Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 10, 2025

Emerging market growth ticks lower at end of 2024 as manufacturing expansion slows

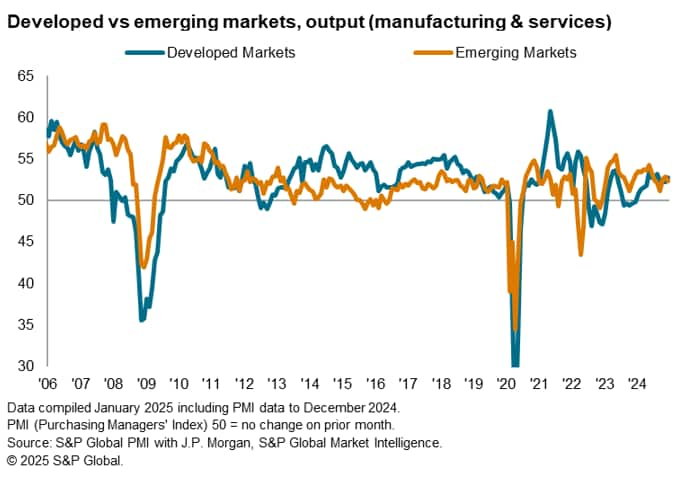

Emerging markets remained in growth territory in the closing month of 2024, albeit with the rate of growth being the softest recorded over the fourth quarter. This was attributed to a slowing manufacturing output expansion, which more than offset faster services growth in December.

Overall, the emerging market manufacturing sector continued to outperform developed markets even as some of the boost stemming from the front-running of tariffs fading in the latest survey period. Meanwhile the expansion of services activity also accelerated to a solid pace, with rising new business inflows signalling further growth in the coming months.

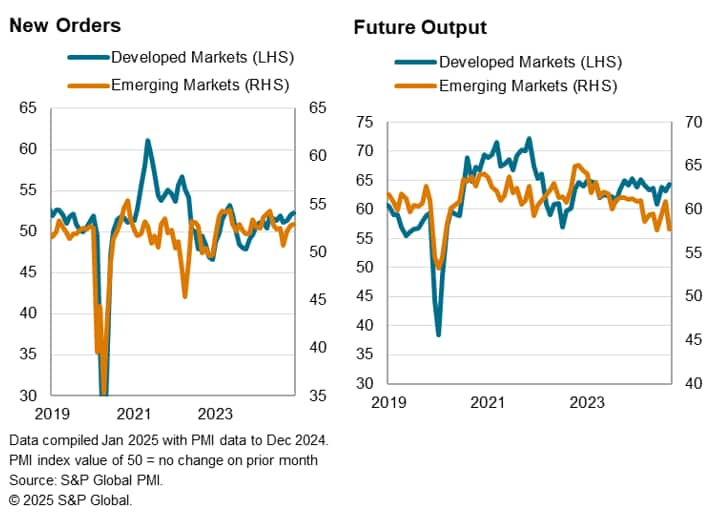

That said, sentiment among emerging market firms eased with business confidence about the year ahead slipping to the second-lowest since May 2020, contrasting with rising confidence in developed markets. This was reflective of concerns over the impact of tariffs upon global trade and demand for emerging market goods and services going into 2025.

Emerging market output growth eases to three-month low in December

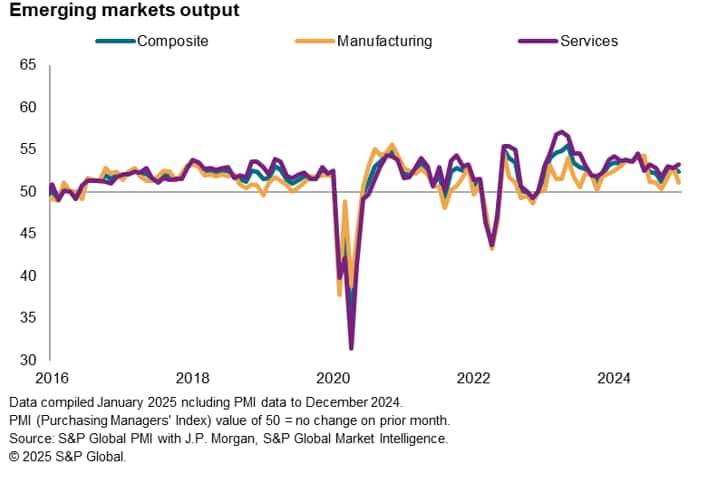

The PMI surveys compiled globally by S&P Global revealed that the rate at which output expanded across the collective emerging markets slowed for the first time since September. The GDP-weighted Emerging Market PMI Output Index slipped to 52.4 in December, down from 52.8 in November. This was mainly attributed to slower manufacturing output growth, as services activity rose at a quicker pace. The latest data also signalled that emerging markets have extended their growth streak to two years as of the end of 2024.

Compared with developed economies, emerging markets posted relatively slower growth for the first time in three months, albeit by only a small margin. Although the emerging markets' manufacturing sector outperformed that of the developed markets, the latter seeing goods output contract at a sharper pace at the end of 2024, developed markets' services activity growth accelerated to a faster pace than the emerging market counterpart, contributing to the outperformance.

Emerging market manufacturing sector US tariff-boost fades in December

While November had seen emerging market factory production expand at the quickest pace since July, the rate of growth eased to a near-neutral level at the end of 2024. This was largely attributed to the fading of the boost that came about with global manufacturers attempting to front-run potential US tariffs in the immediate aftermath of the US election. This was evident from the manufacturing new export orders gaugefor emerging markets, which posted above the 50.0 neutral mark in November to indicate expansion before sliding back into contraction territory in December.

In contrast, emerging market services activity remained in growth at the end of 2024. Moreover, the rate of expansion accelerated to the joint-fastest since May 2024 to highlight the strength of the sector. Although uncertainty regarding the outlook, including the interest rate outlook, heightened into the end of 2024, service sector performance in December was nevertheless buoyed by surging financial and consumer services activity, benefitting from looser financial conditions.

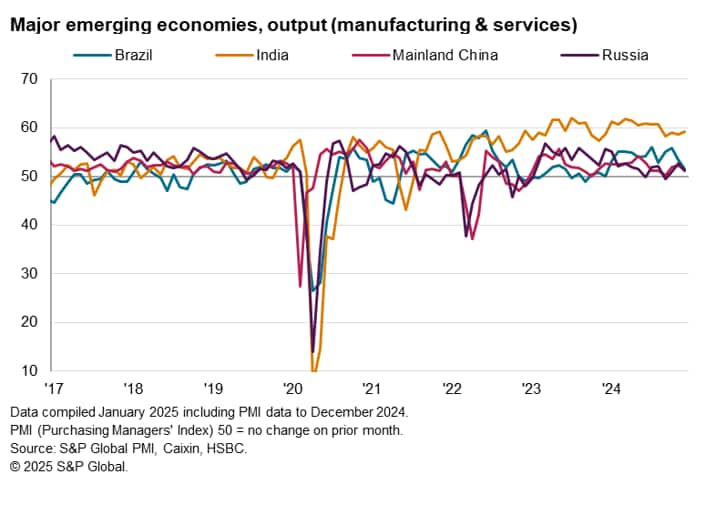

India bucks emerging market trend to post stronger growth in December

All four of the major emerging market economies remained in growth for a third straight month in December. That said, India was the only one to see the rate of growth accelerate from November, further remaining in the lead for the thirtieth month running. The improvement in performance for India was mainly attributed to the service sector as its manufacturing sector posted the weakest growth rate of 2024.

Meanwhile, Brazil, mainland China and Russia all saw their rates of growth wane from November. Specifically, mainland China saw its manufacturing output growth ease to only a marginal pace, underpinned by the abovementioned fading tariff-related boost, while services activity growth strengthened. But it was Brazil that saw the most pronounced softening of growth from November, as both its manufacturing and service sectors experienced an easing of growth from a solid pace.

Emerging market confidence hit by tariff concerns

Forward-looking indicators painted a positive picture for output growth heading into 2025. Notably, overall emerging market new orders rose at a quicker pace in December, the fastest in seven months. This was mainly due to greater services new business inflows, but manufacturing new orders also remained in expansion, contrasting with the broader global picture of falling goods demand. The overall level of unfinished work also increased for a second successive month in December, though driven primarily by rising services backlogs. Altogether, the latest data hinted at the likelihood for emerging market output - both manufacturing and services - to remain on the rise in the coming months.

That said, while confidence improved in November, supported by the brief boost to emerging market output as businesses attempted to front-load their purchases ahead of potential US tariffs, the effect faded at the end of the year. The Emerging Market PMI Future Output Index slipped to the second-lowest level since May 2020, falling further below the series average. Concerns rose surrounding the potential for US tariffs to disrupt trade for emerging markets, thereby weighing on views regarding future output growth in the region. This will remain an area to watch, with further pressure on business confidence potentially limiting demand down the road.

Margin pressures rise for emerging market firms

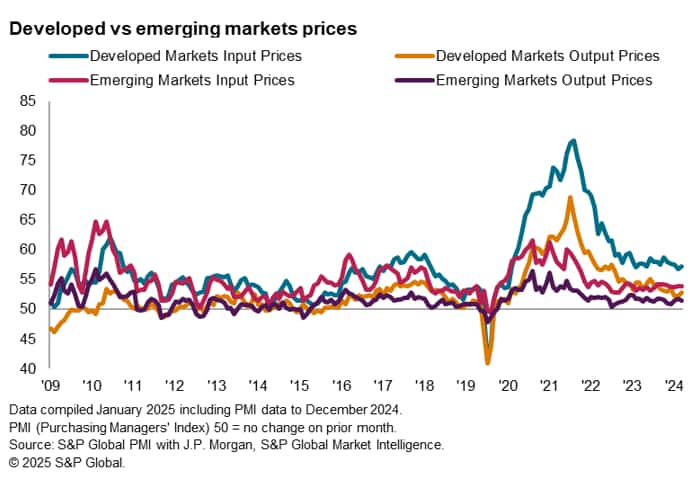

Finally on prices, input cost inflation remained unchanged in December, which was a rate close to the 2024 average. An intensification of services cost pressures more than offset softening cost inflation for goods producers.

More importantly, although input cost pressures stayed unchanged at the end of 2024, selling price inflation eased in December with emerging market manufacturers notably raising selling prices only fractionally. The rate of manufacturing output price inflation was the joint-lowest since July 2023, barring March 2024 (where output prices were unchanged). The latest price trends for the emerging market manufacturing sector therefore showed some intensification of profit margin pressures, which outlined the broader manufacturing sector malaise affecting the global economy.

Overall, the latest emerging market price trends remain supportive of central banks in the region lowering rates. However, with the incoming US administration expected to introduce trade tariffs and other policies that could cause the Fed to pause or slow their rate cuts, emerging market economies could be either directly or indirectly affected.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-ticks-lower-at-end-of-2024-as-manufacturing-expansion-slows-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-ticks-lower-at-end-of-2024-as-manufacturing-expansion-slows-Jan25.html&text=Emerging+market+growth+ticks+lower+at+end+of+2024+as+manufacturing+expansion+slows+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-ticks-lower-at-end-of-2024-as-manufacturing-expansion-slows-Jan25.html","enabled":true},{"name":"email","url":"?subject=Emerging market growth ticks lower at end of 2024 as manufacturing expansion slows | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-ticks-lower-at-end-of-2024-as-manufacturing-expansion-slows-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+growth+ticks+lower+at+end+of+2024+as+manufacturing+expansion+slows+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-ticks-lower-at-end-of-2024-as-manufacturing-expansion-slows-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}