Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 10, 2018

Turkey and CDS Liquidity

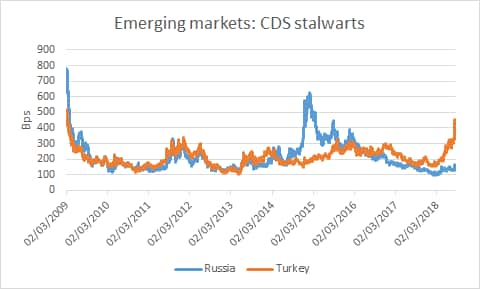

Emerging market sovereigns are regarded as stalwarts of the CDS market. Liquidity is dependable - participants can usually trade in large size with relatively low transaction costs and little price impact. Those that offer doom-laden predictions about the single name product clearly pay little heed to emerging market names.

Turkey is a case in point. The sovereign has been under pressure for some time, primarily due to the markets losing confidence in the government's handling of the economy. In particular, the central bank's credibility on monetary policy has been damaged by political interference. This has led to a sharp depreciation in the Turkish lira, a serious problem for a country with a large current account deficit and a corporate sector burdened with dollar and euro-denominated short-term debt. To make matters worse, the US imposed sanctions on two Turkish ministers earlier this month in relation to a jailed American pastor. This has escalated into a damaging rift with its most important ally.

Unsurprisingly, this calamitous turn of events has led to a marked deterioration in Turkey's credit standing. The sovereign's five-year CDS spreads were trading at 158bps at the beginning of the year; now they are quoted at 477bps, the widest level since 2009. Critics of CDS would no doubt point to low volumes undermining the validity of market moves. In this instance they would be wrong.

Turkey has an IHS Markit Liquidity Score of '1', an indication of strong liquidity. There are 10 dealers quoting on the name and a bid/ask spread of 5bps, while nearly $4 billion in gross notional was traded last week - a considerable amount given the traditionally quiet time of year.

And it is not just Turkey that exhibits solid liquidity. Russia's spreads have reached their widest levels - 166bps - since this time last year after the US announced a fresh round of sanctions in response to the nerve agent attack on a British citizen. Again, the spread movement was backed by meaningful activity. Almost $1.5bn was traded last week, with 10 dealers quoting and a bid/ask spread of just 3bps. Like Turkey, Russia has a stellar IHSM Liquidity Score of '1'.

It would be foolish to deny that there are liquidity challenges in the CDS market, particularly in names that aren't index constituents or centrally cleared. But it also needs to be said that there are hundreds of CDS names that are highly liquid and provide vital hedging and positional capabilities for market participants. Unfortunately, this point can sometimes be lost amid the flurry of negative coverage in some areas of the press.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-and-cds-liquidity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-and-cds-liquidity.html&text=Turkey+and+CDS+Liquidity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-and-cds-liquidity.html","enabled":true},{"name":"email","url":"?subject=Turkey and CDS Liquidity | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-and-cds-liquidity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Turkey+and+CDS+Liquidity+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-and-cds-liquidity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}