Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 04, 2021

High risk trade gives way to shorts

Research Signals - January 2021

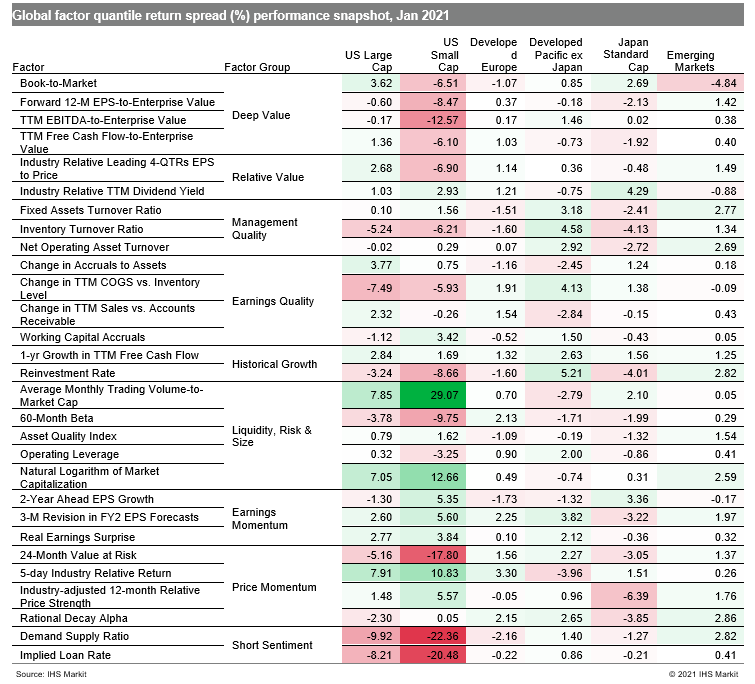

What started out as a relatively uneventful month of positive momentum in high risk shares, carried over from the end of last year on optimistic vaccination and economic outlook, turned into a wild ride for a handful of highly shorted US stocks. This was reflected in historically poor factor performance of Short Sentiment factors mostly concentrated in US markets (Table 1). Investors now wait to see if the bull market will be derailed from retail investors' uprise, vaccine snags and tighter restrictions amid an uncertain global economic environment, with the global manufacturing upturn slowing at the start of the year, though remaining solid, with just a slight dip in the J.P.Morgan Global Manufacturing PMI.

- US: Demand Supply Ratio encapsulated the frenzied trading in highly shorted names, which was especially pronounced among less liquid small caps

- Developed Europe: 3-M Revision in FY2 EPS Forecasts remained a positive signal in January, representing a 31-percentage point improvement in spread compared with November results

- Developed Pacific: Book-to-Market was a strong performer in Japan relative to Industry-adjusted 12-month Relative Price Strength, while 24-Month Value at Risk outperformed in markets outside Japan

- Emerging markets: High quality firms were highly rewarded, such as those gauged by Fixed Assets Turnover Ratio

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-risk-trade-gives-way-to-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-risk-trade-gives-way-to-shorts.html&text=High+risk+trade+gives+way+to+shorts+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-risk-trade-gives-way-to-shorts.html","enabled":true},{"name":"email","url":"?subject=High risk trade gives way to shorts | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-risk-trade-gives-way-to-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+risk+trade+gives+way+to+shorts+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-risk-trade-gives-way-to-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}