Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 06, 2020

Daily Global Market Summary - 6 October 2020

Equity markets closed higher across APAC and Europe, but closed lower in the US despite being higher most of the day and then sharply selling off on President Trump's announcement that negotiations for the next large US stimulus package will be delayed until after the elections. US government bonds and the dollar were higher on the announcement, while CDX widened on the news across IG and high yield. Oil prices came under some pressure post-announcement but still closed higher, while gold and silver were lower on the day.

Americas

- President Donald Trump ended talks with Democratic leaders on a new stimulus package, hours after Federal Reserve Chair Jerome Powell's strongest call yet for greater spending to avoid damaging the economic recovery. "I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business," Trump said Tuesday in a tweet. (Bloomberg)

- All major US equity markets were higher at 2:45pm EST before rapidly selling off and closing lower on the day after President Trump's comments; Nasdaq -1.6%, S&P 500 -1.4%, DJIA -1.3%, and Russell 2000 -0.3%.

- 10yr US govt bonds closed -5bps/0.74% yield and 30yr bonds -5bps/1.54% yield.

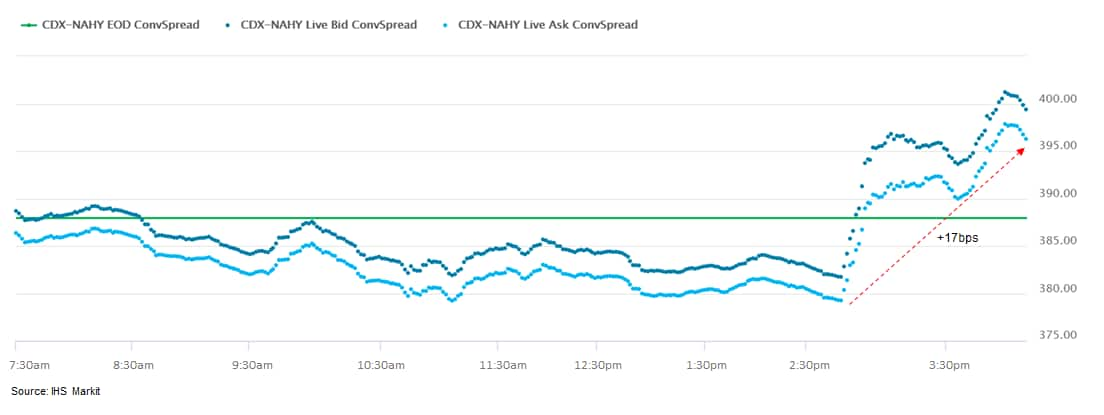

- CDX-NAIG closed +2bps/58bps and CDX-NAHY +9bps/397bps, with

CDX-NAHY widening 17bps to the close after President Trump's

announcement.

- DXY US dollar index closed +0.3%/93.82, with most of the gain occurring after President Trump's announcement.

- Gold closed -0.6%/$1,909 per ounce and silver -2.6%/$23.92 per ounce.

- Crude oil closed +3.7%/$40.67 per barrel.

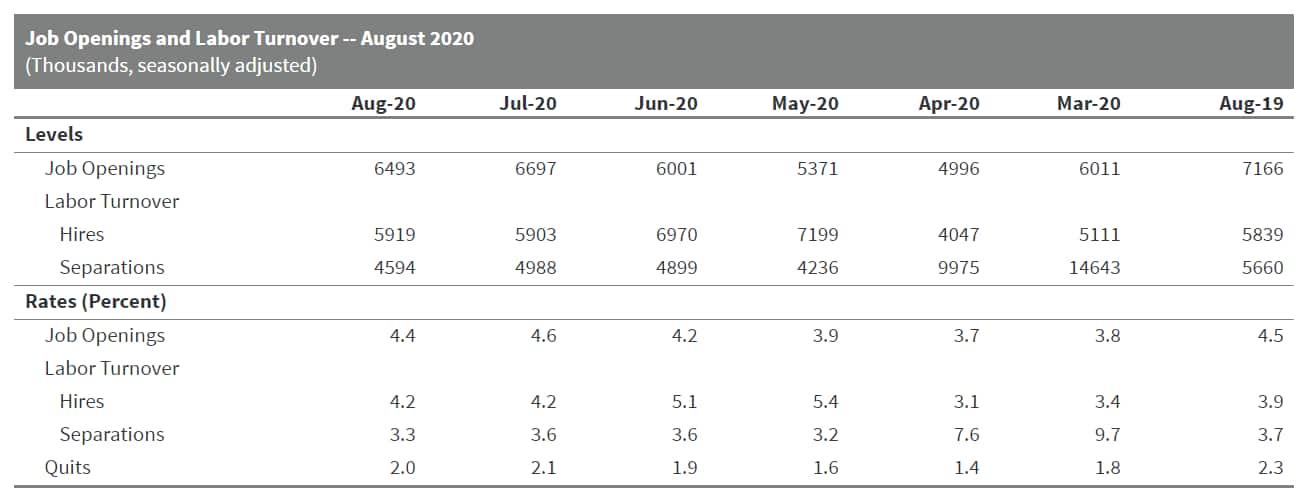

- The August US JOLTS report suggests that the labor market

recovery is losing steam with employment still short of the

pre-pandemic peak. (IHS Markit Economist Akshat Goel)

- The number of hires was unchanged at 5.9 million and the number of job openings ticked down to 6.5 million in August. Both are hovering near their long-term pre-pandemic averages.

- Job separations fell to 4.6 million in August and remain well below the all-time high of 10.0 million reached in April.

- The layoffs and discharges rate decreased to a series low of 1.0% in August. The quits rate, a valuable indicator of the general health of the labor market, edged down 0.1 percentage point to 2.0%; it remains below the two-year pre-pandemic average of 2.3%.

- Over the 12 months ending in August, there was a net employment loss of 7.0 million.

- There were 2.1 workers competing for every job opening in

August. In the two years prior to the pandemic, the number of job

openings exceeded the number of unemployed in every report.

- The nominal US trade deficit widened in August by $3.7 billion

to $67.1 billion, close to our estimate. Underlying the headline

number, nominal exports rose 2.2% and nominal imports rose 3.2% in

August, both shy of our estimates. (IHS Markit Economist Kathleen

Navin)

- In response to this morning's report on trade, we lowered our estimate of third-quarter GDP growth 0.6 percentage point to 32.6% and left our forecast of fourth-quarter GDP growth unrevised at 3.7%.

- August marked the third consecutive month of gains in both exports and imports, following sharp declines this spring amidst the global pandemic. While both exports and imports continue to recover from recent lows, the pace of increase in each slowed in August relative to June and July.

- Real imports of goods are back to their pre-pandemic level, driven by a recovery in domestic spending. Real exports of goods, however, remain roughly 10% below their February 2020 level, as demand from overseas has yet to catch up.

- In the details of today's report, both imports and exports of transport services continued to turn up from lows in April. Imports of travel services also rose slightly in August, while exports of travel services continued to ease.

- These areas of trade were hit particularly hard by the pandemic as air travel was all but shut down for much of March and April and as the recovery has been slow. We look for trade in these sectors to gradually improve over the coming months.

- Anticipating the arrival of foods made with cultured seafood

cells to the US market, FDA seeks information that will help it

ensure for consumers proper, transparent labeling of these novel

food-science products. (IHS Markit Food and Agricultural Policy's

William Schulz)

- FDA is seeking comments for 150 days on its request for information, "Labeling of Foods Comprised of or Containing Cultured Seafood Cells," which is set to publish in the Federal Register on October 7.

- "Ensuring that food made with cultured seafood cells are properly labeled is consistent with FDA's goal of empowering consumers by providing information to help them make better informed choices," the agency said in its Constituent Update.

- "Various companies, both domestic and foreign, are developing products using animal cell culture technology," FDA said. "This technology involves the controlled growth of animal cells and their harvesting and processing into food, either alone or combined with other food."

- The agency said it particularly seeks data and other evidence concerning names or statements of identity for foods made with cultured seafood cells. Regulators want to know how consumers understand those terms including how to distinguish cell cultured versus conventionally produced seafood.

- FDA and USDA have agreed to jointly oversee the production of food products derived from the cultured cells of animals and fish. Cultured cells of seafood species come under FDA's regulatory jurisdiction whereas USDA will oversee cultured cell products from livestock, poultry, and Siluriformes fish.

- Both agencies said they are "working to develop joint principles for product labeling and claims to ensure that products are labeled consistently and transparently."

- FDA's request for information enumerates some existing rules

that will apply to labeling of seafood from cultured cells:

- Representations made or suggested must not cause the labeling to be misleading, either affirmatively or by omission of material facts

- Offering a food for sale under the name of another food is prohibited

- The labels of non-standardized foods must bear the common or usual name of the food

- Food sold in packaged form is required to be labeled with an accurate description of the food or a fanciful name commonly used by the public; such description or name must not be false or misleading.

- The US National Science Foundation (NSF) announced last month that it will fund studies of cell-based meat and seafood by University of California, Davis, researchers to the tune of some $3.5 million. Goals of the five-year project, which is led by David Block, chair of the UC Davis Department of Viticulture and Enology, include developing stable stem cell lines from which cultivated meat can be grown, developing inexpensive, plant-based media in which to grow cells; and assessing the nutritional value, stability, and sensory qualities of cultivated meat products.

- Romeo Systems, a battery maker with a joint venture (JV) with BorgWarner, plans to go public through a merger with a special-purpose acquisition company (SPAC) called RMG Acquisition Corp, according to a company statement. Romeo Power plans to be traded on the New York Stock Exchange under the ticker 'RMO'. Romeo says the deal is expected to raise USD384 million for the new business combination, including USD150 million from fully committed private investment in public equity (PIPE) investors. Romeo intends to use the funding for capacity expansion and research and development to further its next generation of battery system technologies. Romeo Power is specifically targeting the commercial vehicle industry, serving the battery electric medium-duty short-haul and heavy-duty long-haul trucking markets, as well as specialty trucking and bus sectors. According to Romeo and RMG, the pro-forma equity value of the combined company is USD1.33 billion. The CEO of RMG, Robert Mancini, and the chief operating officer of RMG, Philip Kassin, are expected to join the board of Romeo Systems. The deal is expected to be closed in the fourth quarter. Romeo describes itself as a leading energy technology company focused on designing and manufacturing lithium-ion battery modules and packs for commercial vehicles. Romeo says its technology delivers energy-dense batteries, with longer life and shorter charge times than rival products. It has completed the construction of a 7-GWh-capable manufacturing facility in Los Angeles, California, United States. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Bristol Myers Squibb (BMS, US) has entered into a definitive agreement to acquire clinical-stage company MyoKardia (US) for USD225.00 per share in cash - a 60% premium over the closing share price on 2 October - for a total transaction value of USD13.1 billion. MyoKardia focuses on the development of targeted therapies for serious cardiovascular diseases, including its leading clinical candidate mavacamten as well as danicamtiv (formerly MYK-491) and MYK-224, which are both in clinical development. The company's innovative pipeline of targeted therapeutics was "designed to change the course of disease and return the heart to normal function", according to MyoKardia's chief executive (CEO) Tassos Gianakakos. The acquisition will likely be minimally dilutive to non-GAAP (generally accepted accounting principles) earnings per share (EPS) in 2021 and 2022, and accretive starting from 2023, although the company has reaffirmed its current 2021 EPS guidance range. The transaction was unanimously approved by both companies' boards of directors and is anticipated to close during the fourth quarter of 2020, subject to certain customary closing conditions. MyoKardia's leading candidate is a breakthrough therapy-designated, potential first-in-class myosin inhibitor that is being developed as a treatment for obstructive hypertrophic cardiomyopathy (HCM). This is a chronic and progressive heart condition characterised by excessive contraction of the heart muscle and reduced ability of the left ventricle to fill, which can result in the development of debilitating symptoms and cardiac dysfunction. There is no available treatment for HCM beyond symptom management. The condition is estimated to affect one in every 500 people, and about 160,000-200,000 people in the United States and the European Union are currently diagnosed with symptomatic obstructive HCM. BMS estimates that only around 25% of individuals with obstructive HCM and only 10% with non-obstructive HCM have been diagnosed. (IHS Markit Life Sciences' Margaret Labban)

- Autonomous truck startup Locomation is to use NVIDIA's autonomous vehicle (AV) computing platform, DRIVE AGX Orin. This partnership will support Locomation's efforts towards full commercialization of its autonomous truck technology in 2022. Locomation has developed autonomous relay convoy (ARC) technology in its trucks, which enables one driver to pilot a lead truck while the following truck operates in tandem. This allows the driver in the following truck to log off and rest. NVIDIA DRIVE AGX Orin is a new system-on-a-chip (SoC) technology that has a processing performance seven times higher than the company's previous SoC, Xavier. Dr Çetin Meriçli, CEO and co-founder of Locomation, said, "We're moving rapidly toward autonomous trucking commercialization, and NVIDIA DRIVE presents an intriguing solution for providing a robust, safety-forward platform for our team to work with. This has the potential to enhance our process significantly and we look forward to working closely with the NVIDIA team." Locomation was founded in 2018 by experts in autonomous technology from the National Robotics Engineering Center of the Robotics Institute at Carnegie Mellon University, United States. The company says that its technology is able to reduce operating costs per mile by 33% and fuel costs by 8%. The company has partnered with Wilson Logistics to trial autonomous freight deliveries (see United States: 14 August 2020: Locomation conducts trials of autonomous freight deliveries). Wilson Logistics is due to start taking delivery of 1,120 units of Locomation-equipped trucks in 2022. Meanwhile, NVIDIA plans to start shipping Orin samples in 2021, with the earliest installation possible in vehicles at around the end of 2022. Orin is capable of supporting Level 2+ automation to Level 5 fully autonomous vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Visteon is planning a global corporate restructuring, which it expects to complete by mid-2022, according to a company filing with US securities regulators. The filing does not provide details of the plans but notifies investors and potential investors that Visteon expects to incur costs of between USD35 million and USD40 million during the process. Visteon's filing says, "The total expected costs are for cash payments for employee severance, retention and termination costs. The Company also expects to incur minimal other transition costs. The actions under the Plan are expected to be completed by the middle of 2022.The actual timing and costs of the Plan may differ materially from the Company's current expectations and estimates." An Automotive News report quotes an unidentified Visteon spokesperson as writing in an email, "As noted in the 8-K, our restructuring program is global in nature and will further rationalize our footprint to respond to our current economic events and lower industry production volumes. We have no further comment beyond that." (IHS Markit AutoIntelligence's Stephanie Brinley)

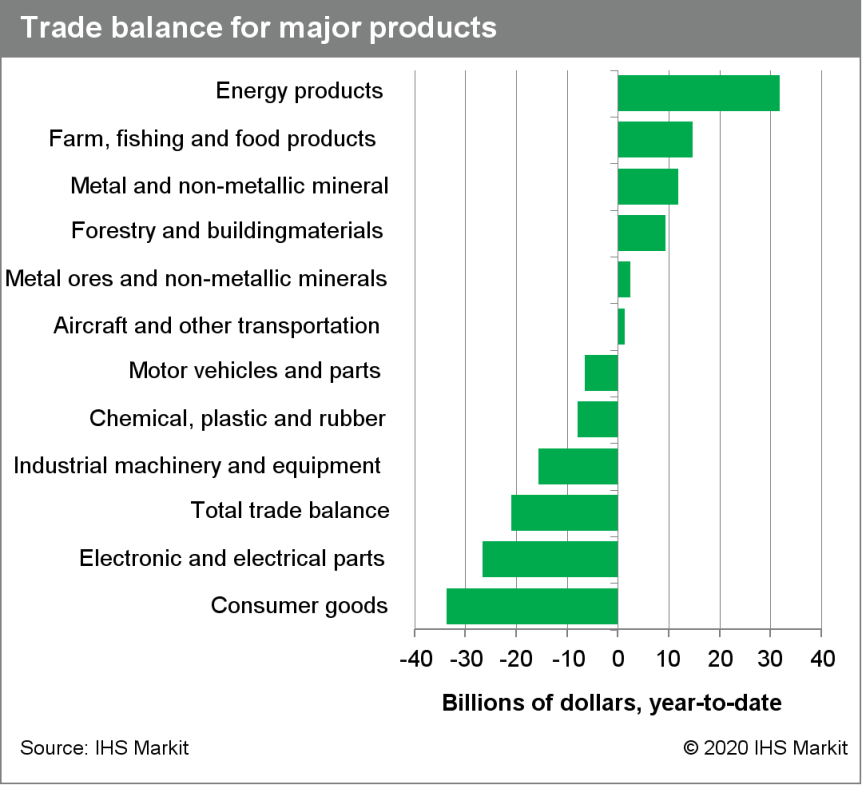

- Canada's nominal imports dropped 1.2% to $47.4 billion, $2.6

billion below February's pre-pandemic level. (IHS Markit Economist

Patrick Newport)

- Lower imports of aircraft and other transportation equipment and parts accounted for most of the decline as no airliner was imported in August; 5 of the 11 remaining major product groups were also down.

- Energy product imports and aircraft and other transportation equipment and parts, respectively down 41% and 49% from February, remain in a deep hole, while consumer imports have reached an all-time high.

- Nominal exports slipped 1.0%, to $44.9 billion in August, $3.4 billion below February's reading, with 6 of 1 major product sections in the red.

- Comparing August to February exports, energy products (down 20.5% from February), industrial machinery, equipment, and parts (down 15.0%), and aircraft and other transportation equipment and parts (down 37.1%) stayed far below the pre-pandemic level, while farm, fishing, and intermediate food products are 16.5% higher than February's level.

- Following three straight monthly increases, imports to the United States fell 1.6% m/m to $30.4 billion in August, while exports, led by lumber, increased 1.0% m/m to $33.8 billion, widening Canada's trade surplus with the United States from $2.5 billion to $3.3 billion.

- Imports from other markets stabilized, inching down 0.4%, and exports declined 6.8% to $11.2 billion—the lowest level since November 2017—widening Canada's trade deficit with countries excluding the US from $5.0 billion to $5.8 billion.

- A work stoppage among longshore workers at the Port of Montréal

likely depressed the August figures, as the national share of

exports by water through the Port of Montréal, which is normally

about 15%, fell to 7.8% in August; the import share was about

normal.

Europe/Middle East/Africa

- European equity markets closed higher across the region; Spain +1.4%, Italy +0.9%, Germany +0.6%, France +0.5%, and UK +0.1%.

- 10yr European govt bonds closed mixed; Spain/Italy -1bp and France/UK/Germany flat.

- iTraxx-Europe closed -2bps/54bps and iTraxx-Xover -10bps/322bps.

- Brent crude closed +3.3%/$43.65 per barrel.

- On 5 October the European Banking Authority (EBA) published its

latest quarterly risk dashboard, covering a sample of 182 EU banks

and covering the second quarter. It warned that there "are further

signs for a deterioration of asset quality amid the unfolding

Covid-19 crisis". (IHS Markit Economist Brian Lawson)

- However, the NPL ratio fell from 3% in the first quarter to 2.9% in the second, reflecting higher levels of lending (and loan moratoria arrangements). The main indicator of risk deterioration related to profitability, with return on equity dropping to 0.5% from 1.3% in the first quarter. Asset quality, market and profitability risks all remained high, the worst available level, with asset quality and profitability both assessed to face deterioration in the coming quarter.

- The EBA reported that weakening profitability came despite an improvement in the sector's cost-to-income ratio from 71.8% to 66.7%: however, in a low interest rate environment net interest income and fees and commission income both fell, although "impairments were the key driver for the contraction of profitability".

- Second-quarter figures are too early to reflect the full impact from the coronavirus disease 2019 (COVID-19) virus pandemic: impairment is likely to rise gradually, accelerating when state assistance measures are scaled back or ended. However, weak economic conditions, upward pressures on impairment and low interest rates already leave the sector facing a bleak position regarding profitability.

- For the second successive quarter, over 80% of banks sampled had return on equity of under 6%. Banks are poorly insulated by existing provisioning: only just above 16% have coverage ratios of over 55% of existing impairment.

- Costs do appear under somewhat better control: 23.4% of banks managed to keep their cost-income ratio under 60% in the second quarter, versus 19.9% in the preceding quarter. However, capital buffers remain strong, with the share of banks with CET1 ratios of over 14% rising from 40.4% to 49.9% during the quarter: less positively, the share of banks with a leverage ratio under 5% increased from 45.2% to 57.4% of those surveyed.

- The German passenger car market did well in September thanks to

a huge uplift in the registration of electrified vehicles, with an

8.4% year-on-year (y/y) increase to 265,227 units. This left the

total for the year to date (YTD) at 2,041,831 units, which was a

decline of 25.5% y/y. The OEMs operating in the German market

mostly enjoyed a positive month in September as pent-up demand, the

lower VAT rate and the increased subsidies on electrified vehicles

all combined to have a positive effect. (IHS Markit

AutoIntelligence's Tim Urquhart)

- The market's leading brand, the Volkswagen (VW) passenger car brand, was actually one of the less spectacular brands in terms of growth during the month, despite the ID.3 electric vehicle (EV) beginning customer deliveries and the Mark 8 Golf now being fully on stream. In the first three quarters of the year the brand declined by 26.3% y/y to 367,181 units.

- Mercedes-Benz occupied its usual position in second place, but the gain it posted in September, like VW, also fell well short of the market average, with a 1.9% y/y increase to 27,360 units. However, in the YTD Mercedes-Benz was one of the better performing volume brands, limiting its sales decline to a market-beating 16.6% y/y, which equated to registrations of 207,014 units.

- BMW was the third best-selling brand during the month, although it did not outperform the overall gain in the market. In September its sales rose by only 1.9% y/y to 20,267 units. Its decline in the YTD also mirrored that of Mercedes-Benz with a market-beating decline of 16.6% y/y to 166,927 units.

- Ford was fourth in the brand list but actually failed to improve y/y unlike the three brands ahead of it. Ford sales declined by 0.8% y/y to 18,696 units, which left the YTD at 139,939 units, a fall of 33.8% y/y.

- Skoda took fifth place, and was the first OEM with no German manufacturing capacity. It posted a very strong uplift of 29.6% y/y to 18,152 units, helped by the ongoing market launch of the fourth-generation Octavia, and ongoing strong SUV demand. YTD registrations were down by 20.8% y/y to 127,790 units.

- The brand with the biggest monthly rise in the top-10 brands in September was Audi, which recorded a massive increase of 42.4% y/y in registrations during the month to 16,427 units. This was exacerbated by a low base comparison with September 2019 and helped by the launch of the new A3. Registrations for the first nine months saw a 28.0% y/y decline to 154,140 units as the VW Group's volume premium brand underperformed the overall market during the period.

- For the full year 2020 IHS Markit is forecasting the German passenger car market at 2.92 million units, down from 3.61 million units in 2019.

- French firm Ynsect has broken its own record for the largest amount of funding raised in the alternative animal nutrition space. Established in 2011, Ynsect breeds mealworms (Tenebrio molitor) and turns them into ingredients for fish feed, pet food and organic plant fertilizers. The mealworms comprise more than 70% protein and are a natural source of nutrients for animals such as poultry, pigs, fish, cats and dogs. Ynsect extended its series C funding round to $372 million, which it claims is the largest amount ever raised by a non-US agtech business. In 2019, Ynsect secured $125m as part of its original series C financing tranche. This brings the firm's total financing to date to $425m - more than the total amount raised by the entire global insect protein sector so far. The financing will enable the firm to complete development of its first fully automated facility for the production of premium insect protein in Amiens, France, which is due to open in 2022. Ynsect claims the FARMYNG site will be the largest insect farm in the world and will produce 100,000 tons of insect products annually. The firm will create 500 direct and indirect jobs at the facility. Ynsect will also use the series C capital to expand into North America, with the support of its first US-based investors Upfront Ventures and Robert Downey Jr's FootPrint Coalition. Ynsect will also be able to grow its product lines and markets into the supply of wet pet food. The company also received funding from Belgium's Astanor Ventures, the Luxembourgian Armat Group, early-stage French investor Supernova Invest and Hong-Kong headquartered Happiness Capital. Equity and debt financing was sourced from Caisse des Dépôts - a venture arm of the French government - and French banks Crédit Agricole Brie Picardie and Caisse d'Epargne Hauts-de-France. Other equity and debt financers included BNP Paribas, Credit Agricole Franche Comté, Caisse d'Epargne Normandie and Crédit Mutuel. Ynsect noted global consumption of animal proteins is anticipated to surge by 52% between 2007 and 2030. The animal feed market is currently worth approximately $500 billion and is expected to reach $600bn by 2027. The firm is aiming to become a global market leader in the alternative protein space. (IHS Markit Animal Health's Daniel Willis)

- Ireland's spirits producers warned that the COVID-19 crisis has hit the sector's production, exports, and sales following the closure of the hospitality and foodservice industry, urging policymakers to keep them open. Drinks Ireland, the national trade association for the sector, said in its latest Irish Spirits Markets Report that the growth it experienced in 2019 has been effectively undone by the coronavirus pandemic. The group reported that in 2019, global Irish whiskey sales grew by 10.9%, from 10.58 million to 11.93 million nine-liter cases, while Irish cream liqueur sales increased by 3.9%, from 8.2 million to 8.52 million nine-liter cases. Domestic sales grew by 0.7% from 2.4 million to 2.42 million nine-liter cases. "It is fair to say that this growth seen by the sector in 2019 has been reversed as a result of COVID-19," the report states. The trade group sees many future risks to the market performance of the Irish drink sector, singling out the combined weight of COVID-19 and US tariffs imposed following the dispute with the EU over subsidies going to Airbus and Boeing. This saw the US apply 25% duties on Irish liqueurs and on single malt Irish whiskey from Northern Ireland. An earlier round of tariffs saw the EU apply 25% in tariffs to US whiskey and bourbon imports in retaliation for US tariffs on European steel and aluminum products. These are due to increase automatically to 50% in July 2021. Members of the European Parliament have pushed incoming Trade Commissioner Valdis Dombrovskis to impose go ahead with these tariffs, which could be worth €3.4 billion ($4 billion), to ensure the US respects the rules of global trade. Brexit also risks piling further pressure on the Irish spirits sector, given the possibility that there could be a 75% drop in the country's agri-food exports to the UK if the Brits leave the EU without a trade agreement. Drinks Ireland says spirit producers are particularly vulnerable because the UK, along with the US, are the sector's biggest export markets for the country's high-value alcoholic beverages protected by Geographical Indications (GIs). A no-deal scenario is looking increasingly likely as the UK House of Commons passed a bill that would give the UK government powers to unilaterally override parts of the EU-UK Withdrawal. Since then, British Prime Minister Boris Johnson told BBC that they 'can live with' a no-deal Brexit. (IHS Markit Food and Agricultural Policy's Steve Gillman)

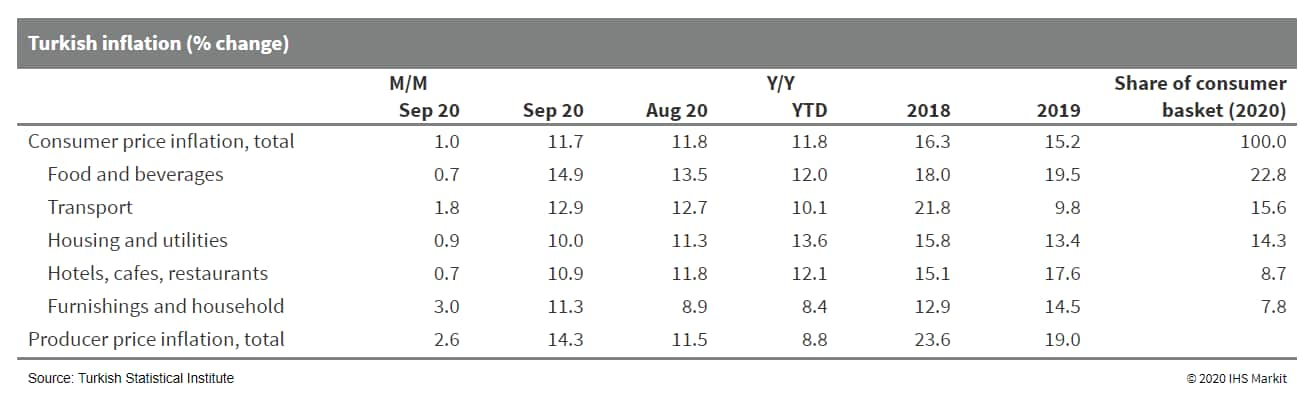

- Lira depreciation since late July put upward pressure on

Turkish consumer prices, keeping the country's annual inflation

rate elevated, at 11.7% in September. Despite a tightening of

monetary policy in recent weeks, lira losses continued throughout

September, suggesting inflationary pressures will remain high in

the fourth quarter 2020. The central bank's end-year annual

inflation target of 10.5% is increasingly out of reach. (IHS Markit

Economist Andrew Birch)

- In September 2020, the Turkish Statistical Institute reported that annual consumer price inflation was 11.8%, continuing to hover around the same level at which it has been since November 2019.

- Annual consumer price inflation remained elevated despite a sharp deceleration of energy price inflation over the course of the third quarter. In June 2020, annual energy price inflation had been 24.8%. As of September 2020, that inflation rate had plunged to 9.4% due to shifting base effects, low global prices, and weak domestic demand.

- However, during the third quarter, the Turkish lira once again resumed depreciation against the dollar, ending the quarter 13% weaker than it had been at the end of the first half. The depreciation pushed up import prices, exacerbating the rise of both core prices and food prices from end-June to end-September.

- In its New Economic Plan, the Turkish government has set the

end-year inflation target at 10.5%, a rate that IHS Markit believes

is out of reach given the ongoing lira losses. Any hope of driving

inflation down from its 11-12% range will depend upon a tightening

of monetary policy and a stabilization of the lira.

- Dacia has announced that it will publicly show the production version of its first ever electric vehicle (EV), the Dacia Spring, on 15 October, according to Esmerk Eastern European News. The launch will be part of the Renault eWays online event dedicated to electric mobility. Sales of the Dacia Spring will start in the first half of 2021, with Dacia claiming that it will be the most affordable electric car in Europe. Dacia also claims that the Spring will have a range of 200km. The concept of the Spring was initially due to be shown at the cancelled Geneva Motor Show back in March. (IHS Markit AutoIntelligence's Tim Urquhart)

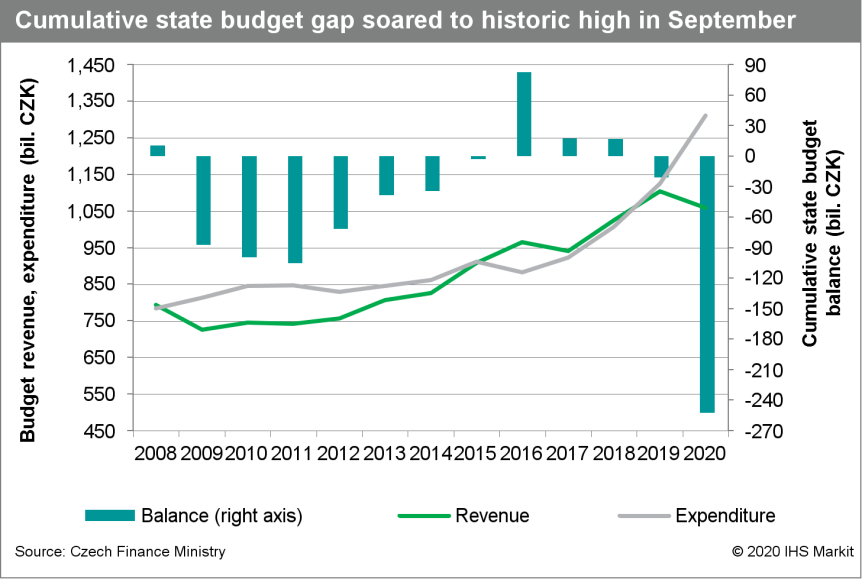

- The COVID-19 virus pandemic has triggered a sharp deterioration

of the Czech Republic's public finances, and the Czech Finance

Ministry's revised 2021 deficit target is far above pre-crisis

levels. (IHS Markit Economist Sharon Fisher)

- According to the Czech Statistical Office, the general government deficit jumped to CZK100.4 billion (USD4.3 billion) in the second quarter, equivalent to 7.5% of GDP. Public debt soared to 39.9% of GDP, up from 32.8% in the first quarter of 2020 and 30.2% at the end of 2019.

- Pulled downwards by falling tax receipts from income as well as production and imports, government revenues dropped by 7.2% year on year (y/y) in the second quarter, reaching 42.6% of GDP. Expenditures jumped by 14.0% y/y to 50.1% of GDP, driven by a surge in capital transfers and subsidies.

- Cumulative data through to September put Czechia's state budget gap at CZK252.7 billion (equal to 50.5% of the revised full-year target), up from CZK21.0 billion in the same period of 2019. While revenues fell by 4.1% y/y, expenditures soared by 16.6% y/y.

- Although Czechia's second-quarter fiscal deficit was almost

precisely in line with IHS Markit's September forecast, we will

consider raising the full-year outlook (currently at 5.8% of GDP)

in the October round. The second quarter's public-debt-to-GDP ratio

was higher than we had anticipated, and we are tentatively planning

to raise our end-2020 forecast (from 39.0% of GDP currently).

- Kazakhstan's current account in the second quarter returned to

a deficit after enjoying a healthy surplus in the first quarter,

while annual comparison showed the deterioration of the primary

income deficit cancelling the easing in the trade surplus,

resulting in the overall current account deficit narrowing by

one-third y/y. Deficits are likely to persist in the second half of

the year, while Kazakhstan's low government debt and high share of

FDI-related intercompany lending of gross external debt suppress

risks related to external lending, which will need to increase

given the weak outlook for FDI inflows. (IHS Markit Economist Venla

Sipilä)

- According to the latest balance of payments results from the National Bank of Kazakhstan (NBK), the current account in the second quarter registered a deficit of USD1.1 billion, a clear deterioration compared with the surplus of USD2.8 billion posted in the first quarter. This result marks narrowing of 32% year on year (y/y) for the second quarter, while leaving the first-half 2020 balance at a surplus of USD1.7 billion.

- The goods trade surplus, in particular, narrowed by 39% y/y in the second quarter, with exports contracting by 24% y/y and imports falling by 17% y/y. The service trade deficit eased by 27%, as both service income inflows and outflows clearly falling.

- Decisive in the overall improvement of the current-account balance was moderation of the shortfall on the primary income account. This was mainly due to a sharp fall in FDI-related income outflows.

- Net FDI inflows recovered after having been negative in the second quarter of 2019. Totaling USD3.1 billion, net FDI inflows covered the whole deficit in the second quarter.

- Net portfolio investment inflows turned negative, while net outflows also remained negative, and this left the portfolio investment balance showing liability inflows USD1.7 billion above asset outflows in April-June.

- Kazakhstan's gross external debt ended June at USD159.8 billion, up 0.8% from the beginning of the year and 3.2% since end-March. General government debt accounted for 7.4% of the total, having increased by 3.9% during the second quarter.

- The Nigerian government intends to convert vehicles to run on compressed natural gas (CNG) and is beginning the initiative with the conversion of commercial vehicles in Nigeria, reports The Punch. Yemi Osinbajo, vice-president of Nigeria, said that the plan was already being experimented in the state of Edo where Dangote Group, a multinational conglomerate company in Africa, had converted all its trucks to run on CNG. He said, "One of the ways is by using Compressed Natural Gas. Government is committed to do the conversion. First of all, we are starting with commercial vehicles." He added, "Most commercial transporters will have the capacity to use both gas and petrol. That is already being done experimentally in Edo State. Dangote, for instance, has converted all his trucks to the use of CNG, and that is 4,000 or even more of those trucks. It is not a particularly difficult thing to do for the commercial transporters, it may be expensive for the individual but that is also part of the commitment of government, to be able to do the conversion, and the price of gas comes at about almost half the price of petrol." Meanwhile, OMAA Global has launched a range of mini-buses that can run on gasoline (petrol), CNG, or liquefied petroleum gas (LPG). The buses have a single or dual-fuel engine system that can be offered with a combination of gasoline and CNG or gasoline and LPG. They are available in a manual transmission, with plans for the introduction of an automatic transmission as well. Chinedu Oguegbu, founder of OMAA Global, said "Currently, OMAA is finalizing our assembly operations. This November, we will commence commercial deliveries of OMAA vehicles in large volumes. Next, we will have a phased migration from SKD to CKD localizing components, up-skilling staff and contributing to the burgeoning automotive ecosystem." The CNG conversion plan is part of the Nigerian government's strategy to make energy cheaper for Nigerians. OMAA Global's launch comes during the conversion plan, and the initiative is expected to drive sales of the OMAA mini-buses. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- APAC equity markets closed higher across the region; India +1.5%, Hong Kong +0.9%, Japan +0.5%, Australia +0.4%, and South Korea +0.3%.

- Prime Planet Energy, a battery joint venture (JV) between Toyota and Panasonic has announced plans to manufacture lithium-ion batteries for hybrid cars at a Panasonic factory in Tokushima Prefecture (Japan) from 2022 to meet growing demand for electric vehicles (EVs), according to Reuters. The plant will have annual capacity to produce batteries for around 500,000 vehicles. The JV, Prime Planet Energy & Solutions, Inc., was established at the beginning of this year to develop competitive and cost-effective batteries for Toyota and other customers across the globe. The scope of business operations under the JV includes research, development, production engineering, manufacturing, procurement, and order receipt and management of automotive prismatic lithium-ion batteries, solid-state batteries, and next-generation batteries. As the world shifts its focus towards electrified vehicles, there has been a huge surge in demand for batteries for such vehicles and has resulted in an increased competition between global battery manufacturers such as Panasonic, Samsung, LG Chem, and China's CATL. The increased capacity to be added from the planned production line will give Panasonic an edge in meeting the demand for lithium-ion batteries. Last month, Panasonic said that it is evaluating options for new EV battery production with Tesla after the latter announced a plan to increase output and halve the cost of the batteries. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Toyota Yaris has replaced Honda's N-Box as the best-selling model in the overall Japanese new-vehicle market in September, according to data released by the Japan Automobile Dealers Association and the Japan Mini Vehicles Association. The rankings include mini-vehicles, which are categorised as vehicles with an engine capacity of up to 660 cc. Toyota sold 22,066 units of the Yaris last month (sales started in February 2020). The next two places in the monthly rankings were held by the Honda N-Box and the Suzuki Spacia with 18,630 units, down 35.6% year on year (y/y), and 15,592 units (down by 1.0% y/y), respectively. The Toyota Corolla took the fourth spot with 13,579 units (up by 22.9% y/y), followed by the Toyota Raize with 13,077 units (sales began in November 2019) and Daihatsu Tanto with sales of 11,897 units, down by 45.6% y/y. They were followed by the Nissan Juke (10,736 units), Toyota Alphard (10,436 units), Daihatsu Move (8,999 units), Toyota Harrier (8,979 units), and Honda N-Wagon (8,977 units). The Yaris is the first vehicle to adopt the Toyota New Global Architecture (TNGA) platform for compact cars, also known as the GA-B platform, and features a host of safety systems including 'Advanced Park', an advanced parking support system being offered for the first time by Toyota. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korean automakers posted 2.2% year on year (y/y) growth

in their combined global vehicle sales to 678,531 units in

September, according to data released by five major domestic

manufacturers and reported by Yonhap News Agency, as compiled by

IHS Markit. (IHS Markit AutoIntelligence's Jamal Amir)

- The five automakers reported a 23.3% y/y surge in their combined domestic sales last month to 138,530 units, while their combined overseas sales went down by 2.0% y/y to 540,019 units.

- South Korea's top-selling automaker, Hyundai, posted global sales of 360,762 units in September, down by 5.3% y/y. Hyundai's domestic sales jumped by 33.8% y/y to 67,080 units last month, while its overseas sales declined by 11.2% y/y to 293,682 units.

- Global sales of Hyundai's affiliate, Kia, increased by 10.3% y/y to 260,023 units in September. Kia's domestic sales grew by 21.9% y/y to 51,211 units last month, while its overseas sales grew by 7.7% y/y to 208,812 units.

- General Motors (GM) Korea reported an 89.5% y/y surge in its total sales to 40,544 units last month, with its domestic sales up by 17.9% y/y to 6,097 units and overseas sales up by 112.3% y/y to 34,447 units.

- SsangYong's global sales declined by 4.4% y/y to 9,834 units during September. Last month, the automaker sold 8,208 units in South Korea, up by 23.3% y/y, and around 1,626 units in its overseas markets, a decline of 46.7% y/y.

- Finally, Renault Samsung's sales nosedived by 51.6% y/y to 7,368 units in September, with its domestic sales plunging by 24.1% y/y to 5,934 units and its overseas sales plummeting by 80.4% y/y to 1,452 units. The plunge in the automaker's overseas sales was mainly due to the end of production of the Nissan Rogue at its plant after its contract to produce the model expired in September 2019.

- In the year to date (YTD), Hyundai's global sales were down by 19.4% y/y to 2.60 million units. It was followed by Kia with sales of 1.86 million units (down by 8.8% y/y), GM Korea with 268,961 units (down by 12.9% y/y), Renault Samsung with 91,544 units (down by 29.5% y/y), and SsangYong with 74,707 units (down by 24.5% y/y).

- The Indonesian government is in early discussions with electric vehicle (EV) manufacturer Tesla over a potential investment in the country, reports Reuters. "It was still an early discussion and was not detailed yet," said Ayodhia Kalake, a senior official at the Coordinating Ministry for Maritime and Investment Affairs. "We need further discussion with Tesla," he said, adding that Indonesia has a number of incentives for investment in EVs. The report highlights that Tesla is looking to increase production of trucks and solar projects, and its CEO Elon Musk earlier this year urged miners to produce more nickel and offered long-term contracts if they mine efficiently and in an environmentally sensitive way. Nickel-rich Indonesia is keen to develop a full supply chain for nickel in the country, especially to extract battery chemicals, make batteries, and eventually build EVs. Nickel and cobalt are key materials to make lithium-ion (Li-ion) batteries. The country has stopped exports of unprocessed nickel ore to support investment in its domestic industries. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2020.html&text=Daily+Global+Market+Summary+-+6+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 October 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+October+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}