Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 24, 2024

Flash PMIs point to diverging growth and inflation trends across major developed economies

The flash PMI data compiled by S&P Global Market Intelligence signaled some widening economic differentials among the world's major developed economies in September.

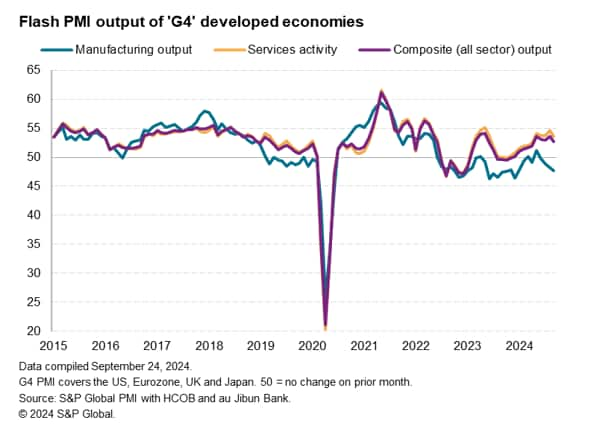

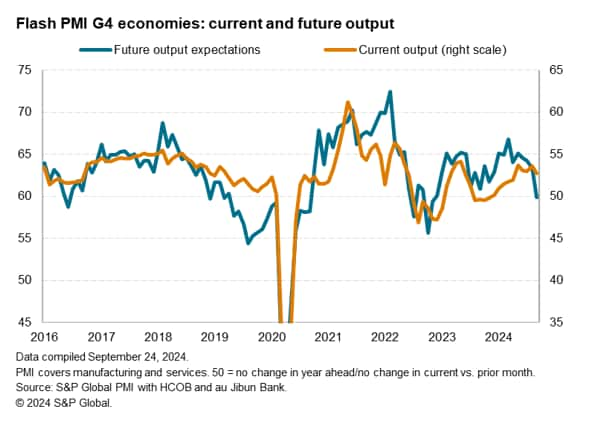

At the G4 headline level, solid - albeit slightly slower - service sector growth was countered by an accelerating downturn of manufacturing output. The latter was most pronounced in the eurozone, which also saw a near-stalling of services output to result in an overall drop in output for the first time in eight months. In contrast, US growth remained encouragingly solid, and further modest output gains were seen in the UK and Japan.

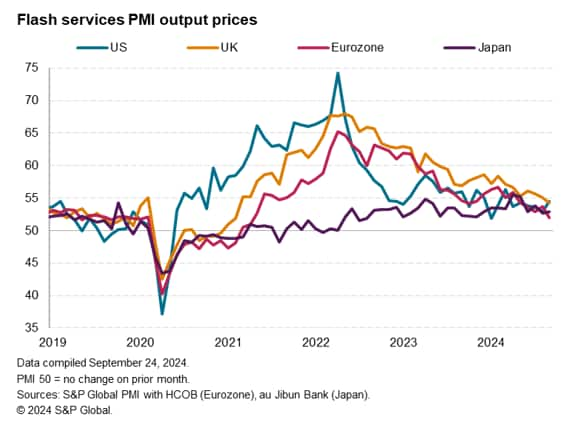

These growth differentials were reflected in price trends: firm demand facilitated an increased rate of selling price inflation in the US whereas prices rose in the eurozone and UK at the slowest rates since February 2021, fueled principally by diverging rates of service sector inflation.

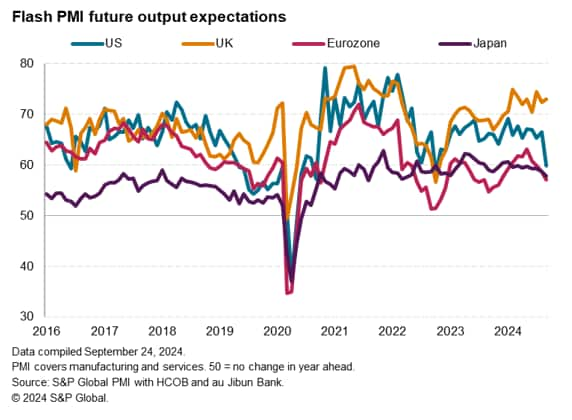

The surveys forward-looking sentiment gauges meanwhile suggest that the overall pace and drivers of economic growth in the major developed economies could see some marked changes in the coming months, reflecting intensifying political uncertainty.

G4 economic growth slows as manufacturing downturn intensifies

Flash PMI data for September from S&P Global Market Intelligence brought further news of widening divergences in terms of developed world economic growth.

Measured across the G4 largest developed economies, output growth cooled to a five-month low, albeit still signalling a solid GDP expansion in the third quarter. However, the upturn was driven solely by the service sector, as manufacturing output fell for a fourth straight month. The production declining was the steepest rate since last December, pointing to an intensifying downturn in the goods-producing sector.

Barring the pandemic, the divergence between the strongly-performing services economy and the struggling manufacturing sectors has been at its widest since comparable data were available in 2009 over the past two months.

Eurozone slides into decline

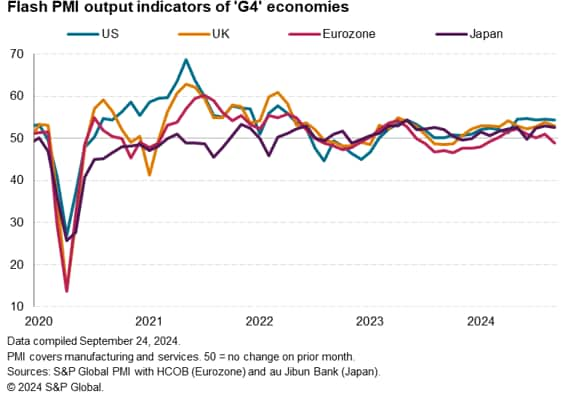

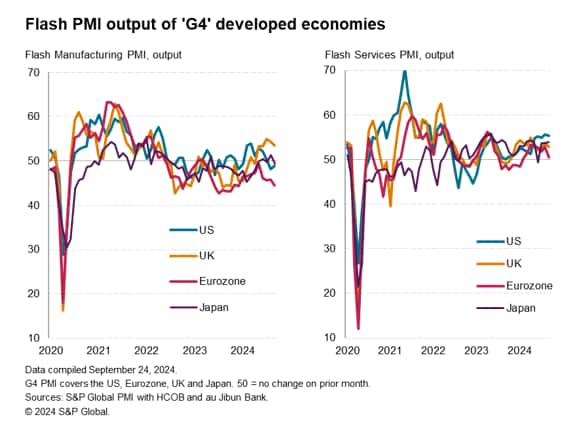

The flash PMI also showed a widening divergence among the G4 economies. The US reported the strongest expansion for the fifth successive month, outpacing all other G4 economies to a notable extent, as growth slowed in the UK and Japan and the eurozone fell into decline for the first time since February.

Key to the eurozone's underperformance was a steepening downturn of the region's manufacturing sector, where output fell sharply and at the most pronounced rate for nine months. Especially steep factory production falls were seen in Germany and France, though the rest of the region also reported a modest decline.

Although manufacturing output also fell in the US and Japan, the declines here were only moderate in comparison to that recorded across the eurozone. The UK continued to buck the manufacturing downturn, though the rate of growth slowed for a second month running.

However, the eurozone also underperformed in terms of service sector activity, reporting a near-stalling of output in the sector to contrast with solid growth in the UK and Japan and an especially robust increase in the US.

Price trends vary

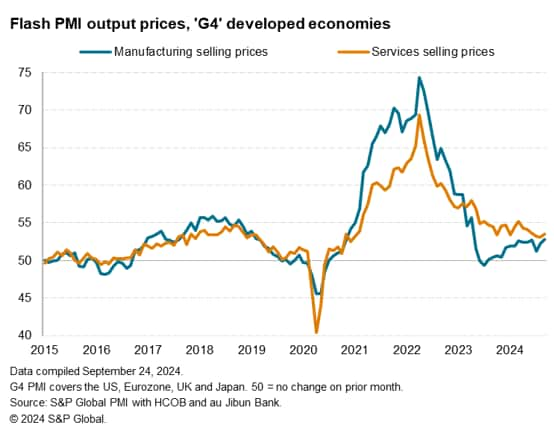

Although growth across the G4 economies slowed slightly, price pressures ticked higher. Goods prices rose at the fastest rate for 17 months, while service price inflation also edged up, hitting a two-month high.

However, regional divergences were again notable. In particular, whereas average prices charged for goods and service in the US rose at the fastest pace recorded by the PMI survey for six months, prices rose at the slowest rates since February 2021 in both the eurozone and UK. Notably from a monetary policy perspective, faster service sector inflation in the US - often attributed to strong demand and wage pressures - contrasted with slower rates of increase in Europe.

Confidence lowest for nearly two years amid political uncertainty

As to future output trends, much is likely to depend on political developments. The US outperformance in particular looks fragile, given a steep drop in optimism about the year ahead seen in September, linked in many cases to uncertainty about the policy landscape ahead of the Presidential Elections. The flash Future Output Expectations Index fell in the US to its lowest snice October 2022.

However, political uncertainty also unsettled businesses in the eurozone, where future sentiment dropped to its lowest since last November. Meanwhile, elevated levels of confidence among UK businesses were qualified by concerns over the upcoming Labour government's Budget, and the potential for tax rises to derail business expansion plans and hit demand. Prospects dimmed markedly in the UK's manufacturing sector, though were sustained by optimism in the services economy surrounding hopes for lower interest rates.

Sentiment in Japan also cooled, dropping to a 29-month low amid economic growth worries, taking business optimism across the G4 economies down to its lowest since November 2022.

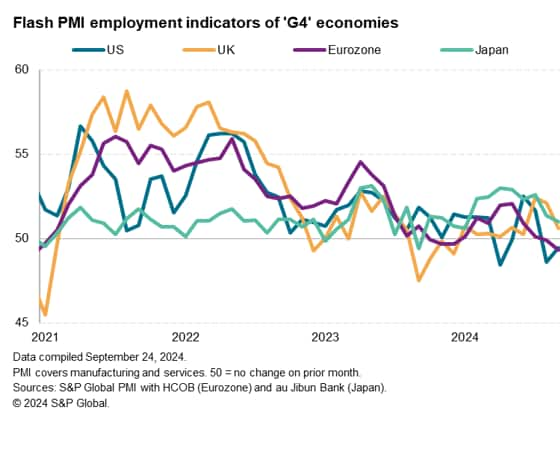

Employment falls

This uncertainty has dented firms' appetite to hire. Employment fell in the US and eurozone in September, while slower rates of job creation were evident in the UK and Japan. Measured across the G4 as a whole, employment consequently fell for a second month. Although only modest, this decline in employment in the past two months is significant in being the first such period of job losses seen since the early pandemic months.

Access the US, UK, Eurozone and Japan press releases.

Also refer to our latest releases for Australia and India.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-diverging-growth-and-inflation-trends-across-major-developed-economies-Sep24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-diverging-growth-and-inflation-trends-across-major-developed-economies-Sep24.html&text=Flash+PMIs+point+to+diverging+growth+and+inflation+trends+across+major+developed+economies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-diverging-growth-and-inflation-trends-across-major-developed-economies-Sep24.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs point to diverging growth and inflation trends across major developed economies | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-diverging-growth-and-inflation-trends-across-major-developed-economies-Sep24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+point+to+diverging+growth+and+inflation+trends+across+major+developed+economies+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-diverging-growth-and-inflation-trends-across-major-developed-economies-Sep24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}