Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 29, 2021

Daily Global Market Summary - 29 November 2021

All major European and most US equity indices closed higher, while APAC was mixed. US and most benchmark European government bonds closed lower. CDX-NA and European iTraxx closed tighter across IG and high yield. The US dollar, oil, and copper closed higher, while gold, silver, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for Russell 2000 -0.2%; Nasdaq +1.9%, S&P 500 +1.3%, and DJIA +0.7%.

- 10yr US govt bonds closed +3bps/1.51% yield and 30yr bonds +3bps/1.86% yield.

- CDX-NAIG closed -2bps/55bps and CDX-NAHY -8bps/318bps.

- DXY US dollar index closed +0.3%/96.34.

- Gold closed -0.2%/$1,782 per troy oz, silver -1.3%/$22.80 per troy oz, and copper +1.2%/$4.34 per pound.

- Crude oil closed +2.6%/$69.95 per barrel and natural gas closed -11.4%/$4.85 per mmbtu.

- Moderna (US) announced an update to its strategy for dealing with SARS-CoV-2 variants of concern following the emergence of the Omicron variant. As stated in its press release, Moderna is working to check whether the current 50 µg dose of its Spikevax (mRNA-1273) vaccine used for booster vaccinations would remain effective against the Omicron variant, with results expected in the next few weeks. As stated by the company, it has already carried out tests on 306 trial participants of a 100 µg booster dose, which have, according to the company, "resulted in the highest neutralizing titers against prior SARS-CoV-2 strains". It is now working to test sera from recipients of the high booster dose to check whether this dose would lead to superior protection against the new Omicron variant. Additionally, it has reported that studies of two multivalent booster candidates are already undergoing clinical trials. These candidates include a number of mutations present in the Omicron variant. Finally, it stated that it aims to move forward quickly with a booster candidate specifically for Omicron - mRNA-1273.529. The company asserted that it has already been able to develop boosters specifically intended for the Beta and Delta variants in 2021, succeeding in advancing candidates into clinical testing in 60-90 days. Moderna's chief medical officer told the BBC that it would be able to confirm whether Spikevax provided protection against the Omicron variant within a couple of weeks, adding that it would be early 2022 before a new vaccine could be made available. He emphasized the flexibility of the mRNA technology platform, which allowed for a very quick turnaround in adaptions to an existing vaccine. (Life Sciences by GlobalData's Brendan Melck)

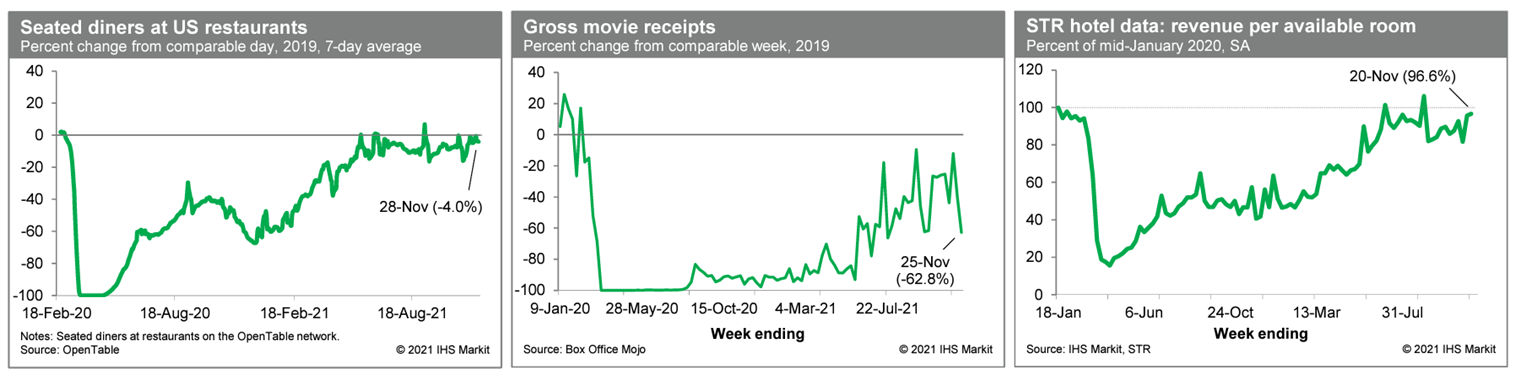

- Averaged over the last seven days, the count of seated diners

on the OpenTable platform was 4.0% below the comparable period in

2019. This is at the higher end of a recent range, perhaps

suggesting some modest improvement in restaurant activity.

Meanwhile, box-office revenues last week were 62.8% below the

comparable week in 2019, according to Box Office Mojo. The latest

weekly reading was below recent averages, which were up

considerably from spring and summer. The Thanksgiving holiday may

have affected the comparison with 2019, so we will look to upcoming

weeks to assess the ongoing recovery in movie-theater activity.

Finally, revenue per available room at US hotels over the week

ending 20 November, after seasonal adjustment, rose to 96.6% of the

mid-January 2020 level (estimate based on weekly data from STR).

This mirrors recent improvement in the airport passenger traffic

data, reinforcing the notion that key portions of the travel sector

have nearly fully recovered. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- The US Pending Home Sales Index (PHSI) shot up 7.5% in October

from September to 125.2, its highest reading in 11 months. The

index is up 18% since May. All four regions saw month-on-month

gains. (IHS Markit Economist Patrick

Newport)

- According to Lawrence Yun, the National Association of Realtors' chief economist, "Motivated by fast-rising rents and the anticipated increase in mortgage rates, consumers that are on strong financial footing are signing contracts to purchase a home sooner rather than later… The notable gain in October assures that total existing-home sales in 2021 will exceed 6 million, which will shape up to be the best performance in 15 years."

- The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average)—which had been sliding since January but turned three months ago, growing 13% since—is pointing to higher sales in the fourth quarter than in the previous two quarters.

- The PHSI leads existing home sales by a month or two. The latest two PHSI readings point to higher existing home sales in November or December or both.

- Pending home sales rose sharply in October, in contrast to IHS Markit analysts' expectation for a decline, implying more brokers' commissions and residential investment in the fourth quarter. As a result, we raised the tracking forecast of fourth-quarter GDP growth by 0.1 percentage point to 7.5%.

- US Senate Democrats have reintroduced a bill to radically

overhaul the EPA's pesticide regulatory review process and force

the Agency to ban several pesticides linked to severe human health

risks and ecological harm. The legislation would compel the EPA to

prohibit the use of organophosphate and neonicotinoid insecticides

as well as the herbicide, paraquat. It also lays out a series of

sweeping reforms to strengthen the EPA's pesticide regulations and

increase protections for farmworkers. (IHS Markit Crop Science's JR

Pegg)

- "As we sit down with family and friends for Thanksgiving, let this day also be one of gratitude for the workers who have worked tirelessly to ensure we have food on our tables," said Senator Cory Booker, a New Jersey Democrat. "Farmworkers are often exposed to dangerous and toxic pesticides, risking their health as they work to provide our food. It is imperative that we address this issue directly by updating our laws in order to protect farmworkers, frontline communities, and our environment."

- The 42-page bill says that the EPA "regularly fails to incorporate updated scientific understanding to protect human health and the environment from the harmful effects of pesticide products" and allows the use of "billions of pounds of pesticides" every year that were approved based on outdated science.

- "The United States lags behind the European Union and other developed nations in protecting its people and its environment from toxic chemicals, allowing the use of 72 pesticides that have been banned or are being phased out in the European Union alone," the bill states, adding that once the EPA has approved a pesticide, it is nearly impossible to get it off the market.

- The legislation would also create a new process under the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA) to allow citizens to petition the Agency to identify dangerous pesticides and remove them from the market. In addition, it seeks to limit the EPA's ability to issue emergency exemptions and conditional registrations for pesticides that have not gone through full health and safety review.

- As expected, Canada's current-account balance remained in

surplus for a third consecutive quarter. Although the headline

balance was almost identical to the previous quarter, trade of

goods and services played a much larger role. Reflecting the

consistent monthly merchandise trade surpluses, the goods trade

account reached its largest surplus since the third quarter of

2014. (IHS Markit Economist Evan Andrade)

- The third-quarter balance of international payments hit a surplus of $1.4 billion. The second-quarter surplus was revised down from $3.6 billion to $1.4 billion, because of a much narrower goods trade surplus than initially reported.

- Total goods exports rose 4.9% quarter on quarter (q/q), as energy product exports were aided by higher prices and strong demand from the United States. Lower prices hurt forestry product and building material exports. Although most categories increased, the 3.1% q/q jump in goods imports was driven by a partial rebound in automotive imports from the previous quarter.

- With Canada's vaccination efforts slowing in the third quarter, lower consumer goods imports were likely the result of reduced pharmaceutical imports.

- The widening services trade deficit was caused by a higher vaccination rate and reduced travel restrictions. With a healthy increase in Canadians travelling abroad, causing travel imports to rise, the travel services surplus narrowed $784 million to $1.3 billion. Transport services also added to the wider services trade deficit.

- On November 29, Capital Power Corp. and Enbridge Inc. announced

a memorandum of understanding to collaborate on carbon capture and

storage (CCS) solutions in the Wabamun area west of Edmonton,

Alberta, near Capital Power's Genesee Generating Station. (IHS

Markit PointLogic's Barry Cassell)

- Enbridge would serve as the transportation and storage service provider and Capital Power as the CO2 provider for this project, subject to the Government of Alberta's competitive carbon hub selection process and a future final investment decision. Enbridge, with the support of Capital Power, is applying to develop an open access carbon hub in the Wabamun area through the Government of Alberta's Request for Full Project Proposals process, which is expected to start as early as December 2021.

- Capital Power's Genesee Generating Station near Warburg currently provides over 1,200 MW of baseload electricity generation. Capital Power is currently repowering the Genesee 1 and 2 units with natural gas combined-cycle power generation units. The Genesee CCS Project is expected to capture up to 3 million tons of CO2 annually from the repowered units, which would be transported and stored through Enbridge's open access carbon hub that could also serve several other local industrial companies. Subject to the award of carbon sequestration rights and regulatory approvals, the proposed project could be in service as early as 2026.

- In October, with Capital Power's support, Enbridge responded to the Government of Alberta's call for Expressions of Interest to construct and operate carbon storage hubs. Within its proposal, Enbridge outlined its plans to develop an open access carbon storage hub with cost-effective, customer-focused CCS solutions in the Wabamun area while minimizing any infrastructure footprint to protect land, water and the environment, the companies said.

Europe/Middle East/Africa

- All major European equity indices closed higher; UK +0.9%, Italy +0.7%, Spain +0.6%, France +0.5%, and Germany +0.2%.

- Most 10yr European govt bonds closed lower except for Spain flat; Italy/France +1bp, Germany +2bps, and UK +3bps.

- iTraxx-Europe closed -2bps/56bps and iTraxx-Xover -11bps/280bps.

- Brent crude closed +2.3%/$73.22 per barrel.

- UK Prime Minister Boris Johnson has announced new restrictions

in England to tackle the emerging COVID-19 variant called Omicron,

with early evidence suggesting that the heavily mutated virus is

more infectious than the highly contagious Delta variant. (IHS

Markit Economist Raj

Badiani)

- Early data suggest that it transmits between people who are double vaccinated, and research is under way to discover the effectiveness of current vaccines against the new strain.

- The World Health Organization (WHO) has labelled Omicron a "variant of concern".

- Several Omicron cases have been detected in the United Kingdom, with Johnson urging that "we need to slow down the spread of this variant here in the UK, because measures at the border can only ever minimize and delay the arrival of a new variant rather than stop it all together".

- Travel restrictions are now tighter. All UK arrivals will have to take a PCR test and self-isolate until they return negative results. In addition, the UK has placed six countries on its red travel list, and they are South Africa, Botswana, Namibia, Zimbabwe, Lesotho, and Eswatini, with the prospect of the inclusion of further countries. Therefore, all UK and Irish citizens or residents arriving from those countries will have to pay to enter hotel quarantine for 10 days, while all other travelers are prohibited from the UK.

- The economic sentiment indicator (ESI) for the eurozone showed

the first decline in four months in November, slipping from 118.6

down to 117.5, matching the market consensus expectation. The

breakdown by key sector, however, showed unusual divergence. (IHS

Markit Economist Ken

Wattret)

- Consumer sentiment (accounting for 20% of the ESI) dropped by just over two points, the fourth decline in five months and the biggest for a year. Weakness was evident across all the main sub-components in November, particularly the economic outlook and unemployment expectations.

- In contrast, services, retail, and construction sentiment indices all improved in November and industrial sentiment was unchanged at its second highest level on record. The industry sub-survey of orderbooks, including for exports, remained elevated, suggesting that recent supply-chain constraints on production have not fundamentally damaged demand.

- Eurozone employment expectations indices also held firm across all key sectors in November, which is indicative of confidence among businesses that economic prospects will remain favorable despite the various growth headwinds at present.

- At the member state level also, November's ESI data showed pronounced divergence, reflecting recent COVID-19-related developments. Sentiment fell markedly in Austria, the Netherlands, and Germany, for example, where new cases have surged recently, leading to the reimposition of restrictions, but improved in France, Italy, and Spain.

- Germany's Federal Statistical Office (FSO) reported, based on

data from various regional states, that the country's national

consumer price index (CPI) declined by 0.2% month on month (m/m) in

November. This smaller-than-usual seasonal dip drives up the annual

inflation rate from 4.5% in October to 5.2% year on year (y/y) in

November, a level not seen since the post-unification boom of 1992.

(IHS Markit Economist Timo

Klein)

- The EU-harmonised CPI measure unexpectedly posted even firmer data, as a 0.3% m/m increase boosted its year-on-year rate from 4.6% y/y to 6.0%. This is linked to the reduction in the weight of package tours in the harmonized 2021 goods basket to only about one-third of its weight in 2020, therefore its massive seasonal monthly decline (-21.6% m/m) had much less of a dampening effect on the CPI index compared with November 2020. Much of this distortion will unwind in December (when package tour prices rebound because of Christmas travel), and a likely upward revision in the weight of package tours in January 2022 (based on 2021 spending patterns) will reinforce this downward adjustment of the harmonized year-on-year rate.

- The detailed breakdown of the German national data will only be published with the final numbers on 10 December, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). The CPI in this state posted -0.3% m/m, lifting its year-on-year rate from October's 4.5% to 5.1%.

- In NRW, energy prices increased by 1.6% m/m, less than half of October's 3.5% m/m. Nevertheless, the base effects boosted their annual rate from 17.0% to 20.1%. Energy prices apart, upward inflation pressure came from package tours (from 2.4% y/y to 9.7% y/y, accounting for a 0.2% impact on total CPI), clothing/shoes (from 0.8% to 1.6%), furniture and household goods (from 4.0% to 4.7%), healthcare (from 1.6% to 1.9%), and food (from 4.3% to 4.5%). Year-on-year rates of all other categories remained broadly stable; there was no major offset to the downside.

- Volkswagen (VW) Group is planning to make a further investment into its Autoeuropa facility located in Palmela (Portugal) in the medium term. ECO News quoted Alexander Seitz, the VW brand board of management member with responsibility for Controlling and Accounting, as saying, "Over the next five years we intend to invest more than EUR500 million in product, equipment and infrastructure." The senior executive added that VW will refocus production at the site to support the growing momentum towards sustainable mobility. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Volkswagen (VW) Group will not tender a higher offer for Europcar than the one currently on the table for EUR2.9 billion (USD3.27 billion), according to a Reuters report. VW is the main element of the consortium that is looking to acquire Europe's biggest car hire firm, along with asset management business Attestor Holdings and Dutch automotive conglomerate Pon Holdings. If the acquisition goes through, VW will own the majority of the business with Attestor taking a 27% stake and Pon Holdings having 7%. Commenting on the offer, the head of VW financial services Christian Dahlheim said, "With a takeover premium of 30-40 percent, depending on the reference point, we have presented a very attractive offer." The consortium is offering EUR0.50 a share, which could add EUR0.01 if 90% of shareholders agree to take up the offer. (IHS Markit AutoIntelligence's Tim Urquhart)

- Tesla has opted to not take up potential state aid from the German government to the tune of EUR1.14 billion (USD1.3 billion) as it has decided to first build a new battery cell at its Texan plant, according to a Bloomberg report. The new 4680 battery cell offers greater energy density and manufacturing benefits. Tesla has already proved the cell design in a pilot assembly line, and is keen to begin serial manufacturing of the cell type for production cars. An unnamed source said that if Tesla manufactured the new cell type at the battery plant it is building in Germany it would have been eligible for the grant money through the European Union's Important Project of Common European Interest (IPCEI) initiative, with the German government able to allocate its tranche of the funding to battery electric vehicle (BEV) cell production and research and development (R&D). (IHS Markit AutoIntelligence's Tim Urquhart)

- BMW Group has expanded its eDrive zones in another 20 European cities, bringing the total to 138 cities, according to a company statement. BMW eDrive zones automatically switches its plug-in hybrid electric vehicles (PHEVs) into purely electric driving mode as soon as it enters an area that the system recognizes such as a low-emission zone. BMW has also introduced a loyalty program that will reward drivers of BMW PHEVs via a points system. The incentive scheme will offer points for every purely electric kilometer driven and twice the points for every km with an eDrive zone. This will give participants access to rewards such as free charging on BMW's charging system. BMW expects to roll out the service in at least another 30 cities worldwide in the coming year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In 2020, retail sales of fresh mushroom in Germany rose by 17%

y/y with an estimated per capita consumption of 2.13 kg. The trend

continued in in the first nine months of 2021 with a 3% y/y

increase in volumes, data from the Agricultural Market Information

(AMI) reveals. (IHS Markit Food and Agricultural Commodities'

Cristina Nanni)

- In 2020, 66.8% of private households purchased mushrooms at least on one occasion, which is a 1.4 percentage points increase compared with the previous year. In the January-August 2021 period, about 64% of the German households purchased mushrooms against 62.7% in the same period of the previous year. Consumption of fresh organic mushrooms rose by 48% in 2020 while annual growth between 2015 and 2019 has never exceeded 36%.

- Compared with all other vegetable purchasers, the group of buyers for mushrooms is younger: families with children, couples without children and single households.

- The pandemic also brought processed mushrooms back to growth in 2020 after a long-term decline. Canned mushroom per capita consumption rose by 11% y/y to 1.49 kg and that of frozen were up by 23% to 70 g. Data about processed mushroom sales will be released between February and March 2022.

- Mushroom production in Germany amounted to 85,100 tons in 2020 against 78,900 tons in 2019, mainly champignon (95%). About 12,150 tons of harvested mushrooms were organic. Production costs rose due to the implementation of COVID-related health and safety measures, energy and fuel rising costs.

- With the increase in production, imports were pushed back slightly. In 2020, Germany imported around 92,000 tons of fresh mushrooms against 94,000 tons in 2019. Its main suppliers are Poland and the Netherlands, the two largest mushroom producers in the EU. Canned mushroom imports were 1% above those of 2019 and around 57,000 tons, while dried imports declined by 13% y/y to 1,735 tons. Frozen mushrooms intakes dropped by 8.5% to 25,800 tons.

- Bladt Industries has received contract from Vattenfall to

manufacture and deliver transition pieces for Vesterhav Nord and

Vesterhav Syd offshore wind farms. In total the company will

manufacture 41 transition pieces for the Vesterhav project that is

21 units for Vesterhav Nord and 20 units for Vesterhav Syd with

each TP having height of 22.5 meters and weight approximately 260

tons. These TP's will be manufactured at Bladt Industries'

facilities in Aalborg, Denmark. The fabrication is planned to start

in the spring of 2022, with delivery planned for early 2023. (IHS

Markit Upstream Costs and Technology's Monish Thakkar)

- The Vesterhav Syd and Nord offshore wind farms will consist of 41 Siemens Gamesa 8.4 MW wind turbines with a total capacity of 344.4 MW and will be in the water dept of approximately 20 meters.

- Due initiation of new EIA processes by the Danish Energy Agency, Vattenfall had to delay the projects which were initially planned to commission in 2020. After which the company changed the layout of the wind farms, pushing the turbines as far offshore as possible. Hence, the commissioning of the two wind farms is now expected by the end of 2023.

- Floating Power Plant (FPP), will be testing its hybrid floating offshore wind and wave power generating platform with the Oceanic Platform of the Canary Islands (PLOCAN). The platform will be deployed north of the PLOCAN test site and will be grid connected via a new subsea cable. According to the Danish-based FPP, the platform will be able to generate over 5MW of combined power from the wind turbine and wave energy converters. FPP ws founded in 2007 and is targeting the deep water small to large wave regions. Its platform can be fitted with wave absorbers to increase overall power production and consistency in power generation. The company has stated that its platform can be altered to accommodate 4-15 MW of wind turbine capacity, and 2-3.6 MW of wave power. (IHS Markit Upstream Costs and Technology's Melvin Leong)

Asia-Pacific

- Major APAC equity indices closed mixed; India +0.3%, Mainland China flat, Australia -0.5%, South Korea -0.9%, Hong Kong -1.0%, and Japan -1.6%.

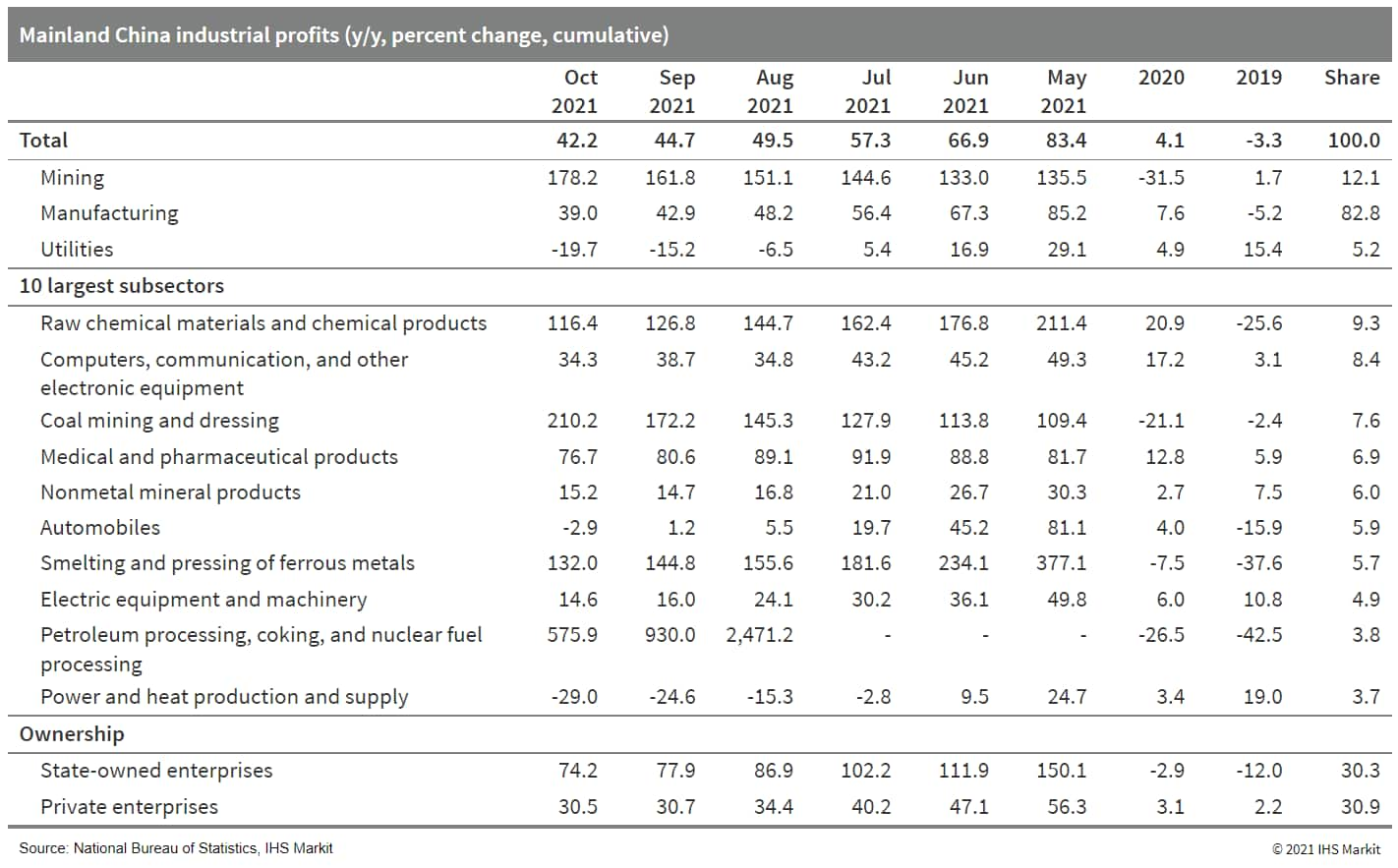

- Mainland China's industrial profits expanded by 42.2% year on

year (y/y) through October, lower by 2.5 percentage points from the

first three quarters. On a two-year (2020-21) average basis,

industrial profits increased by 19.7% y/y in the first 10 months,

up by 0.9 percentage point from the month-ago reading. For October

alone, industrial profits recorded growth of 24.6% y/y,

accelerating from 16.3% y/y in September, according to the National

Bureau of Statistics (NBS). (IHS Markit Economist Lei Yi)

- The cumulative profitability ratio came in at 7.01% by the end of October, ending the three-month consecutive decline over the third quarter. While the profitability ratio of the upstream mining sector posted larger increases - rising by 1.07 percentage points to 19.32% in October - that of manufacturing and utility sectors also recorded smaller declines than previous months, edging down by 0.01 percentage point and 0.17 percentage point to reach 6.57% and 4.92%, respectively.

- By sector, industrial profit strength held up for mining and

raw material manufacturing in October, owing to eased production

curbs and elevated raw material prices. With the authorities

ramping up coal production to ensure power supply, industrial

profits of coal-related sector surged by 438% y/y in October, up by

69.6 percentage points from the September reading. Thanks to rising

demand driven by the "double 11" shopping season along with

increasing inflation pass-through, industrial profit growth of

consumer goods manufacturing recorded a rise of 3.6% y/y in October

compared with a year-on-year decline in September. The high-tech

manufacturing sector continued to report double-digit profit

growth, 17.4% y/y in October, led by vaccine and computer

products.

- Xiaomi Corp is to build an electric vehicle (EV) manufacturing plant in Beijing. Xiaomi signed an agreement with Beijing Economic-Technological Development Area on 27 November to locate its new plant in the development zone in the Chinese capital, reports the China Securities Journal. The plant is to be built in two phases, each of which is to have an annual production capacity of 150,000 vehicles. The new plant marks an important step in Xiaomi's plan to introduce its own model in the market by 2024. This agreement also settles speculation over whether the smartphone maker would enter into manufacturing deals with established automakers such as Great Wall and Geely Auto to launch vehicle production. There are still lots of unknown elements in Xiaomi's expansion plan into the auto sector, such as its product plan, pricing strategy, and target customers. Xiaomi has recently announced several investments in startup auto suppliers in an attempt to secure supplies of key components and facilitate the research and development of its new model. Hesai Technology, a Chinese Lidar supplier, announced on 16 November that it has received an investment of USD70 million from Xiaomi in its D round of fundraising. Apart from its investment in Hesai, Xiaomi has acquired Deepmotion Tech, a company specializing in autonomous driving technology development, for USD7,737 million. These investments indicate Xiaomi's new models are to feature high-level automated driving technologies, which are the core competency of a smart EV company, according to CEO Lei Jun. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China is seeking to kickstart its hydrogen economy by

subsidizing fuel-cell vehicles and their infrastructure in three

major city clusters. But industry experts said Beijing has to

refine policy instruments and stimulate more investment to put the

country on a sustainable decarbonization pathway. (IHS Markit

Net-Zero Business Daily's Max Lin)

- To reach an official target of carbon neutrality by 2060, the world's largest GHG-emitting nation has been aiming to replace fossil fuels with hydrogen in parts of its economy.

- In September 2020, Chinese policymakers said they would provide subsidies for the value chains of automobiles powered by hydrogen fuel cells around eligible city clusters. Three metropolitan areas were selected earlier this year: Beijing, Shanghai, and Guangdong.

- Each of them can receive up to ¥1.5 billion ($235 million) for fuel-cell vehicles and ¥200 million for hydrogen supply during a four-year demonstration period. Shanghai unveiled a detailed grant scheme in early November, while others are expected to follow suit soon.

- Observers believe the scheme is targeting fuel-cell heavy trucks with a gross vehicle weight of 31 metric tons (mt) or more. Battery-driven electrical passenger cars and light trucks already enjoy high market penetration because their charging network is well under development.

- While the steelmaking, cement, aluminum, and petrochemical sectors can all make great progress in decarbonization by replacing fossil fuels use with clean hydrogen, trucks provide another entry into this fledgling market. Fuel-cell trucks are already in the market, and the infrastructure costs for refueling them are relatively low compared with other hard-to-abate sectors.

- Several polyester producers in China announced production rate

cuts of 20%, in order to preserve margins, according to Chinese

analysts and traders on Monday. Polyester producers said in a joint

statement that they ran sales promotions at loss-making levels last

week, which eroded their profits from the first half of this year.

In order to remain profitable for 2021, polyethylene terephthalate

(PET) producers in Xiaoshan, Zhejiang province, spearheaded by the

chemical fibers sector, will cut operating rates to preserve

margins. Four-to-five producers will participate, involving 23

million mt of capacity, industry participants reported. (IHS Markit

Chemical Market Advisory Service's Chuan Ong)

- These plants decided late-week to reduce production by around 20%, with details to follow, according to industry participants.

- "Polyester producers have been lowering their prices in order to promote sales early last week. Inventory might be high at the moment. Margins are fine, if we disregard the high inventory," said an analyst.

- According to a trader, it is doubtful if polyester producers will carry through on their threat. "They are not making losses, although the inventory is high. Their customers are just not buying feedstock. So, it's only when polyester producers run promotions, do they see some turnover," said the trader. End-users of polyester in the textiles sector are not under pressure, as inventory levels are normal and margins are fine, said the trader.

- "The main issue is that their sales have been weak," added the trader.

- A broker said that polyester producers Hengli, Tongkun, Xinfengming and Tiansheng have not announced timelines for operating rate cuts yet.

- Production cuts in polyester will reverberate upstream to paraxylene, which hit a 24-week low last Friday to close at $864/mt CFR. Despite rising crude prices, PX gains have been capped by dwindling margins against PTA.

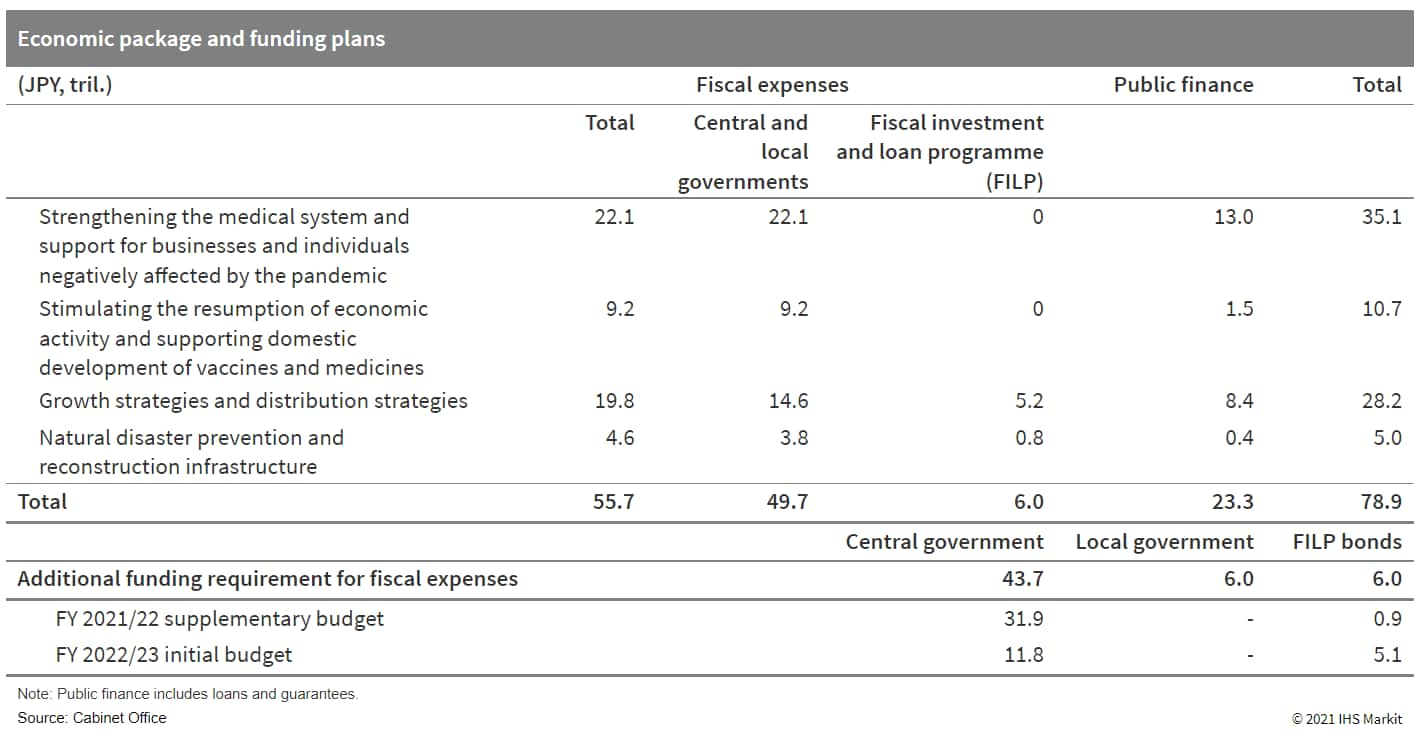

- Japan's Cabinet Office has approved a larger-than-expected

economic package intended to counter the effect of the resurgence

of coronavirus disease 2019 (COVID-19), stimulate a recovery, and

generate economic growth and wealth redistribution. However, the

fiscal expenditure is unlikely to contribute to immediate real GDP

growth to the extent that the government expects, and it will

probably delay fiscal consolidation. (IHS Markit Economist Harumi

Taguchi)

- The Cabinet Office approved a JPY78.9-trillion (USD696 billion) economic package on 19 November 2021 and the supplementary budget for fiscal year (FY) 2021/22 (ending March 2022) on 26 November 2021. The planned measures total JPY55.7 trillion, equivalent to about 10% of GDP, which is the largest-ever fiscal spending plan for a single economic package. While additional funding required for the national government is JPY43.7 trillion, the government aims to pass a JPY31.9-trillion supplementary budget bill during an extraordinary parliamentary session by the end of 2021. JPY11.8-trillion worth of measures will be included in the initial FY 2022/23 budget.

- The economic package was primarily designed to address persistent concerns about the medical system in case of the resurgence of COVID-19 and mitigate the prolonged effects of the pandemic on businesses and individuals. Measures include purchases of COVID-19 vaccine booster shots and medicines. Along with funds for extended support for medium and small enterprises and the self-employed, the package includes up to JPY2.5 million in financial aid for businesses suffering from lower revenues because of the pandemic.

- For individual support, the package includes JPY100,000 in cash

and coupon handouts for children aged under 18 and aid for

low-income households and students facing financial difficulties.

The government also plans to implement measures to mitigate the

negative effects of higher energy prices, including subsidies to

oil wholesalers if domestic gasoline prices surpass certain levels

in order to prevent an excessive rise in retail gasoline

prices.

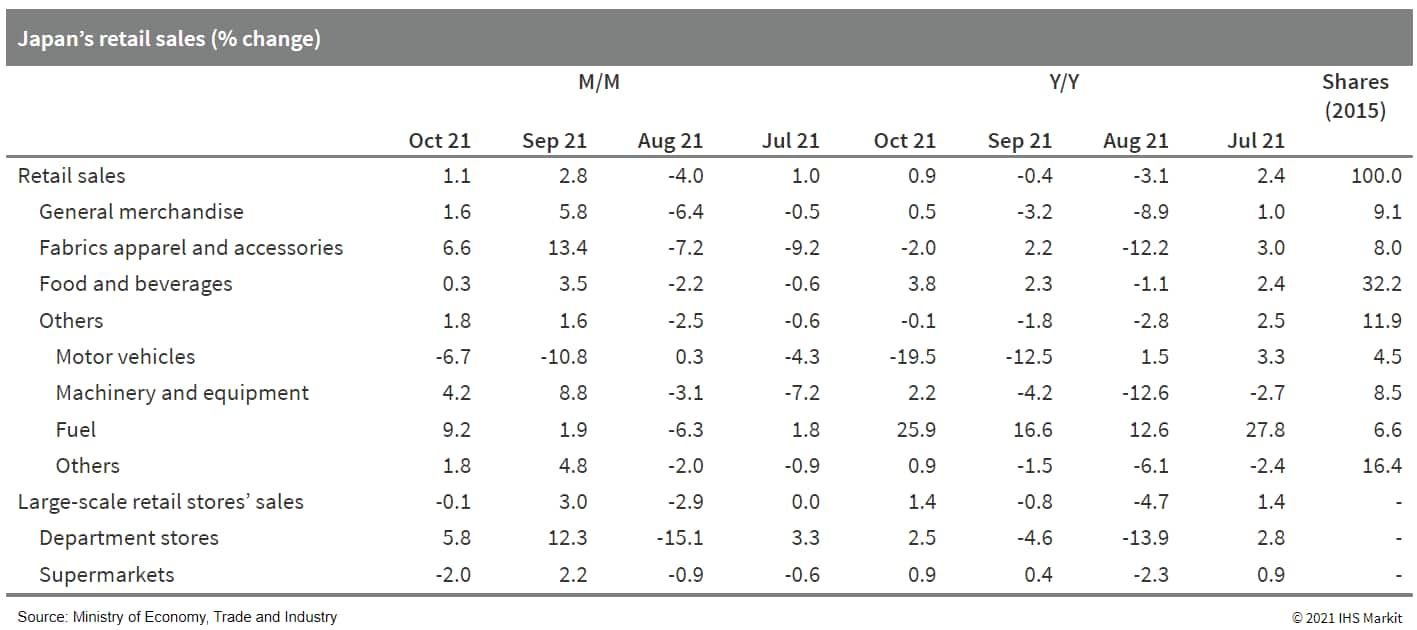

- Japan's retail sales increased by 1.1% month on month (m/m) in

October following a 2.8% m/m rise in September. The year-on-year

(y/y) figure also rose by 0.9% after two consecutive months of

declines. The continued m/m improvement largely reflected the

gradual easing of COVID-19 containment measures and a faster rise

in fuel prices. (IHS Markit Economist Harumi

Taguchi)

- The major contributors to the improvement were a faster rise in sales of fuel and continued increases in sales of apparel and accessories, machinery and equipment, general merchandise, and food and beverages. While the resumption of business activity and cooler temperatures helped lift sales of fuel, higher prices for gasoline and kerosene also contributed to the increase. Those improvements were partially offset by a continued decline for auto sales because of difficulties in delivering new cars prompted by shortages of semiconductors and parts.

- The October results were better than IHS Markit anticipated,

but retail sales are still below the April level (following the

easing of containment measures to counter the fourth wave of

COVID-19 infections). The October 2021 level was above the

pre-pandemic December 2019 level, but still below the level before

the disruption caused by the October 2019 consumption tax

increase.

- Samsung Electronics has announced plans to construct a semiconductor manufacturing facility in Taylor, Texas (United States). According to a company press release, the estimated USD17-billion investment in the US will aid in the production of advanced logic semiconductor solutions that power next-generation innovations and technologies. Samsung Electronics Device Solutions Division vice-chairman and CEO Kinam Kim said, "As we add a new facility in Taylor, Samsung is laying the groundwork for another important chapter in our future." The executive added, "With greater manufacturing capacity, we will be able to better serve the needs of our customers and contribute to the stability of the global semiconductor supply chain." The new facility is to produce products based on advanced process technologies for use in mobile, 5G, high-performance computing (HPC), and artificial intelligence (AI). Samsung says it remains committed to assisting customers around the world by making advanced semiconductor fabrication more accessible and meeting rising demand for cutting-edge products. (IHS Markit AutoIntelligence's Jamal Amir)

- The Seoul metropolitan government said that three autonomous cars will start operating for the public this week in Sangam-dong district in South Korea, reports Yonhap News Agency. The cars will transport passengers between DMC Station and nearby apartment complexes and office areas. Initially, the service will run on an advance reservation system until 4 December, and then users can book them using an app called 'TAP!'. By the end of December, three additional autonomous vehicles (AVs), including an autonomous bus, will be deployed on the same route in Sangam-dong. The city government plans to test the free service for a month, and users will be required to pay for the service starting from January 2022. It suggested a fee of KRW1,200 (USD1.0) for the autonomous bus service and around KRW3,000 (USD2.5) for the autonomous car service, while private operators may charge considerably less. Seoul eventually plans to operate more than 50 AVs in Sangam's pilot zone by 2026. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- HHI plans to establish technical guidance for offshore green hydrogen plants. Together with Korea Shipbuilding & Offshore Engineering (KSOE), a preliminary deal has been signed with American Bureau of Shipping (ABS). Aim of the deal is to establish guideline and safety regulations for the design of offshore green hydrogen plants. HHI aims to obtain approval for the guideline from ABS by the first half of 2022. Earlier in May 2021, HHI struck a deal with nine other entities, including state-run Korea National Oil Corp., to build a green hydrogen plant in the East Sea by 2025. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- ABS has approved Sembcorp Marine's 3D printed parts after successful onboard testing on an oil tanker. The 3D printed (additive manufactured) parts were installed on an oil tanker, Polar Endeavour, six months ago and put in operation. The parts were retrieved, inspected and remotely surveyed after six months of operation. The parts were validated to be in good working condition. The 3D printed parts were the gear set and gear shaft for boiler fuel supply pump, flexible coupling for marine sanitation devices pump, and an ejector nozzle for fresh water generator. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Tata Group plans to set up its own semiconductor assembly unit

in India with an investment of USD300 million, reports Autocar

India citing Reuters as the source. The group is reportedly in

talks with three states - Tamil Nadu, Karnataka, and Telangana -

and is scouting for land for setting up the outsourced

semiconductor assembly and test (OSAT) plant. An OSAT plant sources

silicon wafers from semiconductor foundries, packages, assembles

and tests them, finally turning them into finished semiconductor

chips. Tata Group has already looked at some potential locations

for the plant and the venue is likely to be finalized by next

month, highlights the report. (IHS Markit AutoIntelligence's Jamal

Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-november-2021.html&text=Daily+Global+Market+Summary+-+29+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 November 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+29+November+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}