Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 09, 2021

Municipal Calendar Week of 09/06/2021 (Labor Day Holiday)

Calendar Week of 09/06/2021 (Labor Day Holiday)

New issue activity is positioned to throttle down over the holiday-shortened week as buyside accounts seek to take down muni bond paper amidst lighter supply in effort to satisfy various investment objectives. While bond issuance YTD remains in the red, it is important to factor the plethora of supply which hit the market last summer after issuers flooded the primary arena, driving a greater variance in supply figures (%) as compared to September of 2020. Muni benchmarks adjusted slightly over the course of last week, with a 1bp cut noted across the curve, outperforming US treasuries resulting in the 10YR Muni/UST ratio hovering at 70%. Following Jerome Powell's remarks on August 27th, primary market fundamentals generally remained intact, as participants directed attention towards core economic indicators coupled with potential rate hikes/fed tapering and most notably, extended federal support appropriated towards state and local governments. Despite cross currents flowing out of Washington and evolving macro market trends, mutual funds continue to demonstrate strength with sustained inflows as accounts continue to put away primary bonds, with a greater concentration noted in high yield paper as investors search for greater returns. Muni progression over the course of the year has been noteworthy, after the market faced heighted uncertainty a year ago during the apex of the pandemic with mounting financial pressures across the country after a large portion of local issuers faced revenue/budget shortfalls. Despite greater financial strain spread throughout various state and local governments over the course of the past year, the market continues to demonstrate resiliency as participants successfully adapt to a new pandemic landscape with a core focus on financing our nation's state and local governments in a coordinated effort to foster national economic success.

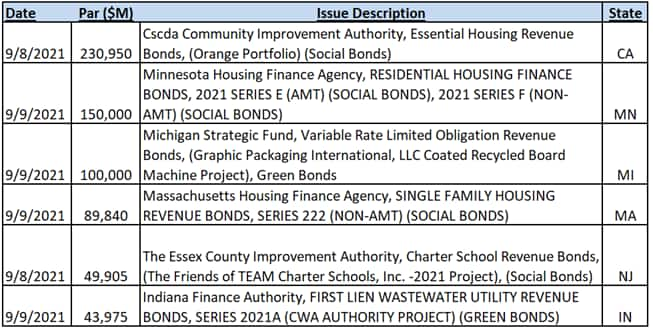

Primary activity will remain subdued following the Labor Day Holiday, with last week's calendar registering $6.1Bn of new issue activity after several large issuers entered the primary arena to finance new issue bonds. The New York City Transitional Finance Authority led last week's calendar, successfully pricing $950mm of future tax secured subordinate bonds with spread tightening noted throughout the scale, with the greatest bumps (3bps) concentrated in the intermediate range of the curve (+50bps to MAC). The State of Wisconsin also tapped into the primary market to take advantage of current borrowing levels, financing $326mm of general obligation bonds, with noteworthy bumps across the scale ranging from 18-20bps, as accounts swarmed investment grade paper driving a significant reduction in true interest cost to the issuer. This week's holiday-shortened calendar is slated to fall in line with last week's volume offering $6.3Bn across 172 new issues, alongside a greater presence of various ESG offerings amounting to $.65Bn, with the greatest concentration noted in the housing sector. The Hamptons Roads Transportation Accountability Commission (Aa2/A+/-) will lead this week's negotiated calendar, supplying $818mm of senior lien notes within a sole 07/2026 tranche, senior managed by Citi with an EPD of tomorrow 09/09. The City of Grand Forks, North Dakota will also come to market, offering $383mm for the Altru Health System (Baa2/-/BBB-) across one series, senior managed by Bank of America. This week's competitive calendar will span 105 issues for a total of $2.3Bn or ~37% of the total weekly calendar, led by the State of Minnesota auctioning three separate tranches for an aggregated total of $879mm on Thursday 09/09.

Negotiated ESG Offerings Week of 09/06/2021

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09062021-labor-day-holiday.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09062021-labor-day-holiday.html&text=Municipal+Calendar+Week+of+09%2f06%2f2021+(Labor+Day+Holiday)+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09062021-labor-day-holiday.html","enabled":true},{"name":"email","url":"?subject=Municipal Calendar Week of 09/06/2021 (Labor Day Holiday) | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09062021-labor-day-holiday.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Municipal+Calendar+Week+of+09%2f06%2f2021+(Labor+Day+Holiday)+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09062021-labor-day-holiday.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}