Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 10, 2021

Daily Global Market Summary - 10 September 2021

All major APAC equity indices closed higher, while all major US and European indices closed lower. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA were almost unchanged on the day across IG and high yield. The US dollar, copper, and oil closed higher, while gold, silver, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; S&P 500 -0.8%, DJIA -0.8%, Nasdaq -0.9%, and Russell 2000 -1.0%.

- 10yr US govt bonds closed +4bps/1.34% yield and 30yr bonds +3bps/1.93% yield.

- CDX-NAIG closed flat/47bps and CDX-NAHY +1bp/277bps, which is

flat and +2bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/92.58.

- Gold closed -0.4%/$1,792 per troy oz, silver -1.1%/$23.90 per troy oz, and copper +3.9%/$4.45 per pound.

- Crude oil closed +2.3%/$69.72 per barrel and natural gas closed -1.8%/$4.94 per mmbtu.

- Forestry offsets have been popular among corporations with

hard-to-abate emissions, and some major oil companies have

established dedicated businesses for investment in Nature-Based

Solutions, including afforestation and reforestation. Exchanges

have launched new products seeking to capitalize on rising demand

for these and other types of offsets. (IHS Markit Climate and

Cleantech's Peter

Gardett and Conway Irwin)

- Afforestation and reforestation voluntary carbon offsets are cost-effective, mature, and often come with environmental and social co-benefits. They also rely on a supply of land that is exhaustible and exposed to physical risk, and face obstacles to accounting, transparency, and liquidity.

- Accounting for emissions from afforestation and reforestation projects is challenged by the absence of universally accepted standards or oversight and the potential for double-counting, as well as issues of actual sequestration capacity and project permanence. There are additional questions related to how forestry projects linked to carbon credits should be managed over time, as well as concerns over lifecycle emissions and some past cases of fraud.

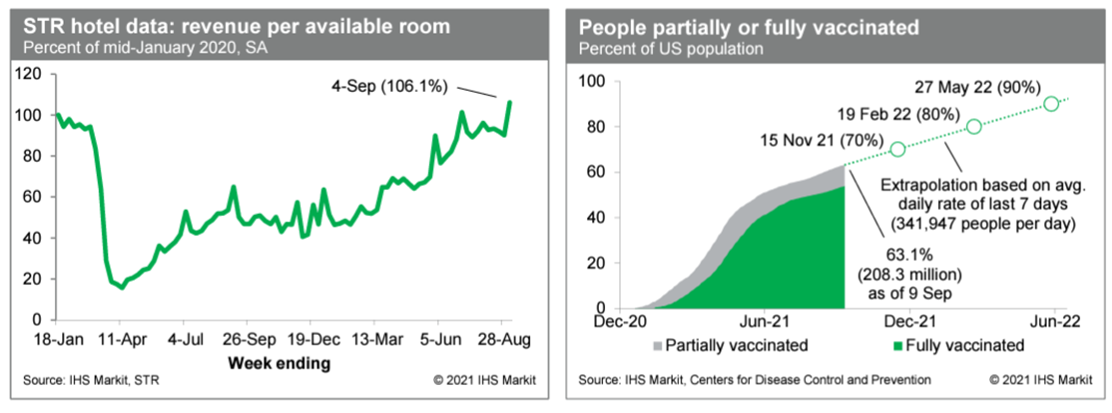

- Revenue per available room at US hotels last week, after

seasonal adjustment, was 6% above the January 2020 level (IHS

Markit estimate based on weekly data from STR). While encouraging,

the jump in seasonally adjusted activity could reflect the timing

of the Labor Day holiday. Readings over the next few weeks will

clarify the underlying trend in hotel activity. Meanwhile, averaged

over the last seven days, about 342,000 people per day received a

first (or only) dose of a COVID-19 vaccination, down from the prior

week's rate of about 421,000 per day. New vaccination mandates at

the federal level have the potential to raise this rate in coming

weeks. As of yesterday, 208.3 million US residents, or about 63.1%

of the population, were at least partially vaccinated against

COVID-19. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- US Producer prices for final demand increased 0.7% in August

from July and a record 8.3% from a year earlier. Note: (1) many

prices in this report advanced at a record pace in August, but

given that November 2009 is the initial data point for the headline

and many other price indexes, that is not surprising; and (2) base

effects are still one reason PPI prices are higher than last year,

although that role is now small. (IHS Markit Economists Michael

Montgomery and Patrick

Newport)

- Final demand for services grew 0.7%. Two-thirds of this increase came from a 1.5% jump in final demand trade services, which measures changes in the margins received by wholesalers and retailers; indeed, a 7.8% leap in margins for health, beauty, and optical goods retailing drove about 30% of the increase in final demand for services. Final demand for services pace from a year ago, 6.4%, was also a record.

- Final demand goods prices jumped 1.0 % from July and a record 12.3% from a year earlier. Half of the monthly rise came from a 2.9% increase in final demand foods, with meat, up 8.5%, playing a major role. Final demand goods excluding food and energy rose 0.6% from July and a record 7.9% from a year earlier.

- In the intermediate demand category, processed and unprocessed goods both advanced 1.0% from July and 23% and 50%, respectively, from last August; intermediate services edged up 0.3% in August and 8.6% from a year earlier.

- Bottom line: Inflationary pressures persisted in August because of bottlenecks, supply shortages, and strong demand.

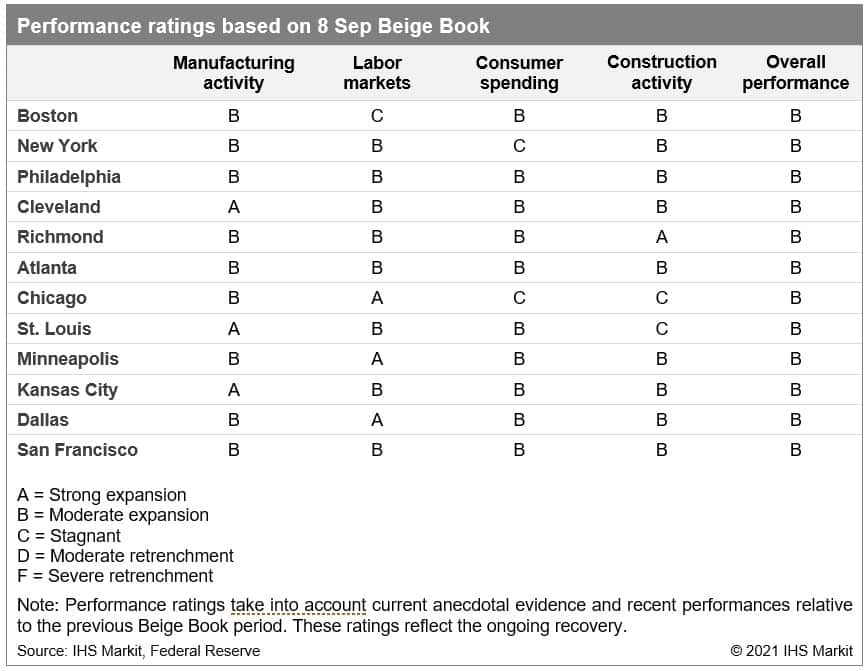

- The surge in Delta-variant cases and hospitalizations and

continuing international travel restrictions posed challenges for

leisure and hospitality businesses in early July and August,

resulting in modestly lower growth in much of the country according

to the US Federal Reserve's latest Beige Book report, containing

anecdotal information from regional business contacts. While retail

sales were supported by healthy back-to-school shopping, auto sales

sagged from the microchip shortage and leisure spending eased off

in much of the country as the Delta variant surged. Employment

continued to rise, but widespread reports of labor shortages

restrained business growth. Supply chain disruptions, exacerbated

by Delta-variant outbreaks internationally, hampered manufacturing

operations along the West and East Coasts. Lack of homebuilding

materials and labor limited new construction in the Great Lakes

while homebuilders in the South pushed ahead. (IHS Markit Economist

James

Kelly)

- Consumer spending leveled off or was only modestly higher in the Northeast, Plains, and West as consumers reduced spending at restaurants, hotels, and attractions due to the threat posed by the Delta variant surge. While retail sales in much of the country were supported by healthy back-to-school shopping, a lack of international visitors and few office workers limited hospitality businesses in major cities.

- Labor markets expanded strongly in the upper Midwest and in Texas despite reports of labor shortages causing hiring challenges and overwork of current employees. Many firms in the Northeast and around the Great Lakes have seen a decline in applicants per job caused by a combination of childcare concerns, virus fears, early retirements, and workers changing careers.

- Manufacturing activity rose slightly in the Northeast and West as severe supply chain disruptions and lack of raw materials post major challenges. Outbreaks of the Delta variant in Asia and Europe resulted in significant supply delays, restraining overall production growth for many firms.

- Construction activity remained strong in the South, but costs

of materials and appliances rose quickly with homebuilders facing

delays and reluctant buyers as home prices moved higher. Home sales

in Texas were "not as frothy" and some builders began to

reintroduce incentives. Shortages of labor and materials were

widespread around the country despite the recent drop in lumber

prices.

- The final stages of Canada's job recovery are progressing at a

decent pace as employment is down 156,200 jobs since the start of

the pandemic. The details of the net employment gain were as

expected. Hefty increases in tourism and hospitality employment

were also supported by increased demand from fully vaccinated US

residents with Canada's border reopening in early August. (IHS

Markit Economist Arlene

Kish )

- August's net employment gain blew past expectations and the above-consensus IHS Markit call. The improvement in the jobless rate was also better than expected.

- Generally, employment was up in most groupings. Services net employment was like the previous month, at 92,900. More than two-thirds of the gain was in full-time positions. Part-time positions also advanced. Private sector net employment was also a big winner. The jump in public sector net employment was healthy. Goods-producing industry employment and self-employment were the only net losses.

- The labor force participation rate edged down to 65.1% with almost no change in the labour force.

- The net employment increases suggest that Canada's economic recovery is on the right track. Yet supply conditions are prolonging the GDP and employment recoveries. As Bank of Canada Governor Tiff Macklem recently noted, the recovery will be bumpy as global and pandemic uncertainty necessitates accommodative monetary policy and quantitative easing.

- Speaking at a webinar held by the Consumer Federation of

America (CFA) last week, a group of experts mapped out the greatest

challenges and concerns that remain with the emerging field of

cell-cultured meat products. (IHS Markit Food and Agricultural

Policy's Margarita Raycheva)

- While experts from the Good Food Institute (GFI) and New Harvest stressed the critical need for independent and, possibly government-backed research to support the novel cell-cultured meat sector, Tom Neltner, chemicals policy director at the Environmental Defense Fund (EDF), warned that regulation of the novel products is at a critical stage and should be handled with transparency and caution.

- With at least one US company moving on with plans to bring cell-cultured seafood to the American market, possibly as early as this year, and the US-based EAT Just already selling cell-based chicken in Singapore, it is critically important that regulators at USDA and FDA establish a process that can ensure the cultured products are safe for consumers, Neltner said.

- While recognizing that cell-based seafood and meat products in the US are still under development, Neltner warned the sector is moving quickly. And while USDA and FDA are still in the early stages of setting up frameworks for regulation and oversight, some cell-based companies are already making plans to bring the first cell-based products to the US consumer market, he cautioned.

- San Diego-based maker of cell-based seafood BlueNalu announced earlier this year it is quickly approaching the point of being able to make small-scale products under FDA-inspected, Good Manufacturing Practices (GMP) conditions. The company says it has applied for regulatory approval from FDA and is looking to complete by the end of the year a new 40,000 square foot facility that will allow small-scale production of the startup's first cell-based seafood products.

- White House plans to boost sustainable aviation fuel (SAF) production to 3 billion gallons a year by 2030 with a production tax credit as part of a goal announced 9 September to reduce GHGs from the sector. The tax credit, once approved by US Congress, would require the lifecycle GHGs of the SAFs be 50% lower than those of regular jet fuel. The White House said the tax credit would help producers reach the 2030 goal, and make sure sufficient SAF is in place to meet 100% of US aviation fuel demand by 2050, which it added is currently projected to be around 35 billion gallons per year. The 2030 goal, which the White House announced following a roundtable on sustainable aviation, aims to reduce aviation sector GHGs by 20% compared with current levels by increasing SAF use in aircraft and through improving aircraft engine efficiency. The White House said it would release a more comprehensive climate action plan for the aviation sector later. The roundtable included federal agency officials, lawmakers, as well as airline industry and fuel producers, who all backed the 2030 goal. Aviation (including all non-military flights within and departing from the US) represents 11% of the country's transportation-related emissions, which in 2019 the US Environmental Protection Agency estimated at roughly 178 million mt CO2 equivalent. (IHS Markit Net-Zero Business Daily's Amena Saiyid )

- The Global Wind Energy Council (GWEC) raised its offshore wind

installed capacity forecast through 2030 by 36 GW or 18% compared

with a year earlier while also more than doubling its prediction

for floating offshore wind installations over the same period. In a

report issued 9 September, GWEC said it expects 235 GW of new

offshore wind capacity to boost the generation sector's cumulative

total to 270 GW in 2030. The trade association's 2030 forecast for

floating offshore wind capacity increased to 16.5 GW from 6.5 GW a

year earlier, spurred by "ambitious government targets and major

investors' development plans." Last year was the second-best year

for offshore wind in terms of new installations, with 6.1 GW

installed globally, with nearly half that in Chinese waters (3 GW),

GWEC's annual state of the industry report said. GWEC Market

Intelligence predicts annual installations will top 20 GW in 2026

and potentially reach 40 GW in 2030. Some 70% of the forecast

235-GW total will be installed in the latter half of the decade, it

added. The outlook to 2030 has grown even more promising over the

past 12 months, it said, because (IHS Markit Net-Zero Business

Daily's Keiron Greenhalgh):

- A sharp drop in offshore wind's levelized cost of energy-the average cost of production over a facility's lifetime-made it more competitive;

- Progress continued in commercialization and industrialization for floating wind;

- And, offshore wind increasingly played a unique role in facilitating cross-industry cooperation and decarbonization.

- Veoneer has said that it is still backing a deal proposed by Magna International despite other bids being proposed. In a statement, the company said that it had filed a "definitive proxy statement with the Securities and Exchange Commission (SEC) ahead of a Special Meeting of Veoneer stockholders". It said that this meeting of shareholders will take place on 19 October and it will ask them to consider the previously announced merger agreement with Magna. However, it added that it continues to discuss a competing offer proposed by Qualcomm, saying that if it "provides a final, complete proposal for the acquisition of Veoneer, including a merger agreement, the Veoneer Board intends to evaluate, in consultation with Veoneer's financial and legal advisors, whether it constitutes a 'Superior Proposal'". Veoneer said that at this point it will "negotiate with Qualcomm and/or Magna, if appropriate, to seek to obtain the best available transaction for the Veoneer's stockholders". (IHS Markit AutoIntelligence's Ian Fletcher)

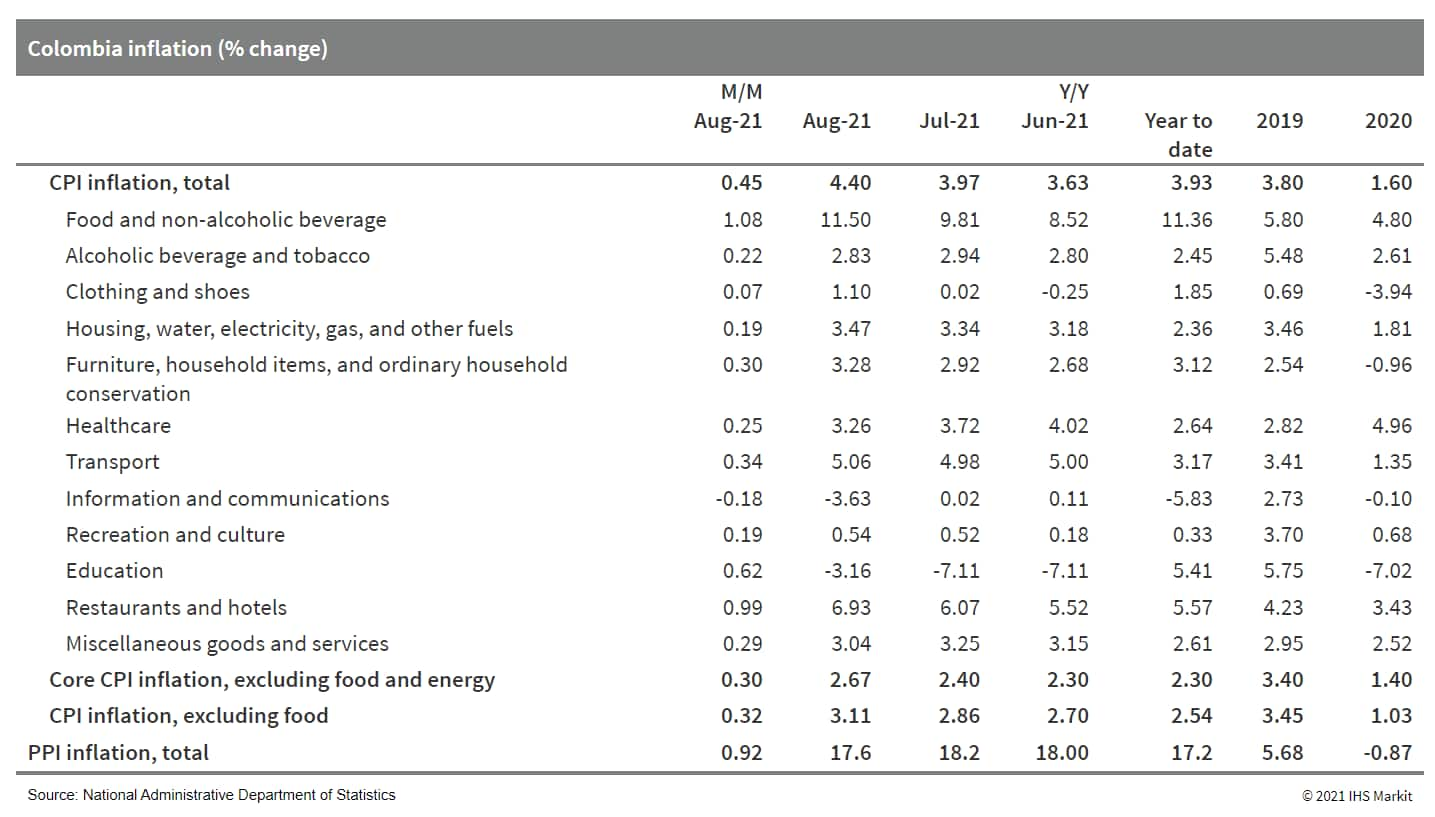

- According to Colombia's National Administrative Department of

Statistics (DANE), the country's consumer price index (CPI) rose

from 4% year on year (y/y) in July to 4.4% y/y in August as IHS

Markit expected, taking the headline rate even further above the

mid-point of the Banrep's target. The bank targets inflation at

3.0% +/- 1 percentage point. (IHS Markit Economist Rafael

Amiel)

- Excluding food and energy prices (core inflation), consumer prices rose further to 2.7% y/y, up from 2.4% y/y while the measure, which does not include food prices, also increased to 3.1% y/y from 2.9% y/y as the reopening of the economy added to price pressures in the services sector.

- On a monthly basis, the CPI rose by 0.5% month on month (m/m)

in August from 0.3% m/m in July. This was a second month in a row

that the index posted a monthly rise and was a bit softer than our

forecast (0.6% m/m). The result was mostly driven by price

increases in food and non-alcoholic beverages, restaurants, and

hotel services, as well as education, transport, and public

services. In contrast, the only decline in prices was registered in

the information and communications sector.

Europe/Middle East/Africa

- Most major European equity indices closed lower except for UK +0.1%; Germany -0.1%, France -0.3%, Italy -0.9%, and Spain -1.2%.

- 10yr European govt bonds closed lower; UK/Spain +2bps, Germany +3bps, and Italy/France +4bps.

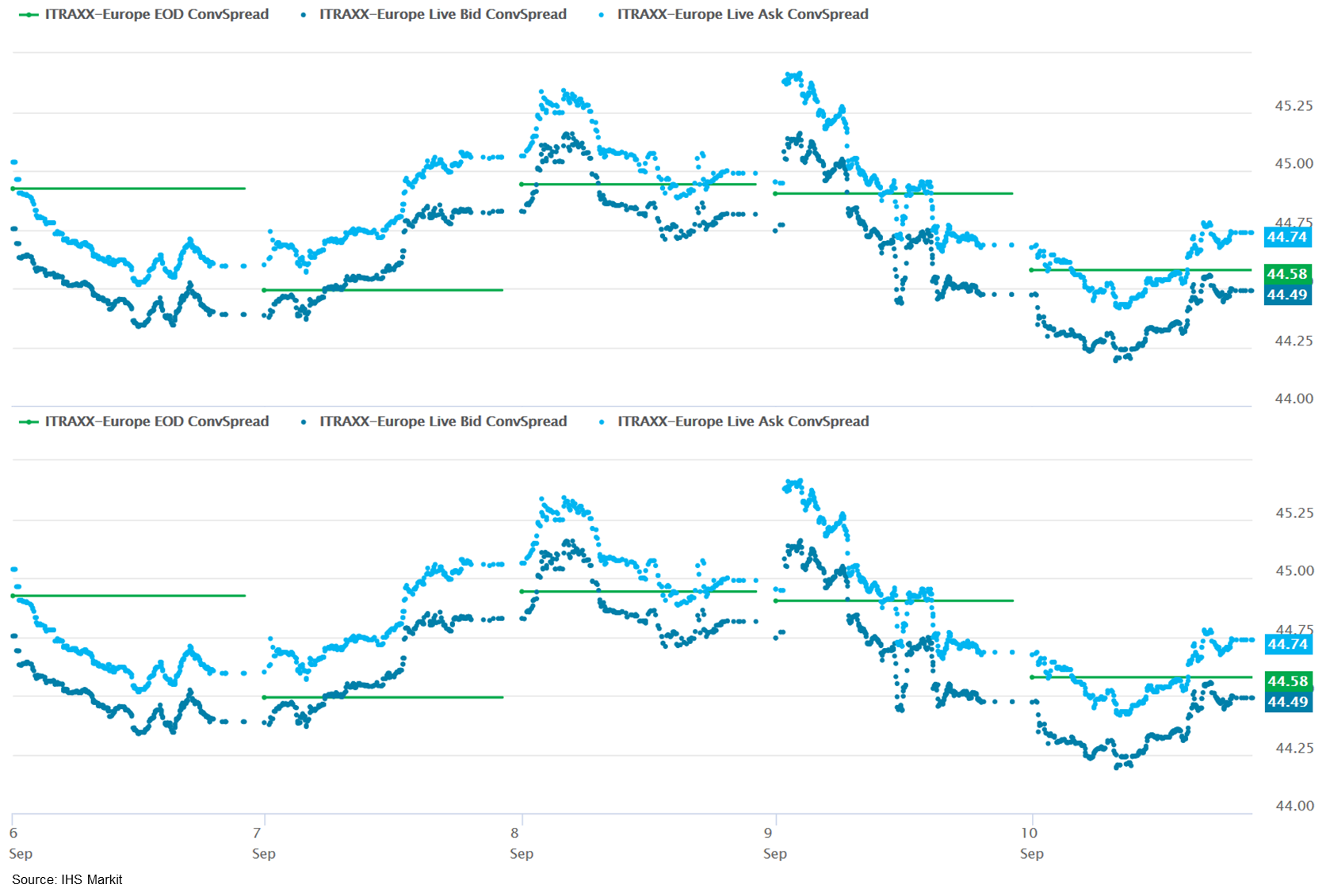

- iTraxx-Europe closed flat/45bps and iTraxx-Xover +1bp/227bps,

which is flat and +1bp week-over-week, respectively.

- Brent crude closed +2.1%/$72.92 per barrel.

- The Office for National Statistics (ONS) reports that the UK

economy grew by just 0.1% month on month (m/m) in July, after gains

of 1.0% m/m in June and 0.6% m/m in May. The figure for July was

below the market consensus, which had predicted a 0.5% m/m gain

during the month. (IHS Markit Economist Raj

Badiani )

- Moreover, this was after real GDP rose by 4.8% quarter on quarter (q/q) in the second quarter of 2021.

- Overall, real GDP in July was 2.1% below the level before the first COVID-19-related lockdown in February 2020.

- The ONS reports that real GDP grew by 3.6% in the three months to July when compared with the previous three months (February to April). This partly reflects the gradual reopening of accommodation and food service activities, the reopening of non-essential stores, and the increase in school attendance.

- Services output was unchanged between June and July and remained 2.1% below its pre-COVID-19-pandemic level of February 2020. This was after strong growth of 1.5% m/m in June.

- Consumer-facing services output shrank by 0.3% m/m in July, its first fall since January, due primarily to a 2.5% m/m decline in retail sales.

- Production output increased by 1.2% m/m in July. This partly reflected a reopening of an oil field production site after it had been closed for planned maintenance. This triggered a 22.0% m/m expansion in mining and quarrying output, which prevented a decline in real GDP in July.

- The Office for National Statistics (ONS) has reported that the

volume of UK retail sales fell by 2.5% month on month (m/m) in July

after a 0.2% m/m gain in June. In addition, retail sales rose by

5.2% in the three months to July compared with the previous three

months. They stood 5.8% higher than their pre-COVID-19-pandemic

February 2020 levels in July. (IHS Markit Economist Raj

Badiani)

- In July, retail sales appeared to take a hit from consumers spending more on services after the last layer of COVID-19-related restrictions ended on 19 July. In addition, food store sales fell by 1.5% m/m in July after they were boosted in June with more households staying indoors to watch the Euro 2020 football tournament.

- Meanwhile, sales in non-food stores fell for a second straight month in July, by 4.4% m/m in volume terms. The worst performer was the category "other stores", which includes shops selling second-hand goods and computer and telecoms equipment.

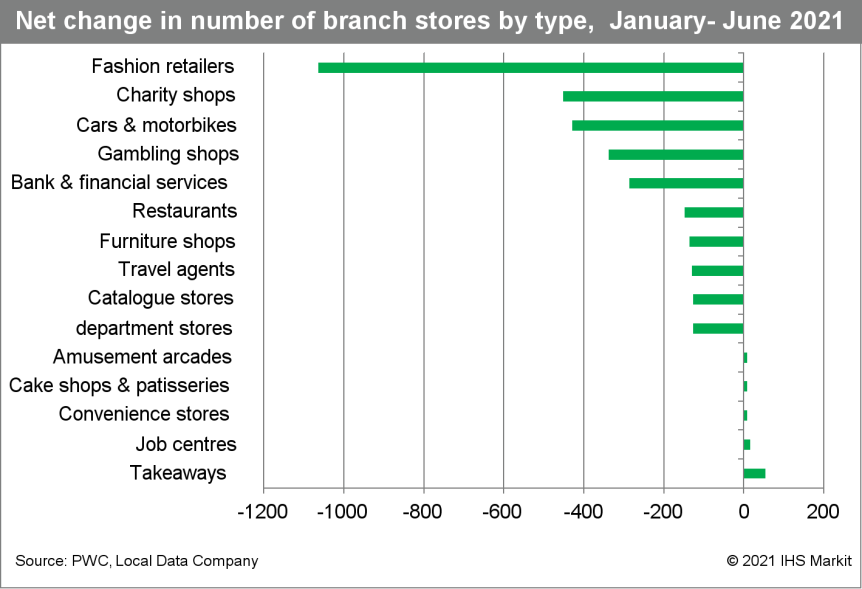

- Research conducted by the Local Data Company on behalf of

accountancy firm PwC estimates that close to 9,000 chain stores

closed in UK high streets and commercial centers and retail parks

in the first six months of 2021, which amounts to an average of

nearly 50 physical outlets per day. This was accompanied by 3,488

stores opening in the same period, implying a net decline of 5,251

outlets, 750 fewer net closures than in the first six months of

2020.

- Aker Solutions, Siemens Energy and Doosan Babcock have formed a consortium targeting the United Kingdom's carbon capture, utilization and storage (CCUS) market. Aker Solutions will be the project integrator of the consortium. Together, they employ more than 6,500 people across the United Kingdom and can provide combined cycle gas turbine (CCGT) engineering and design, and engineering, fabrication and construction services. The consortium will also work with Aker Carbon Capture to tap on the latter's CO2 capture technology. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- CS Wind United Kingdom (UK) has appointed FRP Advisory, who will now market all the assets of company for sale. South Korean based CS Wind had acquired Wind Towers (Scotland) based in Argyll, Scotland and established CS Wind UK in 2016. At that time Wind Towers (Scotland) was the only factory in UK to produce on and offshore wind towers. In recent years company failed to secure any new contracts resulting in all its staff either leaving or been made redundant by the company. The facility was effectively mothballed in November 2019. CS Wind (UK) and its predecessor have supplied high quality wind tower solutions to clients across the UK and Europe but the current market conditions has resulted in the business being unsustainable and with no immediate prospect of recovery. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

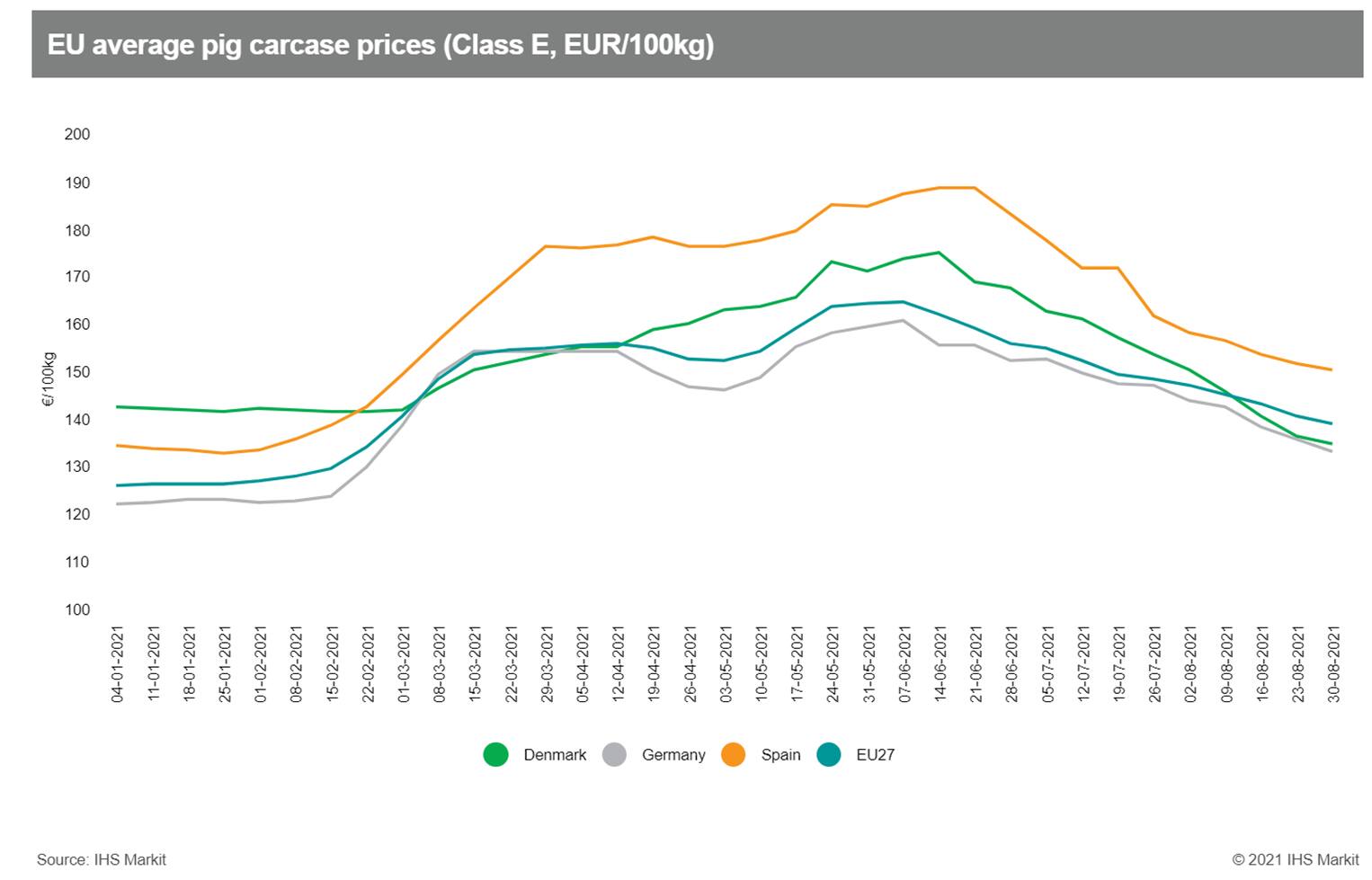

- The gloom surrounding the EU pig market shows no sign of being

dispelled as pig prices have fallen over the past week for the

twelfth week in a row. Prices have now fallen by more than 15%

since reaching their 2021 peak in early June, and there is no

immediate sign of any price recovery. (IHS Markit Food and

Agricultural Commodities' Chris Horseman)

- With feed prices at their highest levels for some years, pig producers are coming under increasing pressure, with the German pig producer association saying this week that farmers are now losing EUR60-70 per animal.

- This, they warned, would make it impossible for farmers to invest in the kind of welfare-friendly production units which supermarkets are increasingly demanding.

- The sector is being squeezed by a combination of low levels of internal demand, seasonally increasing output, and much reduced exports following the collapse of the Chinese market.

- In June, the EU exported a total of 259,862 tons of pig meat to

third countries - down by more than a third on export sales in

March, when they topped 400,000 tons. China accounted for the vast

majority of this decline.

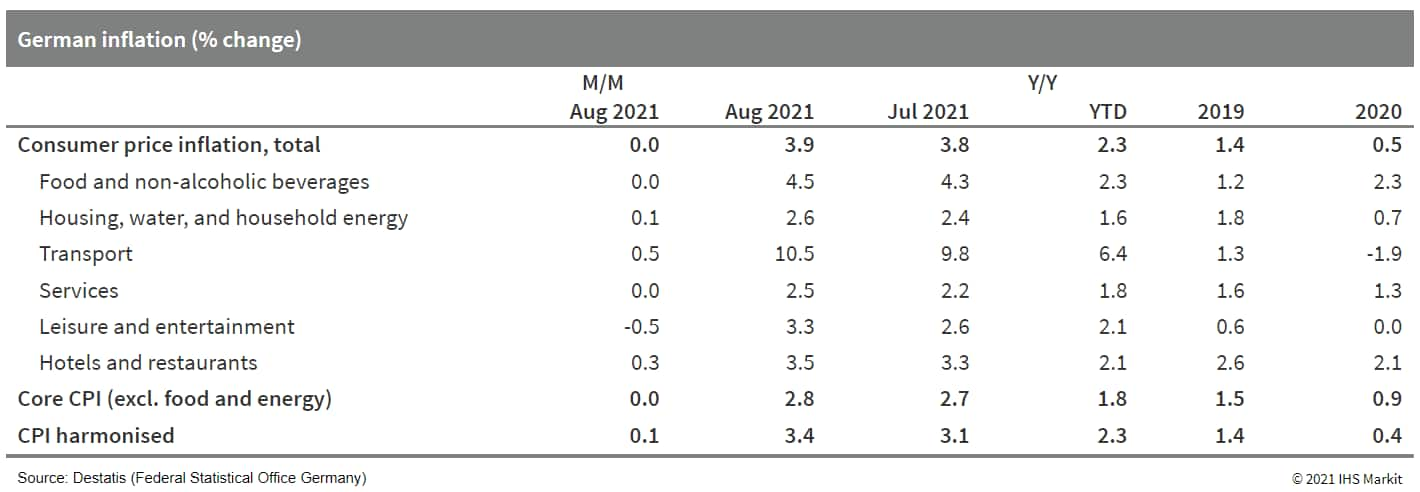

- German consumer price index (CPI) inflation increased slightly

further in August following July's pronounced jump, which had been

exacerbated by a value-added tax (VAT) base effect. Inflation will

fluctuate around the 4% level until the end of 2021 before

unwinding base effects allow a calming to around 2.5% in 2022,

notwithstanding lingering pipeline pressures linked to supply-chain

disruption. (IHS Markit Economist Timo

Klein)

- Final August data based on national methodology from the Federal Statistical Office (FSO) have confirmed the "flash" data release of 30 August, posting readings of 0.0% month on month (m/m) and 3.9% year on year (y/y). The latter is up from 3.8% y/y in July, continuing to contrast starkly with average inflation of 1.4% in 2019 and 0.5% in 2020.

- The EU harmonised CPI measure increased by 0.1% m/m in August, raising its - recently lagging - annual rate from 3.1% to 3.4% y/y. This exceeded the eurozone average of 3.0% in August. It should be noted that January's reweighting of (only) the harmonized rate to the changed consumer spending patterns in 2020 initially provided it with a 0.3-0.4-percentage-point add-on relative to the national rate, favoring those categories that showed the largest price increases in 2020, but this effect has gone into reverse since May as the seasonal spike in travel-related prices during the summer months is now underweighted compared with the national rate.

- The national measure of core CPI inflation (excluding food and

energy) edged up further from 2.7% y/y in July to 2.8% y/y in

August, well above the 1.4% average during the first four months of

2021, let alone the December 2020 level of 0.4%. The leap in July

had been caused mainly by the base effect of the implementation of

a temporary VAT cut in July 2020, but input price pressures from

global supply-chain bottlenecks and the loosening of

pandemic-related restrictions since May have been contributing

increasingly too.

- Continental is looking to make its new Autonomous Mobility unit a conduit to partnering with small technology startups, according to an Automotive News Europe report. The new unit's head, Frank Petznick, believes that the more autonomy he has to make deals and alliances, the quicker Continental will be able to boost its technology portfolio. He said, "The less corporate overhead I have, the faster I can act in terms of partnerships, signing contracts, and also give the partner companies a feeling that they are partnering with this automated mobility unit, not with this big mother ship and really big, administrative corporation." The new unit will be launched on 1 January 2022 and will be headed by Petznick, who also acts as Continental's head of advanced driver assistance systems (ADAS). There will be a focus on partnerships and licensing at the new unit, with an emphasis on bringing new technology partners under the Continental corporate umbrella. (IHS Markit AutoIntelligence's Tim Urquhart)

- RWE Renewables and EDF Renewables have been selected by

Bundesnetzagentur, Germany's Federal Network Agency, as winners of

the recent tenders to develop up to 958 MW of offshore wind

capacity. The bids offered were all subsidy-free and according to

the Federal Network Agency, demonstrates the interest shown despite

the comparatively moderate size of the areas offered. (IHS Markit

Upstream Costs and Technology's Melvin Leong)

- RWE Renewables submitted zero-subsidy bids for the 225 MW N-3.7 zone in the North Sea, and the 300 MW O-1.3 zone in the Baltic Sea, while EDF Renewables did the same for the 433 MW N-3.8 zone in the North Sea. As the agency received several zero-subsidy bids for the two larger zones, a lottery process was carried out to draw the winners, in accordance to the tender regulations.

- Of the three zones, only the development of the N-3.7 zone is certain at present. The other two zones, though with winners selected, are still waiting for the decision of two companies who have step-in rights. These rights were granted to the two unsuccessful companies whose projects did not advance past the second transitional tender in the 2018 auctions. The companies are Nordsee Two, comprising Northland Power and RWE Renewables, and Iberdrola's Windanker. The former holds the rights for N-3.8, and the later for O-1.3.

- French industrial production grew by 0.3% month on month (m/m)

in July, according to seasonally adjusted figures released by the

National Institute of Statistics and Economic Studies (Institut

national de la statistique et des études économiques: INSEE).

Production had increased by 0.6% m/m in June. (IHS Markit Economist

Diego

Iscaro)

- Production rose by 4.0% year on year (y/y) in July. However, industrial output is still 4.8% below its level immediately before the pandemic in early 2020.

- The m/m growth rate was boosted by a 2.9% m/m increase in production of transport equipment. Whereas production of motor vehicles, trailers, and semi-trailers dropped by 0.8% m/m, production of 'other' transport equipment rose by 5.3%.

- Supply-chain disruption has particularly hit car production, where output remains around 20% below its February 2020 level, but it recovered somewhat in July.

- Production of food and beverages also rose by 1.7% m/m in July, following a 0.3% m/m increase in June. Production of food/beverages was the only item that overtook its level in February 2020.

- Meanwhile, production of machinery and equipment goods also rose for the second consecutive month in July (by 0.7% m/m, following +1.2% m/m in June), despite a modest decline in production of electrical equipment (-0.3% m/m).

- Siemens is in discussions with the Russian authorities over supplying charging stations for battery electric vehicles (BEVs), according to an ITAR-Tass news agency report. The president of Siemens in Russia, Alexander Liberov, said that negotiations were taking place in the wake of the Russian government announcing a plan to accelerate vehicle electrification in the country. Librov said, "We are currently negotiating two pilot projects on this topic [the supply of charging stations from Germany - TASS]. One is for DC chargers, and the other is for AC chargers. (IHS Markit AutoIntelligence's Tim Urquhart)

- Solar electric vehicle (EV) startup Sono Motors has expanded its community car-sharing service in Germany, according to a company statement. This will allow the startup to share any car beyond its solar EV, the Sion, via its Sono app. This will support the company's aim to generate a platform service revenue of EUR295 million (USD348 million) by 2025. Through its pilot projects, Sono Motors demonstrated that a community car-sharing service can increase vehicle utilization up to 150% and reduce car owners' monthly costs by up to 85%. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Saudi Aramco announced an expansion of its industrial

investment program, Aramco Namaat, with the signing of 22 new

Memoranda of Understanding (MOUs) and 1 joint venture (JV)

agreement. These are focused on capacity building in four key

sectors, namely, sustainability, technology, industrial and energy

services, and advanced materials. Those MOUs relevant to Cost and

Technology include (IHS Markit Upstream Costs and Technology's Jie

Sheng Aw):

- Three separate non-binding MOUs to evaluate carbon capture and sequestration opportunities involving the combination of Air Liquide, Haliburton and the Saudi Arabia Public Infrastructure Fund (PIF); Baker Hughes and PIF; and Linde, Schlumberger and PIF.

- Three separate MOUs each with Samsung Engineering, Hyundai E&C and Saipem on engineering, procurement and construction (EPC).

- An MOU with Baosteel to conduct an engineering study and develop plans needed to build, own and operate an integrated steel plate manufacturing facility in Saudi Arabia.

- TotalEnergies is set to help Iraq build the water, gas and

power facilities, including a 1-GW solar power plant, urgently

needed to get the southern city of Basra through a crisis. (IHS

Markit Net-Zero Business Daily's Cristina Brooks)

- In Basra, the French company will invest in equipment to recover associated natural gas flared at three oil fields, a gas gathering network, and treatment units to supply the gas to local power stations, according to a 6 September statement. It will also provide expertise to the operators of the Ratawi oil field.

- Iraq is experiencing electricity shortages due to increased demand from the population. TotalEnergies' planned recovery installations will allow the country to add 1.5 GW of gas-fired power generation capacity in the first phase of the deal and an additional 1.5 GW in the second phase.

- The French major will also develop 1 GW of solar generation capacity to supply the Basra regional grid. TotalEnergies CEO Patrick Pouyanné said its ambition was to be part of Iraq's sustainable future, including through water management and solar development.

Asia-Pacific

- All major APAC equity markets closed higher; Hong Kong +1.9%, Japan +1.3%, Australia +0.5%, South Korea +0.4%, and Mainland China +0.3%.

- WeRide has unveiled its Level 4 autonomous cargo van that will be deployed for urban logistics service, reports China Daily. To achieve this, WeRide has partnered with a major Chinese automobile manufacturer, Jiangling Motors, and a leading express delivery company in China, ZTO Express. The robovan's design is based on Jiangling's battery electric vehicle (EV) model with a fully redundant vehicle platform, and is employed with WeRide's full-stack software and hardware solutions. Robovan is WeRide's third product, in addition to robotaxi and mini robobus. WeRide has received a permit to test autonomous cars without a driver behind the wheel on designated streets in San Jose (California, US). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- ODE has entered into a Memorandum of Understanding with DongYang Engineering (DYE) to pursue offshore wind and other prospects across South Korea and globally. ODE is part of the DORIS Group. ODE and DYE will collaborate across business development activities and the execution of engineering services including the joint-development of an offshore substation design specifically targeted to South Korean offshore wind farms. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- The Indian government is looking to offer INR257.5 billion (USD3.5 billion) in incentives to automakers under a clean technology scheme, reports Reuters, citing sources with knowledge of the matter. The incentives will be disbursed over the next five years to boost manufacturing and exports of clean-technology vehicles, including electric and hydrogen fuel-powered vehicles. In order to qualify for the incentives, the report adds that automakers will be required to invest a minimum of nearly USD272 million over a five-year period. Eligible automakers could receive 10-20% of their turnover as cashback payments for electric and hydrogen fuel-powered vehicles. Additionally, component manufacturers could receive incentives to produce components for such vehicles and for investing in advanced safety technology related parts. Final details of the scheme are expected to come out in the next few days (IHS Markit AutoIntelligence's Isha Sharma)

- Ford will completely exit manufacturing in India by the second

quarter of 2022, although it intends to continue to participate in

the light-vehicle market using global products. The company's

Business Solutions team in the country, however, will grow and

continue to support Ford's global operations. Ford says that the

move follows losses in India of more than USD2 billion over 10

years and a USD0.8-billion non-operating write-down of assets in

2019. With the change, Ford expects profitable operations in India.

This is not unlike the announcement that Ford made relative to

Brazil earlier this year. The automaker expects a pre-tax special

item of USD2.0 billion related to the restructuring. (IHS Markit

AutoIntelligence's Stephanie

Brinley)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2021.html&text=Daily+Global+Market+Summary+-+10+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}