Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 05, 2021

Daily Global Market Summary - 5 February 2021

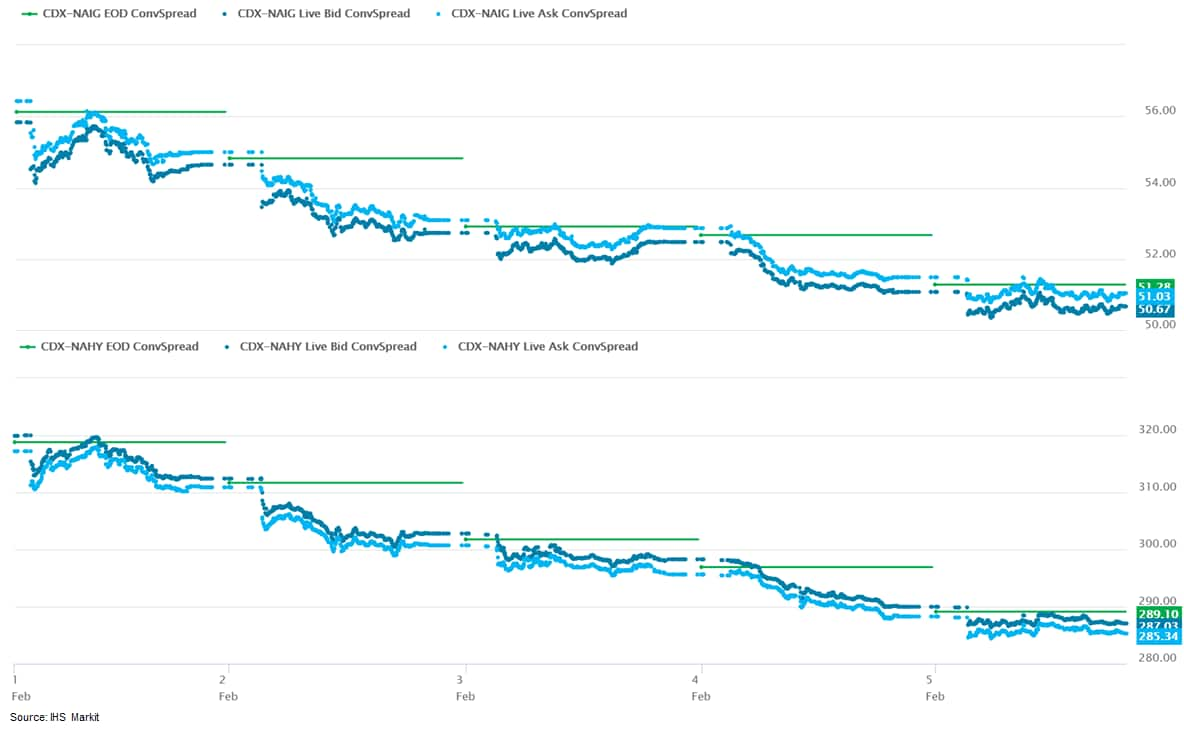

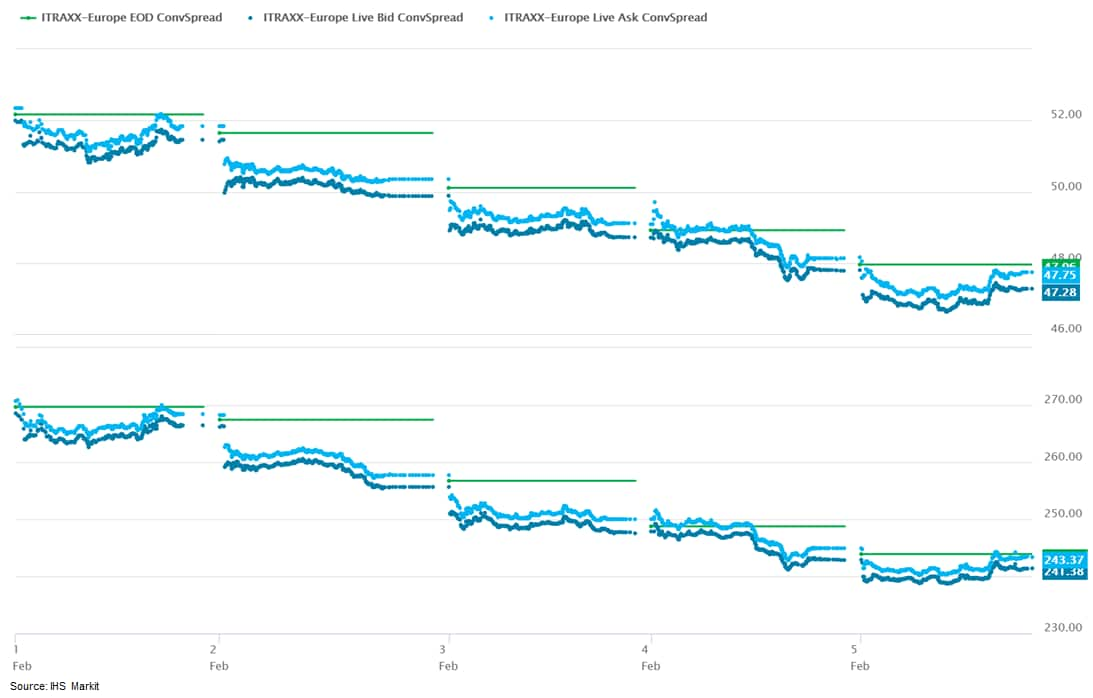

US and most APAC equity markets closed higher, while Europe was mixed. US government bonds closed lower and benchmark European bonds were mixed. European iTraxx and CDX-NA closed almost unchanged today after both indices tightened across IG and high yield on the week. The US dollar closed lower and oil, gold, silver, and copper were all higher. Today's US nonfarm payroll report indicated an underwhelming 49K jobs were added in January, albeit it was in line with consensus expectations.

Americas

- US equity indices closed higher and the Russell 2000, Nasdaq, and S&P 500 all closed at new record highs; Russell 2000 1.4%, Nasdaq +0.6%, S&P 500 +0.4%, and DJIA +0.3%.

- 10yr US govt bonds closed +2bps/1.17% yield and 30yr bonds +3bps/1.97% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY -3bps/286bps, which is

-5bps and -33bps week-over-week, respectively.

- DXY US dollar index closed -0.5%/91.04.

- Gold closed +1.2%/$1,813 per ounce, silver +3.0%/$27.02 per ounce, and copper +2.3%/$3.63 per pound.

- Crude oil closed +1.1%/$56.85 per barrel.

- US developers brought 16.913 gigawatts (GW) of wind generation

online in 2020, an 85% increase compared with 2019, according to

the American Clean Power Association (ACPA), which was a record

annual total and enough to power more than 5 million American

homes. (IHS Markit Climate and Sustainability News' Keiron

Greenhalgh)

- As a result, some 122.468 GW of wind power capacity was operational in the US at the end of last year, the trade association said in a report issued 4 February.

- The jump in installations was due in part, ACPA said, to "strong continued demand from American consumers for clean energy to power their homes, as well as technological improvements that have allowed renewable energy prices to become more and more competitive in the marketplace." It said corporate demand also played role, as did the anticipated expiration of federal tax incentives, although said credits have since been extended.

- Some 10.593 GW of 2020's capacity installations were brought online in the final three months of 2020, the highest quarterly total on record, and more capacity than was installed in any full year except 2012.

- And the momentum isn't slowing, projects totaling 34.757 GW were under construction (17.302 GW) or in advanced development (17.455 GW) at the end of December in the US, the trade group, which replaced the American Wind Energy Association (AWEA), said. Federal waters host 26% of the total development pipeline, it added.

- A total of 54 projects across 20 states were commissioned in the final quarter of the year, the data show. Texas led the table with 2.197 GW installed, followed by Wyoming at 895 megawatts (MW), Oklahoma (866 MW), Iowa (861 MW), and Missouri (786 MW).

- GE Renewable Energy topped the table for US turbine

installations in 2020, capturing 53% of the market through

December. Vestas ranked second with 35%.

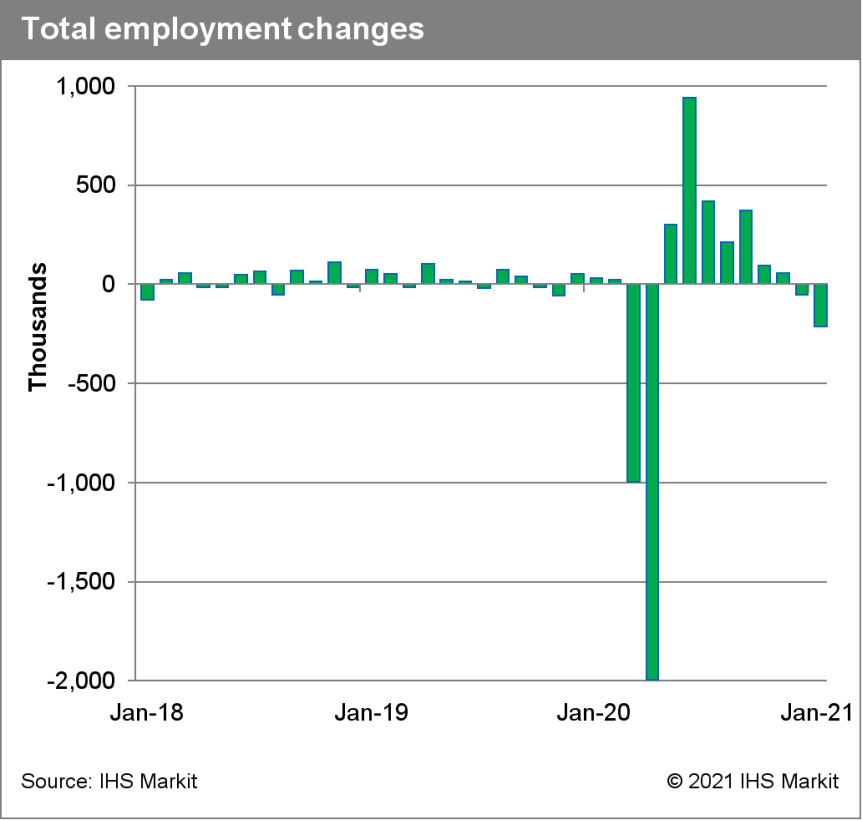

- US nonfarm payroll employment rose only 49,000 in January,

below expectations. Revisions to prior months were mixed. The

unemployment rate declined 0.4 percentage point to 6.3%, as

civilian employment rose and the civilian labor force declined.

(IHS Markit Economists Ben Herzon and Michael Konidaris)

- Over the three months ending in January, nonfarm payroll employment rose at an average monthly rate of only 29,000 per month. This followed much larger gains over the summer and fall, as the recovery in employment has lost steam.

- As of January, the level of payroll employment was roughly 10 million below the February 2020 level and even further below what had been a firming pre-pandemic trend.

- A large majority of the shortfall relative to February 2020 is in services. Particular weakness remains in leisure and hospitality, where employment remains roughly 4 million below February 2020. Shortfalls of roughly 1 million each remain in education and health services; trade, transportation, and utilities; and professional and business services.

- Private payroll employment rose only 6,000 in January and at an average monthly rate of only 54,000 over the last three months.

- There was a large increase in the private workweek in January and a moderate increase in average hourly earnings. So despite the modest gain in jobs, private wages and salaries in January should post a healthy gain.

- In the Household Survey, after adjusting for the impact of new population controls, civilian employment rose a much healthier 381,000, and the civilian labor force declined 206,000, both driving the unemployment rate lower.

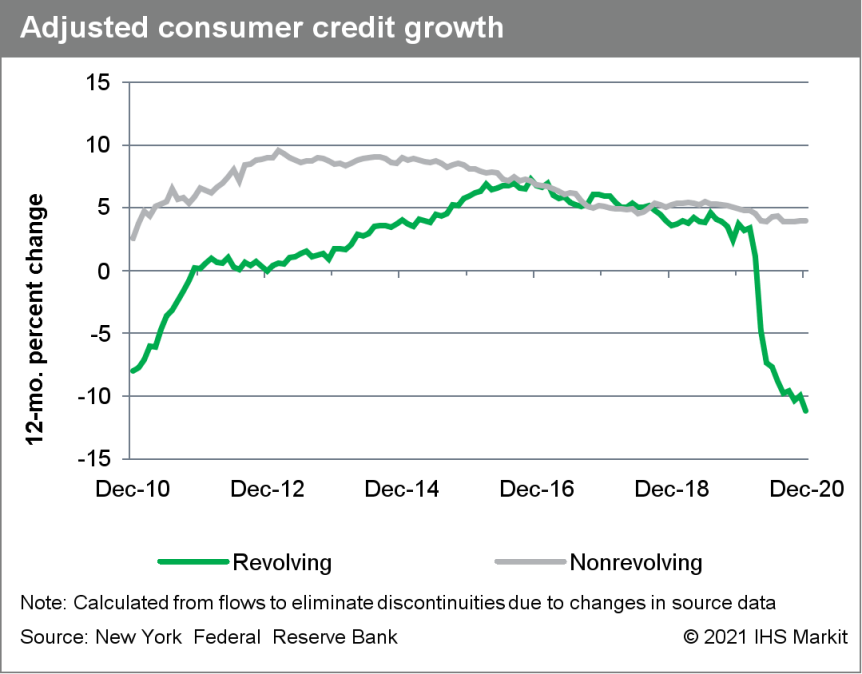

- US outstanding nonmortgage consumer credit rose $10 billion to

$4.18 trillion in December after a $14 billion increase in

November. (IHS Markit Economist David Deull)

- The 12-month change in outstanding consumer credit fell 0.3 percentage point to 0.1%, as declines in revolving consumer credit have essentially offset increases in the nonrevolving category.

- Revolving (mostly credit card) consumer credit posted a third consecutive negative month, falling $3 billion and bringing its cumulative decline since February to $123 billion. The 12-month change in this category was -10.8%, a record low in data that begin in 1969.

- Nonrevolving credit increased $13 billion in December and its 12-month growth rate was unchanged at 3.9%. This category includes student and auto loans, and the growth of these types of obligations has remained steady.

- The ratio of nonmortgage consumer credit to disposable personal income fell 0.1 percentage point to 24.1%.

- Consumers have pulled back dramatically on credit-card spending

during the pandemic and paid down card balances. Fiscal stimulus

boosted incomes in January and further stimulus appears likely,

which would extend the decline in credit-card borrowing.

- Ford Motor Company has reported a USD2.8-billion net loss in the fourth quarter of 2020, as it launched three new products and saw a reduced F-150 inventory. In the fourth quarter, Ford's results included USD5.0 billion charge for exiting manufacturing in South America. Ford also reported a loss in 2020, its first full-year loss since 2008. In addition, Ford announced increased planned EV and AV investment. Ford closed last year with a loss in the fourth quarter and ended 2020 with its first full-year net loss since 2008. However, some of these losses were on restructuring actions intended to better position the company for the future. Additionally, although Ford's divisions in South America and China and International Markets Group continued to see losses, these continued to shrink. The company should benefit from new products in late 2020 and in 2021, with a mix of forward-looking EV products and ICE products set to have an immediate impact on sales. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup TuSimple has secured an undisclosed amount of funding from Goodyear Ventures, the venture capital arm of The Goodyear Tire & Rubber Company. Goodyear is already a partner of TuSimple as it supplies tires and tire management services to TuSimple's autonomous freight network. Abhijit Ganguly, senior manager of Goodyear Ventures, said, "We are excited to build upon Goodyear's relationship with TuSimple through this investment. TuSimple's autonomous technology, combined with its vision of autonomous freight as a service, has the potential to create a lot of value in the commercial freight industry." Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry and has its trucks running out of facilities in Arizona and Texas (United States), China, Japan, and Europe. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's Ivey Purchasing Managers' Index (PMI) modestly

rebounded, up 1.7 points to 48.4 in January. Given the negative

impact of the regional lockdown measures, purchasing managers'

spending activity shrank in January. (IHS Markit Economist Chul-Woo

Hong)

- Partly reflecting the substantial net employment decline seen in January's labor force survey, the employment index decreased 4.3 points to 41.5, the lowest level since the previous lockdowns in April 2020. After staying in contraction mode for four months, the inventories index surged 12.9 points to 56.7, indicating a modest rise in inventories.

- Despite the increase in the month, supply-chain pressures continued to weigh on the supplier deliveries index as the index remained low at 34.7.

- The prices index soared 15.9 points—the largest monthly increase since September 2014—and it reached a survey record of 82.8, indicating strong inflation pressure in the month.

- Canada's net employment declined 212,800 positions in January,

far exceeding market expectations with a large 0.6-percentage-point

pop in the jobless rate to 9.4%. (IHS Markit Economist Arlene Kish)

- Lockdown restrictions were more widely implemented in Ontario and Quebec at the end of December, resulting in outsized job losses in each province, down 153,500 and 97,900, respectively.

- Massive job losses were concentrated in face-to-face services industries like trade; accommodation; and information, culture, and recreation.

- The labor force shrank for the third consecutive month, lowering the participation rate to 64.7%, yet total hours worked increased 0.9% from the previous month given the reduction in part-time employment.

- Talk of gradually reopening the economy in some provinces

indicates the downturn will be temporary, but a substantial

improvement in the labor market is not anticipated until

spring.

- The Argentine government has signed an agreement with Chinese company Jiangsu Jiankang Automobile (JJA) to manufacture urban electric vehicles (EVs) and batteries in Argentina using the lithium reserves present in the country, reports NF News Center. Argentine President Alberto Fernández said, "In this way, Argentina will be able to industrialize the lithium it owns in one of the largest reserves in the world. The EV market remains small in the country. EVs do receive a tax credit in Argentina, as they are subject to only 2% of customs duty rather than the usual 35%. Efforts to grow the EV business in Argentina and Brazil reflect worldwide interest in increasing sales of these types of vehicles, although it is expected that EV infrastructure will grow relatively slowly in these two countries. JJA, a company engaged in the manufacturing and research and development of special vehicle technology, is an affiliate of Guoxuan Group, a China-based group founded in 1995. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +1.1%, France +0.9%, Italy +0.8%, Germany flat, and UK -0.2%.

- 10yr European govt bonds closed mixed; Italy -1bp, Spain Flat, France/Germany +1bp, and UK +4bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -2bps/242bps,

which is -4bps and -28bps week-over-week, respectively.

- Brent crude closed +0.8%/$59.34 per barrel.

- As expected, the Bank of England kept its monetary policy

unchanged following its latest meeting. The Bank appears to have

shifted its monetary policy focus away from the impact of the third

national lockdown to the likely economic recovery from mid-2021.

(IHS Markit Economist Raj Badiani)

- The Bank of England's Monetary Policy Committee (MPC) voted unanimously to maintain the Bank Rate at 0.1% at its meeting that ended on 3 February and did not hold a vote to impose negative rates.

- The MPC agreed unanimously for the Bank to continue with its existing programs of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves.

- The target is to increase the total stock of these purchases to GBP895 billion (USD1.2 trillion) by the end of this year, consisting of government and non-financial investment-grade corporate bonds, at GBP875 billion and GBP20 billion, respectively.

- As of 3 February 2021, the total stock of the Asset Purchase Facility (APF) was GBP759 billion, which included an increase of GBP14 billion as part of the GBP150-billion program of UK government bond purchases planned for 2021, which was announced on 5 November 2020.

- The MPC again failed to spell out how additional stimulus would lift spending when public and private borrowing costs are already at historically low levels. Indeed, the 10-year gilt yield stands at 0.26%. However, the expanded quantitative easing (QE) program will help maintain cheap financing costs, with the government facing a public-sector net borrowing requirement of around GBP400 billion, and around 20% of GDP in the 2020/21 financial year (FY).

- The inflation outlook is benign. The rate stood at 0.6% in December 2020 and is set to remain low in early 2021, below the Bank's 2% target.

- The EU-UK trade deal has shortcomings, and this underpins our less upbeat growth assessment. UK firms face a period of adjustment after the end of the Brexit transition period, which will weigh down on growth in early 2021. The EU-UK trade arrangement to deliver "zero tariff, zero quota" trade in goods fails to replicate the frictionless trade that previously existed between the two parties, and this will hamper the UK's recovery from the COVID-19 virus shock.

- After previously ruling out negative rates because of their impact on the banking system's capacity to lend, Bailey confirmed that the Bank has completed its technical review of negative interest rates and wishes to have them "in the toolbox". Indeed, the MPC highlighted the importance of starting preparations "to provide the capability to do so if necessary in the future".

- The United Kingdom Crown Estate's Offshore Wind Leasing Round 4 has entered the third stage, the Invitation to Tender Stage 2 (ITT Stage 2) of its five-stage leasing process. This stage will see a multi-cycle bidding process, using option fees bid by eligible bidders to determine preferred bidders. Round 4 kicked off in late 2019 and has since completed its first stage, the pre-qualification of potential bidders, and the second stage, which is the first ITT stage where the financial and technical robustness of projects submitted by pre-qualified bidders were evaluated. Up for grabs are four seabed areas with water depths as deep as 60 meters - Dogger Bank, Eastern Regions, South East, and Northern Wales & Irish Sea. Projects are expected to have minimum capacities of 400 MW, and may go up to 1.5 GW. Bidding will carry on until at least 7 GW of capacity have been taken up. Bidding cycles are on a daily basis and once concluded, details of the outcome, such as the successful bidders, location, and capacity, will be shared in a transparent manner. The next phase of the leasing process (Stage 4), will the Plan-level Habitats Regulations Assessment where the environmental impact of the preferred projects will be considered, followed by the final stage (Stage 5) where the leasing agreements will be concluded. The entire process is expected to be completed by Spring 2022. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Fugro is set to begin geophysical survey work for the Dublin Array offshore wind project, approximately 10km from the Irish coastline. Fugro's work scope of includes characterization of the project's offshore array and export cable search data to provide route options to possible landfall options in the area of Shanganah Park and Poolbeg. Four vessels will be operating on the project. Fugro Mercator will work at depths greater than 7m, Spectrum 1 and Fugro Seeker will work at depths less than 7m, and Fastnet Pelican will hold station and carry out environment operations. The project is expected to start from 9 February 2021 and to continue until 11 May 2021, depending on the weather conditions. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

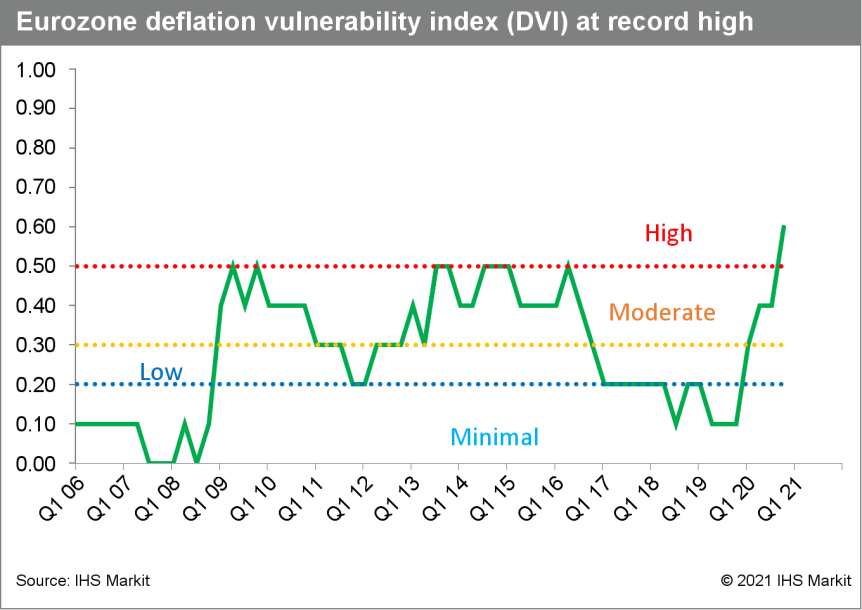

- The exceptionally large Eurozone output gap and very low

inflation rates were again the key drivers, although January's

subsequent jump in inflation should contribute to a moderation in

the index in the first quarter of 2021. (IHS Markit Economist Ken

Wattret)

- We have previously drawn attention to the vulnerability of the eurozone to deflation and its potentially debilitating economic and financial consequences. Past policy missteps, persistent low inflation expectations, and a series of adverse economic shocks, including the COVID-19 virus pandemic, have all contributed to these concerns.

- To better gauge these risks, we created a Deflation Vulnerability Index (DVI) for the eurozone, based around 10 economic and financial indicators.

- The methodology, initially pioneered by the International Monetary Fund (IMF) to better understand what led to the onset of deflation in Japan, separates the levels of the DVI into four categories of risk: minimal, low, moderate, and high.

- The latest quarterly update, based on the fourth-quarter-2020 data, showed the eurozone DVI rising sharply, from 0.4 to 0.6, a record high, entering the "high risk" bracket for the first time.

- Following the two prior adverse shocks, the global financial crisis (GFC) in 2008-09 and the subsequent eurozone crisis in 2011-12, the DVI peaked at 0.5, still in the "moderate risk" category.

- The key drivers of the current elevation of the DVI are as

follows:

- Very low headline and core rates of harmonized index of consumer price (HICP) inflation.

- Declines in GDP due to the COVID-19 virus pandemic, leading to a surge in the output gap.

- Higher growth rates in narrow money versus broad money.

- The appreciation of the trade-weighted euro exchange rate.

- The other variables, including developments in credit, house

prices, and equity markets, have not contributed to the rise in the

DVI, in large part because of the effectiveness of the European

Central Bank's (ECB)'s various monetary policy responses since

March 2020.

- Volvo Group has announced its financial results for 2020, which

have shown that the company has felt a significant impact from the

coronavirus disease 2019 (COVID-19) virus pandemic. During the 12

months ending 31 December 2020, the company's sales revenues

dropped by 21.7% year on year (y/y) to SEK338,446 million.

Operating income during this period decreased by 44.5% y/y to

SEK27,484 million, which meant its operating margin for the period

dropped from 11.5% to 8.1%. However, when additional items are

considered, adjusted operating income fell 40.4% y/y to SEK28,564

million. Overall, income for this period stood at SEK20,074

million, a fall of 45% y/y. (IHS Markit AutoIntelligence's Ian

Fletcher)

- From a business unit perspective, its dominant Trucks unit has been at the heart of the fall in net sales this year, with a decline of 24.7% y/y to SEK208,262 million. This has been mainly a result of a 28.3% y/y fall in deliveries across its regions to 166,841 units.

- The Buses division also struggled during the year as the pandemic and the social distancing measures introduced in many markets meant that public transport and holiday travel was undesirable. Its net sales fell by 36.2% y/y to SEK19,791 million, as its global deliveries retreated by 36.1% y/y to 6,215 units.

- Its Construction Equipment (CE) business recorded a relatively modest decline in sales revenues compared to the Trucks and Buses units. Net sales dropped by 8.1% y/y to SEK81,453 million as total deliveries actually increased by 7.9% y/y to 93,760 units, thanks to a jump in Asia underpinned by stimulus measures in China, as well as a strong performance in South America.

- Pharmaceutical prices in Turkey are expected to rise between 15% and 22% later this month (February) as a result of the annual adjustment in the fixed exchange rate used for pharmaceutical pricing. According to Turkey's Yeniçağ daily newspaper, the Republican People's Party (CHP) Ankara Deputy Gamze Taşcıer said that, "In the middle of this month, the Pharmaceutical Price Decree will be renewed and there will be great hikes in drugs. With the increase in the euro rate, a hike in drugs is expected at least 15 to 22 percent." The source also reports that the anticipated increase in prices has stoked concerns over expenditure at Turkey's Social Security Institution (SGK), the main funding source for public pharmaceutical expenditure in the country. Mounting financial difficulties at the SGK, combined with expectations of higher drug prices, are expected to lead the public health insurance institution to reduce drug reimbursement rates and to increase levels of patient co-payments. (IHS Markit Life Sciences' Sacha Baggili)

Asia-Pacific

- Most APAC equity markets closed higher, except for Mainland China -0.2%; Japan +1.5%, Australia/South Korea +1.1%, Hong Kong +0.6%, and India +0.2%.

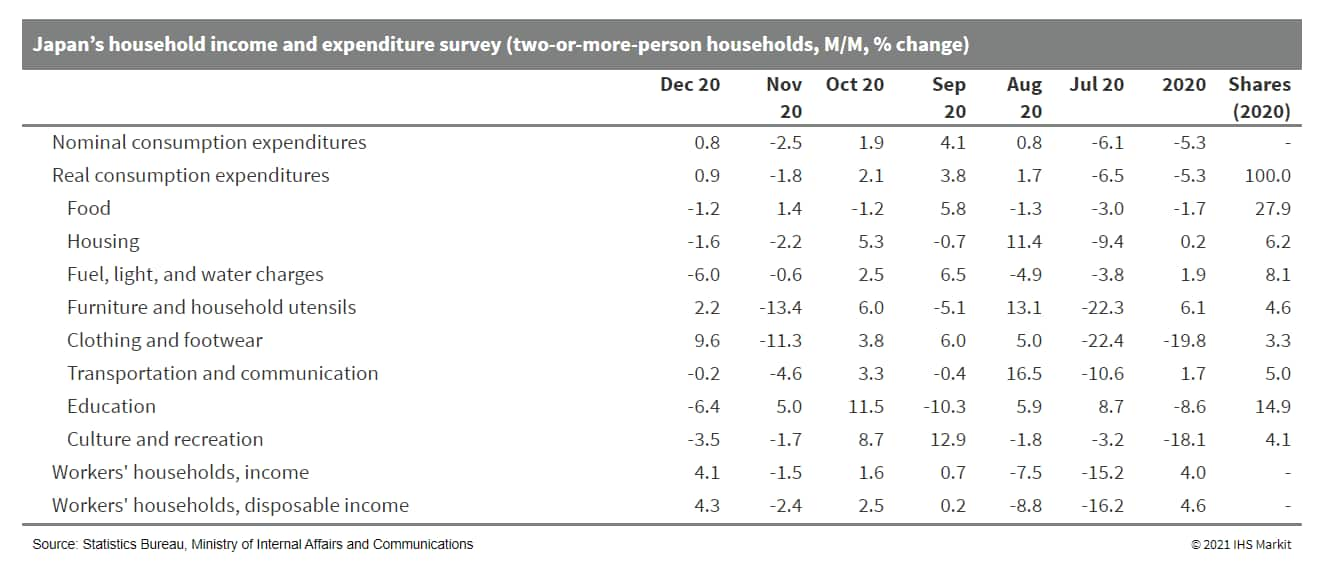

- Japan's Real household expenditures rose by 0.9% month on month

(m/m) in December 2020 following a 1.8% drop in November. However,

household expenditure for 2020 declined by 5.3% because of the

negative effects of containment measures in the first half of the

year and only a moderate recovery in the second quarter. The

containment measures severely affected spending for clothing and

footwear (down 19.8% y/y) and culture and recreation (down 18.1%

y/y). (IHS Markit Economist Harumi Taguchi)

- The m/m improvement was thanks largely to rebounds in spending for furniture and household utensils, clothing and footwear, and miscellaneous items. These increases were partially offset by declines in spending for food, housing, utilities, culture and recreation, and education. Although rising concerns about the resurgence of COVID-19 weakened consumer confidence, the effect of requests by mayors of several prefectures that eating and drinking places reduce their operating hours was insignificant in December.

- The December results were in line with IHS Markit expectations.

A 4.2% quarter-on-quarter (q/q) rise in real household expenditures

suggests a continued q/q increase in real GDP growth for the fourth

quarter of 2020 (which will be released on 15 February 2021).

- South Korean automakers posted a 4.8% year-on-year (y/y) increase in their combined global vehicle sales to 597,213 units in January, according to data released by the five major domestic manufacturers, as reported by Yonhap News Agency and compiled by IHS Markit. The five automakers reported a 16.7% y/y surge in their combined domestic sales last month to 116,270 units, while their combined overseas sales went up by 2.3% y/y to 480,943 units. The country's best-selling automaker, Hyundai, posted global sales growth of 1.6% y/y to 319,959 units in January. Its domestic sales totaled 59,501 units, up by 25.0% y/y, while its overseas sales declined by 2.5% y/y to 260,458 units. Global sales of its affiliate, Kia, rose by 2.5% y/y to 226,298 units, with domestic sales up by 12.0% y/y to 41,481 units and overseas sales marginally up by 0.6% y/y to 184,817 units. (IHS Markit AutoIntelligence's Jamal Amir)

- Lotte Chemical (Seoul, South Korea) says recovering

petrochemicals demand and rising selling prices for its major

petchem products have helped to more than double its fourth-quarter

net profit year on year (YOY) to 97.2 billion South Korean won

($86.5 million). (IHS Markit Chemical Advisory)

- The 104% rise YOY in net earnings came despite a 12% decline in sales to W3.2 trillion. Operating profit for the quarter ended 31 December rose 49% compared with the prior-year period to W212.5 billion. Sales were up 6% sequentially on the third quarter, but net earnings were 51% lower quarter on quarter (QOQ). Operating profit rose 19% QOQ.

- Operating profit at its largest business segment, basic chemicals, was down 19% YOY to W89 billion but up W10 billion sequentially, while sales fell 22% YOY to W1.35 trillion but were up 10% on the third quarter. Production and sales increased QOQ due to the restart of its Daesan steam cracker in December following a fire, with key product spreads improving "due to tight supply and robust demand," it says. "Demand remained firm on expectations that the global economy would recover," it says.

- Lotte says it expects base olefins earnings and sales to improve with its Daesan plant operating normally in the first quarter of 2021, with demand expected to be good as the global economy continues to gradually recover. Although some steam crackers in the region will restart during the quarter, a number of turnarounds are also scheduled that are expected to offset some of the QOQ supply growth, it says.

- Lotte's aromatics division reported an operating loss of W6 billion, narrowing from a loss of W23 billion a year earlier, but swinging from a profit of W6 billion in the third quarter. Sales slipped 20% YOY to W391 billion but rose QOQ by W15 billion. Profitability decreased due to strong raw material prices and weak off-season demand, it says. For the first quarter, the market is forecast to continue to be oversupplied, but profitability is expected to improve.

- Lotte's advanced materials unit turned in a strong fourth-quarter performance, with sales rising 25% YOY and 2% QOQ to W885 billion.

- Lotte Chemicals says it is also continuing to focus on maximizing the cracking of liquefied petroleum gas (LPG) as feedstock, having expanded its use to 20% of total company feedstock by the end of 2020, saving an estimated W30 billion in costs, it says. The company is aiming to expand LPG feedstock usage to 30% of the company's total feedstock supply by 2023, with planned investments at its Daesan cracker, it says.

- As part of its recently unveiled 2030 ESG strategy Lotte Chemical says it is also aiming to produce 360,000 metric tons/year of recycled polyethylene terephthalate by 2023, as well as 260,000 metric tons/year of recycled polypropylene, recycled acrylonitrile-butadiene-styrene, and recycled polycarbonate.

- Singapore's largest taxi operator, ComfortDelGro, has launched a beta trial of its ride-hailing service, reports the Nikkei Asian Review. ComfortDelGro will deploy 25 private hire cars to test the reception for the service. Users can select the ride-hailing option through the operator's taxi-booking mobile application. ComfortDelGro is eyeing the increased use of land transport to boost its business as Singapore is set to open its economy this year following a challenging 2020 due to the COVID-19 virus pandemic. ComfortDelGro operates more than 41,000 buses, taxis, and rental vehicles, and also runs light and heavy rail networks in Singapore. Apart from its home country, ComfortDelGro has overseas operations in Australia, China, Ireland, Malaysia, the United Kingdom, and Vietnam. By expanding its service portfolio, ComfortDelGro will be able to compete with other apps that offer ride-hailing services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- After two years since contract announcement, Vestas has commissioned its largest intertidal wind project in Vietnam to date. The 100 MW Dong Hai 1 intertidal wind project is owned by Bac Phuong JSC and located in shallow waters in the Mekong Delta, close to shore in Bac Lieu Province, Vietnam. In December 2019, Vestas announced its first order of 13 units of V150-4.2 MW turbines with a customization for intertidal installation. The units will operate in a configuration of 10 units in 3.8 MW and three units in 4.0 MW to achieve a 50 MW output. This was followed by a second announcement for the same number of turbines in July 2020. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The Indonesian government has received an investment proposal from electric vehicle (EV) manufacturer Tesla, reports Reuters, citing the country's deputy head for investment and mining co-ordination, Septian Hario Seto. The details of the proposal have not been released due to a non-disclosure agreement, but the focus of discussions had been on batteries and energy storage solutions. "If they only want to buy raw materials, we are not interested. This [proposal] is beyond just taking the raw material," said Seto. Nickel-rich Indonesia is keen to develop a full supply chain for nickel in the country, in particular to extract battery chemicals, make batteries, and eventually build EVs. Nickel and cobalt are key materials in making lithium-ion (Li-ion) batteries. The government aims to make the country an electrified-vehicle hub in Asia and beyond, and intends to start production of such vehicles in 2022. The country aims for electrified vehicles to account for 20% of its total car production by 2025. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-february-2021.html&text=Daily+Global+Market+Summary+-+5+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}