Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Jun 25, 2020

Exogenous risks to US bank dividends

Bank dividends at risk due to macroeconomic situation

There has been quite the back and forth on the question of bank dividends in the last two months. US banks have not followed their global counterparts in suspending dividends wholesale. Executives at major banks have, in the last two months, reiterated their commitment to dividend payments and are generally opposed to an order to suspend dividends wholesale.

However, there have been calls by former regulators to require the banks to suspend dividends to increase their capital buffers now. The argument being if they shore up now and end up not needing the capital to support credit in the economy, then they can boost dividend payments. By not increasing capital buffers now, they'll have exposed themselves to significant risk and public criticism should they need tax-payer bailouts later. In this report, we review the regulatory risks to banks, the strain they may face due to CECL and COVID-19 provisions, and firm-specific exposures that could be a source of risk for dividends.

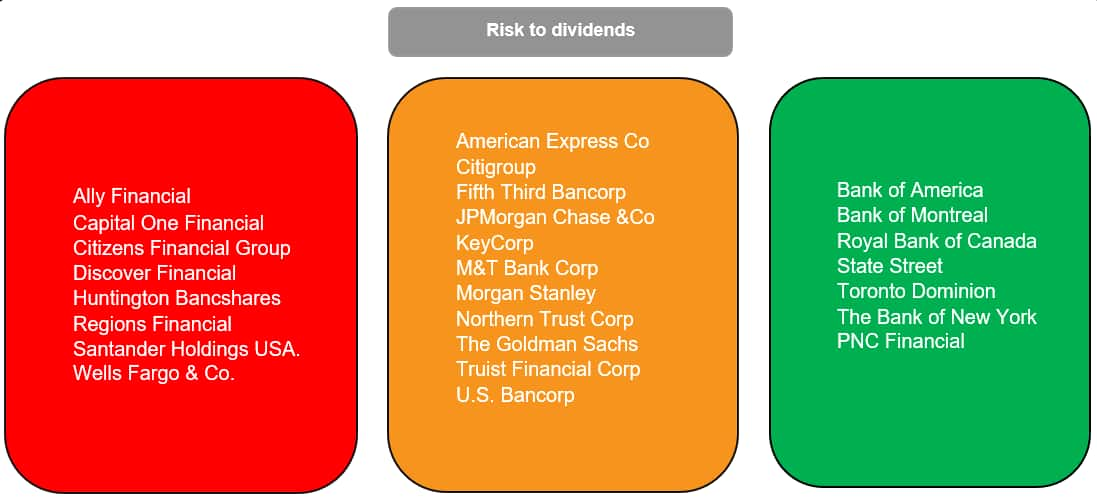

Looking at the entire group, we categorized the banks dependent on the risk we see to their dividend. Among the banks with the riskiest dividends are Huntington Bancshares (HBAN) and Wells Fargo (WFC<span/>). Historically, Huntington Bancshares (HBAN) has been conservative with their capital and cut its dividend during the previous financial crisis to maintain TCE. Both TCE and CET1 are currently at the lower end of the bank's target range, and the bank has high (10.6%) exposure to COVID-19 high-impact sectors.

Regulatory & Political Risk

The most substantial risk to bank dividends in the upcoming quarter is regulatory risk. The Federal Reserve will release the results of both DFAST and CCAR to the public this afternoon. Considering the current economic situation, the Fed will be adding a COVID-19 overlay to the DFAST scenarios that the banks received in February. If the overlay affects a bank's capital to the extent that the CET1 to RWA ratio (henceforth, CET1 ratio) does not meet the required minimum amount, that bank would be limited in the capital distributions it could make.

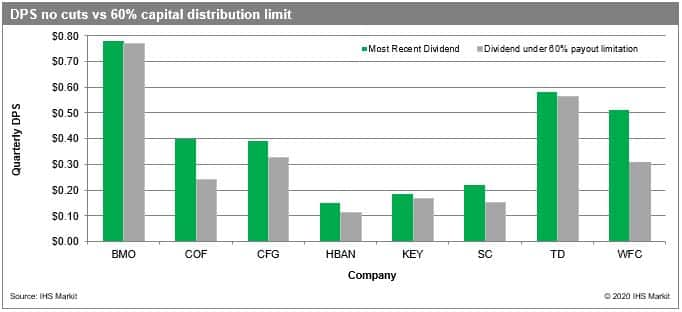

The limits on capital distribution differ depending on how far below the CET1 minimum requirement a bank's ratio drops. For example, if a bank's CET1 ratio dips slightly below the minimum (up to 0.625% below requirement), then the bank would be allowed to pay up to 60% of eligible retained earnings. The farther below the requirement the CET1 ratio drops, the more stringent the limitation on capital distributions would become (at 1.875% below the requirement a bank is no longer allowed to make any capital distributions). The standard method to determine eligible retained earnings for capital distributions is to calculate the sum of the previous four quarters' net income minus any distributions (e.g. share repurchases, preferred dividends, and common dividends). In March, to promote bank lending in a time where the economy needed liquidity, the Fed introduced a more lenient method to calculate eligible retained earnings determined as the average net income over the preceding four quarters. If a bank falls below the capital requirements and has limits imposed on its distributions, then it can choose whichever of the two methods gives the larger amount of eligible retained earnings.

Consensus estimates do not currently show any of the DFAST banks' CET1 ratios dropping below the requirement; however, depending on the severity of the COVID-19 overlay, the banks' capital could be impacted to the point where limitations would be put in place (on a bank-by-bank basis). Because all the banks suspended share repurchases earlier this year, any eligible distributions could go toward dividend payments. Taking as an example the 60% cap - because it the least strict level and none of the banks are currently estimated to dip into their capital conservation buffers -- Capital One (COF), Citizen's Financial Group (CFG), and six other DFAST banks would see their dividends impacted. With the more stringent 40% limit only nine of the banks could maintain stable dividends. At the 20% limit, none of the banks undergoing the DFAST would be able to maintain their current dividend payment.

Revenue Exposure

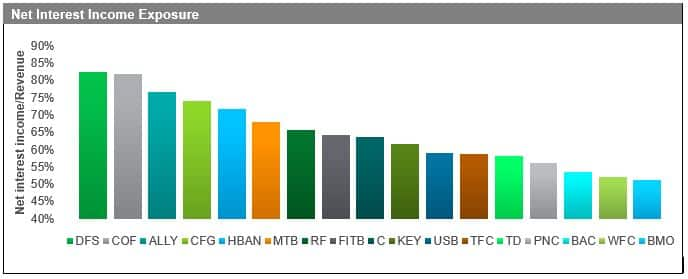

Amid the uncertainties associated with the COVID-19 pandemic, the personal savings rate nearly doubled, and discretionary spending considerably deteriorated, which implies consumer conservatism. Consequently, the consumer finance companies remain under-pressure with less new lending and weakened card revenues.

Hypothetically, if consumer spending picks up more rapidly, some

banks may have to increase interest rates on deposits to attract

cash, even while the Fed keeps the interest rate at nearly zero. As

a result, the net interest margins would further decline unless the

spreads are effectively managed.

Generally, consumer finance companies and banks tend to align their

dividend distributions to their earnings. Expected earnings

headwinds could, therefore, lead to higher dividend payout ratios

and raise the risk to sustainability.

Contacts:

Amira Abdulkadir, Product Analysis & Design Director

Adi Blanc, Research Analyst

Karandeep Singh, Research Analyst

Email: dividendsupport@ihsmarkit.com

To access the report, please contact dividendsamer@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexogenous-risks-to-us-bank-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexogenous-risks-to-us-bank-dividends.html&text=Exogenous+risks+to+US+bank+dividends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexogenous-risks-to-us-bank-dividends.html","enabled":true},{"name":"email","url":"?subject=Exogenous risks to US bank dividends | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexogenous-risks-to-us-bank-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Exogenous+risks+to+US+bank+dividends+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexogenous-risks-to-us-bank-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}