Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 02, 2022

Defensive sector positioning in the current earnings season

Research Signals - December 2022

The 2022 market downturn has been characterized by several bouts of active dip buying, including in recent months as investors applauded suggestions that the US Federal Reserve may ease off its aggressive rate hiking cycle. However, additional increases are expected, albeit at lower increments, and the potential for an economic recession still looms. Moreover, in the third quarter of 2022, S&P 500 index constituents saw a 5.7% decrease from the prior quarter in the number of firms that beat S&P Capital IQ earnings estimates, according to S&P Global Market Intelligence. Thus, we study attributes of defensive versus growth sectors given the potential impact of already implemented and future rate hikes on companies' bottom lines.

- The November S&P Global Investment Manager Index™ survey of institutional investors identified energy and health care as the most favored sectors, while technology and consumer discretionary were among the least favored, as risk appetites worsened and earnings expectations have lowered

- 44% of companies achieving a positive earnings surprise in the current quarter were also associated with an annual decrease in shares outstanding, compared with just 28% in the third quarter of 2021, with a more pronounced increase in the consumer discretionary sector relative to other sectors

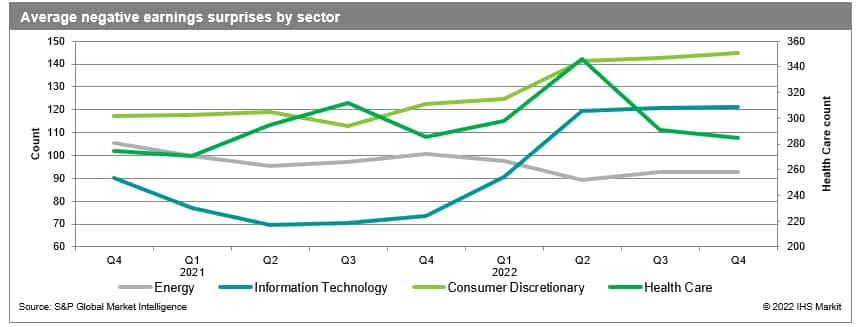

- Technology and consumer discretionary stocks have seen a notable increase in negative earnings surprises in the current quarter compared with the prior year, while energy's count decreased over the same period and health care dropped off more recently

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-sector-positioning-in-the-current-earnings-season.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-sector-positioning-in-the-current-earnings-season.html&text=Defensive+sector+positioning+in+the+current+earnings+season+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-sector-positioning-in-the-current-earnings-season.html","enabled":true},{"name":"email","url":"?subject=Defensive sector positioning in the current earnings season | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-sector-positioning-in-the-current-earnings-season.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Defensive+sector+positioning+in+the+current+earnings+season+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-sector-positioning-in-the-current-earnings-season.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}