Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 19, 2022

Week Ahead Economic Preview: Week of 19 December 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

More central bank meetings are expected in the coming week across Japan and Indonesia following a busy week in which the Fed and ECB signalled further rate hikes in the coming months. The US core PCE figures and final Q3 GDP readings will also be anticipation in addition to personal income and consumption figures. In Europe, the UK also releases revised Q3 GDP numbers while the eurozone consumer confidence figures will be eagerly assessed for signs that any downturn is being softened by lower inflation prospects and fiscal help with the region's energy crisis. China's Loan Prime Rate will also be updated alongside key inflation figures in Japan and Singapore.

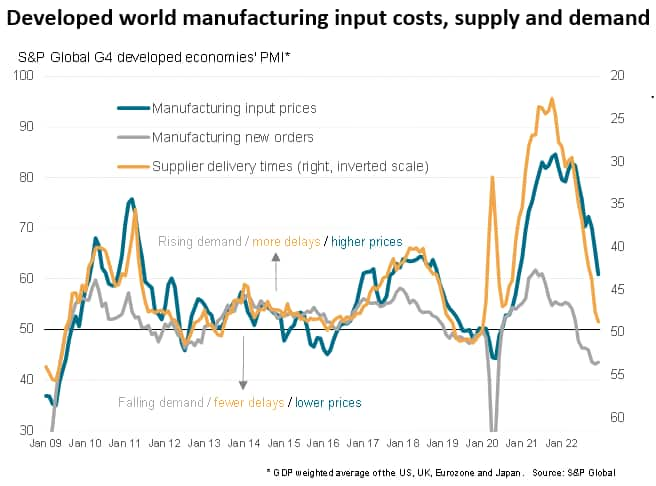

More rate hikes are coming was the main takeaway from the latest Federal Open Market Committee (FOMC) meeting, followed by a similar hawkish tone at the ECB and a matching 50 basis point hike by the Bank of England. However, while the central bankers went to great lengths to manage expectations of the likely need for more rate hikes in 2023, the reality is that all three banks have slowed the pace of tightening. Both the lagging official CPI data and more timely PMI price gauges are signalling a peaking of inflation, with the latter pointing to a potentially marked cooling across the board as weakened demand meets improved supply (see box). The cost of this fight against inflation is meanwhile becoming increasingly evident via further economic contractions in the US and Europe in December. At present, policymakers seem to be accepting of this cost, but markets will be increasingly looking out for a pivot.

Once again, this means a firm focus on the data signals in the coming week with the core US PCE gauge due alongside personal income and consumption data, all of which will shed more light on inflation and consumer demand conditions. Consumer confidence figures will also be released.

Finally, following the series of central bank meetings across the US, UK and eurozone, the Bank of Japan and Bank Indonesia are set to update monetary policy settings for the final time in 2022. Bank Indonesia will be one to watch for further tightening despite the fact that Indonesia's manufacturing sector continue to grapple with weak external demand in line with the wider Asia region. Inflation figures will also be due from export-oriented Asian economies, Japan and Singapore.

Peak inflation

A peaking of inflation has been hinted at by recent official data in the US, eurozone and UK, but these moderations in the rate of growth of consumer prices is nothing compared to the easing of price pressures signalled by the latest flash PMI data for December. The surveys indicate that two key forces which helped drive inflation sharply higher over the past year are now reversing.

First, surging demand has given way to falling demand, as higher interest rates and the soaring cost of living erode spending power and companies seek to work down high levels of warehouse inventories in the face of growing recession worries.

Second supply chains have healed, to the extent that suppliers' delivery times are now shortening in the US and Eurozone. Shorter (faster) deliveries are a function of fewer logistical delays as the pandemic-related issues fade, as well as suppliers being less busy due to the drop in demand for their products and services.

Hence, pricing power is now moving from the seller to the buyer, reflected most clearly in a sharp reduction in the rate of increase of producer input prices in the December PMI surveys. However, note that service sector cost growth is also cooling markedly now.

These price and supply gauges are important, as they tend to lead price development sin the wider economy and on the high street. For more detail, see our special report on page 4.

Key diary events

Monday 19 December

Malaysia Trade (Nov)

Germany Ifo Business Climate New (Dec)

Canada Producer Prices (Nov)

United States NAHB Housing Market Index (Dec)

Tuesday 20 December

Australia RBA Meeting Minutes (Dec)

New Zealand Trade Balance (Nov)

China (Mainland) Loan Prime Rate 1Y and 5Y (Dec)

Germany Producer Prices (Nov)

Taiwan Export Orders (Nov)

United States Building Permits (Nov)

United States Housing Starts Number (Nov)

Canada Retail Sales MM (Oct)

Eurozone Consumer Confidence (Dec, flash)

Japan BOJ Rate Decision (20 Dec)

Wednesday 21 December

Australia Composite Leading Index (Nov)

Germany GfK Consumer Sentiment (Jan)

United States Current Account (Q3)

Canada CPI Inflation (Nov)

United States Consumer Confidence (Dec)

United States Existing Home Sales (Nov)

United Kingdom GDP (Q3)

Thursday 22 December

Thailand Customs-Based Trade Data (Nov)

Japan Leading Indicator (Oct, revised)

United Kingdom Current Account (Q3)

Norway Labour Force Survey (Nov)

Taiwan Jobless Rate (Nov)

United States GDP (Q3, final)

United States Initial Jobless Claims

United Kingdom House Price Rightmove (Dec)

Indonesia 7-Day Reverse Repo (Dec)

Friday 23 December

China Market Holiday, United Kingdom (partial)

Japan BOJ Summary of Opinions (Dec)

Japan BOJ Meeting Minutes (Oct)

Japan CPI (Nov)

Singapore CPI and Manufacturing Output (Nov)

Taiwan Industrial Output (Nov)

United States Personal Income and Consumption (Nov)

United States Core PCE Price Index MM (Nov)

United States Durable Goods (Nov)

Canada GDP (Oct)

United States UoM Sentiment Final (Dec, final)

United States New Home Sales (Nov)

Thailand Manufacturing Production (Nov)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US Q3 GDP (final est.), November core PCE, personal income and consumption, December consumer confidence data, Canada CPI

The final reading of US Q3 GDP will be unveiled in the coming week, though the focus is likely to be with the November core PCE release after November's weaker than expected CPI numbers. The Fed, at the latest December meeting, reiterated their commitment in tackling inflation, signalling that more hikes are to come. That said, asset prices reflected some scepticism and it will boil down to the data to do the work in providing further guidance. As such, the core PCE reading, the Fed's preferred inflation gauge, will be keenly watched to provide clues on the Fed's path forward. November personal income and consumption data, durable goods orders, consumer sentiment and a plethora of housing market statistics will also be of interest as we assess the health of the US economy against the backdrop of rapidly rising interest rates.

Europe: UK Q3 GDP, eurozone consumer confidence and German Ifo business climate index figures

In the UK, revised Q3 growth figures will be released on Wednesday to confirm the contraction seen in the third quarter. Preliminary figures pointed to GDP shrinking 0.2% quarter-on-quarter. This follows flash PMI updates for December, which indicated a further contraction in the fourth quarter, albeit with some signs that the pace of decline may be moderating.

Across the eurozone, consumer confidence will likewise be expected for December after the region's flash PMI releases pointed to a moderating downturn and a marked cooling of price pressures. German Ifo figures will also be of interest after PMI data showed improving supply chains.

Asia-Pacific: BOJ, BI meetings, China Loan Prime Rate, Japan and Singapore CPI data

In APAC, the Bank of Japan and Bank Indonesia will convene with the BoJ still staying put with CPI unlikely to reach the central bank's target in a sustainable manner while BI persists on their hiking path. Japan's November inflation data will also be released while Singapore's CPI and manufacturing output data will outline conditions for the export-oriented economy that has been seeing an increasingly challenging economic climate.

Special reports:

Flash PMI Data Signal Worsening Developed Market Economic Growth, but also Point to a Further Sharp Cooling of Price Pressures - Chris Williamson

India's Economic Expansion Continues as Inflation Pressures Ease - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-december-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-december-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+December+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-december-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 December 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-december-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+December+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-december-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}