Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 09, 2020

Daily Global Market Summary - 9 June 2020

US and APAC equity markets closed mixed, while European markets were lower across the region. US government bonds closed higher again, while European bond yields increased. The US dollar and CDS credit indices came under pressure for the second consecutive day, while oil ended up modestly higher.

Americas

- Most US equity markets closed lower today, except for Nasdaq which briefly broke through 10,000 for the first time ever and ended the day +0.3%; Russell 2000 -1.9%, DJIA -1.1%, and S&P 500 -0.8%.

- 10yr US govt bond yields closed -5bps/0.83% yield.

- The US dollar continues to weaken according to the ICE US Dollar index and is only 1.6% away from the 1.5 year low close of 94.90 reported on 9 March.

- CDX-NAIG closed +5bps/72bps and CDX-NAHY +35bps/461bps.

- Crude oil closed +2.0%/$38.94 per barrel.

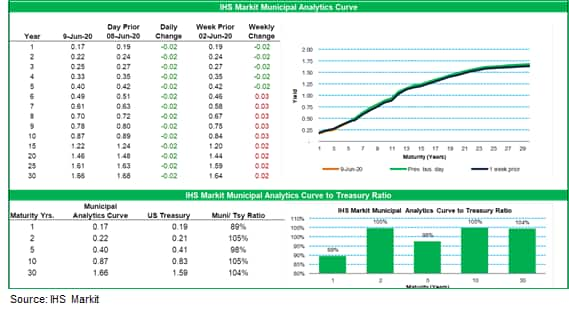

- IHS Markit's AAA Municipal Analytics Curve (MAC) tightened 2bps today across the entire maturity curve and the AAA MAC to Treasury yield ratios for 1- and 5-years bonds are now below 100%, and 2-, 10-, and 30-year yields are close to falling below US Treasury bond yields for the first time since 4 March.

- The April US JOLTS report illustrates the depth and severity of the impact on the labor market due to COVID-19 as a majority of Americans were advised to stay at home and nonessential businesses were shuttered. (IHS Markit Economist Akshat Goel)

- US job separations fell from an all-time high of 14.6 million in March to 9.9 million in April; the level is still the second-highest point in the series history.

- The layoffs and discharges rate fell from an all-time high of 7.6% to 5.9% in April. The quits rate, a valuable indicator of the general health of the labor market, fell to a nine-year low of 1.4% after averaging 2.3% for almost two years.

- The number of job openings decreased to a five-year low of 5.0 million in April. The number of hires declined to an all-time low of 3.5 million.

- Over the 12 months ending in April, there was a net employment loss of 13.9 million. Net employment change over 12 months went from positive 2.4 million to negative 13.9 million in a span of two months.

- The "leisure and hospitality" industry, which includes entertainment, accommodation, and food services, was again the worst hit and responsible for 21% of total job separations.

- There were 4.6 workers competing for every job opening in April. With the exception of March and April, the number of job openings has exceeded the number of unemployed in all months in the last two years.

- Eli Lilly (US) and partner Junshi Biosciences (China) have announced the dosing of the first healthy volunteers in a Chinese clinical trial investigating the safety, tolerability, pharmacokinetics, and immunogenicity of a recombinant fully human SARS-CoV-2 neutralizing monoclonal antibody (mAb), JS016 (binds to spike protein receptor), as a potential treatment for COVID-19. (IHS Markit Life Science's Margaret Labban)

- JS016 is the second neutralizing mAb candidate in clinical development by Eli Lilly, after the company launched a Phase I trial in collaboration with AbCellera (United States) for LY-CoV555 in hospitalized COVID-19 patients in the US earlier this month.

- LY-CoV555 and JS016 are now the world's first clinical trials for COVID-19 mAb candidates, but several other companies, including Regeneron (US) and Vir (US), are expected to follow.

- Neutralizing mAbs could be significantly beneficial in the fight against the COVID-19 pandemic, providing both a treatment option for sick patients as well as potential prophylactic treatment for those at high risk of severe infections.

- The mAbs could also be combined together into a potent "cocktail" with optimal safety and efficacy. Both Lilly and Regeneron will be advancing antibody cocktails into clinical development.

- Blackberry production in Mexico received twin blows from lower yields and Covid-19, causing a significant dip in the crop's production. In the first four months of the year, blackberry growers in the country harvested 87,081 tons from 8,550 hectares, down from 155,025 tons from 11,789 ha in January-April 2019, according to Mexico's Agricultural and Fisheries Information Service. Average blackberry yields this season contracted to 10.185 tons per ha, down from 13.150 tons per ha in the same period of 2019. Growers in Michoacán state, the largest producer of the crop, harvested 81,538 tons of blackberries in January-April, down from 152,000 tons harvested a year earlier. In a further indicator that harvesting conditions deteriorated during this year's season, only 24,220 tons were harvested in Michoacán in March-April, down from 57,318 tons in the first two months of the year. (IHS Markit Agribusiness' Vladimir Pekic)

- Honda has been forced to interrupt its North American production over a global computer network problem, according to media reports. An Automotive News report quotes an American Honda statement saying, "On Sunday, June 7, Honda experienced a disruption in its computer network that has caused a loss of connectivity, thus impacting our business operations. Our information technology team is working quickly to assess the situation." The report also cites a UK news outlet as stating that the issue affected Honda's operations in Japan and the United Kingdom as well. Jalopnik reports that production was impacted at Honda's facility in Marysville, Ohio, United States; however, this has not been confirmed by Honda at the time of writing. Although there is speculation that the computer issue has been caused by ransomware or malware, this has not been confirmed by Honda. Nor is it clear how much Honda's production has been affected. Honda was one of several companies impacted by a ransomware attack in 2017. (IHS Markit AutoIntelligence's Stephanie Brinley)

- International Flavors & Fragrances (IFF) said that sales fell by 7% year-on-year (YOY) during April and May or by 3% on a currently-neutral basis, in a business update released today. Gross profit fell 12% YOY during those months, due to lower sales volumes, a less-favorable product mix, and some increases in manufacturing and procurement costs due to COVID-19. The company did not disclose exact sales or profit figures for the period. The largest hits to demand were in IFF's fine fragrance and food service businesses, which were impacted by government restrictions on consumer retail businesses and restaurants. These businesses represented about 15% of IFF's full-year 2019 net sales, and saw currency-neutral sales fall by about 40% YOY in April and May. The rest of IFF's product portfolio saw sales rise 3% YOY in April and May. This includes businesses related to packaged food and beverages, hygiene, disinfection, and other personal care products, and represents the remaining 85% of the company's sales. IFF reported about $5.14 billion in net sales for the full-year 2019.

Europe/Middle East/ Africa

- European equity markets closed lower across the region; UK -2.1%, Spain -1.8%, Germany/France -1.6%, and Italy -1.5%.

- Most 10yr European govt bonds closed lower; Spain +7bps, Italy +5bps, France +3bps, Germany +1bp, and UK flat.

- iTraxx-Europe closed +5bps/66bps and iTraxx-Xover +23bps/361bps.

- Brent crude closed +0.9%/$41.18 per barrel.

- Japan will call for an early removal of tariffs on automobile and auto parts during discussions on a post-Brexit trade agreement with Britain, as the latter begins negotiating free trade deals with countries around the world including Japan, according to Reuters. Japanese Trade Minister Hiroshi Kajiyama said, "In the negotiations, we hope to urge [Britain] to bring forward the period for which tariffs will be removed mainly for auto and autoparts ... as well as adopt high-level rules on digital trade." Japanese Foreign Minister Toshimitsu Motegi and UK International Trade Minister Liz Truss will have discussions via video conference on 9 June. According to the source, citing government statistics, Japan was Britain's fourth-biggest non-EU trading partner in 2019, with trade between the two countries totalling GBP31.4 billion (USD39.7 billion). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Speaking to the Egyptian business publication Enterprise on 3 June, Egyptian Electricity Ministry spokesperson Ayman Hamza said that Egypt's current electricity generation was approximately 58 gigawatts (GW) but that peak summer demand was expected to be 30-32 GW. Egypt's economy has been negatively affected by the impact of the COVID-19 pandemic, and IHS Markit expects Egypt's real GDP to contract by 9.28% in 2021, after being downgraded to 2.5% growth from 2.6% in 2020. The ministry assessed that domestic demand for electricity had fallen by approximately 2 GW since the imposition of partial lockdown measures in Egypt in March. The economic impact of the COVID-19 pandemic and the decline in global crude oil prices is likely to reduce the Egyptian government's willingness to fund new renewable energy generation projects in the short term and will probably increase the likelihood of delays for existing projects over the coming two-year period. (IHS Markit Country Risk's Jack Kennedy)

- Germany's Federal Statistical Office (FSO) external trade data for April (customs methodology, seasonally adjusted, nominal) reflect the full impact of the COVID-19 virus pandemic, with exports being hit hard as most car manufacturers shut down factories between mid-March and late April. (IHS Markit Economist Timo Klein)

- The monthly decline of exports by 24.0% month on month (m/m) is unprecedented, as is the somewhat more limited drop by 16.5% of imports.

- Accordingly, year-on-year (y/y) rates (unadjusted) deteriorated from -7.7% in March to -31.1% in April for exports and from -4.4% to -21.6% for imports.

- In unadjusted terms, the current-account surplus shrunk even more sharply than the trade surplus in April versus March, as the so-called trade supplements as well as primary and secondary income balances also deteriorated.

- Compared with April 2019, the trade and current-account surplus both narrowed in a comparable fashion (by EUR13-EUR14 billion). The seasonally adjusted trade surplus similarly plunged from EUR12.8 billion to EUR3.2 billion in April, a near 20-year-low point and well below the 2019 monthly average of EUR18.8 billion.

- Germany's Federal Statistical Office (FSO) data, gleaned from a quarterly earnings survey, show that labor costs per hour - in the producing sectors (manufacturing, construction, mining, and energy and water) and the whole service sector - jumped from an almost stagnation in the fourth quarter of 2019 to 2.4% quarter on quarter (q/q) in the first quarter (seasonally and calendar adjusted). (IHS Markit Economist Timo Klein)

- This is largely caused by the lockdown imposed by the authorities in mid-March owing to the COVID-19 virus pandemic, as employees were either urged by their employers to take annual leave as orders and production plunged or had to do so to take care of their children who could no longer go to kindergarten or school.

- The year-on-year (y/y) increase in labor costs from 3.0% in the fourth quarter of 2019 to 4.3% in the first quarter compares with a long-run average of 2.1% during 1997-2019.

- Separately, a Europe-wide comparison on a local currency basis for the fourth quarter of 2019 - this always lags by one quarter - shows that German labour cost growth at 2.6% y/y was very similar to that in the EU as a whole (2.8%) and in the eurozone (2.5%).

- Germany's cabinet is set to accelerate the introduction of a range of economic support measures for the country, including those directed at the vehicle market. Reuters has been told by spokesperson Steffen Seibert that a special cabinet meeting is scheduled to take place on 12 June, at which large parts of the EUR130-billion-worth of measures are intended to be passed. Reuters has also reported that as well as funding incentives to purchase battery electric vehicles (BEVs) that is said to be worth over EUR2 billion, the coalition government is also considering introducing a new surcharge for vehicles producing CO2 emissions of over 95 g/km from 2021. The draft law seen by the news service suggests that the amount paid would also double for those vehicles producing CO2 emissions of over 195g/km. The country is also considering exempting all BEVs from any vehicle taxes until the end of 2030. (IHS Markit AutoIntelligence's Ian Fletcher)

- Daimler has announced that it has established a new fuel cell subsidiary. The company, Daimler Truck Fuel Cell GmbH & Co. KG, will comprise all the company's fuel cell activities. It has appointed Andreas Gorbach and Professor Dr Christian Mohrdieck as managing directors of the new unit. The decision to establish this subsidiary focused on this alternative powertrain technology is another step towards a joint venture (JV) with Volvo Group in this area that was announced in April. This will focus on the development, production and commercialization of fuel cell systems for heavy-duty commercial vehicles and other applications such as stationary use. As part of the deal, Volvo will acquire 50% of this unit. <span/>(IHS Markit AutoIntelligence's Ian Fletcher)

- State Secretariat for Economic Affairs (SECO) data reveal that Switzerland's seasonally adjusted unemployment increased anew in May, rising by 14,306 people or 9.8% month on month (m/m) to 159,925 (see table below). This compares with just 105,000 only five months ago, the end point of a downward trend that started in mid-2016 at roughly 150,000. (IHS Markit Economist Timo Klein)

- Notwithstanding May's further increase, upward momentum has already slowed. The seasonally adjusted unemployment rate, which hovered at a 17-year low of 2.3% in 2019 before starting to edge higher in January 2020, increased from 3.1% in April (revised down from 3.3%) to 3.4% in May.

- Among other labor-market indicators, seasonally adjusted job vacancies declined by 12.2% m/m to 21,013 in May, a similar monthly decline as in April. The vacancy level in May is now 42% lower than a year ago.

- The number of short-time workers - lagging by two months and unadjusted for seasonal variations - jumped to a huge extent in March, namely from just over 4,000 in February to over 782,000, thus almost 200-fold.

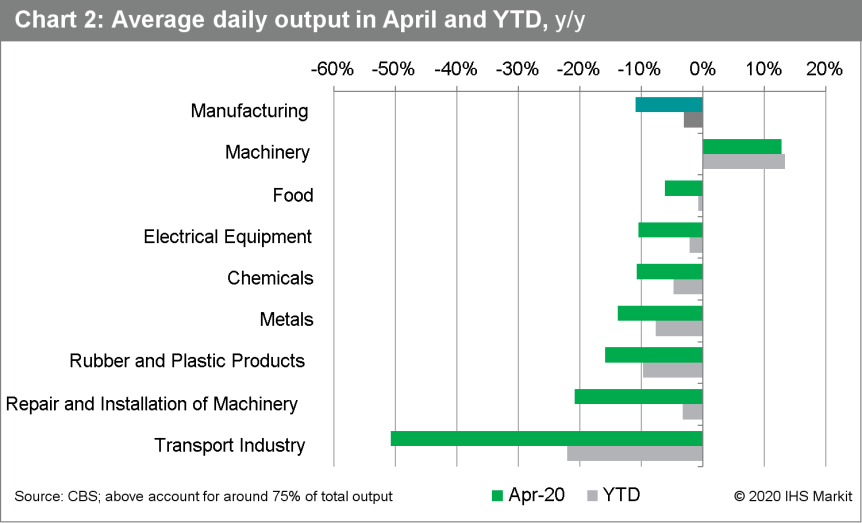

- In April, average daily output of the Dutch manufacturing sector was down by 11.0% year on year (y/y) on a seasonally unadjusted basis. This is the largest monthly drop since 2009. On a three-month moving average basis, output was down by 4.6% y/y. (IHS Markit Economist Daniel Kral)

- On a seasonally and working-day-adjusted basis, manufacturing output was down by 10.1% y/y in April. Even prior to the COVID-19 virus pandemic, manufacturing output has been on a declining trend, peaking in early 2018.

- In January, the only support was provided by machinery, which was up by 12.8% y/y. The biggest drops were recorded in transport industry, declining by 50.7% y/y, repair and installation of machinery, which fell by 20.8% y/y, and rubber and plastic products, down by 15.9% y/y.

Asia-Pacific

- APAC equity markets closed mixed; Australia +2.4%, Hang Seng +1.1%, China +0.6%, South Korea +0.2%, Japan -0.4%, and India -1.2%.

- China's Ministry of Transport (MOT) issued a notice on 8 June, planning to improve the nation's transport infrastructure to support consumption revival. (IHS Markit Economist Lei Yi)

- Inter-city transport and logistics infrastructure especially in rural areas will be the key focuses of MOT to better develop local consumption potential. Specifically, MOT will continue to push for transport integration in city clusters to further reduce commuting times within these regions to one or two hours.

- On top of infrastructure investment, collaboration between transport and other industries will also be promoted to offer a more direct boost for consumption. Planning and construction of expressways should take surrounding tourism resources into consideration to provide better transport connectivity; digital transformation of traditional transport infrastructure will be encouraged to improve logistics efficiency; and new energy vehicles should be used more widely for buses and taxis to support the development of "green consumption".

- Tesla has sold 11,095 units of its locally made Model 3 electric vehicle (EV) in China in May, three times the delivery volumes of the Model 3 in April, reports Reuters, citing data from the China Passenger Car Association (CPCA). Tesla has yet to report its sales in China on a regular basis, so data from the CPCA and China Passenger Car Association (CPCA) are often being used to track the automaker's sales and production activities in the country. According to the China Association of Automobile Manufacturers (CAAM), Tesla produced 11,070 vehicles in April, while its sales stood at 3,635 units. The gap between Tesla's production and delivery volumes indicates the US automaker's most pressing task is to secure new orders for the Model 3 before the more lucrative Model Y arrives in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Jaguar Land Rover (JLR) is said to be in talks with Chinese company BYD with regards to supplying electric vehicle (EV) batteries, reports Autocar citing an Automotive News Europe (ANE) article. The trade publication cited a source familiar with the discussions that could lead to the production of batteries in the UK to meet the automaker's demand. The source has also suggested that JLR and BYD are also discussing a collaboration on electric propulsion system development. At present JLR has only one battery electric vehicle (BEV); the I-Pace; which has its battery pack supplied by LG Chem. However, the company has felt some production disruption due to problems with the supply of batteries earlier this year. (IHS Markit AutoIntelligence's Ian Fletcher)

- Geely Auto has announced its sales results for May. The combined sales volumes of Geely- and Lynk & Co-branded vehicles in May totaled 108,822 units, up 20% year on year (y/y). The data includes sales in the Chinese market and exports. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Geely Auto's sales in May also marked a rebound of 3% from April, when it sold over 105,000 vehicles.

- In the first five months of the year, the total sales volumes of Geely Auto were 420,317 units, down 25% y/y, which represents 30% of the company's target of 1.41 million units in 2020.

- A breakdown of Geely's sales by vehicle type shows sport utility vehicles (SUVs) are still in high demand, along with sedan models. Geely's sales of SUVs and sedans stood at 63,602 units and 42,994 units in May.

- Sales of multi-purpose vehicles (MPVs) totaled 2,226 units in May.

- The sales volumes of Lynk & Co brand surged 41% y/y in May to 12,950 units.

- The results also marked a six-month high in sales for the Lynk & Co brand. Geely's export business, by contrast, continues to tumble as demand falls in overseas markets due to the COVID-19 virus outbreak. The automaker's exports in May fell by 44% y/y to 3,099 units.

- Geely Auto's strong May sales have been eclipsed by recent reports that its parent company intends to acquire a stake in Chinese truck manufacturer Hualing Xingma Auto. Hualing Xingma is a commercial vehicle manufacturer based in Anhui province, China.

- According to a statement released on 23 May by Xingma Group, Hauling Xingma's parent company, the group intends to sell an equity stake of 15.24% to new investors to finance its growth.

- On 8 June, Hualing Xingma further disclosed details of the ongoing transaction with Geely, saying Geely Commercial Vehicle, a subsidiary of Zhejiang Geely Holding Group (Geely Holding), has submitted documents as part of seeking approval for taking a stake in Hualing Xingma.

- The statement confirmed earlier reports of Geely's involvement in the equity transfer initiated by Hualing Xingma, although Geely Holding has yet to make a further statement on the matter at the time of writing.

- Japan's monthly cash earnings fell by 0.6% year on year (y/y) in April. The weakness was due largely to a 12.2% y/y drop in non-scheduled cash earnings, reflecting an 18.9% decline in non-scheduled hours worked in response to stricter containment measures for the coronavirus disease COVID-19 virus. (IHS Markit Economist Harumi Taguchi)

- The contraction of monthly cash earnings was particularly severe for eating and drinking services (down 10.1% y/y), as well as life-related services (down 7.3% y/y) and manufacturing (down 2.4% y/y) because of closures or shortened business hours during the state of emergency.

- The containment measures significantly dampened monthly cash earnings of part-timers (down 3.9% y/y) because of declines in the hours worked, while the number of part-timers also fell (by 0.4% y/y).

- The April results suggest that stricter containment measures have hit earnings and employment of part-timers harder. The moderate contraction of cash earnings could be underestimating the effect of the pandemic because of changes in the sample base, since cash earnings for the same sample groupings declined at a faster pace (down 1.9% y/y). This could mean full-timers' cash earnings were also affected by containment measures.

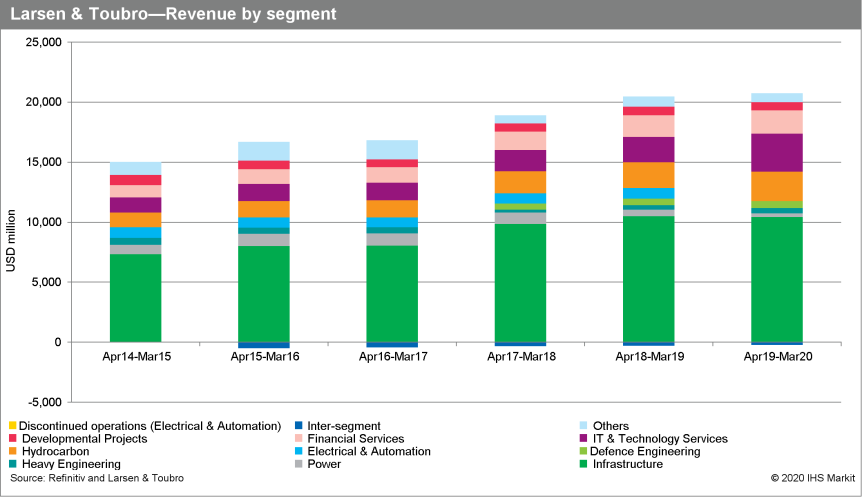

- Larsen & Toubro reported a 2% y/y growth in revenue and 6% y/y growth in profit for FY 2019/20 in Indian rupee terms. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- On an annual basis, the revenue increased to USD20.5 billion (INR1,454 billion) at the end of 31 March 2020 as compared with USD20.2 billion (INR1,410 billion) at the end of 31 March 2019. The revenue gain was mainly due to the growth in the Infrastructure, Services, Defence Engineering and Hydrocarbon segments.

- The company posted a net profit of USD1.35 billion (INR96 billion) in FY 2019/20 against a net profit of USD1.28 billion (INR89 billion) in FY 2018/19. It grew by 6% y/y.

- The operating profit contracted by 10% y/y, from USD2.1 billion (INR145 billion) in FY 2018/19 to USD1.9 billion (INR134 billion) in FY 2019/20.

- The total backlog of the company as of 31 March 2020 (end of FY 2019/20) stood at USD40 billon (INR3,038 billion).

- The Infrastructure segment made up 74% of the backlog. The share of the Hydrocarbon segment in the backlog was 15% at the end of the fourth quarter of FY 2019/20.

- Pertamina (Jakarta, Indonesia), the state-owned energy group diversifying into petrochemicals, today gave an update on its refinery and petrochemical project at Tuban, East Java, Indonesia. The project is being implemented in a joint venture (JV) between Pertamina and Rosneft (Moscow, Russia). This is a priority project with land acquisition almost completed and land clearance well under way, Pertamina says. Engineering has reached 30% completion. The target date for the complex to become operational is 2026.

- Pertamina's director/processing and petrochemical mega projects, Ignatius Talulembang, says he is optimistic about the development of the Tuban refinery, which is on target. With a capacity of 300,000 b/d, the refinery will provide additional supplies of fuel, liquefied petroleum gas, and petrochemicals.

- The Tuban refinery is being developed by PT Pertamina Rosneft Pengolahan dan Petrokimia, a JV in which Pertamina holds 55% and Rosneft has the rest. Tecnicas Reunidas (Madrid, Spain) is carrying out basic and front-end engineering design.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2020.html&text=Daily+Global+Market+Summary+-+9+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}