Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 09, 2021

Daily Global Market Summary - 9 September 2021

Most major US and APAC equity indices closed lower, while Europe was mixed. US and most benchmark European government bonds closed sharply higher. CDX-NA closed almost unchanged across IG and high yield, iTraxx-Europe was flat, and iTraxx-Europe closed slightly wider. Natural gas, copper, silver, and gold closed higher, while the US dollar and oil were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower; Russell 2000 flat, Nasdaq -0.3%, DJIA -0.4%, and S&P 500 -0.5%.

- 10yr US govt bonds closed -4bps/1.30% yield and 30yr bonds -6bps/1.90% yield.

- Longer-dated U.S. Treasury yields moved lower today after a strong auction for 30-year Treasury bonds at 1:00pm ET closed out $120 billion in coupon-bearing supply this week. A $24 billion 30-year bond auction was strong, analysts said, and yields on both the benchmark 10-year and 30-year hit session lows following its completion. Yields had been trending higher earlier in the day before reversing course heading into the auction following data on the labor market and a policy announcement from the European Central Bank. (Yahoo Finance)

- CDX-NAIG closed flat/47bps and CDX-NAHY +1bp/276bps.

- DXY US dollar index closed -0.2%/92.48.

- Gold closed +0.4%/$1,800 per troy oz, silver +0.5%/$24.18 per troy oz, and copper +1.3%/$4.29 per pound.

- Crude oil closed -1.7%/$68.14 per barrel and natural gas closed +2.4%/$5.03 per mmbtu.

- All US employers with 100 or more employees would have to require that their workers be vaccinated or undergo at least weekly Covid-19 testing under a new plan by President Biden to curb the spread of the pandemic, senior administration officials said. The Labor Department's Occupational Safety and Health Administration in the coming weeks plans to issue an emergency temporary standard implementing the new requirement, which will cover 80 million private-sector workers, officials said. Businesses that don't comply can face fines of up to $14,000 per violation, they said. (WSJ)

- In a press release, ExxonMobil Corporation announced a new oil

discovery at the Pinktail well on the Starbroek Block offshore

Guyana, bringing the total number of discoveries on the Stabroek

Block to 23. The well, located approximately 21.7 miles (35

kilometers) southeast of the Liza Phase 1 project and 3.7 miles (6

kilometers) southeast of Yellowtail-1, encountered 220 feet (67

meters) of oil-bearing reservoirs in 5,938 feet (1,810 meters) of

water, the company said. (IHS Markit Upstream Companies and

Transactions' Karan Bhagani)

- In April 2021, ExxonMobil announced a new oil discovery at the Uaru-2 well on the Starbroek Block.

- In June 2021, ExxonMobil Corporation announced a new hydrocarbon discovery at the Longtail-3 well on the Stabroek Block.

- In July 2021, ExxonMobil announced two new oil discoveries at the Whiptail prospect in the Starbroek Block.

- ExxonMobil (45% interest) is the operator of Stabroek Block, with partners Hess (30%), and CNOOC Limited (25%).

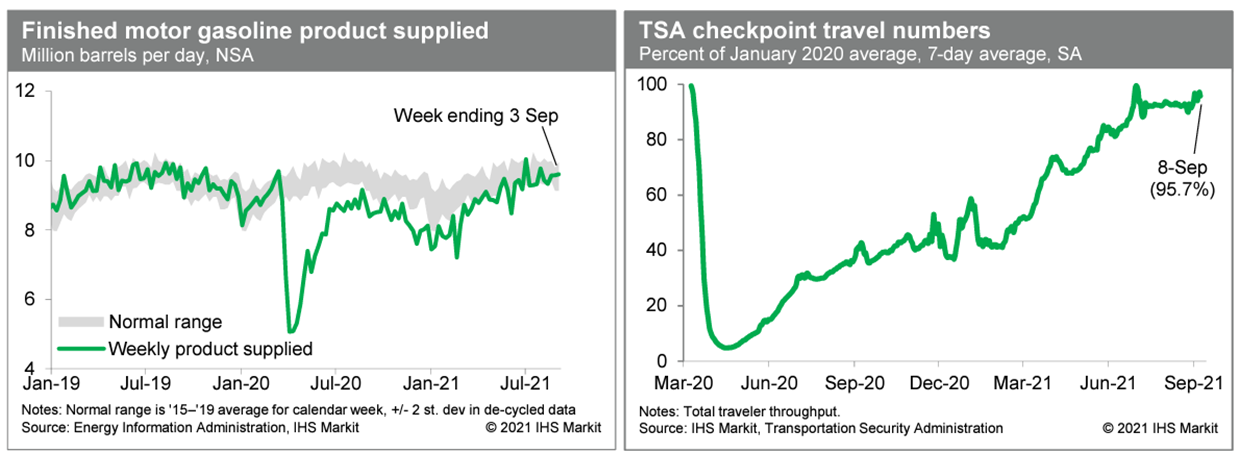

- Consumption of gasoline rose somewhat last week and remained

squarely in the middle of a range consistent with normal internal

mobility. Meanwhile, averaged over the last seven days, and after

seasonal adjustment, passenger throughput at US airports was about

95.7% of the January 2020 level. This is higher than readings in

recent weeks but could reflect the timing of the Labor Day holiday.

Readings over the next week or so will clarify the underlying trend

in air travel. (IHS Markit Economists

Ben Herzon and

Joel Prakken)

- Seasonally adjusted US initial claims for unemployment

insurance decreased by 35,000 to 310,000 in the week ended 4

September, its lowest level since the week ended 14 March 2020.

Claims continue to move lower and show no signs of a new round of

layoffs in response to the fourth wave of COVID-19; however, there

was some localized weakness reflecting fallout from Hurricane Ida.

Louisiana, which was the hardest hit by the hurricane, reported the

largest increase in claims, with unadjusted claims rising from

2,060 to 9,319 in the week ended 4 September. (IHS Markit Economist

Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 22,000 to 2,783,000 in the week ended 28 August, hitting its lowest since 14 March 2020. The insured unemployment rate was unchanged at 2.0%.

- In the week ended 21 August, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 7,646 to 3,807,646.

- In the week ended 21 August, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 322,714 to 5,090,524.

- Pandemic-related federal unemployment benefits expired on 5 September. As a result, nearly nine million people claiming benefits under PUA and PEUC will lose access to benefits entirely and individuals claiming regular state benefits will see their weekly checks reduced by $300.

- ProQR Therapeutics (Netherlands) has announced that it has entered into a collaboration with Eli Lilly (US) to discover, develop, and commercialize potential new medicines for genetic disorders in the liver and nervous system. The collaboration will develop up to five targets using ProQR's proprietary Axiomer RNA editing platform, which is designed to enable the editing of single nucleotides in RNA in a highly targeted manner. ProQR will receive USD50 million, consisting of an upfront payment of USD20 million as well as an equity investment in its ordinary shares of USD30 million. ProQR is also eligible to receive up to approximately USD1.25 billion for development, regulatory, and commercialization milestones, as well as tiered royalties of up to mid-single-digit percentage on product sales. According to ProQR, its Axiomer platform technology has the potential to reverse more than 20,000 guanosine (G) to adenosine (A) mutations in humans that are known to cause disease. (IHS Markit Life Sciences' Milena Izmirlieva)

- Autonomous truck startup Plus has added Teledyne FLIR's thermal cameras to its sensor stack used for Level 4 autonomous technology, according to a company statement. This is expected to provide an additional layer of perception, especially for heavy-duty trucks travelling in low-visibility and high-contrast conditions. Plus says that the thermal cameras can detect pedestrians at distances of up to 250 meters. Plus, which recently went public through a merger agreement with a special-purpose acquisition company (SPAC), focuses on developing Level 4 autonomous technology. The company plans to begin mass production of its autonomous platform PlusDrive this year with Chinese commercial vehicle maker FAW. The companies plan to introduce the Level 3 automated heavy-duty truck J7, which is deployed with seven cameras, 5mm wave radars, and one LiDAR, as well as an autopilot system. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Major European equity indices closed mixed; France +0.2%, Italy +0.1%, Germany +0.1%, Spain -0.4%, and UK -1.0%.

- Most 10yr European govt bonds closed higher; Italy -9bps, France/Spain -6bps, Germany -4bps, and UK flat.

- iTraxx-Europe closed flat/45bps and iTraxx-Xover -3bps/226bps.

- Brent crude closed -1.6%/$71.45 per barrel.

- The UK energy regulator Ofgem has announced some of the steps that it is taking to support consumer take-up of battery electric vehicles (BEVs) and expand the charging infrastructure. In a statement, it said that it will not only take steps to undertake investment in the power network to meet this new demand, but is also making access to this network easier. It is proposing to bring costs down for large users such as charging stations where reinforcement of the grid is required. It also plans to maximize the benefits of smart charging and support the development of vehicle-to-grid technologies that can export electricity back to the grid from a vehicle battery when required. Ofgem will also work with energy suppliers to make sure there are a range of products, services, and tariffs on offer for UK energy consumers. (IHS Markit AutoIntelligence's Ian Fletcher)

- Irish tax-domiciled and US-based pharmaceutical company Perrigo has announced the acquisition of HRA Pharma (France) in an EUR1.8-billion (USD2.1 billion) deal. The purchase is expected to enhance Perrigo's over-the-counter (OTC) medicine portfolio, particularly in the contraceptives market. In July 2021, Altaris (US) acquired the company's generic prescription business for an estimated USD1.55 billion. The sell-off of generic assets was seen as an attempt to refocus Perrigo's strategy onto its consumer healthcare business, and the acquisition of HRA Pharma serves that strategy. The leading OTC brands that HRA Pharma will bring to Perrigo include pharmacy sales of the daily, oral pregnancy prevention drug ellaOne, which has market expansion opportunities in "underpenetrated" European markets and the US. The emergency contraception currently has reimbursement status in a handful of "high-performing" European markets, including Denmark (single/individual reimbursement), Belgium (January 2019), France (January 2010), and Ireland (December 2019), according to IHS Markit POLI. (IHS Markit Life Sciences' Eóin Ryan)

- While the European Central Bank (ECB) carefully avoided using

the term "tapering", the most likely scenario remains for net

Pandemic Emergency Purchase Programme (PEPP) purchases to cease

early in 2022, although the overall monetary policy stance will

remain highly accommodative. (IHS Markit Economist

Ken Wattret)

- The ECB made various adjustments to its statement following its latest policy meeting, including the one below in particular, stating that the pace of its net asset purchases under the PEPP will slow:

- "Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favorable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase program (PEPP) than in the previous two quarters."

- All the other aspects of its policy stance and guidance were unchanged, however, including:

- "Net asset purchases under the PEPP, with a total envelope of EUR 1,850 billion, will continue until at least the end of March 2022 and, in any case, until the coronavirus crisis phase is over."

- "Principal payments from maturing securities purchased under the PEPP will continue until at least the end of 2023."

- "Net purchases under the Asset Purchase Programme (APP) will continue at a monthly pace of EUR 20 billion. [They are] expected to run for as long as necessary and to end shortly before ECB interest rates start to rise."

- "The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation stabilizes at its two per cent target over the medium term."

- The key aspects of the ECB's quarterly update of its macroeconomic projections included the following:

- Headline and core HICP inflation projections were revised up, for 2021 particularly. The longest horizon projections, however, for 2023, remained well below the ECB's new 2% inflation target.

- The 2021 GDP growth projection was also revised higher, to 5%, in line with IHS Markit's current forecast.

- The ECB's risk assessment for inflation also shifted. "If supply bottlenecks last longer and feed through into higher than anticipated wage rises, price pressures could be more persistent."

- German Federal Statistical Office (FSO) external trade data

(customs methodology, seasonally and calendar-adjusted, nominal)

reveal that exports increased for the 15th month in succession in

July (0.5% m/m), whereas imports suffered a large setback (-3.8%).

Owing to import outperformance during the first half of 2021,

however, the year-on-year (y/y) rate for imports based on this

adjusted series still exceeds its exports' counterpart (19.0% vs

15.6%, respectively). (IHS Markit Economist

Timo Klein)

- The comparison with February 2020, the last pre-pandemic month, is positive for both exports (1.6%) and imports (5.9%).

- The seasonally adjusted trade surplus, which had peaked at EUR21.3 billion in January in the wake of the initial recovery from the COVID-19 virus outbreak before declining to an interim low of EUR12.8 billion in May, rebounded to EUR17.9 billion in July. This exceeds the 2020 monthly average of EUR14.8 billion but cannot quite match the 2019 average of EUR18.9 billion.

- Germany's Vay has unveiled its 'TeleDriving' technology that allows cars to be driven remotely, according to a company statement. The company's trained "teledrivers operate from stations equipped with a steering wheel, pedals and several large monitors for 360-degree vision without blind spots". Initially, Vay will enable customers to order a remote-controlled car, drive themselves to their desired destination, and leave the vehicle without parking it. In a later step, the company plans to introduce a ride-hailing service that is entirely remote-controlled. Vay co-founder and CEO Thomas von der Ohe said, "Our advanced technology enables a person (the 'teledriver') to remotely drive a vehicle ('teledriving'). This allows for a safe and timely rollout of driverless mobility services that users and cities trust as a human is still in full control." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ice cream retail sales in Germany rose by 4% in the first half of 2021, the Federal Association of the German Confectionery Industry (BDS) estimates. A warm and sunny June, with temperatures 2.1°C higher than in 2020, drove up demand from German households. Ice cream brands recorded significantly stronger growth this year than the private labels. This is because consumers have generally purchased more premium products than private labels since the start of the pandemic. The BDS estimates that this trend is likely to continue for the rest of 2021. Ice cream multi-packs (several small ice-creams individually packed sold in one box) were particularly popular increasing their sales by around 4%, while tubs sold less. At the same, food service sales were in the red, leading to a 2% decline in the sales for the whole sector. Germany remains the largest ice cream exporter worldwide with 106,800 tons traded in the first half of 2021, despite an 8% drop y/y. At the same time, shipments from countries such as France and Poland soared by 17% and 25% to 95,127 tons and 70,000 tons, respectively. Global ice cream imports were stable in the range of 786,800 tons with Germany and the UK, first and second-largest importer, accounting together for 20% of the total with 90,000 tons and 76,700 tons, respectively. France is the third-largest buyer of ice cream worldwide with 57,500 tons totaled in the first half of 2021, followed by 44,200 tons from Belgium. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Prysmian along with its partner Asso.subsea have secured a USD35.6 million (EUR30 million) contract from RTE to supply and install a submarine export power cable system for the Gruissan floating wind farm offshore southern France. As per the press release by the Prysmian Group, it will be responsible for the design, supply, termination, testing, and commissioning of one 66 kV three-core export submarine cable of 25 km with ethylene-propylene-rubber (EPR) insulation and a 1 km- 66kV submarine dynamic cable with EPR insulation connecting the shore to a floating sub-station. The Group will also provide additional 3 km of onshore 66 kV cables with cross-linked polyethylene (XLPE) insulation. All submarine cables will be manufactured at the company's centre of excellence in Nordenham, Germany, and the land cables at its Gron plant in France. Commissioning is scheduled for July 2023. Earlier, Prysmian had supplied cables for RTE's other offshore wind farm projects in Fécamp, Courseulles-sur-Mer, St. Nazaire and Noirmoutier. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

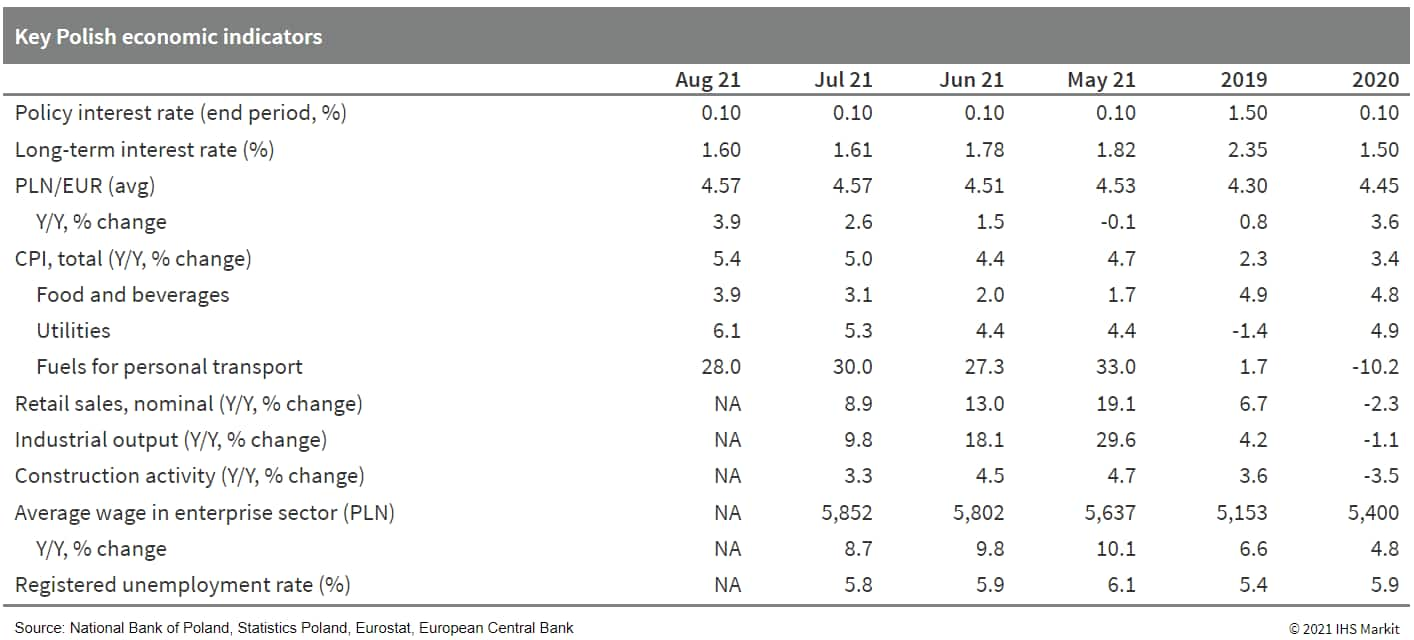

- Poland's monetary policy council (MPC) left the base interest

rate at a historic low of 0.1% during its session on 8 September.

That was despite monetary tightening across much of Central and

Eastern Europe in recent months. (IHS Markit Economist

Sharon Fisher)

- Although Polish inflation surged to a 20-year high of 5.4% year on year (y/y) in August, the MPC argued that it has been driven largely by factors outside its control, including the prices of global commodities (particularly fuel) and agricultural products. The rise in electricity prices at the start of 2021 has also played a role, further exacerbated by supply-chain disruptions and higher international transport costs.

- In justifying its latest move, the MPC commented that the Delta

variant of COVID-19 has raised economic uncertainty across the

world, adding that major central banks are keeping interest rates

low while continuing asset purchases amid a muted recovery.

Although Polish GDP returned to pre-COVID-19 levels during the

second quarter - thanks largely to booming private consumption -

July data's signaled a slowdown into the third quarter of 2021, not

only for retail sales but also for construction

- Russian technology giant Yandex has announced plans to launch autonomous taxis in Moscow this year, reports Reuters. Robotaxis will be available through the company's Yandex.Go application in the city's Yasenevo district for certain customers Yandex owns a 73% stake in its Self-Driving Group (SDG) and has agreed to buy the remaining shares from Uber by the end of this year. Yandex launched its autonomous vehicle (AV) project in May 2017. Yandex's fleet of around 170 AVs has travelled more than 14 million kilometers in Israel, Russia, and the United States. Its fleet includes fourth-generation autonomous Hyundai Sonatas created in partnership with Hyundai Mobis, which have nine cameras, increased from six. Yandex has also built its own autonomous delivery robot, Yandex.Rover, for last-mile deliveries to homes and offices. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) manufacturer Lucid has unveiled plans to start manufacturing its EVs in Saudi Arabia in 2024, reports the Saudi Gazette. The EV manufacturer has submitted a request for a model accreditation certificate to the Saudi Standards, Metrology and Quality Organisation (SASO). According to the source, the gains of Public Investment Fund (PIF) (which owns 62% of Lucid's shares) have exceeded USD22 billion from its investment in Lucid on the Nasdaq stock exchange. The EV manufacturer is due to start deliveries in Saudi Arabia of the Lucid Air EV, which will compete with the likes of the Tesla Model S. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- Major APAC equity markets closed mixed; Mainland China +0.5%, India +0.1%, Japan -0.6%, South Korea -1.5%, Australia -1.9%, and Hong Kong -2.3%.

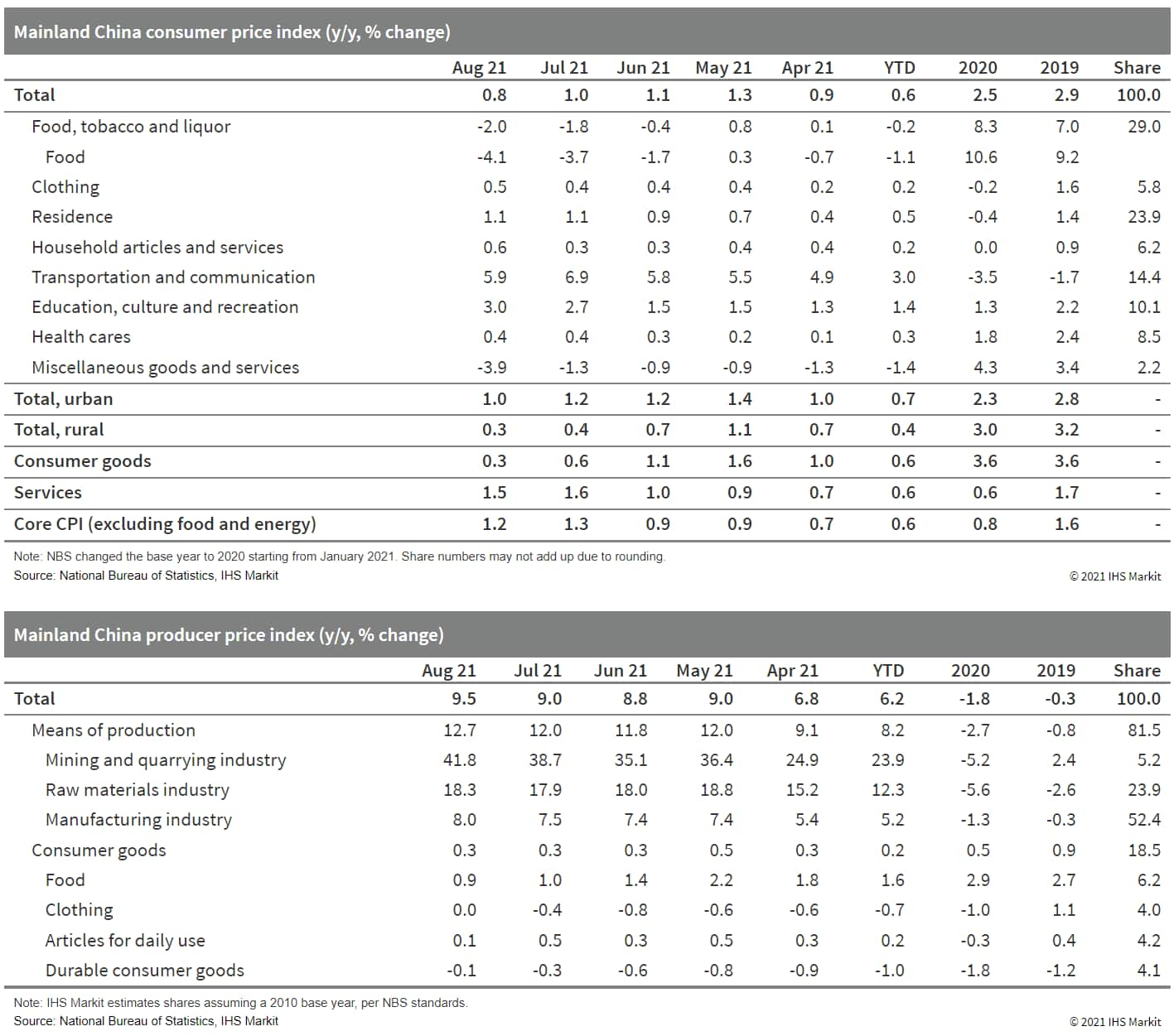

- Mainland China's Consumer Price Index (CPI) increased by 0.8%

year on year (y/y) in August, down by 0.2 percentage point from the

July reading, according to the National Bureau of Statistics (NBS).

Month-on-month (m/m) CPI inflation edged down by 0.2 percentage

point to 0.1% m/m, staying in the inflation territory despite

renewed regional outbreaks in August. (IHS Markit Economist

Lei Yi)

- The logic behind the August declines of year-on-year and month-on-month CPI inflation are somewhat different. Falling food prices were again the main driver behind the moderation in year-on-year CPI inflation, as pork price deflation further widened from 43.5% y/y in July to 44.9% y/y in August. While on a month-on-month basis, distortions from regional outbreaks and summer flooding resulted in a 0.8% m/m increase in August food prices. Fresh vegetables, in particular, registered inflation of 8.6% m/m in August, up by 7.3 percentage points from the prior month. Month-on-month pork price deflation continued to narrow, from 1.9% m/m in July to 1.4% m/m in August.

- The month-on-month CPI disinflation largely came from non-food components, of which prices fell by 0.1% m/m. The downward slide of crude oil prices in August due to the raging Delta variant globally led vehicle fuel prices to fall by 1.3% m/m. With flaring-up infections restricting traveling activities, prices of air tickets and hotel accommodation declined in August, and overall services prices inflation weakened by 0.6 percentage point to 0.0% m/m. Excluding the volatile food and energy components, core CPI inflation came in at 1.2% y/y and 0.0% m/m, respectively in August.

- The Producer Price Index (PPI) inflation hit a new high this year at 9.5% y/y in August, up by 0.5 percentage point from July. Month-on-month PPI inflation reached 0.7% m/m, up from 0.5% m/m in July.

- Divergence between upstream and downstream sectors persisted

due to the weak inflation pass-through. While the PPI subindex of

producer inputs further increased by 0.7 percentage point to 12.7%

y/y in August, that of consumer goods had stayed unchanged at 0.3%

y/y for three consecutive months.

- Mainland China's merchandise exports increased 25.6% year on

year (y/y) in August in terms of US dollars, picking up speed from

a 19.3% growth in July but still below the second quarter average

growth of 30.7%, according to the General Administration of Customs

(GAC). Merchandise imports growth accelerated from 28.1% in July to

33.1% in August. In terms of the 2020-21 average, August exports

growth rose by 6 percentage points from the previous month and was

the fastest since the beginning of the year. (IHS Markit Economist

Yating Xu)

- Export strength in August was across major trade partners, with the European Union leading the recovery. It partially reflected the supply-chain recovery in western countries that supports demand of raw materials and capital goods. Meanwhile, the export breakdown showed a broad-based uptick across products. Particularly, the rebound in consumer goods such as electronics, furniture, and recreational productions probably reflected mainland China's substitution to the supply of Southeast Asia where the continuous Delta-variant spread had led to industrial lockdowns. Also, it could reflect inventory replenishment in western countries ahead of the Christmas shopping season.

- The acceleration in import growth was largely supported by still high commodity prices and the low baseline during the same period last year. Mainland China's coal imports rose 35.8% y/y owing to tight domestic supply under the decarbonization goal, while iron ore imports picked up for the first time in five months.

- The new National Pension Insurance Company will help develop

mainland China's third-pillar pension system and fill in the

funding gap for a basic pension system amid the aging population

and declining working force. (IHS Economist

Yating Xu)

- Mainland China's National Pension Insurance Company got regulatory approval on 8 September, in an effort to encourage the growth of the private pension polices, according to an announcement on the website of China's Banking and Insurance Regulatory Commission (CBIRC).

- This state-owned pension company has a registered capital of CNY11.15 billion with 17 financial institutions that will take stakes, including mainland China's Big Five state banks and state-owned investment enterprises. An official of the State Administration of Foreign Exchanges was proposed as chairman of this new company.

- The newly established National Pension Insurance Company will serve as a component of mainland China's third-pillar pension system, on top of the first pillar of the basic state pension program and the second pillar of annuities. Mainland China's pension system is heavily dependent on the first pillar, which accounts for about 80% of total pension funds.

- Toyota has announced an investment of USD100 million for local production of hybrid electric vehicles (HEVs) in Pakistan during a meeting with Prime Minister Imran Khan, reports The Express Tribune. According to the source, the investment will aid in the localization of components, the expansion of the plant, as well as production preparation for the country's first HEV in the Indus Motor Company (IMC) plant in the city of Karachi. The prime minister said, "We value our relationship and Toyota's trust in Pakistan's economy and welcome this new investment for environment-friendly hybrid electric vehicles." He added, "Indus Motor Company is a wonderful example of how global companies can grow successfully here in Pakistan." The automaker aims at making HEV technology available in Pakistan by the end of 2023. Toyota Asia CEO Yoichi Miyazaki said, "We are excited to announce the new investment and it is a testament to our strong commitment to Pakistan and trust in the government." The setting up of a HEV plant in Pakistan aligns with Imran's vision of Clean Green Pakistan (CGP). CGP is a flagship five-year campaign wherein the government aims to implement environment-centered activities to mitigate the impact of climate change and encourage low-carbon mobility solutions. According to IHS Markit light-vehicle production data, Toyota is the second largest producer of light vehicles in Pakistan after Suzuki. (IHS Markit AutoIntelligence's Tarun Thakur)

- The South Korean government has passed a bill that sets the year 2050 as the target for carbon neutrality in the country. This new bill, called the 'Climate Crisis Response Act', mandates a 35% reduction in greenhouse gas emissions by 2030 compared with 2018 levels. According to a report filed by electrive, the country's National Assembly has also earmarked KRW12 trillion (USD10.3 billion) in 2022 for the e-mobility sector. The budget covers incentives for both battery electric vehicles (BEVs) as well as hydrogen fuel-cell electric vehicles (FCEVs), in addition to the installation of electric vehicle (EV) charging stations across the country. The government has also pledged financial support in order to lower the number of combustion engine vehicles and reduce the number of coal-based thermal power plants across South Korea. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2021.html&text=Daily+Global+Market+Summary+-+9+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}