Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 02, 2020

Daily Global Market Summary - 2 September 2020

European and US equity markets closed higher, while APAC markets closed mixed. Oil and gold closed lower on the day, as the US dollar rallied for the second consecutive day and created additional headwinds for commodities. Government bonds were higher across the US and Europe again today, with most 10yr European benchmark bonds rallying at least 6bps on the day.

Americas

- US equity markets closed higher, with the S&P 500 and Nasdaq breaking new records and the Nasdaq closing above 12,000 for the first time; DJIA +1.6%, S&P 500 +1.5%, Nasdaq +1.0%, and Russell 2000 +0.9%.

- 10yr US govt bonds closed -3bps/0.65% yield and 30yr bonds -4bps/1.38% yield.

- CDX-NAIG closed flat/62bps and CDX-NAHY -2bps/350bps.

- Companies have raised more debt in the US bond market this year than ever before, with overall US corporate bond issuance to $1.919 trillion so far this year, surpassing the previous annual record of $1.916 trillion set in 2017, according to data from Refinitiv. (FT)

- DXY US dollar index closed +0.3%/92.65 today and is +0.9% from yesterday's lowest level since April 2018.

- Gold closed -1.7%/$1,944 per ounce.

- Crude oil closed -2.9%/$41.51 per barrel.

- US manufacturers' orders rose 6.4% in July, the third

consecutive solid increase following sharp declines over March and

April. Shipments also posted a healthy gain in July (4.6%) on the

heels of solid growth over May and June. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- The details in this report that bear on our GDP tracking were consistent with our prior estimates of a 31.6% annualized decline in the second quarter and 28.7% annualized growth in the third quarter.

- Readings on orders and shipments through July support the view that recovery in the goods-producing sector is outpacing recovery in services. The recovery in orders through July has already reversed 73% of the decline over March and April, and the recovery in shipments has reversed 81% of the decline over March and April.

- Indeed, our measure of real monthly goods GDP for July has already surpassed the February level, while our measure of real monthly services GDP for July is still about 8% below the February level.

- Turning to the details in this report that bear directly on our GDP tracking, both orders and shipments of nondefense capital goods excluding aircraft were little revised through July, implying virtually no revision to our forecast of third-quarter equipment spending (currently at 39.4% annualized growth).

- Manufacturers' inventories, though, were weaker than we had assumed in July. However, we took this opportunity to lessen our previously assumed declines in nonfarm inventories over August and September, as we have come to view there to be some upside risk to those figures.

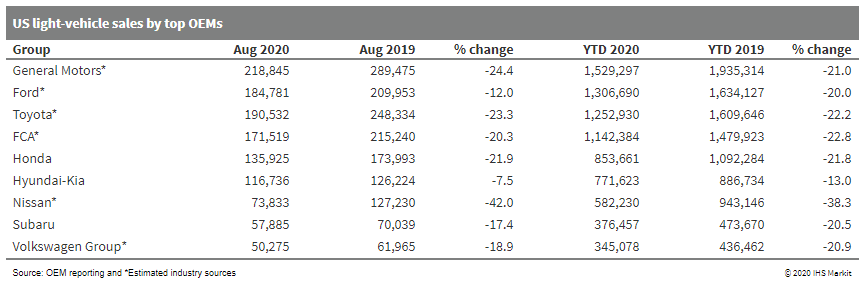

- With an estimated seasonally adjusted annual rate (SAAR) in the

range of 15.0-15.5 million units at the time of writing, the pace

of US light-vehicle sales continues to improve from the April 2020

low of 8.7 million units. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Although remaining well below year-earlier levels, incoming sales figures for August reflect the sustained recovery in demand, and are up 7.5% compared with July 2020.

- The total volume for the month is down when compared with the August 2019 result - with some impact from two fewer selling days and a change in the 2020 calendar, with Labor Day events occurring in September this year - but both the pace of sales and total volumes for the month are estimated to have meaningfully improved from the prior-month levels.

- Consumers continue to be motivated by OEM incentives, 0% interest rates, and government stimulus effects.

- The outlook for the second half of the year remains opaque but the sequential rise in demand levels since April indicates that consumers who are willing, ready, and able to make a new car purchase are doing so.

- There were 26 selling days this August, two less than in the same month last year.

- On a unit volume level, August's sales are estimated to have climbed to approximately 1.32 million units, above the previous month's result of 1.23 million units, but down approximately 20% from the August 2019 level.

- Some potential headwinds remain as we progress through the second half of the year, including possible inventory concerns, uncertain fleet activity, still high unemployment, and potentially waning incentive levels.

- In August 2020, average marketing spend increased 1.5% compared with August 2019, although YTD spend is up 8.9% on industry average.

- We do not expect the pace of sales to advance much further than

the August result, but the ongoing recovery in sales lends upside

bias to expectations for the remainder of the year.

- A group of buyout investors has made a takeover offer for railroad operator Kansas City Southern, which has a market value of more than $17 billion, according to people familiar with the matter. Blackstone Group Inc. and Global Infrastructure Partners submitted the bid after a previous approach was rebuffed, the people said. It is unclear whether Kansas City Southern will be receptive this time and details of the offer couldn't be learned. (WSJ)

- Peterbilt has announced its customers can now order the Model 220EV, a medium duty electric vehicle (EV); customer deliveries are expected at the end of 2020, according to a company statement. Peterbilt has about 30 in operation already. The Model 220EV can be configured for Class 6 or 7 medium duty applications, with an electric motor, two battery packs and an on-board charger. Under DC fast charging, Peterbilt says its new battery packs can recharge in one to two hours. With 200 miles range on a full charge, Peterbilt says it is ideal for local pick-ups and deliveries as well as short regional haul operations. The vehicle is a cab-over-engine configuration, and Peterbilt says it delivers superior maneuverability, enhanced visibility, a spacious interior and ease of serviceability to help maximize uptime. Jason Skoog, Peterbilt general manager and PACCAR vice-president, is quoted as saying, "Peterbilt is leading the charge when it comes to commercial vehicle electrification featuring a full line up of EV Models, with over 30 out collecting real world miles. With the addition of the Model 220EV to our SmartSpec® sales tool Peterbilt dealers can easily spec and quote exactly what customers have been asking for in a zero-emission medium duty truck." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Unilever has announced that it will source 100% of the carbon currently derived from fossil fuels in the company's cleaning and laundry product formulations with renewable or recycled carbon by 2030. The move is set to transform the sustainability of cleaning and laundry brands including Omo (Persil), Sunlight, Cif, and Domestos, the company says. The chemicals used in Unilever's cleaning and laundry products make up the greatest proportion of their carbon footprint, 46%, across their lifecycle, the company says. "By transitioning away from fossil-fuel-derived chemicals in product formulations, the company will unlock novel ways of reducing the carbon footprint of some of the world's biggest cleaning and laundry brands," Unilever says. The company expects the initiative alone to reduce the carbon footprint of the product formulations by up to 20%. Unilever says it is ring-fencing €1.0 billion ($1.2 billion) for Clean Future to finance biotechnology research, CO2 and waste utilization, and low-carbon chemistry, which it says will drive the transition away from fossil-fuel-derived chemicals. The investment will also be used to create biodegradable and water-efficient product formulations, to halve the use of virgin plastic by 2025, and support the development of brand communications that make these technologies appealing to consumers, the company says. The Clean Future investment is in addition to Unilever's previously announced €1-billion Climate and Nature fund and is focused on developing "affordable cleaning and laundry products that deliver superior cleaning results with a significantly lower environmental impact," it says.

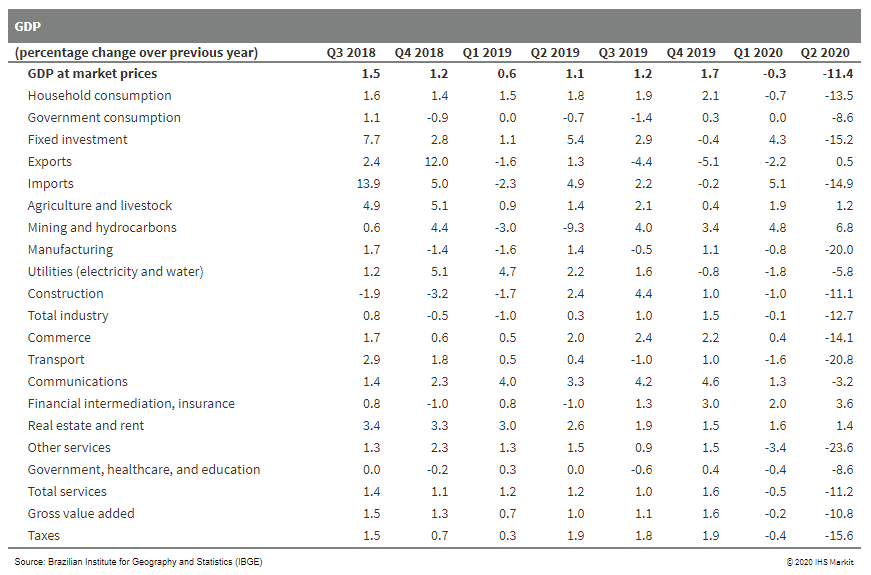

- The National Statistics Office of Brazil ((Instituto Brasileiro

de Geografia e Estatistica: IBGE) reported that seasonally adjusted

GDP plunged by 9.7% in the second quarter of 2020 compared with the

first quarter (not annualized). On the annual comparison and using

unadjusted data, GDP fell by 11.4%. These plummeting figures take

the GDP level to where it was in 2009. (IHS Markit Economist Rafael

Amiel)

- Sizeable declines in private consumption and investment led to GDP plunging the most in a quarter in the series that started in 1996. Lockdown measures and sizeable levels of uncertainty have been major constraints on consumption and investment. Government spending has also decreased significantly. Net trade was a positive as exports increased slightly while imports declined substantially. Strong demand from China helped Brazilian exports to keep momentum, especially in terms of purchases of soybeans, iron ore, and related products and meats.

- From a supply-side perspective, most sectors posted large declines except for agriculture, financial services, and real estate. Production of agricultural products was not affected by the pandemic, although some distribution channels may have suffered; still, this counts as service GDP. The growth in financial services may be hiding some potential losses because of non-performing loans that may materialize later in the year or perhaps in early 2021, once COVID-19-virus-related support is withdrawn.

- Manufacturing has suffered, with most plants having been closed in April. Commerce, transport, and professional services have been heavily affected by the confinement and lockdown measures.

- Labor market indicators show that the Brazilian economy lost over 10 million jobs (11% of the total) from February to July. Government support in the form of direct transfers is helping the most vulnerable. The government asserts that around 60 million Brazilians are benefiting from these transfers.

- The IBGE revised quarter-one figures and stated that in

January-March, GDP declined by 2.5% quarter on quarter (q/q),

instead of the 1.5% reported three months ago.

- Chinese electric car manufacturer BYD has announced the beginning of operations at its lithium iron phosphate (LFP) battery plant in Manaus (Brazil), reports Yicai Global. BYD has invested BRL15 million (USD2.7 million) in the 5,000-square-metre plant, which has a production capacity of 18,000 battery modules a year. According to the source, the first batch of batteries will be delivered to the city of São José dos Campos in São Paulo, which has bought 12 22-metre electric buses from BYD for its urban rapid transit system. Li Tie, general manager of BYD Brazil, said, "With the new battery factory, we will join hands with more companies dedicated to the development of clean energy to keep promoting the electrification of public transport in Brazil." He added, "We are in the ramp-up phase of production capacity now. It is estimated that we will make more than 1,000 battery modules by the end of this month." This is BYD's third plant in Brazil. BYD has been competing in the local photovoltaic equipment market since 2017 with a factory in Campinas. The plant also assembles BYD bus chassis. With its presence in Brazil, BYD supplies fleets of electric waste trucks and buses, respectively, to Comlurb, Rio de Janeiro's municipal urban cleaning company, and Transwolff, a transport operator in São Paulo. In January, BYD revealed its plans to double solar panel production in Brazil. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed higher across the region; Germany +2.1%, France +1.9%, UK +1.4%, Italy +1.3%, and Spain +0.6%.

- 10yr European govt bonds closed significantly higher across the region; UK/Italy/France -7bps and Spain/Germany -6bps.

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover -6bps/305bps.

- Brent crude closed -2.5%/$44.43 per barrel.

- The EU is completing a disappointing wheat harvest this year due to a series of poor weather conditions, with wet autumn and winter disrupting sowings and a unusually dry spring hurting yields. On 27 August, the European Commission forecast the bloc's soft wheat production at 114.4 million tons, which would be 13.3% less than last year's volume and 9.9% below the latest five-year average. Similarly, European grains association COCERAL put total wheat production in the EU and UK (excluding durum) at 129.1 million tons, down by more than 12% from last year's 146.8 million tons. The nearly finished harvests show mixed results between countries, with reasonable crops seen in Germany and Poland and severe losses for French and British farmers. In France, the EU's largest producer, soft wheat harvesting has ended with an estimated 25% decline from last year to around 25 million tons - one of its poorest crops in decades. The losses were mainly caused by reduced sowings following excessive rainfall and a dry spring hurting yields. The UK also faces its worst harvest since the 1980s with an expected production loss of 35% to around 10 million tons, according to the National Farmers' Union of England and Wales ( NFU). The farm union said that less than half of the usual amount of wheat was planted due to heavy rainfall and flooding last fall, while the crop further suffered from subsequent drought and rains in August. Germany, the second largest producer in the EU, has not experienced the same crop disasters as those seen in France and the UK. With harvesting almost finished, the country's farming ministry estimates total wheat production to fall by 5.1% year-on-year to a near-average volume of 21.88 million tons. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- According to Federal Statistical Office (FSO) data, German real

retail sales excluding cars slipped modestly by 0.9% month on month

(m/m, seasonally and calendar adjusted) in July, following a huge

rebound in May (13.2%) and a first correction in June (-1.9%). (IHS

Markit Economist Timo Klein)

- The spike in May had been linked to catch-up effects when non-food stores reopened, following the March-April lockdown that had depressed retail sales by a cumulative 8.5%.

- Net/net, July's level of retail sales was still 1% above February's level and even 3% above that of the fourth quarter of 2019, prior to the pandemic.

- Unadjusted y/y rates in July were 4.2% in real terms and 5.6% in nominal terms, which is not distorted by any shopping day effects. These annual rates thus remain above average growth in 2019 of 3.1% (real) and 3.6% (nominal).

- Major categories of the price-adjusted y/y data for July (total 4.2% y/y, details see table below) reveal hardly any difference any more between food sales (4.2%) and non-food sales (4.4%). This normalization signals that pent-up demand is no longer an issue and that the VAT cut has not led to a surge in the purchase of large durables - except possibly for cars, which are not included in these retail sales data.

- Among non-food sales, 'internet and mail orders' (up 15.6% y/y) are still well ahead of the rest, followed (as before) by 'furniture/household goods/DIY' (12.9%) and 'specialty stores such as for toys, books, bicycles' (7.9%).

- The other major categories all posted declines: pharmaceutical/cosmetic goods -4.1% y/y, textiles/shoes -8.0%, and sales at general department stores even -14.5%.

- Details of the latest GfK consumer confidence survey conducted during August (overall index down modestly from -0.2 to -1.8) show that household's assessment of their personal financial situation in the next 12 months was the driving factor (decline by 5.6 points), along with a rising propensity to save (up 5.5 points). By contrast, consumers' willingness to make major purchases continued to improve. Although the monthly gain was small (1.2 points), the August level of 43.7 is much closer to pre-pandemic levels around 54 than to its long-term average of 16.1. The short-time work instrument continues to have a reassuring effect despite the accompanying income losses.

- Continental has announced a more far-reaching review of its cost structure in response to the financial impact of the COVID-19 virus pandemic which will place up to 30,000 jobs across its global operations under review. According to a company press statement, about 13,000 of the jobs under review will be in Germany, and the program will also target other high-cost production locations, with the roles in question either 'modified, relocated, or made redundant'. Continental will complete 90% of this program by 2025. Commenting on the rationale behind this aggressive program, which is targeted at achieving EUR1 billion of annual savings, Continental CEO Elmer Dagenhart said, "The entire automotive industry is currently faced with enormous challenges. It has not experienced a larger, more severe crisis in the past 70 years. This crisis is hitting suppliers particularly hard. It will demand a lot from us in the short term and push us to our limits in the coming years. After roughly a decade of fast, profitable growth and workforce expansion in line with the growth model of the automotive industry at that time, we are now gearing our operations to a new kind of growth with future technologies. That is why we are in intensive discussions with employee representatives to find the most sustainably effective solutions and strike a balance with the interests of our workforce." (IHS Markit AutoIntelligence's Tim Urquhart)

- Spain's registrations fell back again during August despite market support measures. According to the latest data published by the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles Turismos y Camiones: ANFAC), demand has fallen by 10.1% year on year (y/y) to 66,925 units. The year-to-date (YTD) figures now stand at 524,706 units, a decline of 40.6% y/y. The decline in the Spanish passenger car market has come despite the introduction of support for parc replacement and those looking to purchase alternative powertrain vehicles which was introduced in mid-June (see Spain: 16 June 2020: Spanish government reveals automotive industry support measures). This also comes despite a positive July during which gains were recorded. The lack of impact of these measures during August is underlined by the weaker demand from private consumers, which fell 9.5% y/y. However, company car registrations also fell by 15.5% y/y to 24,230 units. The only positive improvement has come from the rental car market, as tourism in the country has opened up again and vehicles that would have been renewed or added to fleets early in the year are now being registered, causing a gain this month of 21.5% y/y to 5,031 units. However, the YTD figures show the true extent of the shortfall in rental fleet registrations, with a fall of 62% y/y to 77,782 units for the eight-month period. Nevertheless, the overriding issue at the moment is that incentives have been unable to lift the market in August as they did in July, with ANFAC noting in its statement that while the beginning of the month had a "positive rhythm", sales progressively decreased later in the month. (IHS Markit AutoIntelligence's Ian Fletcher)

- Italy's passenger car registrations fell again in August, although much less than in some earlier months. According to the latest data published by the National Association of Foreign Vehicle Makers' Representatives (Unione Nazionale Rappresentanti Autoveicoli Esteri: UNRAE), demand fell by 0.4% y/y to 88,801 units. Evidence of the extent of the contraction recorded previously can be observed from the YTD data, which showed the market dropping by 38.9% y/y to 809,655 units. In Italy, although the market has contracted for yet another month, there are signs of the benefits that incentives could have in the coming months. At the beginning of August, the previously announced 'Decreto Rilancio' released EUR50 million of funding allocated to support sales of passenger cars with CO2 emissions of under 110g/km priced under EUR40,000. These vehicles were eligible for an incentive of EUR1,750-750 paid by the state, and EUR1,000 paid by the OEM. However, if a vehicle of at least 10 years old is scrapped, the incentive rose to EUR3,500, with EUR1,500 paid by the state and EUR2,000 paid by the dealer. However, it was so popular that it used up the funding during a single week. Its success is underlined by the jump in private registrations of 27% y/y. However, a second, more substantial wave of funding was announced in mid-August as part of 'Decreto Agosto'; applications for which started at the beginning of September. (IHS Markit AutoIntelligence's Ian Fletcher)

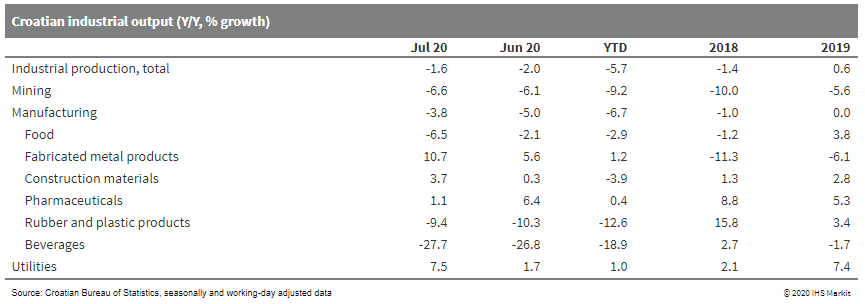

- In the second quarter of 2020, Croatian GDP plunged by 15.1%

y/y, the fall outstripping the average of the European Union. The

COVID-19-induced drop was the largest in the country's recorded

history since independence and the first annual contraction since

emerging from recession in 2014. The decline was very close to the

IHS Markit forecast for the second quarter. (IHS Markit Economist

Andrew Birch)

- In seasonally adjusted data, GDP also contracted by 14.9% quarter on quarter (q/q). The sharp drop-off put Croatia into a technical depression, as the leading impact of COVID-19 also pushed the economy down by 1.3% q/q in the first quarter.

- The spread of COVID-19 devastated Croatia's merchandise exports. Previous, customs based data had suggested a coming decline, with nominal y/y export losses ramping up in March and substantially intensifying in April-June. The resulting fall of real merchandise exports in the national account figures reached 10.9% y/y in the second quarter.

- The larger overall fall of exports and goods and services was triggered by a 67.4% y/y plunge in service exports. Although the country's service exports are concentrated in the third quarter due to tourism patterns, typically those exports begin to ramp up significantly in the second quarter.

- In 2020, leading tourism data showed that in April-June 2020, total tourist arrivals plunged by 84.6% y/y. While domestic tourism was somewhat more resilient, it still collapsed, dropping by 70.4% y/y.

- The drop of imports of goods, by 25.3% y/y, and services, by 42.5%, in the second quarter was not as severe as the fall of exports, but nonetheless historically large. The shutdown efforts domestically was a major contributor to the drop-off of imports in the second quarter.

- The domestic lockdown devastated consumer activity in March and

April, with leading retail trade data showing a nearly 30% decline

in activity over the course of those two months.

- Norwegian companies Ocean Installer and Vard Group are entering into a partnership to develop one of the world's most advanced turbine installation vessels for offshore wind. The subsea EPCI contractor and shipyard plan to jointly develop one of the world's most advanced vessels for installation of future offshore wind turbines, which are too large for the existing turbine installation fleet. The partners aim to design a vessel capable of installing wind turbine components weighing more than 1,000 metric tons at heights more than 150 meters above sea level. They expect the ship to be highly attractive for the construction of large international wind farms in the coming years. The partnership builds on the companies' respective experience, quality standards and efficiency developed over years of work on the Norwegian Continental Shelf. Vard designs and constructs complex offshore construction vessels and advanced special purpose ships: its current project portfolio includes the REV Ocean research and expedition vessel, as well as other highly specialized and autonomous zero-emission vessels. Ocean Installer is prequalified for certain large offshore wind projects and is participating in tenders in the USA and Europe, for both Norwegian and international energy companies. "Such change of direction is very important for traditional Norwegian oil and gas supply chain, which long term will have to replace its existing business with something else," Ocean Installer CEO Odd Strømnes said. "We currently have high expertise and solid revenues from oil and gas, and these resources are now dedicated to establish us as a leading player within the offshore wind space." (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Multiple sources suggest Abu Dhabi's General Holding Corporation (Senaat) has offered National Marine Dredging Company (NMDC) a merger with Senaat's EPC subsidiary National Petroleum Construction Company (NPCC). As part of the offer, sources suggest NPCC will be transferred to NMDC, and NMDC will issue a convertible instrument of 575 million shares to NPCC, representing 69.7% of the issued share capital of NMDC. The share price at which the instrument will convert into shares in NMDC will be AED 4.40 per share, giving an implied equity value of AED1.1 billion (USD300 million). The offer is subject to the standard regulatory approvals. NMDC's board will consider the transaction proposed by the NPCC Shareholders before making any recommendation to shareholders. Should an agreement be reached between the parties, NMDC's shareholders would vote on the transaction during H2 2020. According to NMDC, there is no certainty that any transaction will occur. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

Asia-Pacific

- APAC equity markets closed mixed; Australia +1.8%, South Korea +0.6%, India/Japan +0.5%, Mainland China -0.2%, and Hong Kong -0.3%.

- South Korean automakers posted a 10.5% year-on-year (y/y)

plunge in their combined global vehicle sales to 573,279 units in

August, according to data released by five major domestic

manufacturers and reported by Yonhap News Agency, as compiled by

IHS Markit. (IHS Markit AutoIntelligence's Jamal Amir)

- The five automakers reported a 5.6% y/y decline in their combined domestic sales last month to 111,847 units, while their combined overseas sales went down by 11.7% y/y to 461,432 units.

- South Korea's top-selling automaker, Hyundai, posted global sales of 312,990 units in August, down by 14.2% y/y.

- Hyundai's domestic sales grew by 3.2% y/y to 54,590 units last month, while its overseas sales declined by 17.1% y/y to 258,400 units.

- In the domestic market, the Grandeur (Azera) led the automaker's sales last month with 10,235 units. A strong performance by its premium Genesis brand, supported by the all-new G80 sedan and GV80 sport utility vehicle (SUV), also helped to maintain robust sales momentum in South Korea, according to the automaker.

- Global sales of Hyundai's affiliate, Kia, decreased by 5.2% y/y to 216,945 units in August.

- Kia's domestic sales declined by 11.3% y/y to 38,463 units last month, while its overseas sales fell by 3.7% y/y to 178,482 units.

- Kia said that production line upgrades at a domestic factory temporarily reduced supply. The next-generation Sorento SUV, released in March, and the next-generation K5 sedan, released in December 2019, were the automaker's best-selling SUV and sedan in South Korea, respectively.

- General Motors (GM) Korea reported a 13.2% y/y increase in its total sales to 27,747 units last month, with its domestic sales down by 8.0% y/y to 5,898 units and overseas sales up by 20.7% y/y to 21,849 units. The surge in the automaker's overseas sales was mainly driven by increased exports of the Trailblazer SUV.

- SsangYong's global sales plunged by 19.9% y/y to 8,027 units during August. Last month, the automaker sold 6,792 units in South Korea, down by 15.5% y/y, and around 1,235 units in its overseas markets, a decline of 37.5% y/y.

- Renault Samsung's sales nosedived by 41.7% y/y to 7,570 units in August, its domestic sales plunged by 21.5% y/y to 6,104 units, and its overseas sales plummeted by 71.9% y/y to 1,466 units. The plunge in the automaker's overseas sales was mainly due to the end of production of the Nissan Rogue at Renault Samsung's plant after its contract to produce the model expired in September 2019.

- Exports of alternative-powertrain vehicles from South Korea jumped 23% year on year (y/y) to USD3.16 billion during the first half of 2020, accounting for 20% of the country's total automobile exports, reports the Yonhap News Agency citing data released by the Korea International Trade Association (KITA). However, overall exports of vehicles dipped 27.3% y/y to reach USD15 billion during the period. The surge in exports of alternative-powertrain vehicles from South Korea reflects the growing demand for such vehicles globally. Various governments around the world are preparing to phase out the use of gasoline (petrol)- and diesel-powered vehicles in their fight against pollution and are providing incentives to increase the adoption of alternative-powertrain vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- ZoomCar has selected PASCOS to distribute its cloud-based platform offering, Zoomcar Mobility Services (ZMS) in India, according to a company statement. PASCOS will distribute ZMS as a one-stop shop mobility offering to commercial vehicle operators and government entities to help reduce operating cost, enhance safety, increase vehicle monetization, and improve customer engagement. ZMS includes two primary software offerings: IoT as a service combined with subscription as a service. Greg Moran, co-founder and CEO of Zoomcar, said, "We are delighted to partner with PASCOS to reach wider commercial heavy vehicle operators and government entities to help us build the future of mobility market in India," This follows recent launch of ZMS in August. One of the key elements of ZMS is Zoomcar's proprietary driver scoring mechanism that tracks the real-time driving behavior of the customers. This employs technologies such as artificial intelligence and machine learning thereby helping in enhancing the driving quality. Zoomcar introduced car-sharing services in India in 2013 and currently has over 10,000 cars in its fleet. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SAIC Motor Corporation Ltd (SAIC) has reported double-digit

percentage year-on-year (y/y) declines in revenue and net profit

during the first half of the year on the impact of the COVID-19

virus outbreak. (IHS Markit AutoIntelligence's Abby Chun Tu)

- According to its interim report for the six-month period ending 30 June 2020, SAIC Motor's revenue fell 24.6% y/y to CNY283.7 billion (USD41.6 billion), from CNY376.3 billion in the first half of 2019, while its net profit attributable to shareholders slumped 39.1% y/y to CNY8.4 billion.

- Excluding the impact of non-recurring gains and losses, SAIC's net profit fell by 42.6% y/y to CNY7.2 billion in January-June.

- SAIC's sales in the first half of the year fell by 30.2% y/y to 2.05 million units. Sales of SAIC-VW, SAIC's joint venture (JV) with Volkswagen (VW), contracted by 37.2% y/y to 577,385 units, while sales of SAIC-GM, SAIC's JV with General Motors (GM), fell 33.3% y/y to 556,206 units and sales of the SAIC-GM-Wuling JV shrank by 28.7% y/y to 531,040 units.

- SAIC Maxus, SAIC's commercial vehicle (CV) company, posted an increase of 8.5% y/y to 68,030 units.

- Sales of SAIC's wholly owned brands, Roewe and MG, managed by SAIC Passenger Car Company, dropped 22.5% y/y to 241,475 units in the reporting period.

- Chinese automaker Guangzhou Automobile Group (GAC) has released

its financial results for the first half of 2020, ended 30 June

2020. Revenues decreased by 9.54% year on year (y/y) to CNY25.44

billion (USD1.53 billion). (IHS Markit AutoIntelligence's Abby Chun

Tu)

- Its net profit to shareholders of the listed company slumped 52.87% y/y to CNY2.32 billion during the reporting period.

- Net loss to shareholders of the listed company after deducting recurring gains or losses fell by 38.04% y/y to CNY2.0 billion in the first half of 2020, compared with CNY3.27 billion in the same period last year.

- GAC's basic earnings per share reached CNY0.23, compared with CNY0.48 in the same period last year.

- GAC's gross margin of vehicle manufacturing stood at 1.09% during the first half, compared with 2.80% in the same period of last year.

- With regard to vehicle sales, sales volumes for the GAC Honda joint venture (JV) decreased 20.58% y/y in the first half to 318,451 units while sales volumes of the GAC Toyota JV fell by 3.11% y/y to 320,888 units.

- Sales volumes at GAC Motor, the group's wholly owned passenger car subsidiary, fell by 26.20% y/y to 137,971 units.

- GAC Honda completed construction for its expansion project at its Zengcheng plant in February, giving it capacity of 120,000 units per annum.

- Chinese electric vehicle (EV) startup Xpeng launched a battery leasing program in China yesterday (1 September). The program allows consumers to lease a vehicle's battery for up to seven years, and when the lease ends the consumer will have ownership of the battery. The program covers both Xpeng's G3 electric sport utility vehicle (SUV) and its P7, a high-performance electric sedan. For the Xpeng G3, which starts from CNY145,800 (USD21,358), the program can help lower the model's purchase price by CNY60,000. For the Xpeng P7, which starts from CNY251,900, the program can lower the purchase price by CNY75,000. The monthly fee for the 520-km version of the G3 is CNY780. This model is fitted with a 66.5-kWh battery pack. For the P7 sedan, the monthly fee ranges from CNY780 to CNY900, depending on the configuration of the vehicle. According to the startup, the battery leasing program will be available first in selected cities, including Beijing, Chengdu, Dongguan, Foshan, Guangzhou, Hangzhou, Ningbo, Shanghai, Shenzhen, Tianjin, Wuhan, and Wuxi. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The Bangkok Post reported today (2 September) that the Bank of

Thailand (BoT) has introduced a new debt relief measure for

unsecured loan borrowers, encompassing credit cards, personal

loans, and vehicle loans. (IHS Markit Banking Risk's Angus Lam)

- Under the expanded plan, provided the borrower has good debt-servicing ability and a good payment track record on their mortgage loans, the unsecured loans can be converted into secured loans using the mortgaged assets as collateral from September 2020 to December 2021.

- To benefit from this plan, the secured loan must not be classified as a non-performing loan (NPL), while unsecured loans can be either performing or non-performing.

- According to the newspaper, under this plan, the loan will be charged at an interest rate of between 5.75% and 8.8%, compared to 16% to 25% for the three types of unsecured loans listed for this debt relief measure.

- This is an expanded and more impactful measure on a similar system introduced in June that lowers the interest rate on credit cards and personal loans by 2-4%, and other policies including loan classification relaxation and provisioning.

- IHS Markit believes that this is a risk-positive development because it allows banks to recover as much of the loan as possible and, therefore, reduces banks' capital needs and losses as a result. Given that the country has a high debt-to-GDP ratio of around 80%, the lower interest rate for these loans will help households' repayment abilities.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-september-2020.html&text=Daily+Global+Market+Summary+-+2+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}