Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 03, 2021

Daily Global Market Summary - 3 August 2021

All major US equity indices closed higher, while European and APAC markets were mixed. US and benchmark European government bonds closed mixed. European iTraxx and CDX-NA closed almost unchanged on the day across IG and high yield. Natural gas closed higher, the US dollar and silver were flat, and gold, copper, and oil were lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher, with the S&P 500 +0.8% closing at a new all-time record high; DJIA +0.8%, Nasdaq +0.6%, and Russell 2000 +0.4%.

- 10yr US govt bonds closed flat/1.18% yield and 30yr bonds -1bp/1.84% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY -1bp/293bps.

- DXY US dollar index closed flat/92.08.

- Gold closed -0.4%/$1,814 per troy oz, silver flat/$25.58 per troy oz, and copper -1.1%/$4.39 per pound.

- Crude oil closed -1.0%/$70.56 per barrel and natural gas closed +2.3%/$4.03 per mmbtu.

- COVID-19 hospitalizations in Florida have reached a record high, federal data show, as the state battles a surge in cases brought on by the highly contagious Delta variant. There were 11,515 confirmed Covid-19 hospitalizations in the state, according to data released Tuesday by the U.S. Department of Health and Human Services. The Delta-driven surge has hit a younger population than prior surges while filling hospital beds at a rapid clip, according to the Florida Hospital Association, which represents health centers in the state. The number of COVID-19 hospitalizations in Florida jumped from 2,000 to 10,000 in 30 days during this current surge, double the pace seen last summer, said Mary Mayhew, the association's chief executive. (WSJ)

- Drought in the US West this year is exposing the vulnerability

of hydropower to climate conditions, even as the Biden

administration and Congress indicate support for the power source's

contribution to the country's drive towards decarbonization.

Hydropower in 2020 supplied 7.3% of the US' electricity, or 291

billion kWh. This was, by far, the largest source of renewable

power in the nation, according to the US Energy Information

Administration (EIA), as it represented 52% of the total. (IHS

Markit Net-Zero Business Daily's Kevin Adler)

- A $1-trillion-plus infrastructure plan, which could move through the Senate as early as this week, does not carve out funding for hydropower. But the $3.5-trillion budget that's coming right behind surely will. Several bills have been introduced in Congress, with bipartisan backing, to invest in maintenance of existing dams to support energy production, manage water flow, and mitigate environmental concerns.

- While political support is strong, the US hydro sector faces long-term challenges that include managing capacity during drought conditions. Most of the top locations for dams have been developed, and more existing dams than ever are up for license renewal in the coming decade. And environmental researchers have pointed out that dams are not 100% carbon-free, as the reservoirs they create remove forests and grasslands that captured carbon and, in some cases, the decaying plant life in the dams is a substantial source of methane as well.

- US manufacturers' orders rose 1.5% in June. Shipments rose 1.6%

and inventories rose 1.0%. The gain in orders outpaced the

consensus estimate. Both orders and shipments have surpassed their

pre-pandemic levels, but recent gains were boosted by surging

prices in the manufacturing sector. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- Take, for example, orders. In January of this year, manufacturers' orders were 3.2% above the January 2020 level, while the Producer Price Index (PPI) for manufacturing was up 1.5%, implying a 12-month real gain of 1.7%.

- By this metric, the manufacturing sector had more than fully recovered by January. Since January, manufacturers' orders continued to climb, rising a cumulative 5.6% from January to June, but the PPI for manufacturing rose by more: 8.8%. That is, since January, real manufacturing orders have reversed course, declining 3.2% to below the January 2020 level.

- This illustration points out that we need to be cautious about how we interpret the nominal data in an inflationary environment, even if the inflation is temporary (as we believe is the case).

- Separately, core orders and shipments were revised somewhat higher for May and June (relative to the advance estimate), leading to a small upward revision to our forecast of third-quarter equipment spending. Inventories through June outpaced figures implicit in the advance estimate of the national income and product accounts (NIPAs), implying more second-quarter inventory investment and less of an increase in inventory investment in the third quarter.

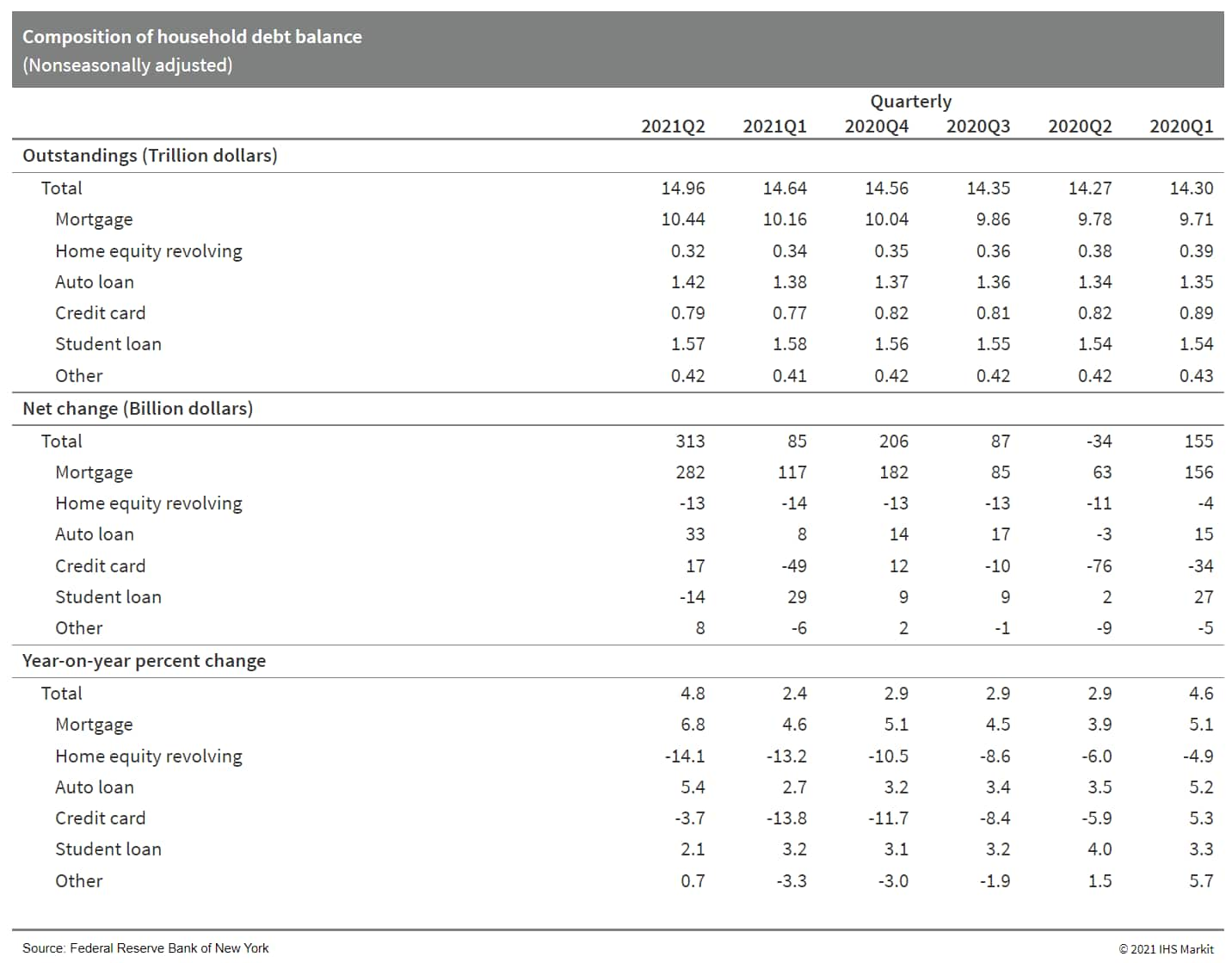

- US total household debt rose in the second quarter by $313

billion, a rise of 2.1% from the first quarter and 4.8% from the

second quarter of 2021. Outstanding household debt totaled $14.96

trillion. (IHS Markit Economist James

Bohnaker)

- The 2.1% increase in aggregate balances was the largest seen since the fourth quarter of 2013 and marked the largest nominal increase in debt balances since the second quarter of 2007.

- Mortgages, the largest category of debt, were also the main source of increase in the first quarter, rising $282 billion for a four-quarter increase of 6.8% (up from 4.6% in the first quarter of 2021).

- In the four quarters ending in the second quarter of 2021, mortgage originations (which include refinances) reached a historical high, with nearly $4.6 trillion in mortgages originated. With the robust pace of originations in the past four quarters, 44% of the outstanding mortgage balance has originated in the past year.

- Nonhousing debt rose by $31 billion in the second quarter as credit-card balances rose $17 billion, only recouping a small portion of the declines seen during the pandemic as stimulus payments and unemployment insurance supplemented incomes, allowing consumers to pay down debts. Credit-card debt was 15.1% below its pre-pandemic level in the fourth quarter of 2019.

- Auto loans rose by $33 billion (2.4%) despite a falling number of accounts for the fifth consecutive quarter, while student loans fell $14 billion (-0.9%). Four-quarter growth for these categories was 5.4% and 2.1%, respectively.

- As of late June, 2.7% of outstanding debt was in some stage of delinquency, a 2.0-percentage-point decrease from the fourth quarter of 2019, prior to the pandemic. Aggregate delinquency rates have remained low and declining since the beginning of the pandemic, reflecting an uptake in forbearances and the impact stimulus funds have had on allowing borrowers to make timely payments.

- About 119,000 consumers had a bankruptcy notation added to

their credit reports in the second quarter of 2021, a small uptick

from the previous quarter but near a historical low. The share of

mortgage balances 90-plus days past due fell to 0.5%, a historical

low as forbearance remains an option and foreclosures are mostly on

hold.

- RNA interference (RNAi) therapeutics specialist Alnylam (US) and peptide-based drug discovery company PeptiDream (Japan) have announced that they have entered into a collaboration to discover and develop conjugates of peptides and small interfering RNA (siRNA) molecules to create multiple opportunities to deliver RNAi therapeutics to tissues outside the liver. Under the collaboration, the two companies will select and optimize peptides for the targeted delivery of siRNA molecules to a wide range of cell types and tissues via specific interactions with receptors expressed on the target cells. This will entail Alnylam selecting a set of receptors for PeptiDream's peptide discovery platform, while PeptiDream will select, optimize, and synthesize peptides for each receptor. Alnylam will then generate peptide-siRNA conjugates and perform in vitro and in vivo studies to support final peptide selection. (IHS Markit Life Sciences' Milena Izmirlieva)

- US House Democrats led by Jan Schakowsky (D-Ill.) have

introduced a new bill seeking to change the way FDA evaluates

chemicals in foods and create a new FDA office charged with

reviewing the safety of at least ten food chemicals every three

years. (IHS Markit Food and Agricultural Policy's Margarita

Raycheva)

- The bill lays out 10 priority chemicals to be reviewed for safety by the new office, including per- and polyfluoroalkyl substances (PFAS), as well as perchlorate and ortho-phthalates.

- The Food Chemical Reassessment Act of 2021 (FCRA, H.R. 4694) would also reestablish FDA's Food Advisory Committee - an advisory body that the agency terminated in 2017, as a cost-and resource-saving measure.

- Backers of the bill - including a number of consumer and environmental groups - have hailed the proposal, noting that changes in the legislation will allow FDA to better ensure the safety of chemicals in the food supply.

- While other countries, and even other US agencies, periodically review the safety of chemicals used in food, FDA relies on the Generally Recognized as Safe (GRAS) process, which does not require continuous review of chemicals, said champions of the bill. As a result, some substances, such as the ten priority chemicals identified in the bill, have either never been reviewed for safety or have not been reassessed in decades.

- Hexion today announced plans for an initial public offering

(IPO), likely in the fourth-quarter of 2021. The company has

submitted a draft securities registration filing to the US

Securities and Exchange Commission (SEC; Washington, DC), it says.

(IHS Markit Chemical Advisory)

- The planned IPO is "subject to SEC review, European works councils review, and market conditions," Hexion adds. The company is still undertaking a strategic review of its busines segments, and management is open to M&A transactions, as well, Hexion CEO Craig Rogerson tells CW.

- Hexion filed for a voluntary Chapter 11 bankruptcy in April 2019, and emerged, with debts restructured, on 1 July of the same year. The restructuring converted most of Hexion's bondholders, largely a group of asset management firms, into equity holders. Hexion sold its phenolic resins busines, as well as a clutch of related businesses, earlier this year.

- A major strategic move is planned "because tailwinds are behind us, in our performance, and the markets we serve are doing well," Rogerson says. These include residential construction, renewable energy, and automotive. Financial markets are also performing well this year, Rogerson notes.

- DuPont reports net income of $478 million for the second

quarter, reversing a loss of $2.5 billion. DuPont's year-ago

quarter included one-time charges due to COVID-19 impacts and a

$2.5-billion non-cash goodwill charge due to divestitures. Results

were higher on sharp recovery in automotive, construction, and

industrial markets along with continued strength in areas such as

semiconductors and smartphones. Net sales of $4.1 billion were up

26% year on year (YOY) on a 20% volume jump as markets recovered

from the impacts of COVID-19. Volumes grew at double-digit rates in

all segments, DuPont says. Reported adjusted earnings were

$1.06/share, up 242% YOY and 12 cts above consensus analyst

estimates, reported by Zacks Investment Research. (IHS Markit

Chemical Advisory)

- The electronics and industrial segment reported net sales of $1.3 billion, up 17% YOY on an organic basis. Segment operating EBITDA was $424 million, up 26% YOY with double-digit growth in all three business lines. Sales gains were led by industrial solutions, up mid-20s percent YOY, reflecting broad-based demand in displays, electronics, healthcare, and automotive markets.

- Water and protection segment sales were $1.4 billion, up 11% YOY on an organic basis. Operating EBITDA totaled $352 million, up 4% YOY with volume growth mostly offset by higher raw materials and logistics costs. Ongoing strength in residential construction and do-it-yourself (DIY) applications along with continued recovery in industrial, oil and gas, and automotive markets increased sales, partially offset by declines for protective garments versus year-ago peak demand and higher logistics costs in water technologies.

- The mobility and materials segment reported net sales of $1.3 billion, up 55% YOY on an organic basis. Operating EBITDA for the segment was $294 million, an increase of $317 million from a loss of $23 million in the year-ago period. Continued recovery in the global automotive market drove significant volume growth.

- Mexico's National Statistics Office of Mexico (Instituto

Nacional de Estadística y Geografía: INEGI) has released its flash

GDP report for the second quarter of 2021, showing that GDP had

expanded by 1.5% from January to March, based on seasonally

adjusted data. Compared with the fourth quarter of 2019, GDP is

still 1.7% below the pre-pandemic level. (IHS Markit Economist Rafael

Amiel)

- Using unadjusted data and comparing with the second quarter of 2020, GDP had increased by 19.7%, although it is 2.7% lower compared with the second quarter of 2019. The gap is wider than in the first bullet comparison since the Mexican economy was already in recession when the COVID-19 virus outbreak began.

- The major driver of growth during April-June 2021 was the service sector as the reopening of many activities continued while COVID-19 cases were declining.

- Growth in the industry was constrained by the shortage of semiconductors; data for industrial production through May show a slight decline in manufacturing, while construction and mining had recorded some improvement. The growth in industrial GDP posted in the flash report suggests that industrial production grew by 0.2% in June.

- High-frequency indicators such as retail sales and the index of service sales show that the expansion of the commerce sector during the second quarter was strong, although it was flattening out toward the end of the quarter.

- According to the Central Bank of Chile (Banco Central de Chile:

BCC), the country's unadjusted monthly economic activity indicator,

which is a proxy for GDP, accelerated from 18.1% year on year (y/y)

in May to 20.1% y/y during June, again setting a record. (IHS

Markit Economist Claudia

Wehbe)

- The strong positive unadjusted result was mainly driven by contributions in services, explaining almost 50% of the y/y result, followed by those in commercial, goods production, and industrial activities.

- Growth in services (up 17.8% y/y) was led by personal services, mainly education and healthcare, followed by business services, restaurants and hotels, and transportation. The 46.4% y/y increase in commercial activity was propelled by gains in wholesale and retail trade. The 21.8% y/y gain in the production of other goods category was mainly fueled by construction and manufacturing, which more than offset a modest drop in mining activity.

- In seasonally adjusted terms, all activities advanced during June, led by industry (up by 3.9% m/m). Services had the largest contribution and explained more than half of the monthly advance, followed by industry. Mining had a minor contribution.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Italy closing flat; France +0.7%, UK +0.3%, Spain +0.2%, and Germany -0.1%.

- 10yr European govt bonds closed mixed; Italy/Spain -1bp, France/UK flat, and Germany +1bp.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +1bp/236bps.

- Brent crude closed -0.7%/$72.41 per barrel.

- Swedish floating offshore wind technology developer Hexicon has acquired the Wave Hub test site in Cornwall, United Kingdom, through its Twinhub Limited subsidiary. Wave Hub was acquired at a cost of GBP2.4 million (USD3.3 million) from the local authority, Cornwall Council, and will be used to install Hexicon's offshore demonstrator project for its floating twin turbine concept. Hexicon, through TwinHub, intends to install a 30-40 MW floating offshore wind turbine off the Celtic Sea by 2025. The company will work with Bechtel to deliver the project. (IHS Markit Upstream Costs and Technology's Melvin Leong)

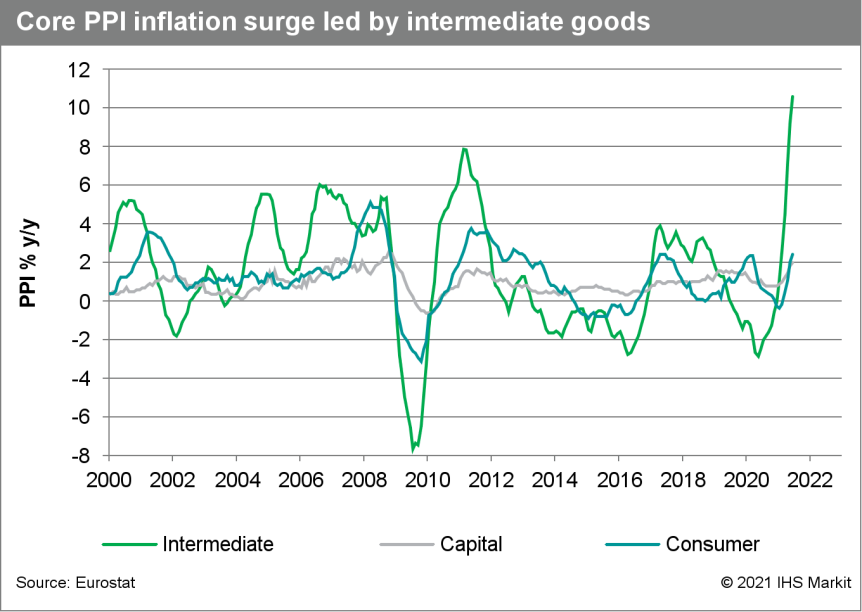

- The year-on-year (y/y) rate of increase in the eurozone

producer price index (PPI) remained exceptionally elevated in June,

rising by 0.6 percentage points to 10.2%, a record high for the

series, although it was slightly below the market consensus

expectation (of 10.3%, according to Reuters' survey). (IHS Markit

Economist Ken

Wattret)

- While base effects have played a key part in boosting y/y inflation rates, the m/m increases in the eurozone PPI have also been unusually robust recently, with the average increase over the first half of 2021 in excess of 1% m/m.

- Energy prices have been pivotal to the acceleration in PPI rates, with the y/y rate in excess of 25% in June, also a record high.

- PPI inflation rates for other goods have also picked up, led by intermediate goods (at 10.2% in June).

- Producer price inflation for consumer goods have accelerated much less rapidly to date, though a clear upward trend is evident and June's 2.4% y/y increase was the highest in over four years.

- The eurozone PPI inflation rate excluding energy prices also

hit a new record high in June, of 5.6%. Various business surveys,

including IHS Markit's PMIs, suggest the rate will continue to go

up in the coming months, albeit less quickly.

- Germany's federal health minister, Jens Spahn, agreed with the health ministers of the federal states yesterday (2 August) that all children aged between 12 and 17 will be entitled to receive vaccinations against COVID-19, as a prevention mechanism ahead of the new school year. In announcing the decision, Spahn stated that there was absolutely no compulsion for children and adolescents to be vaccinated. German newspaper Frankfurter Rundschau has reported that the decision to allow the vaccination of 12-17 year-olds is controversial, since the main scientific authority on vaccination in Germany, the Standing Committee on Vaccination (part of the Robert Koch Institute), has not recommended the mass vaccination of this age group. The source quoted the chair of the German Federation of General Practitioners, Ulrich Weigeldt, as saying that the decision showed a disregard for the authority of the Standing Committee, adding that it seemed to be a decision motivated by the forthcoming general election in September. The federal and state health ministers also agreed on allowing a third (or booster) vaccination for a limited group of people starting in September. The elderly, immunodeficient and immunosuppressed people, and people in care homes will be able to receive a third COVID-19 vaccine dose, and this will only be one of the mRNA vaccines available - either the Pfizer (US) / BioNTech (US) vaccine Comirnaty or the Moderna (US) vaccine Spikevax. People who have received vector-based COVID-19 vaccines will be offered an mRNA vaccine as a third dose, in the case of those who received the AstraZeneca vaccine Vaxzevria, while for those who received the single-dose Johnson & Johnson vaccine, it will be their second dose. (IHS Markit Life Sciences' Brendan Melck)

- German-Australian startup Vulcan Energy Resources Ltd has signed a deal with Renault to supply lithium for five years, reports Reuters. Vulcan will supply 6,000-17,000 tons of lithium annually to the French automaker from its geothermal brine deposits in Germany starting in 2026. The five-year deal is renewable if both parties agree. Vulcan plans to invest EUR1.7 billion (USD2 billion) to build geothermal power stations and facilities to extract lithium, with a goal to start production of the white metal in 2024, highlights the report. (IHS Markit AutoIntelligence's Jamal Amir)

- Volkswagen (VW) Group and TraceTronic Group have formed a 50:50 joint venture (JV), named neocx, for the automated testing and integration of automotive software and networked services. The JV will create a continuous integration/continuous testing (CI/CT) factory through which VW aims to accelerate the development of digital functions such as over-the-air updates. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Paris (France) public transport operator, Régie Autonome des Transports Parisiens (RATP), has announced that it is to spend EUR825 million to roll out more battery electric buses in the city over the next four years. According to the state-owned company, it has signed five framework agreements with Bluebus/Bolloré, Irizar, Iveco, MAN, and Solaris. This has since led to the signing of the first vehicle supply contracts with the deliveries scheduled for 2022 and 2023. Bluebus/Bolloré will supply 158 vehicles, Irizar will supply 113 vehicles and Iveco will supply 180 vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

- Audi Hungaria has collaborated with Jungheinrich to deploy six driverless transport (FTFs) vehicles within the Otto engine production plant, which makes 2.0-litre four-cylinder engines, according to a company statement. The FTFs deliver engine parts from the logistics area straight to the production line; they automatically stop at 57 stations during their journey of more than 1,000 meters, 50 of which are located right next to the production line. This allows for particularly efficient and reliable material transport, the company stated in the press release. (IHS Markit AutoIntelligence's Jamal Amir)

- Estonian startup Bolt has raised EUR600 million (USD714 million) in funding from new investors Sequoia, Tekne, and Ghisallo, as well as existing backers G Squared, D1 Capital and Naya. Bolt's post-round valuation has doubled to EUR4 billion (USD4.8 billion), reports Reuters. The company plans to use these proceeds to launch a 15-minute grocery delivery product, Bolt Market, in 10 European countries over the coming months. Bolt, which operates food delivery and ride-hailing services, recently entered the car-sharing market to diversify its revenue streams. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Strong export demand has limited Turkey's merchandise-trade

deficit through the first half of the year. Additionally, tourism

earnings in the first half of 2021 are well up from the same period

of 2020. For 2021 as a whole, the trade deficit is expected to

re-widen as import demand remains strong. However, greater tourism

export earnings will offset much of the merchandise trade deficit

worsening. (IHS Markit Economist Andrew

Birch)

- In the first half of 2021, Turkey posted a merchandise-trade deficit of USD21.166 billion, down by more than USD2.7 billion as compared to the same period of 2020. Both merchandise exports and imports grew rapidly year on year (y/y) due to severe base effects.

- The European Union provided the largest impetus for Turkish exports, with shipment to the Union rising by 42.4% y/y in the first half of 2021, with Spain, Italy and France driving that gain. Meanwhile, rising iron and steel purchases drove Turkey's overall import increase in the first half.

- At the same time Turkey's trade deficit narrowed, its services balance is also improving. According to preliminary tourism data, Turkey earned USD5.456 billion in tourism revenues in the first half, up from USD4.101 billion in the same period of 2020. With over 73% of this income from foreign visitors, this income represents a strong improvement in the tourism service balance.

Asia-Pacific

- APAC equity markets closed mixed; India +1.7%, South Korea +0.4%, Hong Kong -0.2%, Australia -0.2%, and Mainland China/Japan -0.5%.

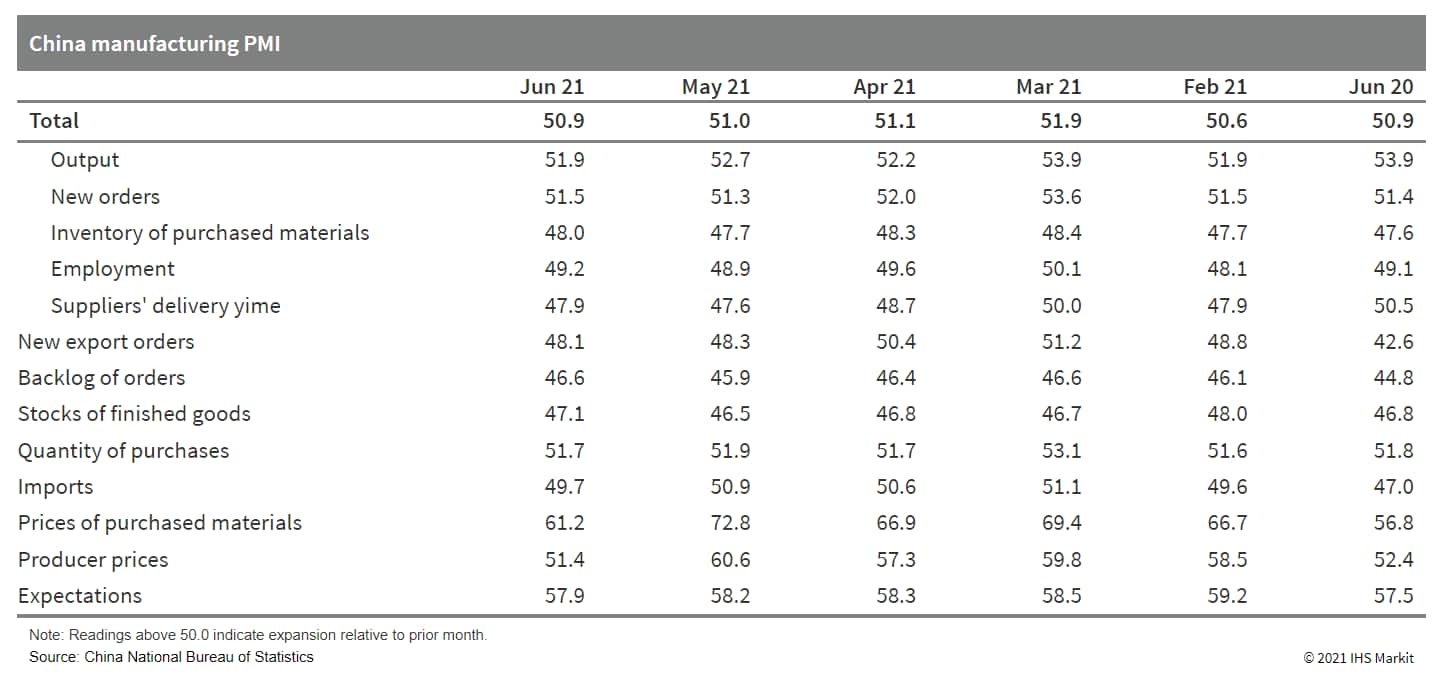

- China's official composite output Purchasing Managers' Index™

(PMI™), covering the manufacturing and non-manufacturing sectors,

fell by 0.5 percentage point from the previous month to 52.4, owing

to the slowdown in manufacturing and construction activities.

However, services activity improved. (IHS Markit Economist Yating

Xu)

- China's official manufacturing PMI fell by 0.5 percentage point to 50.4 in July, registering its fourth consecutive month of decline, but it has remained in expansionary territory for 17 straight months. Demand and supply recovery both weakened as the new orders and output sub-indexes declined to their lowest since April 2020.

- The new export orders PMI further contracted, dragged down by the lumber and furniture, ferrous metals, and special-purpose equipment segments, while food and beverage, textiles, and telecommunication exports continued to expand.

- The inventory of purchased materials and finished goods contracted further. On the other hand, prices surged again after a temporary slowdown in June, while the softer rise in input prices compared with output prices reflects the effects of the government's price control measures. The surge in inflation and weakened downstream demand further weakened the manufacturing outlook as the employment and expectations sub-index declined further.

- By scale of firms, the deterioration in the headline manufacturing PMI was largely driven by the 1.3 percentage point decline in the PMI of small firms to 47.8. This is compared with the a 0.8 percentage point decline in medium-sized firms and unchanged reading in large firms. By sector, telecommunication, equipment manufacturing, electronic equipment and pharmaceutical maintained robust growth.

- China's non-manufacturing Business Activity Index reading fell

by 0.5 percentage point to 52.4 in July, with the decline entirely

driven by the moderation in construction activity, while the

Services Business Activity Index picked up. High temperatures and

floods may have restrained construction activity this summer. On

the other hand, 18 sectors among the 21 surveyed service sectors

were in expansion territory, up by 6 sectors from the previous

month.

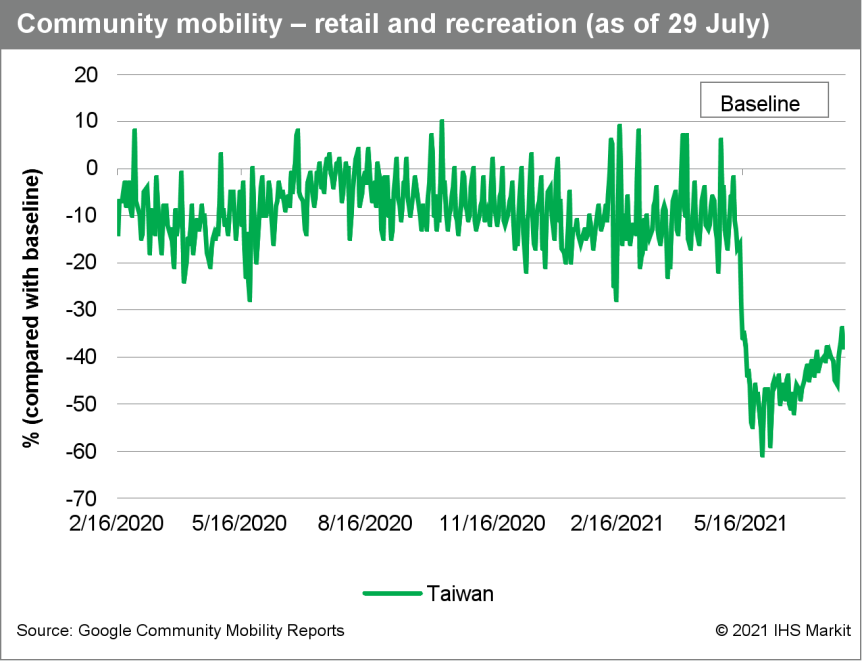

- Preliminary data show that Taiwan's economy, despite some

moderation, retained relatively strong momentum in the second

quarter of 2021 as exports powered ahead, which helped boosted

investment demand and partly offset the sharp turnaround in

consumer spending. Real GDP climbed 7.5% y/y in the second quarter

of 2021, although decelerating from an 8.9% y/y surge in the first

quarter, which marked the fastest expansion since the third quarter

of 2010. (IHS Markit Economist Ling-Wei

Chung)

- Strong net exports remained the key driving force of the second quarter's economic expansion, contributing 5.2 percentage points to GDP growth, as exports continued to soar at more than 20% y/y for the second straight quarter. With exports outpacing imports, the contribution from net exports has remained above 5 percentage points for three consecutive quarters.

- Domestic demand added 2.3 percentage points to second-quarter growth as gross investment contributed 2.2 percentage points and government spending added 0.3 percentage point, offsetting the subtraction of 0.2 percentage point by private consumption.

- Merchandise exports soared 37.4% y/y (in US dollar terms, or 28.6% y/y in Taiwan dollar terms) in the second quarter, accelerating from an already-strong 24.5% y/y in the first quarter, as shipments to all major markets surged during the quarter. Shipments to Europe and ASEAN soared by more than 40% y/y in the second quarter. Exports to the US and mainland China jumped more than 30.0% y/y, and those to Japan climbed 23.7% y/y.

- Benefiting from booming technology demand, shipments of electronics, information and communication products, and optical products continued to surge, by 31.1% y/y, 28.7% y/y, and 26.9% y/y, respectively. Recovering overseas demand and stronger international oil and commodity prices also prompted the revival of exports of non-technology products. Shipments of plastics, chemicals, machinery, transportation equipment, and base metal soared 20-60% y/y in the second quarter.

- Together with services, total exports of goods and services surged 22.9% y/y in the second quarter of 2021, marking the fastest expansion since the second quarter of 2010, accelerating from an already-strong 21.3% y/y jump in the first quarter of 2021. This came despite a still-stagnant tourism sector that dragged on exports of services.

- Local companies, such as semiconductor firms, have continued to expand capacity to meet demand, which in turn bolstered investment in machinery equipment and related outlays. This reflected a 24.4% y/y surge in imports of capital goods (in Taiwan dollar terms) and a 13.6% y/y jump in manufacturing production of investment goods. Coupled with investment on factory expansion, 5G infrastructure, green energy, construction, and transportation equipment, these factors have helped boost investment demand.

- Consumer spending has borne the brunt in the second quarter as consumer sentiment was devastated by fears of infections and the historical alert placed by the government to contain the outbreak. The result showed a severe impact on food, restaurant, retail sales, and other service sectors, although the increase in online shopping and e-commerce sales provided some offset.

- The ease in containment measures should provide some relief to

consumer sentiment and spending in the months ahead, although the

remaining restrictions will remain the restraining factors.

Google's Community Mobility Reports show slight improvement in

public movement in July and the easing restrictions will provide a

further boost.

- Kakao Mobility has reportedly acquired an undisclosed amount of shares in on-call chauffeur service firm Korea Drive. It has established a new company called K Drive to take over Korea Drive's 1577 Chauffeur business, reports The Korea Herald. Kakao Mobility, a subsidiary of Kakao Corporation, provides transport services such as online taxi-hailing, parking, navigation, and electric bike sharing. The company offers these services through its app, Kakao T, which has 28 million registered users. It has been expanding beyond ride-hailing and has been adding value to its platform through mergers and acquisitions. In 2016, it purchased parking platform operator Parking Square, and it acquired carpooling startup Luxi in 2018 and valet parking services provider My Valet in 2020. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Container shortages and increased freight rates continue to affect Indian agriculture exports, according to India Times. Container availability can barely meet half of the demand, causing exports disruption, with shipping schedules and costs being unpredictable. Freight rates have leaped 2-3 times from pre-pandemic levels, according to the Federation of Indian Export Organizations (FIEO). Freight rates to most destinations, such as the West Coast, have risen, with no sign of them softening. Rates to the Middle East have doubled, and to the US and Europe are now USD8,000 per container compared with USD2,000 in pre-pandemic times. The shortage of 40 ft containers is more serious than other sizes. Shipping to Asian destinations such as Vietnam, Malaysia and Taiwan and Latin American ports is also facing rate hikes. The waiting time for a container could be about 10-15 days compared with one day in early 2020. Some logistics companies said that vessels are skipping India due to lack of container space. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- ABB India Limited has announced a partnership with Audi India for providing charging solutions for Audi's e-tron and Audi e-tron Sportback vehicles, reports Indiainfoline news service. According to a statement issued by the company in a filing, "To ensure a premium charging customer experience, the newly launched Audi e-tron and Audi e-tron Sportback are offered with ABB's smart Terra AC wall box charger along with the car to its customers for smart charging at home. The Terra AC wallbox charger is capable of delivering 11 kW power to the Audi e-tron and complies with all safety standards and necessary certifications." The charger's connectivity options include LAN, Wi-Fi, and 4G SIM, as well as cloud connectivity via on Open Charge Point Protocol (OCPP) protocol. (IHS Markit AutoIntelligence's Isha Sharma)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-august-2021.html&text=Daily+Global+Market+Summary+-+3+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-august-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 3 August 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+3+August+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}