Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 24, 2022

Weekly Global Market Summary Highlights: January 14-21, 2022

All major US and European equity indices closed sharply lower on the week, while APAC markets were mixed. US government bonds closed higher on the week, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed wider week-over-week across IG and high yield. The US dollar, gold, silver, copper, and oil closed higher, while natural gas was lower on the week.

Americas

All major US equity markets closed lower for one of the worst weeks since March 2020; DJIA -4.6%, S&P 500 -5.7%, Nasdaq -7.6%, and Russell 2000 -8.1% week-over-week.

10yr US govt bonds closed 1.77% yield and 30yr bonds 2.07% yield, which is -3bps and -4bps week-over-week, respectively.

DXY US dollar index closed 95.64 (+0.5% WoW).

Gold closed $1,832 per troy oz (+0.8% WoW), silver closed $24.32 per troy oz (+6.1% WoW), and copper closed $4.52 per pound (+2.3% WoW).

Crude Oil closed $85.14 per barrel (+1.6% WoW) and natural gas closed $3.78 per mmbtu (-7.3% WoW).

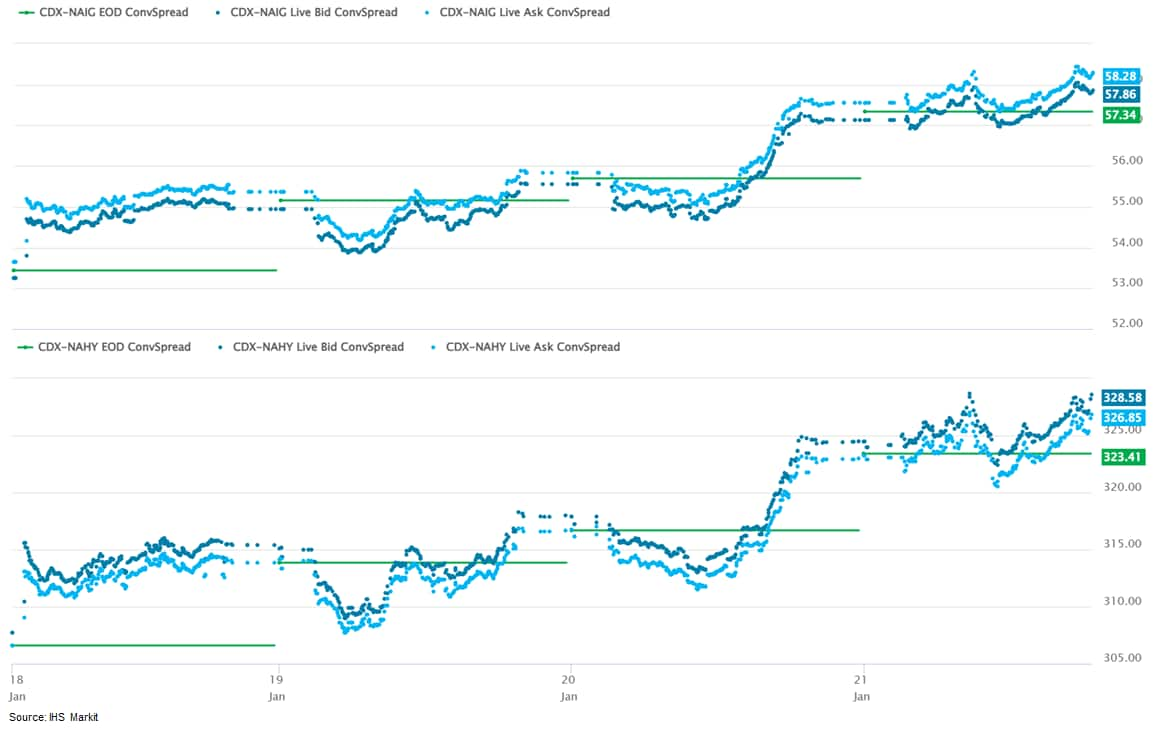

CDX-NAIG closed 58bps and CDX-NAHY 326bps, which +5bps and

+21bps week-over-week, respectively.

EMEA

Major European equity indices closed lower on the week; UK -0.6%, France -1.0%, Spain -1.3%, Italy -1.8%, and Germany -1.8% week-over-week.

Major 10yr European government bonds closed mixed on the week; Germany closed -2bps, Spain flat, France +1bps, UK +2bps, and Italy +3bps week-over-week.

Brent Crude closed $87.89 per barrel (+2.1% WoW).

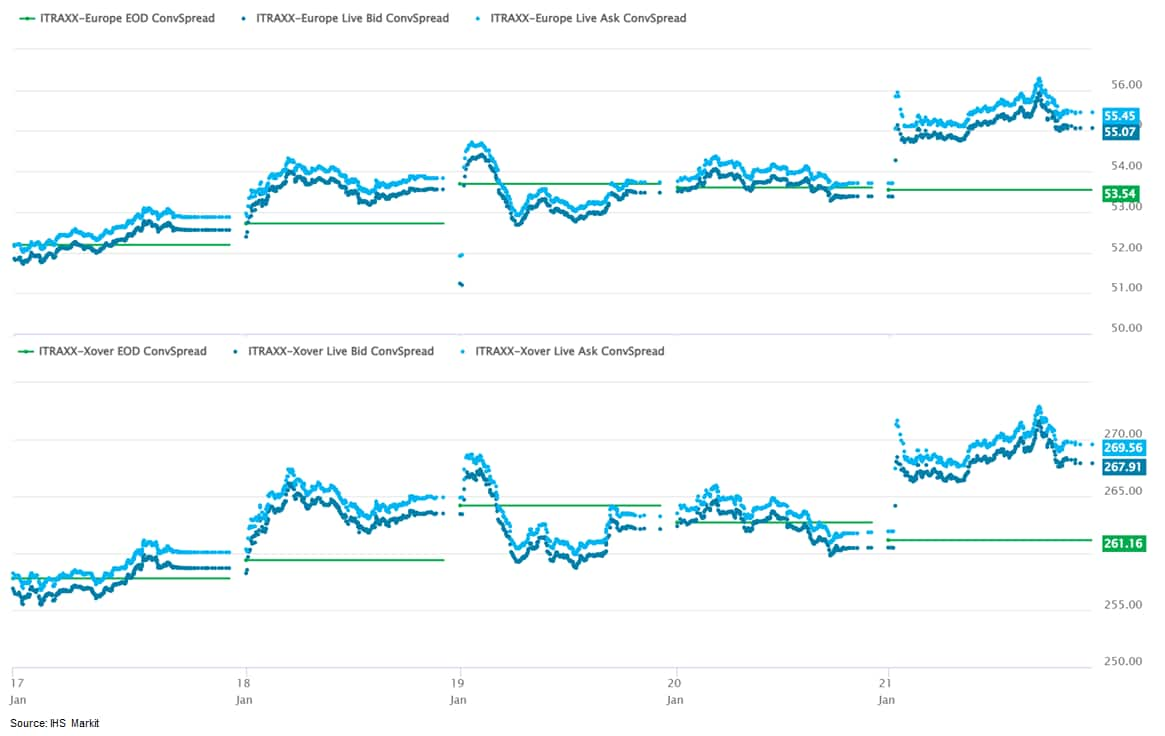

iTraxx-Europe closed 55bps and iTraxx-Xover 269bps, which +3bps

and +11bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed on the week; Hong Kong +2.4%, Mainland China flat, Japan -2.1%, Australia -2.9%, South Korea -3.0%, and India -3.6% week-over-week.

Monday, January 17, 2022

US Markets were closed for the Martin Luther King Jr. Day holiday

Tuesday, January 18, 2022

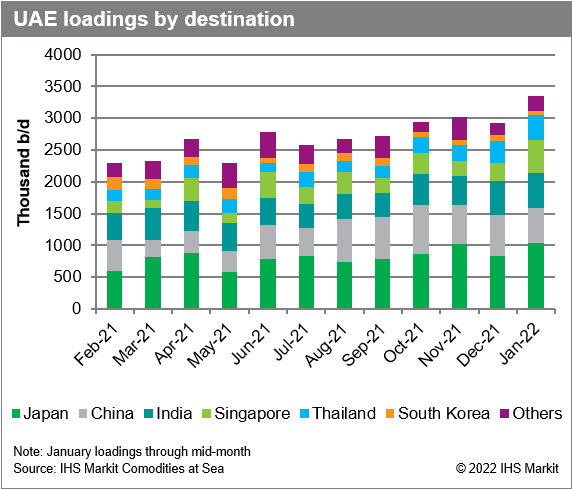

- Disruptions have helped ease concerns of oil surpluses in

1H2022 and heightened geopolitical tensions are sharpening fears of

potential shortages. Oil prices at the top of our range of

$65-$90/bbl benefit from biases on both sides of the balance

ledger. (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst)

- Towering inflation rates reaffirm the short-term demand story and push aside risk of Omicron-related slowdowns, while burgeoning fears of limited global spare capacity are stoked as tensions rise on the Ukrainian-Russian border and in the Mideast with the Houthi attack on oil infrastructure in Abu Dhabi.

- Drone attacks on Abu Dhabi over the weekend, while limited in direct impact on oil production, have catapulted the global geopolitical risk temperature that was already rising from Russia-Ukraine to feverish levels, drawing capital into oil markets with no immediate catalyst to create more sellers.

- The Houthi-claimed drone attack on Abu Dhabi is a reflection of

events in Yemen, and the ability of the Houthis to retaliate

against the latest UAE-backed offensive. Importantly, this attack

is an indication that ongoing tensions in the Gulf are unlikely to

be resolved with a prospective Iran deal, if it materializes, with

a scenario for continued escalation even in tandem with

de-escalation on the US-Iran front.

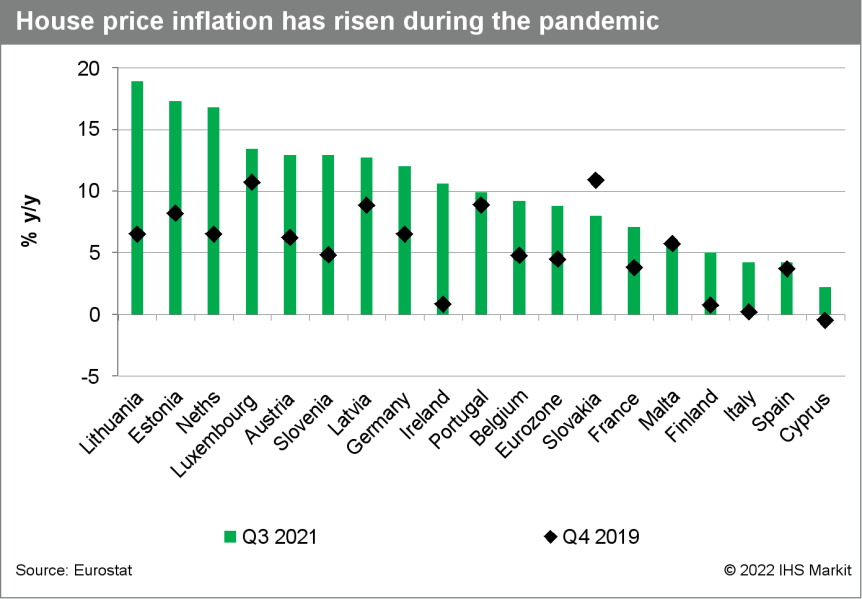

- House prices in the eurozone increased by 8.8% y/y in the third

quarter of 2021, up by two percentage points versus the prior

quarter and the fastest rate of increase in the series' history,

which dates back to 2005. (IHS Markit Economist Ken

Wattret)

- The y/y rate of increase has picked up in seven of the past eight quarters, with the cumulative increase in eurozone house prices compared with the pre-pandemic level exceeding 13%.

- Unlike some other indicators, the exceptionally strong y/y rates of increases in house prices are not a result of base effects. The third quarter of 2021's quarter-on-quarter (q/q) increase was 3.3%, following a 2.6% gain the prior quarter, representing the biggest back-to-back increases on record.

- The strength in the third quarter of 2021's data was broad-based across most of the eurozone, with nine of the 18 member states for which data are available (Greece is the exception) showing y/y increases in double digits.

- In general, although not uniformly, there has been a divide between house price dynamics in the northern member states and those in the south, with the latter having suffered lasting damage in the period after the post-global financial crisis as the bubbles that had built up beforehand burst with devastating consequences. However, although comparatively low, even in the southern member states, y/y rates of increase in house prices have also been picking up in recent quarters.

- Increases in house prices are not a new development in the eurozone. Prices have been increasing on a q/q basis since the start of 2015, consistent with very accommodative monetary policy, reflected in record low interest rates and favorable credit conditions.

- What is relatively new is the acceleration in the pace of the

house price increases in many member states since the start of the

COVID-19 virus pandemic, as demand for accommodation has

strengthened while monetary policy has remained

ultra-stimulative.

- Canada's Housing starts plunged 22.3% month over month (m/m) to

236,106 units (annualized). (IHS Markit Economist Chul-Woo

Hong)

- The plunge in Ontario's housing starts was led by the 56.3% m/m plummet in urban multiples mainly due to the large pullback in the Toronto area. Ontario's urban single starts fell 9.1% m/m. Starts in Alberta and Quebec also fell sharply, returning to more normal levels.

- Urban multiple starts fell 29.0% m/m while urban single starts dropped 4.2% m/m. Rural starts declined 3.4% m/m.

- The loss was concentrated in Ontario (down 46% m/m), hitting the lowest level since May 2020.

- Despite the larger-than-expected drop in housing starts, the overall trend was in line with the IHS Markit expectation that starts will moderate in the short term.

- Total dwellings under construction (not seasonally adjusted) fell for the first time since September 2020.

- Spain's farming industries expect production costs to rise

significantly in 2021, increasing from 47% of revenues to 62%,

driven by major increases in important inputs. (IHS Markit Food and

Agricultural Commodities'

Jose Gutierrez)

- Farming associations estimates year-on-year rises in 2021 in electricity (up 300%), diesel oil (up 80%), fertilizers (up 50%), animal feed (up 26%), seeds (up 20%) and irrigation water (up 33%).

- Electricity is essential for coldstores and irrigation. The Spanish irrigated area totals around 3.8 million hectares (14% of the planted area), producing around 65% of total volume, and the technology which cuts water expenses is itself intensive in electricity consumption.

- Agricultural production costs in Spain rose significantly last year, driven largely by increases in the cost of diesel oil and electricity. The government estimates costs grew almost 11% between June 2020 and August 2021 with energy costs 38% higher, and fertilizers and animal feed costs rising by 12% and 16%, respectively.

- Farmgate prices kept pace, up by 12% in August 2021 year-on-year. However, there was significant variation between crops, with cereals rising 35%, oilseeds/beets up 45%, olive oil up 64% and citrus fruit up 26%. Meanwhile, livestock and dairy prices were up only 2%, vegetables up 4%, grapes/must/wine/vinegar up 9% and potatoes down 13%.

- Prices for Spanish agricultural products are likely to rise in H1 2022 and begin to stabilize in Q3.

- Toyota has announced revised production plans for February 2022. According to a company statement, due to rising numbers of COVID-19 cases among employees and shortages of semiconductor chips, the automaker has adjusted its planned production by around 150,000 units globally to be around 700,000 vehicles. As a result of the revision, the automaker forecasts its total global production in the fiscal year ending 31 March 2022 to be lower than the volume of 9 million units it forecast previously. In Japan, Toyota plans to suspend operations of 11 lines at eight plants for different periods next month. At the Motomachi plant, which produces the GR Yaris, the automaker plans to shut the GR line for 12 days during February. At the Miyata plant, which produces the NX, CT, UX models, production line 1 is to be shut for 10 days. At the Iwate plant, which produces the C-HR, Aqua, and Yaris models, production lines 1 and 2 are to be closed for 11 days. At the Fujimatsu plant, which produces the Noah and Voxy, production line 2 is to be suspended for 13 days. At both the Takaoka plant and the Tsutsumi plant, which produce models including the Corolla, RAV4, Harrier, Prius, and Camry, production lines 1 and 2 are to be shut for two days during February. Since September, Toyota has trimmed its global output substantially owing to challenges in acquiring components because of the spread of the COVID-19 virus in Southeast Asian countries. However, this is the first time that the automaker has lowered its yearly production target of 9 million units. Meanwhile, last week, Toyota's operations at its joint-venture plant in China were affected due to new lockdown and testing protocols after cases of the Omicron variant of COVID-19 surfaced. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Honda and LG Energy Solution are reportedly in early talks to form a joint venture (JV) in the US to set up a KRW4-trillion (USD3.3-billion) electric vehicle (EV) battery factory, reports The Korea Herald. The report mentioned that the two companies are planning to set up a battery plant with annual production capacity of 40 GWh, which it estimates is enough to power nearly 600,000 EVs. Details such as establishment date, location and ownership structure have not been decided yet but are expected to be ironed out in six months, highlights the report. "Nothing has been decided yet," said a company official, who added that the firm "has continued talks with various global automakers for possible partnerships." (IHS Markit AutoIntelligence's Jamal Amir)

Wednesday, January 19, 2022

- The People's Bank of China (PBOC) announced a cut to the

medium-term lending facility (MLF) rate on 17 January. The PBOC

injected CNY700 billion worth of one-year MLF loans to replace the

CNY500 billion worth of matured loans, with the rate lowered to

2.85% from 2.95% in previous operations. This marks the first cut

since April 2020. (IHS Markit Economist Yating

Xu)

- The PBOC also announced seven-day reverse purchase rate cuts worth CNY100 billion, with the interest rate lowered by 10 basis points to 2.1%.

- The central bank's decision to cut policy rate in January 2022 - following the reserve requirement ratio cut, introduction of structural tools, and loan prime rate (LPR) cut in December 2021 - is in line with the authorities' pledge early this month to roll out monetary policies that support economic stabilization. It points to the increasing downward pressure on the economy, with the continuous real estate market weakness and spread of the Omicron variant of COVID-19. Expectations of a US rate hike also accelerated mainland China's monetary easing. We expect a corresponding cut to mainland China's LPR on 20 January 2022.

- US builders started 1.595 million houses in 2021, the highest

since 2006 and 15.6% more than in 2020; 1.123 million units

(highest since 2006) were single-family and 472,000 were

multifamily (highest since 1987). (IHS Markit Economist Patrick

Newport)

- Housing starts fell in the second and third quarters but bounced back to a 1.644-million-unit rate in the fourth, their highest level since the third quarter of 2006. It is too early to tell how much of this was weather-related and how much was underlying demand. December 2021 was the warmest December on record, going back to 1895; October and November also ranked in the top 10 warmest for their respective months. Housing starts in December increased 1.4% but that increase was not statistically significant.

- Builders took out an annualized 745,000 multifamily housing permits in December, a 30-year high. According to the press release, "Philadelphia enacted several real estate tax changes for residential projects permitted after December 31, 2021." These changes led builders to take out permits early. Single-family permits ended the year on a solid note, increasing 2.0% in December and 5.4% in the fourth quarter. Builders took out 1.725 million permits in 2021, 17.2% more than in 2020 and a 15-year high.

- The number of homes under construction in December increased to a seasonally adjusted 1.519 million, the highest total since November 1973. Authorized but not started homes are at a series high of 270,000 (data start in 2000).

- Builders are facing stiff pandemic-fueled headwinds—rising material costs, labor shortages, and issues with the supply chain for building materials. Another headwind has also emerged: higher mortgage rates, which have moved up 40 basis points in the past three weeks. All this adds up to declining housing starts this year.

- The Office for National Statistics (ONS) has reported that the

UK's 12-month rate of consumer price index (CPI) inflation

increased from 5.1% in November to 5.4% in December 2021, the

highest rate since the series began in January 1997, and since

March 1992 (7.1%) when using the historical modelled data. (IHS

Markit Economist Raj

Badiani)

- During 2020 and 2021, CPI inflation averaged 0.9% and 2.6%, respectively.

- The CPI including owner-occupiers' housing costs (the CPIH) rose by 4.8% in the 12 months to December, up from an increase of 4.6% in November. In addition, the 12-month rate of the retail prices index increased to a 30-year high of 7.5% during the same month.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 26.8% year on year (y/y), the ninth successive double-digit increase. This was in line with global crude oil prices rising by 48.4% y/y to average USD74.4 per barrel (pb) in December, the 12th successive y/y gain.

- The ONS also reported an even sharper rise in household energy bills during December after the increased regulatory price cap on domestic natural gas and electricity from 1 October. Natural gas and electricity prices increased by 28.1% y/y and 18.8% y/y in December, respectively.

- Meanwhile, restaurant and café prices increased by 6.0% y/y in December, compared with a gain of 5.2% y/y in November.

- Food prices rose at a brisker rate, increasing by a nine-year high of 4.2% y/y in December from 2.4% y/y in November. This is a worrying development, adding to the cost-of-living crisis facing many UK households.

- The ONS also reported that steeper increases in prices of furniture and clothing contributed to the higher inflation rate during December.

- All-services price inflation was 3.4% in December, up from 3.2% in November; for goods, it stood at 6.9%, up from 6.5% in the previous month.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, moved up to 4.0% in November from 3.4% in October.

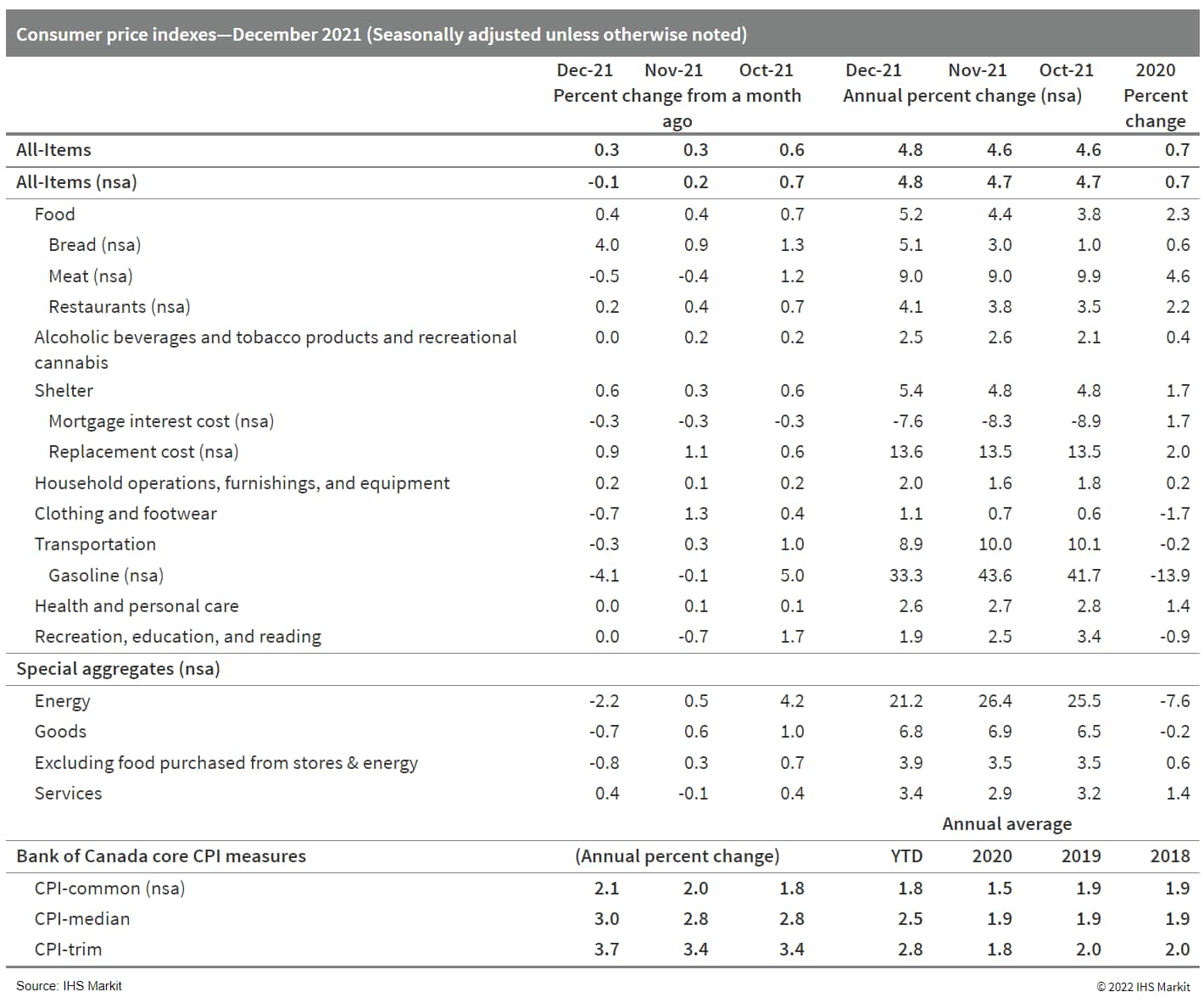

- Canada's consumer prices peaked once again in December,

matching rates not seen since the early 1990s. Annual price

inflation rose faster for food, shelter, household operations,

furnishings, and equipment, as well as clothing and footwear. The

monthly decline in gasoline prices contributed the most to the

slower annual increase in the transportation price index. Gasoline

price inflation moderated to 33.3% y/y in December after rising

43.6% y/y in November. Other top contributors to annual inflation

include homeowners' replacement costs at 13.6% y/y, purchase of

passenger vehicles at 7.2% y/y, other owned accommodation expenses

at 13.4% y/y, and meat at 9.0% y/y. As restrictions were few in the

month Canadians resumed usual December travel patterns as demand

lifted air transportation prices 24.7% m/m, which was similar to

the increase two years earlier. (IHS Markit Economist Arlene

Kish)

- There was a notable difference in the monthly change in consumer prices as there was a gain of 0.3% month on month (m/m) on a seasonally adjusted basis (SA) but a decline of 0.1% m/m on a non-seasonally adjusted basis (NSA).

- Annual inflation quickened to 4.8% year on year (y/y) NSA and SA.

- All three Bank of Canada preferred core inflation rates were higher in the month, averaging 2.9%, 0.2 percentage point higher than November's average.

- High inflation, pandemic restrictions, and consequential job

cuts are making a rough road for many Canadians in the third year

with COVID-19.

- South Korean President Moon Jae-in held talks with Saudi Arabia's Crown Prince Mohammed bin Salman to co-operate on fields including hydrogen. During the talks, the two leaders have agreed to build a hydrogen ecosystem where Saudi Arabia will supply carbon-neutral hydrogen and ammonia while South Korea will support the Arab nation in operating hydrogen-powered cars and hydrogen facilities such as fueling stations. Moon also confirmed that the two nations have expanded co-operation beyond construction, infrastructure and energy by signing 14 preliminary agreements on areas of manufacturing, energy and public health as well as hydrogen, reports The Korea Herald. The latest development is in line with the South Korean government's aim to improve air quality in the country by bringing down particulate levels, increasing the adoption of alternative-powertrain vehicles, fostering hydrogen-related businesses as future growth drivers, and reducing the country's heavy reliance on imported oil. South Korea is one of Saudi Arabia's key strategic partners for its Vision 2030 policy, under which the country aims to reduce its reliance on oil and develop its public service sector. Saudi Arabia plans to increase hydrogen production to 400 tons per year by 2030, to achieve carbon neutrality by 2060. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- According to S&P Global's news outlet, foreign-owned bank

UniCredit SpA, Russia's 12th largest bank by assets, is aiming to

acquire PJSC Bank Otkritie Financial Corporation, the country's

sixth-largest bank. The merger, if it takes place, would create the

fourth-largest entity in the Russian banking sector by assets.

Otkritie has been owned by the Central Bank of the Russian

Federation (CBR) since it took it over after severe liquidity

strains in 2017. Prior to that, it was the largest privately owned

bank in Russia. The CBR in August 2021 released its intention to

offload shares in Otkritie, in the hopes of completely removing its

stake in the bank. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- While Unicredit appears not to be the only bank interested in acquiring Otkritie, its recent attempts to expand its operations (such as through Banca Monte dei Paschi di Siena SpA in Italy, which was unsuccessful because of valuation discrepancies between the relevant parties) suggest that it has the funds and strategic aims to concretize a merger.

- The latest developments in Otkritie suggest that its sale would not impose a burden on the sector as it has improved its balance sheet and has progressively become more efficient. Additionally, given its extensive network of operations across most of Russia, it could expand UniCredit's coverage domestically.

- Otkritie was one of the affected entities of the Moscow Garden Ring crisis in 2017, becoming the first bank to experience liquidity problems. In the years prior to that crisis, Otkritie had experienced very high levels of credit growth, prompted by related-party lending. The rapid levels of growth eventually eroded the trust of its depositors, leading to liquidity strains.

- Since its takeover by the CBR, Otkritie has refocused its efforts towards embracing digital technologies across its businesses. This acquired efficiency has translated into increased net interest margins, standing at 4.8% in September 2021, when last reported. Consequently, it has grown at a fast rate, particularly through 2021, where the total group assets grew by 9%, reaching RUB3,780 billion (USD49.3 billion), largely because of credit growth in the retail and small and medium-sized enterprise (SME) segments.

- The gross loan portfolio has also shown signs of improvement, with the non-performing loan (NPL) ratio falling to 6.1%, from 7.7% at the end of 2020, and the NPL coverage ratio increasing to 95.0%, from 86.0% as of end-2020, in the third quarter of 2021.

Thursday, January 20, 2022

- Mainland China's one-year loan prime rate (LPR) cut will help

boost credit expansion and total social financing in mainland China

in the first quarter of 2022. Further monetary and fiscal easing

policies are still expected over the first half of the year. (IHS

Markit Economist Yating

Xu)

- The People's Bank of China (PBOC) lowered the benchmark loan prime rate (LPR) on 20 January, following the medium-term lending facility (MLF) loan rate cut earlier this week

- The PBOC lowered the one-year LPR by 10 basis points (bps) from 3.8% to 3.7%, the second consecutive reduction since December 2021. Meanwhile, the five-year LPR has been reduced by 5 bps, to 4.6%, marking the first cut to the five-year LPR since April 2020, when the central bank broadly eased monetary policy to offset COVID-19 impacts.

- The LPR cut comes largely expected following the MLF loan rate cut earlier this week and the lower year-on-year (y/y) GDP growth rate registered in fourth quarter 2021. The PBOC stated at an 18 January briefing that it aims to "open the monetary policy toolbox wider, maintain stable money supply, and avoid a collapse in credit". On the same day, China's National Development and Reform Commission also pledged to introduce upfront policies to support the economy, including advancing infrastructure investment. These statements and measures reflect the Chinese authorities' growing concerns about the economy, and signal a generally positive attitude toward policy easing to stimulate domestic demand and help prevent a sharp slowdown in 2022. IHS Markit currently expects mainland China to register 5.4% y/y GDP growth in 2022.

- US existing home sales fell 4.6% to a 6.18-million unit annual

rate in December; sales were down in all four regions. December's

update closes the book for the year 2021 and its fourth quarter

(outside of data revisions). Existing home sales totaled 6.12

million in 2021—the highest since 2006 and 8.5% higher than

2020. (IHS Markit Economist Patrick

Newport)

- The average and median price of a home increased 11.0% and 16.9%, respectively, in 2021. The growth rates of both prices slowed in the second half. In December, the median price stood 15.8% higher than 12 months earlier, down from the peak in May 2021 of 23.6%; the average price was 9.6% higher than a year earlier, down from the May peak of 16.9%.

- Sales fell in the first half and picked up in the second, climbing 4.6% to a 6.33-million rate in the fourth quarter, the second-highest reading since the fourth quarter of 2006.

- Inventory and the months' supply for homes fell to all-time lows of 910,000 and 1.8 months in December (data start in January 1999). Inventory of single-family homes and the months' supply also ended the year at all-time lows of 780,000 units and 1.7 months (data start in 1982).

- Properties took 19 days to sell in December, up from 18 days in November and down from 21 days in December 2020; 79% of homes sold in December were on the market less than a month.

- Freddie Mac's 30-year fixed-rate mortgage has risen to 3.56%, up from 3.05% four weeks ago. This has yet to dent demand. The Mortgage Bankers Association's Purchase Index (four-week average) increased last week and remains at high levels.

- U.S. chemicals and plastics producer Eastman Chemical Company

plans to build in France the world's largest advanced recycling

facility, the company said this week. This $1 billion facility,

which is expected to be operational by 2025, will use Eastman's

polyester renewal technology, which it calls PRT, to recycle up to

160,000 mt/year of hard-to-recycle plastic waste. These are

currently incinerated because it either cannot be mechanically

recycled, Eastman said. Eastman did not specify the kinds of

polymers it will produce at this facility. (IHS Markit Chemical

Market Advisory Service's Chuan Ong)

- This multi-phase project includes units that would prepare mixed plastic waste for processing, a methanolysis unit to depolymerize the waste, and polymer lines to create various first-quality materials for specialty, packaging, and textile applications, said Eastman.

- The company will use its molecular recycling technology to break down this waste into its molecular building blocks, to be reassembled into virgin-quality material. This enables potentially infinite reuse of materials by repurposing them after lifecycles, potentially reducing greenhouse gas emissions by up to 80% versus traditional methods.

- Eastman also plans to operate by 2025 an innovation center for molecular recycling that would research alternative recycling methods and applications to curb plastic waste incineration instead of fossil feedstock.

- The company said that LVMH Beauty, The Estée Lauder Companies, Clarins, Procter & Gamble, L'Oréal and Danone have signed letters of intent for multiyear supply agreements from this facility.

- Advanced recycling is also known as molecular recycling or chemical recycling. Solvents, heat, enzymes, and other techniques are used to purify or transform plastics at the molecular level.

- According to Eastman, it uses two different types of molecular recycling technologies, carbon renewal technology and polyester renewal technology.

- The company's PRT takes polyester plastics, such as soft drink bottles, carpet, or polyester-based clothing, breaking them down to basic monomers. These monomers are then sent through a polymerization process to make final products.

- Eastman's carbon renewal technology, which it terms CRT, uses a broad mixture of plastic waste such as mixed plastics, textiles, and carpet as source materials. This mixture is converted to small molecules that are used to make new products.

- According to Eastman, the two main differences between PRT and CRT are the type of feedstock, and the outputs produced. CRT can process a broad mix of plastic waste except polyvinyl chloride (PVC), whereas PRT uses polyester as input.

- The Chilean National Development Agency (Corfo) selected six

green hydrogen production projects for development in late

December, accelerating the country's effort to become a world

leader in the emerging clean energy. Winning bids would result in

more than 45,000 metric tons (mt)/year of new green hydrogen

capacity, with each of the plants expected to begin operations in

2025 or earlier. Representing commitments by international energy

and chemicals companies of more than $1 billion in investment, the

projects are (IHS Markit Net-Zero Business Daily's Kevin Adler):

- Faro del Sur. Enel Green Power Chile, a subsidiary of the Italian energy firm Enel, will produce 25,000 mt/year in the Magallanes Region, using 240 MW of new wind power. "The green hydrogen is expected to be sold to HIF Chile, a company that will produce ethanol and e-gasoline for export to Europe," Corfo said. Chilean industrial firm AME is the lead developer, and it's joined in a consortium by state-owned oil company Enap, German engineering firm Siemens, and Enel. Construction has started on this project.

- HyPro Aconcagua. German chemicals company Linde will produce 3,000 mt/year of green hydrogen in the Valparaiso Region, using 20 MW of power. The output will replace part of the current production of gray hydrogen that they have installed in the Aconcagua oil refinery for National Oil Company (ENAP), Corfo said.

- HyEx-Green Hydrogen Production. French utility and oil and gas producer Engie will produce 3,200 mt/year in the Antofagasta Region using 26 MW of new power. Chilean mining services firm Enaex will buy the green hydrogen as a feedstock to produce green ammonia for export.

- Antofogasta Mining Energy Renewable. French industrial gases producer Air Liquide will produce 60,000 mt of e-methanol using green hydrogen, captured CO2, and 80 MW of renewable energy.

- Hydrogen Green Bahia Quintero. GNL Quintero, a Chilean natural gas and LNG firm, will produce 430 mt/year of green hydrogen from a plant in the Valparaiso Region, using 10 MW of new power.

- H2V CAP. CAP, a Chilean mining and steel company, plans to produce 1,550 mt/year of green hydrogen in the Biobio Region, using 20 MW of renewable power.

- Also in December, the H2 Magallanes project was announced, and it will include 10 GW of wind capacity in southern Chile to power an 8-GW green hydrogen electrolyzer and an ammonia plant. Total Eren, the developer subsidiary of French energy giant TotalEnergies, is the lead developer.

- A large swath of seabed has been reserved for offshore wind

farms in Scotland, raising the capacity bar for both fixed and

floating wind. Scotland's land manager this week offered 17

projects the right to reserve specific areas of seabed for a

combined £699.2 million ($949.78 million). Altogether, the projects

have a capacity of 24.8 GW, three times the 8 GW capacity offered

by the UK in February at the UK Crown Estate seabed leasing round.

The capacity exceeds Scotland's 2020 target to build 11 GW of

offshore wind in the next decade. (IHS Markit Net-Zero Business

Daily's Cristina Brooks)

- In July, Crown Estate Scotland opened bids on the round, attracting developers from abroad with Scotland's strong wind resources.

- The capacity offered is Europe's largest for any single offshore wind tender or lease round. "It's also the largest space awarded for floating offshore wind. So, this is a breakthrough for floating offshore wind," said IHS Markit Senior Research Analyst Diego Ortiz Garcia.

- But challenges lie ahead for the floating wind projects due to the high cost and limited supply chain of the emerging technology involved. This is especially true as subsidies have not been confirmed, according to Garcia.

- High floating wind project construction costs contrast with currently plunging costs to build fixed-bottom offshore wind projects. "The floating wind projects will definitely need some kind of support, but the fixed projects are today quite competitive in terms of Levelized Cost of Energy, and can potentially go without a subsidy," Garcia said.

- IHS Markit forecasts that costs for floating wind projects, which currently cost 82% more than their fixed counterparts, will decrease to 50% of those costs by 2030.

- Hyundai has partnered with IonQ, a leader in trapped-ion quantum computing, to use quantum computers to develop more effective batteries, according to a company statement. The partnership will create the largest battery chemistry model yet to be run on a quantum computer, simulating the structure and energy of lithium oxide. Quantum-powered chemistry simulation is expected to significantly enhance the quality of next-generation lithium batteries by improving their charge and discharge cycles, as well as their durability, capacity and safety, according to the automaker. "This creative collaboration with IonQ is expected to provide innovation in the development of basic materials in virtual space for various parts of the future mobility," said TaeWon Lim, executive vice-president and head of materials research and engineering center at Hyundai Motor Group, adding, "We're excited to step into the upcoming quantum era and take advantage of the opportunities that await with more effective battery power". (IHS Markit AutoIntelligence's Jamal Amir)

- In our bi-weekly US rig update, we continue to see the rebound

in onshore rig activity play out with 21 rigs added, largely in

liquids-directed plays. The continued recovery in rig activity,

which could reflect in part the early signs of implementation of

2022 budgets, is in line with our base case expectations and should

support an acceleration of growth in 2022. Although many people are

rightfully pointing to decelerating DUC wells unwinding requiring

an increase in rigs just to hold flat, rig increases in recent

months have started to materially exceed maintenance levels and

enter growth territory. (IHS Markit Plays and Basins' Imre

Kugler and Prescott Roach, and Energy Advisory's Karim

Fawaz)

- Another important signpost over the past two weeks is public E&Ps and majors (ExxonMobil and Chevron in particular) driving the majority of rig increases, an important component of the acceleration in supply growth this year as some of the relatively dormant engines of US supply growth start getting revved up. We are also starting to see some low-grading in the Permian and rigs returning to smaller plays, indicative of an industry that is getting more comfortable with higher prices. With WTI forward curves flirting with $80/bbl in 2022, comfortably in the money for most acreage quintiles across most major plays, we will continue to watch for any inflection point in activity that would suggest growth could overshoot.

- The US lower-48 onshore rig count rose by 21 over the past two weeks to reach 647 rigs on 19 January. Horizontal rigs drove nearly all recent gains to reach 552. Vertical and directional rig counts, for their part, climbed by two net units to reach 95; vertical and directional rig counts have remained rangebound since May 2021. Liquids-directed plays accounted for virtually all growth in rig counts over the past two weeks, while activity in major gas plays remained unchanged.

- Although private operators have been at the vanguard of the recovery in rig counts over the past 18 months, independent and global E&Ps accounted for virtually all incremental gains over the past two weeks. Since 6 January, independent E&Ps have added 13 net horizontal rigs while global E&Ps added four net rigs. Among majors, ExxonMobil and Chevron led the charge in terms of recent additions: ExxonMobil added three net rigs over the past two weeks, while Chevron added two net rigs.

- Rig activity in the SCOOP/STACK fully returned to pre-pandemic levels during the week of 19 January. Only the Utica and Haynesville plays had previously attained this milestone. Notably, the SCOOP/STACK represent the only liquids-directed plays to have reached such levels. Nevertheless, other liquids-prone plays appear poised to reach pre-pandemic levels: the Wolfcamp Midland and Eagle Ford/Austin Chalk rig counts are just 11% and 13% below February 2020 levels, respectively. Other plays have significant gaps to make up: Bakken and Wattenberg rig counts remain more than 40% below pre-pandemic levels, while activity in the prolific Delaware Basin remains 30% below its February 2020 level.

- In a sign that operators believe in oil market strength, Permian operators returned to pre-pandemic acreage targeting in late 2021 following significant high-grading in 2020 and 1H2021.

- Witnesses from the bitcoin mining industry told a US House

panel on January 20 that energy efficiency and clean energy are

among their concerns, while other witnesses called into question

this nascent industry's energy consumption patterns. The US House

Committee on Energy and Commerce held a January 20 hearing called

"Cleaning up Cryptocurrency: The Energy Impacts of Blockchains."

One of the participants at the hearing was Subcommittee on

Oversight and Investigations Chair Diana DeGette, D-Colorado. (IHS

Markit PointLogic's Barry Cassell)

- DeGette noted in her prepared testimony: "Cryptocurrencies rely on blockchain technologies, which are essentially networks made up of many computers working collaboratively to record and verify data. Blockchain technology has numerous potential applications beyond cryptocurrency that will likely soon make our lives more efficient and secure. Health care records, for example, will become more portable and accessible to patients. Energy management will improve through the use of smart contracts. And, due to data being distributed across a network rather than in a centralized location, our online information will be more secure. New, innovative uses of blockchain technology are being explored every day, and we should continue to encourage that. As this innovation continues, however, it is important that we keep energy efficiency and the reduction of carbon emissions at the forefront of the discussion."

- DeGette said about a primary concern from some industry critics: "Some cryptomining companies have based their facilities in communities with cleaner and less expensive renewable energy, such as hydroelectric, wind, and solar. Others, however, have revitalized or prolonged the use of otherwise-shuttered fossil fuel plants. For example, one company in upstate New York upgraded a previously closed coal-power plant to run on natural gas—a plant which now operates primarily for the purpose of the company's bitcoin mining activities. Another company restarted two coal-fired plants in Pennsylvania in order to generate power for its cryptomining operations."

- Full committee Chairman Frank Pallone, Jr., D-New Jersey, said in his opening statement: "Right now, some blockchains are consuming enormous amounts of energy. One estimate found that the energy required to process transactions on the Bitcoin network could power a home for more than 70 days. Last year, there were hundreds of thousands of transactions on this network. Just imagine the climate implications. Another estimate found the 2021 carbon emissions from Bitcoin and Ethereum cryptomining to be 78.8 million tons of carbon—roughly equivalent to the tailpipe emissions from more than 15.5 million gasoline powered cars on the road every year. As this Committee continues its work to combat the worsening climate crisis, it is critical that we examine these impacts."

- Convergence Energy Services Limited (CESL) has floated a tender for 5,580 electric buses (5,450 single decker and 130 double decker) to be deployed in five major Indian cities - Delhi, Kolkata, Surat, Bengaluru, and Hyderabad, reports Moneycontrol. The value of the tender is said to be around INR55 billion (USD738 million) and the first batch of buses is expected to be on the roads by July, according to the report. Called the Grand Challenge Tender, it aims to remove procurement and deployment bottlenecks for different state transport undertakings. The tender is in line with the country's Atmanirbhar Bharat initiative and commitments made towards making India a net zero nation by 2050. The states ordering the buses as part of the Grand Challenge will benefit not just from better air quality but also lower prices for the buses thanks to aggregate demand; high-quality benchmarked technology; and access to Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) incentives, state incentives, and domestic and international sources of finances. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Opibus, a Swedish-Kenyan technology company engaged in the development, design, and manufacture of electric vehicles (EVs) for the African continent, has announced the introduction of an electric bus in Kenya, reports CleanTechnica. The electric bus can be mass produced for the pan-African market by the end of 2023. According to the source, the bus has been designed in Kenya using in-house local engineering while utilizing local manufacturing partners. The new bus, powered by a 121-kWh lithium iron phosphate battery (LiFePO4), has a driving range of 120 kilometers (km) and produces a power output of 225 kW and 706 Nm of peak torque. The top speed of the bus is 85 km per hour and it comes with features such as regenerative braking, electric power steering, IP67 waterproof-rated powertrain, and liquid cooled motor. Dennis Wakaba, Opibus project coordinator for public transport, said, "This first electric bus is set to be launched commercially mid this year. Following this, the platform will be tested at scale in commercial deployment of 10 buses during the second half of 2022. In doing so, we ensure that we gather valuable feedback to continue the development of the product for an optimized market fit. It feels great to be the first movers in this very exciting space." Kenya is in the nascent stages of shifting to electric mobility. The country plans for at least 5% of vehicles registered in the country to be EVs by 2025. Other African countries, such as Ethiopia, Nigeria, Algeria, and Kenya, are also taking steps to move to EVs. In 2019, Rwanda was the first African nation to partner with Volkswagen and Siemens to introduce charging stations as well as EVs in the country. The Kenyan government reduced the excise duty for electric cars to 10% from 20% in the 2019-20 budget to promote EV sales. In March 2021, Estonian-based ride-hailing firm Bolt announced the launch of Bolt Green in Kenya, a new category that offers rides in hybrid and EVs. (IHS Markit AutoIntelligence's Tarun Thakur)

- Luminar has announced that it has partnered with Mercedes-Benz for deploying LiDAR technology; Mercedes intends to use Luminar's Iris LiDAR technology, being prepared for series production, according to a Luminar statement. Luminar founder and CEO Austin Russell said, "This partnership is a landmark moment in the industry, demonstrating how substantially increased safety and autonomous driving functions on consumer vehicles are going from sci-fi to mainstream. Mercedes-Benz has always been a technological leader and first mover for the industry, with the brand synonymous with automotive innovation, safety, luxury, and quality." Markus Schäfer, Member of the Board of Management of Daimler AG and Mercedes-Benz AG, Chief Technology Officer responsible for Development and Procurement, said, "Luminar is the perfect addition to our existing roster of first-class cooperations with leading and cutting-edge tech companies. Mercedes-Benz's achievement of SAE Level 3 already marked a huge milestone for automated driving and I am absolutely convinced that partnerships will increase our level of ambition for what is possible in the future. Cooperation is an essential part of Mercedes-Benz's strategy. Therefore, I am highly delighted to have Austin Russell and Luminar on board for our journey." According to an Automotive News report, Mercedes-Benz receives 1.5 million shares of Luminar stock in the partnership agreement as well. The Iris system is being developed to be able to spot objects at a maximum of 600 meters and reach 250 meters at 10% reflectivity, which helps with detecting objects in the dark. (IHS Markit AutoIntelligence's Stephanie Brinley)

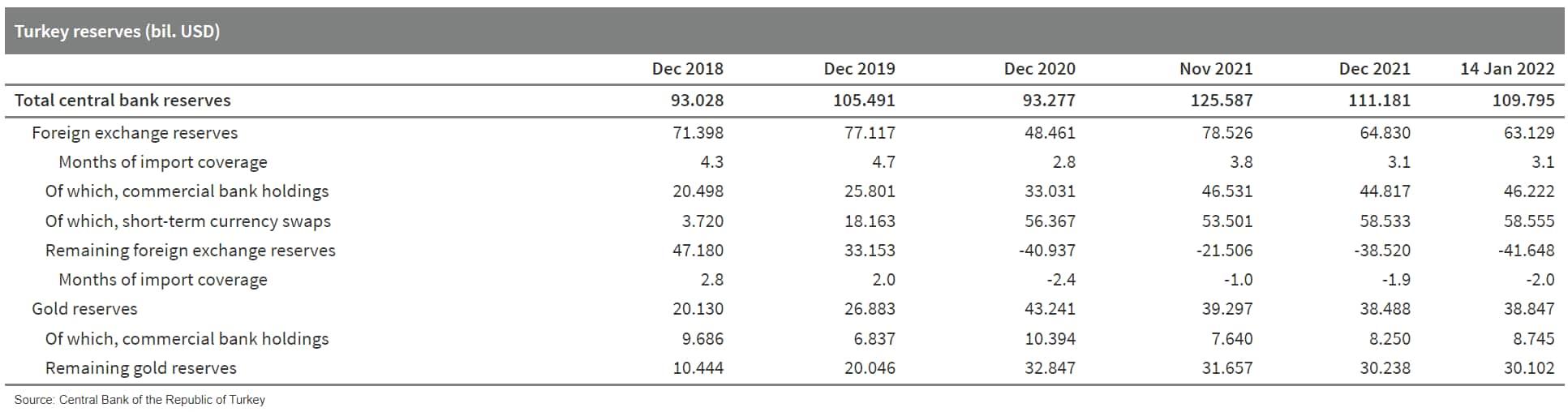

- The Turkish central bank put its rate cut cycle on pause in

January, holding the one-week repo rate at 14%. Although inflation

remains far above the policy rate, at least the ending, for now, of

the rate cuts adds some added support for the lira. Additionally,

state intervention, the deposit scheme, soft capital controls, and

new foreign support from the UAE have all contributed to the

stabilization of the currency. (IHS Markit Economist Andrew

Birch)

- The Central Bank of the Republic of Turkey (TCMB) held its main policy interest rate, the one-week repo rate, steady at 14.0% at its regularly scheduled, 20 January, monthly meeting of the Monetary Policy Committee. The Bank paused what had previously been a four-month rate-cutting cycle that brought the rate down by a combined total of 500 basis points.

- Expectations were high that the rate would indeed be held unchanged at the January meeting, as previously, TCMB Governor Şahap Kavcıoğlu had indicated that following the December rate cut, there was no further room for action. In the December press release, the Monetary Policy Committee had also suggested that it would "monitor" the effects of its previous monetary policy decisions throughout the first quarter of 2022.

- In the January press release, the Committee removed a definite time period, but did state that it would continue to "monitor" the impact of monetary policy decisions. This slight shift does raise risks somewhat that the rate-cutting cycle could begin again sooner than anticipated.

- In immediate post-trading activity, the lira traded slightly stronger against the US dollar. At the close of 20 January, the exchange rate was TRY13.46/USD1.00, 2.3% stronger against the dollar than its 2022 low-point on 7 January and only 0.8% weaker than it had been at end-2021.

- The pause in the rate-cutting cycle - assuming it lasts for at

least a few more months - will add support to the lira moving

forward. The lira remains extremely vulnerable to sharp losses, but

a series of events since mid-December has at least stemmed the

collapse of the currency that had occurred following the November

rate cut.

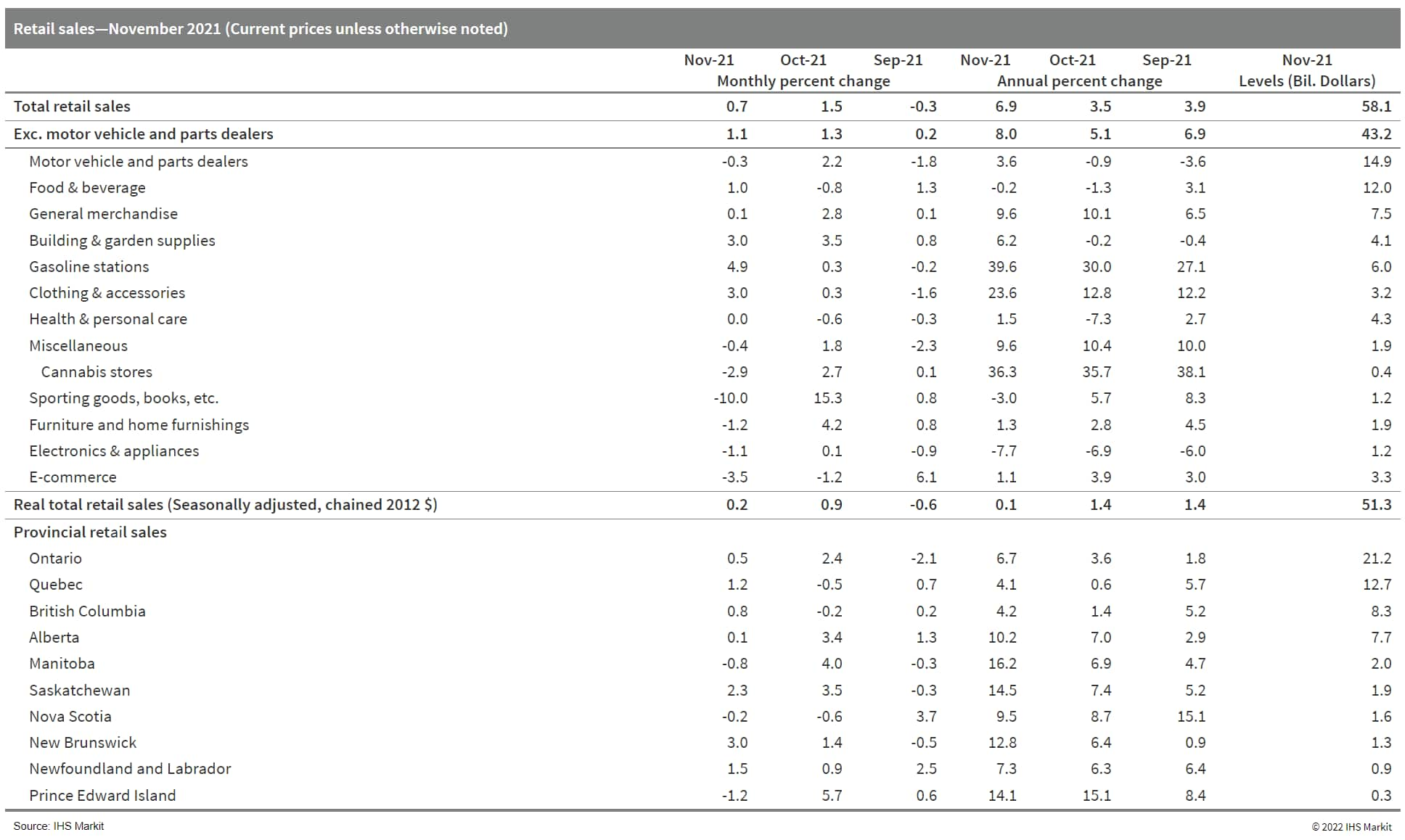

- It was not a particularly strong start to Canada's traditional

holiday shopping season, as around half of retailers reported

softer sales. A combination of consumer reluctance, widescale

floods, and perhaps a lack of Black Friday discounts led to the

sales miss. The most significant increase was the 4.9% m/m rise in

gasoline station sales, which was 1.4 percentage points lower in

real terms. (IHS Markit Economist Evan Andrade)

- Retail sales edged up 0.7% month on month (m/m) to $58.1 billion in November 2021, coming in far below the advance estimate's projected increase of 1.2% m/m.

- Retail volumes rose at a slower 0.2% m/m, as goods prices continued to increase. Retail trade looks to be a secondary contributor to November real GDP by industry growth.

- Fully capturing the effects of the Omicron variant and flooding in British Columbia, preliminary data suggests sales fell 2.1% m/m in December.

- Building material and gardening store sales advanced for a fourth consecutive month, but the sales level remains below what was seen earlier in 2021. Supermarkets offset softer sales from other food and beverage stores.

- The largest decline was in sports, book, and hobby stores,

which saw an unusual jump in October sales. Vehicle and parts

dealer sales fell back 0.3% m/m, as non-car dealerships gave up

sales gains over the previous two months. With inflation reaching

highs not seen in decades, retail volumes were just 0.1% above its

November 2020 level.

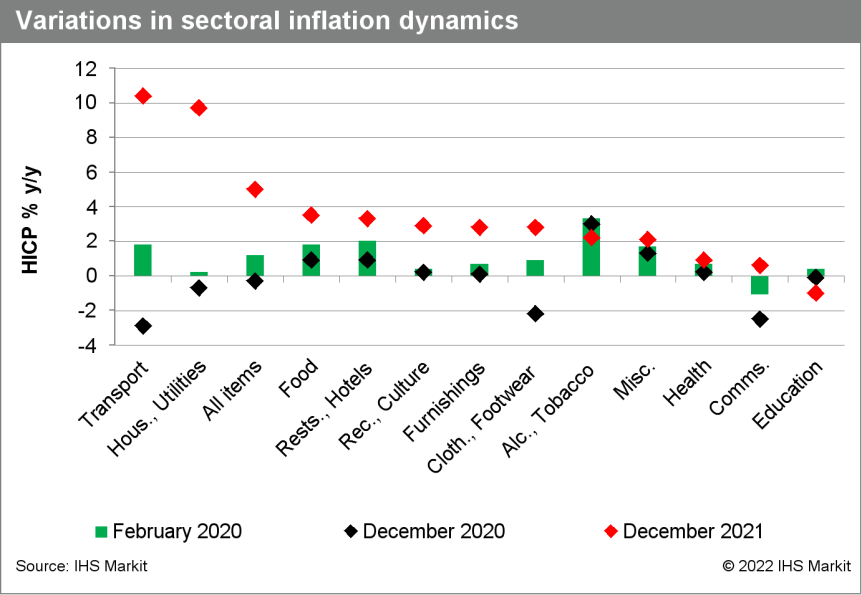

- The final eurozone Harmonised Index of Consumer Prices (HICP)

data for December 2021 confirm the main points from the prior

'flash' release, as follows (IHS Markit Economist Ken

Wattret):

- Headline inflation edged up to 5.0%, a new record high and above the initial market consensus expectation (4.7%).

- Energy inflation moderated for the first time in seven months, although only marginally and energy still contributed half of the overall inflation rate.

- Unprocessed food inflation jumped by almost three percentage points to 4.7%, pushing the contribution of food to overall inflation up to 0.7 percentage point, the highest since April 2020.

- HICP inflation excluding energy, food, alcohol, and tobacco prices was stable at 2.6%, matching the prior month's record high.

- Non-energy industrial goods (NEIG) inflation jumped to a new record high of 2.9%.

- Services inflation partly reversed November 2021's rise, slipping back to 2.4% in December, although it remained well above its pre-pandemic rate (1.6%).

- Following Eurostat's final HICP release each month, IHS Markit updates various alternative inflation metrics for the Eurozone, which provide a broader perspective of underlying price trends.

- Our super core inflation rate includes only the HICP items that

are sensitive to changes in the eurozone's output gap. It rose

again in December to 2.6%, the seventh increase in succession and

the highest inflation rate since September 2008.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-21-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-21-2022.html&text=Weekly+Global+Market+Summary+Highlights%3a+January+14-21%2c+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-21-2022.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: January 14-21, 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-21-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+January+14-21%2c+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-21-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}