Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 22, 2020

Daily Global Market Summary - 22 April 2020

Global sentiment improved markedly today after the prior two days of selling and the coinciding uptick in volatility. Crude oil prices rallied significantly versus yesterday's close, but is still only a bit more than 50% of where they had began the week. Credit closed higher across both Europe and the US, while benchmark government bonds closed lower on the day. On a positive note, each day appears to bring more announcements of factories returning to some level of production in certain regions.

Americas

- US equity markets closed higher across markets; Nasdaq +2.8%, S&P 500 +2.3%, DJIA +2.0%, and Russell 2000 +1.4%.

- 10yr US govt bonds closed the day lower at +6bps/0.63% yield.

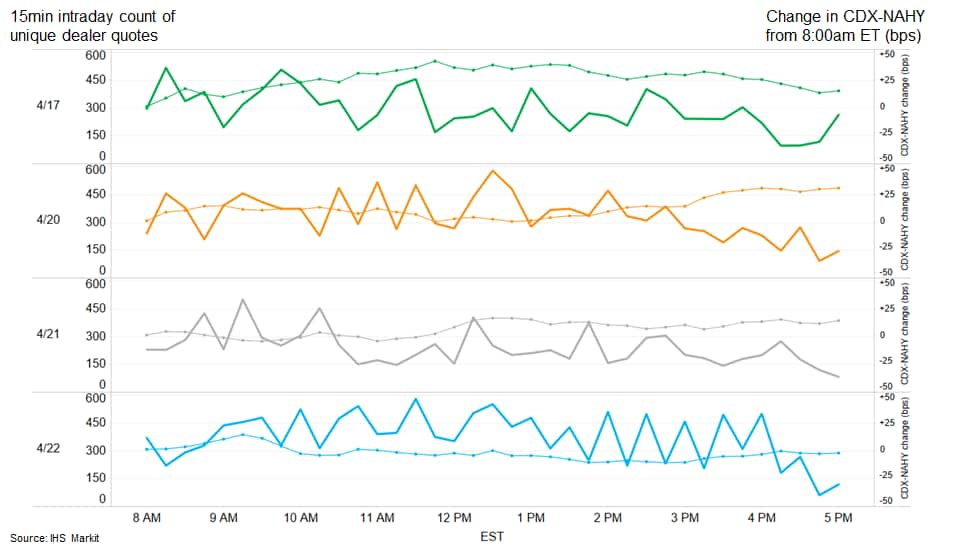

- Credit markets closed the day higher across investment grade

and high yield credit, with IHS Markit's CDX-NAIG closing

-6bps/92bps and CDX-NAHY -21bps/655bps. The below charts show the

total unique high yield bond ≥$1 million quotes by dealers during

15min intervals from 17 April through today versus the change in

CDX-NAHY spread from 8:00am ET. The data indicates that today's

afternoon quote activity increased noticeably compared to the prior

days when it had typically tapered off during that same time of the

day.

- President Trump tweeted today "I have instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea," which appeared to have triggered a rebound in oil markets on the potential for increased tensions in the Middle East. Crude oil closed +19%/$13.78 per barrel today.

- Herland Soliz, president of state-owned hydrocarbons firm YPFB, said on 20 April that he expected hydrocarbons revenue in Bolivia to drop by 45% in 2020 because of low global oil prices. Bolivia's natural gas exports to Brazil and Argentina have also declined in recent years, by 6.5% in 2018 and 12% in 2019. The lower natural gas prices, weaker export activity, and high spending needed to combat the spread of the COVID-19 virus are likely be concentrated in the second half of 2020, resulting in a fiscal deficit of just over 8% of GDP this year, compared with 7.2% in 2019, and contributing to the current-account deficit reaching over 7% in 2020 from a 5.6% average over the last five years. IHS Markit forecasts that international reserves will decline by 33% in 2020 to cover this deficit. (IHS Markit Country Risk's Johanna Marris and Ellie Vorhaben)

- Volkswagen (VW) has proposed to the Ministry of Productive Development of Argentina reopening its Córdoba and Pacheco plants in Buenos Aires, reports NF News Center. Both plants have remained closed as part of efforts to prevent the spread of the COVID-19 virus. VW has proposed starting production of MQ-250 gearboxes in Córdoba from 27 April with 40% of its staff (equivalent to 450 operators), while it proposes to restart production of vehicles at the Pacheco plant the following week. (IHS Markit AutoIntelligence's Tarun Thakur)

- On 21 April, the Bank of Mexico (Banco de México: Banxico) released a statement detailing 10 new measures to support credit growth and to boost financial-sector liquidity. Most of the measures increase facilities to access liquidity (such as repurchase agreements on sovereign and corporate debt). Another measure announced is the release of funds to both commercial and development banks to boost credit disbursement to small and medium enterprises (SMEs) by up to MXN350 billion (USD14.4 billion). In IHS Markit's assessment the Mexican banking sector still displays solid risk indicators. Its least favorable indicator is its moderately high loan-to-deposit ratio (90.7% as of end-2019), although this is significantly lower than the equivalent ratios in Colombia, Peru, or Brazil. Banxico's measures are likely to increase credit growth within 2020, but not enough to trigger an increase in our credit growth risk score: the MXN350 billion destined to SMEs represents roughly 7% of the stock of credit. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Novartis has announced that it has completed the acquisition of US-based software company Amblyotech, a specialist in the use of digital technology in the treatment of amblyopia ("lazy eye"). Amblyotech's technology has focused on the use of active gaming and passive video technology with 3-D glasses to train both eyes to work together and view entire images effectively. This new acquisition in a niche ophthalmics area is the latest in a series of expansions into the digital area by Novartis, including a high-profile deal with Amazon in 2019 for the digital transformation of business operations. (IHS Markit Life Sciences Janet Beal)

- Hexcel today reported first-quarter net income down 41.3% year on year (YOY), to $42.4 million, on net sales down 11.3% YOY, to $541.0 million. Adjusted earnings totaled 64 cents/share, down 23.8% YOY, and short of analysts' consensus estimate of 70 cents/share, as reported by Refinitiv (New York, New York). The COVID-19 pandemic began to hit in the quarter, forcing plant shutdowns and reducing demand. Commercial aerospace segment sales fell 12.7% YOY during the first quarter, to $362.9 million, due mainly to lower Boeing 737 MAX sales. Space and defense segment sales rose 3.5% YOY, to $111.6 million. Industrial segment sales fell 23.2% YOY, to $66.5 million. Hexcel says it had $329 million in cash on hand at the end of the first quarter, as well as $307 million in borrowing availability under a credit revolver. "We have no near-term debt maturities, we expect to generate cash from working capital in the coming months, and we continue to tightly control discretionary spending, including capital expenditure," says Hexcel CFO Patrick Winterlich.

Europe/Middle East/ Africa

- The European Central Bank approved, by an unscheduled call of the ECB's governing council today, a change of its rules to accept "fallen angel" bonds that lose their investment-grade credit rating to maintain banks' access to its ultra-cheap liquidity during the coronavirus crisis. (FT)

- The Turkish lira briefly reached a new all-time low of ₺7.00 vs the US dollar today. The global economic and financial crisis triggered by the spread of coronavirus disease 2019 (COVID-19) have taken a heavy toll on the Turkish lira. Past expansionary economic policies and depletion of foreign currency reserves to defend the currency makes Turkey vulnerable. The lira is facing an imminent collapse, potentially throwing Turkey into a full external financing crisis. The TCMB now has few resources to defend the currency, as its foreign reserves are significantly lower than officially reported because of actions the Bank took to bolster the lira previously and its interest rate policy is shackled by the president. (IHS Markit Economist Andy Birch)

- As part of efforts to manage the impact of the COVID-19 virus pandemic, Fiat Chrysler Automobiles (FCA) is drawing down a EUR6.25-billion (USD6.79-billion) credit facility and PSA is suggesting that the dividend planned as part of the FCA-PSA merger could be revised. Among the terms announced under the proposed PSA-FCA merger was that each company would pay EUR1.1 billion in dividends to shareholders in 2020, based on 2019 performances. For the dividend to be revisited, both companies (and the boards of directors) would have to agree to and approve any changes. (IHS Markit AutoIntelligence's Stephanie Brinley)

- AkzoNobel reports net income of €114 million ($124 million) in the first quarter of 2020, up by 75% from €65 million in the same period of the previous year. The figure includes the impact of share-consolidation and share-buyback programs. Adjusted operating income increased by 31% year on year (YOY), from €163 million to €214 million, beating analysts' consensus estimate by 23%. Meanwhile, revenue was down 6% YOY, to €2.06 billion compared with €2.18 million in the first quarter of 2019, on a 7% YOY decline in volumes.

- IHS Markit's iTraxx-Xover European high yield CDS index closed

-46bps/509bps, retracing most of yesterday's widening:

- South Africa's President Cyril Ramaphosa announced on 21 April a ZAR200-billion (USD10.6 billion) bank-loan guarantee scheme to be introduced in partnership with major banks, the National Treasury, and the South African Reserve Bank (SARB) to support companies, mostly micro, small, and medium-sized enterprises (MSMEs), amid the COVID-19-virus outbreak. The allocated ZAR200 billion is equivalent to about 4.8% of total loans as of the end of 2019. (IHS Markit Economist Ana Souto)

- Ireland's Department of Employment Affairs and Social Protection announced that for the week of 20 April, it issued payments to 584,000 people as part of the COVID-19 Pandemic Unemployment Payment, of which around 50,000 received the payment for the first time. This means that almost a quarter of those in employment in the fourth quarter of 2019 (2,4 million) rely on this form of income support. This is in addition to 212,000 people on the Live Register, which captures applications for the regular jobseekers' allowance/benefit. Based on the available data on loss of employment and requests for income support, the Irish economy is clearly already in a severe downturn. The bottom will likely be reached in the second quarter. It's worth noting that aircraft leasing, accounted for almost 6% of GDP in 2018 (EUR18 billion), with the airline industry being among the worst hit globally. (IHS Markit Economist Daniel Kral)

- After a strong February performance, Poland's unadjusted industrial output declined by 2.3% year on year (y/y) in March, as measures to hinder the COVID-19 virus spread have contributed to a reduction or a halt in production. The results were much worse in seasonally adjusted terms, down by 7.2% month on month and 4.8% y/y. Unadjusted manufacturing output fell by 3.0% y/y in March, pulled downwards by a steep drop in motor vehicles (down by 28.6% y/y) and coke and refined fuel products (down by 7.0% y/y). These declines were partially balanced by growth in other key branches, including food products, metals, electrical equipment, chemicals, and pharmaceuticals. (IHS Markit Economist Sharon Fisher)

- Brent crude closed +5.4%/$20.37 per barrel.

- The Central Bank of Kuwait (CBK) announced on 21 April that banks should extend loans to small and medium-sized enterprises (SMEs) at a 2.5% interest rate. Kuwait's National Fund for SME Development will provide 80% of the funds at zero interest for up to three years, while the remaining 20% will be provided by banks with a maximum interest rate of 2.5% for the same time frame. (IHS Markit Banking Risk's Gabrielle Ventura)

- 10yr European govt bonds closed lower across the region except for Italy -7bps; Spain +14bps, Germany +7bps, France +5bps, and UK +3bps.

- European equity markets closed higher across most of the region; UK +2.3%, Italy +1.9%, Germany +1.6%, and France/Spain +1.3%.

Asia-Pacific

- Singapore has extended its 'circuit breaker' by another four weeks until 1 June 2020 to contain the COVID-19 outbreak. The definition of essential services has been expanded but will not impact the offshore and marine industry. The operational status of Singapore's yards remains unchanged. Sembcorp Marine Tuas and Admiralty yards will close for two weeks from 17 April 2020. Keppel Tuas is partially closed. Dyna-Mac remains in operations. Despite being operational, the large number of foreign workers impacted by the COVID-19 containment measures has disrupted manpower supply to the yards. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- The Executive Council of the State Council of China has announced that the non-performing loan (NPL) coverage ratio will be lowered by 20 percentage points for small and medium-sized banks, which suggests that the new required level of NPL coverage ratio will fall between 100% and 130%. According to the latest available statistics from the China Banking and Insurance Regulatory Commission, city commercial banks and rural commercial banks, two of the most prominent groups of small banks, reported NPL coverage ratio of 154.0% and 128.2%, respectively, at the end of 2019. (IHS Markit Banking Risk's Angus Lam)

- Total profit in China's non-financial state-owned enterprises (SOE) dropped by 59.8% year on year (y/y) to CNY32.9 billion in the first quarter of 2020, compared to a 4.7% y/y expansion in 2019, according to a release by the Ministry of Finance (MOF) on 22 April. More dramatic decline in operating revenue caused the slump in profits. Operating revenue fell 11.7% y/y compared to an 8.9% y/y decline in operating cost. Meanwhile, cost and expenses ratio fell by 3.4 percentage points to 2.7% in the first quarter. The profit contraction was led by decline in local government controlled SOEs, which recorded a year on year decline of 86.3%, compared to a 49.1% y/y decline in central government controlled SOEs. (IHS Markit Economist Yating Xu)

- FAW Group has formed partnerships with seven companies to accelerate the development of an automotive digital ecosystem, reports Gasgoo. The seven partners are Alibaba Cloud, Autohome, Baidu, Huawei, IBM China, NTT Data, and Tencent, which will all work with the automaker in different areas. The collaboration with Huawei focuses on promoting Internet of Vehicles (IoV) applications and building a digital platform. The development of intelligent connected vehicles (ICVs) has progressed rapidly in China in the past few years, with strong support from the government and automakers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BYD has released its 2019 annual report, with the company's full-year revenues falling 1.78% year on year (y/y) to CNY127.7 billion (USD18 billion). In 2019, BYD's revenues contributed by the automotive business fell by 16.8% y/y to CNY63.3 billion, accounting for 49.5% of BYD's total revenues. Of this total, revenues from BYD's new-energy vehicle (NEV) business fell by 23.4% y/y to around CNY40.1 billion. A sudden cool-down in the new-energy vehicle market has dashed automakers' hopes of quickly ramping up production to achieve the scale needed to stay afloat. BYD is not the only Chinese automaker struggling with falling sales and reduced subsidies. Leading electric vehicle (EV) manufacturers including BAIC BJEV, the EV subsidiary of BAIC Motor, saw its EV sales drop by 5% y/y to 150,000 units in 2019, a long way behind its original target of 220,000 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Bridgestone has announced a temporary phased shutdown of its manufacturing facilities in Japan owing to the current uncertain market situation and declining demand as a result of the coronavirus disease 2019 (COVID-19) virus outbreak, according to a company press release. This temporary shutdown will affect 11 plants in Japan, including eight tire plants shutting down from 29 April until 8 May. Although the tire-maker is idling production in Japan, it plans to resume production at most of its facilities in Europe, Russia, and the Middle East by the end of April. (IHS Markit AutoIntelligence's Tarik Arora)

- Hyundai plans to raise KRW300 billion (USD243.3 million) by selling corporate bonds on 8 May, reports the Maeil Business Newspaper. Debts are expected to be sold in different maturities of three, five, and seven years. Mirae Asset Daewoo, KB Securities, and NH Investment & Securities will lead the debt issuance. The report highlights that the automaker will use the capital to support its operating costs including the repayment of foreign debt. (IHS Markit AutoIntelligence's Jamal Amir)

- Most APAC equity markets closed higher except for Japan -0.7% and Australia flat; India +2.4%, South Korea +0.9%, China +0.6%, and Hong Kong +0.4%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-april-2020.html&text=Daily+Global+Market+Summary+-+22+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-april-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 April 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+April+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}