Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 08, 2020

Daily Global Market Summary - 8 June 2020

Most US and APAC equity markets closed higher on the day, while European markets closed mixed. The S&P 500 today breached the key milestone of closing in positive territory year to date. Most credit indices closed lower on the day, while European and US benchmark 10yr government bonds closed higher. WTI briefly trading above $40 per barrel overnight, but it closed lower alongside Brent.

Americas

- US equity closed higher on the day and the S&P returned to positive performance YTD; Russell 2000 +2.0%, DJIA +1.7%, S&P 500 +1.2%, and Nasdaq +1.1%.

- 10yr US govt bonds closed -2bps/0.88% yield.

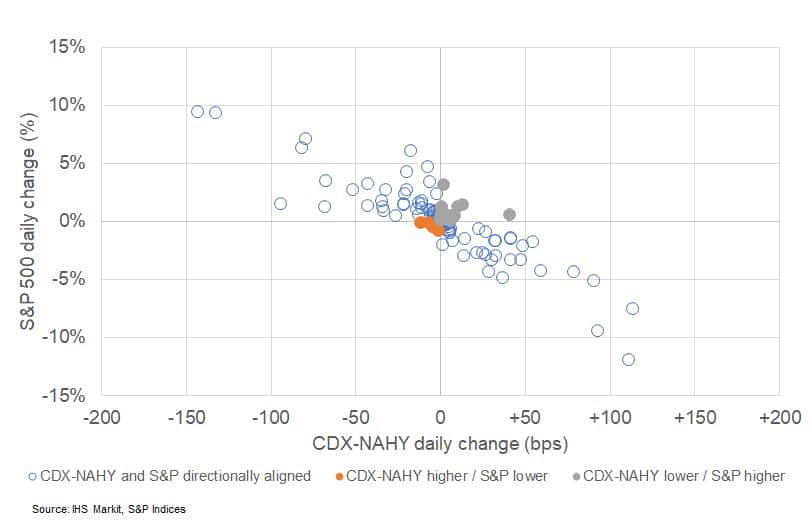

- US credit indices closes lower on the day; CDX-NAIG +2bps/67bps

and <span/>CDX-NAHY

+11bps/424bps. Today is only the 16th day of the 108 trading days

this year that the CDX-NAHY closed lower while the S&P 500

closed higher (grey marker in chart below) and there were only 5

days when the CDX-NAHY closed higher when the S&P was lower

(orange marker):

- Crude oil briefly breached $40 per barrel during the APAC trading day, but closed -3.4%/$38.19 per barrel.

- The OPEC+ alliance of producers have agreed to extend their

record supply cut through the month of July, with a cosmetic

adjustment down from 9.7 MMb/d to 9.6 MMb/d after Mexico's

effective withdrawal. The group had previously agreed to trim the

cuts to 7.7 MMb/d at the start of July. The extension was

buttressed by a strong verbal commitment to compliance and

agreement on a "compensation" scheme consisting of over-compliance

through the next three months to counter any excess production,

although with no real enforcement mechanism. Importantly, the 1.2

MMb/d of voluntary cuts implemented in June by Gulf producers Saudi

Arabia, Kuwait and UAE are now set to unwind starting in July. (IHS

Markit Energy Advisory's Roger Diwan)

- With the OPEC+ cuts now extended, we believe that the recent surge in oil prices reflects a market pricing for perfection in an environment of acute uncertainty.

- As a result, we believe crude price momentum should reverse, with any renewed bullishness contingent on real signs of demand-led physical tightening.

- However, there remains a risk that the broader risk-on environment that has lifted financial markets over the last week will continue to draw capital into crude markets even as oil market dynamics warrant a breather.

- The US Department of Agriculture (USDA) has detected the

country's first case of COVID-19 virus infection in a dog. The

National Veterinary Services Laboratories confirmed a German

shepherd in New York state tested positive for SARS-CoV-2. One of

the dog's owners tested positive for the virus and another showed

symptoms prior to the dog exhibiting signs of illness. Samples were

taken from the dog after it showed signs of respiratory illness.

The animal is expected to make a full recovery. (IHS Markit Animal

Pharm's Sian Lazell)

- The World Organisation for Animal Health (OIE) has also confirmed the first case of SARS-CoV-2 in a domestic animal in Russia. Throat and nasal swabs were taken from a five-year-old cat in Moscow. The animal tested positive for the virus and is currently in quarantine at its place of keeping.

- Recently, outbreaks at two mink farms in the Netherlands were also confirmed by the OIE. One of these farms - listed as 'Farm 1' - had two affected locations. Outbreaks were subsequently identified at a third farm and a third location at Farm 1. It was assumed animals were infected by workers at the farms. However, the Dutch government later said evidence also pointed to a case where the virus was passed back to a worker.

- Canadian total housing starts jumped 16.2% month on month (m/m)

to 193,453 units in May following three consecutive monthly

declines. (IHS Markit Economist Jeannine Cataldi)

- Urban single-family starts rebounded 18.6% m/m while multifamily starts increased 12.3% m/m. Rural starts surged 68.6% m/m.

- Data were collected for Quebec in May but not in April because of a temporary shutdown.

- Given the announced reopening plans from many provinces, total housing starts will gradually rebound in the coming months with some regional differences.

- Housing starts increased in both British Columbia and the Atlantic provinces in May, as growth in multifamily starts was partially offset by continued declines in single starts. Among the remaining provinces, housing starts in Ontario plunged, falling 39.3% m/m, driven by a decline in multifamily starts of 49.5% m/m. Single-family starts in Ontario increased by 3.6% m/m.

- Emerging and developing economies will shrink this year for the first time in at least six decades, according to the World Bank, underscoring the mounting economic toll from the coronavirus pandemic as it spreads across the world. The bank's forecast is that as many as 100 million people in the developing world will be tipped into extreme poverty by a projected 2.5% contraction in emerging markets' gross domestic product, with incomes per capita set to shrink 3.6% globally. The bank defines extreme poverty as an income of less than $1.90 a day. (FT)

- Light-vehicle (LV) registrations in Brazil decreased 75.8% year

on year (y/y) in May, according to data from the National

Association of Motor Vehicle Manufacturers (Associação Nacional dos

Fabricantes de Veículos Automotores: Anfavea). Brazil's LV exports

dropped 92.6 y/y in May, while LV production declined 85.6% y/y.

(IHS Markit AutoIntelligence's Stephanie Brinley)

- Anfavea has reported that, in May, Brazil's light commercial vehicle (LCV) sales decreased 64.9% y/y, while passenger cars sales decreased 77.8% y/y. Brazil's LV market is dominated by passenger cars, although LCVs are gaining some traction. Passenger cars accounted for 77.8% of total LV sales in May 2020, compared with 84.7% in May 2019.

- In May, FCA reclaimed the lead over GM, with 11,355 units (6,918 passenger cars and 4,437 LCVs) compared to GM's 9,970 units (8,238 passenger cars and 1,732 LCVs). In third place was Volkswagen (VW), which had sales of 7,290 passenger cars and 1,402 LCVs.

- The impact of the COVID-19 pandemic severely curtailed economic activity in North and South America in April and May, and Brazil's light-vehicle exports dropped 92.6% y/y in May. In the year to date (YTD), exports are down 45.2%.

- The outlook for the Brazilian LV market is gloomy as the spread of the COVID-19 virus is likely to paralyze sales in May, followed by a weak recovery. Brazil's LV sales were 2.66 million units in 2019 and are forecast to decrease 30.14% to 1.86 million units in 2020.

- Argentina's industrial production decreased over 30% in April

compared with 2019; the highly volatile seasonally adjusted monthly

index decreased by 18% in April compared with March. Most sectors

posted significant annual decline. (IHS Markit Economist Paula

Diosquez-Rice)

- Argentina's industrial production posted a 33.5% year-on-year (y/y) decrease in March, according to the country's National Institute of Statistics and Censuses (Instituto Nacional de Estadística y Censos: INDEC).

- The seasonally adjusted data show a 18.3% month-on-month (m/m) drop in April, a deeper fall when compared with the March figure. The cumulative change for the first four months of 2020 is a decline of 13.5% y/y.

- The biggest annual decreases were in the vehicle assembly and automobile parts, non-metal minerals, other machinery and equipment, clothing and apparel, home furnishings, and tobacco.

- A qualitative industrial poll of companies conducted by INDEC shows that 76% of the respondents estimate that the situation will deteriorate in May-July compared with the same period in 2019 (up from 74% in the previous month survey). Meanwhile, the percentage of respondents expecting demand to pick up decreased to 8.7%, while 66% of the respondents expect exports to decrease during the period.

- Argentina's light-vehicle production dropped 84.1% year on year

(y/y) in May and exports decreased 85.2% y/y, according to figures

released by the Association of Automobile Manufacturers (Asociación

de Fábricas de Automotores: ADEFA). (IHS Markit AutoIntelligence's

Stephanie Brinley)

- The association reports that only 4,802 units were produced in the country in May, up from zero in April but down from 30,280 units in May 2019. Of those, 1,519 were passenger cars and 3,283 were light commercial vehicles (LCVs), the ADEFA data show.

- In the year to date (YTD), light-vehicle production has declined 48.4% y/y to 70,782 units, according to ADEFA.

- Light-vehicle exports have declined 48.7% y/y to 46,347 units in the YTD, with only 3,227 units exported in May.

- Brazil remains the highest-volume trading partner of Argentina, although from January to May 2020, only 30,805 units were exported, nearly 30,000 units less than in the same period of 2019.

- ADEFA reports that, in May, exports of passenger cars declined 84.8% y/y and LCVs fell 85.5% y/y.

Europe/Middle East/ Africa

- European equity markets closed mixed; Spain +0.3%, Italy +0.2%, UK/Germany -0.2%, and France -0.4%.

- 10yr European govt bonds closed higher today; France -5bps, Germany -4bps, Spain/UK -2bps, and Italy -1bp.

- iTraxx-Europe closed +2bps/61bps and iTraxx-Xover flat/342bps.

- Brent crude closed -3.5%/$40.80 per barrel.

- BP plans to cut nearly 10,000 jobs, or 14% of its workforce, and freeze pay increases for senior level managers as it seeks to strengthen its finances, the company said Monday. BP, with a current workforce of around 70,000 people, said the cuts will help to drive down its operating costs by $2.5 billion by the end of 2021. The cost-cutting plan might have to go even further, BP's Chief Executive Bernard Looney said in the email. (WSJ)

- Jackup rig contractor Borr Drilling has obtained amendments to

facilities from its secured lenders and shipyards that will provide

total liquidity improvement of more than USD315 million in the

period to the first quarter of 2022. (IHS Markit Upstream Costs and

Technology's Matthew Donovan)

- These amendments were conditional on Borr issuing 46,153,846 new shares to the subscribers of its USD30 million equity offering.

- Borr Drilling Chairman Paal Kibsgaard stated the amended financing package gives Borr a required cash break-even bareboat contribution in 2021 at around USD20,000/day per rig based on just 12 rigs in operation. The company has six more jackups activated and available, which it only intends to bring back to work on cashflow accretive contracts.

- The amendments include the deferral of the delivery of five newbuild jackups rigs until mid-2022, representing estimated liquidity improvement of approximately USD190 million until the first quarter of 2022.

- The company has also secured the deferral of certain interest payments until 2022, representing an estimated liquidity improvement of around USD60 million, and a deferral of debt amortization in 2021 of USD65 million until maturity of the loans in the second quarter of 2022.

- The European healthcare and pharmaceutical sectors suffered

precipitous declines in output and business confidence, according

to the May IHS Markit Purchasing Managers' Index (PMI) report. The

pharma sectors output index was the fourth-best-performing economic

sector, only narrowly behind automobiles and auto parts,

construction, and technology equipment. (IHS Markit Life Science's

Eóin Ryan)

- The survey results showed business activity for the European pharmaceutical sector declining from an average of 47.4 over the first five months of the year to 36.5 in May. This represents a "series-record" drop, according to analysis by the IHS Markit PMI.

- Business activity in the European healthcare activity also fell from a five-month average of 36.7 to 30.8 during May.

- PMI results registered a "record fall" for healthcare sector employment - down from an average of between January and May of 44.3 to 35.4 in May.

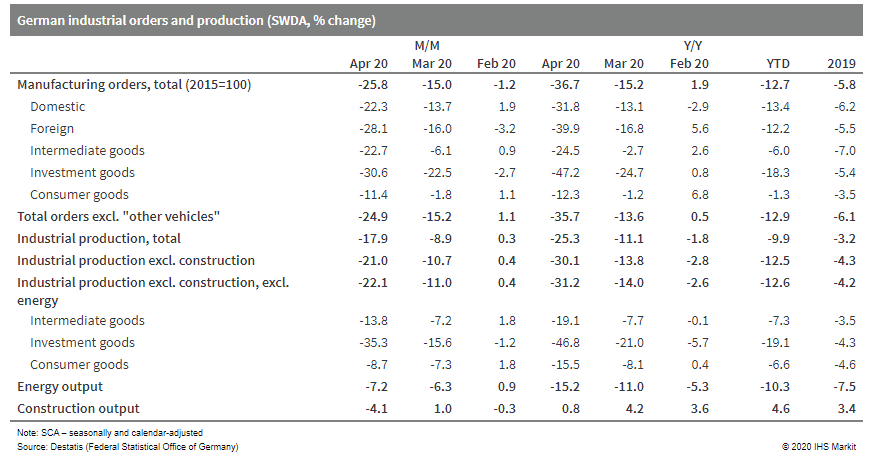

- Seasonally and calendar-adjusted German industrial production

excluding construction declined by 21.0% month on month (m/m) in

April, extending a fall of -10.7% m/m in March. (IHS Markit

Economist Timo Klein)

- The combined drop of 29.5% versus February's level is unprecedented - in the global financial crisis of 2008-09, production had declined by "only" 22.7%, albeit over a period of eight months (September 2008-April 2009).

- Total production including construction declined by a lesser 17.9% m/m in April following -8.9% in March, owing to sub-average output falls in energy and most notably of construction. The latter actually rose slightly in March and declined by just 4.1% m/m in April (see table below).

- The manufacturing breakdown expectedly reveals that production of investment goods output was the main drag at -35.3% m/m, whereas intermediate and consumer goods declined by only around 11% on average. Most importantly, the split according to industrial branches shows that car output - which was only resumed by most major manufacturers at the very end of April - posted -75% m/m and thus an activity level of just 15% compared with 2015=100.

- Orders declined even more sharply than output in April. Their

overall drop by 25.8% m/m (similarly -25.1% excluding big-ticket

items; see chart below) was somewhat more pronounced among foreign

orders than among domestic orders.

- German passenger car production has slumped in May in the wake of the COVID-19 virus pandemic. According to data released by the VDA, output during the month dropped by 66% year on year (y/y) to 151,500 units. It added that this had contributed to overall output in the first five months of the year retreating by 44% y/y to 1,182,200 units. The trade association also noted that the number of passenger cars exported has also reduced significantly, with a drop of 67% y/y in May to 105,100 units, while in the year to date (YTD) this is down by 43% y/y to 904,900 units. Despite Volkswagen (VW) and Daimler pushing to restart production before the end of April, output volumes remained exceptionally low during May. (IHS Markit AutoIntelligence's Ian Fletcher)

- Danish passenger car registrations have declined again during

May. According to the latest data published by the Danish Car

Importers' Association (De Danske Bilimportører), passenger car

demand fell by 40.1% year on year (y/y) to 11,432 units, with all

segments taking some sort of impact from this decline. (IHS Markit

AutoIntelligence's Ian Fletcher)

- The decline last month has resulted in registrations in the year to date (YTD) decreasing 30.6% y/y to 70,489 units.

- The trade association also revealed that light commercial vehicle (LCV) registrations declined 37.6% y/y to 1,815 units in May.

- This dragged the YTD result into a decline as well, with registrations falling by 18.9% y/y to 11,657 units.

- Danish registrations of medium and heavy commercial vehicles (MHCVs) contracted by 45.4% y/y to 268 units in May and decreased 23% y/y to 1,722 units in the YTD.

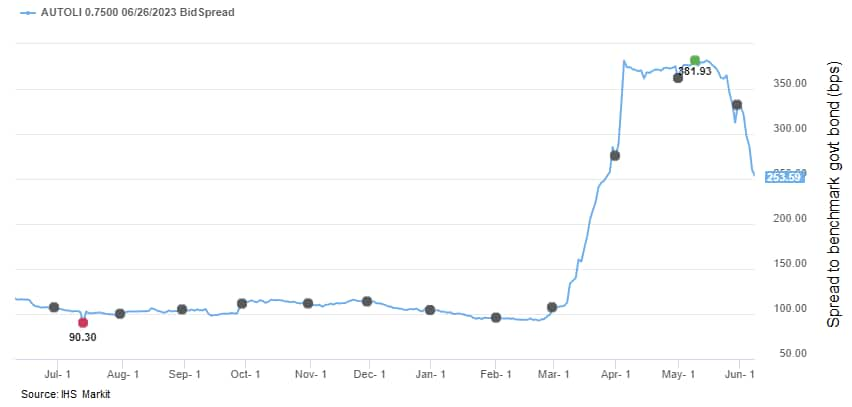

- Autoliv has revealed that it has agreed a lending facility with

the Swedish Export Credit Corporation as part of an update of its

business activities in the wake of the COVID-19 virus pandemic.

According to the company, it comes with support from the Swedish

Export Credit Agency and is worth SEK6 billion (USD652.3 million),

and has a two-year tranche worth SEK3 billion, and a five-year

tranche also worth SEK3 billion. (IHS Markit AutoIntelligence's Ian

Fletcher)

- The company said that the agreement was made on the provision of paying an existing SEK1.2-billion loan that originally matured in June 2022.

- The company said that although it is expecting May to be more challenging that April, at the end of which it had a cash balance of USD1.4 billion, it expects to have enough liquidity to pay down USD500 million of its USD1.1-billion revolving credit facility during the second quarter of 2020, which remains available until July 2023.

- The below Price Viewer graph of IHS Markit's corporate bond

spreads shows the significant spread widening of Autoliv's 0.75%

6/2023 EUR denominated corporate bond issue that began in early

March, hit is lowest point at Bunds +382bps on 8 May, and closed at

Bunds +254bps/1.91% yield today.

- The Irish Central Statistics Office (CSO) has reported that on

a seasonally adjusted basis, real GDP increased by 1.2% quarter on

quarter (q/q) and 4.5% year on year (y/y) in the first quarter of

2020, the highest in the EU27. GNP, which measures net income

earned by Irish residents and hence excludes income earned by

foreign-owned multinationals, grew by 0.1% q/q and 5.5% y/y. (IHS

Markit Economist Daniel Kral)

- The distortions present in the fourth-quarter 2019 data have not been corrected and point to another quarter with large transactions related to multinationals' tax optimization strategies. The relocation of Intellectual Property Products (IPPs) to Ireland results in a large deficit in imports of services, offset by spikes in fixed investment.

- Specifically, in the first quarter of 2020, real fixed investment accounted for EUR50.2 billion (USD56.7 billion), or 57% of real GDP, the same as in the fourth quarter of 2019. Meanwhile, imports of goods and services totalled EUR 111.1 billion, or 127% of GDP, also largely unchanged compared with the fourth quarter of 2019.

- The imports of IPPs drive a large current-account deficit. In the first quarter of 2020, Ireland's current-account deficit reached EUR 15.2 billion, or 17.1% of GDP. Due to the same distortions in the previous quarter, on a four-quarter rolling basis the country's current-account deficit in the first quarter of 2020 stood at 16.7% of GDP.

- Slovakia's seasonally adjusted GDP fell 3.9% year on year (y/y)

and 5.2% quarter on quarter (q/q), slightly less than indicated by

the "flash" estimate, but still one of the worst results in the

European Union. In unadjusted terms, GDP was down 3.7% y/y,

slipping into negative territory for the first time since 2009.

(IHS Markit Economist Sharon Fisher)

- Detailed data indicate that fixed investment and net exports were the drivers of the first-quarter 2020 decline. Exports of goods and services fell much faster than imports, while fixed investment dropped 4.8% y/y, pulled downward by declines in private investment.

- By sector, value added from finance and construction plunged, while industry and trade, transport, and catering recorded moderate declines. In contrast, public administration, healthcare, information and communications, and agriculture registered y/y growth.

- Slovakia's quarterly labor survey showed signs of a deterioration in the first quarter of 2020, with employment down 1.4% y/y (the first drop since 2013) and the jobless rate increasing to 6.0%. By sector, the decline in employment was especially pronounced in certain services (including transport and storage, hotel and restaurant services, education, and construction), while the number of entrepreneurs increased.

- The EU's wheat production is expected to reach one of the

lowest volumes in the last decade, the European Commission has

reported. (IHS Markit Agribusiness' Pieter Devuyst)

- On 28 May, the Commission sharply reduced its forecast for the EU-27's soft wheat output in 2020/21 to 121.5 million tons, down from 125.8 million expected one month earlier. This would be 7.1% lower than the bloc's estimated production in the previous season (2019/20) of 130.8 million tons.

- One week earlier, the Commission's Joint Research Service (JRC) already lowered its yield forecasts for nearly all EU crops - including for winter wheat - after two months of unusually dry and warm weather across Europe.

- The spring drought caused further difficulties for growing wheat after a soggy autumn and winter already disrupted sowings and prevented the crops from establishing strong roots. While rainfall has recently brought some relief for the plants, more moisture will be needed to avoid that this summer's harvest shrinks even further compared to last year's bumper harvest.

- The Commission also expects the production losses to impact the sales of the grain to third countries. It projected EU-27 exports of common wheat in the upcoming 2020/21 season at 26.5 million tons, down from 28 million one month ago. This would be nearly a quarter less than the estimated export volume for 2019/20, which is currently set at 32.5 million tons.

- According to data from the State Statistics Committee, goods

exports from Kazakhstan in the first quarter of 2020 increased by

4.5% year on year (y/y), while imports edged up by a slower rate of

0.7% y/y. As a result, the trade surplus, totaling USD6.8 billion

for the first quarter, managed to widen by 8.7% y/y, after

narrowing by around 32% y/y in the final quarter of 2019. (IHS

Markit Economist Venla Sipilä)

- The share of mineral-sector products of total exports increased to close to 78% in the first quarter. Metals and metal products comprised some 11% of exports.

- Italy retained its position as the leading export market with a share of 18.1%, followed by China, the Netherlands and Russia. Export shares of France and South Korea seem to be waning.

- Mozambique's real GDP increased 1.7% year on year (y/y) during

the first quarter of 2020, which is likely to be followed by a

sharp contraction in economic activity during the second quarter as

the impact of the COVID-19 virus outbreak deepens. (IHS Markit

Economist Thea Fourie)

- Mozambique's real GDP growth of 1.7% year on year (y/y) during the first quarter was up from 1.5% y/y recorded in the fourth quarter of 2019, latest data from Mozambique's statistical service, the National Institute of Statistics (Instituto Nacional de Estatistica: INE), show.

- Most sectors of the economy recorded growth during the first quarter, with the strongest output recorded in the electricity and water (up 6.5% y/y) and transport and communication (up 5.0% y/y) sectors.

- Sectors in which contractions were recorded during the first quarter were mining (down 11.7% y/y); hotels and restaurants, a proxy for tourism (down 1.4% y/y); and financial services (down 0.1% y/y).

- Other services, including government services, remain the largest contributors to overall economic activity in the Mozambican economy, followed by agriculture and fishing and retail trade.

- The Standard Bank purchasing managers' index (PMI) for Mozambique, compiled by IHS Markit, fell to a reading of 37.1 in April and improved only modestly to 40.0 in May, suggesting a sharp contraction in real GDP activity during the second quarter is likely.

Asia-Pacific

- Most APAC equity markets closed modestly higher across the region; Japan +1.4%, China/India +0.2%, Australia/South Korea +0.1%, and Hang Seng flat.

- Australia on 5 June announced changes to its foreign investment

rules that will tighten scrutiny of foreign investments in assets

categorized as a "sensitive national security business". Under the

proposed changes, the need to obtain Foreign Investment Review

Board (FIRB) approval for a foreign investment proposal will be

based on national security grounds rather than monetary value. The

government plans to pass legislation in July and implement the

changes on 1 January 2021. (IHS Markit Country Risk's Hannah

Cotillon)

- The category of "sensitive national security business" remains undefined, allowing for a wide interpretation of the term.

- The federal government's proposed changes to foreign investment rules are significant and are likely to increase expropriation and contract alteration risks in Australia.

- Smaller firms operating in sensitive sectors are likely to be the most impacted by the new regulations.

- Although Home Affairs Minister Peter Dutton has said the new rules would be "country agnostic", they are likely to have been designed to counter Chinese foreign investments in strategic assets.

- The new foreign investment rules are likely to cause further deterioration in relations with China.

- Japan's real GDP growth for the first quarter of 2020 was

revised down to a 0.6% quarter-on-quarter (q/q) drop (or down 2.2%

q/q annualized) from a 0.9% q/q decrease (or 3.4% q/q annualized

decline). (IHS Markit Economist Harumi Taguchi)

- The upward revision largely reflected stronger private capital expenditure (capex), offsetting a slightly softer increase in private inventories. Although the figures were slightly weaker than IHS Markit had expected, the increase in capex was largely in line with trends highlighted in statistics from financial statements for the fourth quarter of 2019.

- While an increase in capex was due to rebounds of investment in building structures and transport equipment, as disruption caused by the consumption tax increase and natural disasters in October 2019 eased, the upward revision partially reflected a rise in investment for machinery to produce medical/sanitary goods in response to a surge in demand because of the COVID-19 virus spread.

- IHS Markit has revised up its forecast of Japan's real GDP, reflecting the revision for the first quarter of 2020 and the government's second economic package announced on 27 May. Even so, Japan's real GDP is likely to shrink by 4.9% in 2020 before a rise of 1.8% in 2021.

- Toyota has formed partnership with five Chinese companies to develop hydrogen fuel-cell systems for commercial vehicles. Beijing Automobile Group (BAIC Group), FAW Group, Beijing SinoHytec, Dongfeng Motor Group, and Guangzhou Automobile Group Co (GAC) have signed an agreement with Toyota to form a joint venture (JV) in Beijing. The total investment will be around JPY5 billion (USD46 million) and the JV will be 65% owned by Toyota. Toyota will be the leading party in the JV, called United Fuel Cell System R&D. The JV will focus on the development of core technologies, such as full-cell stacks and control modules to facilitate application of fuel-cell technology in commercial vehicles. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Nasdaq-listed Chinese e-commerce firm JD.com opened books on 5

June for a Hong Kong share sale and listing that is seeking to

raise USD3.8 billion equivalent. (IHS Markit Economist Brian

Lawson)

- Proceeds could grow to USD4.3 billion if the green-shoe clause is exercised, making the deal potentially this year's largest share raising.

- The shares will start trading on 18 June.

- The listing involves relatively modest dilution: as of 5 June, JD's market capitalization stood at USD73.4 billion, with its shares having more than doubled in price over the past year.

- China's second-largest gaming firm, NetEase, sold 171 million

shares at HKD123 (USD16) each (versus a maximum indicated price of

HKD126), raising about HKD21 billion. (IHS Markit Economist Brian

Lawson)

- The deal was priced on 5 June at a modest 2% discount to its closing price on Nasdaq the preceding day, and shares will start trading on Hong Kong on 11 June.

- The NetEase offering was reported to have been strongly supported by investors, with market claims that it was multiply oversubscribed.

- SAIC Motor (SAIC) posted a decline of 1.6% year on year (y/y)

in its May sales to 473,064 units, according to its sales report

released on 6 June. The sales figure includes the group's joint

ventures (JVs) and its subsidiaries. (IHS Markit AutoIntelligence's

Abby Chun Tu)

- In the year to date (YTD), SAIC's sales have fallen by 36.5% y/y to around 1.57 million units.

- Sales of SAIC-VW, SAIC's JV with Volkswagen (VW), dropped by 14.9% y/y to 131,000 units last month.

- For the YTD, SAIC-VW's sales have contracted by 43.3% y/y to 434,110 units.

- Sales of SAIC-GM, SAIC's JV with General Motors (GM), slid 3.6% y/y to 136,157 units in May.

- Sales of the SAIC-GM-Wuling JV rose by 10.9% y/y to 122,000 units in May; in the YTD its sales are down by 36.9% y/y at 407,040 units.

- Jaguar Land Rover (JLR) has entered into agreements with several Chinese banks for an unsecured three-year term loan facility of CNY5 billion (USD704.5 million), reports Reuters. The three-year revolving loan will be provided by Bank of China, Industrial and Commerical Bank of China (ICBC), China Construction Bank, Bank of Communications, and Shanghai Pudong Development Bank, according to the report citing comments from Arthur Yu, JLR's vice-president and China chief financial officer. (IHS Markit AutoIntelligence's Abby Chun Tu)

- As economic activities started to revive in the country there

has been an increase in arrival of raw materials in China. As per

Commodities at Sea, May 2020 arrivals of coal, iron ore and bauxite

seaborne shipments in the country stood at 22.9mt, 93mt and 7.7mt,

respectively. In the first five months of this year, coal, iron ore

and bauxite shipments into China are calculated at 108.4mt (up

14.1mt y-o-y), 452.1mt (up 32.8mt y-o-y) and 35.9mt (down 1.2mt

y-o-y). (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay

Shukla)

- Thermal coal arrivals in the country in the first five months of 2020 stood at 86.9mt (up 11.4mt y-o-y). There has been a significant increase in imports from Indonesia (53.1mt, up 2.9mt y-o-y), Australia (20.9mt, up 5mt y-o-y) and from Russia (9.5mt, up 2.8mt y-o-y). However, in the coming months thermal coal arrivals are expected to slow down.

- Coking coal arrivals during the first five months of 2020 are calculated at 21.4mt (up 2.7mt y-o-y). The increase in coking coal was all from Australia (17.8mt, up 2.5mt y-o-y).

- Iron Ore arrivals into China during 5M2020 are calculated at 452.1mt (up 32.8mt y-o-y). Due to slow production at the domestic iron ore mines amidst Covid-19, China also got lesser supplies of high Fe ore from Brazil due to heavy rains in the country.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-june-2020.html&text=Daily+Global+Market+Summary+-+8+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}