Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 27, 2024

Week Ahead Economic Preview: Week of 30 September 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide PMIs, US payrolls, eurozone inflation in focus

Markets will once again look primarily to the US for guidance in the coming week, amid a slew of updated economic indicators and Fed speeches which include the non-farm payroll report and the PMIs, the latter also providing insights to global economic trends as the policy focus shifts from inflation to growth.

The 50-basis point cut to US interest rates at the FOMC's September meeting was important in representing a pivotal moment for the US rates outlook, marking the first time that the Fed has cut interest rates since the early pandemic days. However, the cut was also important in potentially opening the door for more aggressive rate cutting by other central banks, if needed. Concerns over interest rate differentials and resultant exchange rate appreciation have arguably limited the room for manoeuvre at some central banks where rate cuts might be necessary.

A case in point is the eurozone, where flash PMI data showed a further cooling of price pressures in September, down to a level below the ECB's target, while at the same time output contracted. In Germany, there are signs that the economy is already in a technical recession, feeling concerns of 'hard landing' risks.

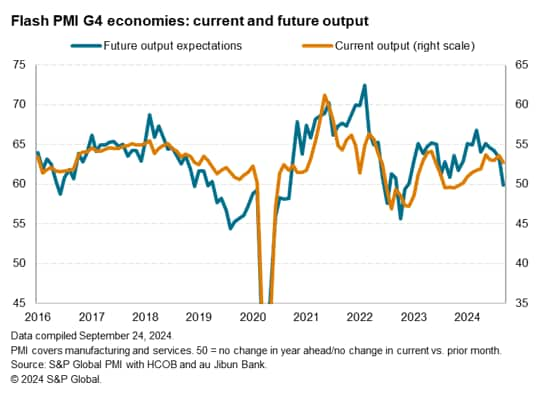

Growth trends could deteriorate further in the major developed economies, as business sentiment about prospects for the year ahead slumped sharply according to the flash PMIs, reflecting heightened geopolitical worries. Topping the list of companies' concerns was uncertainty caused by the US Presidential Elections, including the potential for new tariffs and protectionism. But European companies are also concerned about shifting political sands closer to home, which could affect fiscal policy - notably in the UK but also in the EU, and firms globally are worried about the Middle East and ongoing conflict in Ukraine.

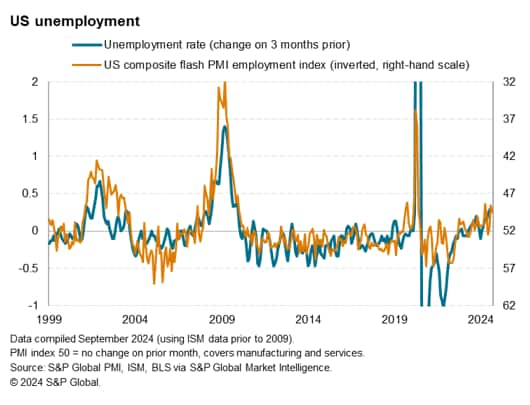

The global PMI data will therefore be important in assessing worldwide growth differentials and signs of softening labour markets in order to seek further clues as to which central banks will be next to move in the rate cutting cycle. The US will of course be central here, as the PMIs are accompanied by the monthly official employment report, for which the flash PMI data have indicated a further cooling of the job market.

Key diary events

Monday 30 Sep

South Korea Industrial Production (Aug)

Japan Industrial Production (Aug, prelim)

China (Mainland) NBS PMI (Sep)

China (Mainland) Caixin PMI* (Sep)

Germany Retail Sales (Aug)

United Kingdom Current Account (Q2)

United Kingdom GDP (Q2, final)

United Kingdom Mortgage Lending and Approvals (Aug)

Italy Inflation (Sep, prelim)

Germany Inflation (Sep, prelim)

United States Fed Powell Speech

Tuesday 1 Oct

China (Mainland), Hong Kong SAR, Mexico Market

Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Sep)

Japan Unemployment Rate (Aug)

Japan BoJ Summary of Opinions (Sep)

South Korea Trade (Sep)

Australia Building Permits (Aug, prelim)

Australia Retail Sales (Aug)

Indonesia Inflation (Sep)

Japan Consumer Confidence (Sep)

Switzerland Retail Sales (Aug)

Eurozone Inflation (Sep, flash)

United States ISM Manufacturing PMI (Sep)

United States JOLTs Job Openings (Aug)

Wednesday 2 Oct

China (Mainland), India Market Holiday

South Korea Inflation (Sep)

Japan Tankan Large Manufacturers Index (Q2)

United Kingdom Nationwide Housing Pries (Sep)

Eurozone Unemployment Rate (Aug)

Brazil Industrial Production (Aug)

United States ADP Employment Change (Sep)

Thursday 3 Oct

China (Mainland), South Korea Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI* (Sep)

S&P Global Sector PMI* (Sep)

Australia Trade (Aug)

Switzerland Inflation (Sep)

Turkey Inflation (Sep)

United States ISM Services PMI (Sep)

United States Factory Orders (Aug)

Friday 4 Oct

China (Mainland) Market Holiday

Philippines Inflation (Sep)

Australia Home Loans (Aug)

France Industrial Production (Aug)

United Kingdom S&P Global Construction PMI* (Sep)

Italy Retail Sales (Aug)

Canada Balance of Trade (Aug)

United States Non-farm Payrolls, Unemployment Rate, Average Hourly

Earnings (Sep)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing, services and sector PMI

September worldwide manufacturing and services PMI data will be released on Monday and Wednesday respectively. Additionally, we have brought forward the release of detailed sector PMI to the third working day of each month, enabling the analysis of both composite and sector data on the same day. Following the update of flash PMI data for September, where we have seen developed economies' growth and inflation trends diverge, worldwide PMI will therefore offer a complete picture of how things have fared at the end of Q3.

Americas: Fed speeches, US labour market report, ISM PMI, Canada trade, Brazil industrial production

Fed appearances will continue in the week and comments will again be parsed for greater insights into the Fed's intentions. The release of the US September labour market report and PMI data will also add signals for the likely aggressiveness of rate cuts in the near term. According to the consensus, a slightly slower increase in non-farm payrolls is expected for September while the unemployment rate is expected to tick up from 4.2% to 4.3%. At the same time, wage growth is expected to slow on a month-on-month basis. According to the latest S&P Global Flash US PMI for September, employment - including both manufacturing and service sectors - fell for a second month running, supporting expectations for a downtrend in job additions.

EMEA: UK GDP, Eurozone inflation, unemployment data, Switzerland, Turkey CPI

Besides PMI data, key data releases include a final reading of UK Q2 GDP, while the eurozone updates its inflation and unemployment data. The HCOB Flash Eurozone PMI for September outlined a further easing of selling price inflation but also a drop in employment. While PMI prices data typically prelude the trend for official inflation, the latest update outlines the likelihood for a further easing of inflationary pressures in the coming months.

APAC: China PMI, Japan Tankan survey, industrial production, consumer confidence, Australia trade

In APAC, detailed PMI data will offer the earliest insights into how growth has fared. This comes after growth was found to have decelerated in August for the emerging market as a whole. Mainland China PMI data will also be key ahead of the National Day holidays in October, with both the National Bureau of Statistics (NBS) and Caixin releases due Monday.

In Japan, a series of official data releases are expected including the Bank of Japan's Tankan survey, shedding light on business sentiment. The more up-to-date September au Jibun Bank Flash Japan Composite PMI future output indicator meanwhile suggested that optimism levels further moderated at the end of the third quarter.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-september-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-september-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+30+September+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-september-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 30 September 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-september-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+30+September+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-september-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}