Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 21, 2020

Daily Global Market Summary - 21 May 2020

Most global equity markets closed modestly lower on the day partially driven by concerns over heightened tensions between the US and China. Oil is now on its sixth consecutive day of gains, while credit was modestly weaker across both investment grade and high yield. Flash PMIs for May are showing some improvement versus April, but still remain firmly in contraction territory.

Americas

- US equity markets opened higher until switching course shortly before 10:00am ET, with most indices closing lower on the day except for the Russell 2000 +0.1%; Nasdaq -1.0%, S&P 500 -0.8%, and DJIA -0.4%.

- 10yr US govt bond closed higher at -2bps/0.68% yield.

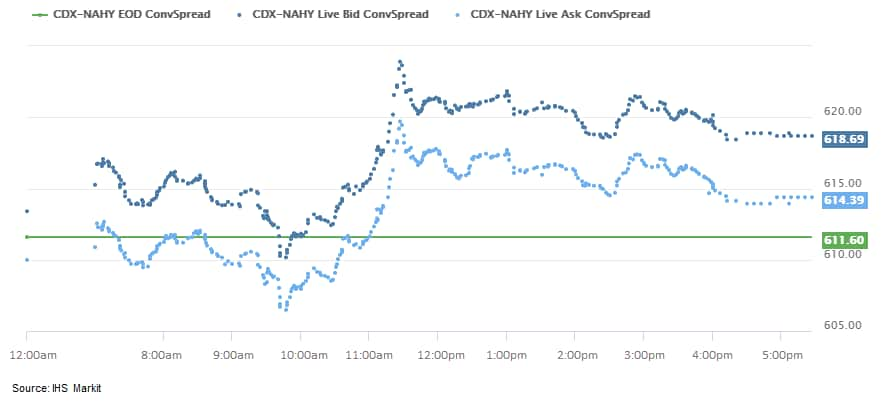

- US CDX indices opened higher, but began to widen shortly before

10:00am ET (see CDX-NAHY chart below) to close lower on the day;

CDX-NAIG closed +2bps/86bps and CDX-NAHY +5bps/617bps:

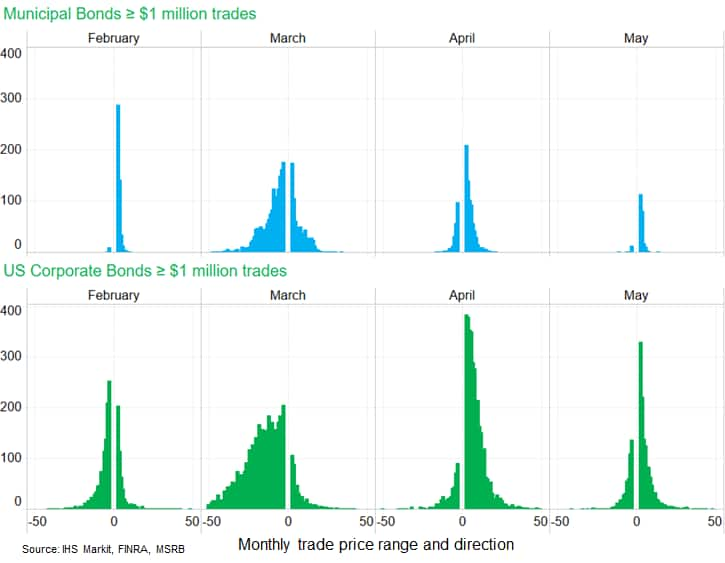

- The below charts are an update of previously published data

showing the count of municipal and US corporate bonds that traded

within intramonth price ranges between -50 to +50 points (excluding

-2 to +2 point ranges given the very high frequency) for larger

bond trades (≥$1 million) during the months of February, March,

April, and May (as of 20 May). The data highlights how more

corporate bonds are trading higher between trades in May and with

wider intramonth price ranges than municipal bonds, which may

indicate some dampening in municipal bond liquidity.

- US initial claims for unemployment insurance, at 2,438,000 in

the week ended 16 May, remained at historically high levels,

although below the all-time high of 6,867,000 in the week ended 28

March. (IHS Markit Economist Akshat Goel)

- This was the ninth straight week with claims in seven figures and a total of 35.3 million non-seasonally-adjusted initial claims have been filed over this period. This is 21.7% of the February labor force.

- There were 2,226,921 initial claims for Pandemic Unemployment Assistance (PUA ) in the week ended 16 May; this total exceeded the non-seasonally-adjusted total of 2,174,329 initial claims under state programs.

- In the week ended 16 May, California led all states with 246,115 initial claims; New York and Florida reported 226,521 and 223,927 initial claims, respectively. For initial claims under PUA, Massachusetts led all states with 1,184,792 claims and was responsible for more than half of the national total.

- Continuing claims, which lag initial claims by a week, rose by 2,525,000 to a new all-time high of 25,073,000 in the week ended 9 May. The insured unemployment rate in the week ended 9 May stood at 17.2%.

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 36.4 in May, up from 27.0 in

April, but nonetheless indicating the second-sharpest decline in

business activity since the series began in late-2009. (IHS Markit

Economist Siân Jones)

- Flash U.S. Services Business Activity Index at 36.9 vs 26.7 in April

- Flash U.S. Manufacturing PMI at 39.8 vs 36.1 in April

- Flash U.S. Manufacturing Output Index at 34.1 vs 28.8 in April

- US existing home sales plunged 17.8% in April from March to an

annual rate of 4.33 million units. Single-family sales fell 16.9%

while condo/co-op sales skidded 26.4%. All four regions had

double-digit declines. (IHS Markit Economist Patrick Newport)

- Inventory of single-family homes dipped to 1.30 million, the lowest reading for April on record (data goes back to 1982). Our seasonally adjusted estimate, 1.26 million, is a record low.

- The median price for single-family homes increased 7.4% year on year from a year earlier in April; the average price was up 5.4%. All four regions saw robust price gains—possibly because few homes are being listed in a month when activity normally perks up.

- Crude oil closed +1.3%/$33.92 per barrel.

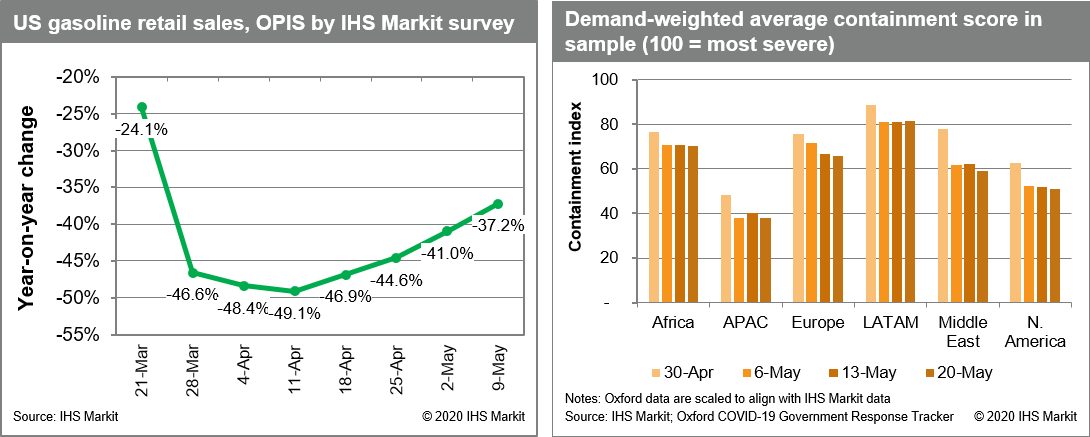

- As of 20 May, we estimate that the share of global gasoline

demand in countries under major restrictions or full shutdown fell

slightly to 68%, despite small moves towards opening globally. As

discussed last week, we anticipate that the recovery will remain

gradual. In the US, we saw further small opening moves across 9

states. OPIS demand data shows a steady recovery in consumption,

with preliminary data for the week to 16 May coming in at -35%.

Data from Apple and Google mirrors this upward trajectory.

Globally, Google mobility data suggests a clear w-o-w uptick in

travel to workplaces in countries from the US to Japan to the

Netherlands. In many countries, travel to transit stations also

appears to be climbing back up, and we are alert to signs of riders

substituting for personal vehicles rather than foregoing their

trip. (IHS Markit Energy Advisory's Roger Diwan)

- Mark Zuckerberg is shifting Facebook Inc. toward a substantially remote workforce over the next decade, permanently reconfiguring the tech giant's operations around the dispersed structure that the coronavirus pandemic forced on it. Within 10 years, Mr. Zuckerberg expects as much as half of Facebook's employees—who currently number more than 45,000—to work from home, he said in an interview before the announcement. (WSJ)

- The Pirbright Institute has moved a step closer to developing a viable vaccine for African swine fever (ASF). A new study has shown 100% of pigs immunized with a vaccine developed at the institute were protected from a lethal dose of ASF virus. The World Organization for Animal Health has warned ASF could wipe out a quarter of the global pig population, partly due to the lack of a vaccine. (IHS Markit Animal Pharm's Sian Lazell)

- Ford temporarily halted production at two US plants after workers tested positive for the COVID-19 virus, reports Automotive News. According to the report, the two plants affected were the Dearborn Assembly Plant in Michigan and the Chicago Assembly complex in Illinois. There were two workers who tested positive at the Chicago SHO Center, a facility about a mile from the main plant where parts are sequenced for the Ford Explorer and Lincoln Aviator, and the facility was closed twice for several hours, the report states. In those cases, Ford says it believes the workers were already infected. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to data from Argentina's National Institute of

Statistics and Census (Instituto Nacional de Estadística y Censos:

INDEC), the economic activity index decreased by 11.5% year on year

(y/y) in March. The seasonally adjusted data show a 9.8%

month-on-month (m/m) decrease in March. When considering the first

quarter of 2020, the steep decline in March drove down the

quarter's average to a 5.3% y/y decline. (IHS Markit Economist

Paula Diosquez-Rice)

- By sector, the economic activity index data show mostly declines in March; for example, there were steep declines in the construction sector, which decreased by 46.5% y/y, in the hospitality sector, down by 30.8% y/y, the manufacturing sector, down by 15.5% y/y, the wholesale and retail sector, down by 11.2% y/y, and transport and communication sector, down by 14.8% y/y. The utility sector was the only sector to post an annual increase, up by 6.7% y/y.

- Information on the utilization of the country's manufacturing capacity shows a decline in March, continuing the trend of the past six months. Oil refining has the highest utilized capacity, at 70.8%, followed by paper and cardboard, chemicals, basic metals, and food and beverages; the sectors with the least utilized capacity are automobiles industry, at 25.9%, ) and the textiles industry, at 28.7%.

- The outlook is bleak and the GDP forecast has been adjusted downwards to a deeper decline in 2020; IHS Markit forecasts an 8.0% decline in GDP in 2020. However, the risk associated with the forecast weighs heavily on the downside.

- After two months of discussion with oil-producing provinces, companies, and oil unions, Argentina's federal government will restore a domestic crude oil price support mechanism, known as the "barril criollo", which was previously used during the 2014-16 oil price downturn, with immediate effect. The executive decree contains two measures to mitigate the impact of the collapse in global oil prices on producers: a minimum domestic sales price for benchmark Medanito crude (produced in the Neuquén Basin) of USD45 per barrel, and an oil export duty exemption when Brent crude is equal to or below the USD4 per barrel base price (which would apply to several crude types). Domestic crude price support will remain in place until end-2020, unless Brent crude exceeds USD45 per barrel for more than 10 consecutive days. (IHS Markit E&P Terms and Above-Ground Risk's Juliette Kerr)

- Volkswagen (VW) is continuing with its USD830 million investment program in Argentina amid the COVID-19 pandemic. Tomás Owsianski, CEO and president of VW Group Argentina, confirmed that the automaker will continue with its USD650-million investment in project Tarek at its General Pacheco plant, investment of USD150 million to launch a new MQ-281 gearbox model, as well as another USD30 million for the construction of an auto parts warehouse amid the COVID-19 virus outbreak, reports NF News Center. (IHS Markit AutoIntelligence's Tarun Thakur)

- Nissan has extended its plant shutdowns in Brazil for the second time at its Resende, Rio de Janeiro (RJ) plant, reports Automotive Business. Production was scheduled to resume on 21 May, but "in order to ensure the health of its employees, suppliers, their families and society in general, in addition to also reflecting the stock situation to the new reality of the automotive market, due to the Covid-19 pandemic in the country ", the automaker has rescheduled the return of workers for 22 June. (IHS Markit AutoIntelligence's Tarun Thakur)

- IHS Markit in May downgraded Jamaica's medium-term rating from 50 to 55, from BB- to B+ on the generic rating scale. The medium-term outlook remains at Stable. We also downgraded Jamaica's short-term rating from 25 to 30 (A- to BBB+ on the generic rating scale). Jamaica's outlook and/or rating had been downgraded by Fitch, S&P Global Ratings (S&P), and IHS Markit during the first half of 2020, spurred by the external shocks that the country faces: the spread of the COVID-19 virus, the global recession, and the ensuing sharp declines in tourism and transportation activity), the fall in bauxite and alumina prices, and the slowdown in remittances and investment. (IHS Markit Economist Ellie Vorhaben)

Europe/Middle East/ Africa

- European equity markets closed lower across most of the region; Germany -1.4%, France -1.2%, UK -0.9%, Italy -0.7%, and Spain flat.

- 10yr European govt bonds closed higher across the region; UK -6bps, Germany -3bps, France -2bps, Spain -1bp, and Italy flat.

- Brent crude closed +0.9%/$36.06 per barrel.

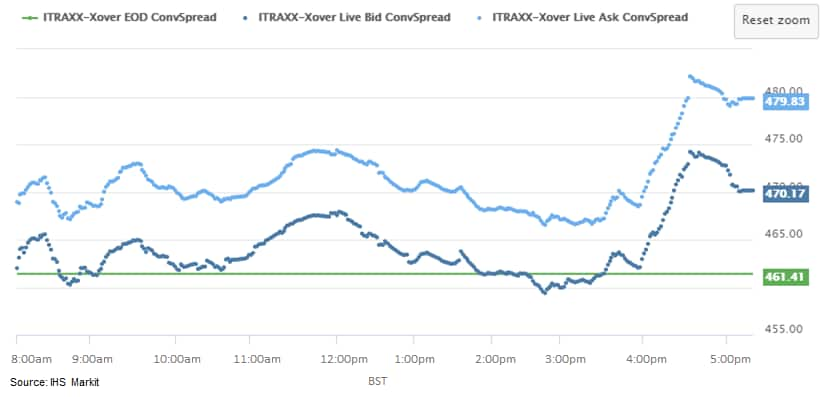

- European CDS indices closed lower on the day, with

iTraxx-Europe closing +1bp/79bps and iTraxx-Xover +14bps/475bps,

with the largest part of the sell-off beginning at around 4:00pm

GMT:

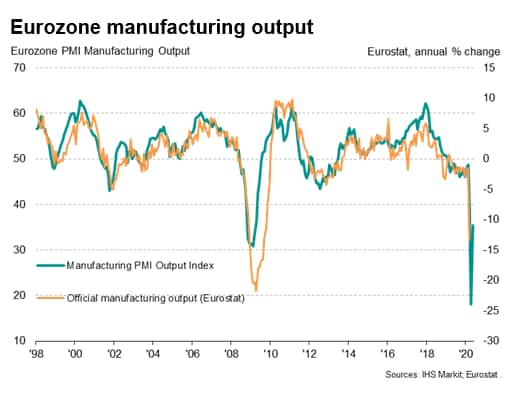

- The flash IHS Markit Eurozone Composite PMI rose from an

all-time low of 13.6 in April to 30.5 in May, its highest since

February. The prior low of 36.2 was seen during the peak of the

global financial crisis in February 2009. (IHS Markit Economist

Chris Williamson)

- The service sector business activity index picked up from 12.0 in April to 28.7, its highest since February, but social distancing and other virus-related lockdown measures continued to hit businesses such as hotels, restaurants, travel and tourism and other consumer-facing firms especially hard, resulting in the third-steepest decline ever recorded.

- The factory sector's output index meanwhile rose from 18.1 in

April to 35.4 in May, albeit likewise still indicating a rapid rate

of decline.

- Dutch consumer confidence has sunk to lows last seen during the

eurozone sovereign debt crisis. In May, the consumer confidence

index compiled by Statistics Netherlands (Centraal Bureau voor de

Statistiek: CBS) has dropped to -31, down from an average of -1 in

2019. Consumers are especially concerned about the economic

situation over the next 12 months, the index for which stands at

-67 (down from -12 in 2019). (IHS Markit Economist Daniel Kral)

- In a separate release, the monthly indicator measuring domestic household consumption has suffered its biggest collapse on record. It was down by 6.7% year on year (y/y) in April, according to shopping-day-adjusted data from the CBS.

- The deterioration is also starting to be visible in the labor market. According to the CBS, the number of people in paid employment fell by 160,000 in April, the largest monthly drop since the series started in 2003. The unemployment rate increased from 2.9% to 3.4% between March and April, kept down by a 124,000 increase in the number of people not looking for work and hence not included in the unemployment rate.

- The Italian government has approved a much delayed

EUR55-billion (USD60-billion) package, or 3.4% of nominal GDP to

support an economy that is in recession, which is expected to

deepen violently in the second quarter of 2020. The new support

plan follows two previous packages, which were announced on 17

March and 8 April. (IHS Markit Economist Raj Badiani)

- The government pledges EUR26 billion to assist furloughed workers, freelancers and unemployment benefits.

- Some emergency income support for workers dependent on the underground economy.

- The support plan also intends to provide additional assistance to companies, totaling EUR15-16 billion. This should include EUR4 billion in tax cuts via the suspension of the regional tax for companies with revenue streams less than EUR 250,000. Also, non-reimbursable grants will be given to small and medium-sized companies.

- A further EUR3.25 billion will be allocated to the health system.

- The fiscal plan also allocates EUR1.2 billion and EUR1.4 billion for the food and agriculture sectors and education system, respectively.

- Italy's agri-food sector is keen to tackle labor shortage difficulties as quickly as possible, while also ensuring full compliance with health and safety measures amid Covid-19, according to the country's ministry of agriculture, food and forestry policies. Should the issue of labor shortages for crop harvesting not be resolved urgently, the ministry warned this would exacerbate the risk of shortages in food supply and food price inflation for consumers. (IHS Markit Agribusiness' Vladimir Pekic)

- The chairman of Fiat Chrysler Automobiles (FCA), John Elkann, has said that the terms related to the automaker's merger with Groupe PSA are "set in stone". Following questions from Italian politicians over the EUR5.5-billion extraordinary dividend to be paid to FCA shareholders prior to its completion, Elkann was quoted by Reuters as telling a conference call after the Exor annual general meeting, "The terms of the FCA-PSA deal are set in stone as binding contracts in their nature are." The EUR5.5-billion dividend that is set to be paid out by FCA has become hugely controversial in Italy following its application to tap into state-backed loan guarantees designed to reduce the impact of the COVID-19 virus-related lockdown measures which have hit businesses. (IHS Markit AutoIntelligence's Ian Fletcher)

- Prysmian Group has finalized a contract with Vattenfall for work on the Hollandse Kust Zuid 3 and 4 offshore wind farm in the Netherlands. Prysmian will provide submarine inter array cable systems, following Vattenfall's successful bid for the permit to develop the non-subsidised wind farms. Prysmian will design, test and supply about 170 km of 66 kV XLPE-insulated inter-array cables, as well as the related accessories. The cables will be produced in Nordenham, Germany. Delivery is due by 2022. The Hollandse Kust Zuid 3 and 4 offshore wind farm will have an installed capacity of around 750 MW, and an annual electricity production equal to the consumption of approximately 1-1.5 million Dutch households. This project is part of a wider energy plan supported by the Dutch government aimed at making 16% of the country's overall energy consumption sustainable by 2023. (IHS Markit's Upstream Costs and Technology Mark Rae)

- The Bank of Zambia (BoZ) cut its policy rate by 225 basis

points to 9.25% during the May meeting of the bank's monetary

policy committee (MPC). (IHS Markit Economist Thea Fourie)

- Although Zambia's projected inflation path over the medium term is higher than the central bank's target range of 6-8%, the monetary easing is in line with measures taken by the government to mitigate the impact of the COVID-19 pandemic on the economy.

- The BoZ warns that Zambia could slip into a recession during 2020. Zambia's GDP is expected to contract by 2.6% during 2020, from a growth rate of 1.9% in 2019.

- Lower output in the construction, wholesale and retail trade, tourism, manufacturing, electricity, and mining sectors is expected due to COVID-19 pandemic-related business operation disruptions.

- The reduction in the BoZ's policy rate is in line with IHS Markit's expectations, although the cut is much deeper than expected. Credit extension growth remains in double-digit percentages (19.5% year on year in March), reflecting higher government borrowing and working capital needs for corporations to bridge financing requirements associated with the COVID-19 pandemic and rising domestic arrears.

Asia-Pacific

- APAC equity markets closed mixed; India/South Korea +0.4%, Japan -0.2%, Australia -0.4%, and China -0.6%.

- The Chinese government is preparing to impose national security legislation on Hong Kong, in a show of legal force that is likely to reignite the territory's pro-democracy movement and exacerbate tensions between Beijing and Washington. Two people briefed on the plans said China's parliament intended to draft the legislation and enter it directly into Hong Kong's mini-constitution, or Basic Law, in a process that will bypass the territory's Legislative Council, or Legco. (FT)

- The South Korean government plans to launch a two-year pilot program to test fuel-cell trucks, reports the Yonhap News Agency. The country's trade, environment, and transport ministries and the nation's leading logistics firms, including Hyundai Glovis, CJ Logistics, and Coupang, have signed a memorandum of understanding (MOU) with Hyundai Motor to improve the fuel-cell trucks' driving performance and safety features from 2021 to 2022. The environment ministry will provide subsidies for the purchase of fuel-cell trucks, while the trade ministry and the transport ministry will help Hyundai improve these trucks' performance and offer hydrogen fuel subsidies. (IHS Markit AutoIntelligence Jamal Amir)

- The headline au Jibun Bank flash Composite PMI, compiled by IHS Markit and covering manufacturing and services, was up slightly in May from 25.8 in April to 27.4, but by remaining well below the neutral level of 50 nevertheless indicated a further substantial decline after the record slump in April. The latest reading signaled the second-largest monthly decline in business activity since data were first available nearly 13 years ago.

- Japan's trade balance recorded a deficit of JPY930 billion

(USD8.6 billion) on a non-seasonally adjusted basis in April

following a JPY5-billion surplus in March. On a seasonally adjusted

basis, the trade deficit widened to JPY996 billion from JPY381

billion in the previous month. The large trade deficit reflected a

sharp decline in exports (down 21.9% y/y) outpacing a decline in

imports (down 7.2% y/y). (IHS Markit Economist Harumi Taguchi)

- Sluggish exports were driven by a 37.8% y/y drop in exports to the US and other countries and regions because of containment measures, which partially offset by a softer decline in exports to China in line with a recovery of economic activity. Major contributors to the severe decline for exports were exports of transport equipment, particularly for autos (down 50.6% y/y) and auto parts (down 39.2% y/y), and ordinary machinery including power generating machinery (down 34.7% y/y).

- The weak imports partially reflected faster declines in import prices of crude oil and other resources. Import volume rose by 1.3% y/y for the first increase since December 2019. While improved production and supply chain strengthening boosted imports from China (up 11.7% y/y), the COVID-19 virus spread lifted demand of domestic production in specific areas, such as textile yarn and fabric (up 124.5 y/y), and medical products (up 27.3% y/y)

- The Commonwealth Bank Australia Flash PMI, compiled by IHS Markit and covering both the manufacturing and service sectors, came in at 26.4 in May, up from April's record low of 21.7. May saw another substantial fall in business activity across Australia, setting the scene for a deepening downturn in the economy during the second quarter. Even as lockdown measures were relaxed in mid-May, this only contributed to a minor easing of the rate of contraction in business activity as demand continued to weaken. This resulted in job losses persisting into May as firms worried about excess capacity. (IHS Markit Economist Bernard Aw)

- S&P Global Ratings downgraded Sri Lanka's long-term

foreign-currency issuer default rating on 20 May by one notch to B-

to reflect the negative impact of the country's fiscal

deterioration on its debt sustainability. (IHS Markit Economist

Jola Pasku)

- The latest move from S&P stems from the shock caused by the coronavirus disease 2019 (COVID-19) virus pandemic, which has to date heavily affected Sri Lanka's tourism and export activities.

- Meanwhile, the delay in parliamentary elections from the original scheduled date in April due to the pandemic will likely instill political uncertainty, as well as weighing on business confidence and prospective foreign direct investment inflows, which will put pressure on the country's liquidity and solvency measures.

- S&P's Stable outlook implies that the agency views Sri Lanka's credit risk outlook as balanced for the near term. IHS Markit's comparable medium-term sovereign risk rating for Sri Lanka stands at 60 - on a par with the current S&P assessment - although in contrast with S&P, our rating outlook stands at Negative.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-may-2020.html&text=Daily+Global+Market+Summary+-+21+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 21 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+21+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}