Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 26, 2020

Daily Global Market Summary - 26 June 2020

US equity markets closed sharply lower today, as investors continue to weigh the negative financial implications of another wave of COVID-19 driven closures in the US versus those closures potentially increasing the likelihood of another round of substantial government stimulus. Most APAC equity markets closed higher, while European markets were higher for most of the day before dropping from intraday peaks around 7:00am EST and most closing lower on the day. Credit indices closed lower across Europe and the US, while US Treasury bonds and German bunds closed higher on the day.

Americas

- Texas Gov. Greg Abbott rolled back some reopening plans and Florida reported a nearly 80% increase in daily coronavirus cases, as the U.S. marked a daily record of nearly 40,000 new infections. Florida, along with Texas, California and Arizona, accounted for nearly half of record-breaking 39,972 confirmed Covid-19 cases reported on Thursday, according to data from Johns Hopkins University. (WSJ)

- US equity markets closed sharply lower; DJIA -2.8%, Nasdaq -2.6%, and S&P 500/Russell 2000 -2.4%.

- US Treasury curve closed higher and flattened on the day; 10yr US govt bonds closed -4bps/0.65% yield and 30yr bonds -6bps/1.38% yield.

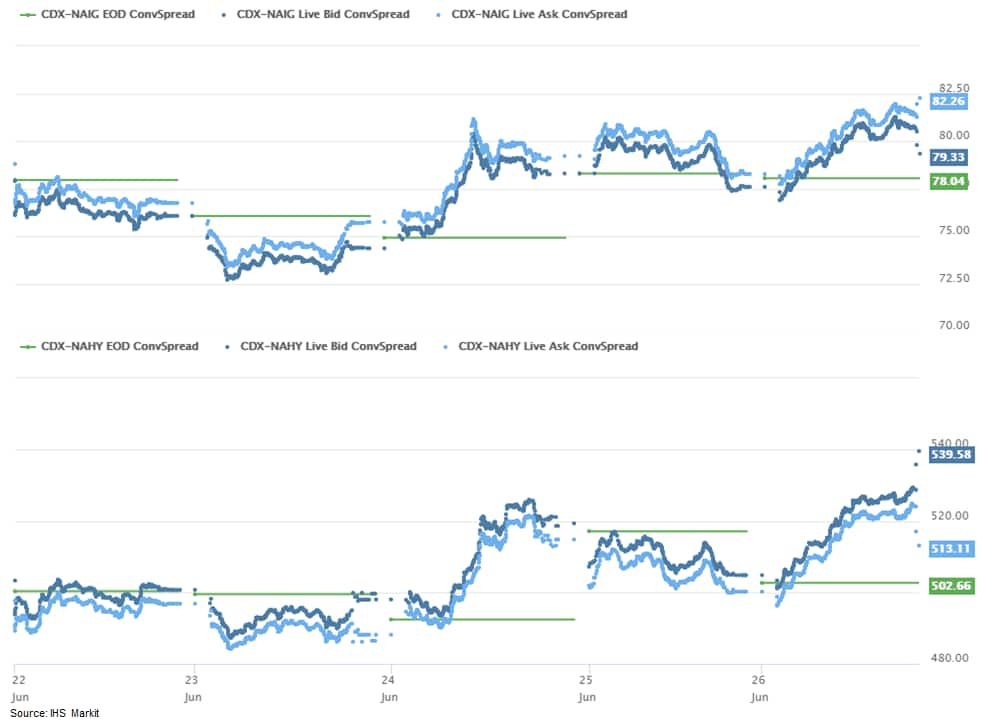

- CDX-NAIG closed +3bps/81bps and CDX-NAHY +24bps/526bps, which

is +3bps and +26bps on the week, respectively.

- US investment groups led by Bill Foley and Quentin Koffey have made a $7bn unsolicited bid to buy CoreLogic, a real estate data analytics company, marking the first large hostile takeover attempt during the coronavirus pandemic. Cannae Holdings, headed by Mr Foley, and Senator, where Mr Koffey is a partner, have offered to pay CoreLogic's shareholders $65 a share, a 23 per cent premium to the data group's closing stock price on Thursday, to acquire the California-based company. (FT)

- Crude oil closed -0.6%/$38.49 per barrel.

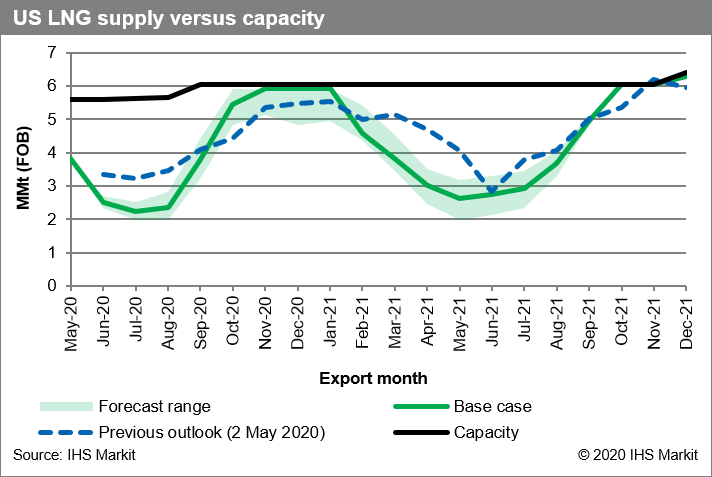

- In the span of two months, US liquefaction utilization has

plummeted from nearly 100% in the first half of April to 44% by

mid-June as many customers have cancelled cargoes in response to

weak LNG market prices. (IHS Markit Energy Advisory's Roger Diwan,

Terrell Benke, Gautam Sudhakar, and Matthew Shruhan)

- Feed gas deliveries to US LNG facilities have fallen accordingly to less than 4 Bcf/d.

- The magnitude of the turndown confirms US LNG's ability to act as a major swing producer when the LNG market is oversupplied.

- With market fundamentals pointing to persistently narrow or negative US LNG price differentials in the near term, IHS Markit has substantially lowered its US LNG production outlook for this summer and much of 2021.

- IHS Markit expects utilization of US liquefaction capacity to average less than 50% from June through September 2020 as offtakers are likely to cancel more cargoes than previously anticipated and projects hold back discretionary volumes.

- Out of 80-90 cargoes per month that would have likely been produced during this period, our revised base case outlook implies approximately 50 cargoes per month cancelled from June through August and approximately 35 in September.

- The more significant change is to our 2021 outlook. Instead of

confining US LNG supply cuts to the typically lower-priced summer

and shoulder months, we now expect the US LNG turndown to extend

into parts of the winter as substantially higher Henry Hub prices

and continued depressed LNG market prices squeeze short-run US LNG

economics.

- Amazon has acquired autonomous vehicle (AV) startup Zoox for about USD1.2 billion, according to Financial Times. According to two unnamed sources familiar with the matter, Amazon would work with Zoox to create a ride-hailing fleet to compete with Waymo. Amazon and Zoox were reported to be in advanced talks last month over the former's acquisition of the latter. The acquisition will help the e-commerce giant's efforts to automate its business. Amazon is stepping up its efforts in the AV sector, as eliminating the cost of a human driver could make delivery services far cheaper. Last year, Amazon invested in Series B funding of AV startup Aurora and tested autonomous trucks developed by Embark to haul cargo on the I-10 highway in the United States. (IHS Markit Automotive Mobility's Nitin Budhiraja)

- US personal income decreased 4.2% in May and real disposable

personal income (DPI) declined 5.0%. The decrease in personal

income primarily reflected fewer "economic impact payments" made to

individuals as most of these were disbursed in April. Partially

offsetting the decrease in other government social benefits was an

expansion in unemployment insurance benefits, which rose $825.3

billion at an annual rate in May. (IHS Markit Economists James

Bohnaker and David Deull)

- A 2.7% increase in wages and salaries also provided some positive offset to personal income as a net 2.2 million workers were added to payrolls in May. Continued rehiring will be crucial for personal income as federal assistance dwindles in the coming months.

- Consumers resumed spending in May as stay-at-home orders and business restrictions began to ease. Real personal consumption expenditures (PCE) rose 8.1% month over month—considerably more than we had expected—driven largely by a 28.4% surge in durable goods spending. We revised up our estimate of second-quarter real PCE growth 5.5 percentage points to -36.7%.

- With outlays partially catching up with personal income in May, the personal saving rate eased from 32.2% to 23.2%.

- The core PCE price index edged up 0.1% in May after declines in the previous two months, yet the 12-month change held steady at 1.0%.

- Despite the strong initial rebound in consumer spending in May, fading fiscal support and rising numbers of positive cases of COVID-19 in many states are likely to prevent a completely smooth recovery in the second half of 2020.

- The US University of Michigan Consumer Sentiment Index rose 5.8

points (8.0%) to 78.1 in June after only marginal improvement in

May. The index was 22.9 points beneath its February peak. (IHS

Markit Economists David Deull and James Bohnaker)

- The final June reading of consumer sentiment showed an 0.8-point retreat from the preliminary reading. Survey collection concluded on 22 June. The period between the initial and final readings coincided with an alarming resurgence in confirmed cases of COVID-19, particularly in some southern and western states.

- Changes in consumer sentiment diverged sharply by region in June. Consumer sentiment in the Northeast region, where new confirmed cases of the virus have generally continued to decline, jumped by 19.1 points to 81.7—from the bottom of the pack to the top. In contrast, consumer sentiment in the South and West rose by only 0.5 and 3.3 points, respectively.

- The current conditions index recovered 4.8 points in June, to 87.1, while the expectations index regained 6.4 points to 72.3.

- Consumer sentiment rose 6.5 points to 81.6 among households earning more than $75,000 a year and rose 4.3 points to 73.4 for lower earners.

- Buying conditions improved across the board in June. The index of buying conditions for large household durable goods rose 10 points to 115, still depressed relative to its pre-COVID-19 range.

- The index of buying conditions for homes was close to its 2019 range after an 11-point increase to 130, and the index of buying conditions for vehicles climbed 9 points to 140—the highest since June 2018—amid low interest rates.

- Consumer sentiment regained some ground in June because of the reopening of states and businesses, but recent developments in the spread of the disease reinforce that the path to recovery will be rocky and inconsistent between regions.

- The quota report released by the US Customs and Border

Protection (CBP) shows quota status on Monday, 22 June 2020. All

major steel demand sectors are being pummeled by the COVID-19

pandemic: i.e., automotive, energy, construction, and machinery.

Around 17% of NAFTA steel capacity has been idled and industry

capacity utilization has fallen to around 54%; however, this is now

up on the low of 52%. This indicates the severity of demand

destruction that has taken place. It does however point to that

fact that mills are continuing to operate and that demand is

returning, albeit slowly. (IHS Markit Pricing and Purchasing's

William May)

- Import quotas of blooms, billets, and slabs from Brazil reached 100% full by the start of June, continuing the trend we have seen since the quota system was established in 2019. The appreciation of the US dollar has made imported steel more competitive, perhaps boosting demand for blooms, billets, and slabs in April.

- Weakness in oil prices has undermined the import market of certain oil country tubular goods (OCTG) product categories, such as Argentinian Oil Country Pipe and Tube (99038018), which has seen only 0.8% of its quota used in the second quarter. However, South Korean OCTG (99038018) will finish the quarter around 61% filled. Brazilian Pipe and Tube (99038045) fared better earlier on in the quarter with demand filling 86.6% of its quota by the start of June. Since then, however, there have been no further imports from Brazil.

- Despite weakness in fabricated structures and automobile manufacturing so far this year, flat-rolled products have been performing relatively well. Both Korean and Brazilian flat-rolled products have seen demand (>98% of quota filled), although this is not comparable to 2019 demand levels where these major categories would fill mid-quarter. This year has so far benefitted Brazil, South Korea, and Argentina who chose to accept quotas vs. tariffs, which has made them 25% more competitive than European products, for example.

- Bellwether CBOT wheat futures continued to languish near nine-month lows early this week as an approaching large 2020 world harvest kept bulls on the defensive. Nearby CBOT July recently slipped to the upper USD4.70's per bushel - still some way off the sub-USD4.20 post-harvest bottom of September 2019 when both world production and carryover stocks were smaller than this year's (forecast) levels. A couple of private Russian crop forecasts added to bearish sentiment, coming in higher than the recent USDA forecast of 77 million tons and strengthening ideas that the top exporter would remain a formidable force in pricing (usually among the cheapest)for the season ahead. Better than expected yields from the early US winter wheat harvest also encouraged some selling along with a two-point rise to 52% in 'good/excellent' ratings for the 70% or so still in the field (albeit still below last year's at this point). More supportive was news that French soft wheat, the EU's largest export source, remained in far worse condition than last year, the lowest rated for over a decade. The Commission also cut its total EU soft wheat crop forecast by 4.3 mln to 117.2 mln tons and exports by 1.5 mln to 25 mln tons versus last year's upwardly revised 34 mln. There have also been some concerns about US spring wheat ratings, declining from an excellent start under spreading drought conditions in more northerly US states where the bulk of the crop is grown. Some rain on the radar may help. Quality hard spring wheats made up about 27% of last year's total US wheat crop. There have also been some rumblings about Canada's quality spring wheat crop facing dryness, especially in key province Saskatchewan although there too, forecast rain may soon bring some relief. (IHS Markit Food and Agricultural Commodities' John Buckley)

- The central bank of Mexico (Banco de México: Banxico) on 25

June cut the policy rate by 50 basis points to 5.0%. This is the

fifth cut during 2020 and the fourth during the pandemic. At the

beginning of the year the policy rate stood at 7.25%, while

inflation was 2.8%. (IHS Markit Economist Rafael Amiel)

- Deteriorating economic and financial conditions have prompted further action from Mexico's monetary authority. In April, Banxico announced additional measures to strengthen the credit channels, provide liquidity, and foster an orderly functioning of financial markets. Combined with measures previously announced, the monetary stimulus now amounts to MXN750 billion (USD30.7 billion), or 3.3% of GDP.

- Although overall inflation is at 3.2%, core inflation, which excludes some agricultural products and energy-related items, is currently at 3.7%.

- Banxico targets inflation at 3% +/- 1 percentage point; inflation is currently at 3.2%, which is close to the center of the targeted band. IHS Markit assesses that the deep recession the country is going through will be the dominant force in the equation and thus inflation will remain subdued during the rest of the year.

- As of April, Chile's economy has lost 0.85 million jobs

compared with the end of 2019; this accounts for approximately 10%

of the total jobs. The worst-affected sectors include artistic,

entertainment, and recreation activities (-32.4% employment),

accommodation and food services (-21.1%), and household activities

(-19.2%). (IHS Markit Economist Ellie Vorhaben)

- Chile was on a generally upward trend in terms of job creation through January 2020. As global economic growth slowed and the number of COVID-19 cases increased, job losses began in February and have accelerated since then.

- The Chilean economy is estimated to have declined by 14.1% annually in April because of a 15.5% decline in non-mining activity and a -0.1% decline in the mining sector.

- There are not yet many indicators of economic growth for May, but IHS Markit anticipates that it could be as bad or worse as April because of falling copper exports, which will dampen the relatively robust mining sector.

- As of 24 June, Chile had 254,416 confirmed cases and 4,731 deaths, making it the third worst impacted country in Latin America, behind Brazil and Peru. On 20 June, Codelco, the state-owned copper mining company, announced that it would be suspending work in mines in the region of Antofagasta because of rising case counts and safety concerns.

- Belize's governing United Democratic Party will hold its

leadership convention on 12 July to replace Prime Minister Dean

Barrow ahead of the November 2020 general election, Amandala

newspaper reported on 21 June. The process overlaps with Belize's

request to negotiate an interest payment deferral on its

US-dollar-denominated 2034 sovereign bond with about USD526.5

million outstanding amid a COVID-19-virus-related collapse of its

tourism sector; failure to reach an agreement on the bond will

increase non-payment and technical default risks in 2020. (IHS

Markit Economists Paula Diosquez-Rice and Kari Pries)

- Bondholders likely to push for an early agreement on negotiation terms. Belize's bondholders responded in an 18 June statement that they had formed a creditor committee to study the government's request, which is likely to be discussed through early July giving ample time before the 20 August interest payment deadline.

- Belize's political cycle increases non-payment risks if the bond renegotiation agreement is delayed beyond mid-July. Barrow has served the maximum number of terms under Belize's constitution and has stated that he will step down before the 2020 electoral campaign to allow his successor time to settle in and establish an individual platform. If bondholder negotiations extend beyond the 12 July United Democratic Party (UDP) leadership convention, as is likely, it is likely that Barrow's successor will request to participate in the bond renegotiation process.

- Rejection by a majority of bondholders would cause Belize to face outright default or force it to make a payment despite acute economic dislocation, increasing pressure on its scarce resources.

Europe/Middle East/ Africa

- Most European equity markets closed lower except for UK +0.2%, but all closed near the lows of the day; Spain -1.3%, Germany -0.7%, Italy -0.6%, and France -0.2%.

- 10yr European govt bonds closed mixed; UK +2bps, France/Italy/Spain flat, and Germany -2bps.

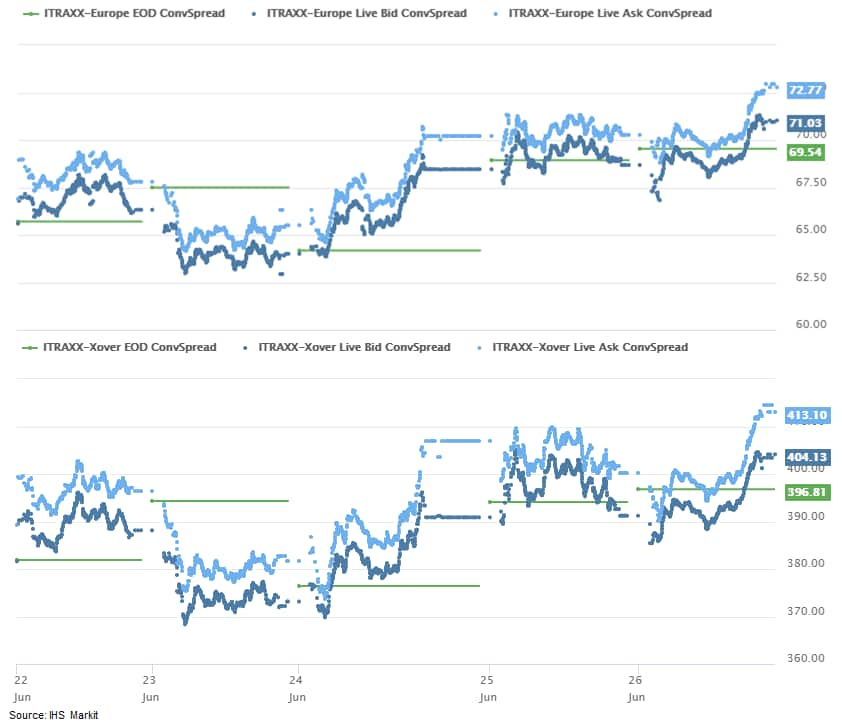

- iTraxx-Europe closed +2bps/72bps and iTraxx-Xover

+12bps/409bps, which is +6bps and +27bps on the week,

respectively.

- Brent crude closed -0.5%/$40.93 per barrel.

- The European Union moved closer to recommending that travelers from the U.S. shouldn't be allowed to enter the bloc even after July 1, according to a draft decision being considered by governments. Diplomats have agreed on a provisional list of 15 countries, including Canada, Japan, Australia and South Korea, that should be allowed into the EU because their level of new Covid-19 cases meets the bloc's safety criteria, according to a draft seen by Bloomberg. Chinese residents will also be allowed to visit the EU, on the condition that Beijing confirms that it will also allow European citizens to travel to China, according to the document. (Bloomberg)

- Volvo and Waymo have announced a partnership with the goal of developing an autonomous vehicle (AV) designed for ride-hailing use, according to a joint statement made by them. Waymo is now the "exclusive" Level 4 partner of Volvo Car Group and the first project will be to integrate Waymo's fully AV technology into an "all-new mobility-focused electric vehicle platform for ride-hailing services". The strategic partnership includes Volvo Car Group as well as affiliates Polestar and Lynk & Co, according to the statement. Volvo also has an agreement with Uber, although Uber's AV development slowed after a fatal accident in 2018 and against the cost cutting measures introduced to offset the lost revenues owing to the COVID-19 virus in the first half of 2020. However, according to Reuters, Volvo will continue to provide vehicles to Uber, despite it not working with Uber on AV deployment. The statement issued on 25 June was brief and did not indicate when or where the first vehicle would be deployed, production location, or timing; it also does not yet indicate whether the vehicle would be operated in a Volvo or a Waymo fleet. Volvo was previously working with Uber on AVs. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Passenger car production in the United Kingdom dropped significantly in May as some automakers continued COVID-19-virus-related stoppages. According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), output in May dropped by 95.4% year on year (y/y) to just 5,314 units. Of this, 4,260 units were designated for export, a decline of 95.5% y/y, and 1,054 units were for domestic sale, down 95.2% y/y. The drop has meant that year-to-date (YTD) volumes are now down by 41.7% y/y to 557,295 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Spanish vehicle production remained weak in May despite the

resumption of output following COVID-19-virus-related stoppages.

According to data published by the Spanish Association of Passenger

Car and Truck Manufacturers (Asociación Española de Fabricantes de

Automóviles Turismos y Camiones: ANFAC), passenger car output

during the month dropped by 68.3% year on year (y/y) to 73,322

units. (IHS Markit AutoIntelligence's Ian Fletcher)

- This has dragged production volumes down during the five months since the beginning of the year by 41.2% y/y to 586,708 units.

- There have also been no pick-up trucks recorded as built this month because of ongoing strike action related to Nissan's Barcelona (Spain) facilities, which has meant that output is now down by 69.6% y/y in the year to date (YTD) to 5,696 units.

- In the commercial vehicle category, light commercial vehicle (LCV) output fell 79.1% y/y to 6,068 units in May, resulting in YTD production being down by 41% y/y to 76,127 units.

- Production of box vans retreated by 51.2% y/y in the month to 11,250 units and this has meant that its YTD was down by 38.2% y/y at 64,829 units.

- With its main policy rate more than 300 basis points below the

prevailing rate of annual inflation, Turkey's central bank has

finally paused its interest-rate reduction cycle, holding the

one-week repo rate unchanged at 8.25% at its June meeting. However,

the bank continues to ease monetary policy by finding other ways to

reduce the interest rate at which it funds the markets and may

resume further cuts. (IHS Markit Economist Andrew Birch)

- After cutting its main policy interest rates at nine consecutive Monetary Policy Committee meetings, the Central Bank of the Republic of Turkey (CBRT) finally paused its interest-rate reduction cycle at the 25 June meeting. The one-week repo rate was unchanged at 8.25%.

- In its press release alongside its regularly scheduled meeting, the CBRT pointed to a recent rise in core inflation because of increased, pandemic-related unit costs. The bank suggested that supply-side influences on headline inflation were paramount in the first half of the year, with depressed demand-side influences likely to have a greater effect in the latter half of the year.

- With the cuts to the main policy rate at a pause for now, the one-week repo rate remains 1,575 basis points down from when the rate-cutting cycle began in July 2019. Moreover, after the reacceleration of inflation in May, the main policy rate is 315 basis points below the prevailing, annual, consumer-price inflation rate of 11.4%.

- Ford Sollers is planning to reduce the production rate at its site in Yelabuga (Russia), reports TASS news agency. A spokesperson for the company said in a statement, "Considering the market situation, macroeconomic changes and the effect of the coronavirus pandemic influencing on the automotive industry, Ford Sollers revises the company's operating conditions. The transition to the four-day workweek will be implemented from July 1 for the purpose of preserving the staff and business efficiency." The representative added that the automaker will be ready to return to normal operations when demand improves. The site, which builds Ford's Transit and Transit Custom models, had previously undertaken stoppages related to COVID-19-virus pandemic measures between 30 March and 24 April. The decision to reduce production comes as demand in the country has been far weaker, with light-vehicle demand halving during May. (IHS Markit AutoIntelligence's Ian Fletcher)

- Saudi Arabia's largest lender, National Commercial Bank (NCB),

announced on 25 June that it has signed a non-binding agreement to

pursue a merger with regional rival Samba Financial. Samba was the

sector's fifth largest bank as of end-2019. NCB's statement

explains that the combined entity will operate under the NCB name.

(IHS Markit Banking Risk's Gabrielle Ventura)

- NCB is expected to purchase Samba shares at a 19.2-27.5% market premium.

- The next stage will be for each bank to preform due diligence and determine whether both agree to move forward with the process, before seeking regulatory approval from the Saudi Arabian Monetary Authority and the Capital Market Authority.

- NCB is Saudi Arabia's largest lender, accounting for around 20% of total banking sector assets. Samba accounted for 9.7% of total sector assets when last reported in December 2019.

- The combined entity would account for approximately 30% of total sector assets.

Asia-Pacific

- APAC equity markets closed mixed; Australia +1.5%, Japan/South Korea +1.1%, India +0.9%, and Hong Kong -0.9%.

- Indian automaker Mahindra & Mahindra (M&M) is in the process of selling its South Korean subsidiary SsangYong and has appointed a lead manager for a potential exit from the loss-making affiliate, reports the Yonhap News Agency. Neither M&M nor SsangYong have confirmed whether they have named an unidentified adviser for the stake sale. M&M acquired SsangYong from creditors in 2010 and has since struggled to revive its fortunes. M&M currently owns a 74.65% stake in SsangYong. The latest report comes after M&M recently revealed that it is looking for a financial investor for its South Korean subsidiary and that it may give up control of the unit as part of a plan to exit all its loss-making businesses. SsangYong is struggling, and recorded a net loss for the 13th consecutive quarter in the first quarter of 2020. (IHS Markit AutoIntelligence's Jamal Amir)

- Bridgestone Corporation has completed the purchase of iTrack Solutions Business from UK-based Transense Technologies, according to a Bridgestone official statement. Vice-president and senior officer of G-MAA (Mining, Aircraft, Agriculture) Solutions Business at Bridgestone Corporation, Tomohiro Kusano, said, "This acquisition helps move Bridgestone closer to its goal of becoming a leader in sustainable and advanced mobility solutions." iTrack is a provider of tire management solutions in the off-road segment offering products such as comprehensive tire-pressure monitoring systems for mining tires. Along with tire temperature and pressure monitoring, its tire management platform provides customizable geofencing and speed alerts to help mining customers optimize their operations for increased productivity and profitability. Bridgestone has accelerated its efforts to transform into a global leader in advanced mobility and sustainable solutions. In November 2019, it announced plans to create 'Bridgestone Innovation Park', a global research and development center. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-june-2020.html&text=Daily+Global+Market+Summary+-+26+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}