Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 17, 2018

Digging down under quant performance

Research Signals - September 2018

As an export economy, Australia is vulnerable to global economic developments which have caused many global markets to decline in recent months. However, the Australian share market ended August trading near ten-year highs off early-April lows, despite trade tensions between major trading partners - the US and China - before correcting in the early days of September. Given the heightened trade rhetoric over the course of this year, we review the Australian economic landscape and recent quantitative model and factor performance within the Research Signals Global Factor Library.

- Services and manufacturing firms maintain a positive view on the outlook for the year, despite recent moderation in the private sector economy and outflows in equity ETFs

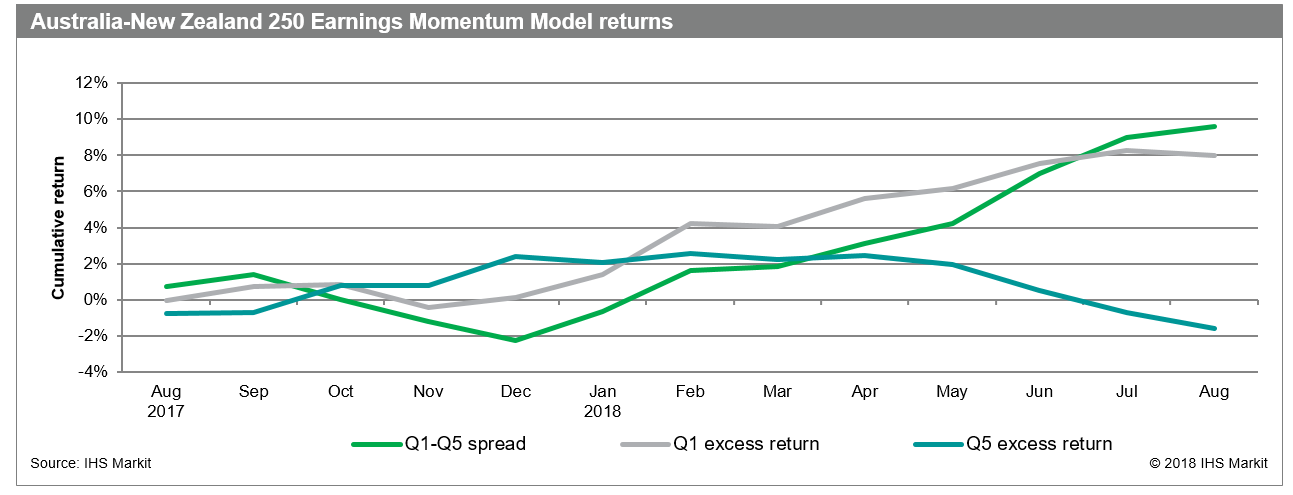

- All five of our thematic models recorded positive performance thus far this year for buy-rated stocks and negative returns for sell-rated stocks relative to the market, led by the Earnings Momentum (1.48% average monthly spread) and Price Momentum (1.20% average monthly spread) models

- From a long-only perspective, earnings revisions factors and measures of fundamental growth outperformed on average year-to-date, while low profits as a ratio of sales was successful in identifying underperforming stocks

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdigging-down-under-quant-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdigging-down-under-quant-performance.html&text=Digging+down+under+quant+performance+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdigging-down-under-quant-performance.html","enabled":true},{"name":"email","url":"?subject=Digging down under quant performance | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdigging-down-under-quant-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Digging+down+under+quant+performance+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdigging-down-under-quant-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}