Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 27, 2020

Daily Global Market Summary - 27 July 2020

The US dollar continued to sell-off today to a two-year low, enabling a new all-time high for gold and a multiyear high for silver. US equity markets closed higher, APAC was mixed, and European markets were mostly lower. iTraxx-Europe (IG) closed tighter and iTraxx-Xover (HY) closed wider, while European benchmark government bonds were stronger on the day. The US Senate Republicans put forward their proposal for an additional $1 trillion stimulus package, with many aspects of the bill likely to be met with resistance by Democrats in Congress.

Americas

- US equity markets closed higher; Nasdaq +1.7%, Russell 2000 +1.2%, S&P 500 +0.7%, and DJIA +0.4%.

- 10yr US govt bonds closed +2bps/0.61% yield.

- CDX-NAIG flat/70bps and CDX-NAHY -11bps/451bps.

- Crude oil closed +0.8%/$41.60 per barrel.

- US Senate Republicans set the stage on Monday for a clash with congressional Democrats by unveiling a White House-backed plan for $1tn in new stimulus that would cut emergency unemployment benefits by two-thirds. (FT)

- At first read, the below are some of the highlights of the

Senate's proposed US stimulus package (IHS Markit US Government

Affairs' Salman Banaei):

- Unemployment insurance supplemental payments lowered to $200 from $600 (per week). Starting in October, this payment would be replaced with a payment (up to $500) that, when combined with the state UI payment, would replace 70 percent of lost wages.

- Authorizes $100 billion for SBA 7(a) "Loans to Recovery" loans. These would be <=20 years, fixed 1% interest loans to recovery sector businesses with no more than 500 employees, and that demonstrate at least a 50% reduction in gross revenues. Loan amounts would be available at up to twice the borrower's annual revenues, not to exceed $10 million.

- Authorizes $190 billion for "PPP Second Draw Loans"

- Amends PPP conditions to, e.g., forgive expenses related to cover supplier costs, covered worker protection expenditures, and covered operations expenditures.

- Authorizes $10 billion in long-term debt with equity features to registered SBA Small Business Investment Companies (SBICs) that invest in small businesses with significant revenue losses from COVID-19, manufacturing startups in the domestic supply chain, and low-income communities.

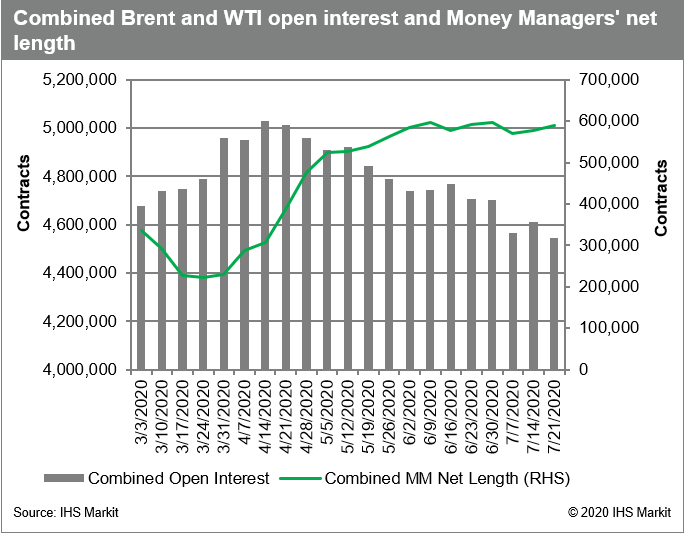

- Open interest in crude futures has continued to slide lower in

recent weeks, with combined Brent and WTI open interest falling to

just above 4.5 million contracts, down more than 500,000 contracts

from their mid-April highs. To be sure, the surge in crude prices

since then has offset some of the net impact of this contract

decline in terms of underlying dollar exposure in crude markets,

but the drop off does signal that markets may be taking a breather

after the spring frenzy. Speculative net length in crude futures

has stabilized since mid-June at just under 600,000 contracts, with

minor weekly deviations since as markets await clearer signals. The

retail capital boom in oil-linked exchange-traded instruments is

also showing signs of losing steam, with net weekly outflows in

each of the past nine weeks as the rally fizzled. Importantly,

however, there remains significant retail exposure even with recent

declines, with a continued unwinding liable to keep the pressure on

prices. However, oil has benefited from a steady weakening of the

dollar over the past two months, a trend that is expected to

continue as the US deals with a worsening COVID-19 situation and

the Fed commits to locking in extremely low interest rates for the

foreseeable future. (IHS Markit Energy Advisory's Roger Diwan,

Karim Fawaz, Justin Jacobs, Edward Moe, and Sean Karst)

- DXY US dollar index closed -0.8%/93.65 at an over two-year low, with an intraday low of 93.48 at 11:04am EST.

- Gold closed +1.8%/$1,931 per ounce and broke a new all-time high of today $1,958/ounce since surging even higher after the New York close.

- Silver futures closed +7.2%/$24.50 per ounce and is now at its highest level in over seven-years.

- Manufacturers' orders for durable goods rose 7.3% in June

following a 15.1% increase in May, while shipments of durable goods

rose 14.9% in June, following a 4.2% increase in May. (IHS Markit

Economists Ben Herzon and Lawrence Nelson)

- These data are consistent with other indicators of broad recovery through June. The levels of orders and shipments, though, remain materially below pre-pandemic levels, with the former still 16.0% below February and the latter still 8.2% below February.

- The details of this report that enter our GDP tracking led us to raise our estimate of second-quarter GDP growth by 0.2 percentage point to a 35.1% annualized rate of decline and our forecast of third-quarter GDP growth 0.7 percentage point to an 18.9% annualized rate of increase.

- Income support from temporary fiscal measures to prop up the economy is waning, and new confirmed cases of COVID-19 are surging. At the same time, several high-frequency indicators of economic activity in July are softening, leading us to believe that the pace of recovery is slowing.

- We expect this to feed back into the manufacturing sector and manifest as some backtracking in new orders for durable goods.

- There is some risk to this assessment, though, as our own IHS Markit purchasing managers indexes (PMIs) for manufacturing output and new orders were above 50 in the flash reading for July, a sign of expanding activity.

- Turning to some details in today's (27 July) report, a sharp increase in orders for motor vehicles and parts in June was partially offset by a large decline in new orders (net of cancelations) for nondefense aircraft and parts, the level of which has been negative in three of the last four months; i.e., cancelations of aircraft orders have been outpacing new orders over this period.

- US President Donald Trump signed four executive orders (EOs) on

24 July aimed at controlling pharmaceutical prices in the United

States. The orders address several main areas: the reimportation of

drugs for personal use from countries that have lower prices;

requiring that certain discounts and rebates are passed on to

patients; and, crucially, providing pharma companies with a

one-month deadline to reduce pharmaceutical prices or face the

enforcement of international reference pricing (IRP) that would

effectively cap US prices in relation to those in other

Organization for Economic Co-operation and Development (OECD)

countries. The EOs instruct the Department of Health and Human

Services (HHS) to take the following actions (IHS Markit Life

Science's Milena Izmirlieva):

- End profits to middlemen, with a requirement that any rebates from pharma companies are passed directly to US senior citizens eligible for prescription drug coverage under Medicare Part D. According to the HHS press release, in 2018 these Part D discounts totaled more than USD30 billion, equivalent to an average discount of 26-30%.

- Require Federally Qualified Health Centers (FQHCs) that

purchase insulins and epinephrine in the 340B program to pass the

savings from discounted drug prices directly on to medically

underserved patients. This would benefit about 28 million patients

who visit FQHCs every year, more than six million of whom are

uninsured.

- Finalizing a rule allowing states to develop safe importation plans for certain prescription drugs

- Authorizing the reimportation of insulin products made in the US if the HHS secretary finds that reimportation is required for emergency medical care pursuant to section 801(d) of the Food, Drug, and Cosmetic Act

- Creating a pathway for safe personal importation through the use of individual waivers to purchase drugs at lower cost from pre-authorized US pharmacies.

- Ensure that the Medicare program and seniors pay no more for the costliest Medicare Part B drugs than in any economically comparable OECD country. This order takes effect in 30 days unless Congress acts, according the HHS press release

- Rivian has issued a statement updating its plans for its first product deliveries and noting that the pilot production lines have begun running. Rivian said that it is closer to its full production launch and can deliver more precise timing expectations. In the statement, Rivian said, "Keeping our team safe while making progress has been our top priority over these past few months. We look forward to sharing more updates soon, including details on key vehicle features, the date you'll be able to configure your R1T or R1S, as well as our plans for our charging network." Rivian had delayed its sales and production start for the vehicles as a result of COVID-19 virus-related lockdowns, changing from an initial plan for deliveries to begin in late 2020. Although delayed, this latest schedule suggests that Rivian's products will be available to customers ahead of General Motors's (GM)'s Hummer electric vehicle (EV) truck and sport utility vehicle (SUV) as well as Tesla's Cybertruck and Ford's F-150 EV. However, the launch of these competing models is also expected within a year or so of Rivian's launch. Amazon has ordered 100,000 delivery vehicles from Rivian. However, the timing for the first of these vehicles to be produced is currently unclear, although Rivian is not expected to deliver all of the vans to Amazon until 2030. (IHS Markit AutoIntelligence 's Stephanie Brinley)

- A federal judge has approved Formosa Plastics' agreement not to

start construction work on its $9.4-billion petrochemical complex

in St. James Parish, Louisiana, after opponents filed a preliminary

injunction on 14 July to block work on the site.

- The company agreed Thursday not to build a construction dock on the Mississippi River or work near wetlands or five areas that may contain unmarked graves.

- The agreement will protect the site until the resolution of a lawsuit challenging federal approvals that was filed by opponents in January.

- The groups plan to file a motion for summary judgment asking US District Judge Randall Moss to invalidate permits issued last year by the Army Corps of Engineers.

- "Now that Formosa Plastics has agreed not to disturb graves and wetlands on the site through February 2021, we can focus on this project's deeply flawed approval process," says Julie Teel Simmonds, a senior attorney with the Center for Biological Diversity, a national nonprofit conservation organization.

- Formosa Plastics' proposed petrochemical complex, called the Sunshine Project after the nearby Sunshine Bridge, is expected to comprise 14 plants on a 2,400-acre site along the Mississippi River, which the company acquired in 2018.

- Louisiana groups and national environmental organizations earlier this year filed two lawsuits challenging the Formosa Plastics project, one over its federal permits, represented by the Center for Biological Diversity, and one over its state air permit, represented by Earthjustice.

- Formosa Plastics broke ground on the project in late March after receiving final permits but has now agreed to limit its construction activities until February 2021.

- The company plans to build the complex in two phases over 10 years. The first phase would include a 1.2-million metric tons/year ethylene plant using ethane as feedstock, with downstream facilities that will produce high-density polyethylene (HDPE), linear low-density polyethylene, and ethylene glycol (EG). A propane dehydrogenation plant and a polypropylene facility are also planned.

- Rental-car company Hertz has reached an interim deal with its lenders to resolve a bankruptcy court dispute over a plan to reduce its leased fleet of rental cars, reports Reuters. Under this deal, Hertz will pay USD650 million to lenders in cash in equal monthly installments from July to December. In addition, the company will dispose of at least 182,521 leased vehicles between June and December. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The national statistics office of Mexico (INEGI) reported that,

in May, the monthly index of economic activity (MIEA) plunged 22.7%

y/y. In April it had dropped 19.8% y/y. Growth in agriculture was

more than offset by plummeting output in the industry and in the

service sector as well. (IHS Markit Economist Rafael Amiel)

- Seasonally adjusted data show that IMAE fell 2.6% month on month (m/m). This follows significant contraction in April (down 17.3% m/m). Except for agriculture, all other sectors contracted during May.

- Data from the social security administration show that, during the pandemic, Mexico has lost more than 1 million formal jobs, approximately 5% of the total. Other surveys from INEGI, that include informal jobs from the underground economy estimate losses of over 15 million jobs.

- Within the industry, manufacturing fell only 0.3% m/m showing signs of stabilization and while trade figures for May were also worse than in April, we asses this reflects the lag between production and exports.

- Retail sales in May expanded 0.8% m/m, as some businesses started to reopen; supermarket sales and departments sores started to increase and there was significant growth in sales of electronics, automobiles.

- Argentine real retail sales increased by 5.1% year on year

(y/y) in supermarkets, but plunged by almost 96% y/y in shopping

centers in May as these were not considered essential and remained

mostly closed. In terms of supermarket sales, less than 5% were

online purchases; the main drivers of growth were electronic items

and appliances, fresh produce, and pantry dry goods. (IHS Markit

Economist Paula Diosquez-Rice)

- The economic activity index decreased by 20.6% y/y in May; the seasonally adjusted data show a 10% month-on-month (m/m) increase during the month. For the first five months of 2020, the steep declines in March-May drove down the average to a 13.2% y/y decline.

- By sector, the economic activity index data show only declines in May. There were steep declines in the construction sector, which decreased by 62% y/y; the hospitality sector, which was down by 74.3% y/y; the manufacturing sector, which fell by 25.7% y/y; and the transport and communication sector, which dropped by 21.6% y/y.

- Argentina's manufacturing capacity increased to 46% in May. Paper and cardboard had the highest utilized capacity, at 65%, followed by chemicals, tobacco, food and beverages, and editing and printing. The sectors with the least utilized capacity were the automotive industry, at 6.2%, and the textiles industry, at 17.8%.

Europe/Middle East/ Africa

- European equity market closed lower across the region except for Germany flat; Spain -1.7% and Italy/UK/France -0.3%.

- 10yr European govt bonds closed higher across the region; France -5bps, Germany -4bps, UK -3bps, Italy -2bps, and Spain -1bp.

- iTraxx-Europe closed -2bps/56bps and iTraxx-Xover +12bps/359bps.

- Brent crude closed +1.3%/$43.90 per barrel.

- The Euro closed at €1.18/USD, which is its strongest level since September 2018.

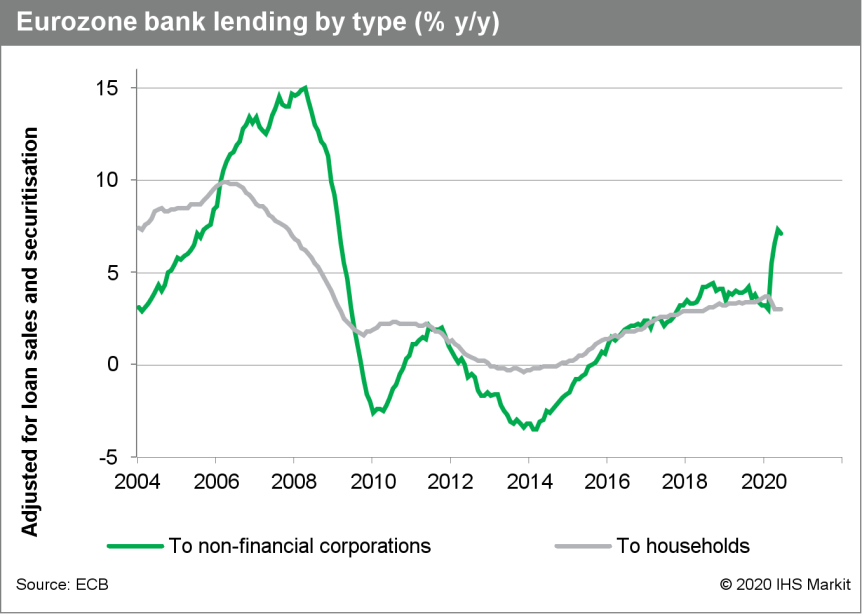

- June's 'hard' lending data from the European Central Bank (ECB;

which are adjusted for loan sales and securitization effects)

showed the first deceleration in the year-on-year (y/y) growth rate

for NFCs since February. The growth rate ticked down only

marginally, however, from 7.3% to 7.1%, following a surge in the

prior quarter. (IHS Markit Economist Ken Wattret)

- With businesses in distress due to the effects of the COVID-19 virus, demand for loans surged from March to May. This was also captured in the ECB's bank lending survey (BLS) for the second quarter, with the net percentage of banks reporting an increase in loan demand from enterprises at +62, a record high.

- The BLS reported much higher demand for short-term loans (net percentage +60) than long-term loans (+11), with financing needs for inventories and working capital rocketing, while financing needs for fixed investments declined.

- This is captured to some extent in the breakdown of June's 'hard' lending data, with growth in loans to NFCs with a maturity of over 5 years (6.1% y/y in June) not increasing anywhere near as quickly as loans with a maturity of 1 to 5 years (16.2% y/y). Loans with a maturity of less than 1 year contracted (-1.0% y/y).

- Loan growth to the household sector has been relatively low and

stable in recent months, edging down to 3.2% y/y in June, less than

half the equivalent rate of increase for NFCs (chart below).

However, the headline rate of change masks the divergence between

loans for house purchases (4.1% y/y in June, versus 4.3% in

February) and consumer credit (0% y/y in June, versus 6.2% y/y in

February).

- Germany's headline Ifo index - which reflects business

confidence in industry, services, trade, and construction combined

- posted its third increase in a row in July, rising from 86.3 to

90.5. This is, however, a smaller increase than during the last two

months, leaving it still below the level in February or long-term

average of 97.2. (IHS Markit Economist Vaiva Seckute)

- Expectations continued rising faster than the current conditions, however the increase in expectations was only half of that witnessed during the last two months. Expectations increased from 91.6 to 97, the highest level since the end of 2018.

- The business climate this time improved the most markedly in manufacturing as not only did expectations recover the fastest among the sectors, but the business situation has also improved for the first time since January.

- Capacity utilization increased from 70.4% to 74.9%, but remained below its long-term average of 83.5%.

- The current conditions index increased for the second month in a row and at a slightly higher pace compared with June, as it rose from 81.3 to 84.5. It remained significantly below the level in March (92.8).

- In the retail sector, the business situation continued to improve more rapidly than in other sectors and came back to January's level. However, business expectations inched up only by 1.3 after much more impressive growth during the last two months.

- Business climate climbed into positive territory for services and was close to zero in the retail sector. Unlike retail, expectations in the service sector also improved significantly in July.

- BMW has announced plans to offer a fuel-cell electric vehicle (FCEV) version of the X5 in 2022, with fuel-cell parts supplied by Toyota. Bloomberg first reported the news, citing BMW, noting that the i Hydrogen NEXT will receive a limited production run starting in 2022. BMW CEO Oliver Zipse said that the technology "could have the potential to become another pillar in the portfolio of BMW". The X5-based vehicle is expected to follow the specifications BMW announced earlier in relation to the fuel-cell project with Toyota (see Germany: 30 March 2020: BMW Group gives update on latest hydrogen fuel-cell development). The fuel-cell system generates 170hp, with electric motors pushing it to 374hp, and the vehicle will have two 700 bar tanks that can hold 6 kg of hydrogen. The vehicle will be based on the current G05-generation X5. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Spain reported approximately 2,255 new COVID-19 cases confirmed

on 24 July, implying a weekly number of nearly 11,000 new

infections diagnosed, four times higher than two weeks ago. (IHS

Markit Economists Raj Badiani and Laurence Allan)

- The highest number of infections occurred in Barcelona, Zaragoza and Leida. In response, Catalonia decided to close nightclubs in Barcelona, and could roll out the shutdown across the region. In Barcelona and several other regions of Catalonia, authorities have asked everyone to stay home unless for essential purposes.

- Antonio Zapatero, Madrid's senior public health official, has warned that the region will be enacting new measures. He warns the region is currently studying "limiting the size of gatherings, reducing maximum capacity and exercising stronger control over nightclubs and bars."

- More worryingly, some of Spain's top epidemiologists suggest this could be the beginning of a second wave.

- The new spike in COVID-19 cases coincides with the reopening of the tourism sector, and the impact is evolving rapidly. The UK government now demands that British holidaymakers visiting Spain must self-isolate for two weeks upon their return. This represents a significant blow to Spain's tourism sector, with UK tourists being its largest single national visitor group.

- Not surprisingly, Spain is in talks with the UK government about excluding the tourist hotspots of the Balearic and Canary Islands from the quarantine measures.

- Meanwhile, the French Prime Minister has "strongly encouraged" residents to avoid travel to Catalonia, while the Norwegian government announced it will reimpose a 10-day quarantine for anyone arriving from Spain.

- On 24 July, the Central Bank of the Republic of Turkey (TCMB)

once again held its main policy rate steady at its regularly

scheduled, monthly Monetary Policy Committee meeting. (IHS Markit

Economist Andrew Birch)

- After slashing the one-week repo rate by 1,575 basis points in nine meetings from July 2019 to May 2020, the TCMB has kept the rate at 8.25% at both the June and July meetings.

- In its press release alongside its latest meeting, the TCMB acknowledged that risks are on the upside to its current, end-year inflation forecast of 7.4%. Back in January 2020, the main policy rate fell below the prevailing rate of inflation. Since that time, annual inflation accelerated to 12.6% as of June, more than 430 basis points higher than the policy rate.

- The weekend prior to the Monetary Policy Committee meeting, the TCMB had raised foreign currency reserve requirements aimed primarily at rebuilding severely depleted foreign currency reserves. However, the move also removed approximately USD9 billion from the market, reflecting a tightening of monetary policy.

- Dubai Future Foundation (DFF) has requested investments in autonomous transport after the COVID-19 virus pandemic, reports Zavya. According to DFF, this call was made after noting the fall in demand for public transport by as much as 90% in some cities in the United Arab Emirates (UAE), thereby providing an opportunity to test autonomous vehicles without interrupting traffic flow. The Dubai Metro, tram, and marine transport were suspended for a sanitization initiative. According to a foundation report, public transport companies in Egypt have reported a 75% fall in revenue during the pandemic time, and have appealed to the government for economic support. A reduction in transport demand provides a safe opportunity for companies to test their autonomous vehicles without interrupting traffic flow. In May 2020, the UAE's Ministry of Health and Prevention (MoHAP) deployed an artificial intelligence (AI)-based autonomous shuttle to deliver personal protective equipment for people in a residential complex in Sharjah. (IHS Markit AutoIntelligence's Tarun Thakur)

- Angola's real GDP contracted by 1.8% year on year (y/y) during

the first quarter of 2020, latest statistics from the Angolan

Statistical Agency (INE) show. Oil-GDP fell by 1.7% y/y while

non-oil GDP contracted by 1.8% y/y over the period. (IHS Markit

Economist Thea Fourie)

- Sectors that showed the sharpest contraction in the non-oil segment of the economy included diamonds and other minerals, down by 5.2% y/y, trade, down by 11.6% y/y and financial services, down by 5.1% y/y.

- Sectors that showed resilience during the first quarter included manufacturing, up by 10% y/y, electricity and water supply, up by 3.9% y/y and construction activity, up by 2.9% y/y.

- The post and telecoms industry and real estate and other services continued to show growth during the first quarter.

- The latest statistics produced by the Bank of Angola (BNA) furthermore show that Angola maintained a current-account surplus of USD1.2 billion during the first quarter of 2020, from a surplus of USD1.8 billion in the fourth quarter of 2019.

- A downturn in goods exports was matched by a significant fall in import demand during period, leaving the trade balance in a surplus position of USD1.4 billion. The services account deficit combined with the primary income deficit also narrowed during over the period.

- The fall in Angola's GDP during the first quarter of 2020 exceeded IHS Markit's expectation. The slowdown in Angola's oil-GDP has not been surprising given the lower oil production levels and sharp reduction in global oil prices recorded during the first quarter of 2020. Softness in non-oil GDP exceeded our expectation, nonetheless.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.8%, Australia +0.3%, China +0.3%, Japan -0.2%, Hong Kong -0.4%, and India -0.5%.

- The Japanese yen closed at ¥105.37/USD, which is its strongest close since 12 March.

- Japan's Ministry of Finance irregularly released revisions to

corporate financial statements statistics for the first quarter of

2020 because of fewer responses for the usual survey period due to

difficulties with accounting under COVID-19-related containment

measures. (IHS Markit Economist Harumi Taguchi)

- Sales for all Japan's industrial sectors, excluding finance and insurance, were revised down from a 1.9% quarter-on-quarter (q/q) rise to a 1.7% q/q drop, and from a 3.5% year-on-year (y/y) decrease to a 7.5% y/y fall, largely reflecting sluggishness for sales in manufacturing.

- However, ordinary profits were revised up from an 11.6% q/q drop to an 8.7% q/q decline and a 32.0% y/y fall to a 28.4% y/y decrease, thanks largely to upward revisions in profits of food and beverages, chemical and chemical products, wholesale and retail sales, and information and communications.

- Investment in plant and equipment (including software) was revised down from a 6.7% q/q rise to a 3.6% q/q increase, and from a 4.3% y/y rise to a 0.1% y/y increase, largely because of downward revisions in manufacturing, particularly for electrical machinery and transportation equipment.

- South Korean OEMs have reported a 19.8% year-on-year (y/y) drop

in their combined domestic output to 1.63 million units during the

first half of 2020, reports the Yonhap News Agency, citing data

released by the Korea Automobile Manufacturers Association (KAMA).

(IHS Markit AutoIntelligence's Jamal Amir)

- It is the lowest figure since the 1.53 million units produced in the first half of 2009. Hyundai's first-half 2020 production fell 17% y/y to around 742,370 units, while its affiliate Kia posted 18.5% y/y drop to around 608,300 units.

- General Motors (GM) Korea's production plunged 31% y/y to 159,400 units. SsangYong's first-half output dipped 32.6% y/y to some 48,160. The South Korean OEMs' overseas shipments plunged 33.4% y/y to around 826,700 units in the first half, the worst record since 2002.

- In contrast, their domestic sales came to nearly 802,500 units, highlights the report.

- SsangYong has announced that it has reported a net loss of

KRW8.9 billion (USD7.4 million) in the second quarter, compared

with a net loss of KRW51.5 billion during the same period of 2019.

(IHS Markit AutoIntelligence's Jamal Amir)

- It also recorded an operating loss of KRW117.1 billion in the second quarter, compared with an operating loss of KRW49.1 billion in the same quarter of 2019.

- Sales revenue stood at KRW707.1 billion in the quarter, down by 24.4% year on year (y/y) from KRW935.0 billion in the same period of 2019.

- SsangYong's total global sales stood at 25,280 units in the second quarter, down by 28.6% y/y from 35,426 units in the corresponding period of 2019.

- Its domestic sales declined by 18.4% y/y during the period to 23,338 units and its sales in export markets plunged by 71.5% y/y to 1,942 units.

- SsangYong is struggling and has recorded a net loss for the 14th consecutive quarter in the second quarter. However, compared with the previous quarter, its net loss contracted, thanks to an uptrend in domestic sales for two consecutive months on the back of the launch of upgraded models; South Korean government's move to reduce consumption tax on passenger vehicle purchases; and a fixed-cost reduction through self-rescue plans such as the reduction in welfare and labor costs and the sale of non-core assets.

- Chinese electric vehicle (EV) startup Li Auto has launched an initial public offering (IPO) of up to USD950 million in the US. The EV maker is selling USD950-million-worth of American depositary shares (ADDS) at an indicative range of USD8-10 per share, according to Reuters, citing an updated prospectus that Li Auto filed with the US Securities and Exchange Commission (SEC) on 24 July. Private equity firm Hillhouse Capital plans to invest USD300 million in the float, the company said in the filing. The planed IPO initiated by Li Auto will make the biggest US listing by a Chinese firm this year. The EV maker's shares are set to begin trading on the Nasdaq under the symbol "Li" on 31 July. Li Auto will become the second Chinese EV startup listed in the U.S market. Li Auto's rival, NIO, successfully raised around USD1 billion with a US IPO in September 2018, at a time when investors were largely bullish on the growth potential of the Chinese EV market and held high hopes of the emergence of an Chinese EV startup to rival Tesla. (IHS Markit AutoIntelligence's Abby Chun Tu)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-july-2020.html&text=Daily+Global+Market+Summary+-+27+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}