Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 24, 2022

Daily Global Market Summary - 24 January 2022

All major US equity indices closed higher after being sharply lower for most of the day, all major European indices closed lower, and APAC markets were mixed. US government bonds closed mixed with the curve being steeper on the day, while benchmark European bonds were higher on the day. The US dollar, natural gas, and gold closed higher, while oil, copper, and silver were lower on the day. Markets will be closely watching this Wednesday's FOMC statement and press conference for any indication of a further acceleration of the tightening timeline.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher despite being sharply lower for most of the day; Russell 2000 +2.3%, Nasdaq +0.6%, and DJIA/S&P 500 +0.3%.

- 10yr US govt bonds closed flat/1.77% yield and 30yr bonds +3bps/2.11% yield.

- CDX-NAIG closed flat/58bps and CDX-NAHY -3bps/325bps.

- DXY US dollar index closed +0.3%/95.92.

- Gold closed +0.5%/$1,842 per troy oz, silver -2.1%/$23.80 per troy oz, and copper -2.5%/$4.41 per pound.

- Crude oil closed -2.1%/$83.31 per barrel and natural gas closed +2.5%/$3.88 per mmbtu.

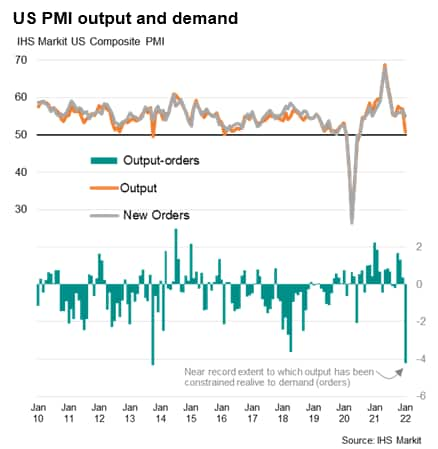

- Adjusted for seasonal factors, the IHS Markit Flash US

Composite PMI Output Index - covering both manufacturing and

service sectors - posted 50.8 in January, down sharply from 57.0 in

December. The resulting increase in activity was only marginal, and

the smallest since July 2020. (IHS Markit Economist Chris

Williamson)

- The January flash PMI is therefore indicative of annualized GDP growth close to stalling at the start of 2022, representing a marked contract to the robust growth of 3.25-3.5% signaled for the fourth quarter of 2021.

- Both manufacturing and service sector firms reported near-stagnant output as the steep spike in virus cases associated with the Omicron wave dented demand and meant ongoing supply issues and labor shortages were exacerbated by renewed pandemic related containment measures.

- Although output was constricted by the Omicron wave, demand growth remained somewhat more resilient. New orders for goods and services continued to rise strongly, albeit registering the weakest rise since December 2020. The resulting gap between output and new orders was the second largest recorded by the survey to date, exceeded in the last 12 years only by the gap seen in October 2013, reflecting the near-unprecedented constraints on output recorded in January due to the flare up of COVID-19 cases and accompanying virus containment precautions.

- Average supplier delivery times lengthened to a slightly

greater degree than in December due to the Omicron impact, but the

extent of delays remained far below that seen throughout much of

the second half of 2021.

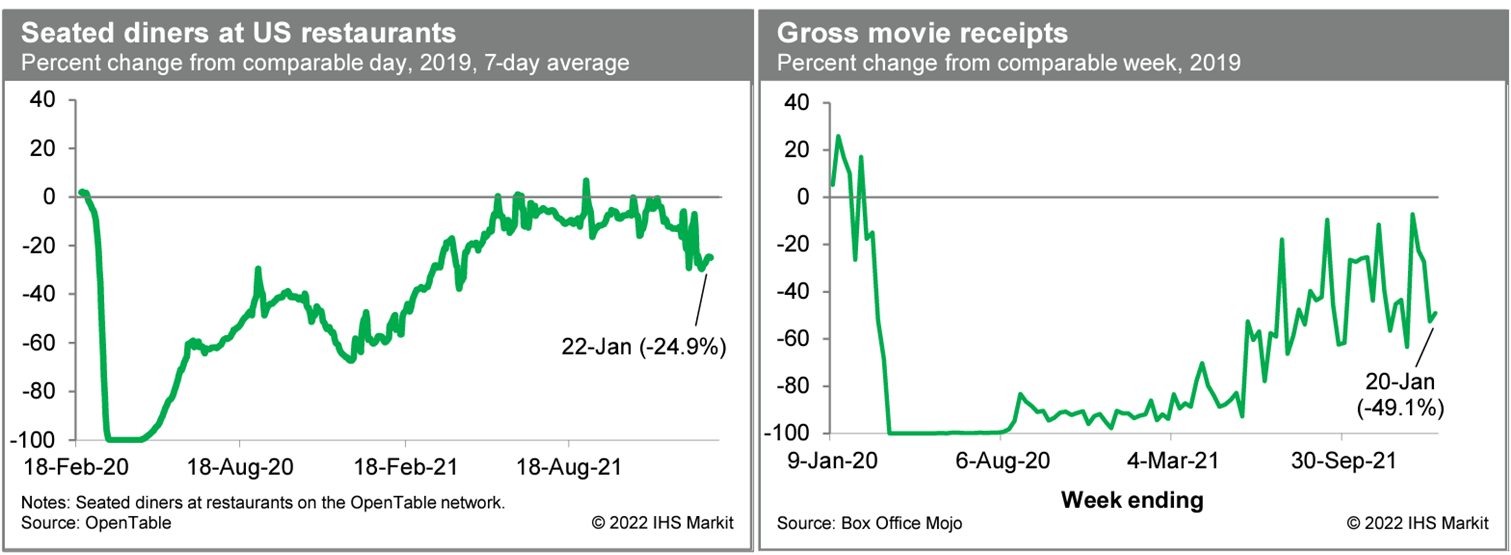

- Averaged over the last seven days, the count of seated diners

on the OpenTable platform was 24.9% below the comparable period in

2019. This is well below readings late last year and indicative of

heightened caution in the face of an elevated rate of new COVID-19

infections. Meanwhile, box office revenues last week were 49.1%

below the comparable week in 2019, according to Box Office Mojo.

This is close to last week's reading and down considerably from

readings late last year. (IHS Markit Ben

Herzon and Lawrence Nelson)

- General Motors (GM) is reported to be investing USD6.5 billion in Michigan for battery and vehicle assembly, said to be announced the week of 24 January. Separately, GM has confirmed USD154 million at a New York plant for electric motor components. The Detroit News reported on 21 January that GM plans to spend USD6.5 billion at two facilities in Michigan. Reportedly, USD4.0 billion will go to the Orion Assembly Plant and USD2.5 billion to a new battery plant in Lansing. The report says that the Lansing battery plant will bring about 1,700 jobs and the investment into Orion will make that the third US battery electric vehicle plant (BEV), after Factory Zero in Detroit and the addition of Ultium EV production at the company's Spring Hill (Tennessee) plant. These reports are similar to reports in December and January as well. The Lansing battery plant would reportedly be located on the same site as GM's Lansing Delta Township Assembly plant, which builds the Buick Enclave and Chevrolet Traverse. GM's Michigan investment has not been confirmed, but reportedly will be in the coming days. At that time, IHS Markit will report on the final details, and how we expect the investment to affect GM's US production. GM has committed to shifting its light-vehicle sales in the US to 100% zero emissions by 2035 and has committed USD35 billion in funding to get there. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Intel has announced plans to invest USD20 billion to establish a new "epicenter" for advanced microchip manufacturing in the United States. According to a company statement, under the plans, the facility would come online in late 2025. Intel said it expects the project to create 3,000 jobs at Intel and 7,000 building jobs over the course of construction at the site. The company plans to build the new facility on a 1,000-acre site in Licking county, near Columbus, Ohio. Intel says the facility will be a mega-site capable of accommodating eight microchip factories and support operations and ecosystem partners. Intel says that its full development of the site over the course of a decade could involve an investment of USD100 billion. Intel says planning for the first two factories is to start immediately and construction is to begin in late 2022, with production due to start in late 2025. Intel also says several of its suppliers have indicated plans to establish a physical presence at the site as well. The investment in microchip production is expected to benefit the auto industry as well as others when the facility comes online, although this will not be soon enough for its output to have an immediate impact on inventory pressures. In the longer term, however, this facility should provide additional, domestic fabrication capacity to be used for devices used in autonomous cars and other advanced automotive applications. However, Intel also states that the investment is dependent on US government funding. US President Joe Biden has proposed USD52 billion in government funding for projects such as this one, although the funding has not been passed yet. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Fermata Energy, a vehicle-to-everything (V2X) technology services provider, has raised USD40 million in funding, according to a company statement. The company has raised capital from new partners, including funds managed by global investment firm Carlyle and Verizon Ventures. Fermata Energy's V2X technology provides energy storage to the power grid to help with the transition to renewables as well as offer revenue generation capabilities for vehicle and fleet owners. J.B. Oldenburg, managing director specializing in renewables investing at Carlyle, said, "Bidirectional charging technology will become essential as electric vehicles increasingly become a key component to global decarbonization. We are proud to partner with Fermata Energy to accelerate the deployment of its bidirectional offering and believe Carlyle's broad network and expertise in business development will help jumpstart the company's growth". Fermata Energy, founded in 2013, focuses on developing V2X software technology with an aim to transform electric vehicles (EVs) into energy-storage assets. This technology will enable a centralized power infrastructure to load balance, transfer, and store renewable energy through the EV, mobile device and IoT markets. The company's offerings include bidirectional chargers, a cloud-based management software platform, and a system architecture for gathering renewable energy and storing it in EVs. Fermata Energy's existing investors include Skyview Ventures, I Squared Capital, and ClearSky. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US federal government, states, and cities have launched a

new program, the Building Performance Standards Coalition, to push

forward Biden administration initiatives to reduce the GHG

emissions from the energy use in buildings. Announced on 21 January

to coincide with Biden's speech at the US Conference of Mayors

meeting, the $1.8-billion program aims to retrofit buildings for

energy efficiency and develop and implement new building codes.

(IHS Markit Net-Zero Business Daily's Kevin Adler)

- To date, 33 state and local governments have signed up to work with DOE and the Environmental Protection Agency (EPA) in the new coalition. The participants represent 22% of the US population and nearly 20% of the nation's building footprint (more than 15 billion square feet of floor space), the White House said.

- DOE says there are almost 129 million non-industrial buildings in the US that collectively use 75% of the nation's electricity and 40% of its energy. Energy use in buildings is responsible for 35% of US CO2 emissions, according to DOE. For those reasons, buildings were cited specifically on 22 April 2021 when Biden raised the US goal for carbon reduction by 2030 to 52-55% below a 2005 baseline. "The United States can create good-paying jobs and cut emissions and energy costs for families by supporting efficiency upgrades and electrification in buildings through support for job-creating retrofit programs and sustainable affordable housing, wider use of heat pumps and induction stoves, and adoption of modern energy codes for new buildings," the White House said at the time.

- On 8 December, he issued a directive for federal buildings and facilities to achieve net-zero emissions by 2045 through energy efficiency, electrification, and use of carbon-free electricity. In May 2021, Biden launched a program to train workers in retrofitting federal buildings to reduce energy use. January's announcement about the new coalition said that DOE already has granted over $25 million in funds under this project, working closely with labor unions to train a new generation of construction workers.

- At the core of the new program is a pledge by the states of Colorado and Washington, Washington, DC, and 30 local governments (include population centers such as New York City, Los Angeles, Chicago, and Seattle) to develop stricter building performance standards. Each government pledged to advance legislation or regulation by Earth Day 2024 (22 April).

- The Central Bank of Paraguay (Banco Central del Paraguay: BCP)

at its January meeting increased its policy interest rate by 25

basis points, from 5.25% to 5.5%. Several additional rate increases

can be expected over the course of 2022, albeit at a slower pace.

(IHS Markit Economist Jeremy

Smith)

- The BCP had previously aggressively increased its policy rate by 125 basis points in each of the final three months of 2021 as consumer price inflation quickly rose beyond the 2-6% target range. These moves had been explicitly previewed in the October 2021 policy communiqué.

- The policy rate, which was at an historic low as recently as July 2021, now stands at its highest point since July 2017. Nonetheless, interest rates remain negative in real terms.

- Consumer prices held steady in December 2021 compared with November, with inflation moderating in annual terms, from 7.4% to 6.8%. Price movements in Paraguay continue to be strongly influenced by international commodity markets, especially of staple grains, beef, and crude oil.

- Inflation expectations for 2022 and 2023 stood at 4.5% and 4.0%, respectively, in a January 2022 survey conducted by the central bank. Medium-term expectations therefore remain anchored to the midpoint of the target range, suggesting confidence in monetary policy, limiting the risk of a wage-price cycle.

- The Central Bank of the Argentine Republic (Banco Central de la

República Argentina: BCRA) on 20 January published its credit

conditions survey covering the last quarter of 2021. The document

highlights that banks perceived that credit conditions neither

tightened nor loosened in all lending segments during the last

quarter of 2021. Banks also noted that credit demand from corporate

borrowers was very similar to that observed in September 2021;

however, households were perceived to have increased in the

non-mortgage segment. As for approved credit, all segments (except

credit cards) observed a loosening in fees and in interest rate

spreads, although there were no changes in terms of guarantees,

loan terms, and loan sizes. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- Both the reported data and the forecast reveal that banks are still very cautious about their lending practices and are likely to further this into 2022. IHS Markit forecasts that credit growth over 2022 will be very close to the rate of inflation, consistent with the survey.

- Since 2018, banks have experienced a sharp increase in credit standards and, despite that, the decline has stabilized since the sovereign debt restructuring of August 2020; it has not returned to the levels prior to the 2018 decline. What this suggests is that Argentina's sovereign situation has been the main factor that has negatively affected the sector's development over the last four years, and it is unlikely that the conditions will change until the full sovereign debt renegotiations are settled.

- Because of this, the path to economic recovery, but more importantly, the results of the debt discussions with the International Monetary Fund (IMF), will be crucial in determining the credit growth path (and other key indicators) over our three-year outlook. An improvement in the sovereign debt situation will improve the country's credit growth, while a more uncertain situation will maintain tightened credit conditions.

Europe/Middle East/Africa

- All major European equity markets closed lower; UK -2.6%, Spain -3.2%, Germany -3.8%, and France/Italy -4.0%.

- 10yr European govt bonds closed higher; Germany/UK -4bps, France -3bps, and Italy/Spain -1bp.

- iTraxx-Europe closed +3bps/58bps and iTraxx-Xover +12bps/281bps.

- Brent crude closed -1.8%/$86.27 per barrel.

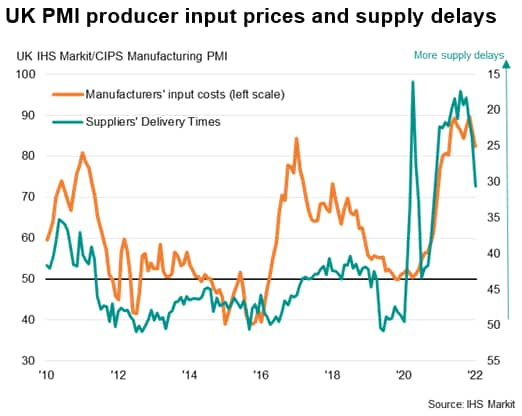

- The IHS Markit/CIPS composite UK PMI output index, covering

both services and manufacturing, fell from 53.6 in December to 53.4

in January, according to the early 'flash' reading, indicating the

slowest rate of expansion since the lockdowns in February of last

year. (IHS Markit Economist Chris

Williamson)

- Service sector growth slowed - albeit only slightly - in January, easing for a third month running to hit the weakest since last February. There were, however, wide divergences within this vast section of the UK economy.

- Rising COVID-19 cases and heightened restrictions imposed to contain the Omicron variant caused activity in the hotels & restaurant sector to fall sharply for a second month running, dropping at a rate not seen since last February, accompanied by a further sharp deterioration in transport and travel services activity. On the other hand, growth of business-to-business services accelerated to the fastest since last July, with financial services activity also picking up strongly during the month, helping to largely offset the weakness in hospitality-oriented sectors.

- Manufacturing output growth meanwhile ticked up to the fastest since August as alleviating supply constraints allowed factories to stem the recent rapid growth of backlogs of uncompleted orders. Suppliers' delivery times lengthened to the least extent since November 2020.

- Although manufacturing input cost inflation slowed, feeding through to a marked cooling of factory gate selling price inflation, service sector costs rose at an increased rate, fueled in particular by higher energy prices and wage growth. Charges levied for services consequently rose at the second-steepest rate on record as firms passed higher costs on to customers.

- Service sector prospects consequently improved in January, with new orders growth lifting from December's ten-month low and expectations for the year ahead perking up to the brightest since August

- The outlook is less bright in manufacturing, however. While

output growth was boosted by fewer supply constraints, growth of

new orders slowed sharply to the weakest since January of last

year, registering the second-worst performance since June 2020. New

export orders for goods barely rose after four months of continual

decline, with around one-in-three firms linking lost export

business at least in part to Brexit.

- The UK's Office for National Statistics (ONS) has reported that

the volume of retail sales slumped in December 2021, falling by

3.7% month on month (m/m).Therefore, retail sales volumes fell by

0.2% in the three months to December 2021 compared with the three

months to September 2021. (IHS Markit Economist Raj

Badiani)

- Nevertheless, retail sales volumes in December 2021 were 2.6% higher than their pre-COVID-19 February 2020 levels

- Non-food volumes fell by 7.1% m/m during December 2021, with all the main sub-sectors reporting falls (department stores, clothing stores, other food stores, and household stores).

- Lower non-food sales in December 2021 was partly due to very robust sales in November 2021 when consumers brought forward their Christmas shopping to avoid the prospect of shortages and higher prices close to the holiday season.

- In addition, the spread the Omicron variant of COVID-19 during December 2021 hit footfall on the high street, with shoppers minimizing the risk of infection and the need to self-isolate over the Christmas and New Year period.

- Automotive fuel sales volumes fell by 4.7% m/m in December 2021 after the government issued new work guidance to tackle the rapid spread of Omicron. Therefore, they remained 6.6% below their pre-COVID-19 levels (February 2020).

- The proportion of retail sales online rose slightly to 26.6% of total sales and stood notably higher than the 19.7% in February 2020.

- Zenzic has launched a pilot project to build and test vehicle-to-everything (V2X) technology across the UK, according to a company statement. The project will assess the current "state of play" of the V2X landscape across the UK and deploy a pilot installation across CAM Testbed UK. The project, which is funded by the government's Centre for Connected and Autonomous Vehicles (CCAV) and coordinated by Zenzic, will be led by Commsignia in partnership with CAM Testbed UK partners. Zenzic was established by the UK government and industry players to manage a nationwide platform for developing and testing autonomous vehicles (AVs). The company has launched the UK Connected and Automated Mobility Roadmap (CAM) to 2030, which the company claims is the world's first roadmap for AV operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Britishvolt has announced that it has secured funding from the UK government and other investors to support its new battery manufacturing facility. These announcements will help add flesh to the bones of what will be a significant project to further support the growth of local battery electric vehicle (BEV) production. IHS Markit currently forecasts that despite plans to end the sale of non-plug-in light vehicles in the UK from 2030, the total share of production of such vehicles will rise from 9.4% in 2022 to 51.2% in 2030, of which BEVs will make up 6.2% and 47.5%, respectively. (IHS Markit AutoIntelligence's Ian Fletcher)

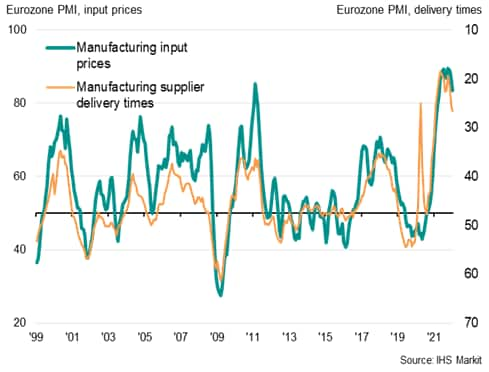

- The headline IHS Markit Eurozone Composite PMI® dropped two

points from 55.4 in November to 53.4 in December, according to the

'flash' reading*, indicating an easing in the rate of output growth

to the lowest since March. The decline takes the average reading

for the fourth quarter to 54.3, substantially lower than the 58.4

average seen in the third quarter. As such the PMI data point to a

marked weakening of economic growth in the closing quarter of 2021,

albeit with the rate of growth remaining above the survey's

pre-pandemic long-run average of 53.0. (IHS Markit Economist Chris

Williamson)

- The slowdown masked wide variations in performance by sector. Service sector output growth slowed sharply for a second month running, dropping to its lowest since last April, amid soaring COVID-19 infection rates. The rapid spread of the Omicron variant led to the reimposition of many measures to contain the virus in recent weeks, notably in Germany, France, Italy and Spain, which adversely affected consumer- and hospitality-oriented businesses in particular.

- Manufacturing growth meanwhile accelerated to the fastest since last August. Although staffing issues curbed output in some factories, supply constraints eased, helping boost production in many firms. Average supplier delivery delays lengthened to the least extent since January of last year, with fewer items reported in short supply and shipping delays showing signs of easing. Growth was recorded in all major manufacturing sectors, including a second consecutive month of rising production in the auto sector.

- By country, business activity rebounded in Germany after a slide into mild contraction in December, registering the strongest expansion since September thanks to a surge in factory production and a return to growth for the service sector. In contrast, growth in France hit the lowest since April, reflecting a near-stalled factory sector and a sharply weaker service sector performance. Meanwhile, growth ground almost to a halt across the rest of the region as a whole amid a renewed contraction of services activity.

- Average selling prices measured across both manufacturing and

services meanwhile picked up to grow at a rate matching the survey

all-time high recorded in November. A new record was seen in the

service sector as costs were driven higher by energy and wage

costs. Prices charged for goods leaving the factory gate also rose

at an increased rate, just shy of November's survey high, though an

easing in manufacturers' input price inflation to the lowest since

last April was also reported, linked in part to the alleviating

supply crunch.

- Insects are proving a solution to many of the European Union's

most pressing challenges, being able to fill protein gaps in food

and animal feed, counter high fertilizer prices through their waste

products (frass), and potentially consuming millions of tons of

former foodstuffs, thereby preventing food waste. After a bumper

year for the insect production sector in 2021 with the first two

insect novel food approvals, frass authorized for fertilizer and

authorization for insect proteins in pig and chicken feed, 2022

promises to continue this positive trend. (IHS Markit Food and

Agricultural Policy's Sara Lewis)

- June 2021 saw the milestone first insect approval under the EU's 2015 novel foods regulation (2283/2015) with a dried yellow mealworm (Tenebrio molitor) range for French producer, Agronutris. A second insect novel food authorization followed in November for Dutch producer Fair Insects and its migratory locust (Locusta migratoria) range.

- The momentum is set to continue in 2022 with the European Commission due to adopt regulations authorizing the third and fourth insect novel foods at the end of January or beginning of February, following clearance by member states via a written procedure in the Standing Committee on Plants, Animals, Food and Feed's (PAFF) novel foods and toxicological safety of the food chain section that ended 8 December. Fair Insects is the producer of both these novel foods, which are dried, ground and frozen house cricket (Acheta domesticus) and (another) frozen, dried and powdered yellow mealworm (Tenebrio molitor) range.

- A further nine applications are currently undergoing risk assessments at the European Food Safety Authority (EFSA), with another eight due to start once the agency completes initial suitability checks. The sector's producer association, the International Platform of Insects for Food and Feed (IPIFF), expects the knowledge gained with the first four risk assessments to accelerate the process for those coming after.

- Other species where applications are pending include Alphitobius diaperinus (lesser mealworm), Gryllodes sigillatus (banded crickets), Hermetia illucens (black soldier fly), and Apis mellifera male pupae (honeybee drone brood).

- In all four opinions on edible insects so far, EFSA has flagged up the risk of allergic reactions and recommended that there should be research on allergenicity both to the relevant species and insects in general, including cross-reactivity. Insects could be therefore added to the EU's list of 14 allergens that have to be labelled under the 2011 food information to consumers regulation (FIC - 1169/2011), either by being highlighted in bold in the list of ingredients or in a separate list next to it, but not as part of the proposals to revise the legislation that the Commission is due to publish at the end of this year.

- Lamborghini is set to build and sell its last non-electrified vehicles in 2022. Stephan Winkelmann, the brand's CEO, told Bloomberg News in an interview, "It will be the last time that we only offer combustion engines." He added that the automaker plans to unveil four products in 2022 as it hybridizes its line-up before 2023. The senior executive also said that Lamborghini is still working on the design of its first fully battery electric vehicle (BEV), and is leaning towards a four-door model that can be used on a daily basis. Lamborghini announced last year that its entire line-up would be electrified within the next couple of years. As well as the wider inclusion of mild-hybrid technology in its sports cars, we also expect the Urus to benefit from a plug-in hybrid powertrain. The company is investing hugely in these projects, but the majority of the EUR1.5 billion earmarked for this transition is likely to be spent on bringing its first BEV to market, expected by IHS Markit to arrive in 2028. (IHS Markit AutoIntelligence's Ian Fletcher)

- Norwegian city Stavanger will test an electric Level 4 driverless bus on public roads, reports Railly News. The bus, which is manufactured by Turkish company Karsan and integrated with autonomous technology developed by Applied Autonomy, has started testing at Forus Business Park in Stavanger. The eight-meter-long bus has capacity for over 21 people and will be tested for two years in the public transport system in Stavanger city center. Mustafa Varank, Turkey's Ministry of Industry and Technology, said, "Another proud day of the Technology Move! For the first time in Europe, an unmanned bus will be integrated into the public transport system and will be used in city traffic." (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Major APAC equity indices closed mixed; Japan +0.2%, Mainland China flat, Australia -0.5%, Hong Kong -1.2%, South Korea -1.5%, and India -2.6%.

- China's zero COVID policy and stringent testing and quarantine

measures have contributed to logistics costs hikes, big price

fluctuations in origin countries and uncertainty for importers. The

Chilean cherry season is under way in China and stakeholders in the

supply chain are facing huge logistics challenges. Wholesale prices

are expected to go down after the Chinese New Year, which falls on

1 February. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Chinese New Year for this year is a bit earlier than usual years. Now is the peak period for imported fruit sales, especially those from the southern hemisphere. The delay in shipment arrivals has negatively affected the supply.

- China and Hong Kong SAR continue to adopt the zero Covid policy and enforce very stringent testing and disinfectant measures for customs clearance. The process is long and slow and the requirements are high and complex.

- Jack Liu, a local importer based in Shanghai told IHS Markit: "Over 10,000 containers carrying cherries are waiting for customs clearance at Hong Kong SAR. Every day only 180-500 containers can complete the process and be cleared. The delay to the end consumers is about 10 days.

- "This year air freight rates are rising to CNY7-8/kg ($1.11-1.26/kg) from CNY5-6/kg of last year. We have to multiply the costs to each 5kg box and pass the costs on." Additionally, logistics companies have to pay extra port charges when the goods are stuck at the port.

- The current reduced cherry supplies meant spot prices are firm, about CNY400 per box (5kg) for size J, JJ CNY480/box. After Chinese New Year, consumer demand will slow down. However, there will be more cherries arrived by then. The ample supplies and slower demand may push the prices down, meaning a huge margin shrinkage for importers. The prices are expected to drop to CNY100-150/box for J, JJ CNY200-250/box after the festive season.

- China's Yantai greenhouse grown cherries has started this year's campaign from 20 January, sold for CNY600/kg for wholesale. Local sources said that domestic production has limited varieties, small volume and the prices remain high compared with imports. For cherries, China's research and development and cultivation are still far lagging behind Chile's.

- Volkswagen (VW) resumed vehicle production on 21 January at its Tianjin plant after suspending production since 10 January owing to the recent COVID-19 outbreaks in the city, reports Reuters, citing VW. In a separate report, a Toyota spokesperson has confirmed to Reuters that the company's vehicle production plant in Tianjin resumed production on 22 January. The production site was shut down on 10 January because of the impact of mandatory COVID-19 testing of city residents on suppliers. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Mainland Chinese wind turbine manufacturer has secured a contract for its MySE 11-203 typhoon class hybrid drive offshore wind turbine for the first two phases of the Yuedian Yangjiang Qingzhou project, amounting to 1 GW in total capacity. The project is situated off the cost of Guangdong province and is developed by Guangdong Electric Power Development, through its wholly-owned subsidiary Guangdong Wind Power Generation Company. Qingzhou 1 has a capacity of 600 MW, and Qingzhou 2, a capacity of 400 MW. Both project phases are estimated to cost around USD2.7 billion and are planned to be commissioned in 2023. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Greenland Technologies Holding Corporation, a Chinese group engaged in the development and manufacture of electric industrial vehicles, has announced its entry into Morocco's market following the signing of a distribution agreement, reports NF News. According to the report, the agreement is for a minimum potential market value of USD5 million and up to USD8.4 million. As a part of the agreement, Greenland's partner company in Morocco, Elive Maroc, will hold the exclusive right to market and sell the Chinese group's electric industrial vehicles in the country. Raymond Wang, Greenland's CEO, said, "This agreement plants Greenland Technologies' banner in Africa, a continent where we plan to expand as we expand our electric industrial vehicle product line." He added that the Moroccan market is "advantageous" and has the added benefit of low electricity costs of USD0.116 per kWh. Greenland aims to establish itself in the Moroccan market. Morocco is in the process of positioning itself as a center of EV production with national plans such as the New Development Plan and Generation Green 2020-2030. In August 2021, Stellantis announced that its German auto-manufacturing subsidiary Opel would begin EV production in Morocco. Meanwhile, STMicroelectronics is setting up a new production line in Morocco to manufacture electronic chips for EV maker Tesla. (IHS Markit AutoIntelligence's Tarun Thakur)

- Renault Group and Zhejiang Geely Holding Group (Geely Group) have entered into an agreement to jointly launch hybrid electric vehicles (HEVs) and internal combustion engine (ICE) models in South Korea. New vehicles under this partnership will be produced at the Renault Samsung facility in Busan (South Korea), with production forecast to begin in 2024. These new vehicles will be initially designed for the South Korean market, with exports for the overseas market planned at a later stage. The partnership also forms part of Renault's "Renaulution" program to upgrade the Renault Samsung Motors (RSM) brand and product portfolio by using industry leading technology, engineering, and services as well as working with strong local partners. New models developed under this joint initiative will be based on Geely's compact modular architecture (CMA). Geely will also share its hybrid powertrain technologies as part of the agreement. Renault and RSM will contribute their expertise in design and customer experience. Following the signing of a memorandum of understanding (MOU) in August 2021, Renault and Geely have formally inked the deal that would bring benefits to both companies. However, it is still unclear how Geely and Renault intend to leverage Lynk & Co's product line in South Korea, apart from the confirmed plan to produce new models using Geely's CMA platform. We expect more details to be released at a later stage. Geely is eager to expand its presence outside China. The Chinese automaker not only aims to sell more vehicles in the global market but has also been actively advancing its plans to become a provider of key automotive technologies and knowledge. With brands, including Volvo and Polestar, shifting their focus to electric vehicles (EVs), Geely's collaboration with Renault will allow the Chinese automaker to continue to tap into its ICE and hybrid technology assets pool and widen its source of revenues. (IHS Markit AutoIntelligence's Abby Chun Tu)

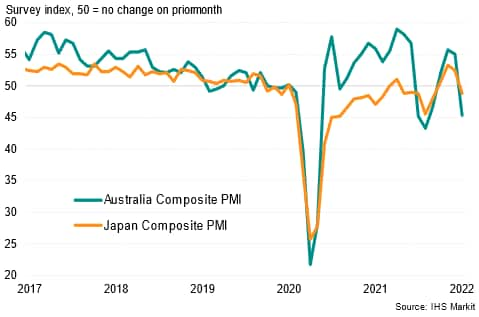

- The latest IHS Markit flash PMI data revealed that APAC

economies Japan and Australia both saw their private sector

activity contract at the start of 2022. This marked a sharp

downturn from December 2021, when the PMI data showed growth

momentum merely easing from the initial recovery boost post the

COVID-19 Delta wave. The deteriorating picture primarily reflects

the detriments of the COVID-19 Omicron wave. (IHS Markit Economist

Jingyi

Pan)

- Specifically, Australia's Composite PMI slumped to 45.3 in January while Japan fell to 48.8, both the lowest in at least four months and in both cases indicating a third spell of economic contraction due to the pandemic.

- Manufacturing output also contracted in Australia, though the service sector output index fell almost twice as fast as its manufacturing counterpart. Not only was demand weighed by the latest pandemic developments, with consumers holding back their consumption of services as COVID-19 cases raced to a record high, widespread supply and labor disruptions were also reported, contributing to the sharp downturn in the service sector. Manufacturing output in Australia had similarly been affected, even as demand growth persisted in January, seeing production efforts hampered by the spate of supply disruptions, including the lengthening of lead times at a more severe rate, and employee absenteeism.

- On the other hand, Japan's manufacturing output expanded at a stronger rate, though arguably COVID-19 cases remain on the climb in Japan, suggesting that it is still early days for the 'sixth wave' of infections. Service sector output meanwhile demonstrated a clear decline alongside demand.

- Australia's selling price inflation eased from the record rate in December 2021 but input price inflation continued the climb to a fresh survey record. Anecdotal evidence suggested that the surge in COVID-19 infections aggravated input costs for firms, although weaker demand conditions limited firms' ability to pass on some of these costs to their clients. In comparison, Japan - which appears to be in the early part of the new COVID-19 wave - had seen the easing of price pressures across both input costs and output charges. Further developments on the COVID-19 front will continue to be closely scrutinized for the effect on Japanese prices moving forward.

- Business confidence across both Japan and Australia was seen

reacting immediately to the latest developments on the COVID-19

front. Future output expectation indices, while reflecting

sustained optimism, plunged to the lowest readings seen since April

2020 and January 2021 for Australia and Japan respectively.

- The Renault-Nissan-Mitsubishi Alliance plans to triple its investment and spend EUR20 billion (USD22.65 billion) over the next five years for joint development of electric vehicles (EVs), reports Reuters. The alliance partners are expected to announce a formal plan this week. Under the plan, the alliance is expected to come up with more than 30 new EVs underpinned by five common platforms by 2030. The planned investment will be in addition to the EUR10 billion they have already spent on vehicle electrification. The report confirms the alliance's commitment to jointly develop electrified vehicles. The alliance aims to drive synergies in the development and manufacturing of electrified vehicles and gain a stronger foothold in the EV industry globally. Meanwhile, Renault, Mitsubishi and Nissan have already announced their individual targets for year 2030. In November 2020, Mitsubishi unveiled plans to raise the proportion of EVs, including plug-in hybrid EVs (PHEVs) and hybrid EVs, in its total sales to 50% by 2030 as part of its revised Environmental Plan. In November 2021, Nissan released its 'Ambition 2030' long-term plan focused on electrified vehicles and technological innovations. The plan supports Nissan's goal to be carbon-neutral across the life cycle of its products by fiscal year (FY) 2050. The automaker aims to invest JPY2 trillion (USD17.6 billion) over the next five years to accelerate the electrification of its model line-up. It will introduce 23 new electrified models, including 15 new EVs by FY 2030, aiming for an electrification mix of more than 50% globally across the Nissan and Infiniti brands. In June 2021, Renault announced its plans for accelerating its electrification strategy which is expected to lead to Renault's electric and electrified vehicle line-up making up around 65% of its sales mix in 2025, of which 30% are battery electric vehicles (BEVs). BEVs are expected to make up to 90% of the Renault brand mix by 2030. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A group of Japanese companies have secured a two-year grant under the Green Innovation Fund program administered by the New Energy Industrial Technology Development Organization (NEDO). The companies, JERA, MODEC, Toyo Construction, and Furukawa Electric Industry, aims to establish component technologies for the tension leg platform floating wind concept by 2030. The joint technology development will see JERA conduct surveys and measurement of the planned verification site, design power generation facilities, and establish environmental parameters. MODEC will conduct simulations and studies on floating and mooring systems, mooring foundations will be covered by Toyo, and Furukawa will cover power transmission systems. The companies will aim, in the short term, to develop a basic plan for a 15 MW generation facility, and consider supply chains for mass production and cost-reduction. The longer term plan is to reach commercialization by 2030. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Indian government think tank NITI Aayog has prepared a draft policy for the Indian Railways to set up electric vehicle (EV) charging infrastructure at various railway stations across the country, reports the Hindustan Times. According to the news source, the aim of the policy is to promote use of EVs and it recommends the supply of renewable energy to the charging facilities for the Indian Railways to achieve net-zero carbon emissions by 2030. Reportedly, according to the think tank, the EV charging infrastructure could be provided immediately at 123 redeveloped railway stations and made available at all stations in a phased manner by 2030. Amitabh Kant, NITI Aayog's CEO, said, "Railway stations are landmark locations and they play a unique role in the entire transport sector, which make them strategic locations for providing public charging solutions for EVs." (IHS Markit AutoIntelligence's Tarun Thakur)

- Taiwan's Foxconn has signed a memorandum of understanding (MOU)

with the Indonesian Ministry of Investment as well as Indonesia

Battery Corporation, energy firm PT Indika Energy, and Taiwanese

electric scooter vendor Gogoro to jointly develop a battery

manufacturing and electric vehicle (EV) ecosystem in the country,

according to a company press release. Under the MOU, Foxconn,

together with its partners, aims to explore a wide range of

investment, from electric battery manufacturing - including battery

cell, battery module, and battery pack development - to the

formation of a four-wheeled and two-wheeled EV ecosystem. The

co-operation will also include the development of EV supporting

industries such as energy storage systems (ESSs), battery exchange

stations, and battery recycling. In the initial phase, the

development of new energy and full battery platform production in

Indonesia - producing lithium iron phosphate or solid-state EV

batteries - will be the priority. The press release did not

highlight any information regarding timeline or investment costs

for these. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-january-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-january-2022.html&text=Daily+Global+Market+Summary+-+24+January+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-january-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 January 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-january-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+January+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-january-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}