Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 26, 2024

Week Ahead Economic Preview: Week of 29 April 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

FOMC meeting, US payrolls, Eurozone GDP and global PMI data

The Fed's FOMC meeting will be the key focus at the start May, followed by US April payrolls and wage growth numbers, all highlights in a week where we are also anticipating worldwide manufacturing PMI releases. Additionally, GDP and inflation figures are expected from the eurozone, alongside Q1 growth figures from various other economies. Earnings releases will also continue to drive market sentiment.

The May Federal Open Market Committee (FOMC) meeting, taking place over April 30 and May 1, and the updated US employment report will provide clues on rate cut prospects. A sharper than anticipated rise in core PCE inflation over the first quarter added to concerns that any reduction to interest rates will need to be delayed until late in the year, with markets now not pricing in the first full 25 basis point cut until December. Equities fell and bond yields rose in response to the reduced rate cut outlook, and markets will now look for fresh forward guidance from the Fed via the FOMC meeting as well as key updates to payroll and wage growth, as well as unemployment.

As US rate cut hopes are fading, expectations continue to mount that the European Central Bank (ECB) could be the first of the major central banks to lower rates. This view will be put to the test as first quarter GDP and April flash CPI inflation are due in the eurozone. Subdued conditions are expected to be reflected with Q1 GDP, as observed from PMI data in the first three months of the year, but the data may at least show some positive signs of recovery. More up-to-date April HCOB Flash Eurozone Composite PMI has so far reflected improved growth momentum at the start of Q2, with the difference against the subdued US PMI helping to support EUR/USD post-release. Inflation data due Tuesday will meanwhile provide official confirmation of whether inflation pressures have remained stubborn in the eurozone.

Finally, worldwide manufacturing PMI data will be due across May 1-2, while some services data also available at the end of the week, all of which will help shed light on economic conditions at the start of the second quarter. A key area to watch will be the development of rising commodity prices and the potential feed through to goods price inflation, which was hinted at by the flash PMI numbers.

European growth accelerates as US economy slows

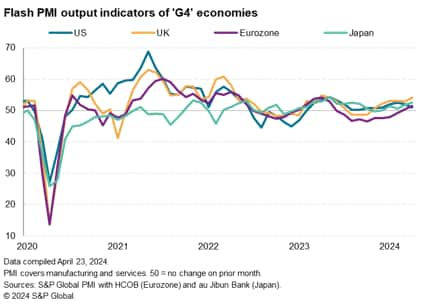

The flash PMI data released for April showed an increasingly broad-based economic expansion across the four major developed economies, albeit with signs of improving growth in Europe and Japan contrasting with a slowdown in the US. The US also bucked a broader trend of rising employment, suffering the first cut to employment since the early pandemic months.

The overall inflation picture remained one of stubbornly higher service sector inflation rates combined with signs of reviving price pressures in manufacturing. However, overall selling price inflation rates are only modestly above levels consistent with central bank 2% targets in the US and eurozone, the former having cooled sharply in April. While a more elevated rate is signalled for the UK, the rate of increase slowed in April. An especially high and accelerating pace of price increase was meanwhile seen for Japan, in part due to the weaker yen.

The flash data raise interesting questions as to whether we are seeing a change in the pattern of growth. Is US growth waning as Europe revives? Certainly, there is a suggestion that improved prospects of ECB and Bank of England rate cuts could be benefitting interest-rate sensitive parts of Europe's economy, a contrast to the situation in the US, where Fed rate cut hopes are fading.

To learn more about the drivers of these changing growth dynamics as we head into the second quarter we will need to see updates to the sector details, which will come through with the final PMIs to be published in early May.

Key diary events

Monday 29 April

Japan Market Holiday

Sweden GDP (Q1, flash)

Spain Inflation (Apr, prelim)

Eurozone Economic Sentiment (Apr)

Germany Inflation (Apr, prelim)

Tuesday 30 April

Japan Unemployment (Mar)

Japan Industrial Production and Retail Sales (Mar)

Australia Retail Sales (Mar)

China (Mainland) NBS PMI (Apr)

China (Mainland) Caixin Manufacturing PMI* (Apr)

Eurozone, France, Germany, Italy, Spain GDP (Q1, prelim)

Germany Retail Sales (Mar)

France Inflation (Apr, prelim)

Taiwan GDP (Q1, advance)

Eurozone Inflation (Apr, flash)

Italy Inflation (Apr, flash)

Mexico GDP (Q1, prelim)

Canada GDP (Feb)

United States CB Consumer Confidence (Apr)

Wednesday 1 May

Brazil, China (mainland), France, Germany, Hong Kong SAR,

India, Indonesia, Italy, Malaysia, Mexico, Netherlands, Norway,

Philippines, Singapore, South Africa, South Korea, Spain, Sweden,

Switzerland, Taiwan, Thailand, Turkey, United Kingdom Market

Holiday

Australia Employment (Q1)

Japan Consumer Confidence (Apr)

United States ADP Employment Change (Apr)

United States ISM Manufacturing PMI (Apr)

United States JOLTs Job Openings (Mar)

United States S&P Global Manufacturing PMI* (Apr)

Canada S&P Global Manufacturing PMI* (Apr)

United States FOMC Interest Rate Decision

Thursday 2 May

China (Mainland) Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* released across May

1-2 (Apr)

South Korea Inflation (Apr)

Japan BoJ Meeting Minutes (Mar)

Australia Trade (Mar)

Indonesia Inflation (Apr)

United Kingdom Nationwide Housing Prices (Apr)

Switzerland Inflation (Apr)

Hong Kong SAR GDP (Q1, advance)

Canada Trade (Mar)

United States Trade and Factory Orders (Mar)

Friday 3 May

China (Mainland), Japan Market Holiday

Turkey Inflation (Apr)

Eurozone Unemployment (Mar)

United States Non-Farm Payrolls, Average Hourly Earnings and

Unemployment Rate (Apr)

United States ISM Services PMI (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing and services PMI releases

Following April flash PMI updates, worldwide manufacturing PMI will be due May 1-2, and services will follow over May 3-6, ahead of the more detailed sector PMI data.

Global growth will be assessed with the release of worldwide April PMIs after flash data from major developed economies revealed that moderate growth was sustained across the G4 economies at the start of the second quarter, while output in India accelerated to the fastest since mid-2010. Additionally, price trends will be closely watched after signs of stubborn services inflation were again observed in April, albeit with a welcome easing of inflation pressures in the US.

Americas: US FOMC meeting, labour market report, ISM PMI, Canada monthly GDP, trade data

The May FOMC meeting concludes Wednesday, May 1, with no changes in monetary policy expected according to market consensus, though the focus will be on the Fed's stance regarding inflation and the outlook for interest rates. Concerns around the possibility of the Fed hiking rates again in the current cycle have gathered of late after hawkish comments from Fed chair Jerome Powell. That said, more up-to-date US flash PMI data revealed that economic growth and inflation trajectories lowered in April, which added to confidence that the economy remains on track to allow rate cuts later in the year. Rhetoric from the Fed meeting will therefore be closely scrutinised. This is in addition to a barrage of releases including the April employment report, where the market expectation is for fewer payroll additions (in line with flash PMI indications), as well as ISM, JOLTS, trade and factory orders data.

EMEA: Eurozone GDP and inflation

Official first quarter growth statistics and flash April inflation data out of the eurozone are anticipated in the week. Improved Q1 GDP readings are expected for the eurozone and also for key member states France and Germany.

Meanwhile April eurozone flash inflation data will help guide expectations that the ECB might be in a position to cut rates as soon as June, in line with broad market expectations. For that to happen, monthly inflation changes will need to have cooled from the strong 0.6% and 0.8% increases seen in the headline rate in the prior two months.

APAC: China NBS PMI, Japan industrial production, unemployment rate and consumer confidence

In APAC, both NBS and the Caixin Manufacturing PMI data will be due on Tuesday ahead of Labour Day holidays for a first look into April business conditions.

Japan's industrial production, employment figures and consumer confidence will also be key releases in the week.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-april-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-april-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+29+April+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-april-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 29 April 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-april-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+29+April+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-april-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}