Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 29, 2020

Daily Global Market Summary - 29 June 2020

US and European equity markets closed higher today, despite the day beginning with APAC markets ending lower across the region. iTraxx credit indices closed higher across IG and high yield, while CDX-NAIG closed tighter and CDX-NAHY wider. 10yr US government bonds rallied, while 10yr German bunds were slightly weaker. The markets will continue to be focused on the speed of the growth of new COVID-19 cases in the southern and western US, as well as tomorrow's quarter/month-end which includes congressional testimony by Fed Chairmen Powell and Treasury Secretary Mnuchin. The US holiday shortened week also includes the release of the FOMC minutes on Wednesday and several other major economic reports, including the non-farm payrolls report on Thursday.

Americas

- US equity markets closed higher today, ending the day with a micro surge occurring across indices during the last 10 minutes of the trading session; Russell 2000 +3.1%, DJIA +2.3%, S&P 500 +1.5%, and Nasdaq +1.2%.

- Boeing closed +14.4% on the news of today's first of several 737 Max regulatory certification flights, which helped drive the DJIA's outperformance today.

- 10yr US govt bonds closed -2bps/0.63% yield.

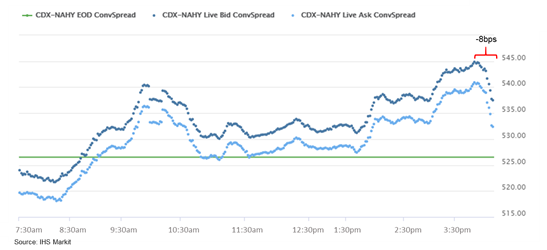

- CDX-NAIG closed -2bps/79bps and CDX-NAHY +8bps/534bps. Similar

to the US equity market, US credit indices rallied shortly before

the 4:00pm EST equity close, with CDX-NAHY tightening 8bps between

3:55-4:55pm EST:

- The Federal Reserve Bank of New York today announced at 1:30pm EST today that the Primary Market Corporate Credit Facility (PMCCF) is operational and available for use beginning June 29. The PMCCF provides a funding backstop for corporate debt to eligible issuers and is available to (i) purchase qualifying bonds as the sole investor in a bond issuance and (ii) purchase portions (up to 25%) of syndicated bonds at issuance ("co-investor" transactions). (New York Federal Reserve)

- A coronavirus cluster in New York linked to a graduation ceremony and parties in Chappaqua, NY has reached 13 confirmed cases, New York State Gov. Andrew Cuomo announced Monday morning. A person who recently traveled to Florida attended the Horace Greeley High School graduation ceremony and parties and began showing symptoms of the coronavirus, officials said. The person later tested positive for COVID-19. There were 336 graduating seniors at the ceremony, as well as family, friends and staff. (Patch)

- Crude oil closed +3.1%/$39.70 per barrel.

- Chesapeake Energy said in a Sunday statement that it had filed for bankruptcy protection. "Chesapeake intends to use the proceedings to strengthen its balance sheet and restructure its legacy contractual obligations to achieve a more sustainable capital structure," the company said, adding that it will continue to operate as normal while it goes through the chapter 11 process. (Barron's)

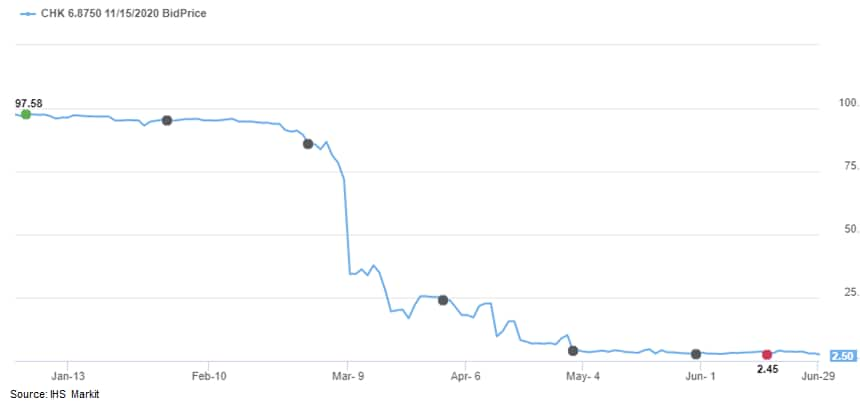

- Chesapeake Energy's 6.875% 11/2020 bond issue began 2020 at a

price of 97.55 on 1 January, but closed -97.2% YTD at a bid price

of 2.75 today. The below chart from Price Viewer shows the bond's

rapid decline in price that began in early-March:

- The US Pending Home Sales Index (PHSI) jumped a record 44.3% to

99.6 from an all-time low. It stands 10.6% below February's value

and 5.4% below its year-earlier reading. (IHS Markit Economist

Patrick Newport)

- The regional gains were also stratospheric, ranging from the Midwest's 37.2% advance to the West's 56.2%.

- COVID-19 hit the Northeast hard. That may explain its still low reading, 61.5 or 33.2% below the May 2019 value. COVID-19 cases in the Northeast have dropped sharply in recent weeks, so the Northeast index will likely post another double-digit gain next month.

- The index for the South, which accounted for 44% of existing home sales in May, was 1.9% above its year-earlier reading. COVID-19 cases have risen sharply in Florida, Texas, and a few smaller southern states. This could put the brake on sales in the next two months.

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors (NAR). Expect a solid bounce back in existing home sales in June or July or both.

- Pending home sales rebounded sharply in May, and weekly mortgage applications for home purchases through the first half of June point to a further firming in June. This suggests more existing home sales and brokers' commissions in the second quarter than previously forecast. As a result, we raised our tracking forecast of second-quarter GDP growth by 0.1 percentage point to -35.6%.

- Autonomous truck startup TuSimple seeks USD250 million in funding from investors to stand up among increasingly crowded pool of rivals, reports TechCrunch. To support this, the company has hired investment bank Morgan Stanley, which recently sent potential investors an informational packet that contains a snapshot of TuSimple and an overview of its business model. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry. The company currently has about 40 vehicles in its test fleet and expects that fully autonomous operations can be achieved in 2021. In August 2019, UPS's venture capital arm, UPS Ventures, invested an undisclosed amount in TuSimple. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- General Motors (GM) Defense has announced the award of a USD214.3-million US Army contract to provide the Infantry Squad Vehicle in a company statement. The Infantry Squad Vehicle (ISV) is based on the 2020 Chevrolet Colorado ZR2 mid-size pick-up truck and uses 90% off-the-shelf parts. The Army is approved for 2,065 vehicles initially. GM Defense says the vehicle is a light and agile all-terrain troop carrier to move a nine-soldier infantry squad, and that it is light enough to be sling loaded from a UH-60 Blackhawk helicopter and compact enough to fit into a CH-47 Chinook helicopter. Standard parts include multimatic dual spool-valve dampers and Chevrolet Performance suspension components. The vehicles will use GM's 186-hp 2.8-litre Duramax turbo-diesel engine and six-speed automatic transmission. The statement notes that GM partnered with Ricardo Defense after the US Army awarded three USD1 million contracts to competing providers to develop prototypes. Ricardo Defense will provide key product logistics support and fielding requirements. Although this is not a large contract in terms of volume, it shores up GM's business with the US military and is a win for GM Defense, established in 2018. (IHS Markit AutoIntelligence's Stephanie Brinley)

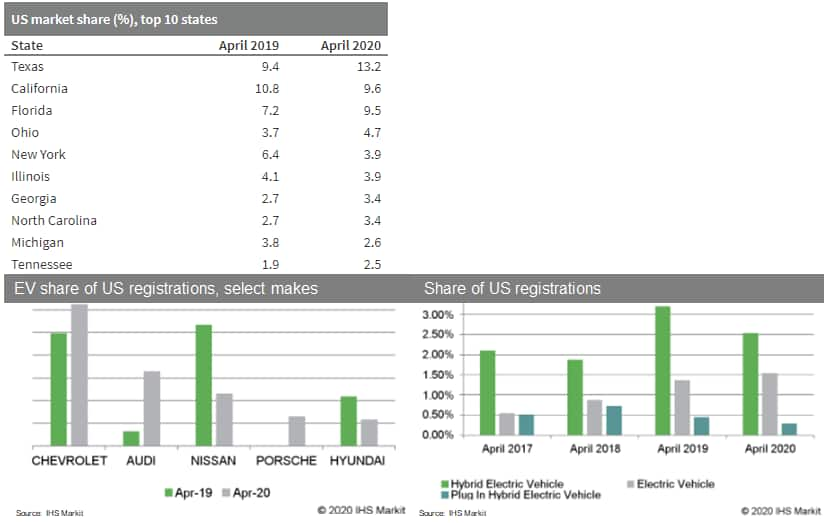

- US consumer trends in the type of new vehicles purchased in

April largely followed the trends set in 2019 and during the first

few months of 2020, despite data from IHS Markit's US vehicle

registration data indicating a 48% y/y decline in April on

government COVID-19-pandemic-related restrictions on auto sales and

production across the country during the month. The top 10 states

by auto sales in the United States in April 2020 was reshuffled

versus April 2019, as New Jersey, Pennsylvania, and Oklahoma

dropped out of the top ten, while Georgia, North Carolina, and

Tennessee entered the list. In April 2020, 1.5% of US registrations

were electric vehicles (EVs), only slightly up from 1.4% a year

earlier. Hybrid electric vehicles (HEV) saw their share drop from

3.2% to 2.5%. Plug-in hybrid electric vehicles (PHEVs) also

continue to see a market share decline. In April 2018, PHEVs

accounted for 0.7% of US registrations, which dropped to 0.4% in

April 2019 and to 0.3% in April 2020. Non-electrified powertrains

saw a small increase in share in April 2020 to 95.6%, from 95.0% in

April 2019. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/ Africa

- European equity markets closed higher today; Italy +1.7%, Spain +1.4%, Germany +1.2%, UK +1.1%, and France +0.7%.

- 10yr European govt bonds closed slightly higher across the region except for Germany +1bp and Spain flat; Italy, France, and UK all -1bp on the day.

- iTraxx-Europe closed -1bp/70bps and iTraxx-Xover -11bps/396bps.

- Brent crude closed +2.2%/$41.85 per barrel.

- National Petrochemical Co. (Perochem; Riyadh, Saudi Arabia) says the board of its subsidiary Saudi Polymers Co. has decided to shut down permanently its polystyrene (PS) manufacturing complex at Jubail, Saudi Arabia, and write down its value. Saudi Polymers, in which Petrochem has 65% and Arabian Chevron Phillips the rest, says the move reflects difficulties in achieving profits amid challenging market conditions in PS markets worldwide. The company expects the closure to have an impact of up to 277 million Saudi riyals ($73.9 million) on its second-quarter financial results.

- BP has agreed to sell its petrochemicals business to Ineos for

$5 billion, encompassing the whole of BP's worldwide aromatics,

acetyls, and related businesses.

- Ineos says it will pay $4 billion on completion with the remaining $1 billion deferred until June 2021 "at the latest."

- A deposit of $400 million will initially be paid to BP by Ineos, with a further $3.6 billion on completion, with the transaction expected to be completed by the end of the year subject to regulatory and other approvals, BP says.

- An additional $1 billion will be deferred and paid in three separate installments of $100 million in March, April, and May 2021, with the remaining $700 million payable by the end of June 2021, it says.

- Ineos Styrolution, the wholly owned styrenics subsidiary of Ineos, will be the formal acquirer of BP's businesses.

- Proceeds from the sale will be used by BP for general corporate purposes.

- BP's petchems segment is focused on two main businesses, aromatics and acetyls, with interests in 14 manufacturing plants in Asia, Europe, and the US

- In 2019 the business produced 9.7 million metric tons of petrochemical products, says BP.

- The company has a "strong presence in growth markets in Asia," it says. The sale will also include related interests, such as the chemical recycling technology BP Infinia and the company's interest in acetylated wood developer Tricoya.

- The businesses included in the transaction together employ more than 1,700 staff worldwide, with these employees expected to transfer to Ineos on completion, BP says.

- The McDonald's fast food chain has announced that it will offer electric vehicle (EV) charging points at its drive-through restaurants in the United Kingdom, according to the South Wales Argus. The restaurant chain will offer fast chargers, which it stated could charge a vehicle to 80% in under 20 minutes. The company is partnering with infrastructure provider Instavolt. Commenting on the partnership McDonald's UK and Ireland CEO Paul Pomroy said, "This partnership and ambition takes advantage of our scale, and is a real step forward for those already driving electric vehicles, as well as people considering making the switch. With over 1,300 restaurants our ambition would mean you would never be far from a charging point. Our ultimate ambition is to have more EV charging points on our premises than any other company in the UK and Ireland." The lack of public charging infrastructure remains a key objection to EV ownership and this kind of initiative is required if the UK is to have any hope of meeting its ambitious target of banning the sale of new gasoline (petrol) passenger cars by 2035. It is also a good PR initiative for McDonald's, whose public image is sometimes at odds with green or progressive values. (IHS Markit AutoIntelligence's Tim Urquhart)

- Germany's Federal Statistical Office (FSO) has reported, based on data from various regional states, that the country's national consumer price index (CPI) increased by 0.6% month on month (m/m) in June. This is 0.3-0.4% firmer than the average monthly increase seen in June in recent years and boosts the inflation rate from 0.6% to 0.9% y/y, returning to the rate observed in April. The EU-harmonized CPI measure increased by 0.7% m/m, in this case raising its year-on-year (y/y) rate from 0.5% to 0.8%. (IHS Markit Economist Timo Klein)

- Spanish annual consumer price inflation remained below zero for

the third straight month in June, according to a flash release from

the National Statistics Bureau (Instituto Nacional de Estadística:

INE). The European Union-harmonized consumer price inflation for

Spain stood at -0.3%, compared to a 49-month low of -0.9% in May.

(IHS Markit Economist Raj Badiani)

- The less negative inflation rate in June is primarily because of a lower y/y percent decline in global crude oil prices and domestic energy related prices. Specifically, Dated Brent crude oil price decreased by 37.6% y/y to average USD40.1 per barrel (bbl) during June, and this compares to drops of 58.7% y/y in May and 74.1% y/y in April.

- The average rate of inflation in the first six months of 2020 stood at zero, compared to 1.1% in the corresponding period a year ago. This signifies a welcome boost to household purchasing power, helping to alleviate some of the pressure on household incomes arising from substantial job losses due to the lockdown to contain the COVID-19 virus.

- Inflation in June was higher than expected, with IHS Markit estimating -0.9% in the June forecast update. A key factor was global crude oil prices in June overshooting our estimate. We expect to raise our 2020 inflation forecast of -0.5% moderately in the July update.

- South Korean automaker Kia has partnered with Spanish oil company Repsol to deploy charging points for electric and plug-in hybrid vehicles in Spain. Repsol will install charging points at Kia's 220 points of sale in Spain. Meanwhile, Kia will offer its customers in Spain the option to install Repsol electric vehicle charging infrastructure in their homes. The companies have previously partnered to launch the car-sharing service Wible in Spain. Wible launched its service in August 2018 by deploying a fleet of 500 Kia Niro plug-in hybrid vehicles in Madrid (Spain) and currently has over 170,000 active users. Wible is the fourth car-sharing service in Madrid along with Car2Go, Emov, and Zity. (IHS Markit Automotive Mobility's Surabhi Rajpal)

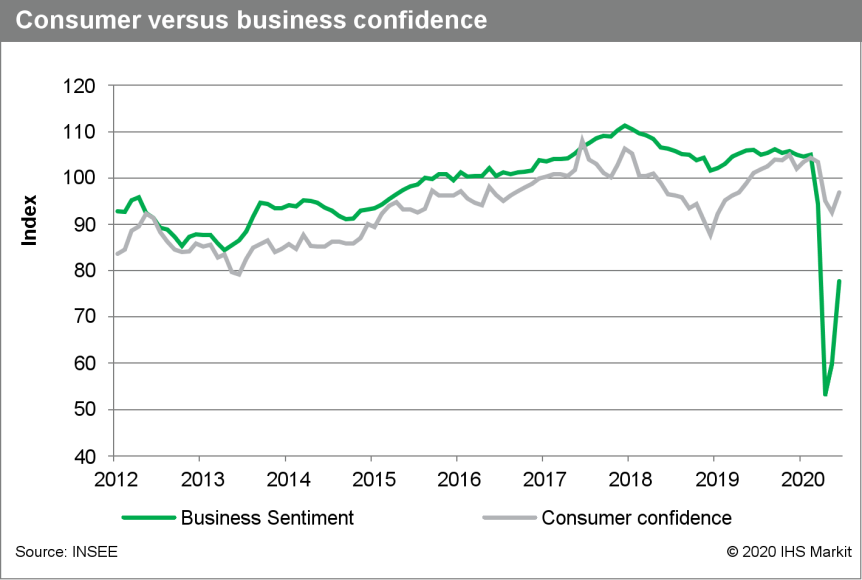

- France's consumer confidence index, published by the INSEE,

stood at 97 in June. The index rose from 93, which had been the

lowest reading since January 2019. (IHS Markit Economist Diego

Iscaro)

- The most encouraging message from the survey was the large increase in the index measuring households' major purchasing intentions over the coming year, which rose by 30 points to -14. June's increase in the index was the largest since the data started to be collected, although the index remains 4 points below their level in February 2020.

- The indices measuring households' financial situation and the economic general situation over the coming year also improved strongly in June, although the later remains very depressed by historical standards.

- Not so positively, households' perceptions on the labor market conditions continued to worsen in June, with the index measuring expected unemployment over the coming year rising to its highest value since 2013. June's reading of 89 is not far from the sub-index all-time low of 85 in 2009.

- Households' savings intentions also increased in June to a level not seen since April 2013. This came hand in hand with a large rise in the index measuring expected saving capacity, which stood at a survey-high in June.

- So far, consumer confidence has held up considerably better

than business sentiment during the COVID-19 virus pandemic. It is

likely that the large fiscal support targeted to sustain the income

of those hit by the pandemic helped to limit the impact on

households' confidence.

- Construction of Gazprom's ice-resistant platform (ICP) to be installed in the Kamennomysskoye-Sea field in the Bay of Ob, in the Russia Arctic commenced on 25 June. A foundation-laying ceremony was held at Southern Shipbuilding and Repair Center's (SSRC) shipyard in the Astrakhan Region. SSRC is a company of the United Shipbuilding Corporation (USC). The topsides comprises main and auxiliary drilling modules, gas processing facilities, and living quarters for 120 people. A total of 33 directional wells will be drilled from the platform. The topsides will be installed on a gravity-based foundation, secured to the muddy seabed with 56 2m-wide piles. The entire platform is estimated to weigh 40,000 metric tons, excluding piles. Final assembly will take place at USC's Kaliningrad's yard, with sailaway anticipated in the summer of 2024. First gas from the Kamennomysskoye-Sea is expected in 2025. The extracted gas will be treated at an onshore comprehensive gas treatment unit before entering the Unified Gas Supply System. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

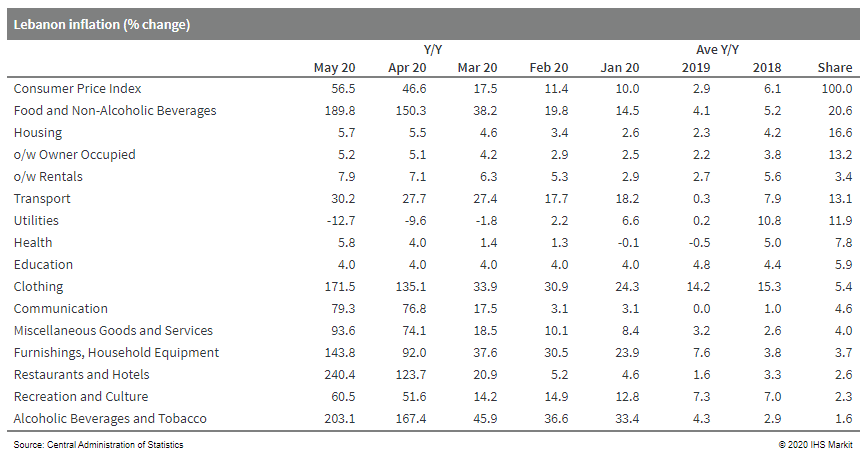

- Lebanon's Central Administration of Statistics (CAS) recently

released a backlog of consumer price inflation (CPI) data, showing

that inflation surged to 47% year-on-year (y/y) in April and 57%

y/y in May, after 10-18% y/y from January to March. Inflation began

rising since nationwide protests erupted in October 2019, but it

has soared since April as the dollar shortage worsened and demand

for food rose during lockdowns imposed in response to the COVID-19

pandemic. (IHS Markit Economist Ana Melica)

- Food prices (especially imported food), forming one-fifth of the index, contributed the most to headline inflation (25 percentage points of 57%). They surged 190% y/y in May; that is, food prices increased 2.9 times compared to a year earlier. Prime Minister Diab recently warned of the risk of a food security crisis in Lebanon.

- The next largest contribution came from clothing prices, which surged 172% y/y and contributed 5.5 percentage points. This was followed by transport; furnishings, household equipment and routine household maintenance; and restaurants and hotels.

- Import prices (particularly food) have surged as the Lebanese

pound has depreciated and food demand soared during the lockdown.

The notable exception, and only category to decline, were utility

prices. These fell 12.7% y/y, reflecting lower fuel costs as global

oil prices collapsed.

- Global Fund to Fight AIDS, Tuberculosis and Malaria has released a new report estimating that countries most affected by HIV, tuberculosis and malaria urgently need USD28.5 billion to protect the gains achieved in the fight against these diseases in the past two decades, and warning that deaths from HIV, TB and malaria could "as much as double" if urgent action is not taken. The report, entitled Mitigating the impact of COVID-19 on countries affected by HIV, Tuberculosis and Malaria. It highlights the impact of the COVID-19 virus pandemic on healthcare resources and on efforts to tackle HIV, TB and malaria, which cumulatively still kill more than 2.4 million people annually, despite considerable progress since 2002. It warns that if resources are not reinforced and health systems are overwhelmed by COVID-19, the significant gains made could be reversed. The warnings underscore the potentially catastrophic impact of the current pandemic on healthcare systems in low-income countries, aside from the direct death toll from COVID-19 infections. (IHS Markit Life Science's Sacha Baggili)

Asia-Pacific

- APAC equity markets closed lower across the region; Japan -2.3%, South Korea -1.9%, Australia -1.5%, Hong Kong -1.0%, and China/India -0.6%.

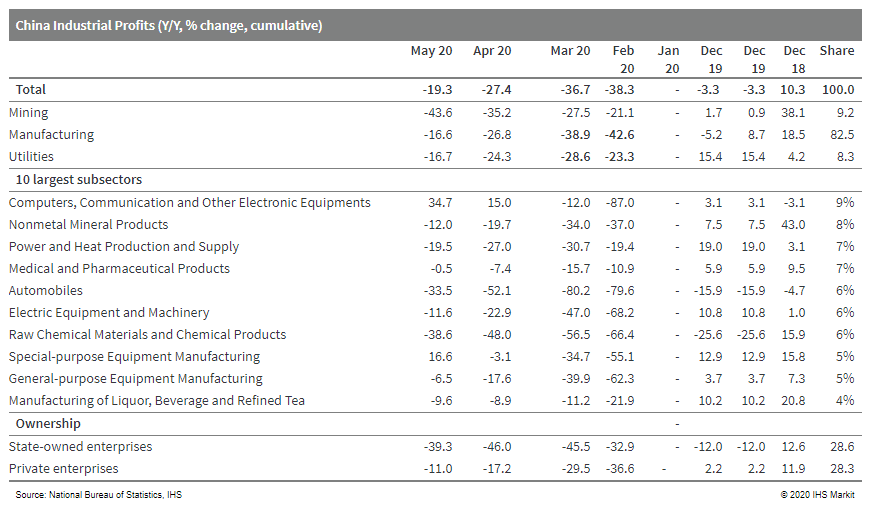

- Chinese industrial profit rose 6.0% year on year (y/y) in May,

the first expansion since December last year, according to the

release by the National Bureau of Statistics (NBS). (IHS Markit

Economist Yating Xu)

- The profits in the five months remained in 19.3% y/y contraction, narrowing from 27.4% through April. The improvement was largely due to the easing cost pressure as the increase in unit operating cost fell 83% from the increase in April.

- Deeper deflation in industrial input prices compared to that in industrial output prices drove up the profitability.

- Sharp increase in investment revenue continued to contribute to the headline profit growth. The profit margin in May registered 6.82%, up 1.15 percentage points from April and 0.29 percentage point from a year ago.

- Revenue growth moderated in May despite of acceleration in industrial production.

- By sector, 20 among the 41 surveyed sectors report y/y profit increase in May, down from only 23 in April. Profit performance varied across sub-sectors as equipment manufacturing and electronics maintained strong growth and auto manufacturing continued to recover with policy incentives, while upstream sectors such as mining, chemical, and steel remained in deep contraction and consumption manufacturing such as clothes, leather and beverage are yet to recover.

- Inventory pressure continued to ease as the increase in inventory of finished goods slowed from 10.6% y/y at the end of April to 9.0% in May, but it remained at high level since 2015.

- Industrial profits improved across ownership, with private

sector leading the recovery while state-owned enterprises lagged

behind. The average liability-to-asset ratio at 56.9% was 0.1

percentage points up from the end of April, the third consecutive

months of the increase.

- According to data by the China Banking and Insurance Regulatory

Commission (CBIRC) for the first quarter of 2020, the NPL ratio for

the largest banks in China was 1.39%, while the NPL ratios for city

commercial banks, privately owned banks, and rural commercial banks

were 2.45%, 1.14% and 4.09%, respectively. However, the data do not

match with the data reported by the NAO, which is likely because of

the different grouping used by the two official bodies. (IHS Markit

Economist Angus Lam)

- The NAO's finding of 16 banks under-reporting the NPL ratio is concerning for several reasons. Although the loan moratorium introduced by the regulators at the start of the year to reduce the impact of the coronavirus diseases 2019 (COVID-19)-virus outbreak on borrowers and banks and the delay in classifying unpaid loans from micro, small, and medium-sized enterprises (MSMEs) as non-performing are likely to have contributed to the mis-reporting, smaller banks' larger proportion of MSME loans is a cause for concern.

- The combination of lower provisioning coverage ratios of 149.89% and 121.76% for city commercial banks and rural commercial banks, respectively (compared with around 160% for large banks), and their lower capital adequacy ratios of 12.65% and 12.81%, respectively, means that these banks are already under pressure from a rise of NPLs from MSMEs, but this risk is further exacerbated by the under-reporting of actual NPLs.

- Overall, the risk of these banks failing is somewhat curbed by the recent official announcement that the government is looking to use part of the COVID-19 bonds to inject capital into smaller banks.

- The US-based investment company Carlyle Group has announced that it will acquire a 20% stake in Piramal Pharma, the pharmaceutical arm of India's Piramal Enterprises. According to Indian newspaper The Telegraph, the stake will be purchased for USD490 million. Greg Zeluck, co-head of Carlyle Asia Partners' advisory team, said, "India is a hugely strategic part of Carlyle's Asia business, and a market where we continue to see many attractive investment opportunities." The transaction will translate into an enterprise value of USD2.775 billion for the pharma business. It is also reported that the transaction agreement includes "an upside component of up to USD36 million", which will depend on the company's performance during the current fiscal. The transaction is expected to be completed in 2020. (IHS Markit Life Science's Sacha Baggili)

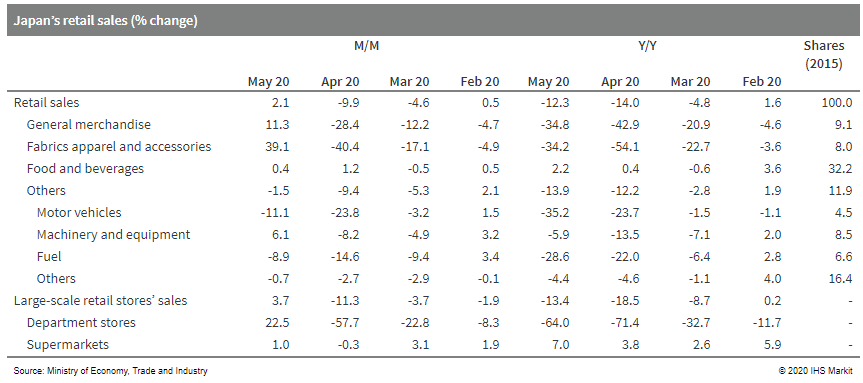

- Japan's retail sales rose by 2.1% month on month (m/m) in May

following two straight months of decline, but the year-on-year

(y/y) figure continued to fall, moving down 12.3%. (IHS Markit

Economist Harumi Taguchi)

- The improvement largely reflected increases in sales of general merchandise, particularly for department stores (up 22.5% m/m) and fabrics apparel and accessories, reflecting easing containment measures in response to the lifting of the state of emergency.

- Rises were largely offset by continued declines in sales of motor vehicles and fuel because of containment measures and low gasoline prices.

- Although stay-home/working-from-home lifestyles helped lift

sales of household appliances and other machinery and equipment,

the new lifestyles also weighed on sales of cosmetics and sales of

convenience stores, reflecting the largest decline in sales of

lunch/snack and soft drinks.

- Toyota Group has announced its global production figures for

May 2020. It reported a 56.5% year-on-year (y/y) decrease in

overall output to 408,842 units. The figure includes output at its

subsidiaries Daihatsu Motor and Hino Motors. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- According to data released by the automaker on its website on 29 June, worldwide output of the Toyota brand was down by 54.4% y/y to 365,909 units last month, Daihatsu's output was down by 69.8% y/y to 36,336 units, and Hino's production declined by 58.7% y/y to 6,597 units.

- By region, Toyota Group's production fell by 56.1% y/y in the domestic market to 164,858 units and by 56.7% y/y in overseas markets to 243,984 units.

- Japanese output of the Toyota brand was down by 57.0% y/y to 122,744 units. Volumes for Daihatsu were down by 53.1% y/y to 36,252 units, while those for Hino were down by 54.5% y/y to 5,862 units during May.

- In overseas markets, the production volume of the Toyota brand during May was down by 53.0% y/y to 243,165 units, and Daihatsu posted a 99.8% y/y decline to 84 units while Hino's output declined by 76.3% y/y to 735 units.

- In the year to date (YTD; January-May), Toyota's global production declined by 28.9% y/y to 3.253 million units.

- The Toyota brand's YTD output was down by 29.5% y/y to 2.724 million units.

- YTD production for Daihatsu was down by 24.1% y/y to 469,682 units and for Hino by 34.7% y/y to 58,857 units.

- By region, total YTD production in Japan declined by 21.8% y/y to 1.532 million units, while production outside Japan declined by 34.2% y/y to 1.720 million units.

- Mazda will resume both day and night shift operations at all its Japanese plants by the end of July with no suspensions planned, according to a company statement. As a result, production volume in July will recover to up to 80% of the levels in July last year. In Japan, the Ujina plant No. 1 & 2 and Hofu plant no. 2 will begin double shift operations from 1 July while Hofu plant no.1 will begin operations in both shift from 27 July. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The government of South Korea has extended the temporary cut in consumption tax on passenger vehicles by another six months, reports the Yonhap News Agency. The government reduced consumption tax on purchases of passenger vehicles to 3.5%, from the previous 5%, between March and June 2020. It has now extended the tax cut until December. South Korean consumers will continue to receive a maximum KRW1.43 million (USD1,187) price cut when buying a new car. (IHS Markit AutoIntelligence's Jamal Amir)

- NagaCorp Ltd., a Phnom Penh integrated casino and resort

operator, has brought a rare frontier market deal and only the

second bond deal from Cambodia. (IHS Markit Economist Brian Lawson)

- On 26 June, it placed USD350 million of four-year bonds with a 7.95% coupon and issue price of 98.167%.

- It had become the country's first issuer in 2018 with USD300 million of 9.125% bonds due in May 2021 priced at the time to yield 9.625%: the new sale will fund the redemption of the prior offering with any residual being for general corporate purposes.

- According to the Gambling Insider website, the company has curtailed its activities because of the COVID-19 virus pandemic, but claims to hold 18 months of operating liquidity at its reduced operating levels.

- After temporarily closing in April, the firm is now running its Naga 1 hotel at reduced capacity, with Naga 2 remaining closed. The company is also developing Naga 3, a facility with several thousand more hotel rooms.

- Prior performance had been favorable, with the firm having grown its gaming revenues and net profit by 20% and 33%, respectively, in 2019 versus 2018, to USD1.7 billion and USD521.3 million: the company recorded compounded annual growth rates over the five-year period to 2019 of 34% and 31% in gross revenues and net profit.

- Vietnam's GDP growth rate slowed to a pace of 0.36% year on

year (y/y) in the second quarter of 2020, as domestic lockdown

measures and the international travel ban hit economic activity

despite the very low number of total COVID-19 cases recorded in the

first half of 2020. (IHS Markit Economist Rajiv Biswas)

- In the second quarter of 2020, primary industries output grew at a pace of 1.72% year on year (y/y), while manufacturing output grew by 1.38% y/y. However, service sector output recorded a contraction of 1.76% y/y.

- For the first half of 2020, the Vietnamese economy grew by 1.81% y/y, helped by first-quarter GDP growth of 3.68% y/y. Industrial production in the first half of 2020 rose by 2.8% y/y, although retail sales declined by 0.8% y/y while exports fell by 1.1% y/y.

- In the first half of 2020, manufacturing output was up 4.6% y/y, helped by a 9.8% y/y increase in output of computer, electronic, and optical products, notably a 12.8% y/y rise in output of communications equipment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-june-2020.html&text=Daily+Global+Market+Summary+-+29+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+29+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}