Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 27, 2021

Leveraged Loan Settlement: Embracing Automation in the European Market

In this month's post we turn our attention to the maturation of the European (LMA) leveraged loan market, exploring themes that have become evident over the past 12 months and highlighting developments to look out for later this year. We observe that, contrary to outdated characterizations, many market participants in the region are embracing innovation, automation and standardization, resulting in great strides towards shorter settlement times. There are many similarities here with the picture we see across our client base globally.

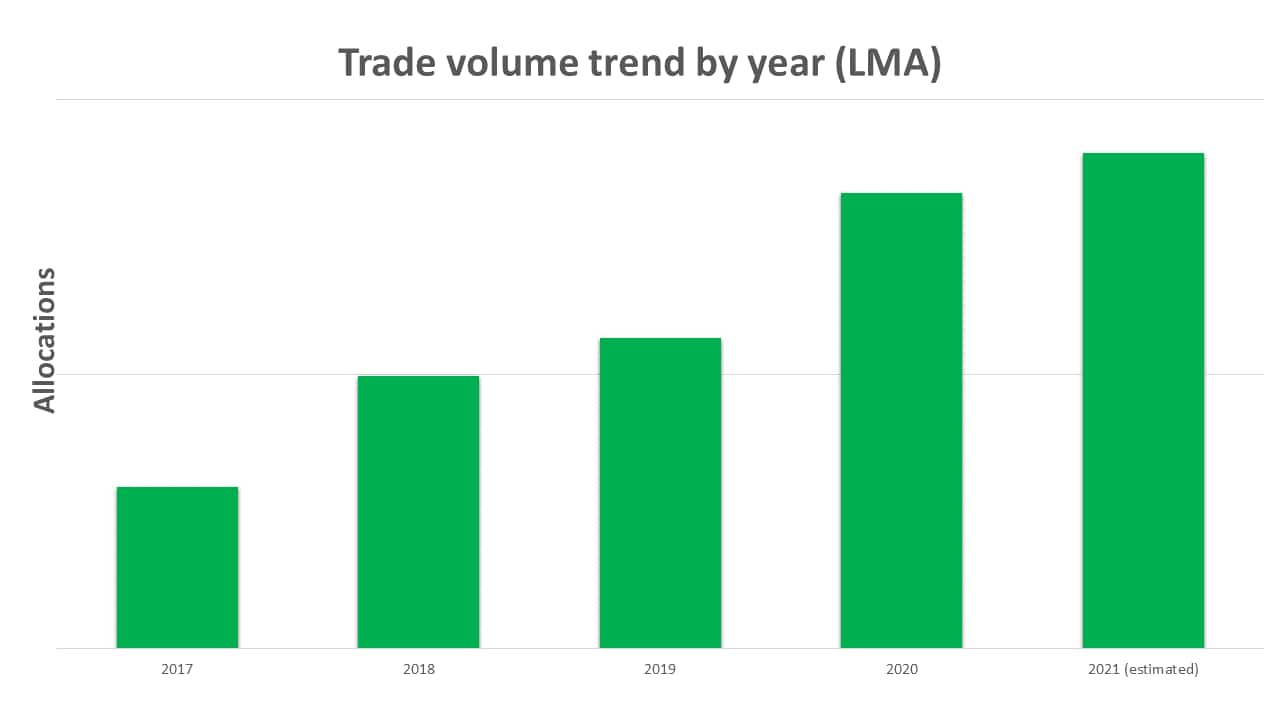

As I am sure you have experienced, volumes in the build-up to and certainly during the global pandemic have been unprecedented and have brought about new challenges for many. But given the speed at which the market had been developing, and the growing rate of technology adoption, perhaps it wasn't so surprising we have seen such explosive activity in secondary trading in particular.

Between 2016 and 2020, the volume of both primary and secondary par trades settled on our ClearPar platform grew by around 350%. You might expect this to have a detrimental impact on settlement times for secondary trading activity. However, during this period there was only a 9% increase, which was almost all attributed to 2020's boom in activity (secondary volumes grew by 50% in 2020). Our decision to add functionality specifically to support the LMA market has been integral to our success in keeping settlement times down, while supporting continued volume growth. This new LMA-specific functionality includes Transfer Questions, Multiple Forms of Transfer Document optionality and Security Agent workflows. It mirrors the support we provide for our clients in the LSTA and other markets.

Like our clients in other

regions, many in Europe responded to 2020's volumes by increasing

their use of technology and the automation that for most was

already at their fingertips. Inevitably, we saw record numbers of

new institutions being onboarded onto ClearPar, whether for the

purposes of syndicating a primary deal or simply settling a

secondary trade as agent. Ensuring agents interact with and execute

trades online is paramount for the settlement workflow and, with

40+ agents using ClearPar to settle LMA trades in 2020, the value

of this network is clear to see.

Like our clients in other

regions, many in Europe responded to 2020's volumes by increasing

their use of technology and the automation that for most was

already at their fingertips. Inevitably, we saw record numbers of

new institutions being onboarded onto ClearPar, whether for the

purposes of syndicating a primary deal or simply settling a

secondary trade as agent. Ensuring agents interact with and execute

trades online is paramount for the settlement workflow and, with

40+ agents using ClearPar to settle LMA trades in 2020, the value

of this network is clear to see.

During the early stages of 2021 the exponential growth in settlement activity combined with industry-wide challenges, such as Brexit and Libor cessation, has led to a slowly rising T+. With said activity expected to continue throughout the year, institutions are turning their attention to operational efficiencies and subsequent automation wins. A recent example of this is the way a large group of CLO investment managers utilized ClearPar to bulk transfer assets away from Dutch-managed CLOs to address regulatory change. Closing out projects of such scale could only have been achieved in such a short timescale with the support of technology and the network behind it.

Existing customers have also expanded the direct connectivity between their environments and ClearPar, while many have explored integration projects for the first time. Our 110+ electronically-integrated clients across the globe are now benefiting from faster trade booking, access to trade data, and reduced execution times. For example, 0.2 days were taken off average entry times for LMA trades in 2020, while fund managers were able to allocate almost half a day faster compared to 2019. When you consider the collective settlement timeline, these reductions make a significant difference for many.

Structural process changes have underpinned the development of the LMA market. Digitalizing Administrative Details Forms, making data available to custodians and centralizing access to lender position data through Loan Reconciliation are examples of the innovations we have introduced to automate previously manual tasks, benefiting our clients in all regions by enabling their staff to focus on higher value tasks (check out our March blog post to learn more about how you can leverage these developments to positively impact your settlement times).

Progress is certainly still needed to ensure the European market develops further efficiencies. This is something we continue to partner with our clients on by supporting them in their adoption of our solutions, reviewing performance data and making operational model changes as a result. With client consent, we have also partnered with and shared data with the LMA to help the industry body and its members analyze trends, create standards and, ultimately, improve industry settlement times (we collaborate in a similar way with the LSTA in the US).

We have seen the need for tools such as ClearPar surge over the last decade and are proud to have been able to support the growth and success of the European loan market. The data and technology needed to reduce settlement times are now readily available, and we look forward to continuing to help clients stay ahead in the ever-changing European market by embracing innovation.

James Irwin (Executive Director, Loans Platforms, IHS Markit) and Elina Gokh (Global Head of WSO & Credit Commercial Strategy, IHS Markit) will be speaking on panels about fintech and end-to-end solutions during the LMA FinTech Virtual Conference on 17 June.Learn more here.

Read other recent blogs in this series:

- Unveiling a Consolidated Ecosystem for Loans

- Loan trade settlement: T+0 is already a reality today

- The Quiet Revolution: A Decade of Transformation in Leveraged Loans

- 2021: What Is Next For Leveraged Loans Settlement?

- Reasons for Optimism: Is This the Start of a New Technology Revolution?

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fleveraged-loan-settlement-embracing-automation-in-the-european.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fleveraged-loan-settlement-embracing-automation-in-the-european.html&text=Leveraged+Loan+Settlement%3a+Embracing+Automation+in+the+European+Market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fleveraged-loan-settlement-embracing-automation-in-the-european.html","enabled":true},{"name":"email","url":"?subject=Leveraged Loan Settlement: Embracing Automation in the European Market | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fleveraged-loan-settlement-embracing-automation-in-the-european.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Leveraged+Loan+Settlement%3a+Embracing+Automation+in+the+European+Market+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fleveraged-loan-settlement-embracing-automation-in-the-european.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}