Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 04, 2020

Daily Global Market Summary - 4 May 2020

Most of the equity markets that were closed on Friday for the May 1 holiday caught up on the losses they averted that day, while most of those that had been open and took losses then were modestly higher or close to unchanged today. On a positive note, Crude oil prices continued to march higher today and are now more than double the April 28 intraday lows.

Americas

- US equity markets closed modestly higher across the region; Nasdaq +1.2%, S&P 500 +0.4%, Russell 2000 +0.3%, and DJIA +0.1%.

- 10yr US govt bonds closed +2bps/0.64% yield.

- Crude oil closed +3.1%/$20.39 per barrel and more than doubled the intraday low $10.07 on April 28.

- IHS Markit's CDX North America Investment grade index closed flat/90bps and High Yield +9bps/660bps.

- The US FDA has granted Gilead Sciences' (US) remdesivir emergency use authorization (EUA) for the intravenous treatment of COVID-19 in adults and children hospitalized with severe disease. This is defined as low blood oxygen levels or needing oxygen intervention, including more intensive breathing support such as a mechanical ventilator. The emergency approval marks a major milestone in the fight against the COVID-19 virus pandemic. The US Institute for Clinical and Economic Review (ICER) has released new results using its two pricing models to gauge various pricing estimates for remdesivir. According to the institute, under a "cost-recovery" approach, the price would range between USD5 to USD10 depending on whether a five-day or 10-day treatment regimen was applied respectively. Using traditional cost-effectiveness analysis, however, the price of remdesivir should not exceed USD4,500 for a 10-day course of treatment to meet the incremental cost-effectiveness ratio (ICER) of USD50,000 per quality-adjusted life year - the lower end of the commonly cited threshold range. (IHS Markit Life Science's Margaret Labban and Brendan Melck)

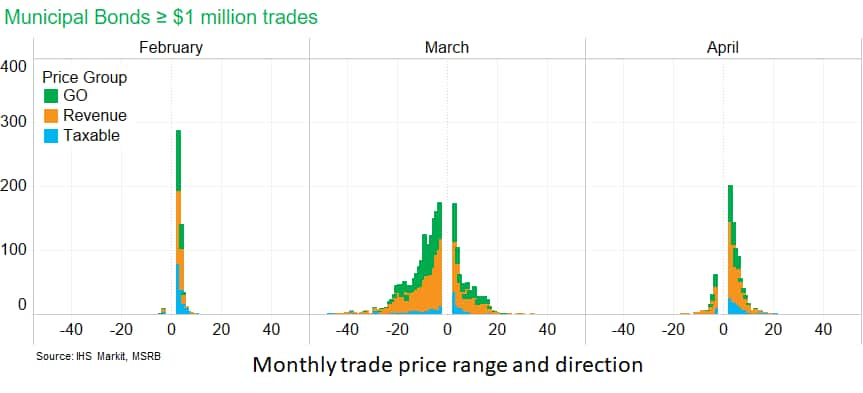

- The below chart shows the count of municipal bonds that traded within intramonth price ranges between -50 to +50 points (excluding -2 to +2 point ranges given the very high frequency) for larger size municipal bond trades during the months of February, March, and April. The analysis includes over 10,000 unique municipal bonds with $1 million or higher trade sizes in February and approximately 15,800 in March and almost 12,000 in April. The data indicates that very few bonds traded down by more than two point in February and revenue bonds made up the largest share of the bonds that traded at a lower intramonth price in March. The data indicates that there were less trades with higher price ranges in either direction in April.

- AIG said its quarterly profits tumbled more than 90%, dragged down by lower investment income and losses tied to the coronavirus outbreak, which chief executive Brian Dupperault said will be the single largest catastrophe loss the insurance industry has seen. The company reported net income, excluding capital gains, of $99 million for the first quarter, $1.3 billion less than the same quarter a year ago, driven primarily by lower investment income and $272 million in coronavirus losses. (FT)

- Light-vehicle sales in the United States are estimated to have dropped 46.6% year on year (y/y) to 710,827 units in April, as authorities' stay-in-place orders and forced restrictions on auto sales in 26 states affected consumers' ability to buy vehicles. In the year to date (YTD; January-April), US light-vehicle sales are estimated to have decreased 20.9% y/y to 4,219,960 units. With auto assembly plants shuttered across the region since late March, April's month-end inventory levels, as reported by AutoData, were down almost 12% from those of the previous month. Compared with month-end March, in April, the inventory was down approximately 434,400 units, with over 80% of that coming from light truck inventory. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US Manufacturers' orders declined 10.3% in March, close to consensus expectations. Meanwhile, manufacturers' shipments declined 5.2% and manufacturers' inventories declined 0.8%. The decline in headline orders was fully accounted for by transportation equipment and petroleum refineries. (IHS Markit Economist's Ben Herzon and Lawrence Nelson)

- The decline in orders at petroleum refineries (which are assumed equal to shipments) was driven by recent sharp declines in oil prices. In percentage terms, domestic oil prices actually declined more than nominal orders (and shipments) at petroleum refineries, implying an increase in real orders (and shipments).

- Therefore, the weakness in real orders was largely accounted for by transportation, reflecting the drop in light-vehicle sales and the halting of domestic auto production.

- US President Donald Trump has given a media interview with Fox News in which he promised to repatriate US pharmaceutical production from overseas locations within a two-year time frame. China and Ireland were singled out in relation to the president's promises to bring back US pharmaceutical production to the country. (IHS Markit Life Science's Eóin Ryan)

- Open weather in many areas of the US Midwest has translated into farmers making fast work of their spring corn and soybean planting this year unlike the situation at this point in 2019. (IHS Markit Agribusiness' Roger Bernard)

- US corn planting in the 18 major states is at 51 percent as of May 3, according to USDA's Crop Progress update, well ahead of the average for 39 percent of the crop to be planted and another major move up from the prior week when 27 percent was in the ground. Traders expected corn planting to have hit 48 percent.

- Soybean planting in the 18 major states reached 23 percent as of May 3, up from 8 percent the prior week and ahead over the five-year average of 11 percent. Traders expected farmers would have 21 percent States showing the biggest corn planting gains are also ones showing the strongest pace of soybean planting.

- General Electric Co. is cutting roughly 13,000 jobs in its jet engine business, expanding its planned cost-cutting efforts as the coronavirus pandemic cripples the aviation industry. (WSJ)

- Hyundai Motor Company and Kia Motors Corporation have announced their US factories are resuming operations in the first week of May, reports Yonhap News Agency. According to the report, Hyundai and affiliate Kia will ensure thorough quarantine measures to safeguard employees from the COVID-19 virus pandemic. Hyundai and Kia restarted production at their plants in Montgomery (Alabama) and West Point (Georgia), respectively, on 4 May. (IHS Markit AutoIntelligence's Tarun Thakur)

- Westlake Chemical reported first-quarter net income of $145 million, up 101% year over year (YOY) from $72 million, mainly on an income tax benefit. Income from operations totaled $134 million, up 2% YOY from $132 million as increased resin volumes were offset by lower pricing for polyvinyl chloride (PVC) and caustic soda. "We experienced a solid first quarter in 2020 anchored by strong sales volumes in both our olefins and vinyls segments," says Albert Chao, president and CEO. "The start of the first quarter saw strength in construction materials and flexible food packaging relative to the first quarter of 2019, but as we progressed through the first quarter, we began to see the impact on the demand for our products as a result of COVID-19 and the response thereto."

- The clothing retailer J. Crew filed for chapter 11 protection in U.S. Bankruptcy Court in Richmond, Va., after reaching a deal with a group of lenders and bondholders to swap about $2 billion in debt for an 82% stake in the reorganized J.Crew. (WSJ)

- On 28 April 2020, the Organisation for Economic Co-operation and Development (OECD) formally admitted Colombia as its 37th member. Colombia's OECD membership confirms its progress and helps to lock in reforms made over the last seven years that improve conditions for foreign investors. These span the regulatory framework, legal stability, upgrading the commercial and labor law codes and introducing more effective anti-bribery laws. Colombia is also likely to make progress on environmental regulation and improve its investment competitiveness via investment in transport infrastructure and enhanced protection of intellectual property. (IHS Markit Country Risk's Carlos Caicedo)

- Karoon said that it is in talks with Teekay Corporation regarding the Neon development off Brazil. The operator states that it commenced conceptual engineering studies with Teekay to evaluate the possibility of utilising a redeployed production system for a future development of the field. The Neon field is located in the Santos Basin. Karoon operates the asset with a 100% interest. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

Europe/Middle East/ Africa

- Daily data shows that the explosion of unemployment notifications in Austria during the second half of March due to radical lockdown measures has turned into broadly a sideways movement during April. (IHS Markit Economist Timo Klein)

- According to the Austrian Labor Market Service (AMS), there were 522,253 unemployed persons in Austria at end-April, up 18,000 from March and up 226,000 (76.3%) versus April 2019.

- The unemployment rate increased moderately further to 12.8%, which increases the gap with the rate a year ago (7.3%) to 5.5 percentage points, up from 4.7 points in March. The unusual additional release of daily data shows that the peak was reached in mid-April, a slight decline occurring thereafter in reaction to the reopening of parts of the retail sector.

- Job vacancies, which had still exceeded their year-ago level until February, posted -32.9% y/y in April (absolute level: 53,846).

- Many jobs related to large public gatherings such as spectator sports, festivals, fairs, cinemas, or theatres will only return sometime in 2021, and some may be permanently lost as companies are unable to cope with lost revenues for more than two or three months.

- In April, the purchasing managers' index (PMI) for Switzerland's manufacturing sector (seasonally adjusted) - compiled by the Trade Association for Procurement and Supply Management procure.ch and published by Credit Suisse - declined from 43.7 to 40.7, having reached an 11-month high of 49.5 as recently as in February. This compares with a low of 32.9 in March 2009 during the recession triggered by the global financial-market crisis and a long-term average of 53.8 since 1995. Unlike the relative resilience shown by manufacturing, Switzerland's service-sector PMI index extended March's huge fall and slipped from 28.1 to 21.4 in April, its lowest level on record. The components for current businesses, new orders, and order stocks also deteriorated to between 15 points and 17 points, with employment at 40.8 being a stabilizing factor despite also slipping by five points. (IHS Markit Economist Timo Klein)

- Tesla has taken tentative steps towards applying to the UK energy regulator for a license to generate electricity, reports the Press Association National Newswire. There is currently no clear reason for Tesla to move into this space in the UK, although there is now the typical speculation that takes place when the company is believed to be involved in something. A company source has suggested to Telegraph Online that it might be related to the introduction of its "Autobidder" platform that aggregates renewable power generators and trades their energy. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ireland's passenger car market has fallen by 96.1% year on year (y/y) in April as a result of measures related to preventing the spread of the coronavirus disease 2019 (COVID-19) virus. In the latest data released by the Society of the Irish Motor Industry (SIMI) and published by beepbeep.ie, registrations dropped from 8,904 units in March 2019 to just 344 units. Although the decline suffered in the Irish passenger car market during March was almost unprecedented, there was a growing expectation that it would be worse in April. On 1 May, Taoiseach Leo Varadkar announced that the current restrictions will only begin to be eased on 18 May, suggesting that May will be yet another challenging month for the industry in the country. (IHS Markit AutoIntelligence's Ian Fletcher)

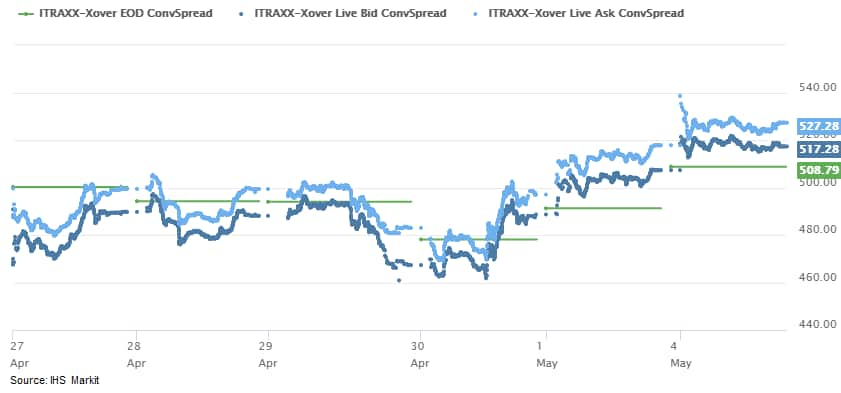

- IHS Markit's iTraxx-Xover high yield index closed weaker at +13bps/522bps today, which is the third consecutive day of widening and the worst close since 21 April:

- Brent crude closed +2.7%/$27.20 per barrel.

- 10yr European govt bonds closed mixed; Italy/UK -2bps, France/Spain +5bps and Germany +3bps.

- European equity markets closed lower across the region, as most markets in the region were closed during Friday's equity sell-off; France -4.2%, Italy -3.7%, Germany/Spain -3.6%, and UK -0.2%. UK equity markets were likely spared some losses today after closing -2.3% on Friday while the others were closed.

Asia-Pacific

- Australian headline consumer inflation surged to a near six-year high of 2.2% year on year (y/y) during the March quarter (first quarter), driven higher by vegetable and tobacco prices. (IHS Markit Economist Bree Neff)

- According to the Australian Bureau of Statistics (ABS), the 6.0% quarter-on-quarter (q/q) rise in fruit and vegetable prices were driven by drought conditions, bushfires, and a sharp spike in grocery shopping in response to rapidly spreading COVID-19 infections.

- The other main contributor to the stronger-than-expected inflation result was a 2.0% q/q rise in tobacco prices as part of the biannual excise tax adjustment.

- The ABS's new payroll jobs report produced with the Australian Tax Office, indicates that in the 14 March-4 April period, jobs decreased by 6.0% and wages paid by businesses declined by 6.7%, with the job losses being greatest in the accommodation and food services sectors, as well as arts and recreation services sectors.

- The inflation result will not affect current monetary policy settings, particularly given that it will be regarded as a one-off event, with prices likely easing (if not outright falling) in the June quarter.

- General Motors' (GM) sales have risen by double digits in China during April, according to Reuters citing a statement from GM's joint venture (JV) partners in the country. The GM-SAIC JV has posted a 13.6% y/y growth in sales in April to 111,155 units including exports while SGMW, GM's JV with SAIC and Guangxi Automobile Group recorded a 13.5% y/y jump in sales to 127,000 units during last month. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tesla has reduced the price of its Model 3 in China in order to qualify for the government subsidies, according to CNN. It will now cost CNY291,800 (USD41,317) before subsidies, and CNY271,500 once the subsidy has been applied. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Preliminary data showed that Taiwan's real GDP rose by 1.5% year on year (y/y) in the first quarter of 2020, decelerating from a 3.3% y/y expansion in the fourth quarter of 2019. (IHS Markit Economist Ling-Wei Chung)

- In seasonally adjusted terms, the economy contracted in the first quarter of 2020 at an annualized 5.9% from the preceding quarter, representing the first quarterly decline since the third quarter of 2015 and marked the largest quarterly contraction since the fourth quarter of 2008.

- Other factors supporting first-quarter economic momentum came from stronger-than-expected export orders, which were boosted by still-robust demand for electronics and other technology products as they continue to benefit from the application of fifth-generation (5G) communications and other advanced technology innovations.

- Despite the increase in the first quarter, imports of semiconductor equipment recorded a 24.5% y/y plunge in March, which could indicate a turnaround in business sentiment and spending during the second quarter.

- The IHS Markit Purchasing Managers' Index (PMI) for Taiwan also fell sharply in April 2020 to the weakest reading since January 2009, pointing to weakening business conditions.

- Preliminary figures for the Tokyo ward area's Consumer Price Index (CPI) held at the March level on a seasonally adjusted basis in April, but the year-on-year (y/y) figure softened to 0.2% on a non-seasonally adjusted basis. The CPI, excluding fresh food (the core CPI), fell by 0.3% month on month (m/m), and the y/y figure also declined by 0.1%. The CPI, excluding fresh food and energy (the core-core CPI), fell by 0.3% m/m, while y/y growth softened to 0.2%. IHS Markit expects the national-level CPI to decline over the near term, reflecting weak oil prices and sluggish demand because of containment measures. (IHS Markit Economist Harumi Taguchi)

- Japan's Ministry of Health, Labor and Welfare (MHLW) is prepared to grant "special approval" following an accelerated review of Gilead Sciences' (US) remdesivir for the treatment of coronavirus disease 2019 (COVID-19), after the candidate received emergency use authorization (EUA) from the US FDA, according to Pharma Japan. Special approval for remdesivir in Japan could come as early as this month, according to Japan's Health Minister Katsunobu Kato, cited by Pharma Japan. (IHS Markit Life Science's Sophie Cairns)

- A major manufacturing hub in Baddi, Himachal Pradesh, India, which ordinarily accounts for 35% to 40% of the country's pharmaceutical production, has resumed operations after being affected by COVID-19 lockdown measures earlier this month, due to the enforcement of COVID-19 containment 'zones', reports India's Business Standard. (IHS Markit Life Science's Sacha Baggili)

- Hyundai India, Mahindra and Mahindra (M&M), and Toyota Kirloskar did not dispatch any vehicles to their dealers in April as their manufacturing facilities and sales networks remained closed following a nationwide lockdown, according to press releases by companies. (IHS Markit AutoIntelligence's Isha Sharma)

- Automakers in India are looking to resume operations, albeit in a staggered manner, from this month, as the Indian government has partially relaxed the COVID-19 virus lockdown conditions, starting from today (4 May). Companies expect to restart output gradually at around 25% capacity of the usual level. Although the Indian government has introduced relaxations under its new red, green, and orange zoning system, resuming production operations remains an uphill task for automakers. Under the new guidelines, OEMs outside of the red zones can reopen their plants in a phased manner, with certain norms and conditions. However, a large proportion of their dealerships are based in metropolitan cities marked as red zones and are not allowed to reopen. (IHS Markit AutoIntelligence's Isha Sharma)

- For the first quarter of 2020, HHI registered a revenue of USD3.3 billion (KRW3.9 trillion) compared with the revenue of USD2.9 billion (KRW3.3 trillion) a year ago. Increased workload in its Shipbuilding segment led to the increase. Net profit increased from USD15 million (KRW17.3 billion) in first quarter 2019 to USD140 million (KRW164.9 billion). For the first quarter of 2020, HHI secured new orders worth USD974 million, 46% higher than the same period last year. Projects secured include three LPG carriers and one naval ship. Backlog as of end March 2020 stood at USD13.0 billion, 7% lower than its 2019 full year backlog of USD13.9 billion. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- The APAC equity markets that returned from Friday's holiday closed lower across the region; India -5.9%, Hong Kong -4.2%, Japan -2.8%, South Korea -2.7%, and Australia +1.4%. Australia's rally today came after closing -5.0% on Friday when all other major markets in the region were closed.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-may-2020.html&text=Daily+Global+Market+Summary+-+4+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 4 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+4+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}