Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 10, 2025

Week Ahead Economic Preview: Week of 13 January 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Inflation rates awaited for US, eurozone and UK markets

Markets will be eager to assess updated inflation data for some of the world's largest economies in the coming week, seeking clues as to the stickiness of price pressures at a time of bond market stress, geopolitical concerns and rising uncertainty in relation to central bank policy paths.

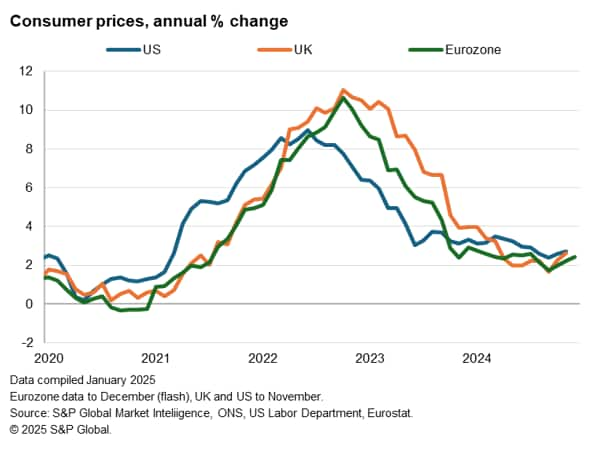

Inflation has been back on the rise, and fresh data for December will be eyed for signs as to whether the upswing has persisted into the year-end. Headline consumer price inflation rose for a second consecutive month in the US during November, lifting from 2.6% in October to a four-month high of 2.7%. In the UK, a second successive monthly acceleration was also recorded in November, the headline rate up from 2.3% to an eight-month high of 2.6%. The eurozone's preliminary estimate for December has meanwhile seen headline CPI rise 2.4% on a year ago, reaching a five-month high after having now accelerated for three successive months.

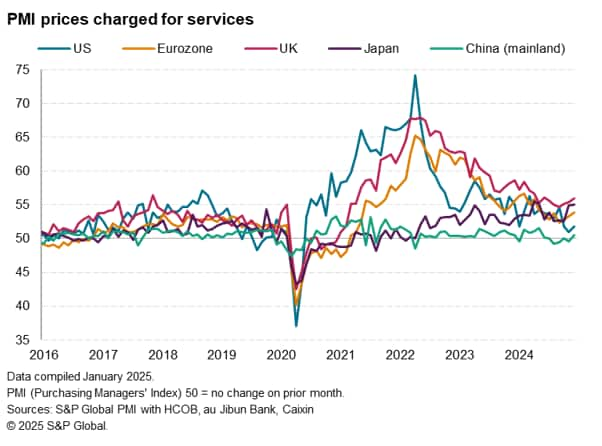

In all three cases, inflation has therefore already risen further above central bank targets even before we see the potential inflationary impact of tariffs and new immigration policies in the US, and rising labour cost burdens on employers in the UK. December PMI data also showed services inflation ticking higher in all three cases.

This has caused concern that central banks may be limited in their scope to reduce interest rates in 2025, contributing to bond market stresses. Such reduced room for manoeuvre could be especially worrying for the UK and Eurozone, which are flirting with downturns and where depreciating currencies could add to price pressures. Hence updated monthly GDP data for the UK and industrial production numbers for the eurozone will be monitored in the coming week for stagflation risks.

Over in Asia, the key data to watch is fourth quarter GDP for mainland China. Growth was just 4.6% in the third quarter and PMI data remained relatively weak throughout the closing months of 2024.

Meanwhile, for an insight into sentiment among money managers at the start of 2025, look out for the S&P Global Investment Manager Index, published Tuesday.

Key diary events

Monday 13 Jan

Japan Market Holiday

India Inflation (Dec)

United States Consumer Inflation Expectations (Dec)

United States Monthly Budget Statement (Dec)

Global GEP Supply China Volatility Index* (Dec)

Tuesday 14 Jan

Australia Westpac Consumer Confidence Change (Jan)

Italy Industrial Production (Nov)

United States PPI (Dec)

S&P Global Investment Manager Index* (Jan)

Wednesday 15 Jan

Indonesia Trade (Dec)

Japan Machine Tool Orders (Dec)

Germany Wholesale Prices (Dec)

United Kingdom Inflation (Dec)

United Kingdom Regional Growth Tracker* (Dec)

France Inflation (Dec, final)

Spain Inflation (Dec, final)

Germany Full Year GDP

Eurozone Industrial Production (Nov)

United States Inflation (Dec)

Thursday 16 Jan

Australia Unemployment (Dec)

South Korea BoK Interest Rate Decision

Germany Inflation Rate (Dec, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Nov)

United Kingdom Goods Trade Balance (Nov)

United Kingdom Bellwether Report* (Dec)

Italy Inflation (Dec, final)

Eurozone Balance of Trade (Nov)

Canada Housing Starts (Dec)

United States Retail Sales (Dec)

United States Export and Import Prices (Dec)

United States Business Inventories (Nov)

United States NAHB Housing Market Index (Jan)

Friday 17 Jan

Singapore Non-Oil Exports (Dec)

China (Mainland) House Price Index (Dec)

China (Mainland) GDP (Q4)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment (Dec)

China (Mainland) Unemployment Rate (Dec)

Malaysia GDP (Q4)

United Kingdom Retail Sales (Dec)

Indonesia BI Interest Rate Decision (Jan)

Eurozone Inflation (Dec, final)

Eurozone Current Account (Nov)

United States Housing Starts (Dec)

United States Building Permits (Dec, prelim)

United States Industrial Production (Dec)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US inflation, retail sales, industrial production and building permits data

The key release of the week will be US inflation data for December, being a key data point for the Fed amidst the uncertainties shrouding the path forward for policies and economic trajectories. According to consensus, both the headline and core CPI are expected to remain little changed from November. This is largely in line with the trends shown by S&P Global US PMI prices data, where price pressures remained subdued but rose slightly in December. Diverging manufacturing and services PMI output trends meanwhile hint at robust retail sales data contrasting with weak industrial production numbers.

EMEA: UK inflation, monthly GDP and retail sales data; Eurozone inflation and industrial production

The UK will publish December's inflation data on Wednesday. According to the latest December S&P Global UK PMI prices data, inflation pressures intensified at the end of 2024. As PMI price data tend to precede the trend for official CPI, the data are therefore suggesting that UK core CPI like likely to remain a concern to policymakers. November's GDP data is meanwhile expected to show softening growth following the indications from S&P Global UK Composite PMI data. The weakness is focused on the manufacturing sector, but services activity growth also slowed in November.

Separately, the final December eurozone inflation data will be due at the end of the week with the annual rate up from 2.2% to 2.4% according to flash data.

APAC: China GDP, industrial production and retail sales data; India inflation; BoK meeting; Australia employment

A series of releases from mainland China will include fourth quarter GDP to round off 2024 and monthly activity data such as industrial production and retail sales. The market is looking for a print slightly above 5%, in line with the performance observed from Caixin China PMI data in the final quarter of the year. Industrial production numbers are also expected, whereby the rate of growth may soften from November according to the manufacturing PMI.

S&P Global Investment Manager Index and Global Supply Chain Volatility Index

The January S&P Global Investment Manager Index will be published on Tuesday, January 14, for indications into sentiment among money managers just ahead of the change in US government.

Separately, December's GEP Global Supply Chain Volatility Index will also be published for insights into trade conditions ahead of potential US tariff announcements.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-january-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-january-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+13+January+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-january-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 13 January 2025 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-january-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+13+January+2025+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-january-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}