Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 27, 2021

Daily Global Market Summary - 27 May 2021

Most major US equity indices closed higher, while Europe and APAC were mixed. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA credit indices closed almost flat across IG and high yield. The US dollar, gold, and natural gas closed lower, while copper, oil, and silver were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for the Nasdaq closing flat; Russell 2000 +1.1%, DJIA +0.4%, and S&P 500 +0.1%.

- 10yr US govt bonds closed +3bps/1.61% yield and 30yr bonds +2bps/2.28% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -2bps/289bps.

- DXY US dollar index closed -0.1%/89.97.

- Usage of the Federal Reserve's reverse repo facility -- a mechanism that's part of the central bank's arsenal for helping to steer short-term interest rates -- surged on Thursday to an unprecedented $485.3 billion. And with the forces driving the dollar glut still some way from abating, that figure could climb further, adding fuel to an increasingly complex debate about what the Fed should do with its various tools to keep a rein on policy. While the offering rate on the Fed reverse repo facility is 0%, there is a lack of alternative places to safely stash money for very short periods. (Bloomberg)

- Gold closed -0.3%/$1,899 per troy oz, silver +0.2%/$27.94 per troy oz, and copper +2.9%/$4.66 per pound.

- Crude oil closed +1.0%/$66.85 per barrel and natural gas closed -2.3%/$2.96 per mmbtu.

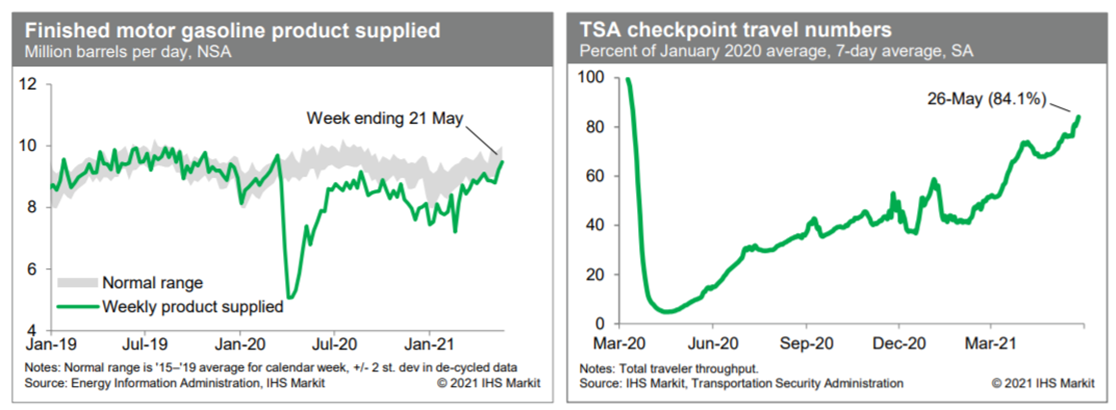

- US Consumption of gasoline rose last week to within a range

that we would consider normal for this time of year. Continued

readings in such a range would indicate a full recovery in internal

mobility. Meanwhile, passenger throughput at US airports has

continued to firm in recent days. As of yesterday, the seven-day

average of throughput (after seasonal adjustment) was 84.1% of the

January 2020 level. The recovery in air travel, while not complete,

has come a long way. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- President Biden is expected to propose a $6 trillion budget on Friday that would lay the foundation for his plans to modernize the nation's infrastructure and expand the government's role in providing healthcare, education and other social services, according to people familiar with the plans. The Biden administration's first budget, for the fiscal year beginning Oct. 1, would put the nation on a path to spend $8.2 trillion annually by the end of 2031, the people said. Under the plan, debt would exceed the record level seen at the end of World War II within a few years and reach 117% of economic output by the end of 2031, up from about 100% this year. (WSJ)

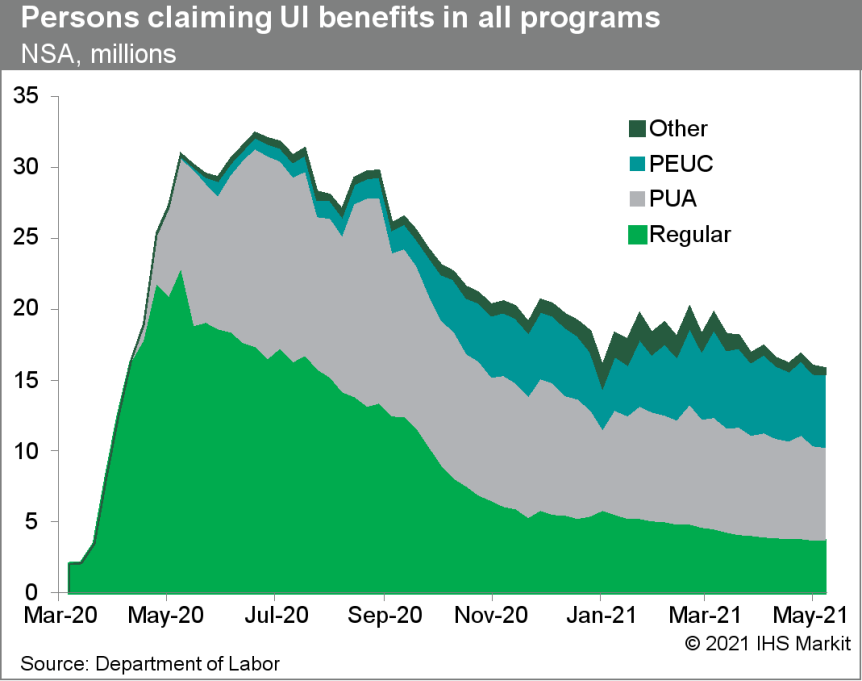

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 38,000 to 406,000 in the week ended 22 May, its

lowest level since the week ended 14 March 2020. (IHS Markit

Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) decreased by 96,000 to 3,642,000 in the week ended 15 May. The insured unemployment rate edged down to 2.6%.

- Individuals who have exhausted regular benefits are eligible for up to 53 weeks of extended benefits under the PEUC program. In the week ended 8 May, continuing claims for PEUC rose by 49,272 to 5,191,642.

- Independent contractors, self-employed individuals, or individuals who otherwise would not qualify for benefits in regular state programs can apply for claims under the PUA program. There were 93,546 unadjusted initial claims for PUA in the week ended 22 May. In the week ended 8 May, continuing claims for PUA dropped by 90,541 to 6,515,657.

- In the week ended 8 May, the unadjusted total of continuing claims for benefits in all programs fell by 175,255 to 15,802,126.

- Governors in many states—24 at last count—have

announced an early end to pandemic-related federal unemployment

programs. The federal pandemic-related unemployment programs, which

include extra $300-a-week payments, the PUA and PEUC, were set to

expire on 6 September. They are now slated to expire between 12

June and 19 July in the 24 states that have opted out.

- US real GDP rose at a 6.4% annual rate in the first quarter,

according to the Bureau of Economic Analysis's "second estimate".

This was unrevised from the "advance estimate" but 0.5 percentage

point below our tracking estimate. (IHS Markit Economists Ken

Matheny, Michael

Konidaris, and Lawrence Nelson)

- Relative to the advance estimate, upward revisions to growth of personal consumption expenditures (PCE; 0.6 percentage point), business fixed investment (1.1 percentage points), and residential investment (1.9 percentage point) were offset by downward revisions to inventory investment, net exports, and government consumption and gross investment. The latter was concentrated in state and local components.

- Relative to our tracking estimates, PCE growth was above expectations. However, this was more than offset by lower-than-estimated figures for inventory investment and net exports.

- Wages and salaries were revised up by $158 billion in the second estimate, based on new data from the Quarterly Census of Employment and Wages.

- The US Pending Home Sales Index (PHSI) dropped 4.4% in April to

106.2—below the February 2020 pre-pandemic reading of 110.8.

(IHS Markit Economist Patrick

Newport)

- All four regional indexes were lower in April than in February 2020. The index for the Midwest was the only one to move up in April.

- Lawrence Yun, the National Association of Realtors' chief economist, says that demand remains strong and that low inventories are holding sales down. He wrote, "Contract signings are approaching pre-pandemic levels after the big surge due to the lack of sufficient supply of affordable homes."

- More inventory will show up as new home completions ramp up and as the mortgage forbearance program winds down.

- The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average) is back to its pre-pandemic levels, indicating that demand for loans has tailed off.

- US manufacturers' orders for durable goods declined 1.3% in

April, while shipments of durable goods rose 0.6%. Both remained

well above their pre-pandemic trends, signaling continued healthy

recovery in the goods sector. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- In response to the details in this report that bear on our GDP tracking, we raised our forecast of second-quarter GDP growth by 0.2 percentage point to 11.1%.

- A striking feature of this report was the continued surge in orders for nondefense capital goods excluding aircraft, or "core" capital goods. A 2.3% increase in April followed gains in 11 of the last 12 months, raising the April 2021 level 25.3% above the April 2020 trough.

- This is a clear indication of business confidence in the durability of the broad recovery, as businesses are putting equipment capacity in place at a rapid clip.

- Shipments of core capital goods also posted a healthy increase in April, but less of an increase than we had assumed. Indeed, the gain in shipments was on the soft side, given how strong orders were. Still, core shipments are trending along with core orders and are well above pre-pandemic levels.

- This morning's report also featured a robust increase in shipments of civilian aircraft. The increase was more than we had assumed and was largely responsible for raising our second-quarter projections for both equipment spending and exports.

- Manufacturers' inventories rose 0.5% in April. This was below our prior assumption but nevertheless consistent with our prior projection for second-quarter inventory investment.

- Fugro has been awarded a renewed site characterization contract from Atlantic Shores Offshore (Atlantic Shores) for provision of real-time wind and metocean measurements off the coast of in the US in the next two years. Besides the metocean services, Fugro's geophysical and geotechnical contracts had been renewed earlier. All the contracts will assist safe design and construction of future wind farm facilities in the 740km2 lease area. Fugro is utilizing two SEAWATCH Wind Lidar Buoy for the metocean contract. These systems will deliver cost-effective and reliable collection of wind, wave, current and meteorological data for greater optimization of wind turbine design, installation, operations, and maintenance. The geophysical and geotechnical contracts which commenced before the metocean contract, focused on the continued characterization of the lease area, export cable routes and inter-array cable modules. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- GE has shared details of its on-going two-year research program with Glosten, an engineering consultancy, to design and develop advanced controls to support its 12MW floating wind turbine. The USD4 million project is conducted through the United States ARPA-E's (Advanced Research Projects Agency-Energy) ATLANTIS (Aerodynamic Turbines Lighter and Afloat with Nautical Technologies and Integrated Servo-control) program. The project, to be featured at ARPA-E's annual innovation summit, is based on implementing GE's 12MW Haliade-X offshore wind turbine on Glosten's Pelastar tension-legged platform (TLP) concept. GE has stated its target to reduce tower and floating platform mass by up to 35%, and consequently, the levelized cost of energy (LCOE). (IHS Markit Upstream Costs and Technology's Melvin Leong)

- USDA's latest forecast shows Fiscal Year (FY) 2021 US agricultural exports hitting a record $164 billion, up $7 billion from their February outlook, with China's demand for US agricultural products a big driver of the increase. If realized, the forecast $164 billion in US ag exports would eclipse the previous $152.3 billion record set in FY 2014 and represent a 21% ($28 billion) increase over FY 2020 levels. Besides demand from China, higher commodity prices and weaker foreign competition are other factors at play in the expected export surge, the report said. Key takeaways from the update are higher forecast exports for US corn, soybean, livestock, poultry and dairy products, with FY 2021 corn exports reaching $17.2 billion, up $3.2 billion from the February outlook, on "strong demand and reduced competition." (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Ford laid out a new plan called Ford+ on its Capital Markets Day, setting a new target for electric vehicle (EV) sales, increasing investment through to 2025, and placing a new focus on customers.The Ford+ plan can be seen as the next stage for initiatives, investments, and developments Ford has been signaling for the past five years, beginning in 2017 under former CEO Jim Hackett. Then, Ford revealed a strategy that included evolving its product portfolio to focus on trucks, sport utility vehicles (SUVs), and commercial vehicles, as well as plans to create connectivity and software-based services and to direct more investment to battery electric vehicles. Under current CEO Jim Farley, who was also a key contributor to strategic plans under Hackett, Ford is ready to move these plans to a commercialization and deployment phase, as well as both further refining the approach and broadening the scope. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous mobility firm Beep has closed a USD20-million Series-A funding round from Intel Capital and Blue Lagoon Capital, according to a company statement. The company will use the infused capital towards expanding its autonomous fleet deployments in geo-fenced urban environments across North America. Beep is an autonomous mobility solution company that offers services to fleet operators in planned communities and low-speed environments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ashland says it is exploring strategic options, including a potential sale, for its performance adhesives business unit. The move is part of the company's push to grow in additive ingredients, particularly in the pharma, personal care, and coatings end markets, which will be a focus for investment. The performance adhesives business produces adhesive used in packaging, converting, and structural applications, according to Ashland's annual report. This includes pressure-sensitive adhesives and adhesives for the automotive and construction markets. The business, a part of Ashland's industrial specialties segment, generated $310 million in revenue and $71 million in EBITDA in 2020 and has six manufacturing sites in the US and the UK. The business could fetch a valuation of more than ten times EBITDA, which would be as much as $860 million, based on 2021 estimates, according Laurence Alexander, an analyst with Jefferies (New York, New York). (IHS Markit Chemical Advisory)

Europe/Middle East/Africa

- European equity markets closed mixed; Italy +1.1%, France +0.7%, UK -0.1%, Spain -0.1%, and Germany -0.3%.

- 10yr European govt bonds closed lower; UK +6bps, Germany/France/Spain +3bps, and Italy +2bps.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -3bps/249bps.

- Three autonomous shuttles developed by Aurrigo will begin passenger trials in Cambridge (UK), reports TheBusinessDesk.com. Passengers recruited for the trials can book the ride through Aurrigo's app; the shuttles will take them across the two-mile route from the Madingley Road Park and Ride site to and around Cambridge University's West Campus. The vehicles will run at a maximum of 20mph, are fully electric with a range of 100 miles, and will operate on a main road surrounded by other traffic. During the trials, a safety operator will be present to control the vehicle manually in case of an emergency. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Uber has struck a trade union deal in the UK that will give its ride-hailing drivers with increased powers to collectively bargain, reports The Business Times. This deal will allow Uber's 70,000 drivers in the country to organize and collectively bargain under the GMB labor union. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- DORIS will collaborate with French green hydrogen producer Lhyfe in order to identify the best technical options for offshore production and support Lhyfe in the development of a suitable business model. The main objectives of the partnership are to address technical and technological challenges related to offshore hydrogen supply chain; develop viable integrated business models from offshore production to end usage; and to move rapidly towards industrial cases. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- Bayer has announced a five-point plan to address potential

future Roundup litigation following the denial of its motion to

preliminarily approve the Roundup class settlement agreement by

Judge Vince Chhabria of the US District Court for the Northern

District of California. The plan combines legal and commercial

actions designed to help Bayer achieve a level of risk mitigation

that is comparable to the previously proposed national class

solution, the company says. (IHS Markit Chemical Advisory)

- The company will remain in the residential lawn and garden market, but will immediately engage with partners to discuss the future of glyphosate-based products in the US residential market, because the overwhelming majority of claimants in the Roundup litigation allege that they used Roundup lawn and garden products, it says.

- It will also explore alternative solutions aimed at addressing potential future Roundup claims, as well as the creation of an independent scientific advisory panel comprising external scientific experts to review scientific information regarding the safety of Roundup, it says. In addition, the company will continue to be open to settlement discussions but will regularly reassess whether this approach continues to serve the company's best interests, Bayer says.

- Bayer also notes that the weight of scientific evidence and the conclusions of all expert regulators worldwide continue to support the safety of glyphosate-based herbicides. The EPA filed a brief with the US Court of Appeals for the 9th Circuit last week, in which it affirmed once again that glyphosate 'poses no human-health risks of concern,' the company says.

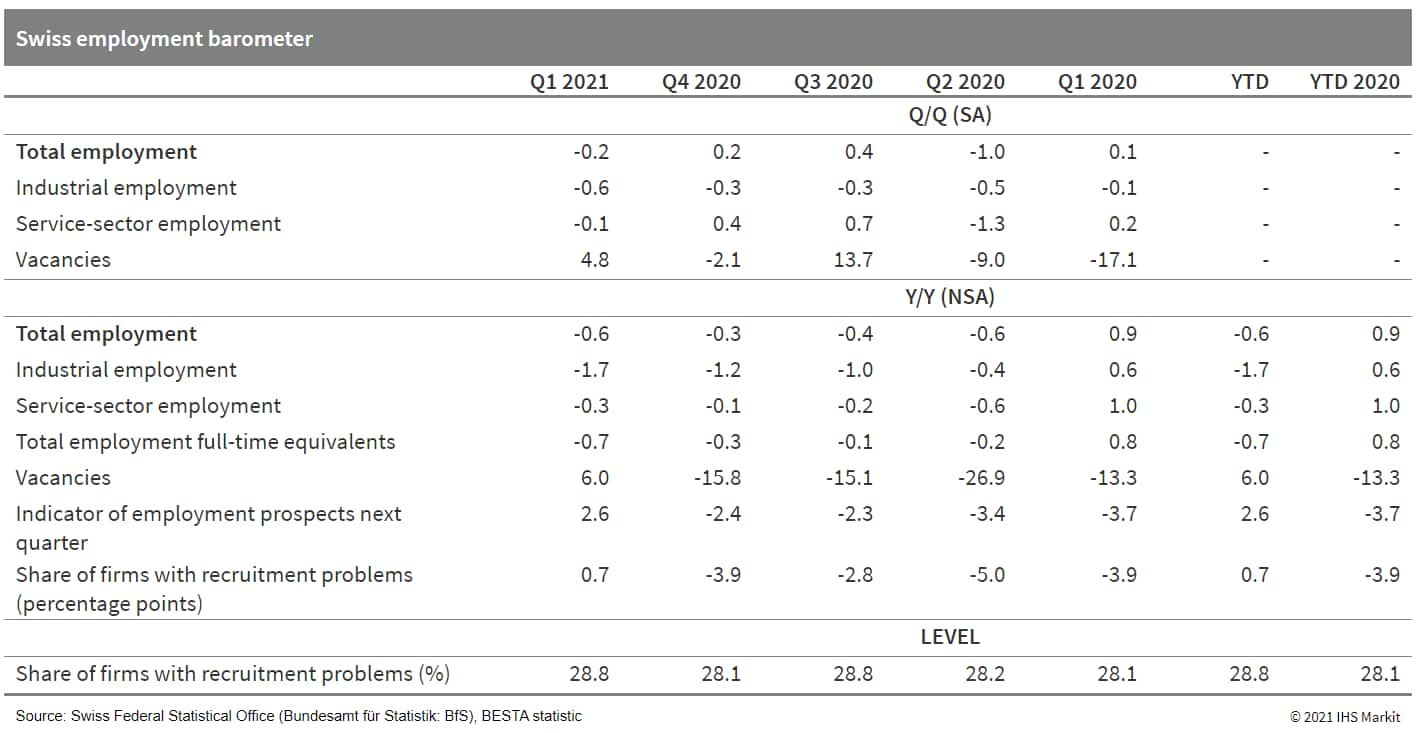

- Switzerland's employment barometer for the first quarter,

published by the Swiss Federal Statistical Office (SFSO), reveals

one final dip in employment ahead of a recovery that is already

under way at present. The so-called BESTA statistic - based on a

comprehensive picture of the corporate landscape, using pension

system statistics that also include many "micro firms" and

employees with fewer than six weekly work hours - shows that

seasonally adjusted employment fell by 0.2% quarter on quarter

(q/q) in the first quarter, following an initial plunge in the

second quarter of 2020 and a partial recovery during the second

half of last year. Having reached an all-time high of 5.15 million

in early 2020, employment fell to 5.10 million in the second

quarter before recovering to around 5.12-5.13 million during the

three latest quarters. (IHS Markit Economist Timo

Klein)

- Russia's grocery acquisitions gain momentum, as two big supermarket chains announce the purchase of other supermarket operations this week. On 18 May, grocery chain giant Magnit announced the purchase of the Dixy Group for RUB92.4 billion (USD1.3 billion). With the deal, Magnit will acquire 2,612 Dixy stores and 39 retail outlets under the Megamart brand. After the closing of the deal (expected on 31 August), Dixy will continue to exist as a separate legal entity, and the stores will continue to operate under the existing brand. Magnit will also acquire Dixy's five distribution centers. According to Magnit's chief executive Yan Dunning, the deal will provide an opportunity to strengthen the company's retail position in both capitals (Moscow and Saint Petersburg). As a result of the deal, the company's share in the markets of Moscow and the Moscow region will more than double from the current 3.8% to 8.2%. In the Northwestern Federal District, mainly due to the Saint Petersburg and the Leningrad region, it will grow by 6.6 percentage points to 19.6%. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- KamAZ will deliver a fourth consignment of battery electric buses to the Moscow-based State transit authority Mosgortrans, according to a company statement. Under the terms of the contract, KamAZ will supply the Moscow transport authority with 350 KamAZ 6282 electric buses. The contract will also include a 15-year maintenance and service provision. The buses will be delivered in batches, as was the case with the previous electric bus contracts, with 150 units to be delivered to Mosgortrans by 31 July, and another 200 by 31 December. The total period for the provision of services (including maintenance of equipment) is until 30 November 2036. (IHS Markit AutoIntelligence's Tim Urquhart)

- According to a report on Russian vaccine supply and export from Forbes.ru, only 15-20 million people in Russia have so far received first-dose vaccination against COVID-19, mostly with the Russian Gamaleya Institute's adenoviral vaccine Sputnik V. Demand for Sputnik V abroad has resulted in export sales of around 16.3 million doses, although analysis of actual delivery figures has reportedly shown that only a small proportion of this has been delivered as yet to countries around the world. While Russia has agreements to export over 205 million doses of Sputnik V, only 8% of its obligations have allegedly been fulfilled, according to Forbes data. This has implications for global confidence in the Russian vaccine program and for supply to countries with poor access from other sources. (IHS Markit Life Sciences' Janet Beal and Alex Kokcharov)

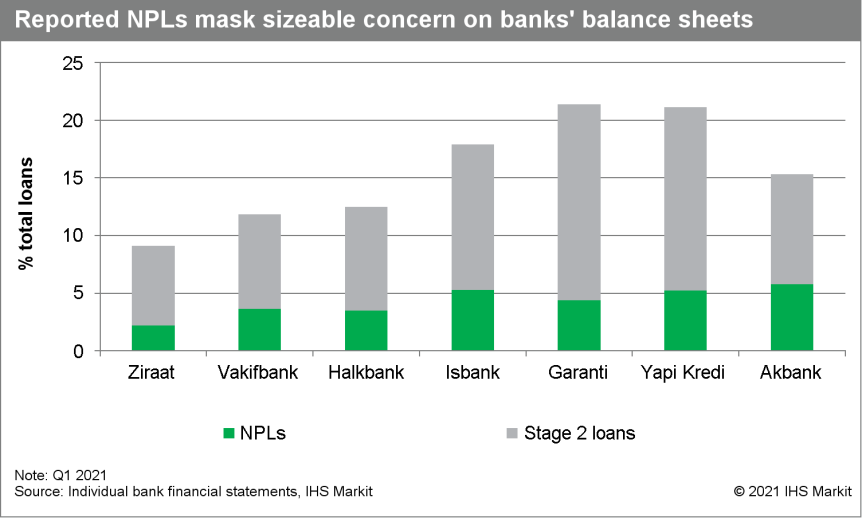

- New first-quarter 2021 data released for Turkey's banking

sector and by its largest banks showcase a continued, but gradual,

deceleration of credit growth rates, moderation of on-paper

non-performing loans (NPLs), sharp drop in profitability at

state-owned banks, and decline in capital buffers. (IHS Markit

Banking Risk's Alyssa

Grzelak)

- Turkish banks continued to expand new credit at a brisk pace. Credit growth decelerated modestly to 30.4% year on year (y/y) at the end of the first quarter of 2021, down from 34.7% growth registered at the end of 2020 but still double the 15% growth registered in the first quarter of 2020 before COVID-19-virus-related countercyclical policies really took hold.

- Headline NPLs fell, but Stage-2 loans remain elevated. In part because of the base effects of high credit growth rates and also because of enhanced restructuring of outstanding loans and forbearance initiatives, the headline NPL ratio continued to decline across all ownership classes of banks in the first quarter.

- As IHS Markit has highlighted repeatedly in the past, Stage-2 loans reported by individual banks highlight continued asset quality concerns and potential for a sharp rise in the NPL ratio if forbearance measures are lifted or credit growth rates slow markedly this year. Across the largest banks in the sector, we calculate a troubled loan ratio (NPLs plus Stage 2) ranging from 9% to 21%.

- Capital buffers moderated for the third consecutive quarter. As

expected, the sector's capital adequacy ratios moderated in the

first quarter of 2021, with the Tier-1 ratio falling back to 15%

for the sector as a whole from a recent high of 16.4% in the second

quarter of 2020.

- Saudi merchandise exports rose by 10.8% year on year (y/y) to a

level of SAR212.4 billion (USD56.6 billion) in the first quarter

2021, the Saudi General Authority for Statistics said today (27

May), and the trade surplus widened beyond the level it had been

when the COVID-19 pandemic started at the end of the first quarter

2020. (IHS Markit Economist Ralf

Wiegert)

- The surplus amounted to SAR74.7 billion, up from SAR59.2 billion in the first quarter a year ago and SAR42.8 billion in the final quarter 2020.

- Non-oil exports led the trade rebound as the first quarter last year was already affected by demand weakness from key Asian markets during the outbreak of the COVID-19 pandemic. Non-oil exports grew by 23.1% in the first quarter, pushing their share in total exports from 25.4% in the first quarter 2020 to 28.2% in the first quarter this year. The share of non-oil exports relative to imports increased from 36.8% to 43.5% at the same time.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +0.4%, India +0.2%, Australia flat, South Korea -0.1%, Hong Kong -0.2%, and Japan -0.3%.

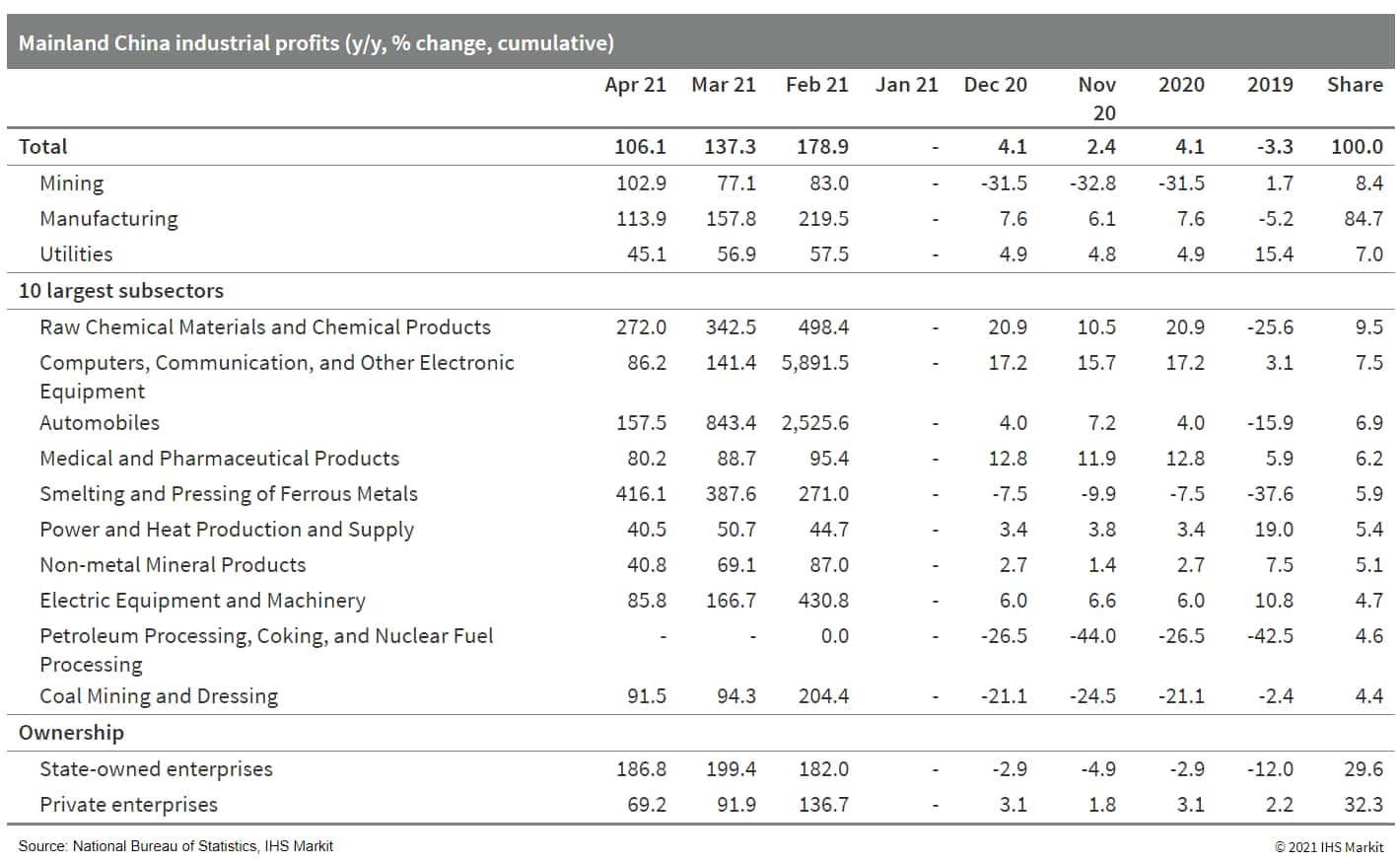

- Mainland China's industrial profits increased 106% year on year

(y/y) through April, down by 31.2 percentage points from March

owing to a faltering low-base effect. On a two-year (2020-21)

average basis, industrial profits expanded by 22.3% y/y in the

first four months of 2021, 0.3 percentage point lower than the

growth in the preceding month. For April alone, industrial profits

grew 57.0% y/y, or by 22.6% y/y on a two-year average basis—the

latter figure is higher than March reading by 10.7 percentage

points, according to the National Bureau of Statistics (NBS). (IHS

Markit Economist Lei Yi)

- Sustained recovery in industrial production and improvements in operating efficiency were behind the strength in industrial profits. Industrial value-added grew by 20.3% y/y through April; while operating costs continued to grow at a slower pace than revenue, at 31.4% y/y and 33.6% y/y, respectively over the same period. As a result, the profitability ratio reached a new historical high of 6.87% by the end of April, up 2.42 percentage points y/y.

- By sector, the global commodity rally pushed up industrial

profits of the upstream mining and raw material manufacturing

sectors, with profits surging by 103% y/y and 366% y/y,

respectively. The strength in the equipment and high-tech

manufacturing segments held steady, with profits expanding by 90.8%

y/y and 88.5% y/y, or by a two-year average of 23.2% y/y and 38.9%

y/y, respectively.

- China is aiming for all the vehicles used in the public service area to be fully electrified and for fuel-cell vehicles (FCVs) to be commercially viable by 2035, according to Gasgoo, citing an action plan by China's Ministry of Industry and Information Technology (MIIT). The government also plans to promote electrified buses and other vehicles used in city logistics services and urban sanitation. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korean steelmaker POSCO has begun construction of a lithium hydroxide extraction plant, a key material for the production of electric vehicle (EV) batteries, according to a report by the Korea Herald. The company held the groundbreaking ceremony in Gwangyang, South Jeolla Province, yesterday (25 May). Construction is expected to complete by end of 2023. The plant, spread across 1,960 square meters, will have an annual production capacity of 43,000 tons of lithium hydroxide, which is enough to make batteries for around 1 million EVs. "We have been able to take a step toward producing lithium by making active investments and innovating technologies, after selecting storage batteries as our next growth engine in the forthcoming era of EVs," said POSCO chairman Choi Jeong-woo. The plant is valued at KRW760 billion (USD679.5 million). (IHS Markit AutoIntelligence's Isha Sharma)

- POSCO acquired a 30% stake in Canadian copper miner First Quantum Mineral's Ravensthorpe Nickel Operation in Western Australia. POSCO paid a total of USD240 million for the deal. Ravensthorpe Nickel Operation is a nickel integrated production company that has its own mines, smelting facilities, desalination, sulfuric acid production, and waste treatment, and was 100% owned by Canada's First Quantum Minerals. POSCO will get the right to supply 32,000 metric tons of processed nickel products (mixed hydroxide precipitate, nickel and cobalt hydroxide mixture) per year from 2024 onwards as secondary battery materials. POSCO and First Quantum have also signed an agreement to explore a strategy partnership for production of battery precursor materials at the Ravensthorpe mine. Nickel is an important raw material for cathodes and helps in increasing the charging capacity of secondary batteries. As the adoption of cathode materials with a high nickel content has recently increased, the importance of securing nickel is growing. By 2030, POSCO aims to supply 220,000 metric tons of lithium and 100,000 metric tons of nickel, which are key raw materials for electric vehicle batteries. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- Autonomous truck startup Kodiak Robotics has partnered with South Korean IT firm SK Inc. to expand its footprint across Asia-Pacific (APAC) markets, according to a company statement. Under this partnership, the companies will work together to seek new business opportunities that will support in accelerating the commercialization of Kodiak's autonomous technology, Kodiak Driver. In addition, they will also provide fleet management services for customers in Asia. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Thai health authorities have quarantined 1,376 (at the last count) workers, mostly Burmese, at Dole's pineapple processing plant in Hua Hin, Thailand, the company's only facility in the country. This precaution was taken after 42 workers, 39 of them Burmese and three Thai, tested positive for Covid-19. According to local media, the cause of the infection was traced to a single worker who had come to the Dole plant after a similar outbreak at the Quality Pineapple Processing (QPP) plant, also in Thailand. The plant has not been officially closed, because the authorities do not want the itinerant workers wandering off to find work elsewhere. However, it is hard to see how it can maintain normal operations at the moment. The plant, during processing, employs roughly 1,400 Burmese workers and a similar number of Thai personnel. In addition, the line on which the infected staff were working has been shut. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- The Reserve Bank of New Zealand (RBNZ) has kept its monetary

policy settings unchanged after its 26 May meeting, citing

continued improvement in the economic outlook against significant

divergences in economic activity over recent months. Retail sales

data further supported the RBNZ's position that the economic

recovery is continuing after a correction in the previous quarter.

(IHS Markit Economist Andrew Vogel)

- The RBNZ's Monetary Policy Committee (MPC) left the official cash rate (OCR) on hold at 0.25% - where it has been since March 2020 - while also leaving the Large-Scale Asset Purchase (LSAP) program and Funding for Lending Programme (FLP) unchanged.

- The RBNZ's views on forecasts have not changed substantially since its April review (see New Zealand: 15 April 2021: Reserve Bank of New Zealand keeps stimulatory monetary settings as conditions slowly recover). However, there are some adjustments from the last formal forecast in February, notably some mild upward revisions to inflation forecasts in 2022.

- More significant was the decision to stop forecasting the "unconstrained" OCR - the interest rate the RBNZ estimated would be necessary to achieve stimulus objectives - which the bank developed when negative interest rates were being investigated as a policy response. The return of the forward interest rate forecasts see a fairly aggressive tightening cycle starting by mid-2022.

- Retail sales rose 2.5% quarter on quarter (q/q) both in real (volume) and nominal (value) terms. The fact that the growth in real sales was equivalent to the growth in nominal sales highlights the balanced price inflation pressures during the March 2021 quarter. Nine sectors recorded increases in both real and nominal terms; most notably hardware, electronics, motor vehicles and parts, and recreational goods, as well as grocery and department store retailing - and only two sectors (clothing and specialized food retailing) recording declines in both volumes and values.

- The New Zealand Parliament is expanding on a government order made in September 2020 requiring large insurers and financial institutions to identify their risks from climate change. The government claims that the Financial Sector (Climate-related Disclosure and Other Matters) Amendment Bill would be the first such national law in the world. If enacted, reporting will be mandatory starting with fiscal year 2022, with the reporting deadline in 2023. The bill, once enacted into law, would cover insurers with over NZ$1 billion (US$750 million) in assets under management; all banks, credit unions, and building societies with total assets exceeding $1 billion; and all equity and debt issuers listed on the national stock exchange NZX. The institutions affected by this bill represent about 90% of assets under management in New Zealand, according to the government's announcement. (IHS Markit Climate and Sustainability News' Kevin Adler)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2021.html&text=Daily+Global+Market+Summary+-+27+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 May 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+May+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}