Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 13, 2024

Emerging markets growth remains solid amid intensifying inflationary pressures

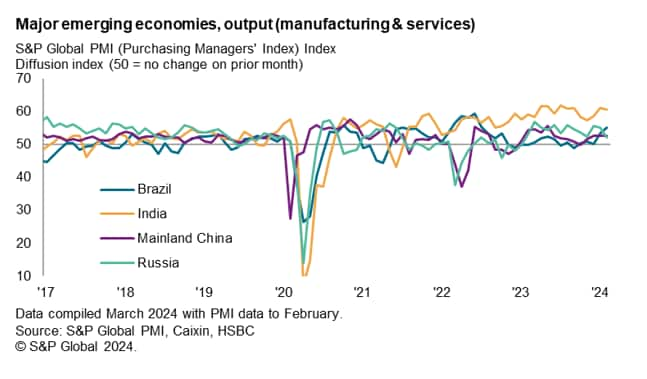

Emerging markets continued to expand at a solid pace midway into the first quarter of 2024, supported by broad-based expansion across both manufacturing and service sectors. India remained the brightest spot in the emerging market space, though major emerging economies such as Brazil, mainland China and Russia all recorded growth as well.

Forward-looking indicators hinted at sustained growth across emerging markets with rising new orders and high level of optimism observed on aggregate. That said, signs of excess capacity can be seen with fresh reductions across backlogs and staffing levels in February. Overall, price pressures have also intensified in the latest survey period.

Broad-based expansion for emerging markets

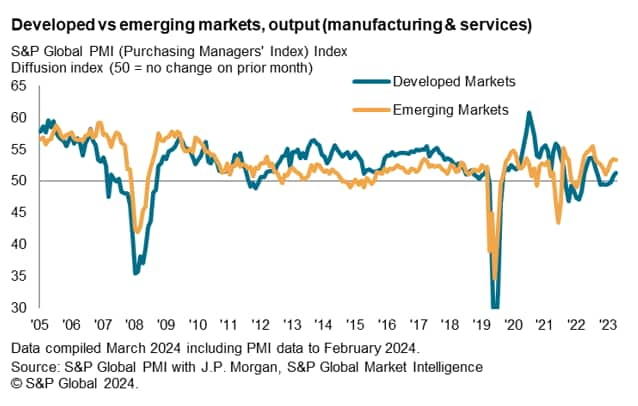

The emerging market expansion sustained into the second month of 2024, according to PMI data, extending the sequence of growth that commenced in January 2023. Despite slowing slightly from the start of the year, the rate of expansion remained amongst the fastest in the past eight months and also surpassed that of developed markets, the latter seeing growth accelerate to the fastest since June 2023. This has altogether been supportive of global growth midway into the first quarter.

Detailed sector data showed manufacturing output growth accelerating to the fastest since May 2023 across emerging markets and was solid overall. The expansion of services activity meanwhile slowed in February, but remained solid overall and continued to outpace that of manufacturing for a fifth straight month.

Among the four major emerging market economies, India continued to be ranked first as the fastest growing nation even as the rate of output expansion - owing to the slowdown in services activity - eased in February. Brazil followed with the rate of output growth accelerating to a 19-month high on the back of improving manufacturing sector conditions. Mainland China and Russia likewise contributed to the emerging market expansion in February, despite registering only moderate rates of growth.

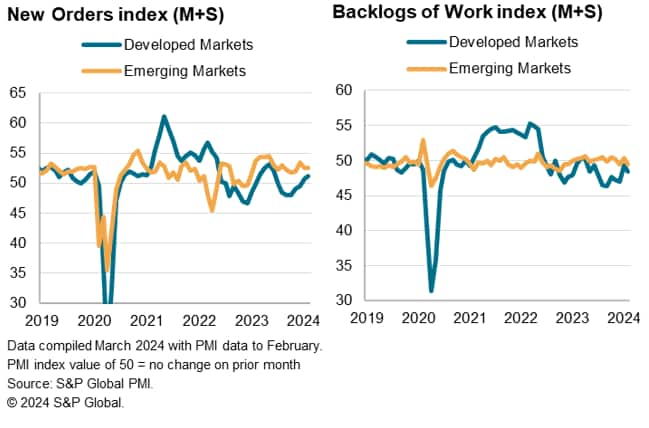

Signs of spare capacity develop

Incoming new orders for emerging market goods and services continued to rise in February at a rate that was solid, and little changed from January. This was supported by an acceleration of new export orders growth in February, which reflected improving trade conditions for emerging markets. The expansion in overall new orders therefore hinted at sustained output expansion in the near term, with emerging market firms further maintaining a positive outlook on output in the 12 months ahead.

That said, the level of confidence among emerging markets remained below average when compared historically. Furthermore, signs of spare capacity have started to show with the level of backlogs falling in February while job shedding also occurred for the third time in 13 months. The rates at which the level of backlogged work were depleted and employment levels fell were nevertheless marginal, but will be worth watching in the months ahead.

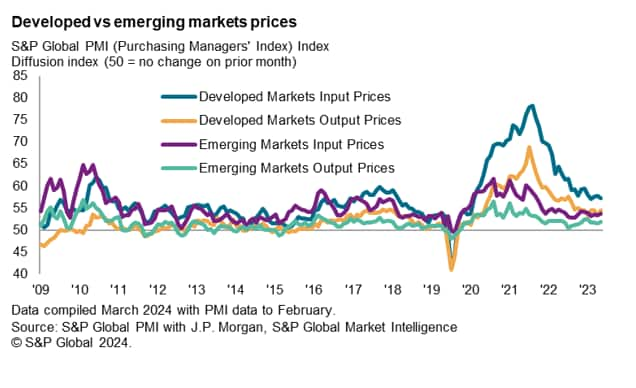

Inflation pressures mount in February

To some extent, business confidence across emerging markets was affected by inflation concerns in February. Overall input prices rose at the fastest rate since last October. Sector data further revealed that both manufacturing and service sectors' input cost inflation increased in the latest survey period amidst reports of rising worldwide shipping costs.

The intensification of input cost pressures therefore led to emerging market firms to raise their selling prices at the quickest pace in four months. Notably, the rate of inflation also returned to a level above the series average to reflect elevated selling price inflation.

Overall, however, the rate of output price inflation across emerging markets remained subdued below the rolling 12-month average globally in February, despite developed market selling price inflation similarly rising in the latest survey period. This suggested that the latest rise in inflation rates is unlikely to upend central bankers in their rate cut plans into 2024, but will nevertheless be worth watching for the extent to which central bankers will lower rates in the year, especially given manufacturing demand only recently recovered globally.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-remains-solid-amid-intensifying-inflationary-pressures-mar24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-remains-solid-amid-intensifying-inflationary-pressures-mar24.html&text=Emerging+markets+growth+remains+solid+amid+intensifying+inflationary+pressures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-remains-solid-amid-intensifying-inflationary-pressures-mar24.html","enabled":true},{"name":"email","url":"?subject=Emerging markets growth remains solid amid intensifying inflationary pressures | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-remains-solid-amid-intensifying-inflationary-pressures-mar24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+growth+remains+solid+amid+intensifying+inflationary+pressures+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-remains-solid-amid-intensifying-inflationary-pressures-mar24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}