Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 22, 2018

Flash PMI points to firmer growth of Japanese manufacturing despite export decline

- Flash manufacturing PMI improves in June

- Exports fall for first time in nearly two years

- Rising price pressures amid supply shortages

The Japanese manufacturing sector continued to enjoy robust growth at the end of the second quarter, according to the flash Nikkei PMI. However, there were further signs of easing demand, especially in export markets, calling into question the sustainability of the current upturn.

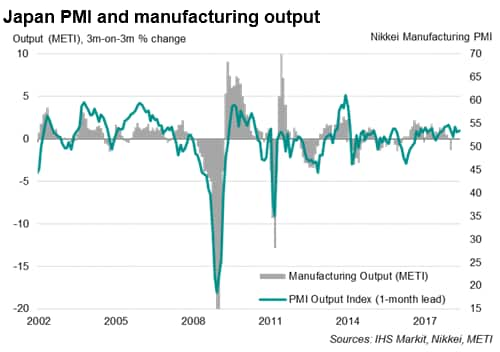

Softer quarterly gain

The Nikkei Japan Manufacturing PMI™ rose to 53.1 in June from 52.8 in May, according to the preliminary flash reading. This took the second quarter average to 53.2, which is indicative of a reasonably robust rate of growth despite being lower than the first quarter.

The outlook appeared mixed. While order book growth moderated further and optimism dipped, factory job creation quickened and input buying picked up.

Export decline

The most compelling sign of output growth potentially waning in July came from the survey's index of new orders, which hit a ten-month low. Slower new order growth was in part due to a disappointing export performance. Overseas sales fell for the first time in nearly two years, a reflection of cooling trade conditions across the world in recent months.

New orders have now grown at a slower rate than output for three successive months, reversing the trend of production lagging behind orders in the prior five months and suggesting production capacity could start to be reined-in.

With the external market being a major driver of Japan's manufacturing industry, the fall in foreign sales at the end of the second quarter raises concerns of future growth. While positive, the PMI data indicated that business confidence relating to output in the year ahead fell from the previous month, dropping slightly below the first half average for 2018.

Supply woes

Another area of concern is the potential damaging impact of over-stretched supply chains. Anecdotal evidence revealed that delivery delays had resulted in some cases of lost sales. The recent run of solid global demand has far outstripped supply for many key inputs. Global shortages of manufacturing inputs such as metal and electronic components have therefore added to goods producers' woes. The extent of the deterioration in delivery times remained marked in June, and greater than the historical trend.

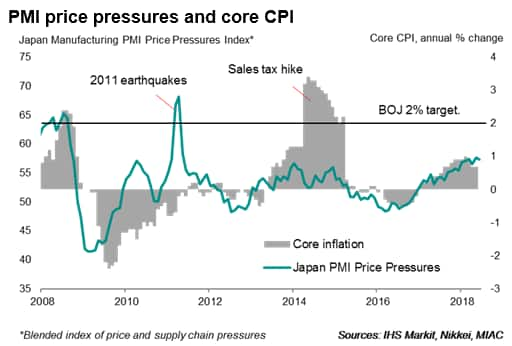

Elevated cost pressures

The PMI survey's gauges of prices meanwhile remained elevated compared to recent years. Increased oil prices were a major reason cited for higher producer costs, but there were also reports of higher prices for metals such as steel and aluminium. Input cost inflation consequently rose to the fastest for three-and-a-half years. The rate of increase in average output prices was among the greatest since before the height of the global financial crisis as firms passed higher costs on to customers.

Monetary policy

Higher prices charged for Japan's manufactured goods is encouraging for inflation watchers, but the rate of increase remained modest, which suggests that subdued levels of consumer inflation may not be given a significant boost. Core CPI stayed at 0.7% in May, far below the 2% goal.

In fact, there are expectations that the Bank of Japan may lower its forecast for consumer price growth at its July policy meeting. Any downgrades in the inflation outlook however are not likely to pave the way for further monetary easing. The removal of the timeframe for hitting its inflation target is now seen as a move to deter markets from linking the failure to achieve the inflation goal to more aggressive policy changes.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-points-to-firmer-manufacturing-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-points-to-firmer-manufacturing-growth.html&text=Flash+PMI+points+to+firmer+growth+of+Japanese+manufacturing+despite+export+decline+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-points-to-firmer-manufacturing-growth.html","enabled":true},{"name":"email","url":"?subject=Flash PMI points to firmer growth of Japanese manufacturing despite export decline | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-points-to-firmer-manufacturing-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+points+to+firmer+growth+of+Japanese+manufacturing+despite+export+decline+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-points-to-firmer-manufacturing-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}