Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2022

Flash PMI survey data signal growing impact from rate hikes on economy and inflation

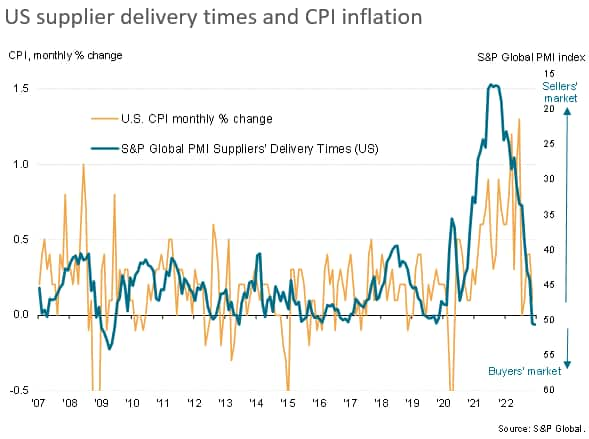

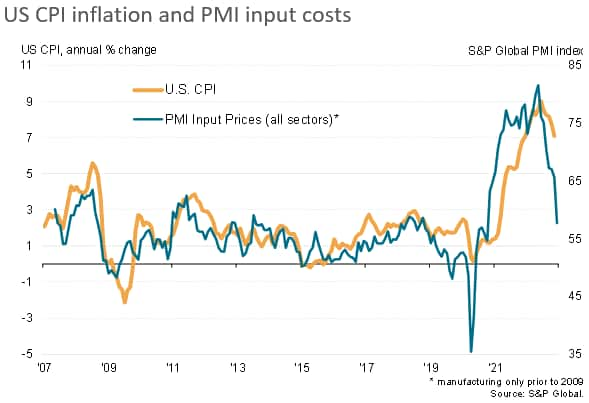

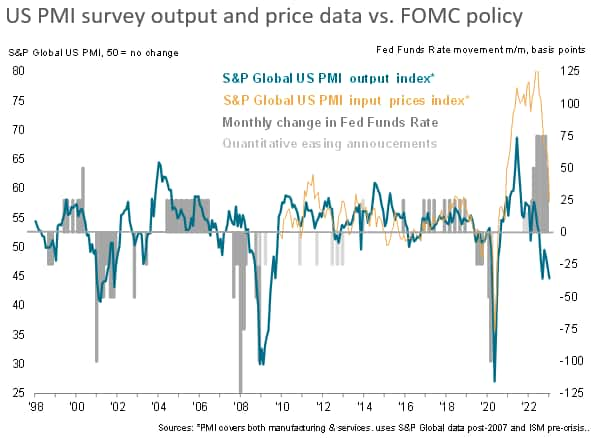

December saw the US economic downturn gather momentum, according to early PMI survey data, as demand for goods and services slumped at one of the steepest rates seen since the global financial crisis. Jobs growth slowed as a result, with further labour market softness signalled for the coming months. However, the slump in demand has brought about an easing of supply constraints, which has in turn led to one of the largest monthly drops in input cost inflation seen in the PMI survey history. Consumer price inflation should consequently moderate further as we head into 2023.

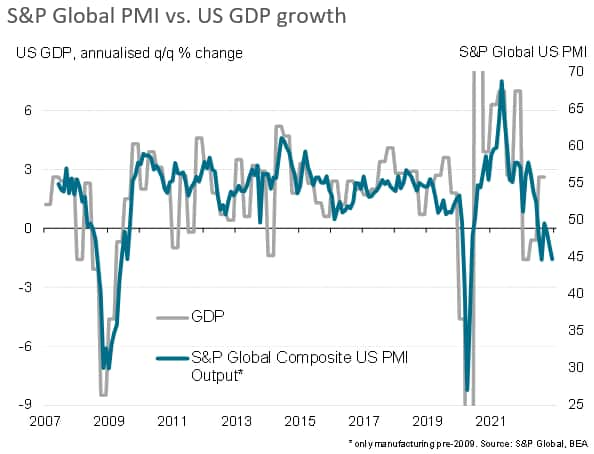

PMI signals fourth quarter GDP decline

Business conditions are worsening as 2022 draws to a close. The headline Flash US PMI Composite Output Index registered 44.6 in December, down from 46.4 in November, to signal the joint-fastest decline in business activity for over two-and-a-half years as 2022. Excluding the initial pandemic period, the downturn over the fourth quarter as a whole has been the sharpest since 2009. Comparisons with official data suggest that the PMI is indicative of GDP contracting in the fourth quarter at an annualised rate of around 1.5%.

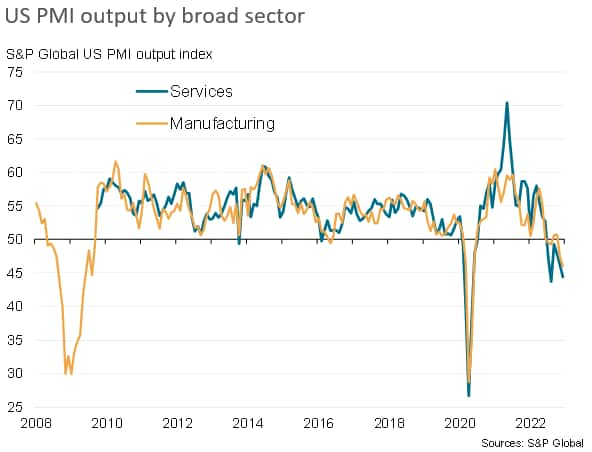

Output fell sharply in both manufacturing and services to register a broad-based deepening of the downturn facing the US economy.

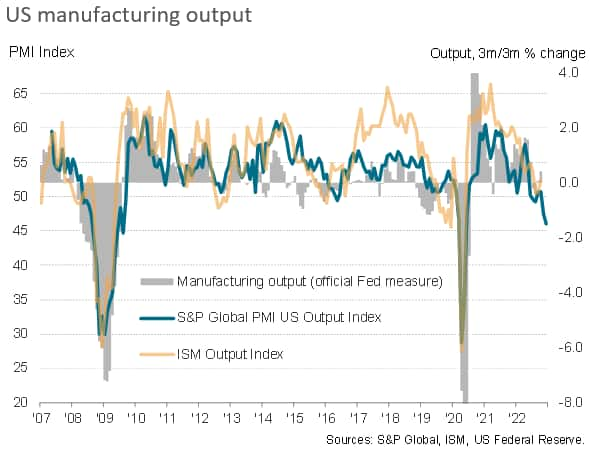

From a manufacturing output perspective, for example, the S&P Global PMI survey is now indicating a quarterly rate of decline of around 2%, and hints at a weakening in the upcoming ISM December survey's production index.

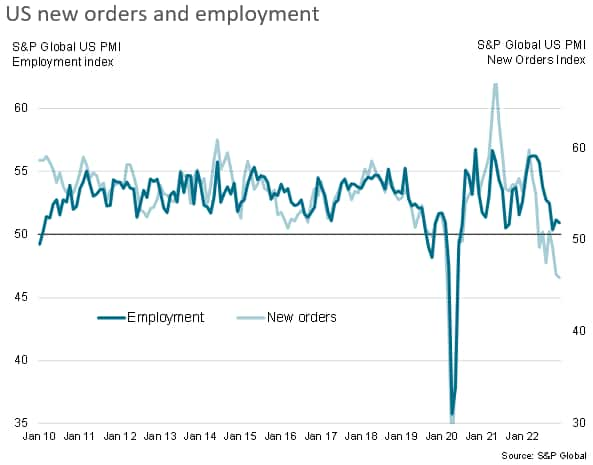

Slumping demand means less need for workers

Jobs growth has meanwhile slowed to a crawl as firms across both manufacturing and services take a much more cautious approach to hiring amid a slump in customer demand. New order inflows across manufacturing and services, a leading indicator of hiring, are now falling at a rate not seen since the global financial crisis if the initial lockdown months of 2020 are excluded.

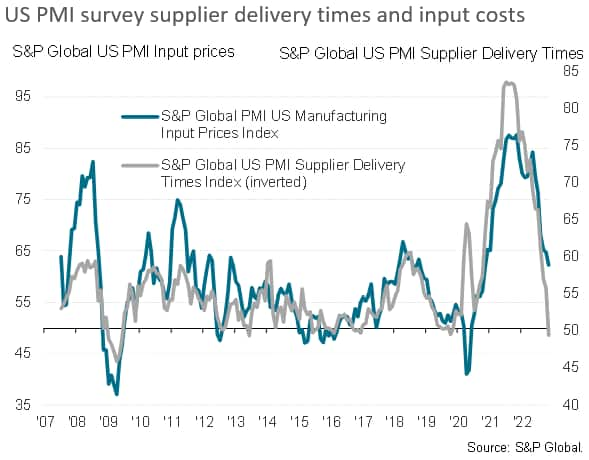

Supply chains continue to heal

The upside is that weaker demand has taken pressure off supply chains which had been stretched during the pandemic. December saw a second successive month of faster supplier delivery times, a phenomenon which not only signals improving supply conditions but also tends to herald the shifting of pricing power away from the seller towards the buyer.

Hence price pressures continue to moderate sharply. In fact, December saw the largest monthly cooling of firms' input cost inflation seen in the 13 year history of the survey barring only the lockdown related slump in April 2020.

Policy impact

In short, the PMI survey data from S&P Global suggest that Fed rate hikes are having the desired effect on inflation, but that the economic cost is building and recession risks are consequently mounting.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-survey-data-signal-growing-impact-from-rate-hikes-on-economy-and-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-survey-data-signal-growing-impact-from-rate-hikes-on-economy-and-inflation.html&text=Flash+PMI+survey+data+signal+growing+impact+from+rate+hikes+on+economy+and+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-survey-data-signal-growing-impact-from-rate-hikes-on-economy-and-inflation.html","enabled":true},{"name":"email","url":"?subject=Flash PMI survey data signal growing impact from rate hikes on economy and inflation | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-survey-data-signal-growing-impact-from-rate-hikes-on-economy-and-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+survey+data+signal+growing+impact+from+rate+hikes+on+economy+and+inflation+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-survey-data-signal-growing-impact-from-rate-hikes-on-economy-and-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}