Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 26, 2021

Daily Global Market Summary - 26 May 2021

Most major US and APAC equity indices closed higher, while most European markets were lower. US government bonds closed lower, while benchmark European government bonds closed sharply higher for a second consecutive day. iTraxx-Europe and CDX-NAIG IG indices closed flat, while iTraxx-Xover and CDX-NAHY closed slightly tighter. The US dollar, gold, copper, oil, and natural gas closed higher, while silver was lower on the day. All eyes will be on tomorrow morning's US weekly jobless claims report for a reading on the pace of recovery of employment ahead of next week's US non-farm payroll report.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for DJIA flat; Russell 2000 +2.0%, Nasdaq +0.6%, and S&P 500 +0.2%.

- 10yr US govt bonds closed +2bps/1.58% yield and 30yr bonds +2bps/2.27% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY -2bp/291bps.

- DXY US dollar index closed +0.4%/90.04.

- Gold closed +0.2%/$1,901 per troy oz, silver -0.6%/$27.88 per troy oz, and copper +0.5%/$4.53 per pound.

- Crude oil closed +0.2%/$66.21 per barrel and natural gas closed +1.8%/$3.03 per mmbtu.

- The XEC-COG merger has more in common with the large deals seen

in 2020 than with deals inked in 2021 so far. As the recovery from

COVID began last fall, a relatively small subset of companies with

the strongest balance sheets and reputations moved to acquire

companies with material positions in the cores of plays. This deal

fits that mold. Cabot owns what is likely the finest major gas

asset in the US, despite being hamstrung by the takeaway problems

bedeviling the Marcellus. When we compare asset and capital

productivity using a market-based conversion factor for gas, the

Cabot assets are often the only gas properties that rank in the top

10. Cimarex also ranks only second to EOG in its acreage footprint.

(IHS Markit Energy Advisory's Raoul

LeBlanc and Imre

Kugler)

- Investors will continue to dislike diversification, though we would argue it adds value to companies. Over the past decade, the overwhelming trend in upstream has been toward specialization. The result has been an industry comprised of single-commodity companies devoted to one or two basins. The rationale has been simple: specialization usually creates efficiencies and knowledge advantages.

- Scale continues to win at this point in the shale revolution. Besides back-shop synergies, we believe that cost savings for this merger will be relatively low. The focus will be on free cash generation and lowering the cost of capital.

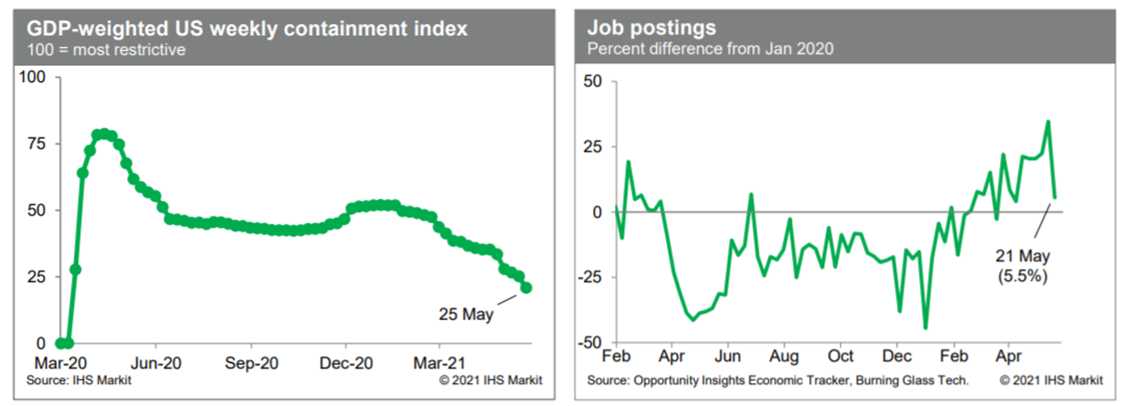

- The IHS Markit GDP-weighted US weekly containment index

declined (eased) 4.3 index points this week to 20.9, continuing a

string of easings that began in late January and accelerated in

March. This week's decline mainly reflected the lifting of mask

mandates in several states. Meanwhile, job postings declined last

week to 5.5% above the January 2020 level, according to the

Opportunity Insights Economic Tracker. These data are volatile and

prone to large weekly moves; the firming trend that has been in

place since early January is still intact, suggesting a fundamental

improvement in labor demand. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

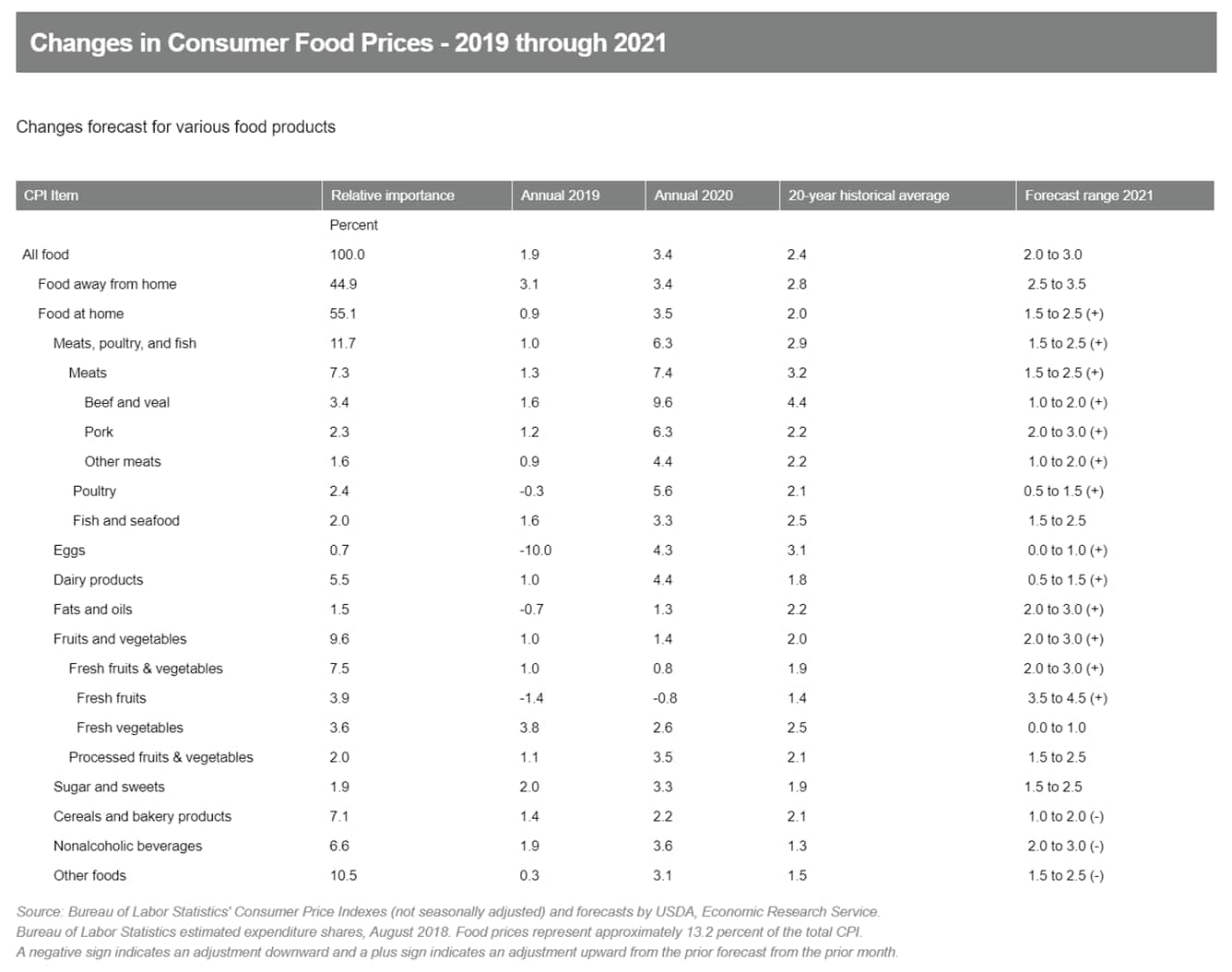

- Upward revisions to food at home (grocery store) price

forecasts for several food categories prompted USDA's Economic

Research Service (ERS) to up their forecast rise in grocery store

prices to an increase of 1.5% to 2.5% in 2021 versus 2020—the

midpoint is right in line with the 20-year average of 2.0%. Overall

food price inflation is still forecast at 2% to 3% (2.4% 20-year

average) with food away from home (restaurant) prices seen rising

2.5% to 3.5% (2.8% 20-year average) from 2020 levels. So far this

year, overall food prices are up 1.7% from the same period in 2020,

with grocery store prices up 1.2% and restaurant prices up 2.4%.

(IHS Markit Food and Agricultural Policy's Roger Bernard)

- Ford is planning to announce two new electric vehicle (EV) platforms at its Capital Markets Day event to be held today (26 May), according to media reports. However, reportedly, Ford has declined to comment on any such products. A Reuters report cites unnamed sources as saying that Ford is to announce the two new EV platforms, one reportedly for full-size trucks and sport utility vehicles (SUVs) and the other for cars and crossovers. The Reuters report says the two platforms could give Ford a base for a wide variety of vehicles and enable it to reduce costs of products. In addition, Reuters reports that Ford is to provide further information on its long-term battery strategy, following reports earlier this month of the automaker signing a memorandum of understanding (MOU) with SK Innovation on North American battery production. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US clinical-stage biotech Pieris Pharmaceuticals announced that it has entered into a multi-program research collaboration and licensing agreement with Roche (Switzerland)'s Genentech unit to discover, develop, and commercialize locally delivered respiratory and ophthalmology therapies that make use of Pieris' proprietary Anticalin technology. Under the terms of the agreement, Pieris will receive an upfront payment of USD20 million and may be eligible to receive more than USD1.4 billion in additional milestone payments across multiple programs, as well as tiered royalties for commercialized programs. (IHS Markit Life Sciences' Milena Izmirlieva)

- Abandonment of fiscal reform due to violent nationwide protests

has exacerbated the country's fiscal weakness and on 20 May, rating

agency S&P Global Ratings (S&P) lowered Colombia's

long-term rating from its investment grade status to speculative

grade. The outlook on the ratings is Stable. (IHS Markit Economists

Rafael

Amiel, Carlos

Caicedo, and Brian

Lawson)

- Colombia's sovereign credit rating was downgraded by one notch, but the move has serious implications because it is also a qualitative downgrade as it moves from investment grade to speculative grade.

- S&P has downgraded Colombia's sovereign credit rating to BB+ from BBB-, over concerns on persistent fiscal weakness: public finances deteriorated significantly with the COVID-19 virus pandemic, both because of the lower revenue due to the recession and because of stimulus spending. A government proposal to raise taxes triggered street protests, roadblocks, and riots, which led President Iván Duque to quickly withdraw the tax bill. Despite that the protests have persisted, with the government offering to take on board demands of economic aid, support to education and health demanded by the leaders of the strike, which are likely to result in higher public expenditure than planned.

- The withdrawal of the tax bill has severely weakened President Duque's administration. For the 12 months until the 2022 presidential election, Duque's government will be in a weaker position that threatens to limit scope for implementation of its policy agenda, with indications that government support in Congress is faltering as key allies are distancing themselves from the fiscal plan outlined by the government. Government popularity has declined sharply, even before the protests, to 33% from about 54% in late 2020, encouraging greater pushback against government initiatives on electoral grounds.

Europe/Middle East/Africa

- European equity markets closed mixed; UK/France flat, Germany -0.1%, Spain -0.1%, and Italy -0.5%.

- 10yr European govt bonds closed sharply higher for a second consecutive day; Italy -5bps and France/Spain/Germany/UK -4bps.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -2bps/252bps.

- Brent crude closed +0.4%/$68.73 per barrel.

- EU member states have been given until December 14th to amend or withdraw product approvals for the herbicide, terbuthylazine, to reflect restrictions on the frequency of its use. Any grace periods granted to use existing stocks must expire by June 14th 2022. The new restrictions limit use to one application every three years on the same field at a maximum rate of 850 g active ingredient/ha. Furthermore, the impurities, propazine and simazine, must not exceed 9 g/kg in the commercially manufactured technical material. The restrictions were agreed by the European Commission and EU member states after an evaluation of confirmatory data identified risks from exposure to metabolites in food and drinking water. (IHS Markit Crop Science's Jackie Bird)

- The VW Group has received a EUR7.5-billion offer for Lamborghini, according to a report by specialist publication Autocar. From a financial perspective the offer is extremely strong and would surely be attractive to VW's management, but some of the offer details reveal why it may be less keen and why the official line is that the ultra-premium brand is 'not for sale'. (IHS Markit AutoIntelligence's Tim Urquhart)

- The improvement in French business confidence is particularly

strong in May. The headline index has risen from 96 to 108, its

highest level since April 2018. (IHS Markit Economist Diego

Iscaro)

- Business confidence collapsed at the start of the pandemic, reaching an all-time low of 64 in April 2020. It has been very volatile since then, and closely linked to the tightening/easing of COVID-19 virus-related restrictions. However, the monthly increase in May is the strongest in the survey's history (since 1980).

- The partial reopening of the economy in mid-May has led to a substantial increase in confidence in the retail (up from 91 to 107) and services (up from 92 to 107) sectors. These two sectors had been particularly badly hit by the containment measures introduced in late March.

- Confidence in the manufacturing sector has also continued to improve, with the index increasing from 104 in April to 107 (its highest level since September 2019).

- Meanwhile, households are also in a more upbeat mood in May. The consumer confidence indicator has risen from 95 to 97.

- Consumer confidence has been less volatile than business sentiment since the start of the pandemic. May's reading is the highest since March 2020.

- SEAT president Wayne Griffiths has said that the company is hoping to catch up production lost due to the semiconductor shortage. The senior executive was quoted by Reuters as stating, "The lack of semiconductor chips is still a challenge, but we are managing it well. What's most important is to have a good demand for our products." He said that SEAT has recently ended the furlough arrangement it implemented in March at Martorell (Spain) and that he wants to increase production at one of its assembly lines from the end of May until July to meet demand for the Cupra Leon and Formentor, provided there is a sufficient supply of semiconductors. Griffiths also said that production at Martorell is also planned to continue during the typical four-week shutdown period in August. (IHS Markit AutoIntelligence's Ian Fletcher)

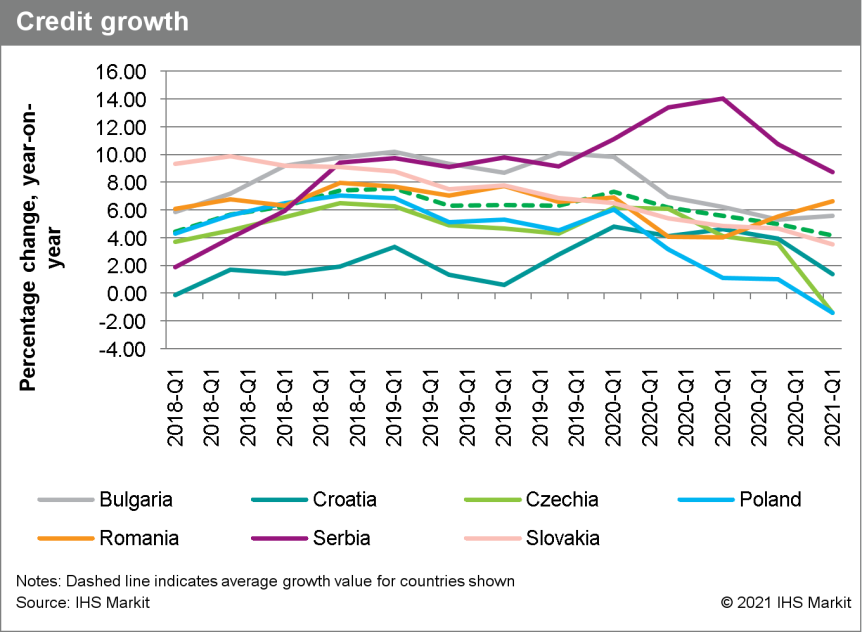

- First-quarter 2021 data for banking sectors in Emerging Europe,

including Bulgaria, Croatia, Czechia, Poland, and Slovakia,

highlight a general year-on-year (y/y) slowdown in credit growth,

robust deposit growth, and contained asset-quality deterioration.

This is unsurprising given that most banks in Emerging Europe

indicated a slight tightening of credit standards on corporate

loans in the period, alongside reduced demand for loans to firms

and households, as reflected in the bank lending surveys. The

credit tightening was due to rising credit risk concerns, while the

weaker demand for corporate loans was owing to lower consumer

confidence in response to the spread of the COVID-19 virus and its

widespread economic implications. (IHS Markit Banking Risk's Greta

Butaviciute and Natasha

McSwiggan)

- Nigeria's central bank maintained its key policy rate at 11.5%

during the MPC meeting on 24-25 May. The asymmetric corridor was

left unchanged at plus 100/minus 700 basis points, while the

liquidity ratio and the cash reserve ratio were both left unchanged

at 30% and 27.5%, respectively. (IHS Markit Economist Thea

Fourie)

- The CBN has made further progress towards the unification of Nigeria's exchange rates by formally adopting the official NAFEX (Nigerian Autonomous Foreign Exchange) rate, at the Import and Export Window (I&E Window), as the official rate. This leaves the official exchange rate down by more than 8% against the US dollar to NGN410.25, from the previous official exchange rate of NGN379.50:USD1.00. This confirms Nigerian Finance Minister Zainab Ahmed's March 2021 announcement that official government transactions would be made at the I&E Window exchange rate in the future.

- Nigeria's inflation rate remains well above the CBN's inflation target range of 6-9%. Headline inflation rate averaged 18.1% year on year (y/y) in April, from 18.2% y/y in March and 12.3% y/y in April last year. Food inflation continues to be a key driver of higher prices in the Nigerian economy. Nigeria's National Bureau of Statistics (NBS) reported a marginal slowdown in overall food inflation to 22.7% y/y in April, from 22.9% in March. The MPC noted that persisting security concerns, especially in major food-producing areas, contributed to the higher food prices as food supply channels remain under pressure.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +0.9%, India +0.8%, Mainland China +0.3%, Japan +0.3%, South Korea -0.1%, and Australia -0.3%.

- The second wave of the COVID-19 virus pandemic in India appears

to be receding, with recorded new daily COVID-19 infections

steadily falling from their peak in early May. However, with the

official caseload likely to be undercounted, the domestic health

system remains under severe strain, implying a likely extension of

lockdowns in several states through June and a bigger economic toll

than estimated in April. IHS Markit downgraded India's real GDP

forecast for FY2021 to 7.7% in May from 9.6% in April. (IHS Markit

Economists Deepa

Kumar, Angus

Lam, and

Hanna Luchnikava-Schorsch)

- India recorded 196,427 new COVID-19 cases on 25 May, a fall from a high of about 450,000 cases in early May. Domestic and international health experts indicate India's caseload and death toll are likely to be undercounted. Therefore, while case numbers and test positivity rates appear to be falling in major urban centers, a sustaining wave in rural areas (more difficult to estimate) means lockdowns (currently in effect in most Indian states) are likely to continue in several states through June given the continued pressure on healthcare systems.

- Starting from 7 June, states are likely to revisit this policy ,with availability of ICU beds as their indicator. For instance, Maharashtra has said it would consider easing its lockdown only after 60% of ICU beds become available in hospitals.

- Early economic indicators suggest that the immediate hit to the economy in the June 2021 quarter will be less severe than during the national lockdown in April-May 2020, with current curbs being more targeted and the economy better adapted to function under mobility restrictions.

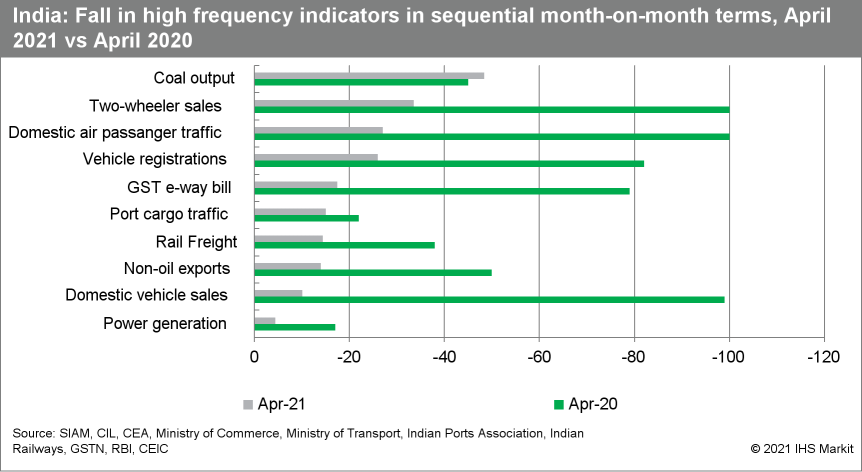

- As anticipated, other lead indicators of economic activity

showed a sharp annual expansion in April, boosted by the low base

of the national lockdown in April 2020. However, in sequential

month-on-month (m/m) terms, most high frequency indicators of real

activity contracted in April, albeit still at a fraction of what

was reported in April 2020. Similar to PMI data, greater impact on

these sectors is likely to show in May.

- Online grocery sales grew by 80% to USD2.66 billion in India last year as Covid-19 compelled consumers to shop more online due to lockdown restrictions and safety concerns. Online food shopping represents less than 1% of total grocery sales in India, but the sector value is expected to reach USD20-25 billion by 2025, the USDA reported. Growth should be driven by rising urbanization and incomes, busier lifestyles, greater internet connectivity, the entrance of offline grocery chains, and changing consumer attitudes that demand greater convenience, product variety, safety/hygiene, and value. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Tata has announced that its Altroz hatchback and Nexon sport utility vehicle (SUV) are to be equipped with an Indian vernacular voice assistant called AVA Auto, reports Autocar. The system was co-developed by Indian technology startup Mihup Communication and Harman International. The native languages used by the system include Hinglish (a mix of English and Hindi language), and the startup company aims to include Tamil, and Bengali language support, as well as for the system to support all major Indian languages by 2022. According to the startup, the Indian vernacular voice assistant is aimed at disassociating voice assistance as a luxury offering, and offering the system for use by the masses with a more diverse dictionary. (IHS Markit AutoIntelligence's Tarun Thakur)

- Bank Indonesia's board of governors has left the seven-day

reverse repo rate on hold - as anticipated - at 3.50% following its

monthly meeting. Given the looming risks to rupiah stability, the

central bank does not plan to adjust the policy interest rate in

the near term, and will instead continue its attempts to find new

strategies to boost credit demand and lending with moral suasion

still on the table. (IHS Markit Economist Bree

Neff)

- Bank Indonesia (BI) Governor Perry Warjiyo's comments during a streamed press event after the decision indicate that the bank does not feel immediate pressure to raise interest rates. Instead, Warjiyo indicated that the bank is unlikely to raise rates until possibly early 2021, when the need to head off rising inflationary pressures arises. Until then, the central bank will continue to work to support the economic recovery, and announced some new measures aimed at boosting liquidity.

- One policy adjustment intended to boost credit demand was a reduction in the maximum interest rate on credit cards, which will be lowered to 1.75% from 2% on 1 July. Another initiative focuses on adjusting the Macroprudential Inclusive Financing Ratio (RPIM) to increase lending to micro, small, and medium-sized enterprises (MSMEs).

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2021.html&text=Daily+Global+Market+Summary+-+26+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 May 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+May+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}