Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 25, 2024

Flash PMIs signal more broad-based expansion as growth rates improve in Europe and Japan

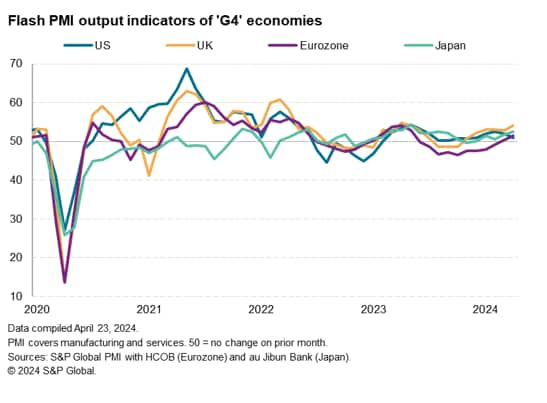

The flash PMI data released for April showed an increasingly broad-based economic expansion across the four major developed economies, albeit with signs of improving growth in Europe and Japan contrasting with a slowdown in the US. The US also bucked a broader trend of rising employment, suffering the first cut to employment since the early pandemic months.

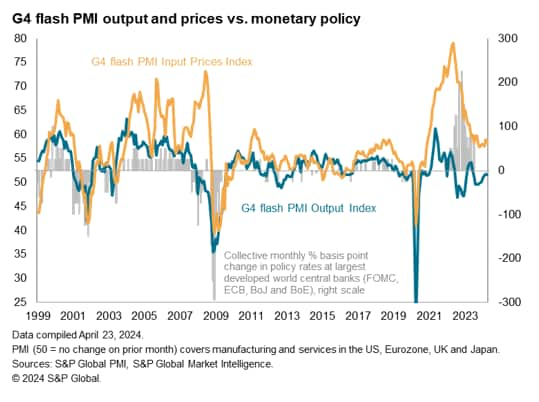

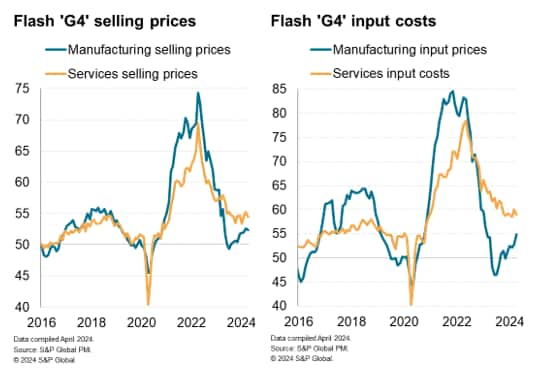

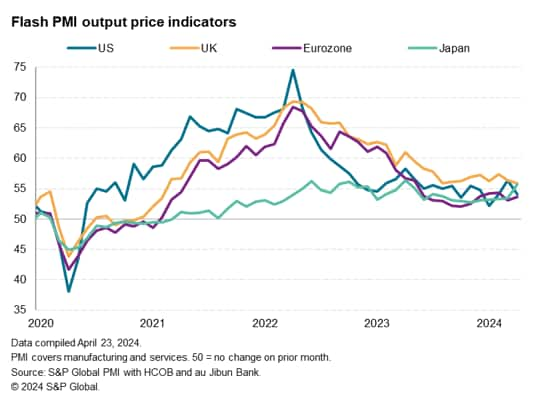

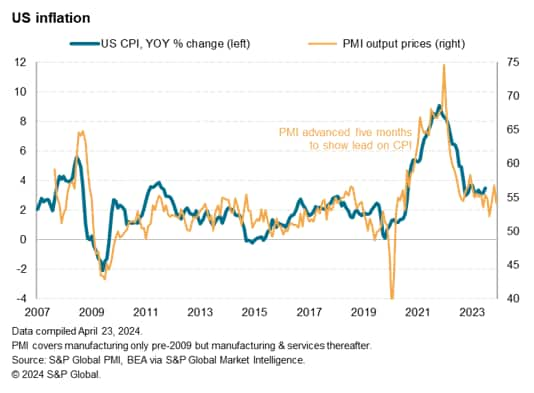

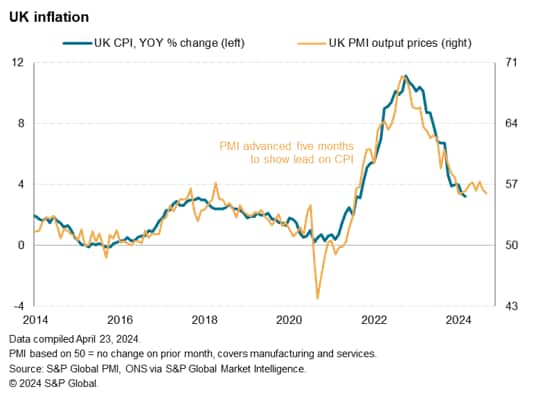

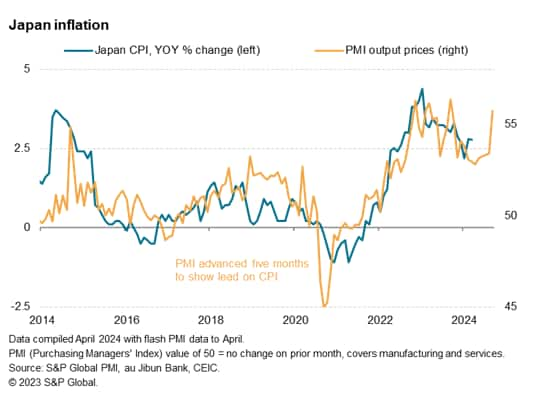

The overall inflation picture remained one of stubbornly higher service sector inflation rates combined with signs of reviving price pressures in manufacturing. However, overall selling price inflation rates are only modestly above levels consistent with central bank 2% targets in the US and eurozone, the former having cooled sharply in April. While a more elevated rate is signaled for the UK, the rate of increase slowed in April. An especially high and accelerating pace of price increase was meanwhile seen for Japan, in part due to the weaker yen.

Broad-based upturn at start of second quarter

Economic growth was recorded across all four largest developed economies in April, building on the renewed expansion seen in the first quarter. It is encouraging that all four economies have now reported growth for a second successive month to hint at a broad-based economic expansion.

However, at 51.6, down from 51.7 in March, the weighted average output index for the 'G4' indicated a very slight loss of momentum.

Furthermore, there were some notable developments beneath the headline numbers. Growth hit an eight-month high in Japan and 11-month highs were seen in the eurozone and UK, indicating further progress by these economies from lifting out of recent periods of malaise and decline. In contrast, US growth slowed to a four-month low, albeit having now expanded continually for 15 months. By comparison, the UK has only notched up six months of expansion and upturns in the eurozone and Japan are limited to just two and four months respectively.

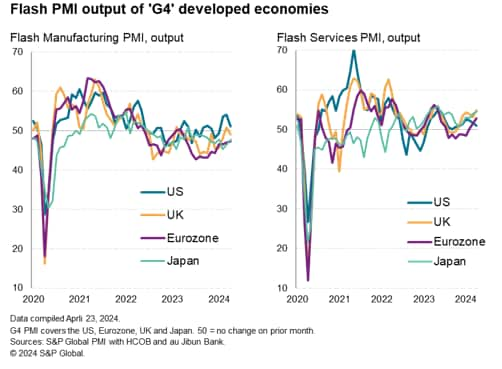

There were also some interesting developments by sector. US growth slowed across both manufacturing and services, albeit with both sectors still growing, but the eurozone, UK and Japan saw notably stronger service sector performances contrast with manufacturing downturns.

Looking ahead, further pace could be lost across the G4 as a whole in May, as the G4 new orders index, measuring changes in demand for goods and services, edged down to 49.9, dropping below the no-change level of 50.0 for the first time since December. Future output expectations also slipped, slumping to a four-month low.

Stalled employment

The order book loss and drop in confidence filtered through to a stalling of the G4 employment situation, with April being the first month without net job creation being recorded since August 2020. However, regional variations were again interesting to note, with stronger jobs gains in the Eurozone, UK and Japan contrasting with a marked drop in US jobs, which fell for the first time since the early pandemic months.

Higher manufacturing costs add to stubborn inflation picture

From an inflation perspective, at the broad G4 level the picture was again dominated by stubbornly elevated service sector input cost and selling price inflation rates, though manufacturing costs and prices also continued to rise. A concern is that an increased rate of manufacturing input cost growth could keep upward pressure on overall inflation rates in the months ahead even if service sector inflation rates cool.

Breaking down the G4 numbers, the steepest growth of selling prices for goods and services was again seen in the UK, followed by Japan. However, whereas UK selling price inflation cooled to the joint-lowest since February 2021, the rate increased in Japan to a 12-month high. The US meanwhile saw a renewed cooling in the rate of selling price inflation to one of the lowest seen over the past four years, and although the rate ticked higher in the eurozone it remained below the average seen over the past year and the lowest of the G4.

The composite PMI selling price index now exceeds the relative pre-pandemic ten-year averages by 6.3 points in Japan, and by 3.7 and 3.2 points respectively in the UK and eurozone, but lies just 1.7 points higher in the US.

Comparing these indices with consumer price inflation rates, the PMI data point to inflation running close to central bank 2% targets in the US and eurozone, but exceeding targets in the UK and most notably in Japan.

There are some details from the PMI surveys to monitor the coming months, however, which could affect the direction of travel for inflation rates. In the UK, costs surged higher (especially in the service sector) on the back of the introduction of a higher National Living Wage. US manufacturing input prices also rose sharply, in part highlighting the pass-through of higher oil prices. Japan's raw material prices also rose at a much-increased rate thanks to the additional impact of a weaker yen.

Access the US, UK, eurozone and Japan Flash PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signal-more-broadbased-expansion-as-growth-rates-improve-in-europe-and-japan-Apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signal-more-broadbased-expansion-as-growth-rates-improve-in-europe-and-japan-Apr24.html&text=Flash+PMIs+signal+more+broad-based+expansion+as+growth+rates+improve+in+Europe+and+Japan+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signal-more-broadbased-expansion-as-growth-rates-improve-in-europe-and-japan-Apr24.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs signal more broad-based expansion as growth rates improve in Europe and Japan | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signal-more-broadbased-expansion-as-growth-rates-improve-in-europe-and-japan-Apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+signal+more+broad-based+expansion+as+growth+rates+improve+in+Europe+and+Japan+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signal-more-broadbased-expansion-as-growth-rates-improve-in-europe-and-japan-Apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}