Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 21, 2018

PMI data indicate headwinds to copper prices

- Copper prices rise by 5% during first two weeks of June

- PMI data suggest the recent price hike is speculative

- Global copper users PMI and copper supply shortages at manufacturing firms remain below trend

Copper prices rose markedly in the first two weeks of June on the back of supply shortage fears and bullish price speculation. However, survey data suggest that current demand and supply fundamentals present a significant headwind for future copper price growth.

Using the copper PMI as a forward indicator

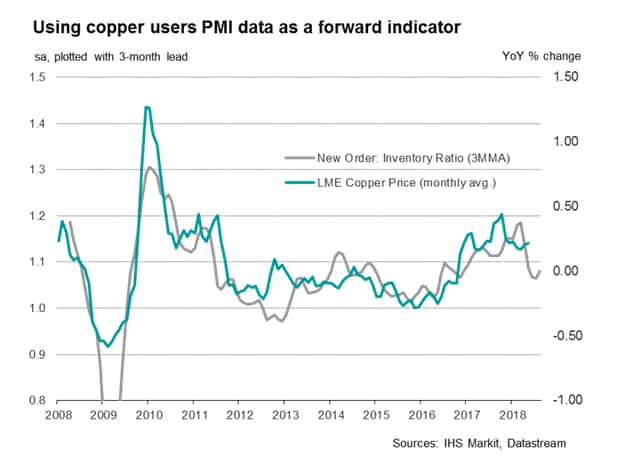

A global PMI index based on business trends at copper-using manufacturers exhibits a strong positive correlation with copper prices, beating the widely-used broader global manufacturing PMI. Furthermore, a ratio of new orders and stocks of finished goods at copper-intensive firms gives a powerful forward-looking indicator for copper demand and price. Taking a three-month smoothed average of the new order/stocks of finished goods ratio gives a positive correlation of 0.79, with the survey data acting with a three-month lead on copper prices. This indicator has predicted every major turning point over the past ten years with the exception of just one miss in 2012.

The month of May saw an uptick in the new order: inventory ratio, but the indicator nevertheless remained at a level not historically supportive of rising copper prices. In fact, the indicator is consistent with flat copper prices over the next three months.

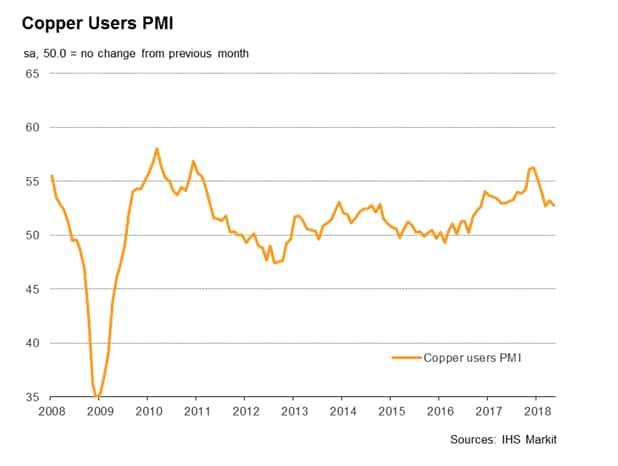

Modest growth at copper-using firms

In addition to the neutral price outlook, the latest PMI data also presented a modest outlook for global copper demand. At 52.8, the Copper Users PMI remained in positive territory scoring above the neutral 50.0 mark, although it was notably below levels seen at the tail-end of last year. Furthermore, job creation among copper using companies eased to a 20-month low, suggesting a reduced need to build capacity, linked in part to export sales growth at copper using businesses falling to a two-year low in May. Fewer capacity needs were also seen in copper-using companies' supply chains. While supplier delivery times continued to lengthen, the extent of delays was the smallest seen in the past four months.

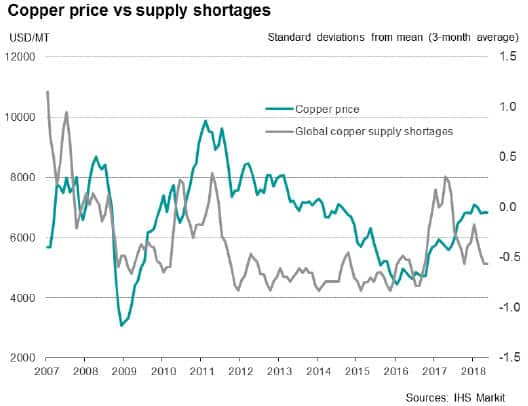

Shortages?

Looking specifically at copper supply, prices are primarily being driven up by fears of supply disruption at the Escondida mine in Chile, the world's largest producing mine. However, the latest IHS Markit Price & Supply Monitor data indicated that copper shortages reported by companies worldwide remained subdued in the context of historical data, with May supply shortage data running at the lowest since October of last year.

Future Outlook

Supply and demand fundamentals monitored by PMI data highlight the possibility that recent higher prices have been the result of speculative pricing in copper markets midway through June, rather than an actual current imbalance of supply and demand fundamentals. Analysis of the Copper Users PMI sub-indices suggest that copper prices may remain flat over the next quarter, providing no further supply side upsets. Furthermore, tightening monetary policy in the US and a stronger dollar will likely provide a further damper to copper price gains.

PMI data provide key guide to metals demand fundamentals

The copper PMI data are derived from IHS Markit's PMI surveys, and include monthly information provided by around 1,500 copper-using manufacturers across the world.

Using data from our established survey panels across Asia, Europe and the US, IHS Markit also produce data tracking trends at aluminium- and steel- intensive goods producers. Data cover indexes for output, new orders, new export orders, input purchasing, stock holdings, prices, vendor delivery times and employment.

The next Copper Users' PMI is released on 9th July.

For further information on commodities PMI data, please contact economics@markit.com.

Sam Teague, Economist, IHS Markit

Tel: 01491 461 018

Email: sam.teague@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-indicate-headwinds-to-copper-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-indicate-headwinds-to-copper-prices.html&text=PMI+data+indicate+headwinds+to+copper+prices+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-indicate-headwinds-to-copper-prices.html","enabled":true},{"name":"email","url":"?subject=PMI data indicate headwinds to copper prices | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-indicate-headwinds-to-copper-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+indicate+headwinds+to+copper+prices+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-indicate-headwinds-to-copper-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}