Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 22, 2020

Daily Global Market Summary - 22 July 2020

Most APAC and European equity markets closed lower, while China and the US markets closed modestly higher. The US dollar weakened further and gold and silver broke through new multiyear highs today. US/European credit indices were close to unchanged across IG and high yield, while benchmark European government bonds closed higher. California officially passed New York today in total confirmed COVID-19 cases this year, as markets will be closely watching tomorrow's 8:30am EST US initial claims for unemployment insurance for a potential second consecutive week of increases in non-seasonally adjusted claims driven by the increasing number of businesses across the US being required to re-close.

Americas

- US equity markets closed higher today; DJIA/S&P 500 +0.6%, Nasdaq +0.2%, and Russell 2000 +0.2%.

- 10yr US govt bonds closed flat/0.60% yield.

- CDX-NAIG closed -1bp/69bps and CDX-NAHY -4bps/454bps.

- Crude oil closed flat/$41.90 per barrel.

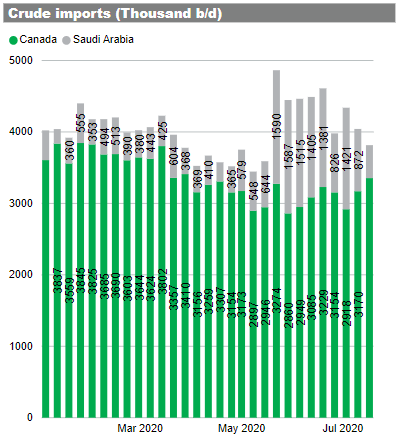

- Preliminary US crude imports point to the tentative end of the

Saudi crude wave that has battered the US Gulf Coast since mid-May,

with weekly imports dipping under 500,000 b/d for the first time

since April. With limited inbound cargoes from the Gulf, the

deceleration in Saudi imports should help ease pressure on

inventories. Conversely however, imports from Canada appear to be

clearly ticking higher, expectedly so given ongoing easing of

shut-ins north of the border. Imports from Canada averaged 3.4

MMb/d in preliminary estimates, their highest level since late

March. The recovery in Canadian flows will continue to creep higher

in coming months, limiting the extent to which lower waterborne

imports tighten US crude markets. (IHS Markit Energy Advisory's

Roger Diwan, Karim Fawaz, Justin Jacobs, Edward Moe, and Sean

Karst)

- DXY US Dollar index was as low as -0.2%/94.95, which is only 0.30 away from this year's 1.5-year intraday low reported on 9 March.

- Gold futures closed +1.1%/$1,865 per oz and at the highest level in nine years.

- Silver futures closed +7.3%/$23.14 per ounce broke another almost seven-year high today.

- US existing home sales reversed course in June, jumping 20.7%

to a 4.72-million-unit annual rate. Single-family sales climbed

19.9% to a 4.28 million rate; condo/coop sales skyrocketed 29.4% to

a 440,000 rate. The percentage increases in single-family,

condo/coop, and total sales were all record highs. (IHS Markit

Economist Patrick Newport)

- Sales were down 11.3% from a year earlier and 18.1% from February—the month before COVID-19 shut down vast swaths of the US economy.

- Inventory of single-family homes dipped to 1.37 million, the lowest reading for June on record (data go back to 1982). Our seasonally adjusted single-family homes inventory estimate, 1.25 million, was an all-time low.

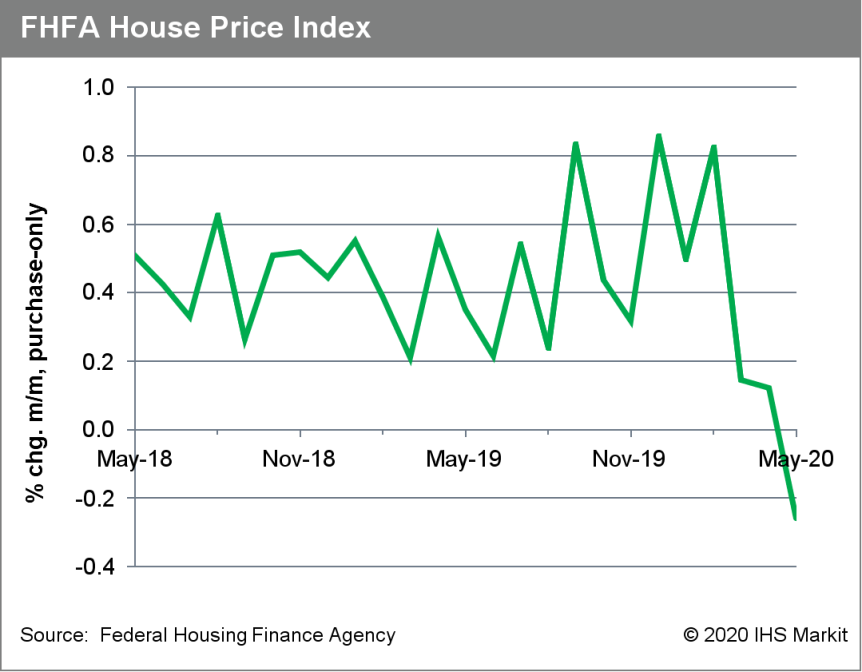

- Both demand for and supply of homes have dropped since February. The price data suggest that demand has taken the bigger hit—the seasonally adjusted average price of a single-family home plummeted about 3% in May, but regained half of that in June. The Federal Housing Finance Agency (FHFA) national home price index, which also came out today and is considered a better measure of home prices than the National Association of Realtors' average price, also dipped in May, falling 0.3%—the largest drop since January 2012.

- June's numbers, which track closings, mostly reflect negotiations that took place in April and May. The Mortgage Bankers Association's seasonally adjusted purchase index grew 14.0% in June, suggesting that July's existing home sales numbers will also be up.

- Bolstering sales will be record-low interest rates—Freddie Mac's average commitment rate for a 30-year mortgage decreased to 3.16% in June and has since dropped below 3%.

- A caveat: the resurgent coronavirus will likely dampen sales in July and August, particularly in the South.

- The Federal Housing Finance Agency (FHFA) House Price Index

(HPI) fell 0.3% month on month (m/m) in May—the first such

monthly decline recorded since January 2017—culminating in a

4.9% year-on-year (y/y) gain, down from the 5.5% recorded in April

and the 6.0% recorded in March.

- Prices rose in only one of the nine Census divisions—the South Atlantic region (Delaware, Maryland, District of Columbia, Virginia, West Virginia, North Carolina, South Carolina, Georgia, Florida) at 0.1% m/m. The West North Central division and the Middle Atlantic were flat in May. The remaining six divisions all experienced declines in the month. (IHS Markit Economist Rebecca Mitchell)

- Losses ranged from -1.0% in New England (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut) to -0.2% in the West South Central division (Oklahoma, Arkansas, Texas, Louisiana).

- Year-on-year price gains were the highest yet again in the Mountain states (Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona, New Mexico) with 6.3% growth, despite their May losses. New England came in last among the nine in this metric with annual growth of just 3.7% y/y.

- None of the divisions hit an index high in May—all having

done so in either February, March, or April of this year—and

the national index has failed to notch a new record for the first

time in well over four years.

- The U.S. has agreed to pay Pfizer Inc. PFE 5.10% and BioNTech SE nearly $2 billion to secure 100 million doses of their experimental Covid-19 vaccine to provide to Americans free of charge, the latest sign the government is readying plans to make vaccines available if proved to work safely. (WSJ)

- The UK government's UK Export Finance is to underwrite around GBP500-million-worth of loans to Ford to support future investment, reports The Telegraph Online. According to the newspaper, this is part of a wider GBP625-million package of loans organized by Barclays, Citibank, NatWest, Lloyds and Sumitomo Mitsui. Ford said that this will be used to fund the development of battery electric vehicles (BEVs) and advanced manufacturing, along with supporting work on next-generation vans at its Dunton (UK) engineering facility. (IHS Markit AutoIntelligence's Ian Fletcher)

- Tesla Inc., for the first time in its 17-year history, reported a fourth-consecutive profitable quarter, a milestone that is sure to bolster Chief Executive Elon Musk's pitch that he can usher in the age of fully electric cars. The achievement of four cumulative quarters of profitability means Tesla can now be considered for inclusion in the S&P 500 index. (WSJ)

- Autonomous truck startup Plus.ai has partnered with Transportation Research Center (TRC) to test its automated driving system using real-world scenarios, reports FreightWaves. TRC is an independent vehicle test facility that operates a proving ground track in Ohio (United States). The facility will create simulated real-world driving scenarios that include highway driving, construction zones, and encounters with disabled vehicles and bicycles. The testing scenarios will also consider varying weather conditions and a range of visibility and lighting conditions. Shawn Kerrigan, COO and co-founder of Plus.ai, said, "We believe an independent party should validate a self-driving system's road readiness using realistic, complex scenarios, much like humans have to pass driving tests in order to be licensed." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Waymo and Fiat Chrysler Automobiles (FCA) are expanding their autonomous vehicle (AV) partnership to commercial vehicles. This deal will make Waymo FCA's exclusive partner for future Level 4 AVs across the company's global fleet. Waymo will begin integrating its AV technology, Waymo Driver, into FCA's Ram ProMaster full-size van. Waymo's autonomous goods delivery unit, Waymo Via, will use these vehicles for commercial delivery customers. FCA CEO Mike Manley said, "Our now four-year partnership with Waymo continues to break new ground. By incorporating the Waymo Driver, the world's leading self-driving technology, into our Pacifica minivans, we became the only partnership actually deploying fully autonomous technology in the real world, on public roads." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Avient, formerly PolyOne, today reported net income down 45.8%

year on year (YOY), to $22.8 million, on sales down 18.6%, to

$609.1 million. Adjusted earnings from continuing operations

totaled 39 cents/share, ahead of analysts' consensus estimate of 27

cents/share, as reported by Refinitiv (New York, New York).

- Results were hit by the impact of the COVID-19 pandemic, the company says. "We experienced an uptick in orders in Asia which also led to better than expected margins in the Color segment," says Avient chairman and CEO Robert Patterson. "Although the pandemic significantly impacted the Americas and Europe, sales in Asia increased 13% for the second quarter."

- Sales into food and beverage packaging and healthcare applications were up 3% and 7% YOY respectively, however, this was more than offset by weakness in the automotive and consumer discretionary sectors due to the pandemic, Avient says.

- Distribution segment sales declined 22.1% YOY, to $238.8 million, while segment operating income fell 27.4%, to $14.6 million.

- Colors, additives and inks segment sales fell 17.9% YOY, to $226.8 million, while segment operating income was down 23.6%, to $32.3 million.

- Specialty engineered materials segment sales fell 18.7% YOY, to $158.8 million, while segment operating income declined 31.7%, to $17.0 million.

- Avient changed it name from PolyOne when the $1.4 billion acquisition of Clariant's masterbatches business, the largest such deal the company's history, closed on 1 July.

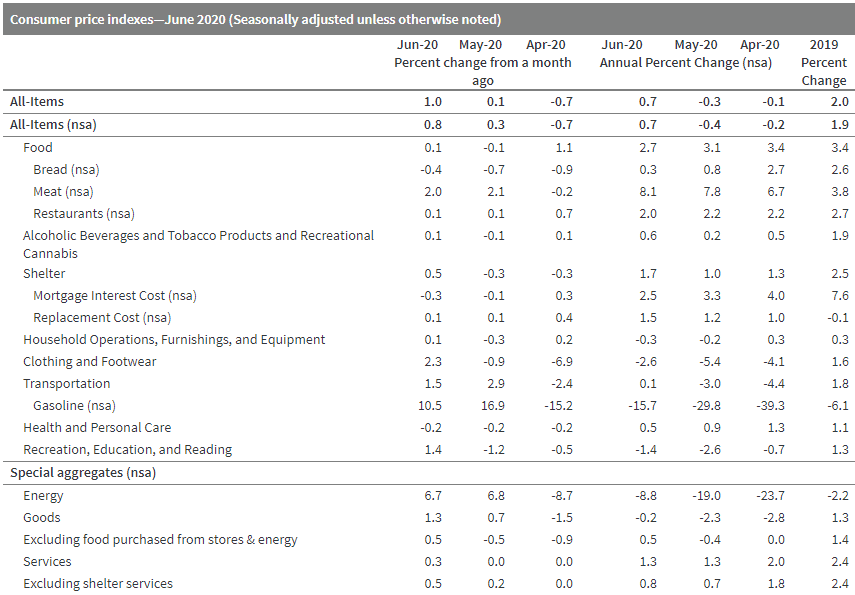

- The reopening of the Canadian economy expanded consumer demand

in June, lifting prices. Canada's consumer prices jumped 1.0% month

on month (m/m) on a seasonally adjusted basis (sa) and 0.8% m/m on

a non-seasonally adjusted basis (nsa). (IHS Markit Economist Arlene

Kish)

- The annual inflation rate leapt 0.7% year on year (y/y) sa and nsa.

- Core inflation readings edged higher for consumer price index (CPI)-common (nsa) and CPI-trim, while CPI-median held steady at 1.9% y/y.

- Once again, the monthly boost in gasoline prices put the most upward pressure on inflation, but the annual price decline contributed the most to the annual figure, keeping overall inflation muted.

- As more businesses got the go-ahead to restart, consumer demand

for items other than essential goods has sparked a low-burning

inflation flame that is still far off from the Bank of Canada's 2%

target.

Europe/Middle East/ Africa

- Most European equity markets closed lower; Spain -1.4%, France -1.3%, UK -1.0%, Italy -0.6%, and Germany -0.5%.

- 10yr European government bonds closed higher across the region; Italy -5bps, Spain -4bps, Germany -3bps, and UK -1bp.

- iTraxx-Europe +1bp/58bps and iTraxx-Xover +2bps/343bps.

- Brent crude closed -0.1%/$44.29 per barrel.

- Dutch consumer confidence improved only marginally in July. The

consumer confidence index compiled by Statistics Netherlands

(Centraal Bureau voor de Statistiek: CBS) improved to -26 from -27

in June. Consumers' assessment of the economic situation in last 12

months has deteriorated, while the assessment of the next 12 months

has improved. Meanwhile, the assessment of the overall economic

climate has improved by one point to -51. (IHS Markit Economist

Daniel Kral)

- In a separate release, the monthly indicator measuring domestic household consumption remains extremely weak in May. Based on shopping-day-adjusted data from the CBS, it was down by 12.8% year on year (y/y) in May, following a record drop of 17.4% y/y in April.

- The labor market is showing signs of improvement, as the number of employed people rose in June by 45,000 compared with May. However, the unemployment rate increased from 2.9% to 4.3% between March and June, as the participation rate recovered some of the earlier losses.

- AkzoNobel says that its net profit in the second quarter of

2020 dropped 44% year on year (YOY), to €129 million ($149

million). Sales went down 19%, to €1.98 billion from €2.45 billion

in the same period of the previous year.

- The fall in sales, which dragged profits down, is mainly due to the impact of COVID-19 on end-market demand that resulted in 18% lower volumes YOY, the company says. EBITDA fell 25% YOY, to €297 million, the company says.

- Margin-management and cost-saving programs were able partly to offset the negative effect of lower demand, the company says.

- AkzoNobel announced preliminary results last week. The company's performance coatings business was hurt most severely by the impact of COVID-19 on end markets, especially the automotive and aerospace industries, recording a 24% YOY decline in sales, to €1.09 billion, AkzoNobel says.

- Sales of the company's decorative paints business went down 10% YOY, to €899 million, it says. Raw material and other variable costs in the second quarter were €32 million lower compared with the year-earlier quarter, the company says.

- Valeo's financial performance during the first half of 2020 has

swung to a loss due to the COVID-19 virus pandemic. For the six

months ending 30 June, the component supplier revealed that its

sales have fallen by 27.8% year on year (y/y) to EUR7,058 million.

(IHS Markit AutoIntelligence's Ian Fletcher)

- Earnings before interest, tax, depreciation and amortization (EBITDA) dropped by 83% y/y to EUR202 million.

- Operating margin tumbled from a profit of EUR514 million in the first half of 2019, to a loss of EUR840 million.

- Net income has slumped from a profit of EUR162 million to a loss of EUR1,215 million.

- On a business segment basis, downward shifts reflect the wider situation. Its Visibility System business' sales dropped by 28% y/y to EUR2,169 million, and its EBITDA contracted by 76.9% y/y to EUR75 million.

- Its Powertrain Systems reported a decline in sales of 26% y/y to EUR1,897 million, as its EBITDA has retreated 71.5% y/y to EUR91 million.

- Comfort & Driving Assistance Systems sales have fallen by 23.8% y/y to EUR1,380 million, while EBITDA was down 70.3% y/y to EUR84 million.

- Its Thermal Systems business struggled most as its sales weakened by 33% y/y to EUR1,560 million, and ended the period with an EBITDA loss of EUR31 million against a profit of EUR262 million a year ago.

- Employment is falling and unemployment is rising in Finland, as

the COVID-19 virus crisis is causing redundancies to rise faster

than during the severe recession of 1991. With business sentiment

in the labor-intensive service sector still particularly downbeat,

the outlook for the labor market remains weak and the unemployment

rate is expected to climb to above 10% from the average of 6.7% in

2019. (IHS Markit Economist Venla Sipilä)

- According to the latest Labor Force Survey published by Statistics Finland, the unemployment rate in June stood at 7.9%, up significantly from 6.2% in June last year. The average unemployment rate for the second quarter as a whole came in at 8.9%, up by 1.2 percentage points in annual comparison.

- In the second quarter, there were an average of 245,000 unemployed people, which marks an increase of over 14% year on year (y/y). The average number of employed people in the same period fell by about 3% y/y, while the fall in hours worked was still steeper, at 6.4% y/y.

- The employment rate (the share of the employed among people aged between 15 and 64 years) in June stood at 73.7, down by two percentage points from June 2019. The inactive population was reported at 1.33 million people in June, having increased by 3.9% y/y.

- Data from the Ministry of Economic Affairs and Employment show that, at the end of June, there were 417,000 people registered as jobseekers at the Employment and Economic Development Offices, a surge of no less than two-thirds y/y.

- The number of long-term (over a year) unemployed people is also rising rapidly again (up by 17.8% y/y), whereas the number of new vacancies reported at employment offices fell by over 9% y/y in June.

- Volvo Cars has announced its financial results for the first

half of 2020 during which its performance was hit hard by the by

the COVID-19 virus pandemic. For the six months ending 30 June, the

automaker's revenues fell by 14.1% year on year (y/y) to SEK111,759

million. (IHS Markit AutoIntelligence's Ian Fletcher)

- This was largely as a result of its retail sales, which contracted by 20.8% y/y to 269,962 units, although the company noted that it did benefit from a strong sales mix due to demand for its sport utility vehicles (SUVs).

- Its revenues were also hit by SEK2,626 million on a downturn in rentals and sales of used cars and parts and accessories, although there was a SEK1,070-million benefit from currency exchange.

- The COVID-19 virus had an even worse impact on its earnings during the first half. Volvo's earnings before interest, taxes, depreciation, and amortization (EBITDA) fell by 48.7% y/y to SEK6,819 million, while earnings before interest and tax (EBIT) dropped from a profit of SEK5,519 million during the first half of 2019 to a loss of SEK989 million.

- The main reason for this was the impact of 'volume, sales mix and pricing', which dropped by SEK6,020 million.

- It noted a SEK1,320-million impact on foreign exchange due to cost of sales and SEK1,679 million on one-off factors such as restructuring and recalls.

- However, it highlighted that these steep falls were partly offset by SEK1,074 million from government support measures mainly related to a temporary layoff scheme in Sweden and tax rebates in China. A further SEK1,437 million stemmed from efficiencies.

- Net income ended the period as a loss of SEK1,171 million, versus a profit of SEK3,398 million a year ago.

- Hyundai has exported the first 10 units of the XCIENT Fuel Cell truck to Switzerland, according to a company statement. Hyundai plans to export 50 units to Swiss companies this year, with the official handover taking place in September. Head of Hyundai's Commercial Vehicle Division In Cheol Lee said, "XCIENT Fuel Cell is a present-day reality, not as a mere future drawing board project. By putting this groundbreaking vehicle on the road now, Hyundai marks a significant milestone in the history of commercial vehicles and the development of hydrogen society." Hyundai is leading the world in this segment; the XCIENT Fuel Cell is the world's first mass-produced heavy-duty fuel-cell truck. Hyundai plans to roll out a total of 1,600 XCIENT Fuel Cell trucks by 2025, they will receive a very high level of support, and data will be gathered from their use by Hyundai engineers. The XCIENT is powered by a 190-kW hydrogen fuel-cell system with dual 95-kW fuel-cell stacks. Seven large hydrogen tanks offer a combined storage capacity of around 32.09 kg of hydrogen, giving the truck a range of about 400km. (IHS Markit AutoIntelligence's Tim Urquhart)

- Russian President Vladimir Putin on 21 July signed a decree on

National Development Goals (NDG) until 2030. The decree included

five goals to replace the nine objectives outlined in a May 2018

decree. It includes goals on demographic stability, opportunities

for self-realization and talent development, comfortable and safe

living environment, efficient labor and successful

entrepreneurship, and digital transformation. (IHS Markit Country

Risk's Alex Kokcharov)

- The 2020 version of the NDG no longer included the objective for Russia becoming one of the top five largest economies globally, as measured by GDP.

- This goal had been part of the Russian government's long-term economic planning since 2007. President Putin said during an address to the parliament in April 2012 that this goal would be "achieved within the next two or three years". IHS Markit estimates that Russia is ranked 12th globally by GDP in 2020, with a total GDP projected at USD1.46 trillion.

- IHS Markit assesses that the changes are indicative of the Russian administration deprioritizing pro-business economic policies aimed at increasing GDP growth, as the new NDG reduces the incentives for the government to conduct structural reforms aimed at reducing the share of the state sector and large oligarchic groups in the economy.

- Instead, the government is likely to focus on a more interventionist approach where key investment projects are led either by SOEs or by large private firms in conjunction with the government and or/SOEs.

- Israel-based ride-hailing firm Gett has raised USD100 million in equity funding from unnamed new and existing investors, reports TechCrunch. The capital will help the company to grow its SAAS travel platform for corporates internationally, and will also support its future plans for an initial public offering (IPO). Dave Waiser, CEO and founder of Gett, said, "Our mobility software is helping businesses thrive by empowering people to be their best on the go. Being fully funded and reaching a key milestone in our profitability journey is an important step for the company". (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- APAC equity closed lower except for China +0.4%; Hong Kong -2.3%, Australia -1.3%, Japan -0.6%, India -0.2%, and South Korea flat.

- The headline au Jibun Bank flash Composite PMI, compiled by IHS

Markit and based on 85-90% of responses received from the monthly

surveys, rose further from 40.8 to 43.9 in July, its highest since

February. However, the latest figure, which measures activity

levels at both manufacturing and service sector companies, remained

well below 50 and signaled a further marked decline in private

sector output at the start of the third quarter. (IHS Markit

Economist Bernard Aw)

- Manufacturing production continued to lead the decline in July. While not as severe as in recent months, the rate of contraction was substantial overall once again. The reduction of output was linked to weakening demand for Japanese manufactured goods both at home and abroad, as reflected by a further severe drop in new orders.

- With the downturn extending into the third quarter, Japan's labor market continued to deteriorate. Survey data showed employment continuing to fall during July, with the rate of job shedding intensifying from June, led by a sharper drop in manufacturing jobs.

- The US government on 13 July toughened its policy towards China

regarding the latter's maritime claims over most of the South China

Sea. In a statement, US Secretary of State Mike Pompeo alleged that

China's maritime claims over offshore resources across most of the

South China Sea were "completely unlawful, as is its campaign of

bullying to control them". In response, China has accused the US of

attempting to sow discord between China and Southeast Asian

countries. (IHS Markit Country Risk's Anton Alifandi)

- The announcement for the first time endorses unambiguously the substance of a 2016 arbitral tribunal brought by the Philippines against China.

- The shift in US policy is likely to further encourage the Philippines to realign its SCS policy away from China. Philippine Minister of Defence Delfin Lorenzana has called on China to comply with the 2016 arbitration ruling hours after Pompeo made his statement.

- The US statement is unlikely to prevent future confrontations in contested areas in the SCS.

- The policy shift increases the likelihood of Chinese state-owned enterprises (SOEs) facing US sanctions.

- During the first half of 2020, China's seaborne import of iron ore, coal, and bauxite is calculated at 563.7mt (up 9pc y-o-y), 137.6mt (up 15pc) and 48.5mt (up 4pc), respectively according to data from Commodities at Sea. NBS has expressed optimism that the Chinese economy to continue recovering in the second half of this year and sustain growth momentum built during the second quarter on the back of strong support from macro-economic policies. Import of bulk commodities into China is an important indicator and total arrivals of major bulk commodities (iron ore, coal, and bauxite) into China during 01-20 days of July 2020 are calculated at 93.4mt (140.1mt on the 30-day basis) vs 131.8mt (30-day PACE) in the previous month and 120.8mt (30-Day PACE) a year ago. The arrival PACE this month is quite strong on the back of healthy arrivals of both iron ore and bauxite shipments; the arrival of coal vessels has slowed down both on a monthly as well as yearly basis. For 3Q20, total iron ore, coal, and bauxite arrivals are forecasted at 305.3mt, 68.2mt, and 29mt. Overall in 2020, iron ore, coal, and bauxite arrivals are forecasted at 1.2bn ton, 260mt, and 100mt, respectively. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

- Chinese battery-maker Eve Energy said yesterday (21 July) that its wholly owned subsidiary, Hubei Jinquan, had entered into the final stages of talks with BMW Brilliance, BMW's joint venture with Chinese vehicle manufacturer Brilliance Auto, regarding a possible battery deal. The statement, however, does not offer any details on the potential supply deal. Eve Energy, based in Guangdong province, has already entered into supply contracts with major OEMs, including Kia Motors and Daimler AG, in recent years. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese ride-hailing giant Didi Chuxing (DiDi) has said that it is not considering an initial public offering (IPO) at the moment and that going public is not its top priority, reports Reuters. Chinese tech media source Pandaily reported yesterday (21 July) that DiDi was preparing for an IPO in Hong Kong. DiDi has more than 31 million drivers registered on its platform and has attracted 550 million customers, who are using the company's range of app-based transportation options. DiDi is strengthening its presence in markets beyond China and has formed a global ride-sharing partnership network with Grab, Lyft, Ola, Uber, 99, Taxify, and Careem, in countries covering more than 80% of the world's population. The company has tapped into many markets worldwide by either launching its own services or investing in local ride-hailing firms. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hitachi ABB Power Grids is looking to introduce its new Grid-eMotion Fleet electric vehicle (EV) charging system to India as part of its partnership with Ashok Leyland, reports NDTVAuto. The Grid-eMotion Fleet is a grid-to-plug EV charging system for large-scale public transport and commercial fleets. The system uses DC technology and can connect to any type of power network, which helps to remove the complexities of integrating AC-DC chargers into a system. "Compared to a conventional connection to the AC grid, the solution brings a 60% reduction in space required for large-scale EV fleet charging, while the depot cabling is reduced by 40%," the company stated in a release. Ashok Leyland and ABB Power Products and Systems India already have a partnership to develop a pilot electric bus that uses ABB's quick-charging technology, Grid-eMotion Flash solution, commonly known as TOSA. (IHS Markit AutoIntelligence's Isha Sharma)

- Bangko Sentral ng Pilipinas (BSP) has lowered the reserve

requirement ratio (RRR) for thrift and rural and co-operative

banks. The central bank noted that the 100 basis-point cut will

release PHP10 billion (USD202 million) and will be implemented on

31 July. The RRR cut for thrift and rural and co-operative banks

will bring their RRRs to 3% and 2%, respectively. (IHS Markit

Banking Risk Angus Lam)

- Thrift and rural and co-operative banks are smaller banks that operate in selected areas, unlike national universal banks. These banks are normally less healthy than larger banks and some rural banks have been shut down by the BSP because of liquidity issues in the past few.

- Thrift and rural and co-operative banks together accounted for around 7.3% of total banking-sector assets as of May. As such, since the 100 basis-point cut in the RRR for these banks only represents PHP10-billion extra liquidity for the sector, this will bring less than 0.1% of increase to total loans as of May.

- This is the second cut in the RRR after the 200 basis-point RRR cut in.

- Considering that the BSP has earmarked a 400 basis-point cut in the RRR in 2020, at least another 100 basis points is expected. Therefore, the impact will depend on which type of banks that the RRR cut will be attached to.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-july-2020.html&text=Daily+Global+Market+Summary+-+22+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}