Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 29, 2021

Weekly Global Market Summary Highlights: November 22-26, 2021

Almost every major global equity market closed lower on the week, except for Mainland China closing modestly higher week-over-week. US government bonds closed higher on the week, while most benchmark European government bonds were lower. CDX-NA and European iTraxx closed sharply wider on the week across IG and high yield. Natural gas closed higher on the week, the US dollar was flat, and oil, gold, copper, and silver were lower week-over-week.

Americas

All major US equity markets closed lower on the week; DJIA -2.0%, S&P 500 -2.2%, Nasdaq -3.5%, and Russell 2000 -4.1% week-over-week.

10yr US govt bonds closed 1.48% yield and 30yr bonds 1.83% yield, which is -6bps and -8bps week-over-week, respectively.

DXY US dollar index closed 96.04 (flat WoW).

Gold closed $1,786 per troy oz (-3.6% WoW), silver closed $23.11 per troy oz (-6.8% WoW), and copper closed $4.28 per pound (-2.8% WoW).

Crude Oil closed $68.15 per barrel (-10.3% WoW) and natural gas closed $5.48 per mmbtu (+6.5% WoW).

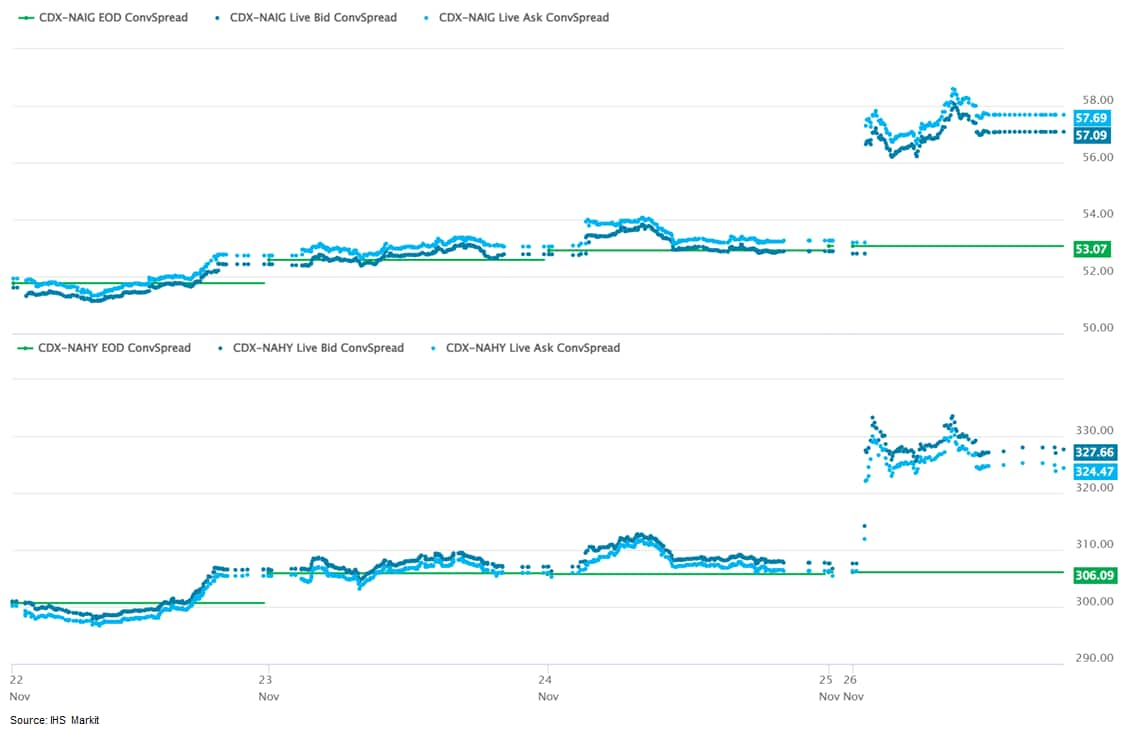

CDX-NAIG closed 57bps and CDX-NAHY 325bps, which is +5bps and

+25bps week-over-week, respectively.

EMEA

All major European equity indices closed sharply lower on the week; UK -2.5%, Spain -4.0%, France -5.2%, Italy -5.4%, and Germany -5.6% week-over-week.

Most major 10yr European government bonds closed lower on the week except for UK -5bps; Germany +1bps, France +4bps, Spain +4bps, and Italy +10bps week-over-week.

Brent Crude closed $71.59 per barrel (-9.3% WoW).

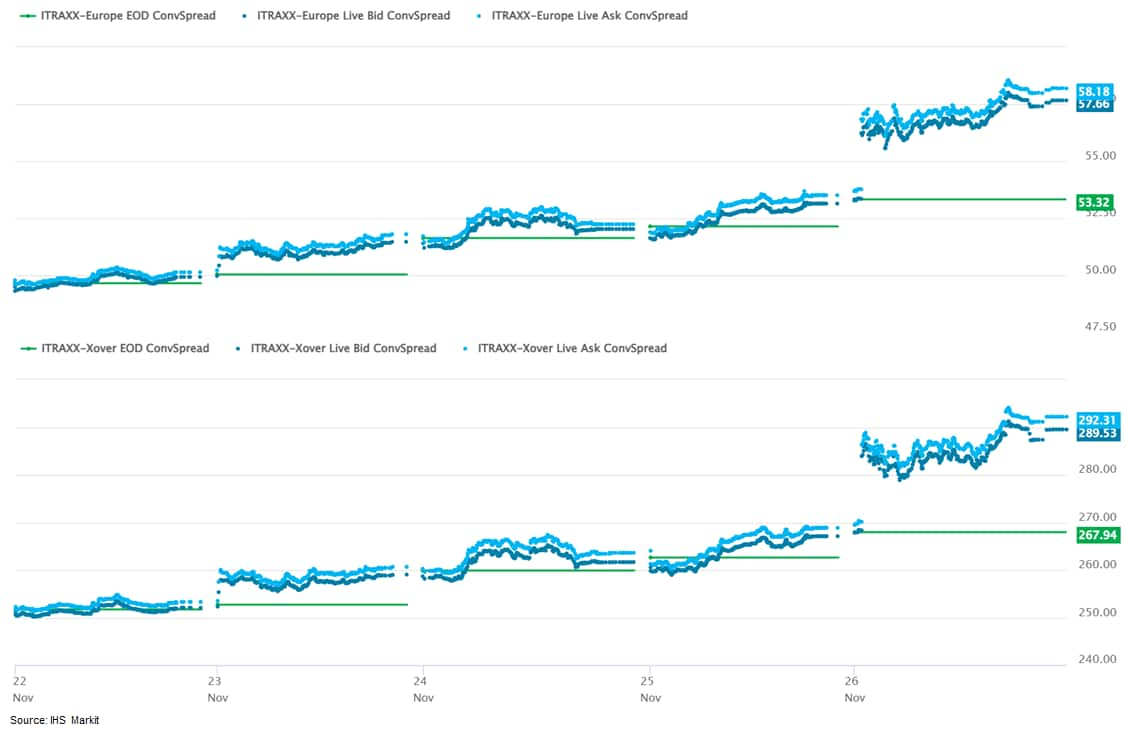

iTraxx-Europe closed 58bps and iTraxx-Xover 291bps, which is

+8bps and +39bps week-over-week, respectively.

APAC

Most major APAC equity markets closed lower except for Mainland China +0.1%; South Korea -1.2%, Australia -1.6%, Japan -3.3%, Hong Kong -3.9%, and India -4.2% week-over-week.

Monday, November 22, 2021

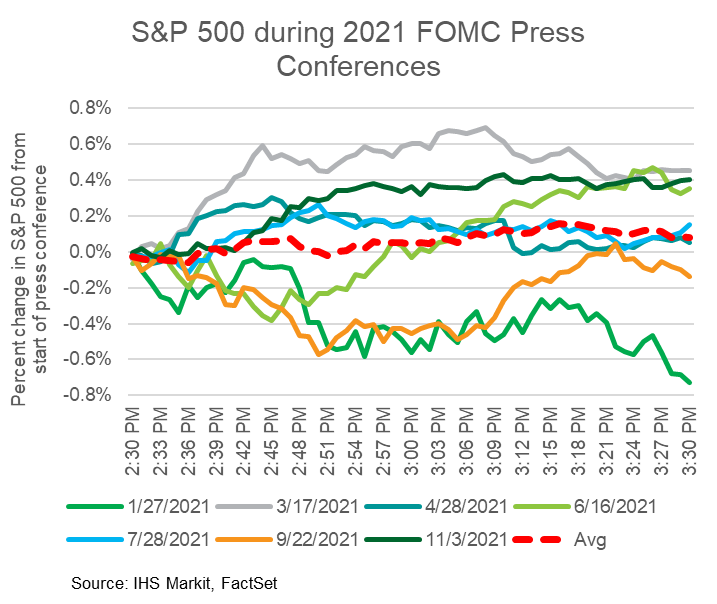

- The below chart shows the S&P 500's performance during

every 2021 FOMC meeting press conference led by Fed Chairman

Powell, with the baseline set at the 2:30pm ET start of each

instance. To Chairman Powell's credit, the S&P 500 ended higher

than it started during the press conference for all but the January

and September meetings.

- The UK's Office for National Statistics (ONS) has reported that

the volume of retail sales rose for the first time since April by

0.8% month on month (m/m) in October. Therefore, retail sales

volumes were 5.8% higher than their pre-COVID-19 February 2020

levels. (IHS Markit Economist Raj

Badiani)

- Underlying developments were less encouraging. Specifically, retail sales volumes fell by 0.9% in the three months to October compared with the three months to July.

- The only main retail sector to enjoy an improvement in October was non-food stores, with sales increasing by 4.2% m/m in volume terms. It appears that many consumers begun their Christmas shopping earlier than normal, fearful of shortages nearer the holiday season and rising prices. Specifically, the ONS reported that strong sales occurred in toy, clothing, and sports equipment stores.

- Food store sales in volume terms fell by 0.3% m/m in October but they remained 3.4% above pre-COVID-19 levels in February 2020.

- Automotive fuel sales volumes fell by 6.4% m/m in October as they normalized after strong growth in September, while soaring gasoline prices appeared to discourage some car journeys. Overall, automotive fuel sales in October were 5.0% below their pre-COVID-19 levels (February 2020).

- The proportion of retail sales online fell to 27.3% in October, its lowest share since March 2020. It stood at 19.7% in February 2020 prior to the COVID-19 virus outbreak.

- Inflation risk in the South African economy has increased,

prompting the South African Reserve Bank (SARB) to raise its policy

rate by 25 basis points to 3.75% during the November Monetary

Policy Committee (MPC) meeting. (IHS Markit Economist Thea

Fourie)

- Global supply chain disruptions amid strong global demand left the price for intermediate goods, raw materials and food combined with oil prices sharply up in recent months. Subsequently, the SARB has raised its inflation forecast for the fourth quarter of 2021 to 5.3% from 5.0% previously, with overall headline inflation during 2021 now expected to average 4.5% from 4.4% previously.

- The SARB's inflation outlooks for 2022 and 2023 have also been slightly revised upward to 4.3% (from 4.2% previously) and 4.6% (from 4.5% previously) respectively. The medium-term inflation outlook assumes low service inflation, a modest increase in until labour costs and relatively stable exchange rate. Furthermore, "a gradual rise in the repo rate will be sufficient to keep inflation expectations well anchored and moderate the future path of interest rates", the SARB states.

- The SARB estimates show that South Africa's negative output gap will close in late 2023. For 2021, the SARB expects GDP to average 5.2%, after which growth is expected to slow to 1.7% in 2022 and 1.8% in 2023 - in line with South Africa's potential growth. Energy supply constraints combined with the negative impact of the social unrests in July 2021 will have a lasting impact on investment decisions and job creation while the high export prices witnessed during 2020-21 is expected to fade during 2022.

- Dominion Energy on November 22 released a new Sustainability

and Corporate Responsibility Report, which outlines progress in

areas like clean energy development. "We aspire to be the most

sustainable energy company in the country," said Dominion Energy

Chair, President, and CEO Robert Blue. "We're hitting the right

milestones on the way to that goal: developing clean, renewable

energy and storage; building a more diverse workforce and supply

chain; improving safety; and investing in our communities to make

sure no one is left behind." In terms of clean energy, the report

highlights the company's work to (IHS Markit PointLogic's Barry

Cassell):

- Develop the largest offshore wind project on this side of the Atlantic Ocean through its Virginia Electric and Power d/b/a Dominion Energy Virginia utility subsidiary.

- Own one of the largest solar portfolios among investor-owned utilities in the US.

- Invest in energy storage, hydrogen and other clean-energy technologies.

- Upgrade the grid to support renewable energy and improve reliability even further.

- Develop the largest renewable natural gas initiative in the country.

- Ford CEO Jim Farley has confirmed that the automaker has scrapped plans to work with electric vehicle (EV) maker Rivian to produce an EV for Ford Motor Company, reports Automotive News. Farley reportedly said, "Right now, we have growing confidence in our ability to win in the electric space. When you compare today with when we originally made that investment, so much has changed: about our ability, about the brand's direction in both cases, and now it's more certain to us what we have to do. We want to invest in Rivian - we love their future as a company - but at this point we're going to develop our own vehicles." In addition, Farley reportedly commented on the market valuations of Tesla and Rivian being higher than those of traditional automakers, and acknowledged "mixed emotions". As discussion of a potential shared product between Rivian and Ford had not increased following the cancellation of a Lincoln program with Rivian, the latest statements do not come as a particular surprise. The report does not discuss Ford's relationship with Volkswagen (VW), but at this time, there is no particular reason to believe that is on weak ground. For Ford, vehicles on VW's MQB platform are well-suited for the European market, in terms of size and cost, while the company has the larger platforms and is developing more for the US market. Ford and VW had intended their relationship to be in the European market only. That plan may change, but at the moment, there is no reason to believe the change in the Rivian relationship suggests that the VW partnership is being rethought. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Delhi Transport Minister Kailash Gahlot has announced on Twitter that diesel vehicles older than 10 years can run in the National Capital Region (NCR) on the condition that they are retrofitted to run on electric power, reports Autocar India. According to the source, this initiative will allow 10-year-old diesel vehicles to bypass the National Green Tribunal's (NGT)'s ban on diesel vehicles. Delhi's transport department will empanel electric vehicle (EV) kit manufacturers before allowing conversions. Furthermore, EV kit manufacturers will also have to get individual certification for each model's EV kit. EV kit makers have requested a universal retrofitting certification (in line with CNG kit certifications) and not for each model as that will require investment of more time and money. The Transport Minister also allowed entry of electric light commercial vehicles (eLCVs; inclusive of L5N and N1 categories) to enter as well as park on NCR roads during no-entry hours. The transport department of the Delhi government has also mandated the use of chromium-based hologram colour-coded fuel stickers on vehicles where blue stickers are for gasoline (petrol) and CNG vehicles and orange for diesel vehicles. There is speculation if retrofitting EV kits will be allowed or not on gasoline models that are older than 15 years and are banned for use on Delhi roads. The use of retrofitted kits is likely to affect new vehicle sales in a negative way and discourages vehicle owners to discard old vehicles. (IHS Markit AutoIntelligence's Tarun Thakur)

Tuesday, November 23, 2021

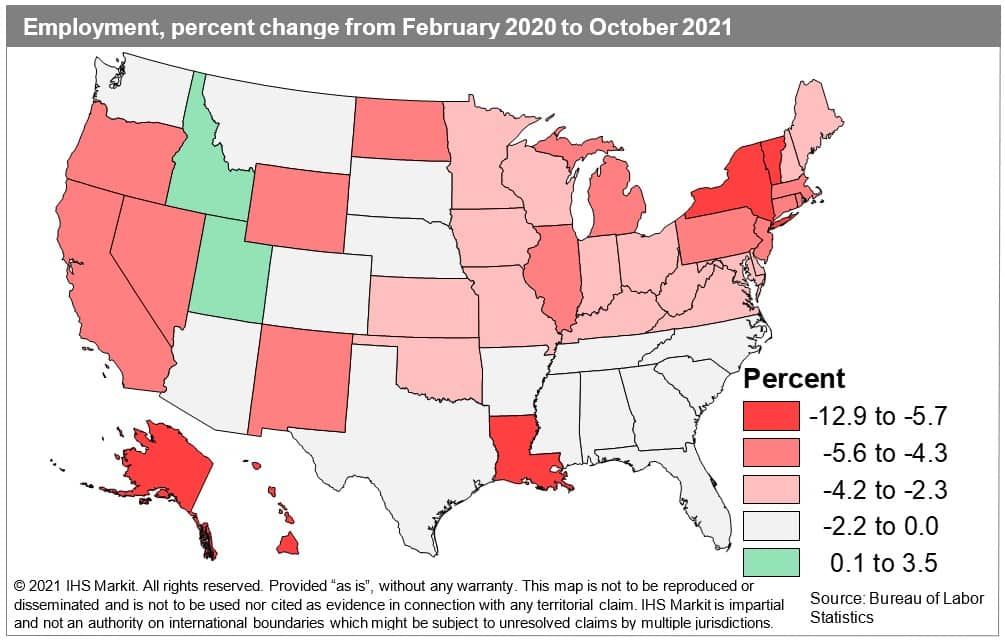

- Job growth around the US accelerated for a second consecutive

month in October as state labor markets continue to move past the

effects of the Delta variant surge over the summer. Total private

nonfarm employment gains kicked up another notch in every region

with the South and West leading the country. The recent quick

expansion in the South was driven by solid expansions in business

services, leisure/hospitality services, and a recovery from

Hurricane Ida in Louisiana. The Midwest found momentum in its

business services and hospitality industries but was restrained by

sluggish education and healthcare hiring. The Northeast and West

have maintained their lead in 2021 with stronger overall job

recoveries fueled by deeper job deficits over the course of the

pandemic. Steady job gains in business services, financial

activities, healthcare, and hospitality in states like California,

New York, and New Jersey have powered these regions over the past

months. (IHS Markit Economist James

Kelly)

- Much of the South, including Texas, Florida, and Georgia, benefited from robust increases in service-sector employment. Hiring in business services, education/healthcare, and leisure/hospitality services rose broadly throughout the region. Louisiana saw the nation's strongest annualized gain in October thanks to the expected recovery from Hurricane Ida. Much of the region also saw moderate increases in trade, transportation, and utilities employment as logistics and e-commerce activity continue to boom. Manufacturing hiring was more mixed, with some of the largest gains in South Carolina, Alabama, and Tennessee.

- Michigan and Illinois led the Midwest to a stronger expansion on solid growth in professional/business and leisure/hospitality services. Most parts of the region saw stagnant to slight expansions in educational and healthcare services with notable declines in Wisconsin, Ohio, and Indiana. As consumer activity in the leisure and hospitality services sector continued to climb, fueled by confidence in COVID-19 vaccinations and lower caseloads, employment at restaurants, hotels, and other hospitality businesses rose solidly in many states.

- The Northeast saw more moderate employment gains in many

states, but still accelerated in October. Sluggish gains or

declines in the financial activities and business services sectors

affected Pennsylvania and New York and held back a more robust

expansion. Massachusetts led the region with notable increases in

business services and hospitality employment. California and Nevada

experienced some of the strongest gains in the West supported by

leisure/hospitality and professional/business services while

Washington and Oregon experienced similar momentum in service

sector hiring.

- The headline IHS Markit Eurozone Composite PMI rose for the

first time in four months in November, climbing from 54.2 in

October to 55.8 according to the 'flash' reading*. Although

indicating an improvement in the rate of growth from October's

six-month low and remaining above the survey's pre-pandemic

long-run average of 53.0, the average reading for the fourth

quarter so far, at 55.0, is substantially lower than the 58.4

average seen in the third quarter, pointing to a weakening of

economic growth in the closing quarter of 2021. (IHS Markit

Economist Chris

Williamson)

- By sector, services outperformed manufacturing for a third straight month, recording the strongest growth of activity for three months. Growth also picked up in manufacturing, though remained the second-weakest seen over the past 17 months. In manufacturing, growth was held back in particular by a third successive monthly drop in production in the autos sector. More positively, especially robust expansions were seen for tech equipment, food & drink and household goods.

- Especially weak factory output growth was again seen in Germany alongside a subdued service sector expansion, though in both sectors, the rate of growth improved on October.

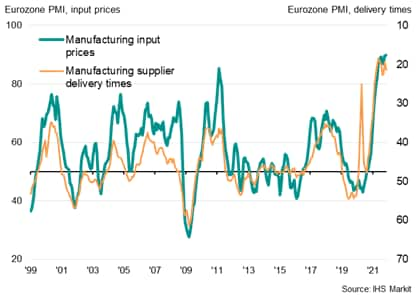

- Weak factory output growth was again commonly attributed to supply constraints. Suppliers' delivery times continued to lengthen at one of the steepest rates seen over more than two decades of survey history, easing only modestly compared to October, amid ongoing supply shortages and transport problems.

- Shortages were meanwhile once again seen as a principal driver

of higher prices for many goods and services, alongside higher

shipping costs, rising energy prices and increases in staff costs.

November consequently saw a survey record increase in firms' input

costs for a second successive month, with unprecedented rates of

inflation recorded in both manufacturing and services.

- US private sector firms signaled a sharp upturn in business

activity during November, despite the rate of expansion slowing

from October. Softer overall growth was largely led by the service

sector, as manufacturers posted a slightly stronger increase in

production. Nevertheless, pressure on capacity remained stark as

labor and material shortages weighed on the private sector. (IHS

Markit Economist Chris

Williamson)

- Flash US Composite Output Index at 56.5 (57.6 in October). 2-month low.

- Flash US Services Business Activity Index at 57.0 (58.7 in October). 2-month low.

- Flash US Manufacturing PMI at 59.1 (58.4 in October). 2-month high.

- Flash US Manufacturing Output Index at 53.9 (52.1 in October). 2-month high.

- The level of outstanding business rose at the second-sharpest pace on record (since October 2009), slipping only slightly from October's series high.

- Both manufacturing and services recorded marked upturns in backlogs of work amid further severe supply chain delays and labor shortages.

- The rate of job creation was solid overall, but many firms noted outstanding vacancies which had not been filled for several months.

- General Motors (GM) has purchased a 25% stake in Pure Watercraft, valuing the electric boat startup at USD600 million, reports Reuters. The automaker is paying USD150 million in cash and payment-in-kind, which includes access to GM's components and manufacturing support, according to Pure Watercraft. Pure Watercraft, based in Seattle, manufactures electric motors for boats driven by lithium-ion batteries, with a plug-and-play design that allows the motors to be used on any boat hull. GM said that it would reveal any products developed from the partnership with Pure Watercraft at a later date. (IHS Markit AutoIntelligence's Jamal Amir)

- Panasonic Corporation is planning to launch a security system that it has developed for automakers to prevent cyber attacks amid an increase in the number of models that are connected to the internet, reports Kyodo News. The security system will enable software installed in internet-connected cars to detect abnormalities, while dedicated teams at Panasonic and automakers will keep a check on the cars around the clock. A Panasonic company official said, "If the computerized control is taken over during driving, it leads to fatal accidents. Practically, abnormalities need to be detected at a much earlier phase." Cyber safety is a crucial consideration in the emerging connected car industry; with the increase in the number of high-tech cars, vehicles are likely to become the targets of dangerous hackers. In order to ensure passenger safety, countries have been setting up cyber security guidelines. (IHS Markit AutoIntelligence's Nitin Budhiraja)

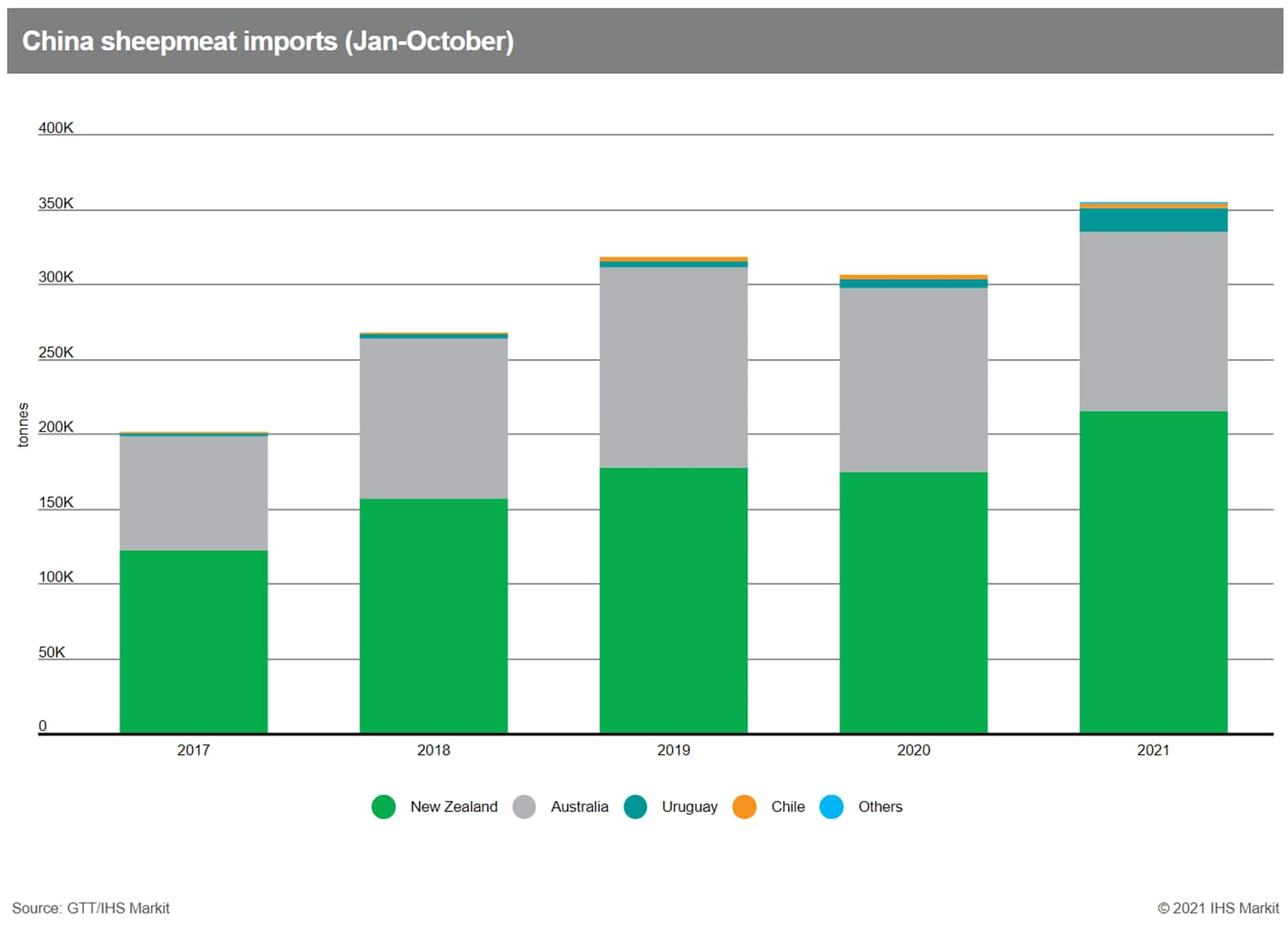

- China strengthened its position as the world's leading buyer of

sheepmeat in the first ten months of this year as the country

brought in imports worth more than $2 billion. (IHS Markit Food and

Agricultural Commodities' Max Green)

- Chinese customs data shows that imports in the January-October period amounted to 354,249 tons, up 16% y/y. These lamb and mutton shipments were valued at $2.01 billion - an increase of 38% y/y.

- To put these figures in context, China's average monthly spend on sheepmeat imports has risen roughly tenfold over the past ten years and by almost 100 times over the past two decades.

- More than 90% of Chinese sheepmeat imports still come from New Zealand and Australia. There has been a big shift in the relative share of these two countries however, with higher imports from New Zealand more than offsetting a drop in purchases from Australia.

- In the first ten months of 2021, imports from New Zealand rose by 23% y/y to reach 214,550 tons, but imports from Australia dropped by 3% y/y to 119,998 tons.

- The only other countries providing China with significant

volumes of sheepmeat are Uruguay and Chile. Chinese imports from

Uruguay surged to 16,396 tons in the Jan-October period - up 178%

y/y. In contrast, imports from Chile were down 10% y/y at 2,438

tons.

Wednesday, November 24, 2021

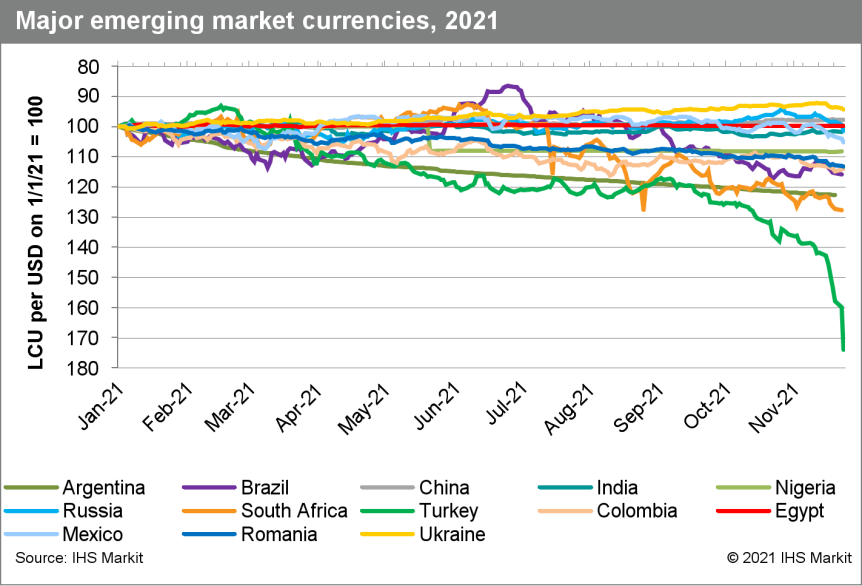

- The Turkish lira continued to plunge on 23 November as

President Recep Tayyip Erdoǧan expanded his anti-interest rate

rhetoric. Severe lira losses are aggravating inflation and

beginning to disrupt real economic activity, as purchase/sale

contracts are unable to be efficiently negotiated against the

plunging lira. Lira losses in 2021 have surpassed those from 2018,

with further depreciation likely given that Erdoǧan is giving no

indication of agreeing to a rate rise as happened three years ago

and the central bank's net foreign exchange reserve position is now

more precarious. (IHS Markit Economist Andrew

Birch)

- The lira continued to plunge on 23 November, with President Erdoǧan once again further enflaming the depreciation with his statements. That day, Erdoǧan pledged to keep interest rates below the prevailing rate of inflation until economic growth in Turkey.

- By doubling down on his previous days' rhetoric of continued monetary policy in the face of high inflation and sharp lira depreciation, the exchange rate reportedly tumbled to as low as TRY13.46/USD1.00 during the day, although it ended the day officially trading at TRY12.17/USD1.00. Even with a late day rally, the lira nonetheless depreciated by 8.8% over the course of the single day and was down by over 25% in less than two weeks.

- The severe lira losses are not only aggravating inflationary pressures, but are beginning to disrupt real production and retail trade activity. According to several various news reports, wholesalers are beginning to refuse to sell their goods to retailers because they cannot properly set prices. They fear that if they sell to retailers at one price, they would need to pay substantially more to replace their inventory.

- Sell contracts between wholesalers and their sources and

between wholesalers and retail outlets are now being drawn up in

foreign currency terms because of the unpredictability of the lira.

The lira losses are putting retailers in a particular predicament,

as they must now purchase goods in foreign currency but, by and

large, must sell in lira, leading to a sharp squeeze on profits. In

one headline-grabbing move, Apple has frozen its retail operation

in Turkey because of an inability to properly set prices.

- US personal income increased 0.5% in October while real

disposable personal income (DPI) decreased 0.3% amid higher

consumer prices. Wage and salary income increased a solid 0.8% in

October and was up 12.9% over a 24-month period; this suggests a

full recovery to the pre-pandemic trend. Also supporting personal

income in October were dividend and interest income, which rose

1.2% and 0.6%, respectively. (IHS Markit Economists James

Bohnaker and William Magee)

- Ongoing advance payments of the Child Tax Credit authorized under the American Rescue Plan raised personal income by $220 billion (annual rate), roughly the same amount as in the previous three months. Fewer unemployment insurance payments under pandemic-era programs—which expired in early September—acted as a drag on income.

- Real personal consumption expenditures (PCE) increased 0.7% in October as PCE for durable goods rose 2.0% thanks primarily to a partial rebound in spending on motor vehicles and parts. Real PCE for services increased 0.5%, but pandemic-sensitive categories such as food services and accommodations experienced declines in October.

- The PCE price index increased 0.6% in October and its 12-month change was 5.0%. Excluding food and energy, for which prices rose strongly, the core PCE price index rose 0.4% during October and 4.1% over 12 months.

- The pandemic and inflation remain headwinds for household spending, but personal income growth rooted in rising compensation is expected to support faster expansion in PCE over the fourth quarter.

- The US University of Michigan Consumer Sentiment Index sank 4.3

points from its October level to 67.4 in the final November

reading—its lowest level in a decade. The decline was driven by

worsening views on both the present situation and the future. The

present situation index fell 4.1 points to 73.6 and the

expectations index declined 4.4 points to 63.5. (IHS Markit

Economists James

Bohnaker and William Magee)

- Households in the bottom half of the income distribution were exclusively responsible for the decline in sentiment. The index of sentiment for households earning below $100,000 per year declined 7.6 points, while that for households earning over $100,000 per year edged up 0.9 point.

- Elevated inflation remains the foremost drag on sentiment. According to the report, one in four consumers cited inflationary erosions of their living standards in November, more than double the proportion from six months earlier. The 12-month change in the consumer price index (CPI) in October was the fastest since 1990 at 6.2%, with highly visible consumer prices, such as those for gasoline and food, rising at even sharper rates. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.1 point to 4.9% to reach its highest level since 2008. Inflation expectations over the 5-10-year horizon were a moderate 3.0%.

- The indexes of buying conditions for large household durable goods, automobiles, and homes were all starkly lower, as rising prices for those items remained the chief reason for poor buying sentiment.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by our expectation for strong job and wage growth in the coming months, and the fact that healthy consumer balance sheets and excess savings will continue to support solid growth of consumer spending. Recent data on credit- and debit-card spending suggest that consumers are spending confidently as we enter the peak holiday shopping season.

- Peru's Financial Superintendence of Banking and Insurance

(Superintendencia de Banca, Seguros y AFP: SBS) on 22 November

published its financial stability report for the second half of

2021; the report is different from the one published by the Central

Bank of Peru (Banco Central de Reserva del Perú: BCRP). (IHS Markit

Banking Risk's

Alejandro Duran-Carrete)

- The document details the current condition of the financial system, highlighting that the improvement in the Peruvian economy has been favorable, aiding the recovery of the banking sector, particularly from a credit growth and profitability perspective. Nevertheless, credit risks - both measured by deteriorated loans and resilience of the corporate portfolio - have been increasing, likely leading to a decline in asset quality.

- IHS Markit agrees with the SBS regarding the persistence of credit risks in the sector. In our view, it is the main concerning factor for Peruvian banks given that the sector excels in other areas such as provisioning and capitalization and has appropriate levels of liquidity, although it has some signals of tightness, such as a high loan-to-deposit ratio.

- The SBS reports that loans that are past due by more than 15 days were at 4% of total loans in September, particularly contributed by the small and medium-sized enterprise (SME) segment, at 7.6%. We assessed that the significant refinancing of loans during mid-2020 was likely to lead to higher credit risks. If we focus on the high-risk trench of the credit portfolio, which includes the refinanced credits, the past-due portfolio is at 6.1%, with the SME segment at 10.0%. Additionally, 15.1% of the 2020 refinanced loans (equivalent to 2% of total loans) are past due by six months, likely leading to a rise in the non-performing loan (NPL) ratio.

- In our current forecast, we expect the NPL ratio to end 2021 at 3.2% and 2022 at 3.1%, well above its 10-year historical average of 2.2%.

- In collaboration with Microsoft and Ballard Power Systems, Caterpillar has embarked on a three-year project to demonstrate a power system incorporating large-format hydrogen fuel cells to produce reliable and sustainable 1.5 MW backup power for Microsoft data centers. The project is supported and partially funded by the US Department of Energy (DOE) under the H2@Scale initiative and backed by the National Renewable Energy Laboratory (NREL). Caterpillar is providing the overall system integration, power electronics and controls that form the central structure of the power solution which will be fueled by low-carbon-intensity hydrogen. Microsoft is hosting the demonstration project at a company data center in Quincy, Washington, while Ballard is supplying an advanced hydrogen fuel cell module. The NREL is performing analyses on safety, techno-economics and greenhouse gas (GHG) impacts. Caterpillar has been working with the DOE on research, development and demonstration projects for more than 20 years. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- World wine production has been dragged down by shortfalls in

the EU, with consumption also thought to be lower but more data is

required. It worth noting there were production gains of 30% in

both Australia and Chile. (IHS Markit Food and Agricultural

Commodities' Julian Gale)

- The sharp drop in EU wine production means that global 2021 output hit an almost record low of around 250 million hectoliters.

- All three big countries, Italy, France and Spain, saw substantial declines. France dropped from second place to third place in the ranking.

- Italy's 2021 wine output is estimated at down 9% y/y to 44.5 million hectoliters.

- Spain is at -14% to 35 million hectoliters and France -27% to 34.2 million hectoliters.

- In 2020 these three European countries together made 136.5 million hectoliters. Their cumulative 2021 volume is only 113.7 million hectoliters, a decrease of 22.8 million hectoliters or -17% collectively.

- These three countries made 78% of all wine in the EU. They also account for almost 50% of the global wine production.

- The International Organization of Vine and Wine (OIV) estimates that the total global production of wine in 2021 will range between 247-253 million hectoliters. This number is very close to the harvest in 2017 of 247 million hectoliters, which was the smallest volume in more than 20 years.

Thursday, November 25, 2021

US Markets closed for Thanksgiving Holiday

Friday, November 26, 2021

- Electric vehicle (EV) maker Rivian has started notifying customers who have reserved the R1S electric sport utility vehicle (SUV) of delivery delays, according to Reuters, citing news from unnamed media outlets. The delivery window for the R1S has been changed to between May and July at the earliest, according to the report. The company had earlier said R1S would begin production at the Normal (Illinois, US) plant in December, with the first deliveries expected that month. Reuters said it could not independently verify the information. (IHS Markit AutoIntelligence's Abby Chun Tu)

- NIO and Shell have signed a strategic co-operation agreement on the development of co-branded battery swap stations. According to a statement from Shell, the co-operation in China will start with two pilot sites and this is aimed to reach 100 sites by 2025. Under the agreement, Shell will offer Shell Recharge high-speed charging at NIO locations and make battery swap available at select Shell locations. Co-operation in Europe will start from exploring pilots in 2022. The NIO-Shell co-operation will pave the way for NIO to expand to European markets. The electric vehicle (EV) startup has already begun deliveries of its flagship ES8 electric sport utility vehicle (SUV) in Norway. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Electric vehicle (EV) charging infrastructure company Ionity has announced that it has raised a further EUR700 million. According to a statement, part of this has come from its existing shareholders, including BMW Group, Ford, Hyundai Motor Group with Kia, Mercedes-Benz, and Volkswagen Group with Audi and Porsche. The shareholders have also been joined by BlackRock's Global Renewable Power platform. Ionity said that the funds will be used to drive its growth and network expansion plans in Europe, with aims to lift the number of 350-kW charging points to around 7,000 kW by 2025. These are planned not only for motorways, but also near major cities and along major trunk roads. The company also noted that future locations will have between 6 and 12 charging points installed, and that existing sites will be upgraded with additional charging points if there is demand. (IHS Markit AutoIntelligence's Ian Fletcher)

- Near-term inflation projections will be revised up at

December's European Central Bank (ECB) meeting but the medium-term

assessment is likely to remain consistent with a cautious

withdrawal of policy accommodation. ECB communications have been

notably dovish against a backdrop of soaring inflation. (IHS Markit

Economist Ken

Wattret)

- The ECB's most recent policy-setting meeting took place on 27-28 October, prior to the pronounced deterioration in coronavirus disease 2019 (COVID-19) trends across many member states of the eurozone. To some extent, therefore, the published account of October's policy meeting has been overtaken by events.

- Nonetheless, regarding inflation developments, prospects, and related risks, the account offers some insight into how the debate within the ECB is evolving. In short, although concerns were expressed by some Governing Council members about persistent recent underestimation of inflation rates and upside risks, the tone of the account overall is supportive of IHS Markit's assessment that the ECB will be very cautious in removing its policy accommodation.

- Indeed, significant concern was expressed at the meeting that financial markets, by bringing forward expectations of policy rate lift-off to late 2022, had not correctly interpreted the ECB's modified forward guidance, including the 'troika' of inflation conditions that would need to be met for a policy rate tightening cycle to begin.

- Although the current phase of higher inflation was projected to last longer than originally anticipated, inflation was still expected to decline during 2022. The upswing largely reflected three factors: the sharp rise in energy prices, a reopening-driven recovery in demand outpacing supply, and base effects related to 2020's value-added tax (VAT) cut in Germany. Members said the influence of all three would ease or fall out of the year-on-year inflation calculation in 2022.

- Reference was made to the recurrent underestimation of headline and underlying inflation rates, corroborating earlier conjectures that the risks around the September 2021 ECB staff projections had been tilted to the upside. Members said it was likely that in December 2021's Eurosystem staff projections, the shorter-term inflation outlook would once again be revised upwards.

- In a surprise move, the Bank of Zambia (BoZ) hiked its key

policy rate, the Bank of Zambia policy rate, by 50 basis points to

9.0% during its latest monetary policy committee (MPC) meeting held

on 22-23 November. The policy rate increase follows in the wake of

the BoZ's upward adjustment to short-term inflation expectations.

Although the central bank expects headline inflation to trail down

over the next eight quarters, the BoZ believes it will remain well

above the inflation target range of 6-8%. The BoZ expects headline

inflation to average 15% in 2022 and 9.3% in 2023. (IHS Markit

Economist Thea

Fourie)

- The high base year of comparison and the lagged impact of the stronger exchange rate of the Zambian kwacha are likely to suppress inflationary pressures in the economy, the BoZ reports. Risks to this inflation outlook remain elevated, nonetheless.

- Zambia is currently negotiating an International Monetary Fund (IMF) support program, which could require the lifting of fuel and electricity subsidies to rationalize government spending commitments and allow for public-sector debt sustainability over the medium term. Higher fuel and electricity costs will keep headline inflation above the central bank's 6-8% objective in the near term. Ongoing supply chain disruptions due to the evolving coronavirus disease 2019 (COVID-19) pandemic add to the near-term inflation concerns.

- Economic growth is expected to benefit from stronger output in

the finance and insurance, information and communication, wholesale

and retail trade, and mining sectors during 2022. The BoZ expects

Zambia's GDP to grow by 3.5% in 2022, from 3.3% in 2021. The

central bank forecasts GDP growth at 3.7% in 2023.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-29-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-29-2021.html&text=Weekly+Global+Market+Summary+Highlights%3a+November+22-26%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-29-2021.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: November 22-26, 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-29-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+November+22-26%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-29-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}