Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 05, 2020

Daily Global Market Summary - 5 June 2020

Global equity markets had already started the day off in positive territory, with APAC markets closing higher and Europe opening higher out of the gate. However, the release of a much better than expected US payrolls report added momentum to Europe's rally and drove US markets higher on the day. The improved sentiment drove credit indices sharply higher and led to a sell-off in benchmark government bonds, as global risk appetite continues to improve. Oil closed higher on the day, with Brent breaking through the $40 per barrel hurdle and WTI now only 45 cents shy of it.

Americas

- US equity markets closed higher on the day after the unexpectedly positive employment report; Russell 2000 +3.8%, DJIA +3.2%, S&P 500 +2.6%, and Nasdaq +2.1%. S&P futures rallied immediately on the 8:30am ET US employment report.

- Crude oil closed +5.7%/$39.55 per barrel on the potential for an extension of production cuts being discussed at tomorrow's OPEC and Russia meeting.

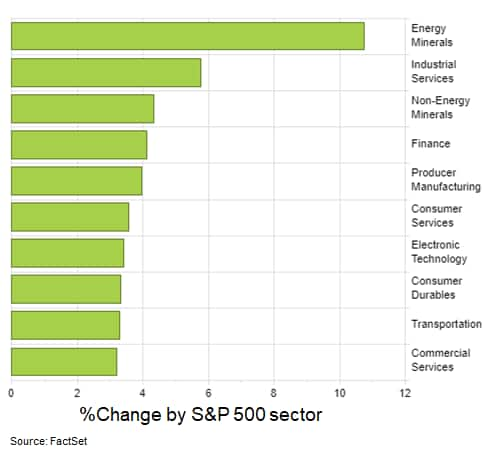

- The energy sector was the best performer in the S&P 500

today, closing +10.8% on the day:

- 10yr US govt bonds closed +7bps/0.90% yield and 30yr bonds closed +3bps/1.67% yield. It's worth noting that 30yr bonds rallied 10bps between the low point of the day at 10:15am and 4:10pm ET.

- US credit indices closed sharply higher today on the US jobs

report; CDX-NAIG -8bps/65bps and CDX-NAHY -51bps/413bps, with the

CDX-NAIG having its best closed since 27 Feb.

- US nonfarm payroll employment rose 2.5 million in May, in sharp

contrast to consensus estimates of a declines of approximately 8

million jobs. Moreover, the unemployment rate declined

(unexpectedly) in May by 1.4 percentage points to 13.3%. (IHS

Markit Economists Ben Herzon and Michael Konidaris)

- The view that employment was poised for a large decline in May was derived from a reported 14 million increase from mid-April to mid-May of the number of persons claiming unemployment insurance benefits in all programs, both regular state and Pandemic Unemployment Assistance (PUA).

- Labor-market conditions are rapidly evolving, and it appears that widespread state "reopenings" boosted actual employment before claimants fell off of unemployment-insurance rolls. Indeed, delays in filing and processing claims likely led to a situation where many persons were returning to work even as claims were still being paid.

- Private payroll employment rose in every major industry. State-and-local employment, though, continued declining.

- Just as occurred in the March and April reports, there was a large number of unemployed persons who were incorrectly counted as employed but absent from work. Had they been classified correctly, the May unemployment rate would have been roughly 16%.

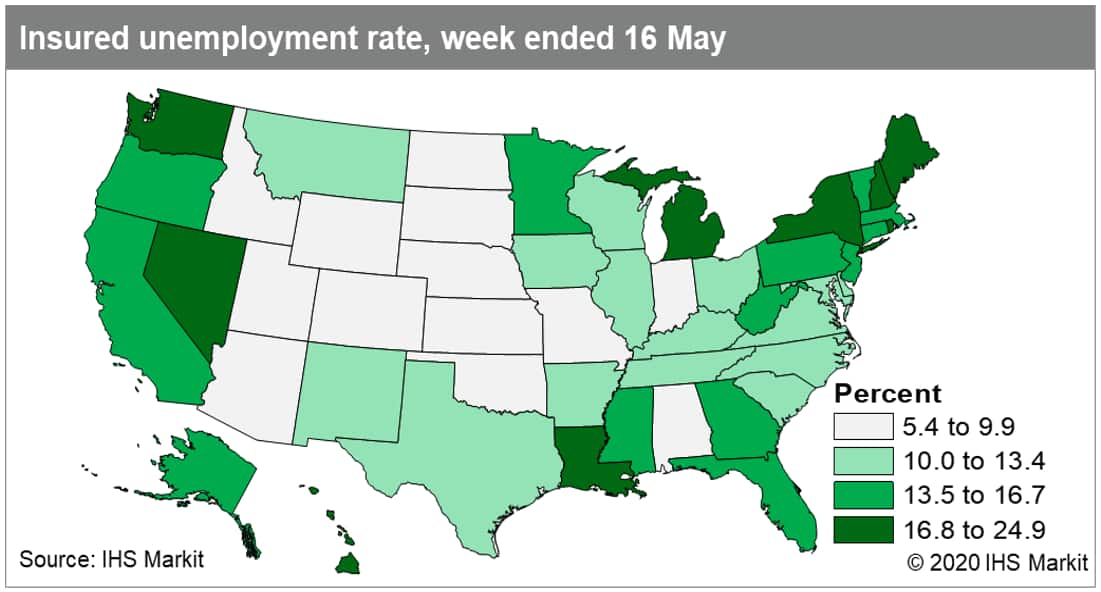

- The US insured unemployment rate fell in 35 states in the week

ended 16 May, but just slightly in most. (IHS Markit Economists

Alex Minelli and Fran Hagarty)

- Major decreases occurred in Washington (down 13.5 percentage points), California (down 5.6 points), and Pennsylvania (down 3.1 points), while all other decreases were less than 3.0 percentage points.

- Maine was the only state that saw a significant increase in its insured unemployment rate, which rose 7.6 percentage points compared with the prior week. Maine recorded the third highest insured unemployment rate at 22.9% in the week ended 16 May, owing to a major uptick in initial claims in recent weeks.

- In absolute terms, Nevada had the highest insured unemployment

rate at 24.9%, a decrease of 1.8 points, followed by Michigan at a

rate of 23.0%, an increase of 0.2 point.

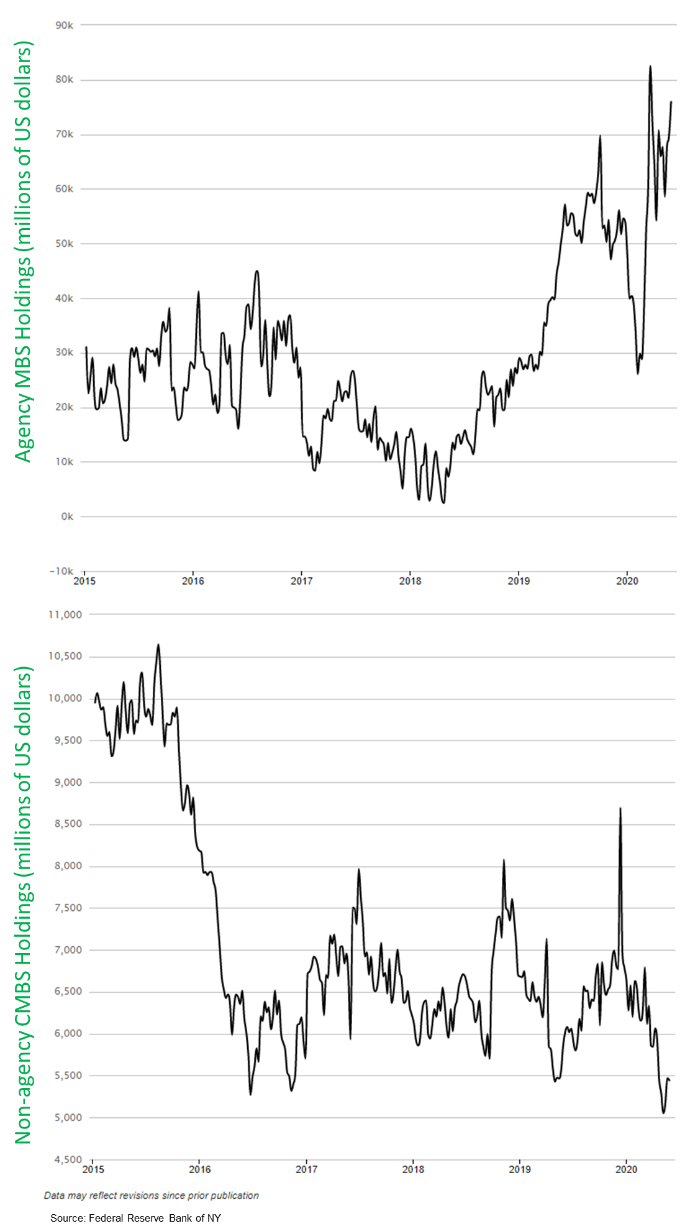

- US primary dealer holdings of US Agency MBS Pass-throughs (top

graph) remain at multi-year highs, with some of that build-up in

inventory likely from the surge in issuance driven by the recent

refinance wave from sharp declines in rates. However, inventories

of non-agency CMBS (bottom graph) remain at multi-year lows, as

concerns continue to grow about the growing numbers of

delinquencies in the sector:

- Canada's Ivey PMI purchasing managers' spending activity showed

some improvement in May, a hopeful sign that the worst is over as

pandemic-related restrictions are loosened. (IHS Markit Economist

Tom Jackson)

- The employment index further improved by 19 points to 41.9, as businesses began to bring back workers, albeit in modified settings to enhance worker safety.

- The prices index rose 3.7 points to 54.9, indicating mild inflation pressure. The inventories index again rose after just a slight increase in April, up 12.3 points to 46.8 as purchasing managers gear up for the start of a hoped-for rebound in customer demand.

- The supplier deliveries index bounced back by 19.5 points to 37.7, indicating some restocking as supply-chain disruptions ease.

- Seasonally adjusted data show that Brazil's industrial

production (IP) plunged by 18.8% in April compared with March

(month on month, m/m) because of the COVID-19-virus lockdown

measures and plant closures. This follows a sizeable drop recorded

in March (-9.0% m/m). (IHS Markit Economist Rafael Amiel)

- Although output in all categories plunged, the worst performers were production of durable goods and production of capital goods. The all-important automotive sector was practically shut down, with output of light vehicles down by 99.7% compared with April 2019 year on year (y/y); production of trucks was down by 95.6% y/y.

- In addition to domestic restrictions, lower demand for Brazilian exports (mainly from Argentina) is weighing down on production.

- Restrictions on people's mobility are being progressively lifted, as in many other countries and many factories are reopening, albeit at limited capacity. IHS Markit expects production of new vehicles to reach 200,000 units per month by August; this is 80% of the 2019 monthly average.

- LATAM, Latin America's largest airline, filed for bankruptcy in

the United States on 26 May. Although the filing does not include

LATAM Brazil, the development has focused Brazil's government on

the need to support the sector: other major Brazilian airlines face

collapse without state support and are currently operating at just

10% of capacity. (IHS Markit Economist Carlos Caicedo)

- LATAM and the other two largest airlines operating in Brazil, Azul and Gol, are reportedly discussing a rescue package with the government.

- The government indicated in March that it was preparing a rescue package for the industry worth about USD2 billion, but subsequent disagreements with the airlines on its structure and conditionality have delayed progress.

- According to media reports, the latest version includes providing credit lines of about USD500 million to each airline and exempting them from several taxes.

- The rescue package is expected to take the form of loans led by state development bank BNDES, with 10% participation from private banks.

- The airlines would offer shares as collateral, but there are ongoing differences over collateral valuation.

Europe/Middle East/ Africa

- European equity markets ended an already strong week on a very high note; Spain +4.0%, France +3.7%, Germany +3.4%, Italy +2.8%, and UK +2.3%.

- 10yr European govt bonds closed lower across the region; UK +5bps, Germany/France +4bps, and Italy/Spain +1bp.

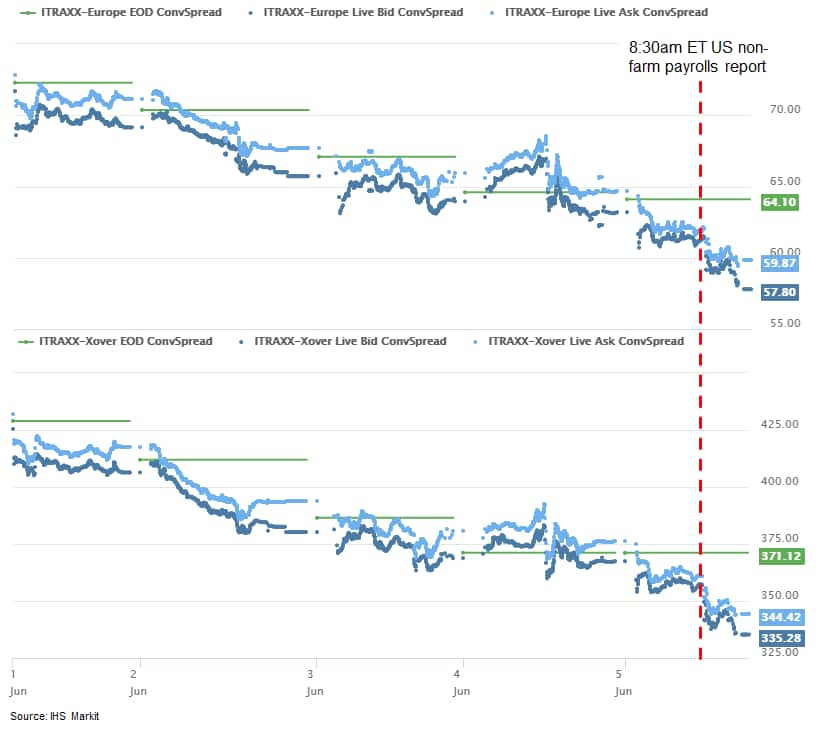

- iTraxx-Europe closed -5bps/59bps and iTraxx-Xover

-31bps/340bps, with both indices rallying on the US employment

report and closing -13bps and -89bps week-over-week,

respectively.

- Brent Crude closed +5.8%/$42.30 per barrel; its first close above $40 since 6 March.

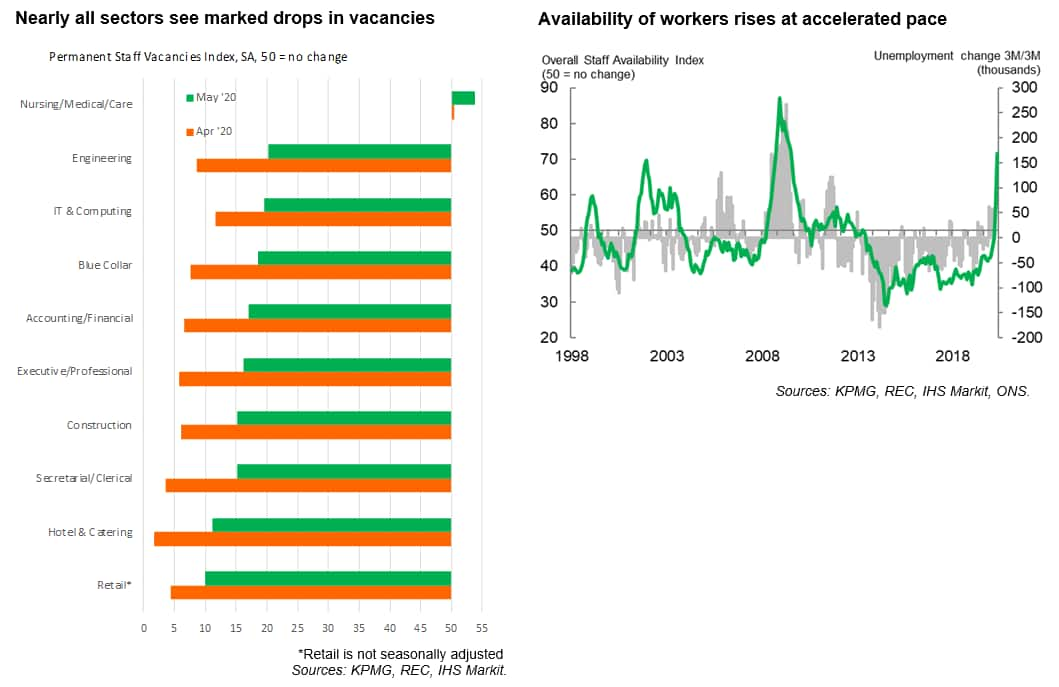

- The latest KPMG and REC Report on UK Jobs data, compiled by IHS

Markit, showed a further severe drop in hiring activity across the

UK as firms placed their recruitment plans on hold amid the

COVID-19 pandemic. Permanent placements and temp billings fell at

the second-sharpest rates on record (behind only April 2020), while

the weaker business outlook led to a further steep reduction in

vacancies. (IHS Markit Economist Annabel Fiddes)

- Vacancy data split by sector showed that only healthcare saw an increase in demand for workers during May. In contrast, substantial falls were seen across all nine other remaining segments, led by Retail and Hotel & Catering, which have also been the hardest hit by coronavirus restrictions.

- The May survey data signaled the steepest increase in overall

staff supply since July 2009, as recruitment agencies reported

increased number of candidates applying for positions following

redundancies or having being placed on furlough. The steep and

accelerated rise in availability signals that unemployment is

likely to increase further during the second quarter.

- Back-to-back double-digit month-on-month (m/m) declines

reinforce the expectations of unprecedented contractions in

consumer spending and GDP during the second quarter of 2020. (IHS

Markit Economist Ken Wattret)

- The COVID-19 virus outbreak and related containment measures decimated retail sales in March and April, with m/m declines in both months in excess of 11%. Sales by type show unprecedented divergence, reflecting the exceptional circumstances.

- Although food sales rose by over 5% m/m in March, this was offset by a somewhat larger decline in April, as the effects of stockpiling started to fade and restrictions were stepped up to try to limit the spread of the virus.

- Excluding food, retail sales volumes collapsed (down by around 35% in March and April combined). Weakness was broad-based across categories, especially in textiles, clothing, and footwear (-64.1%). Sales of pharmaceutical and medical goods also fell (-6.9%), with a large contraction in April offsetting March's increase. The notable exception was mail order and internet sales (+11.7%).

- There were again significant variations across eurozone member states in April, with Germany (-5.3% m/m) much less affected than France (-20.0% m/m). Italian data were not released by Eurostat, suggesting downside risks to the already mind-blowingly weak data. Finland was the only eurozone member state to register an increase in April (0.3% m/m), although sales over the two months were still down.

- The German passenger car market posted another accelerated

decline in May, falling 49.5% year on year (y/y) to 168,148 units,

according to the latest data from the Federal Motor Transport

Authority (Kraftfahrt-Bundesamt: KBA). (IHS Markit

AutoIntelligence's Tim Urquhart)

- For the first five months of the year, the market is down by 35.0% y/y to 990,530 units.

- The decline in May was shared pretty evenly between private and business registrations, with the latter down 50.3% y/y to take a 61.9% share of the overall market, while private registrations fell 48.2% y/y to take a 38.0% share of the market.

- In terms of the fuel spilt, 51.1% of the new cars sold during the month had gasoline (petrol) engines (85,904 units, down 56.3% y/y).

- At the same time, 31.6% of the new cars sold were diesel vehicles, which equated to 53,218 units and a 52.0% y/y drop.

- Pure battery electric vehicles witnessed a 20.5% y/y increase to 5,578 units, while 22,844 hybrids were sold, equating to an 18.3% y/y share.

- The average carbon dioxide (CO2) emissions of the newly registered cars decreased by 2.2% to 154.8 g/km.

- The German government has announced a package of new measures designed to encourage people to buy electric vehicles and stimulate the wider automotive market, although it has excluded internal combustion engine vehicles from the program of grants. The measures will allocate up to EUR9,000 (USD10,198) towards the purchase of an electric vehicle, with a EUR6,000 grant being provided by the government and EUR3,000 being provided by the manufacturer. There will also be a temporary VAT cut from 19% to 16%. (IHS Markit AutoIntelligence's Tim Urquhart)

- The closure of non-essential shops from 11 March led to

plunging retail sales in Italy in both March and April. The

reopening of many shops from 18 May will help to revive retail

sales from June, but still difficult trading conditions will weigh

down on the pace of the recovery. (IHS Markit Economist Raj

Badiani)

- Specifically, retail sales in volume terms declined by 10.5% between March and April and were 26.3% lower than a year earlier. The largest year-on-year (y/y) drops occurred for furniture and textile items and household furnishings (83.6%), clothing (83.4%), sporting equipment, games, and toys (82.5%) and shoes, leather goods, and travel items (90.6%).

- In addition, retail spending fell by a cumulative 29.5% in March and April when compared with February, with non-food sales collapsing by 52.9% over the same period comparison.

- Spain's industrial sector is in deep recession after output

contracted for a second successive month in April. Specifically, it

crashed by 21.8% month on month (m/m) after a 13.2% m/m drop in

March. (IHS Markit Economist Raj Badiani)

- In annual terms, industrial production collapsed by 33.3% in April and by 13.7% in March.

- The fall in output in April was broad-based, with consumer and capital goods output falling by 22.9% year on year (y/y) and 57.4% y/y, respectively.

- The automotive industry was the most-affected sector in April, with output falling by 92.0% when compared with a year earlier.

- Meanwhile, sectors producing consumer durables endured sharp output falls, with the clothing, leather, and footwear industry and furniture manufacturing reporting production declines of more than 70% y/y.

Asia-Pacific

- APAC equity markets closed higher across the region; Hong Kong +1.7%, South Korea +1.4%, India +0.9%, Japan +0.7%, and China +0.4%.

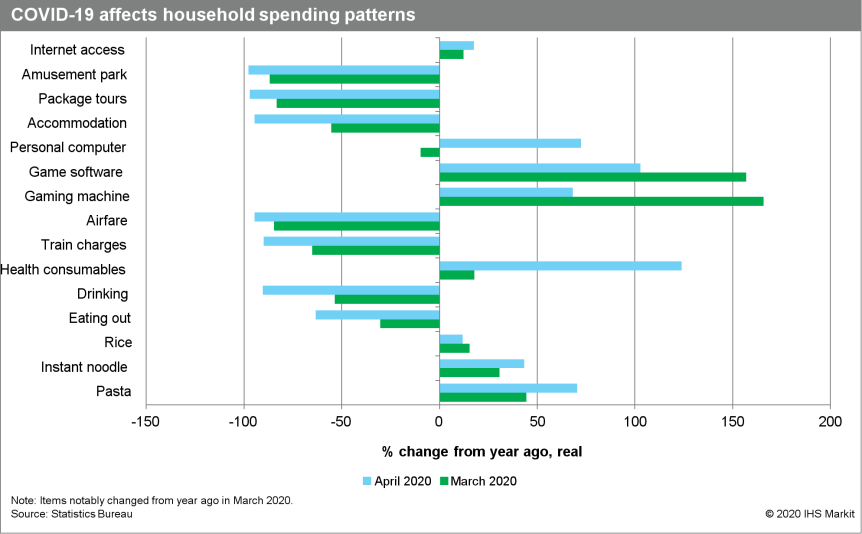

- Stricter containment measures for the COVID-19 virus have led

to an accelerated decline in Japan's household expenditure in

April. The recovery of household spending following the lifting of

the state of emergency is likely to be gradual. (IHS Markit

Economist Harumi Taguchi)

- Japan's monthly real household expenditures continued to decline in April, moving down by 6.2% month on month (m/m), leading to an 11.8% year-on-year (y/y) drop, which is the largest decline since the survey started in January with the current methodology.

- Containment measures also weighed on workers' household income,

as indicated by a 30.7% y/y drop in income from self-employment and

piecework signals severe financial conditions for the

self-employed.

- Nissan's sales in China increased by 6.7% year on year (y/y) to 130,016 units in May, with its year-to-date (YTD) sales falling 21.8% y/y to 459,413 units, according to a company statement. Sales of Nissan's passenger vehicle joint venture (JV) with Dongfeng, which includes the Nissan and Venucia brands, rose 4.8% y/y to 105,362 units in May, with YTD sales at 372,191 units, down 22.7% y/y. Sales of Nissan's light commercial vehicles (LCVs), which include those of Dongfeng Automobile Co (DFAC) and Zhengzhou Nissan (ZNA), were up 21.4% y/y to 22,225 units in May, with YTD sales declining 15.9% y/y to 77,582 units. DFAC's sales increased 33.4% to 18,080 units, while ZNA's sales totaled 4,145 units. Thanks to a competitive product portfolio in the passenger vehicle market, Nissan continues to be among the first automakers to come out of a prolonged decline in the Chinese auto market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- General Motors (GM) intends to deepen its partnership with Chinese electric vehicle (EV) battery maker Contemporary Amperex Technology Ltd (CATL), as the automaker ramps up its EV production in China. The two companies signed a strategic deal to jointly develop EV battery technologies in September 2018. According to a Reuters report, citing GM China president Julian Blissett, GM is not planning to import any major components for the production of new energy vehicle models in China. Core components such as the electric drive units, batteries, and electric motors will be made in China. The Reuters report did not provide specific details regarding the projects the two companies are currently working on. Recent local media reports indicate that much of the effort under the GM-CATL partnership is believed to be focused on battery solutions for GM's BEV3-based models. (IHS Markit AutoIntelligence's Abby Chun Tu)

- As per IHS Markit's Commodities at Sea, Australian iron ore

loadings during week-22 rebounded to 19.7 metric tons (84.6mt on

30-day basis) vs 16.6mt (71.3mt on 30-day basis) a week before.

There was a strong rebound in shipments from Port Hedland (51.9mt

on 30-day basis vs 44.9mt a week before), Port Walcott (18.3mt on

30-day basis vs 14.5mt a week before) and Dampier (10mt vs 8.5mt a

week before). During week-21, iron ore shipments from Australia

were impacted because of cyclone Mangga. (IHS Markit Maritime &

Trade's Rahul Kapoor and Pranay Shukla)

- Chinese steel mills are reported to be offering August 2020 HR cargoes at $460/ton, up $15/t m-o-m. At the SHFE, October 2020 futures for Rebar and HR coils on 4 June 2020 increased 4.4pc and 2.9pc, resp w-o-w. At the DCE, September 2020 iron ore futures increased 6.6pc w-o-w. As per CISA, Chinese daily crude steel production during 21-30 May 2020 calculated at 23mt, up 4.4pc y-o-y.

- On back of rising export demand the Indian steel mills are expected to increase their utilization to above 80pc in June 2020. During April 2020, on back of Covid-19 related restrictions the Indian steel mills utilization levels went down to 35-38pc as mills operated at levels just enough to avoid shutdown of the blast furnaces. During May 2020, utilization levels of the Indian steel mills went up and JSW Steel utilization was reported at 83pc and anticipating rising export demand the utilization levels could cross 90pc during June 2020.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-june-2020.html&text=Daily+Global+Market+Summary+-+5+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}