Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 02, 2018

French REITs keep ratcheting up dividends

Real Estate Investment Trusts (REITs) combine high dividend payouts, above-average yield and protection against inflation

- French REITs exhibit strong and reliable dividends that have increased over time

- We forecast dividends from French REITs to grow 5.3% CAGR over next four years

- REITs forecast to have the highest yield amongst the sectors in the SBF 120

- Unibail-Rodamco is a top prospect with compelling dividend growth and value

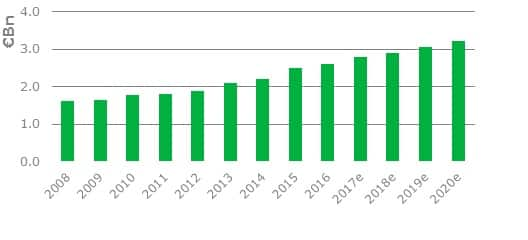

We are forecasting aggregate dividend from the six French REITs listed in the SBF120 to reach €3.2bn by 2020. This reflects a 5.3% CAGR growth over the next four years, above the 4.7% we forecast for France SBF 120 overall. French REITs own assets mainly located in Europe and should benefit from a continued economic expansion associated with potential higher inflation in the region. Eurozone and France GDP have increased 2.5% and 1.9%, respectively, in 2017. And the strong January Flash PMI Composite continued to point to strong activity in the private sector at start of 2018.

Constant aggregate dividend growth from French REITs since 2008

French REITs are also expected to return the highest dividend yield among SBF 120 sectors. Whilst a high dividend yield can sometimes signal a dividend at risk, French REITs have a proven track record of combining above average yields with high payout ratios and reliable growth. They have remained much more stable than other high yielding sectors such as banks, where dividend evolution has been volatile.

While REITs could be vulnerable to adjustments in the ECB monetary policy – which could increase borrowing costs and impact property values – they provide some protection against inflation. The impact of interest rise, when associated with economic growth and rising inflation, should be limited as both factors can positively affect REIT fundamentals. In addition, REITs’ low leverage, low interest costs, long maturities and high coverage ratios suggest that French REITs are well positioned for higher rates.

Unibail-Rodamco (UR) is our top prospect combines compelling dividend growth and value. The acquisition of Westfield announced in December 2017 is expected to be completed in Q218.

UR announced a dividend of €10.8 per share for financial 2017 (up 6%), reflecting a 90% payout ratio of the net recurring result, in line with the 85%-95% dividend policy. We expect dividends to increase 7% CAGR over next four years, exceeding expected growth for Klepierre and European peers’ average. Unibail-Rodamco intends to maintain its current dividend policy post Westfield transaction. Thus, we could revise our dividend forecast upwards for FY18 and beyond, if the transaction is completed depending on recurring EPS accretion.

These dividend expectations are to combine with an attractive value. Unibail trades at a 2% discount to its last reported Net Asset Value per share of around €211, compared to an average 20% premium over 2011-2016. And the dividend yield is at a level not seen since January 2014.

To access the report, please contact dividendsupport@markit.com

Jonathan Chatelain is a Senior Research Analyst at IHS Markit.

Posted 2 February 2018

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrench-reits-keep-ratcheting-up-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrench-reits-keep-ratcheting-up-dividends.html&text=French+REITs+keep+ratcheting+up+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrench-reits-keep-ratcheting-up-dividends.html","enabled":true},{"name":"email","url":"?subject=French REITs keep ratcheting up dividends&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrench-reits-keep-ratcheting-up-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=French+REITs+keep+ratcheting+up+dividends http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrench-reits-keep-ratcheting-up-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}