongside output - continues to be obscured by base effects from the high point in the COVID-19 pandemic during comparison months last year.

- Following a surge of over 46% year on year (y/y) in April, exports from the eurozone in May increased at a decelerated annual pace of 32.2% y/y, even as the base effect turned more favorable. With import growth moderating, even if remaining substantial following the April charge, the trade surplus in May managed to increase by 2.0% y/y.

- However, month-on-month (m/m) comparison reveals deterioration in export performance, with May showing exports contracting by 1.5% m/m in value terms. Apart from January 2021, this marks the first decrease in extra-eurozone exports since April 2020, given that April 2021 results have been revised to show marginal growth of 0.1% m/m after they initially signaled contraction of 2.3% m/m.

- The deceleration of import growth to under 1% m/m in May was not enough to prevent the trade surplus from shrinking by over 30% m/m. With revisions resulting in an April surplus of EUR13.4 billion, the May surplus of EUR9.4 billion (USD11.1 billion) marks the lowest extra-eurozone surplus for the monetary bloc since May 2020.

- In May, exports remained 2.0% below their pre-pandemic level in February 2020, while imports have now climbed 6.7% above their monthly value just before the COVID-19 pandemic. Consequently, the May trade surplus makes just 44% of the average in January-February 2020.

- Eurozone construction output in May returned to modest m/m growth, expanding by 0.9% m/m following a contraction of 0.5% m/m in April (revised up from a fall of 2.2% m/m). This increase remains below the March gain of 4.0% m/m.

- On a more positive note, May output volume in the construction sector now exceeds the pre-pandemic level of February 2020 by 0.5%. Moreover, the positive trend in construction sector sentiment signaled by the European Commission's confidence index since September 2020 continued in July, with the confidence indicator edging further up on the positive part of the scale.

- The herbicide, propoxycarbazone, is to be removed on August 8th from the EU list of active ingredients that are considered candidates for substitution with safer alternatives. The ai was added to the list in 2015 but a reassessment completed in 2017 did not confirm certain hazardous properties. This outcome meant that EU member states no longer had to check if safer alternatives were available before approving propoxycarbazone-based products. The Commission subsequently proposed to remove the ai from the candidate list "to avoid confusion" and the action was cleared by EU member states in June. (IHS Markit Crop Science's Jackie Bird)

- German firm BioNTech has announced plans to acquire individualized solid tumor neoantigen T-cell receptor (TCR) cellular therapy research and manufacturing assets from US firm Gilead Sciences' Kite division. This includes a US manufacturing facility based in Gaithersburg, MD, which could provide scale-up capacity to support US clinical trials of innovative TCR-based cellular therapy products for cancer, and complementing BioNTech's existing cellular therapy manufacturing plant in Idar-Oberstein, Germany. All Kite employees at the Gaithersburg site will be offered a transfer to BioNTech prior to closure of the deal, and BioNTech also plans to hire additional staff and invest further in this facility. Kite will receive an upfront payment from BioNTech for purchase of the TCR discovery platform and Gaithersburg facility, but further financial terms of the deal were not disclosed in the company statement. Closure of the transaction is expected by the end of this month. Following this divestment, Kite is planning to refocus on rapid progression of its current chimeric antigen receptor T-cell (CAR-T) therapeutic pipeline, and will still retain its CAR-T manufacturing facility in Frederick, MD. BioNTech has CAR-T therapeutic candidates of its own, including the CAR-T cell amplifying mRNA vaccine CARVac, and other candidate cellular therapies, such as the NEOSTIM platform; this pipeline will be expanded significantly with addition of the new individualized neoantigen TCR program from Kite. (IHS Markit Life Sciences's Janet Beal)

- Botswana's annual inflation rate maintained its upward

trajectory, increasing to an over nine-year high of 8.2% year on

year (y/y) in June from 6.2% y/y in May, thus remaining above the

upper bound of the Bank of Botswana's medium-term objective range

of 3-6% it breached in April for the first time since June 2013.

(IHS Markit Economist Archbold

Macheka)

- The jump in the June inflation reading was driven largely by higher prices of Transport which rose 17.4% y/y from 8.9% y/y in the previous month. This was attributed to increases in the subcategories of Purchase of Vehicles (19.4% y/y), Operation of Personal Transport (18.7% y/y) and Transport Services (12.0% y/y), largely reflecting the impact of adverse base effects.

- Additional upward pressure came from prices of Housing and Utilities, which accelerated by 8.6% y/y from 6.6% y/y in May, largely reflecting the rise in Rent Paid by Tenants of 6.6% y/y. Food and non-alcoholic beverages inflation ticked up marginally to 6.8% y/y from 6.7% y/y in May, as prices of Bread and Cereals firmed by 9.3% y/y.

- Miscellaneous Goods and Services, which include personal care and insurance costs grew 6.0% y/y, the same growth rate recorded in May. On the other hand, inflation slowed for Clothing and Footwear (down from 3.9% y/y to 3.8% y/y) and Alcohol and Tobacco (down from 13.0% y/y to 9.3% y/y). On a monthly basis, consumer prices rose 0.6% compared to 0.5% in May.

- Social unrest broke out in South Africa during the week

beginning 11 July, resulting in mass looting of retail and

warehouse stock, destruction of infrastructure and other assets

(particularly heavy vehicles hauling cargo), and blocking of major

logistics routes in the country. A state of emergency has been

avoided following the deployment of 25,000 South African National

Defence Force (SANDF) soldiers to assist the police in ending the

violence. (IHS Markit Economist Thea

Fourie)

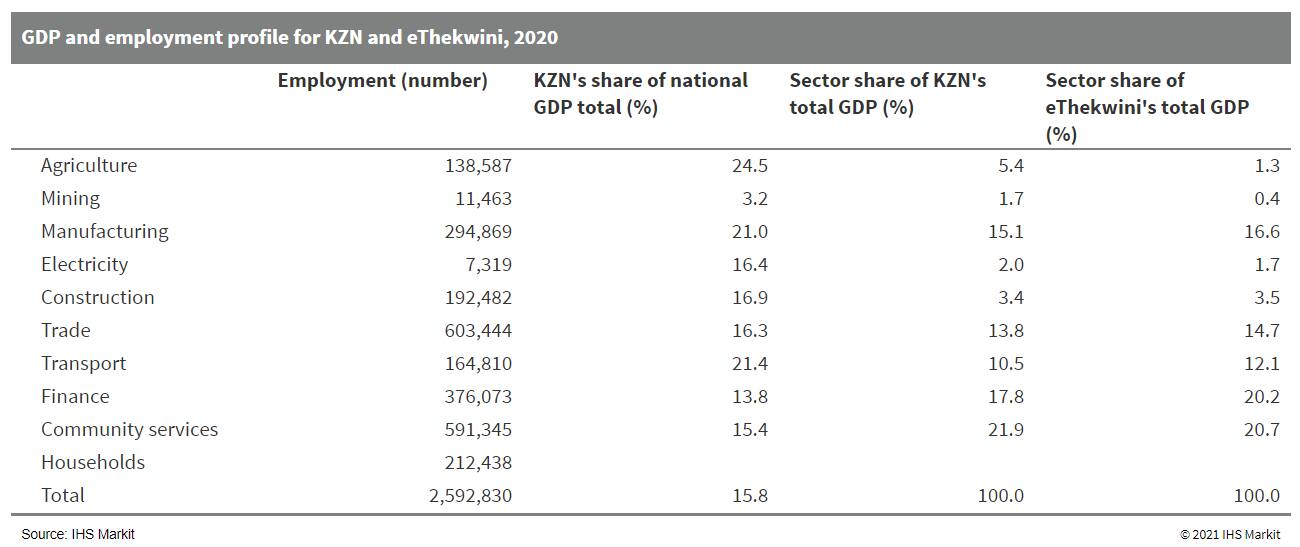

- The social unrest has been localized to KwaZulu-Natal (KZN) province and parts of Gauteng province, primarily in the Johannesburg area. One of the busiest import and export ports in South Africa and the southern African region, namely Durban, lies within the eThekwini Metropolitan Municipality (MM), also situated in KZN.

- KZN also houses two special economic zones (SEZs), comprising the Dube Trade Port and the Richards Bay Industrial Development Zone respectively, being strategically located within the area of the Durban and Richards Bay ports. The Richards Bay Coal Terminal, one of the world's largest coal export terminals, is located at Richards Bay port. Both ports witnessed disruption to business operations due to security and logistics concerns during the week beginning 11 July. The Toyota vehicle assembly plant at Prospecton, whose output is primarily for the export market, is also located close to the Durban area.

- KZN accounts for 16% of South Africa's overall real GDP, while the eThekwini MM accounts for 60% of the province's real GDP and 53% of the province's employment. The province's community services, financial, manufacturing, and transport industries account for roughly 69% of KZN's total real GDP and 72% of eThekwini's total real GDP.

- Retail trade, the sector expected to have suffered the biggest

disruption in economic activity in the province over the short

term, accounts for 14% of KZN's overall GDP. However, trade is a

large provider of employment in KZN, accounting for 22% of total

employment in the province, of which 34% is estimated to form part

of the informal sector.

Asia-Pacific

- All APAC equity indices closed lower; Mainland China -0.1%, South Korea -0.4%, Australia -0.5%, India -0.7%, Hong Kong -0.8%, and Japan -1.0%.

- WeRide has acquired Chinese autonomous truck startup MoonX.AI for an undisclosed amount, according to a blog posted on the Medium website. Qingxiong Yang, founder and chief executive (CEO) of MoonX.AI, will become vice president of WeRide and dean of the firm's research institute. More than 50 engineers from MoonX.AI will join WeRide. WeRide focuses on deploying Level 4 autonomous vehicles (AVs) on public roads, and recently received a permit to test two AVs without a driver behind the wheel on designated streets in San Jose (California, US). In 2020, it began testing fully driverless cars in Guangzhou. The company has also launched a mini-robobus trial service for the public at Guangzhou International Bio Island. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- DeepRoute.ai has opened its robotaxi pilot service to the public in Shenzhen (China), according to a company statement. Users above the age of 18 can reserve the robotaxi ride free of charge through DeepRoute's official WeChat account. The company has deployed 20 robotaxis operating across 124 miles of public roads in Shenzhen's downtown business district, covering 100 pickup and drop-off locations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baidu has opened its Apollo Go robotaxi service to the public in the Chinese city Guangzhou, reports Gasgoo. Residents using the Apollo Go app can hail Baidu's robotaxis, which will transport passengers along a route that encompasses schools, hospitals, parks, hotels, and offices. Currently, the service is available in Guangzhou Science City, a science and technology park located in Guangzhou's Huangpu district, with 237 pick-up and drop-off locations. Baidu's robotaxi service is available in Beijing, Cangzhou, Changsha, and Guangzhou, with plans to expand to 30 cities over the next three years. The company through its smart driving unit Apollo plans to offer robotaxi services to 3 million users in China in 2023. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Taiwanese export data show the growth rate cooling in the

second quarter, corroborating recent PMI survey findings of slower

export gains as the global economy cooled amid further COVID-19

waves. (IHS Markit Economist Chris

Williamson)

- Official data showed Tawian's export orders rising some 31.1% above levels of a year ago in June, marking the sixteenth month of continuous year-on-year expansion. Although down from a peak of 49.3% in January, the annual rate of increase remains higher than anything seen since 2010.

- Seasonally adjusted data results in a new series which suggests export orders peaked in April 2021 at US$58.4bn, and have since eased to $56.8bn, the lowest since March - though clearly still very elevated by historical standards.

- This slowing of growth in the Taiwanese PMI series corresponded with a cooling of global manufacturing output growth in June, which moderated to the slowest since February. However, the good news is that the global economy continues to expand at a rate which is historically consistent with solid growth of demand for Taiwan's exports, with electronics goods and components seeing especially marked demand growth.

- IHS Markit global electronics PMI in fact shows demand for electronic goods continuing to outstrip production, to a large extent due to input shortages curbing production capacity. Taiwan's electronics firms therefore look set to benefit from this developing backlog of work, assuming supply conditions can improve in coming months.

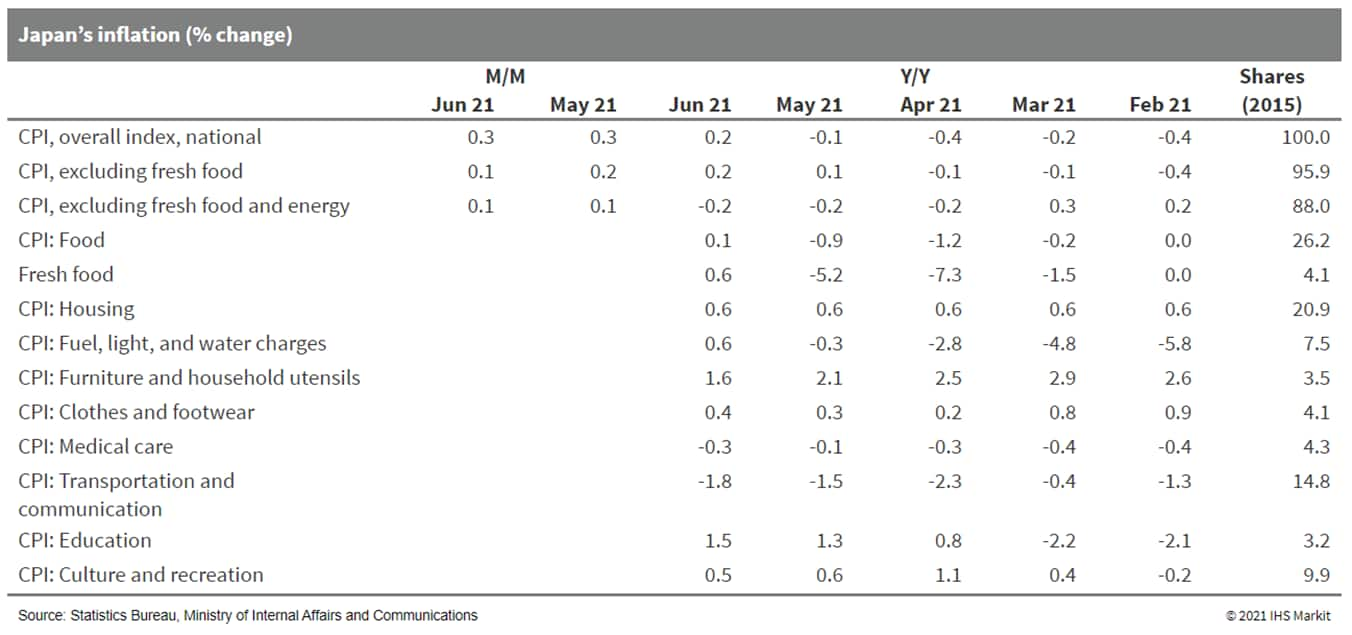

- Japan's CPI rose by 0.3% month on month (m/m) on a seasonally

adjusted basis in June and by 0.2% year on year (y/y). (IHS Markit

Economist Harumi

Taguchi)

- The CPI, excluding fresh food, increased by 0.1% m/m and 0.2% y/y. The CPI, excluding food and energy (core-core CPI), grew by 0.1% m/m, but the y/y contraction continued with a 0.2% drop.

- The first y/y rise in nine months for the CPI was thanks

largely to increases in prices for gasoline and kerosene and fresh

food. The continued sluggishness in the core-core CPI was

attributed to low mobile phone charges introduced by major carriers

in April, which offset other rises, including higher charges for

education as well as furniture and household utensils.

- Money Control reported on 19 July that Union Bank of India, Indian Bank, and Bank of India are aiming to sell 90.3% of ASREC India Limited, an asset reconstruction company (ARC) in India. This is in addition to Punjab National Bank (PNB), which had been intending to sell its 10.0% stake in Asset Reconstruction Company (India) Limited (ARCIL) in February 2021, as well as IDBI Bank's plan to sell its 19.8% stake in ARCIL. For the ASREC purchase, the minimum requirement bidder will need to have at least INR1 billion (USD13.4 million) net worth and INR5 billion assets under management (AUM). IHS Markit research shows that PNB, IDBI Bank, ICICI Bank, and State Bank of India are listed as the main sponsors for ARCIL, and of the four, two banks had already noted that they will sell down their stakes. Since PNB announced that it would sell its stake in February this year, no news has emerged and IDBI Bank only announced in June that it would sell its stake and there has been no progress so far. According to ASREC's latest annual report, as of FY2019/20, the ARC had total assets of INR2.1 billion, with total AUM of INR82.1 billion. The total acquisition cost for these assets was INR17.8 billion, suggesting a potential discount of 78%. (IHS Markit Banking Risk's Angus Lam)

- Tata Power Limited, an Indian integrated electrical utility and power company, has signed a collaboration agreement with Hindustan Petroleum Corporation Ltd (HPCL), reports Autocar India. As a part of the agreement, Tata is to provide end-to-end electric vehicle (EV) charging stations at HPCL's existing petrol pumps across multiple cities and along major highways across India. Currently, Tata Power has a network of over 500 EV chargers across 100 cities in India, while HPCL has more than 18,000 petrol pumps across the nation. According to the news source, the charging is enabled via the Tata Power EZ charge mobile platform. (IHS Markit AutoIntelligence's Tarun Thakur)

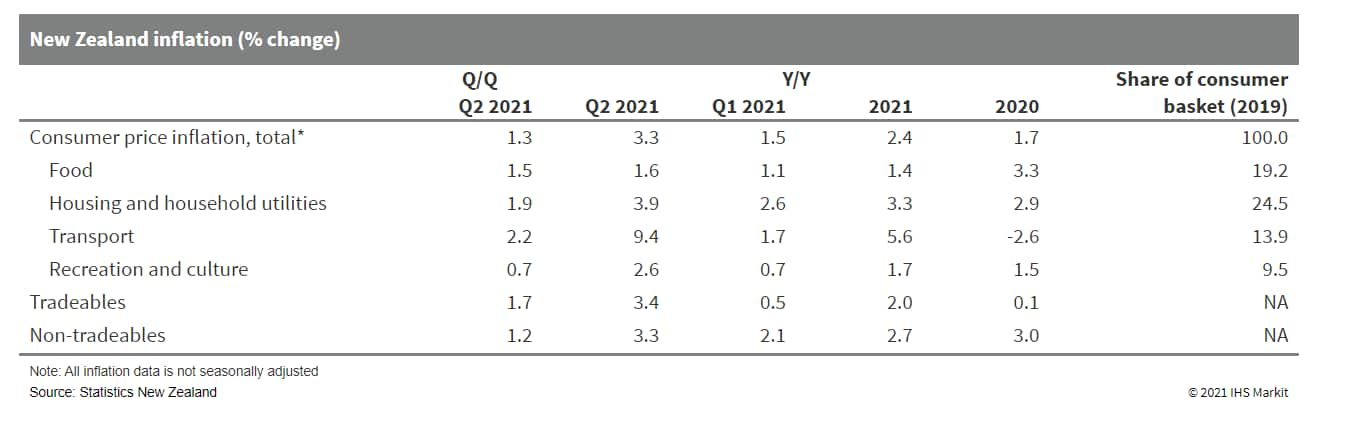

- New Zealand's consumer price inflation surprised above

expectations in the June quarter, rising 1.3% quarter on quarter

(q/q) or 3.3% year on year (y/y) - both the largest increase in 10

years. This is above the Reserve Bank of New Zealand's (RBNZ)

informal inflation target of 2%. (IHS Markit Economist Andrew

Vogel)

- The largest contributor to the uptick in CPI in the June quarter was housing and utilities costs (up 1.9% q/q, or 3.9% y/y), which includes prices for house construction (up 4.6% q/q, or 7.4% y/y) and rent (up 0.9% q/q, or 2.9% y/y), driven by both high demand and supply-chain problems. Regionally, rental prices increased 0.5% q/q in Auckland, 1.3% q/q in Wellington, and 0.6% q/q in Canterbury.

- Transport costs also contributed notably to the increase in inflation (up 2.2% q/q, or 9.4% y/y), driven by higher prices for petrol, international airfares, and used cars. The increase in petrol prices (up 6.1% q/q, or 16.0% y/y) is due to global oil prices recovering to approximately pre-pandemic levels after collapsing in early 2020. International airfares actually fell 7.6% q/q with the changing of the one-way travel bubble with Australia to two-way, but are still higher than they were one year ago; the weight of international airfares in New Zealand's CPI may also be changed in following quarters as travel restrictions are loosened.

- Food prices were similarly up (1.5% q/q, or 1.6% y/y), in

particular influenced by higher prices for vegetables such as

tomatoes, cucumbers, peppers, and lettuce (up 17% q/q, or 6.2%

y/y), as well as restaurant meals and ready-to-eat food (up 2.0%

q/q, or 4.3% y/y).

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2021.html&text=Daily+Global+Market+Summary+-+20+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 July 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+July+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}