Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 26, 2020

Diagnosing factor performance during epidemics

Research Signals - March 2020

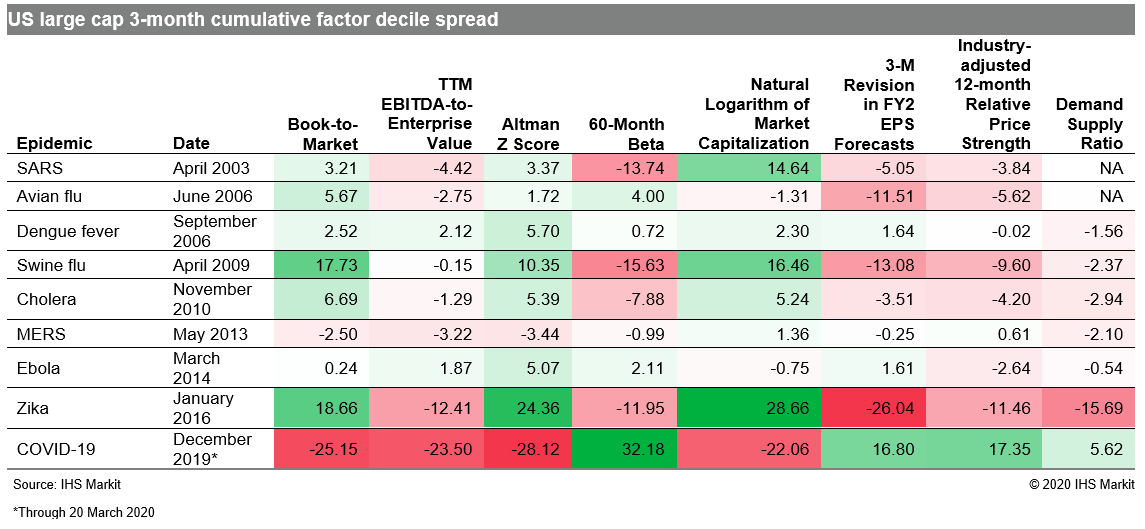

In the final week of February 2020, US stocks recorded their worst weekly loss, at that time, since the financial crisis on fears surrounding the coronavirus, significantly impacting factor performance. Further developments in subsequent weeks saw market volatility spilling over into early March, followed by the official end to the near 11-year bull market run while markets whipsawed on every piece of news. In prior epidemics the economic impact has tended to be temporary, although the initial global economic impact of COVID-19 has been harsher and more widespread. In this report, we attempt to add some sense of order to the chaos, with a review of factor performance during epidemics which have occurred since the turn of the century.

- In prior epidemics, 60-Month Beta, Natural Logarithm of Market Capitalization and, for the most part, Book-to-Market and Altman Z Score saw large magnitude factor performance early on and remained directionally the same over the longer term

- While each epidemic resided in its own unique market environment, underperformance was generally associated with 3-M Revision in FY2 EPS Forecasts and, to a lesser extent, with Industry-adjusted 12-month Relative Price Strength

- Across our style models, value strategies tended to outpace the growth and momentum strategies over the short term at the onset of prior epidemics

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdiagnosing-factor-performance-during-epidemics.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdiagnosing-factor-performance-during-epidemics.html&text=Diagnosing+factor+performance+during+epidemics+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdiagnosing-factor-performance-during-epidemics.html","enabled":true},{"name":"email","url":"?subject=Diagnosing factor performance during epidemics | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdiagnosing-factor-performance-during-epidemics.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Diagnosing+factor+performance+during+epidemics+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdiagnosing-factor-performance-during-epidemics.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}