Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 09, 2018

Equity and credit bears stick with their winnners

- Short sellers add to position as Diebold Nixdorf shares plummet

- CBL & Associates equity and bond shorts hold position amid sell-off

- Most shorted US equities underperform in July & Aug after brutal June

There have been causes for cheer, as well as gloom, amongst short sellers during Q2 earnings season. As a backdrop: In July, the most shorted US equities had their best relative under-performance to the broader market since October 2017, with the most shorted stocks being flat, while the broader market advanced. That followed a brutal stretch of four months of the most shorted outperforming, which culminated in an absolute blood-letting in the first half of June, when the most shorted stocks outperformed by 3.5% on average. While it has certainly been a challenging year on the short side, there have been some bright spots recently.

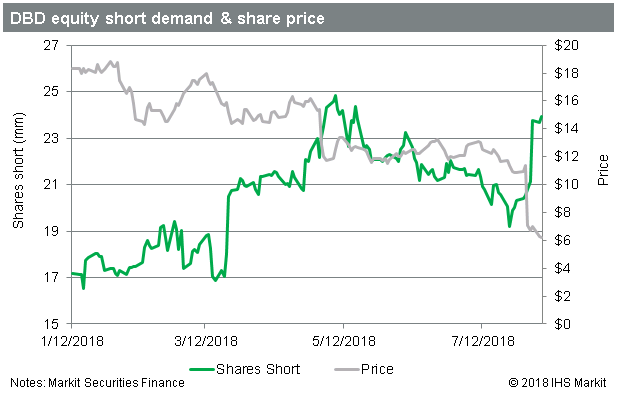

On August 1st Diebold Nixdorf reported a $0.21 per share loss on better than expected revenues, sending shares into a tailspin as analysts had forecast a $0.01 per share profit, per Factset. In the week since the report shares have fallen more than 50%, reaching the lowest point since the firm's initial growth phase in the early 1980's. Equity shorts have increased their position by 3.4m shares since Aug 1st, for a total of 29.3m shares or 31% of free float. In dollar terms, the position has been taken down from a YTD high of $352m on April 30th to $150m at present, owing to the declining share price.

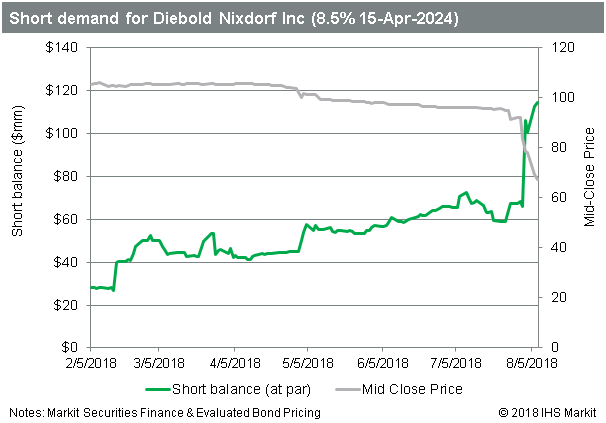

Notably, short demand for the DBD 8.5% 2024 bond has also spiked following the earnings report, as the bonds have also been in a free-fall, hitting a new low of 67 cents on the dollar on August 7th, after having traded down from 92 cents on July 31st. The short position in the 2024's is currently $114m at par, up from $68m prior to the earnings report.

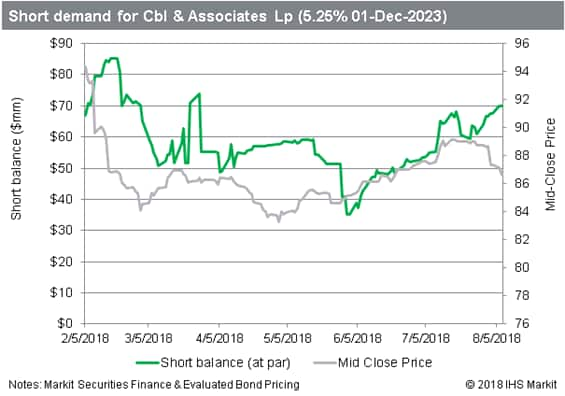

CBL & Associates also reported on August 1st, and while the firm beat expectations for revenue and earnings, the shares traded down 11% over concerns relating to the firm's dividend, as comments from CEO Stephen Lebovitz on the conference call were interpreted as foreshadowing another dividend cut. Equity short sellers have reduced their short position by 765k shares following the announcement, indicating that the selling pressure resulted from investors reducing positions on the long side.

While there was a potential positive for CBL bondholders, in that Lebovitz mentioned a desire to refrain from issuing further debt, the bonds sold off along with the equity. Credit shorts added $10m to positions in the bonds maturing in 2023 and 2026, bringing the total to $133m.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-and-credit-bears-stick-with-their-winnners.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-and-credit-bears-stick-with-their-winnners.html&text=Equity+and+credit+bears+stick+with+their+winnners+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-and-credit-bears-stick-with-their-winnners.html","enabled":true},{"name":"email","url":"?subject=Equity and credit bears stick with their winnners | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-and-credit-bears-stick-with-their-winnners.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Equity+and+credit+bears+stick+with+their+winnners+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-and-credit-bears-stick-with-their-winnners.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}