Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 24, 2020

Daily Global Market Summary - 24 July 2020

Equities closed lower across the globe on increasing tensions between the US/China and weakness in technology stocks. The US dollar continued to sell-off and the Japanese yen rallied, while gold reached yet another record close and briefly broke through $1,900 an ounce. 10yr European government bonds were lower across the region, while 10yr US bonds closed flat.

Americas

- US equity markets closed lower today; Russell 2000 -1.5%, Nasdaq -0.9%, DJIA -0.7%, and S&P 500 -0.6%. The Nasdaq was the worst performer on the week, at -1.3% week-over-week.

- 10yr US govt bonds closed flat/0.59% yield.

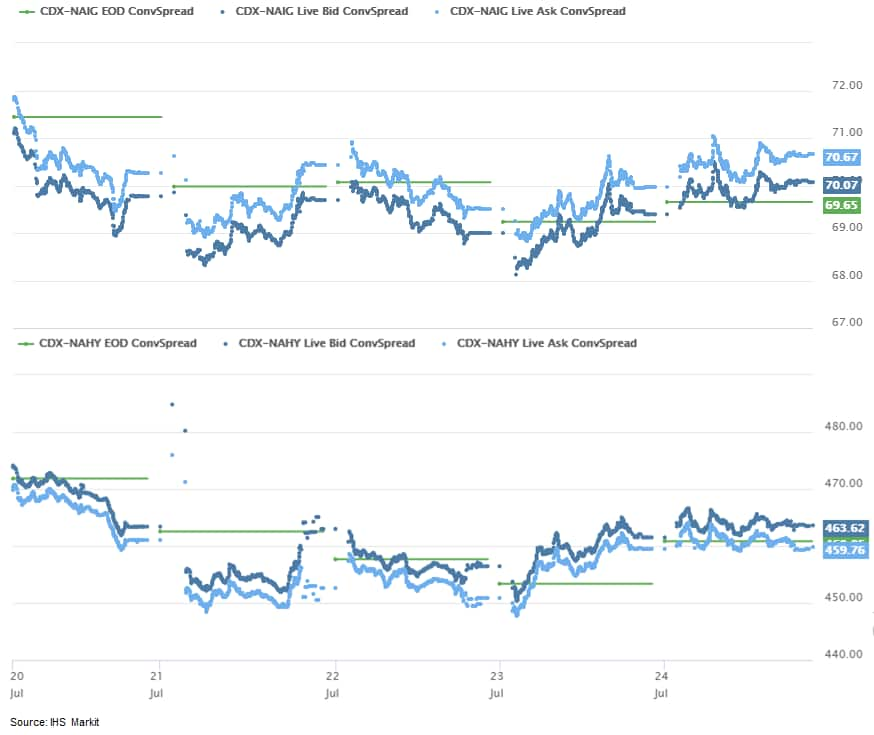

- CDX-NAIG closed +1bp/70bps and CFX-NAHY +1bp/462bps, which is

-1bp and -10bps, respectively, week-over-week.

- Crude oil closed +0.5%/$41.29 per barrel.

- Gold breached $1,900 per ounce at 9:30am EST and closed at +0.4%/$1,897 per ounce, which is a new all-time high close.

- DXY US dollar index closed at -0.4%/94.35, which was near its lowest point of the day.

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 50.0 in July, up from 47.9 at the

end of the second quarter, signaling a stabilization in private

sector output. (IHS Markit Economist Siân Jones)

- Manufacturers signaled the first improvement in operating conditions since February in July, as the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI) posted above the 50.0 neutral mark at 51.3, up from 49.8 in June.

- The seasonally adjusted IHS Markit Flash U.S. Services PMI™ Business Activity Index registered 49.6 in July, up from 47.9 in June.

- Despite some states reversing or pausing their decision to reopen the economy due to a sharp uptick in new COVID-19 cases, both manufacturers and service providers continued to move on an improving trajectory.

- New business, however, was weighed down by reports of challenging demand conditions, especially among service providers, with some struggling with the reintroduction of lockdown measures.

- Service sector firms registered a faster decline in new orders in July.

- In contrast, manufacturing firms signaled the strongest expansion in new orders since January.

- New export orders fell only fractionally in July, with manufacturers recording a marginal rise in foreign client demand.

- US new home sales sizzled in June, soaring 13.8% (±17.8%) to a

seasonally adjusted annual rate of 776,000—a 13-year high. The

reading was not statistically significant, however (90% confidence

intervals). (IHS Markit Economist Patrick Newport)

- Second-quarter sales were down 3.5% from the first quarter; quarterly sales better gauge activity than monthly sales because they are better measured.

- Sales for the prior three months were revised down a cumulative 3,000.

- The number of units for sale dropped 4,000 to 307,000; completed homes for sale came in at 69,000, down 4,000.

- The months' supply of unsold homes fell 0.8 months to 4.7 months.

- The median price in the second quarter fell to 315,500—1.8% below the year-earlier level; the average price was down 2.3% year on year at $366,900.

- The report states: "the Census Bureau has monitored response and data quality and determined estimates in this release meet publication standards."

- The Census Bureau this morning (24 July) also released data on housing permits at the state level. Year-to-date single-family housing permits were higher in 37 states this year compared with last year. Nationally, year-to-date housing permits were 1.5% higher than in 2019.

- Bottom line: This report and the new construction report suggest that COVID-19 dealt the market for single-family new homes a glancing blow and that activity in many states was back to normal in June. This is a brighter picture than the one presented by the employment situation report, which showed the two major residential categories, residential building and residential specialty trade contractors, regaining 307,000 jobs in May and June, after losing 457,000 jobs in March in April.

- One in three renters in the US failed to make their full payment in the first week of July, an Apartment List survey showed. Nearly 12 million renters could be served with eviction notices in the next four months, according to an analysis by advisory firm Stout Risius Ross. And in some cities, like New York and Houston, more than a fifth of renters say they have "no confidence" in their ability to pay next month. (Bloomberg)

- According to IHS Markit Animal Health's database of early-stage

funding, the number of deals executed in the industry this year has

declined so far. (IHS Markit Animal Health's Joseph Harvey)

- In the first six months of 2020 - a period that will be forever synonymous with the COVID-19 pandemic -we tracked 12 investment deals for start-ups.

- For the same period last year, this number totaled 28. However, despite a decline in actual deals, investors' enthusiasm and willingness to chase opportunities in the animal health space has not waned.

- The conference panelists said there had been no slowdown in the number of investment prospects they have seen in recent months. However, Digitalis Ventures' partner Cindy Cole said her firm is carrying out a lot more due diligence on prospective investments to combat concerns about a lack of face-to-face connection.

- Maarten Goossens - co-founder and principal at Anterra Capital - suggested it is hard to financially back a team without meeting in person.

- Nevertheless, as well as guiding existing portfolio companies through this crisis, investors have been scrutinizing the industry segments that have been accelerated by the pandemic.

- One of these areas is biosecurity and infectious diseases, according to Rob Readnour - managing director at Mountain Group Capital Partners. "Infectious disease was off everybody's radar screen as a general theme and now everybody cares about it," he noted. Naturally, with the prominence of COVID-19, zoonotic diseases have been getting more recognition in the media and from investors.

- The pandemic has also highlighted technological gaps across the global food supply chain and brought the concept of One Health to the fore. There is a direct link between infectious diseases and the need for improved point-of-care diagnostics for food animals.

- Farmers across the US are keen to install biodigesters, solar

panels, wind turbines and other renewable technologies to produce

on-farm energy but need more help from Congress, USDA and EPA to

make the needed investments, experts told the House Agriculture

Subcommittee on Commodity Exchanges, Energy and Credit on Thursday

(July 23). (IHS Markit Food and Agricultural Policy's JR Pegg)

- Jim Falk, a Minnesota-based farmer and representative of the National Farmers Union was joined on the panel by three other farmers who have implemented on-farm energy systems and farm conservation systems using private financing along with federal tax credits and support programs. The issue is of growing importance given the push to reduce greenhouse gas emissions and the desire to improve farm profitability - some 15% of production costs for US farms are tied up in energy costs.

- Mike McCloskey, the founder and chairman of Far Oaks Farm in Indiana, detailed how his dairy operations are using two digesters to process cow manure and local pre-consumer food waste into electricity, compost and fertilizer and to create renewable biogas to fuel its commercial fleet of 42 tractor trailers. There are 254 digesters operating on livestock farms across the US including 204 on dairy farms, McCloskey said.

- Lawmakers on the panel voiced support for on-farm renewable energy programs but offered little insights into any actions they might take to help farmers invest in the underlying technologies. House Agriculture Committee Chair Collin Peterson (D-Minn.) said there "is no question" that the efforts are important and viable but voiced concern about subsidies. "The problem has been to make the economics work long-term," Peterson said. "It has to be able … at some point stand on its own. There has to be a light at the end of the tunnel. It can't be something the government subsidizes forever."

- Volkswagen (VW) has announced that it is opening up its Industrial Cloud to manufacturing and technology partners, aiming to optimize production processes. VW is working with Amazon Web Services for the cloud and Siemens as an integration partner. According to a VW statement, opening the cloud will enable a rapidly growing range of industrial software applications for VW's plants. Using an app store approach, each location will be able to obtain applications for its machinery, tools and equipment from the Industrial Cloud. VW says partner companies will be able to scale and further develop their applications and optimize their own processes and products. The Industrial Cloud system is based on AWS technology, including internet of things, machine learning, data analytics and computing services, specific to the requirements of VW and auto manufacturing. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Sasol says that the last remaining production unit to come online at the company's Lake Charles Chemicals Project (LCCP) in Louisiana, the site's low-density polyethylene (LDPE) plant, will start up before the end of October 2020. Sasol had previously said the plant would be onstream by the end of September. The 420,000-metric tons/year LDPE plant was damaged during a fire in January 2020. "Repair work to the unit is tracking well and the unit is expected to achieve beneficial operation before the end of October," Sasol says. "Some challenges to restore the unit have caused a slight delay to the previous market guidance of end-September." During the time of the delay to the LDPE unit's start-up, the ethylene produced by the LCCP steam cracker and destined for the unit is being sold externally, Sasol says. The projected earnings of the LCCP complex in the fiscal year ending June 2021 will only be impacted by the loss in the margin of ethylene to LDPE, the company says. An insurance claim process is under way and the first insurance proceeds have been received.

- Brazil's Minister of Economy Paulo Guedes presented on 21 July a proposal for tax changes. Guedes's proposal was not the comprehensive reform previously promised, instead focusing on combining two federal social security taxes - the Program of Social Integration (PIS) and the Contribution for the Financing of Social Security (COFINS) - into a 12% value-added tax to be levied on goods and services. Notably, the proposal left out the promised unification of multiple sale taxes levied at local and regional levels. Guedes said that his proposal represents only the first phase of tax reform, with unification of local and state taxes to occur subsequently. The heads of Congress have endorsed the proposal, emphasizing the importance of simplifying Brazil's complex tax system. In Brazil, tax compliance procedures take about 2,000 work hours, compared with 100 in the United Kingdom. (IHS Markit Country Risk's Carlos Caicedo)

- As per IHS Markit's Commodities at Sea, Chilean iron ore and concentrates shipments during the first half of 2020 stood at 7.1mt, almost double from previous year levels. The rebound in Chilean iron ore shipments this year is on the back of the resumption of loading activities from Guacolda Terminal 2 starting from Jan 2020, which was after a gap of more than 13 months and strong Chinese demand for high-grade iron ore cargoes. In terms of import countries, in the first half of this year out of total iron ore & conc exports around 88% went to China, and rest was shipped to Japan, Algeria, USA, and South Korea. In terms of vessel segments, Newcastlemax and Capesize in the first half of this year garnered share of 25% (vs 16% a year ago) and 69% (vs 67% a year ago), respectively in total tonnage shipped outside Chile. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

Europe/Middle East/ Africa

- European equity markets closed lower; Germany -2.0%, Italy -1.9%, France -1.5%, UK -1.4%, and Spain -1.2%.

- 10yr European govt bonds closed lower across the region; France/Spain +4bps, Germany +3bps, and Italy/UK +2bps.

- iTraxx-Europe closed flat/58bps and iTraxx-Xover +7bps/346bps, which is -2bp and -22bps, respectively, week-over-week.

- Brent crude closed +0.1%/$43.34 per barrel.

- The flash IHS Markit Eurozone Composite PMI rose further in

July from the all-time low of 13.6 seen back in April, climbing

from 48.5 in June to 54.8. This was the first reading above the

50.0 no-change level since February and indicated the largest

monthly gain in output since June 2018. (IHS Markit Economist Chris

Williamson)

- Both manufacturing and services returned to growth (the latter recording the slightly stronger performance), with growth hitting 23- and 25-month highs respectively. While the rise in service sector output was the first since February, the increase in factory production was the first reported since January 2019.

- French companies led the upturn, reporting a second successive month of output gains, with growth surging to the fastest since January 2018. Both manufacturing and services reported the best output growth for two-and-a-half years.

- In Germany, output rose for the first time since February, increasing to an extent not seen for almost two years. A surge in services activity (the largest gain for two-and-a-half years) was accompanied by a more modest manufacturing output increase. The factory output gain was nonetheless the best seen for nearly two years, fueled by a marked jump in exports.

- The rest of the region outside of France and Germany also saw output return to growth, led by manufacturing, though the overall gain was more modest than seen in France and Germany.

- The concern is that the recovery could falter after this initial revival. Firms continued to reduce headcounts to a worrying degree, with many reporting that underlying demand is insufficient to sustain the recent improvement in output.

- The flash IHS Markit/CIPS composite UK PMI, based on around 80%

of normal replies received from the monthly surveys, jumped from

47.7 in June to 57.1 in July, smashing through consensus

expectations and heralding the first return to growth since

February. The expansion was the largest recorded since June 2015.

(IHS Markit Economist Chris Williamson)

- Manufacturers led the expansion, reporting a second month of rising production, with the rate of growth spiking to the highest since November 2017. Service sector business activity meanwhile rose for the first time since February, growing at the sharpest rate since July 2015.

- The ongoing decline in backlogs of work (albeit the weakest since February) indicates the persistence of spare capacity relative to demand. Hence July saw yet another sharp cut to employment levels as increasing numbers of companies scaled back their operations, notably in consumer-facing sectors.

- Factory headcount losses continued to moderate. Although easing on the recent highs seen at the height of the lockdown, the overall rate of job culling remained only slightly weaker than the peaks seen during the height of the global financial crisis.

- Encouragingly, business sentiment about the coming year improved for a fourth successive month, rising in July to the highest since February. Brighter prospects were recorded across both manufacturing and services (although in many cases merely reflecting the hope that things cannot get any worse than current conditions).

- UK retail sales continued to recover in June after the

reopening of non-essential stores from the middle of the month.

Retail sales (including fuel sales) in volume terms increased by

13.9% month on month (m/m) in June, after a 12.3% m/m gain in May.

In annual terms, they were 1.6% lower than in the same month a year

earlier. (IHS Markit Economist Raj Badiani)

- The level of retail sales in June was just 0.7% below the February level prior to the coronavirus disease 2019 (COVID-19) virus-related lockdown.

- June's monthly gain was primarily due to rises in non-food store and fuel sales, up 45.5% m/m and 21.5% m/m, respectively.

- Non-store retailing continued to increase in volume terms during June, rising by 21.0% m/m. It now accounts for around one-third of all retail spending. In addition, the volume of non-store retailing was 53.6% higher when compared with February.

- The ONS reports that some retail sectors are continuing to struggle. Sales on the high street, or in physical shops, remain one-third lower when compared with pre-lockdown levels. Indeed, spending in non-food stores only partially recovered from strong falls during the pandemic to remain 15.0% lower than February's level.

- The volume of sales decreased by 9.5% in the three months to June when compared with the previous three months, with the only sectors enjoying positive outcomes being food stores and non-store retailing.

- The South African Reserve Bank (SARB) cut its policy rate by 25

basis points during the monetary policy committee meeting held on

22-23 July. This brings the central bank's cumulative interest rate

reduction to 300 basis points since the beginning of the year. (IHS

Markit Economist Thea Fourie)

- The SARB expects South Africa's headline inflation to average 3.4% in 2020, rising to 4.3% in 2021-22, close to the mid-point of the SARB's inflation target range of 3-6%. The risk to the inflation outlook moved to balance from marginally positive previously.

- Food price pressures are expected to remain contained, while the feed-through of the weaker exchange rate of the South African rand on overall headline inflation is expected to remain limited.

- Higher electricity tariffs and other administrative prices and rising fiscal spending pose a risk to the medium-term inflation trajectory.

- The SARB revised its forecast for South Africa's GDP to a 7.2% contraction in 2020, from a 7.0% contraction previously.

- South Africa's GDP is expected to recover to growth of 3.7% in 2021 and 2.8% in 2022.

- Investment spending, exports, and imports are expected to show sharp contractions during 2020. Furthermore, the SARB expects job losses to increase during the year.

- The SARB's Quarterly Projection model indicates one cut of 25 basis points in the repo rate in the fourth quarter of 2020, and that this will remain unchanged in the first quarter of 2021.

Asia-Pacific

- APAC equity markets close lower across most of the region; China -3.9%, Hong Kong -2.2%, Australia -1.2%, South Korea -0.7%, and India flat.

- The Japanese yen has rallied significantly versus the US dollar over the past day, closing +0.8% at ¥105.98/USD today:

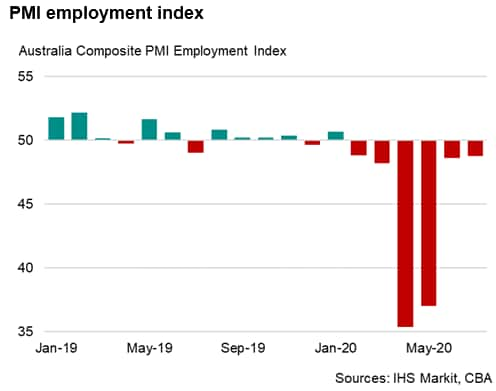

- The Commonwealth Bank Australia Flash PMI, compiled by IHS

Markit and covering both the manufacturing and service sectors,

rose sharply from 52.6 in June to 57.9 in July, indicating the

fastest increase in private sector output for over three years.

(IHS Markit Economist Bernard Aw)

- Services continued to lead the recovery at the start of the third quarter. Growth in services activity accelerated to a record pace during July as the gradual reopening of parts of the economy following a relaxation of COVID-19 restrictions led to more businesses returning to work.

- Survey data also showed a broadening of the recovery, with manufacturing output returning to growth in July, ending a ten-month period of decline.

- Companies reported that the lifting of restrictions and resumption of construction activity were factors behind the rise in factory production.

- The rise in overall business activity was accompanied by a further strengthening in demand. Total new orders rose sharply in July, with the rate of increase the strongest for three years. Australian services continued to lead the improvement in demand while orders for manufacturing products returned to growth.

- Furthermore, with firms battling to stay in business and

seeking to reduce costs, employment numbers were cut further in

July, albeit at the slowest pace since February. Any further lack

of capacity pressures will continue to dampen labor market

prospects.

- According to Australia's' Treasurer Josh Frydenberg, the

government's stimulus measures to battle the effects of the

COVID-19 virus pandemic amount to a total of AUD289 billion (14.6%

of GDP) and have driven a widening of the projected FY 2020-21

underlying cash budget shortfall to AUD184.5 billion, or 9.7% of

GDP. (IHS Markit Economists Bree Neff and Hannah Cotillon)

- Due to the fiscal expansion, the government expects gross central government debt to rise to a projected 45% of GDP by June 2021, up from 27.8% of GDP in June 2019.

- Other extensions focused more on workers. Extensions were granted for the wage subsidy program (JobKeeper) and the Coronavirus Supplement to the existing JobSeeker scheme. JobKeeper wage subsidies will continue until March 2021 but payments will be reduced after September.

- With the unemployment rate having risen to 7.4% in June, and the labor force participation rate still hovering around 20-year lows, the decision to extend these programs was not a difficult one.

- Despite some criticism from the opposition, Labor leaders appear to support the changes, while the Australian Council of Trade Unions and industry groups have publicly stated their support for the extension of both programs.

- Ratings agencies will watch Australia's subsequent fiscal consolidation plans, and if they are insufficient to rein in debt accumulation, Australia could be threatened by a downgrade out of its top-notch credit rating (AAA on the generic scale). Since the start of the pandemic, both Fitch and S&P Global Ratings have put Australia's sovereign credit ratings on Negative outlook over concerns about the medium-term fiscal consolidation path.

- Total profits in China's nonfinancial state-owned enterprises

(SOE) increased 6% year on year (y/y) in June, the first expansion

since the beginning of this year and close to last year's level,

according to a release by the Ministry of Finance (MOF) on 23 July.

Year-to-date profits remained in 38.8% y/y contraction, up 13.9

percentage points from May. (IHS Markit Economist Yating Xu)

- Faster recovery in operating revenue led profits to rise in June. Operating revenue rose 7.1% y/y compared to a 6.2% y/y increase in operating cost. Meanwhile, cost and expenses to profits ratio fell by 0.1 percentage points compared to the same period last year.

- The headline profit improvement was entirely led by rebound in local government controlled SOEs, which recorded a y/y expansion of 19.5%, compared to a 2.0% y/y decline in central government controlled SOEs.

- Liability to asset ratio increased by 0.3 percentage point to 64.6% by the end of June, entirely due to the rise in local government controlled SOEs.

- Strong recovery in nonfinancial SOE profits suggested a rebound in industrial profits, which cover both SOE and private sectors and is set to come out on 28 July. SOE has lagged behind private sectors in profit recovery since March.

- Total issuance of urban construction investment bonds increased

30% year on year (y/y) in the first half, exceeding CNY2 trillion

(USD285.7 billion), reports Caixin citing China Chengxin Credit

Rating Group, China's first and largest credit rating agency. The

net financing amount excluding the matured bonds in the first half

was CNY1.1 trillion, close to the size of the whole year of 2019.

(IHS Markit Economist Yating Xu)

- Urban construction investment bonds are kind of China's quasi-municipal bonds with their issuers being local government financing vehicles (LGFVs) and supported by local government through subsidies and capital injections. It serves as an important financing source for government led investment projects.

- Meanwhile, local governments issued CNY2.37 trillion of special-purpose bonds through June, accounting for 63% of the total quota set for the whole year.

- As China's central bank may slowdown the pace of policy easing in the next half given the strong than expected second-quarter growth, financing environment is likely to be less supportive to urban construction investment bond issuance. Meanwhile, there is an expected CNY1.2 trillion of investment bonds to come due in the second half, which may add to refinancing pressure for local governments.

- Great Wall Motor has reported a 25.7% year-on-year (y/y) decline in net profit during the first half of 2020. The automaker's net profit reached CNY1.15 billion (USD163.8 million) during the period, compared with CNY1.55 billion in the first half of 2019, according to a company filing with the Hong Kong Stock Exchange. Its net profit attributable to shareholders of the company fell by 24.0% y/y to CNY1.15 billion from CNY1.51 billion in the same period of 2019. Total operating income stood at CNY35.9 billion, down 13.17% y/y, in the first half of the year. Great Wall's net profit shrank substantially during the first half due to a sharp drop in its vehicle sales. The automaker's sales fell by 20% to 395,097 units in the first half of the year as auto demand weakened because of the coronavirus disease 2019 (COVID-19) virus pandemic. The automaker also attributed to the net profit decline to higher research and development costs associated with new products. (IHS Markit AutoIntelligence's Abby Chun Tu)

- COVID-19-related shutdowns and demand declines dampened South

Korea's economy more than expected in the second quarter of 2020.

Real GDP fell by 3.3% (12.7% annual rate) compared with the first

quarter. (IHS Markit Economist Dan Ryan)

- The contraction was mostly due to exports, which fell by 17% from the prior quarter, a loss of more than USD100 billion. The global pandemic was reducing demand among South Korea's trading partners.

- Interestingly, private consumption actually increased, although not nearly enough to offset the decline of the previous quarter. The second-quarter rise verifies that South Korean policy-makers' efforts to contain the virus were largely successful.

- Other sectors' changes were small and mixed, except for imports that showed a large decline. This mainly represents the raw and intermediate goods used by manufacturers and thus fell along with exports.

- Kia has announced that its net profit plunged 75.0% year on

year (y/y) to KRW126 billion (USD104.94 million) in the second

quarter of 2020 (April-June), down from KRW505 billion during the

same period of 2019. (IHS Markit AutoIntelligence's Jamal Amir)

- Operating income declined 72.8% y/y to KRW145 billion during the quarter.

- Sales revenue during the period fell by 21.6% y/y to KRW11.37 trillion, down from KRW14.51 trillion in the same period last year.

- Kia's South Korean unit accounted for 38.6% of the second-quarter 2020 sales revenues, while its North American and European operations contributed around 30.2% and 17.7%, respectively.

- Its Indian unit accounted for 1.9% of the sales revenues, while other regions contributed 11.6% of total revenues during the period.

- At the end of the second quarter, Kia's total assets were KRW58.34 trillion, while its liabilities totaled KRW29.44 trillion.

- Kia posted a 28.8% y/y plunge in its global vehicle sales (on a retail basis) to around 527,000 units in the second quarter. Of this total, Kia's South Korean sales accounted for 162,000 units, up 26.8% y/y.

- Its sales in the United States declined 25.5% y/y to 125,000 units, while its sales in Western Europe nosedived 52.0% y/y to 65,000 units.

- Its Chinese sales also remained under pressure, down 26.4% y/y to 57,000 units during the period.

- The automaker's sales in India stood at 8,000 units, while its sales in "other general markets", including the Middle East and Africa, Russia, Latin America, and Asia Pacific, were down 52.5% y/y to 110,000 units.

- VE Commercial Vehicles Limited (VECV), a joint venture (JV) between Volvo and Eicher Motors, has introduced connected vehicle technology, called Eicher LIVE, across its entire commercial vehicle (CV) product portfolio. The automaker announced in a statement that from 1 August, the trucks and buses built on the EUTECH 6 platform will be equipped with pre-fitted hardware. Vinod Aggarwal, managing director and chief executive officer (CEO) of VECV said, "The unique proposition of connected vehicles is a significant step towards modernizing the CV industry. Starting with Eicher Live, then the uptime center and now with 100% connected vehicles, we are closing the loop on providing a connected ecosystem for tomorrow, which is driven by the BS VI wave. These offerings will not only reduce the operational cost by maximizing fuel efficiency but will also increase revenue through improved asset utilization with superior uptime. It will also offer better safety and logistical efficiency to our partners and customers. Large fleet customers who have high demands of fuel efficiency, safety and driving behavior as critical elements will be able to maximize their productivity and profitability. This technology will not only benefit the big logistics players but also the last mile vehicles as effectively." The automaker will offer free data connectivity for the first two years. (IHS Markit AutoIntelligence's Isha Sharma)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-july-2020.html&text=Daily+Global+Market+Summary+-+24+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}